As reported in Lonsec's last Portfolio Partners update ... - Charter Hall

As reported in Lonsec's last Portfolio Partners update ... - Charter Hall

As reported in Lonsec's last Portfolio Partners update ... - Charter Hall

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

May 2012<br />

Trust F<strong>in</strong>ancial Position <strong>As</strong> at June 2012<br />

Property Value $54.8m<br />

Equity Sought $32.0m<br />

Unit Application Price $1.00<br />

Net Tangible <strong>As</strong>sets/unit $0.951<br />

Debt $24.66m<br />

Gear<strong>in</strong>g (Loan to Value) 45%<br />

<strong>Portfolio</strong> Summary<br />

No. of Properties 1<br />

Property Type Office 100%<br />

Property Location Perth, WA 100%<br />

Wtd Avg Lease Expiry 7.83 yrs (by <strong>in</strong>come)<br />

Fund Returns Lonsec Estimates<br />

Est. Trust IRR pre-tax 11.63%<br />

IRR After tax (46.5%/15%) 7.75% (10.38%)<br />

Year end June FY13f FY14f<br />

Distribution per unit 8.85c 9.15c<br />

Pre-tax Yield 8.85% 9.15%<br />

Tax Deferred 44% 41%<br />

After-tax Yield (46.5%) 6.55% 6.64%<br />

After-tax Yield (15.0%) 8.11% 8.34%<br />

Other Fund Details<br />

APIR Code MAQ0788AU<br />

Distribution Paid Monthly <strong>in</strong> arrears<br />

M<strong>in</strong>imum Investment $50,000<br />

Investment Term Five years (June 2017)<br />

Responsible Entity/<br />

Manager<br />

<strong>Charter</strong> <strong>Hall</strong> Direct Property<br />

M‟ment Ltd / C.<strong>Hall</strong> Hldgs P/L.<br />

Manager Fund Hold<strong>in</strong>g: <strong>Charter</strong> <strong>Hall</strong> Group will underwrite up<br />

to 49.9%.<br />

Manager Fees & Expenses<br />

RE Transaction Fee 2% of gross assets<br />

Annual Fee & Expenses Up to 0.8% of gross assets<br />

Performance Fee 15% of excess above 10% pa<br />

RE Disposal Fee/Costs 1% of gross assets sold + onbilled<br />

costs<br />

Advisor Fee: Direct <strong>in</strong>vestors may elect to pay to Advisors a<br />

professional fee for service of up to 3% (<strong>in</strong>cl GST), which will be<br />

deducted from Application Amounts and result <strong>in</strong> less units allotted.<br />

Us<strong>in</strong>g This Fund<br />

This is General Advice only and should be read <strong>in</strong><br />

conjunction with the Disclaimer, Disclosure and<br />

Warn<strong>in</strong>g on the f<strong>in</strong>al page.<br />

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust (CHD<br />

144 Stirl<strong>in</strong>g St or ‘the Trust’) is an unlisted property<br />

trust which <strong>in</strong>vests <strong>in</strong> a s<strong>in</strong>gle property asset with a<br />

small cash reserve.<br />

The Trust aims to provide a susta<strong>in</strong>able and stable<br />

<strong>in</strong>come return (<strong>in</strong>itially 8.85% partly tax deferred) with<br />

the potential for capital growth.<br />

While the returns of the Trust are expected to be less<br />

volatile than equities and listed property securities<br />

<strong>in</strong>vestments, <strong>in</strong>vestors should be aware that the Trust<br />

may experience periods of negative returns and that<br />

there is a risk of <strong>in</strong>curr<strong>in</strong>g capital loss on the Trust.<br />

<strong>As</strong> such, Lonsec considers the Trust suitable for<br />

medium to high-risk profile <strong>in</strong>vestors with a five+ year<br />

<strong>in</strong>vestment-time horizon and it will generally sit with<strong>in</strong><br />

the growth component of a balanced portfolio.<br />

Due to the Trust’s significant exposure to an illiquid<br />

asset (direct property) and that there is no redemption<br />

facility dur<strong>in</strong>g the <strong>in</strong>itial five year term of this closedend<br />

Trust, liquidity risk <strong>in</strong> the Trust is high. (See 1.4<br />

Liquidity for further details).<br />

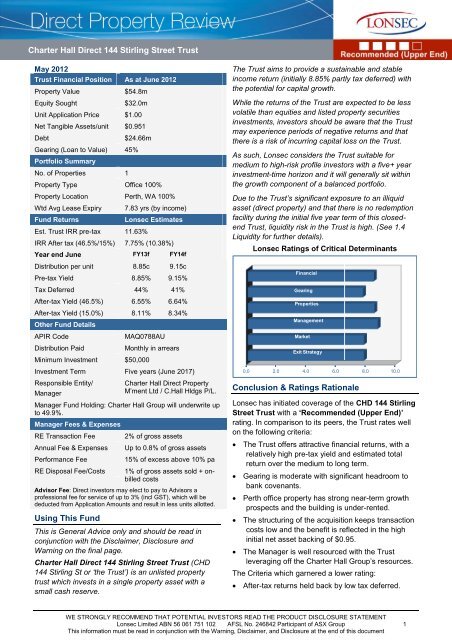

Lonsec Rat<strong>in</strong>gs of Critical Determ<strong>in</strong>ants<br />

F<strong>in</strong>ancial<br />

Gear<strong>in</strong>g<br />

Properties<br />

Management<br />

0.0 2.0 4.0 6.0 8.0 10.0<br />

WE STRONGLY RECOMMEND THAT POTENTIAL INVESTORS READ THE PRODUCT DISCLOSURE STATEMENT<br />

Lonsec Limited ABN 56 061 751 102 AFSL No. 246842 Participant of ASX Group 1<br />

This <strong>in</strong>formation must be read <strong>in</strong> conjunction with the Warn<strong>in</strong>g, Disclaimer, and Disclosure at the end of this document<br />

Market<br />

Exit Strategy<br />

Conclusion & Rat<strong>in</strong>gs Rationale<br />

Lonsec has <strong>in</strong>itiated coverage of the CHD 144 Stirl<strong>in</strong>g<br />

Street Trust with a ‘Recommended (Upper End)’<br />

rat<strong>in</strong>g. In comparison to its peers, the Trust rates well<br />

on the follow<strong>in</strong>g criteria:<br />

The Trust offers attractive f<strong>in</strong>ancial returns, with a<br />

relatively high pre-tax yield and estimated total<br />

return over the medium to long term.<br />

Gear<strong>in</strong>g is moderate with significant headroom to<br />

bank covenants.<br />

Perth office property has strong near-term growth<br />

prospects and the build<strong>in</strong>g is under-rented.<br />

The structur<strong>in</strong>g of the acquisition keeps transaction<br />

costs low and the benefit is reflected <strong>in</strong> the high<br />

<strong>in</strong>itial net asset back<strong>in</strong>g of $0.95.<br />

The Manager is well resourced with the Trust<br />

leverag<strong>in</strong>g off the <strong>Charter</strong> <strong>Hall</strong> Group‟s resources.<br />

The Criteria which garnered a lower rat<strong>in</strong>g:<br />

After-tax returns held back by low tax deferred.

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

The property is on the fr<strong>in</strong>ge of the CBD and the car<br />

park<strong>in</strong>g is leased from the adjacent build<strong>in</strong>g (could<br />

reduce potential purchasers).<br />

The Trust is not widely diversified, hav<strong>in</strong>g only a<br />

s<strong>in</strong>gle asset with two major tenants.<br />

Summary – Lonsec Fund Rat<strong>in</strong>gs Criteria<br />

Property Criteria<br />

The area has good long-term potential, be<strong>in</strong>g on the<br />

northern fr<strong>in</strong>ge of Perth‟s CBD and close to rail<br />

transport with access to the nearby freeway. It is a<br />

develop<strong>in</strong>g area for commercial office, assisted by<br />

<strong>in</strong>creas<strong>in</strong>g residential density.<br />

Tenants are of high quality with global eng<strong>in</strong>eer<strong>in</strong>g<br />

firm Hatch (64% by <strong>in</strong>come) and WA Government<br />

(23%) hav<strong>in</strong>g built-<strong>in</strong> rental <strong>in</strong>creases of 3.75%-4%<br />

p.a. The weighted average term to lease expiry at 7.8<br />

years is slightly above average, with five years still to<br />

run on the Hatch lease by the end of the <strong>in</strong>itial term of<br />

the Trust (mid 2017). Net pass<strong>in</strong>g rental is 5% below<br />

market, with good prospects for cont<strong>in</strong>ued market<br />

<strong>in</strong>creases given the current tight office supply <strong>in</strong> Perth.<br />

The 144 Stirl<strong>in</strong>g St build<strong>in</strong>g has attractive large floor<br />

plates, which is a key driver of tenant demand from the<br />

CBD. It has also achieved 3.5-4.5 (out of 6) NABERS<br />

rat<strong>in</strong>gs for energy and water respectively. Recently,<br />

the present owner spent $2.7m upgrad<strong>in</strong>g the property<br />

to a high standard. Although there is no significant<br />

capital expenditure needed <strong>in</strong> the near-term, the<br />

Manager has allowed $1.5-$1.6m ($150/m2 for office<br />

space) cover<strong>in</strong>g the first five years - similar to that <strong>in</strong><br />

the valuation report.<br />

The build<strong>in</strong>g benefits from be<strong>in</strong>g adjacent to another<br />

<strong>Charter</strong> <strong>Hall</strong> property (which Lonsec reviewed <strong>in</strong> late<br />

2009), <strong>in</strong> particular shar<strong>in</strong>g the car park<strong>in</strong>g located at<br />

130 Stirl<strong>in</strong>g St. In practical terms the Adjo<strong>in</strong><strong>in</strong>g Owners<br />

Agreement (99 year lease) ensures adequate park<strong>in</strong>g<br />

for tenants of each build<strong>in</strong>g and protects owner‟s rights<br />

if the other property is sold or transferred. However,<br />

the lack of park<strong>in</strong>g on the 144 Stirl<strong>in</strong>g St title could be<br />

viewed negatively by potential purchasers of the<br />

property.<br />

F<strong>in</strong>ancial & Gear<strong>in</strong>g Criteria<br />

The near 9% pre-tax distribution yield is at the<br />

upper end of Lonsec‟s sample of recent unlisted<br />

property trusts and mid-range for after-tax yield<br />

given the relatively low tax deferred component.<br />

The issue of the previous vendor pay<strong>in</strong>g out about half<br />

of exist<strong>in</strong>g <strong>in</strong>centives prior to sale is regarded by the<br />

Independent Valuer as “not an unusual practice for<br />

assets of this size”. This br<strong>in</strong>gs the current rental up to<br />

near market levels and makes the property more<br />

attractive to new <strong>in</strong>vestors <strong>in</strong> the Trust. The Manager<br />

has stated that it was not motivated to artificially boost<br />

distributions as <strong>in</strong>come was already comparatively<br />

high. This will be conclusively proved should the<br />

outstand<strong>in</strong>g balance of <strong>in</strong>centives be paid out <strong>in</strong><br />

read<strong>in</strong>ess for the sale of the property at the end of the<br />

Trust‟s expected life.<br />

Estimated total returns are underp<strong>in</strong>ned by the<br />

growth <strong>in</strong> lease and market rent levels. The Trust<br />

exceeds Lonsec‟s hurdle rate for this type of property<br />

trust by a comfortable marg<strong>in</strong>. This is assisted by the<br />

Manager‟s ability to source the asset from a related<br />

party, result<strong>in</strong>g <strong>in</strong> property transaction cost sav<strong>in</strong>gs.<br />

Initial gear<strong>in</strong>g is 45% (47.9%* with planned capital<br />

expenditure) which is around the mid-po<strong>in</strong>t of the<br />

current Loan to Value Ratio (LVR) range for stabilised<br />

unlisted property trusts/funds of 38% to 58%.<br />

Headroom to 60% covenant is significantly higher than<br />

most other unlisted trusts, with the property able to<br />

withstand a 21-25% fall <strong>in</strong> valuation before a breach of<br />

covenant. While debt is only 50% hedged, the<br />

Manager‟s current expectation is that market <strong>in</strong>terest<br />

rates and marg<strong>in</strong>s are more likely to reduce <strong>in</strong> the near<br />

future. The Manager conservatively allows for <strong>in</strong>terest<br />

rates to <strong>in</strong>crease through the life of the Trust.<br />

The overall fees and costs for this Trust (on a present<br />

value basis) are slightly higher than Lonsec‟s average<br />

for new unlisted property trusts. The rat<strong>in</strong>g for this subcriteria<br />

is assisted by there be<strong>in</strong>g no RE removal fee.<br />

(Note*: Over five years and assumes no <strong>in</strong>crease <strong>in</strong> property value).<br />

Management Criteria<br />

The <strong>Charter</strong> <strong>Hall</strong> Group (CHG) is well capitalised with<br />

balance sheet gear<strong>in</strong>g of 8% and look-through gear<strong>in</strong>g<br />

of 33%. Lonsec notes that CHG recorded a good first<br />

half FY12 operat<strong>in</strong>g result (+7% normalised earn<strong>in</strong>gs<br />

per share and +14% distributions per share). The<br />

outlook is underp<strong>in</strong>ned by the solid recurr<strong>in</strong>g <strong>in</strong>come<br />

from its directly held and co-owned property portfolio.<br />

The Directors and senior executives of the RE/<br />

Manager have a strong background <strong>in</strong> the property<br />

and funds management <strong>in</strong>dustries. <strong>Charter</strong> <strong>Hall</strong> is an<br />

<strong>in</strong>tegrated property group, with most activities<br />

undertaken <strong>in</strong>-house, giv<strong>in</strong>g the Trust the benefit of<br />

one of the best resourced teams <strong>in</strong> the sector.<br />

<strong>Charter</strong> <strong>Hall</strong> has a track record of deliver<strong>in</strong>g solid total<br />

returns over a 20-year period across a variety of retail<br />

trusts (closed end) and wholesale property funds when<br />

compared with appropriate benchmarks. The funds<br />

aimed at „retail‟ <strong>in</strong>vestors have delivered <strong>in</strong>come <strong>in</strong>-l<strong>in</strong>e<br />

with their objectives, however some of the open-end<br />

funds for which this team has been responsible for<br />

have underperformed a wholesale benchmark.<br />

Lonsec Limited ABN 56 061 751 102 AFSL No. 246842 Participant of ASX Group<br />

This <strong>in</strong>formation must be read <strong>in</strong> conjunction with the Warn<strong>in</strong>g, Disclaimer, and Disclosure at the end of this document<br />

2

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

While this asset has been sourced through a relatedparty,<br />

<strong>Charter</strong> <strong>Hall</strong> has well-def<strong>in</strong>ed protocols<br />

regard<strong>in</strong>g potential conflicts of <strong>in</strong>terest. Separate<br />

due diligence is conducted (<strong>in</strong>clud<strong>in</strong>g Independent<br />

Valuations), with approvals from both the exist<strong>in</strong>g<br />

owner and <strong>in</strong>com<strong>in</strong>g <strong>in</strong>vestor boards - where executive<br />

directors are not allowed to vote on related party terms<br />

of the transaction. The Group‟s disclosure to <strong>in</strong>vestors<br />

and <strong>in</strong>novative improvements to the Trust enhances<br />

Lonsec‟s rat<strong>in</strong>g of the management criteria.<br />

In order to sell down ownership <strong>in</strong> the property, new<br />

<strong>in</strong>vestors will be allotted different classes of units for<br />

specific periods and amounts of the equity rais<strong>in</strong>g. The<br />

units will either pay a cash return or a property return<br />

and will convert to Ord<strong>in</strong>ary Units should the m<strong>in</strong>imum<br />

targets specified be met. This is to ensure the smooth<br />

transfer of the property and/or return of <strong>in</strong>vestors‟<br />

capital if the First Close m<strong>in</strong>imum of $16m equity is not<br />

reached.<br />

If the Second Close amount of $24m is not raised,<br />

<strong>Charter</strong> <strong>Hall</strong> Group (the underwriter) may elect to own<br />

49.9% of the equity, but its <strong>in</strong>tention is to own less than<br />

25% and possibly 0% if there is sufficient <strong>in</strong>vestor<br />

demand for units <strong>in</strong> the Trust. Lonsec‟s rat<strong>in</strong>g for this<br />

category is marg<strong>in</strong>ally enhanced by <strong>Charter</strong> <strong>Hall</strong>‟s<br />

preparedness to underwrite the equity rais<strong>in</strong>g and to<br />

potentially take a stake <strong>in</strong> the Trust.<br />

Lonsec notes the Drag-Along Rights that the<br />

underwriter has if it holds 49.9% of the Trust. This<br />

enables the holder of the Acquisition Units to at any<br />

time after 30 June 2015 (subject to certa<strong>in</strong> restrictions<br />

under the Constitution) to request the RE to dispose of<br />

the property for not less than market valuation. Any<br />

holder of Acquisition Units has a first right of refusal<br />

to buy out holders of Ord<strong>in</strong>ary Units (if the RE wishes<br />

to sell the property <strong>in</strong> the best <strong>in</strong>terests of <strong>in</strong>vestors).<br />

Market Criteria<br />

The recent performance of office property rema<strong>in</strong>s<br />

the strongest sector overall and the most popular<br />

<strong>in</strong>vestment category for overseas <strong>in</strong>vestors. However,<br />

the effect of the multi-speed economy is becom<strong>in</strong>g<br />

more apparent <strong>in</strong> the different geographic markets.<br />

Persistent uncerta<strong>in</strong>ty <strong>in</strong> the global economy and<br />

equity markets has impacted more heavily <strong>in</strong> Sydney<br />

where the majority of office tenants are <strong>in</strong> the f<strong>in</strong>ancial<br />

or professional services sectors. Meanwhile demand<br />

for office space aris<strong>in</strong>g from the m<strong>in</strong><strong>in</strong>g boom is<br />

especially prevalent <strong>in</strong> Perth and Brisbane.<br />

The Perth suburban office market experienced<br />

improved tenant demand dur<strong>in</strong>g 2011 which mirrored<br />

Perth‟s CBD office prec<strong>in</strong>cts. With vacancy rates<br />

decl<strong>in</strong><strong>in</strong>g to 3.3% overall (1.4% A-grade) 1 , effective<br />

rental growth was strong <strong>in</strong> the CBD which has<br />

resulted <strong>in</strong> modest growth <strong>in</strong> secondary markets dur<strong>in</strong>g<br />

the second half of 2011. (Note 1: Colliers International as at 31<br />

December 2011).<br />

Office supply com<strong>in</strong>g on stream <strong>in</strong> Perth dur<strong>in</strong>g the<br />

next 12-18 months is mostly pre-committed. A new<br />

supply cycle may emerge from 2014 and ease<br />

vacancy rates. Meanwhile effective rental growth is<br />

well supported.<br />

Exit Strategy / Liquidity Criteria<br />

<strong>As</strong> a closed-end syndicate with no liquidity dur<strong>in</strong>g<br />

the <strong>in</strong>itial term, the Trust does not rate as well as<br />

those funds with some liquidity mechanisms (albeit<br />

limited). However, the def<strong>in</strong>ed term of the Trust‟s<br />

Liquidity Review allows <strong>in</strong>vestors to vote on whether<br />

to realise the asset. Even if the Trust cont<strong>in</strong>ues, the<br />

Manager is offer<strong>in</strong>g a Liquidity Strategy to assist<br />

m<strong>in</strong>ority unit-holders to exit at this po<strong>in</strong>t.<br />

There are provisions for hardship situations similar to<br />

other <strong>Charter</strong> <strong>Hall</strong> funds.<br />

The property, if offered for sale, should be attractive to<br />

private <strong>in</strong>vestors and small syndicate managers.<br />

Risk <strong>As</strong>sessment<br />

Lonsec rates the key risk factors associated with the<br />

CHD 144 Stirl<strong>in</strong>g St Trust <strong>in</strong> the table below, which are<br />

assessed <strong>in</strong> the overall context of both compet<strong>in</strong>g<br />

unlisted property funds and relative to other asset<br />

classes.<br />

Risk Factors Table Low Med High<br />

Operational Earn<strong>in</strong>gs<br />

Bus<strong>in</strong>ess Low<br />

Leas<strong>in</strong>g Low<br />

Capital Ga<strong>in</strong> vs. Income Med<br />

Diversification Med<br />

Market Volatility Med<br />

F<strong>in</strong>ancial<br />

Leverage (gear<strong>in</strong>g) Med<br />

Ref<strong>in</strong>anc<strong>in</strong>g Low<br />

Interest Cost / Hedg<strong>in</strong>g Med<br />

Currency Low<br />

Counterparty Low<br />

Support to Distributions Low<br />

Management & Others<br />

Experience Low<br />

Independence Low<br />

Related Party Transactions Med<br />

Liquidity / Exit Strategy High<br />

Lonsec Limited ABN 56 061 751 102 AFSL No. 246842 Participant of ASX Group<br />

This <strong>in</strong>formation must be read <strong>in</strong> conjunction with the Warn<strong>in</strong>g, Disclaimer, and Disclosure at the end of this document<br />

3

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

Capital ga<strong>in</strong> vs <strong>in</strong>come risk is deemed medium given<br />

that property funds have a higher element of capital<br />

risk than some other asset classes (eg: cash / bonds).<br />

Leverage (Gear<strong>in</strong>g) risk is deemed medium <strong>in</strong><br />

comparison to other <strong>in</strong>vestment classes (<strong>in</strong>clud<strong>in</strong>g<br />

listed property trusts), where there is lower or no<br />

gear<strong>in</strong>g (some wholesale property funds).<br />

Ref<strong>in</strong>anc<strong>in</strong>g risk is low as <strong>Charter</strong> <strong>Hall</strong> has a good<br />

record of be<strong>in</strong>g able to ref<strong>in</strong>ance its facilities. Although<br />

there is an <strong>in</strong>herent risk that property funds <strong>in</strong> some<br />

circumstances may not be able to obta<strong>in</strong> debt f<strong>in</strong>ance.<br />

Interest Cost / Hedg<strong>in</strong>g: The RE is target<strong>in</strong>g to<br />

ma<strong>in</strong>ta<strong>in</strong> hedg<strong>in</strong>g contracts <strong>in</strong> respect of at least 50%<br />

of the Trust‟s borrow<strong>in</strong>gs. While fully hedg<strong>in</strong>g protects<br />

<strong>in</strong>vestors from the majority of adverse rises <strong>in</strong> <strong>in</strong>terest<br />

costs, partly hedg<strong>in</strong>g gives flexibility to the Manager <strong>in</strong><br />

order to benefit from a fall <strong>in</strong> <strong>in</strong>terest costs.<br />

Currency: No part of the portfolio is directly exposed<br />

to foreign exchange movements.<br />

Related Party Transactions: The asset is currently<br />

owned by a related party. However, the Manager has<br />

clearly def<strong>in</strong>ed protocols for related party transactions /<br />

potential conflicts of <strong>in</strong>terest.<br />

Liquidity: No liquidity provisions are available dur<strong>in</strong>g<br />

the expected five year term of the Trust (except for<br />

hardship situations). While there is a scheduled<br />

Liquidity Event <strong>in</strong> 2017, sale of the asset or other<br />

liquidity options may not be possible due to market<br />

circumstances.<br />

Tak<strong>in</strong>g all these factors <strong>in</strong>to consideration, Lonsec<br />

considers an <strong>in</strong>vestment <strong>in</strong> the Trust to be of low to<br />

medium risk.<br />

Lonsec Limited ABN 56 061 751 102 AFSL No. 246842 Participant of ASX Group<br />

This <strong>in</strong>formation must be read <strong>in</strong> conjunction with the Warn<strong>in</strong>g, Disclaimer, and Disclosure at the end of this document<br />

4

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

1. Overview<br />

1.1. The Trust<br />

CHD 144 Stirl<strong>in</strong>g St is an unlisted unit trust, registered<br />

with ASIC as a managed <strong>in</strong>vestment scheme. The<br />

Trust will have an <strong>in</strong>itial <strong>in</strong>vestment term of five years.<br />

<strong>Charter</strong> <strong>Hall</strong> Direct Property Management Limited<br />

(CHDPML or „the RE/Manager‟) is seek<strong>in</strong>g to raise<br />

$32m <strong>in</strong> equity along with bank debt of $24.66m to<br />

f<strong>in</strong>ance a s<strong>in</strong>gle property at 144 Stirl<strong>in</strong>g Street Perth.<br />

The current owner is a related-party - <strong>Charter</strong> <strong>Hall</strong><br />

Core Plus Office Fund (CPOF).<br />

Source & Application of Funds<br />

This % %<br />

Rais<strong>in</strong>g Prop Equity<br />

$m<br />

Equity Raised $32.000<br />

Borrow<strong>in</strong>gs $24.660<br />

Total Sources $56.660<br />

Property Cost $54.800<br />

Stamp Duty $0.000 0.0% 0.0%<br />

RE Fees $1.096 2.0% 3.4%<br />

Debt Arranger Fee $0.104 0.2% 0.3%<br />

Debt Estab Costs $0.156 0.3% 0.5%<br />

Other Estab. Costs $0.204 0.4% 0.6%<br />

Cash/Work<strong>in</strong>g Capital $0.300<br />

Total Applications $56.660<br />

Proportion of Prop/Equity 2.8% 4.9%<br />

Equity Capital Rais<strong>in</strong>g Schedule<br />

First Close $16m<br />

Second Close $24m<br />

Total Offer $32m<br />

Current Trust: CPOF owns 100% Acquisition Units.<br />

Until m<strong>in</strong>imum 50.1% ($16m) of new equity is raised,<br />

Foundation Units are issued that pay a cash return. If<br />

this m<strong>in</strong>imum is not raised, <strong>in</strong>vestor application monies<br />

are returned (<strong>in</strong>clud<strong>in</strong>g accrued Distributions) and<br />

CPOF reta<strong>in</strong>s 100% of Acquisition Units.<br />

First Close: If 50.1% of equity capital raised, syndicate<br />

<strong>in</strong>vestors convert to Ord<strong>in</strong>ary Units that pay a property<br />

return. Further new <strong>in</strong>vestors are then issued Ord<strong>in</strong>ary<br />

A units also pay<strong>in</strong>g a property return.<br />

Second Close: If 75.1% of equity ($24m) raised, then<br />

Ord<strong>in</strong>ary A Units convert to Ord<strong>in</strong>ary Units.<br />

<strong>Charter</strong> <strong>Hall</strong> Group will reta<strong>in</strong> up to a maximum of<br />

24.9% of the Trust, as this is below the new account<strong>in</strong>g<br />

threshold for consolidation. However, its <strong>in</strong>tention is to<br />

sell its 100% hold<strong>in</strong>g.<br />

Ord<strong>in</strong>ary A Units: Allotted prior to the Second Close<br />

Amount be<strong>in</strong>g raised. Upon the Second Close Amount<br />

be<strong>in</strong>g achieved, all Ord<strong>in</strong>ary A Units will automatically<br />

convert to Ord<strong>in</strong>ary Units.<br />

Underwrit<strong>in</strong>g by <strong>Charter</strong> <strong>Hall</strong> Group<br />

If $24m or above is raised: <strong>Charter</strong> <strong>Hall</strong> Group may<br />

choose to acquire the balance of units available and<br />

Ord<strong>in</strong>ary A Units issued will convert to Ord<strong>in</strong>ary Units.<br />

If $16m but less than $24m is raised: <strong>Charter</strong> <strong>Hall</strong><br />

Group will acquire 49.9% of the Units <strong>in</strong> the Trust and<br />

Ord<strong>in</strong>ary A Units issued may be compulsorily<br />

redeemed (the Manager will return all Application<br />

Monies to Ord<strong>in</strong>ary A Unit applicants <strong>in</strong>clud<strong>in</strong>g any<br />

accrued distribution entitlements).<br />

Offer Opens: 15 May 2012<br />

Offer Closes: the earlier of the 30 June 2012 or when<br />

the Maximum Offer of $32m <strong>in</strong> equity is raised.<br />

1.2. Investment Limits / Applications<br />

Direct Investors: M<strong>in</strong>imum application is for $50,000<br />

and thereafter <strong>in</strong> multiples of $5,000.<br />

Indirect Investors: <strong>As</strong> advised by their IDPS operator.<br />

1.3. Income Distributions<br />

Trust distributions are expected to be paid monthly (<strong>in</strong><br />

arrears), with the first amount to be paid for the period<br />

end<strong>in</strong>g 30 June 2012 with<strong>in</strong> 30 days of the end of the<br />

month.<br />

1.4. Liquidity<br />

The Trust has been set up as a closed-end syndicate<br />

with an <strong>in</strong>itial term of five (5) years (expiry estimated to<br />

be on or about 30 June 2017) <strong>in</strong> order to provide<br />

greater certa<strong>in</strong>ty to Unit-holders on an exit strategy.<br />

The RE/Manager will not be offer<strong>in</strong>g <strong>in</strong>vestors any<br />

liquidity mechanism over the Trust’s expected<br />

<strong>in</strong>vestment term (apart from hardship liquidity <strong>in</strong><br />

limited circumstances).<br />

The RE/Manager will provide Unit-holders with a<br />

‘liquidity review’ at the end of the five-year<br />

<strong>in</strong>vestment term to vote on whether the Trust should<br />

cont<strong>in</strong>ue to hold the Property.<br />

The Trust will only be rolled forward for an additional<br />

five-year term if at least 75% of Unit-holders vote <strong>in</strong><br />

favour of the resolution.<br />

If the asset is reta<strong>in</strong>ed follow<strong>in</strong>g this vote, the<br />

RE/Manager will implement a ‘liquidity strategy’ to<br />

assist m<strong>in</strong>ority Unit-holders to exit their<br />

<strong>in</strong>vestment. If less than 75% of the Unit-holders do not<br />

support the resolution to extend, then the property<br />

must be sold and the Trust wound up.<br />

Lonsec Limited ABN 56 061 751 102 AFSL No. 246842 Participant of ASX Group<br />

This <strong>in</strong>formation must be read <strong>in</strong> conjunction with the Warn<strong>in</strong>g, Disclaimer, and Disclosure at the end of this document<br />

5

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

1.5. Overview of Trust Property<br />

Property State Value Val'n Transaction % Net Income Valuer's Valuer's Net Vacant Tenants<br />

Date Price Port Income Yield Disc. Cap. Area<br />

$m $m $m Rate Rate m2 m2<br />

144 Stirl<strong>in</strong>g St, Perth WA 54.8 Apr-12 54.8 100% 4.749 8.67% 10.25% 8.50% 11,042 0<br />

1.6. Comparison with Other Office Property Funds<br />

Lonsec Limited ABN 56 061 751 102 AFSL No. 246842 Participant of ASX Group<br />

This <strong>in</strong>formation must be read <strong>in</strong> conjunction with the Warn<strong>in</strong>g, Disclaimer, and Disclosure at the end of this document<br />

Hatch <strong>As</strong>soc; WA Police<br />

Dept, Wilson Carpark<strong>in</strong>g<br />

<strong>Charter</strong> <strong>Hall</strong> Cromwell CorVal Centuria CH Direct<br />

144 Stirl<strong>in</strong>g St Ipswich PT2 8 Aust Ave Prop. Fund<br />

Mar-12 Dec-11 May-11 May-11 Mar-11<br />

Property Sector Office Office Office/Ind. Office Office/Other<br />

No. Properties 1 1 2 1 9<br />

Total <strong>As</strong>sets $54.8m $94.2m $54.5m $31.5m $500m<br />

<strong>As</strong>set Locations (Ma<strong>in</strong>) WA Qld NSW, ACT NSW NSW, Vic, Qld<br />

Valuation Date Mar-12 Oct-11 Apr & May 11 Mar-11 Dec-10<br />

Valuer Cap. Rate (avg) 8.50% 8.50% 7.87% 8.00% 8.53%<br />

Valuer Disc. Rate (avg) 10.25% 10.00% 9.69% 9.50% 9.45%<br />

Pre-tax Distrib. Yield (Yr 1) 8.85% 7.75% 8.50%^^ 8.00% ^^ 6.35%<br />

% Income Support nil 100%*** 3% 17% nil<br />

Tax Def. (Yr 1) 44% 100% 50% 100% 100%<br />

After-tax Distrib. Yield (Yr 1) 6.55% 7.75% 6.52% 8.00% 6.35%<br />

Est. IRR (pre-tax) 11.6% 11.7% 10.7% n/a 11.9%<br />

Lonsec Hurdle Rate 9.8% 9.7% 10.0% 9.9% 9.9%<br />

Premium IRR / Hurdle Rate 19% 21% 7% 7% 20%<br />

Gear<strong>in</strong>g (LVR) 45% 53% 48% 50% 50%<br />

Debt Cost 6.30% 5.79% 7.18% 7.65% 7.16%<br />

Initial NTA (Lonsec adj.) $0.95 $0.92 $0.91 $0.90 $0.98**<br />

Property Initial Yield 8.67% 8.48% 8.82% 8.83% 7.70%<br />

WALE by <strong>in</strong>come (yrs) 7.8 13.7 12.3 6.1 4.7<br />

Occupancy 100% 100% 100% 100% 94%<br />

Major Tenants<br />

Lonsec Rat<strong>in</strong>g<br />

(Note*: Post capital rais<strong>in</strong>g).<br />

(Note ** $1 equvalent basis).<br />

Hatch;<br />

WA Police<br />

Recomm.<br />

(Upper End)<br />

Qld Dept of Public<br />

Works<br />

Recomm.<br />

(Upper End)<br />

Aust. Red<br />

Cross; C'wealth<br />

Dept of E&WR<br />

Recomm.<br />

(Upper End)<br />

(Note ***: Fund<strong>in</strong>g Allowance from Builder equivalent to discount on purchase price).<br />

(Note ^^: Includes <strong>in</strong>come support).<br />

Fujitsu; SOPA;<br />

Watpac<br />

Recomm.<br />

(Upper End)<br />

Orica; Barristers<br />

Chambers; NSW<br />

Gov't; Wilson<br />

Park<strong>in</strong>g<br />

Recomm.<br />

(Upper End)<br />

6

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

2. F<strong>in</strong>ancial Analysis<br />

2.1. Income/Expenses Analysis<br />

Year end Jun-13 Jun-14<br />

$m $m<br />

Property Income 4.920 5.067<br />

Interest Income 0.013 0.017<br />

Total Income 4.933 5.084<br />

Management Fee -0.332 -0.335<br />

Other Expenses -0.111 -0.112<br />

Interest Expense -1.573 -1.601<br />

Total Operat<strong>in</strong>g Expenses -2.015 -2.048<br />

Net Operat<strong>in</strong>g Income 2.918 3.036<br />

(Inc Reserve)/Inc Support -0.086 -0.108<br />

Net Distribution 2.832 2.928<br />

Ord Units Issued (m) 32.000 32.000<br />

Distrib./Unit 8.85c 9.15c<br />

Yield (Annualised) 8.85% 9.15%<br />

% Tax Deferred 44% 41%<br />

The table above details the Manager‟s estimates of<br />

<strong>in</strong>come and expenses for the Trust over the next two<br />

years, which Lonsec has verified as be<strong>in</strong>g achievable.<br />

From net operat<strong>in</strong>g <strong>in</strong>come, the Manager reta<strong>in</strong>s funds<br />

<strong>in</strong> reserve for a later period where there may be<br />

vacancies upon lease expiries result<strong>in</strong>g <strong>in</strong> lower<br />

<strong>in</strong>come. Should this occur, the reserve is available to<br />

boost distributions or if not, the cash will be available<br />

to reduce debt or contribute to capital expenditure.<br />

When the exist<strong>in</strong>g owner (CPOF) was negotiat<strong>in</strong>g the<br />

renewal of the lease with the major tenant (Hatch), it<br />

was agreed that unexpired rental <strong>in</strong>centives would<br />

be paid out if surplus cash was available to CPOF.<br />

Follow<strong>in</strong>g a recent capital rais<strong>in</strong>g, CPOF made a part<br />

payout of $1.9m, which is the present value of $2.7m<br />

(half of the total outstand<strong>in</strong>g). This was accretive to<br />

CPOF‟s earn<strong>in</strong>gs (as it will cont<strong>in</strong>ue to own all/part of<br />

the property until all the equity is raised <strong>in</strong> this Trust).<br />

The Trust will reimburse CPOF the $1.9m by way of a<br />

higher price paid for the property ($54.8m) which is<br />

supported by an <strong>update</strong>d Independent Valuation.<br />

While this has the impact of <strong>in</strong>creas<strong>in</strong>g <strong>in</strong>come to the<br />

Trust for the first four years of the Trust (until 1 July<br />

2016), it br<strong>in</strong>gs the net rental received more closely <strong>in</strong><br />

l<strong>in</strong>e with market rents for this area of Perth.<br />

<strong>As</strong>sumptions underly<strong>in</strong>g <strong>in</strong>come<br />

The Manager‟s allowances on the property <strong>in</strong>come are<br />

reasonable and <strong>in</strong> l<strong>in</strong>e with those made <strong>in</strong> the Valuer‟s<br />

report.<br />

For Lonsec‟s comparative purposes over ten years, it<br />

is assumed that the major tenant (Hatch) will vacate <strong>in</strong><br />

August 2021 (no % retention applied) <strong>in</strong>-l<strong>in</strong>e with that<br />

of the Valuer. The follow<strong>in</strong>g amounts have been<br />

deducted from <strong>in</strong>come upon the major office lease<br />

expiries.<br />

Allowances Upon Expiry<br />

Office<br />

Avg Vacancy (mnths)<br />

Prob. Of Renewal<br />

Effective Vacancy (mnths)<br />

Incentives (5 yr lease)<br />

Incentive – effective (mnths)<br />

<strong>Charter</strong><br />

<strong>Hall</strong><br />

Lonsec Limited ABN 56 061 751 102 AFSL No. 246842 Participant of ASX Group<br />

This <strong>in</strong>formation must be read <strong>in</strong> conjunction with the Warn<strong>in</strong>g, Disclaimer, and Disclosure at the end of this document<br />

4<br />

0%<br />

4<br />

12%<br />

7-8<br />

Valuer<br />

6<br />

0%<br />

6<br />

5-10%<br />

3-6<br />

Total Allowance (mnths) 11-12 9-12<br />

Agent‟s/Leas<strong>in</strong>g Fees 12% 12%<br />

However, for the space occupied by the WA Police<br />

(M<strong>in</strong>istry of Works lease), <strong>Charter</strong> <strong>Hall</strong> assumes a 12<br />

month option is taken-up and then for the tenant to<br />

vacate March 2017. A 25% possibility of reta<strong>in</strong><strong>in</strong>g the<br />

tenant has been applied to the retail café <strong>in</strong> FY14.<br />

Capital Expenditure<br />

<strong>Charter</strong> <strong>Hall</strong> Valuer<br />

Years 1-5 $1.594m $1.539m<br />

Years 6-10 n.a. nil<br />

Per NLA $144/m2 $139/m2<br />

2.2. Debt Position / Interest Costs<br />

The property will be funded by a Bank Loan facility of<br />

$26m secured aga<strong>in</strong>st the property, provided by an<br />

Australian bank on the terms detailed <strong>in</strong> the next table.<br />

The Manager has arranged hedg<strong>in</strong>g (via <strong>in</strong>terest rate<br />

swaps) of 50% of the Bank Loan for three years until<br />

December 2014. Half of <strong>in</strong>terest costs are locked <strong>in</strong> for<br />

this period at an all-<strong>in</strong> effective rate of 6.30% pa.<br />

On the unhedged portion, there is sufficient buffer of<br />

cash reserves so that FY13-14 distributions would not<br />

be affected by an <strong>in</strong>crease of 0.75% <strong>in</strong> <strong>in</strong>terest costs.<br />

7

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

Loan Terms<br />

Facility Limit $26.0m<br />

Drawn-down $24.66m (Initial)<br />

Expiry 3 yrs<br />

(Jan 2015)<br />

Cost of Debt 6.30% (<strong>in</strong>cl hedg<strong>in</strong>g)<br />

% Debt Hedged 50%<br />

Hedge Expiry 9 Dec 2014<br />

LVR 45.0%<br />

LVR Covenant 60%<br />

ICR 2.82x<br />

ICR Covenant 1.65x<br />

Capital expenditure on the build<strong>in</strong>g is expected to be<br />

around $1.5m dur<strong>in</strong>g the <strong>in</strong>itial term of the Trust, which<br />

will be funded from debt. If the value of the property<br />

does not <strong>in</strong>crease, gear<strong>in</strong>g would edge up to 47.9%<br />

(LVR).<br />

Gear<strong>in</strong>g Comparison / Covenant Headroom<br />

Trust Comparison – Gear<strong>in</strong>g (LVR)<br />

Fund / Trust Gear<strong>in</strong>g - LVR<br />

Heathley Diversified 38%<br />

<strong>Charter</strong> <strong>Hall</strong> Direct 43%<br />

<strong>Charter</strong> <strong>Hall</strong> Industrial 45%<br />

CHD 144 Stirl<strong>in</strong>g St 45%<br />

<strong>Charter</strong> <strong>Hall</strong> Retail 46%<br />

CorVal PT2 47%<br />

AU Healthcare 47%<br />

<strong>As</strong>pen Parks 47%<br />

Centuria 8 Aust. Ave 50%<br />

AU Retail 52% (43%)*<br />

Cromwell Ipswich 52.5%<br />

AU Diversified 53% (44%)*<br />

Arena PF<br />

Arena PF (Debt/<strong>As</strong>sets)<br />

(Note*: After current Rights Issue)<br />

52%-54%<br />

(40%-42%)<br />

The Trust‟s Bank Loan to Value Ratio is sensitive to<br />

changes <strong>in</strong> capitalisation rates for properties - as<br />

determ<strong>in</strong>ed by market transactions and valuations. The<br />

table below stress-tests the headroom to covenant,<br />

should these rates rise.<br />

Cap’n<br />

Rate<br />

LVR Sensitivity – CHD 144 Stirl<strong>in</strong>g St<br />

<strong>Portfolio</strong><br />

Valu’n<br />

Value<br />

Chg<br />

LVR Headroom<br />

to<br />

Covenant<br />

Base (8.5%) $54.8m 0 45.0% 15.0% pts<br />

+1.0% $49.0m -11% 50.3% 9.7% pts<br />

+2.8% $41.1m -25% 60.0% 0% pts<br />

The CHD 144 Stirl<strong>in</strong>g St Trust has a very good<br />

coverage above LVR covenant, with the portfolio able<br />

to withstand a 21-25% reduction <strong>in</strong> the value of the<br />

property before reach<strong>in</strong>g its 60% covenant. (The<br />

lower buffer is calculated on the expected higher debt<br />

after borrow<strong>in</strong>g to f<strong>in</strong>ance capital expenditure). A rise<br />

<strong>in</strong> <strong>in</strong>come or property value will improve the headroom.<br />

Interest Cover Ratio of 2.82x (FY13) is strong, with<br />

the property net <strong>in</strong>come hav<strong>in</strong>g to reduce by 42%<br />

before the covenant of 1.65x be<strong>in</strong>g breached.<br />

2.3. Fee Structure<br />

Comparison of Establishment Fees/Costs<br />

Total Establishment Fees/Cost Comparison<br />

Value<br />

$m<br />

%<br />

Prop.<br />

Lonsec Limited ABN 56 061 751 102 AFSL No. 246842 Participant of ASX Group<br />

This <strong>in</strong>formation must be read <strong>in</strong> conjunction with the Warn<strong>in</strong>g, Disclaimer, and Disclosure at the end of this document<br />

%<br />

Equity<br />

RE Fees 1.200 2.2% 3.8%<br />

Other Estab. Costs 0.360 0.6% 1.1%<br />

Total RE Fees & Costs 1.560 2.8% 4.9%<br />

Lonsec Avg (New Funds) n/a 2.7% 5.2%<br />

The RE/Manager will charge a 2% Transaction Fee of<br />

the gross asset value for structur<strong>in</strong>g the transaction;<br />

arrang<strong>in</strong>g the Bank Loan; and rais<strong>in</strong>g the equity.<br />

Lonsec‟s average now excludes the Advisor Fee<br />

component. Exclud<strong>in</strong>g this, the establishment fees &<br />

costs are about average for unlisted property funds.<br />

On-go<strong>in</strong>g Management Fees & Expenses<br />

The Manager‟s annual management fees and<br />

expenses compared to <strong>in</strong>dustry benchmarks are set<br />

out <strong>in</strong> the follow<strong>in</strong>g tables.<br />

Comparison of Management Expense Ratios<br />

% of Gross <strong>As</strong>sets M/ment<br />

Fee<br />

Other<br />

Exp<br />

Total<br />

MER<br />

CHD 144 Stirl<strong>in</strong>g St 0.60% 0.20% 0.80%<br />

Lonsec Unlisted Avg. 1 0.60% 0.16% 0.76%<br />

Lonsec Bus+Prop Avg 1.33% 0.25% 1.58%<br />

Comparison of Indirect Cost Ratios<br />

% of Equity M/ment<br />

Fee<br />

Other<br />

Exp<br />

Total<br />

lCR<br />

CHD 144 Stirl<strong>in</strong>g St 1.09% 0.36% 1.45%<br />

Lonsec Unlisted Avg. 1 1.12% 0.31% 1.45%<br />

Lonsec Bus+Prop Avg 2.05% 0.54% 2.59%<br />

(Note1: Excludes trusts that own property and operate a bus<strong>in</strong>ess<br />

that requires more <strong>in</strong>tensive management and thus higher fees).<br />

8

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

Other Fees<br />

Performance Fee: The RE/Manager is entitled to be<br />

allocated a 15% share of the excess total return<br />

(Internal Rate of Return) above 10% pa.<br />

The performance fee hurdle rate of 10% is similar to<br />

its peer group. The fee entitlement (15%) above this<br />

hurdle rate is <strong>in</strong> l<strong>in</strong>e with the <strong>in</strong>centive structure (midpo<strong>in</strong>t<br />

15%) adopted by its peer group. This fee will<br />

only be paid (if applicable) upon sale of the property<br />

and distribution of net proceeds to <strong>in</strong>vestors.<br />

Sell<strong>in</strong>g Fee: A fee of 1% of the gross value of assets<br />

sold is payable to the RE/Manager with any additional<br />

sell<strong>in</strong>g costs to be deducted from the net proceeds<br />

(est. agent‟s fees, legal costs etc).<br />

Lonsec notes that the Manager has no Removal Fee<br />

(paid if removed as the RE of a Trust by a unit-holder<br />

vote) <strong>in</strong> l<strong>in</strong>e with the <strong>in</strong>dustry mov<strong>in</strong>g away from this<br />

type of „poison pill‟ provision, thereby improv<strong>in</strong>g unitholder‟s<br />

ability to oust poorly perform<strong>in</strong>g Managers.<br />

Total Fees Comparison<br />

For comparative purposes with our sample of unlisted<br />

funds, Lonsec has estimated the present value of total<br />

fees and expenses paid to the RE/Manager by the<br />

Trust over a ten year period. This considers the<br />

differences <strong>in</strong> tim<strong>in</strong>g of <strong>in</strong>itial establishment costs, ongo<strong>in</strong>g<br />

expenses and back-end performance/ disposal<br />

fees, as well as vary<strong>in</strong>g <strong>in</strong>vestment terms. In order to<br />

calculate performance fees, Lonsec has assumed a<br />

30% <strong>in</strong>crease <strong>in</strong> the gross asset value over ten years.<br />

Comparison of PV of Total Fees & Expenses<br />

% Total<br />

<strong>As</strong>sets<br />

% Net<br />

<strong>As</strong>sets<br />

CHD 144 Stirl<strong>in</strong>g St 9.1% 15.2%<br />

Lonsec New Unlisted Fund Avg 8.4% 14.9%<br />

The Trust‟s fee structure (adjusted to a present value /<br />

net assets basis) is slightly higher than the Lonsec<br />

sector average for new* unlisted property funds, due<br />

to the marg<strong>in</strong>ally higher impact of its performance fee.<br />

(Note*: Lonsec has separated out new and exist<strong>in</strong>g funds as<br />

the latter usually have lower establishment costs after hav<strong>in</strong>g<br />

absorbed a large proportion of the up-front costs with<strong>in</strong> the<br />

first few years of operation).<br />

2.4. Distributions / Taxation<br />

Lonsec has compared the CHD 144 Stirl<strong>in</strong>g St Trust<br />

distribution yield with a sample of unlisted trusts that<br />

have made offers to the public over the <strong>last</strong> 12-18<br />

months. The Trust offers a superior yield on a pretax<br />

basis, but on an after-tax basis it is more <strong>in</strong> l<strong>in</strong>e<br />

with the average, given a relatively low tax deferred.<br />

CHD 144 Stirl<strong>in</strong>g St Distributions<br />

FY13 FY14<br />

Unit Cost $1.00 $1.00<br />

Distribution/unit 8.85c 9.15c<br />

Pre-tax Yield 8.85% 9.15%<br />

Tax Advantaged 44% 41%<br />

Yield after 46.5% tax 6.55% 6.64%<br />

Grossed-up Yield 12.23% 12.41%<br />

Yield after 15% tax 8.11% 8.34%<br />

Grossed-up Yield 9.54% 9.81%<br />

Lonsec Industry Distributions Comparison<br />

Trust/Sector (Yr 1) Pre-tax<br />

Yield<br />

Lonsec Limited ABN 56 061 751 102 AFSL No. 246842 Participant of ASX Group<br />

This <strong>in</strong>formation must be read <strong>in</strong> conjunction with the Warn<strong>in</strong>g, Disclaimer, and Disclosure at the end of this document<br />

Tax<br />

Def.<br />

After tax<br />

Yield 1<br />

Lonsec Sample High 8.85% 100% 8.00%<br />

CHD 144 Stirl<strong>in</strong>g St 8.85% 44% 6.55%<br />

Lonsec Office Avg 7.30% 72% 6.38%<br />

Lonsec Sample Avg. 7.00% 73% 6.32%<br />

Lonsec Sample Low 5.69% 22% 3.79%<br />

(Note1: After tax of 46.5%).<br />

Comparisons – Other Property Funds<br />

Fund / Trust Year 1 Distrib. Yield<br />

(Pre-tax)<br />

<strong>As</strong>pen Parks 8.90%<br />

CHD 144 Stirl<strong>in</strong>g St 8.85%<br />

Corval PT2 8.20%<br />

<strong>Charter</strong> <strong>Hall</strong> Industrial 8.16%<br />

<strong>Charter</strong> <strong>Hall</strong> Retail 8.00%<br />

Cromwell ICHT 7.75%<br />

Centuria 8 Aust. Ave 6.94%<br />

AU Healthcare 6.90%<br />

<strong>Charter</strong> <strong>Hall</strong> Direct 6.35%<br />

AU Diversified 6.28%<br />

AU Retail 5.94%<br />

Mill<strong>in</strong>ium HealthCare Option 5.69%<br />

(Note: Excludes Fee for Service negotiated with Advisor)<br />

Fund / Trust Yield After-<br />

46.5% tax<br />

Yield After-<br />

15% tax<br />

<strong>As</strong>pen Parks 8.28% 8.70%<br />

<strong>Charter</strong> <strong>Hall</strong> Retail 8.00% 8.00%<br />

Cromwell ICHT 7.75% 7.75%<br />

Centuria 8 Aust. Ave 6.94% 6.94%<br />

<strong>Charter</strong> <strong>Hall</strong> Industrial 6.66% 7.68%<br />

CHD 144 Stirl<strong>in</strong>g St 6.55% 8.11%<br />

<strong>Charter</strong> <strong>Hall</strong> Direct 6.35% 6.35%<br />

Corval PT2 6.29% 7.58%<br />

AU Healthcare 5.87% 6.57%<br />

Mill<strong>in</strong>ium HealthCare Option 5.56% 5.65%<br />

AU Diversified 4.29% 5.63%<br />

AU Retail 3.79% 5.25%<br />

(Note: Excludes Fee for Service negotiated with Advisor)<br />

9

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

A relatively low portion of distributions paid to <strong>in</strong>vestors<br />

will be tax advantaged. This is due to the property<br />

be<strong>in</strong>g an exist<strong>in</strong>g build<strong>in</strong>g with lower capital allowances<br />

available for structure, plant and equipment and the<br />

write-off (over time) of establishment costs.<br />

2.5. Total Returns<br />

The key f<strong>in</strong>ancial performance measure that Lonsec<br />

focuses on is ten year Internal Rate of Return (IRR) of<br />

the Syndicate and sensitivities. The basic rationale<br />

beh<strong>in</strong>d us<strong>in</strong>g the IRR f<strong>in</strong>ancial analysis is that it<br />

attempts to f<strong>in</strong>d a s<strong>in</strong>gle number that summarises the<br />

merits of an <strong>in</strong>vestment and depends on only the cash<br />

flows of the <strong>in</strong>vestment. The IRR is compared with<br />

Lonsec‟s benchmark hurdle rate.<br />

Lonsec Internal Rate of Return (net after fees)<br />

Pre-tax<br />

Net<br />

(46.5%)*<br />

Net<br />

(15%)*<br />

CHD 144 Stirl<strong>in</strong>g St 11.58% 7.84% 10.30%<br />

Lonsec Benchmark Rate 9.75% 5.71% 8.48%<br />

Lonsec Office Sector Avg 11.15% 8.24% 10.33%<br />

Lonsec Sample Average 11.47% 8.49% 10.47%<br />

(Note*: Also net of capital ga<strong>in</strong>s tax).<br />

Total returns (pre-tax) estimated by Lonsec for the<br />

CHD 144 Stirl<strong>in</strong>g St Trust is about average for<br />

unlisted property trusts and slightly better than<br />

that for office trusts recently reviewed by Lonsec.<br />

Due to low tax deferred, estimated after-tax (46.5%)<br />

total returns are <strong>in</strong>ferior to Lonsec‟s sector averages.<br />

For a superannuation fund <strong>in</strong>vest<strong>in</strong>g <strong>in</strong> the Trust, the<br />

after-tax (15%) total returns are only slightly below<br />

Lonsec‟s sector averages.<br />

Comparison – Other Property Funds<br />

Est. Fund / Trust<br />

IRR<br />

Pre-tax<br />

pa<br />

Net<br />

(46.5%)<br />

Net<br />

(15.0%)<br />

AU Healthcare 13.1% 10.1% 11.8%<br />

Mill<strong>in</strong>ium Health Care 13.0% 9.8% 12.0%<br />

<strong>As</strong>pen Parks 12.7% 9.8% 11.5%<br />

<strong>Charter</strong> <strong>Hall</strong> Direct 11.9% 9.3% 11.0%<br />

Cromwell ICHT 11.7% 8.6% 10.6%<br />

CHD144 Stirl<strong>in</strong>g St 11.6% 7.8% 10.3%<br />

<strong>Charter</strong> <strong>Hall</strong> Industrial 11.5% 8.3% 10.5%<br />

AU Diversified 11.2% 7.5% 9.9%<br />

AU Retail 11.2% 7.9% 10.2%<br />

Centuria 8 Aust. Ave 11.2% 9.4% 10.6%<br />

<strong>Charter</strong> <strong>Hall</strong> Retail 11.1% 8.4% 10.2%<br />

Arena PF 10.7% 8.4% 10.0%<br />

Corval PT2 10.7% 7.8% 9.7%<br />

(Note: Excludes Fee for Service negotiated with Advisor)<br />

These estimates assume a growth <strong>in</strong> rental <strong>in</strong>come <strong>in</strong><br />

l<strong>in</strong>e with market as assessed by the Valuer (3% for<br />

Perth office market) and that the capital value of the<br />

portfolio <strong>in</strong>creases <strong>in</strong> l<strong>in</strong>e with this. Changes <strong>in</strong> market<br />

rental growth and capitalisation rates will determ<strong>in</strong>e the<br />

actual capital growth. The term<strong>in</strong>al capitalisation rate<br />

rises from 8.5% to 8.75% (as per Valuer).<br />

<strong>As</strong> the build<strong>in</strong>g was recently refurbished, capital<br />

expenditure over the next ten years will be relatively<br />

m<strong>in</strong>or (as per page 7).<br />

The estimates also <strong>in</strong>corporate an <strong>in</strong>crease <strong>in</strong> <strong>in</strong>terest<br />

costs as follows:<br />

FY17: No hedg<strong>in</strong>g, rate up 0.25% to 6.55%.<br />

FY18: Rate up 0.25% to 6.80%.<br />

Should some of these costs not occur, then the<br />

estimated returns could be greater. However, <strong>in</strong>terest<br />

costs may rise and other assumptions with regard to<br />

rental levels and operat<strong>in</strong>g costs (both direct property<br />

costs and those associated with the Trust) may be<br />

higher than Lonsec has factored <strong>in</strong> and total returns<br />

may be less than estimated. In the follow<strong>in</strong>g table, we<br />

have detailed total return sensitivities to certa<strong>in</strong><br />

variables.<br />

Sensitivity of Lonsec IRR to Key <strong>As</strong>sumptions<br />

Scenario<br />

Pre-tax<br />

Lonsec Limited ABN 56 061 751 102 AFSL No. 246842 Participant of ASX Group<br />

This <strong>in</strong>formation must be read <strong>in</strong> conjunction with the Warn<strong>in</strong>g, Disclaimer, and Disclosure at the end of this document<br />

After Tax<br />

(@46.5%)*<br />

Lonsec Base Case 11.6% 7.8%<br />

+10% Interest Costs<br />

- 10% Interest Costs<br />

2.0% pa Rental Growth<br />

4.0% pa Rental Growth<br />

11.1%<br />

12.1%<br />

10.6%<br />

12.6%<br />

(Note*: After tax is also net of capital ga<strong>in</strong>s tax).<br />

7.5%<br />

8.2%<br />

6.9%<br />

8.8%<br />

10

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

2.6. Balance Sheet / Net <strong>As</strong>set Back<strong>in</strong>g<br />

<strong>As</strong> at end Jun-12<br />

$m<br />

Cash $0.30<br />

Property Value $54.80<br />

Stamp Duty $0.00<br />

Other Capitalised Expenses $0.26<br />

Total <strong>As</strong>sets $55.36<br />

Current Liabs $0.00<br />

Interest Bear<strong>in</strong>g Loan $24.66<br />

Other Non Current Liabs. $0.00<br />

Total Liabilities $24.66<br />

Net <strong>As</strong>sets $30.70<br />

No. of Units Issued 32.000<br />

Account<strong>in</strong>g NTA per unit $0.959<br />

Less Lonsec Adjustments<br />

Stamp Duty $0.00<br />

Capitalised Expenses $0.26<br />

$30.44<br />

Lonsec Adj. NTA per unit $0.951<br />

Lonsec estimates that the NTA of CH 144 Stirl<strong>in</strong>g St<br />

will exceed <strong>in</strong>vestors‟ <strong>in</strong>itial $1.00 with<strong>in</strong> approximately<br />

two years of the Trust‟s commencement date. This<br />

assumes that the property is revalued, tak<strong>in</strong>g <strong>in</strong>to<br />

account only the <strong>in</strong>crease <strong>in</strong> the market rental of<br />

around 3% pa. If capitalisation rates change, the Net<br />

<strong>As</strong>set Value could change by 3.7c for each 0.25%<br />

po<strong>in</strong>t change.<br />

Thus the break-even period for the Trust is superior to<br />

that of most new unlisted funds rated by Lonsec, which<br />

typically have a break-even period of three to four<br />

years. This is attributable to the lower transaction costs<br />

available to the Trust.<br />

Comparison – Initial Net <strong>As</strong>set Back<strong>in</strong>g<br />

Fund / Trust Net <strong>As</strong>set Back<strong>in</strong>g<br />

Mill<strong>in</strong>ium HealthCare Option^ $1.02<br />

AU Healthcare # $0.99<br />

AU Retail $0.99<br />

<strong>As</strong>pen Parks # $0.98<br />

<strong>Charter</strong> <strong>Hall</strong> Direct $0.98<br />

<strong>Charter</strong> <strong>Hall</strong> Industrial # $0.96<br />

<strong>Charter</strong> <strong>Hall</strong> 144 Stirl<strong>in</strong>g St $0.95<br />

Centuria 8 Aust. Ave $0.94<br />

<strong>Charter</strong> <strong>Hall</strong> Retail $0.92<br />

Cromwell ICHT $0.92<br />

Corval PT2 $0.91<br />

(Note#: NAB based on an equivalent of $1.00). (Note^: Mill<strong>in</strong>ium<br />

property purchased below valuation and no-upfront fees).<br />

Lonsec Limited ABN 56 061 751 102 AFSL No. 246842 Participant of ASX Group<br />

This <strong>in</strong>formation must be read <strong>in</strong> conjunction with the Warn<strong>in</strong>g, Disclaimer, and Disclosure at the end of this document<br />

11

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

3. Management<br />

An assessment of Management is another key<br />

performance measure and is largely qualitative,<br />

focus<strong>in</strong>g on the ownership, operat<strong>in</strong>g and report<strong>in</strong>g<br />

structure, property <strong>in</strong>vestment policy and selection<br />

criteria. Capable and experienced management is vital<br />

to the success of the Trust. Previous performance is<br />

evaluated, but is not necessarily a guide to future<br />

returns.<br />

3.1. The Responsible Entity (RE)<br />

<strong>Charter</strong> <strong>Hall</strong> Direct Property Management Limited<br />

(CHDPML or „the RE‟) will act as the responsible entity<br />

for the Trust. CHDPML is licensed by the Australian<br />

Securities and Investment Commission (ASIC) to act<br />

as the responsible entity for managed <strong>in</strong>vestment<br />

schemes (MIS).<br />

CHDPML is a wholly-owned subsidiary of the ASXlisted<br />

<strong>Charter</strong> <strong>Hall</strong> Group (<strong>Charter</strong> <strong>Hall</strong> or „the<br />

Group‟). <strong>Charter</strong> <strong>Hall</strong> is a specialist property funds<br />

management group with <strong>in</strong>-house development and<br />

property services capabilities. Founded <strong>in</strong> 1991, the<br />

Group is listed on the ASX as a stapled security and is<br />

currently <strong>in</strong>cluded <strong>in</strong> the S&P/ASX A-REIT 200 Index.<br />

<strong>Charter</strong> <strong>Hall</strong> currently has „<strong>As</strong>sets Under Management‟<br />

of $10.1b across listed A-REITs and a number of<br />

wholesale and retail <strong>in</strong>vestor unlisted property funds.<br />

Lonsec has reviewed recent f<strong>in</strong>ancial results of the<br />

Group and notes the follow<strong>in</strong>g:<br />

<strong>Charter</strong> <strong>Hall</strong> Group – F<strong>in</strong>ancial Summary<br />

HY Dec<br />

„10<br />

FY June<br />

„11<br />

HY Dec<br />

„11<br />

Operat<strong>in</strong>g Rev $47.2m $109.6m $59.7m<br />

Op. Cash Flow $23.0m $58.8m $25.3m<br />

Net Profit after tax $46.8m $52.3m $19.6m<br />

Adj. NPAT 1 $30.8m $60.4m $33.2m<br />

Adj EPS 1 10.5c 20.6c 11.2c<br />

Div. Per Share 8.0c 16.5c 9.1c<br />

31 Dec „10 30 Jun „11 31 Dec „11<br />

Funds Under M‟gmt $10.4b $10.7b $10.1b<br />

Net Debt $54.2m $75.6m $76.7m<br />

Gear<strong>in</strong>g (ND/TA) 6.8% 8.1% 8.4%<br />

Gear<strong>in</strong>g (Look-thru) 38.6% 36.6% 33.0%<br />

NTA per share $2.21 $2.21 $2.19<br />

(Note 1: Normalised basis excludes non-operat<strong>in</strong>g items and pre<br />

CQO fee and organisational restructure).<br />

<strong>Charter</strong> <strong>Hall</strong> is well positioned to generate recurr<strong>in</strong>g<br />

<strong>in</strong>come from the 19 wholesale, retail unlisted and<br />

listed property funds. The Group‟s Property<br />

Investment portfolio comprises $576m of co<strong>in</strong>vestments<br />

and contributed 58% of the Group‟s<br />

earn<strong>in</strong>gs (EBITDA) <strong>in</strong> the first half of FY12. The<br />

portfolio has performed strongly, with the <strong>in</strong>come<br />

yield ris<strong>in</strong>g to 7% (annualised) from 6.4% <strong>in</strong> FY11.<br />

Occupancy rose 2% to 97% and weighted average<br />

lease expiry is 6.5 years.<br />

Funds Management activities (28% of earn<strong>in</strong>gs)<br />

also grew with contributions from other vertically<br />

<strong>in</strong>tegrated property bus<strong>in</strong>esses such as leas<strong>in</strong>g,<br />

property management and transactional services.<br />

While some of these earn<strong>in</strong>gs are non-recurr<strong>in</strong>g <strong>in</strong><br />

nature, <strong>Charter</strong> <strong>Hall</strong> has cont<strong>in</strong>ued to raise funds <strong>in</strong><br />

its unlisted funds, which will offset the reduction<br />

from the sale of US assets of the listed CH Office<br />

REIT (soon to be an unlisted fund).<br />

Higher risk Development <strong>in</strong>vestment and other<br />

services (14% of earn<strong>in</strong>gs) have their own pipel<strong>in</strong>e<br />

of projects and derive earn<strong>in</strong>gs from manag<strong>in</strong>g<br />

these as well as third-party development projects.<br />

The Group will grow funds under management and<br />

improve profitability by recycl<strong>in</strong>g equity <strong>in</strong>to higher<br />

return <strong>in</strong>vestments; improv<strong>in</strong>g earn<strong>in</strong>gs <strong>in</strong><br />

underly<strong>in</strong>g <strong>in</strong>vestments and cost/debt control.<br />

Property valuations have stabilised and <strong>in</strong> some<br />

<strong>in</strong>stances are compress<strong>in</strong>g, especially for high<br />

quality assets which are <strong>in</strong> demand from a range of<br />

local and <strong>in</strong>ternational <strong>in</strong>vestors.<br />

<strong>Charter</strong> <strong>Hall</strong> Hold<strong>in</strong>gs – Investment Manager<br />

Lonsec notes that the RE has appo<strong>in</strong>ted <strong>Charter</strong> <strong>Hall</strong><br />

Hold<strong>in</strong>gs Pty Ltd (CHH or „the Manager‟), a related<br />

party entity, to act as the Investment Manager for the<br />

Trust. CHH has been appo<strong>in</strong>ted under an „<strong>As</strong>set<br />

Management Agreement‟ (AMA) that specifies the<br />

asset management services CHH is to provide.<br />

Importantly for <strong>in</strong>vestors, the RE may at any time<br />

replace CHH. The services to be provided <strong>in</strong>clude:<br />

Manag<strong>in</strong>g the property;<br />

Report<strong>in</strong>g on Trust performance to <strong>in</strong>vestors;<br />

Provid<strong>in</strong>g adm<strong>in</strong>istrative support; and<br />

Arrang<strong>in</strong>g the disposal of the property.<br />

All material decisions relat<strong>in</strong>g to the Trust must be<br />

ratified by the Independent Directors of the RE.<br />

Lonsec Limited ABN 56 061 751 102 AFSL No. 246842 Participant of ASX Group<br />

This <strong>in</strong>formation must be read <strong>in</strong> conjunction with the Warn<strong>in</strong>g, Disclaimer, and Disclosure at the end of this document<br />

12

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

3.2. Management Team<br />

Board of Directors – <strong>Charter</strong> <strong>Hall</strong> Direct Property<br />

Management Limited<br />

Director Position Jo<strong>in</strong>ed Group*<br />

Peeyush Gupta Indep. Chairman 2010<br />

David Harrison Exec. Director 2004<br />

David Southon Exec. Director 1991<br />

Cedric Fuchs Exec. Director 1991<br />

Richard Higg<strong>in</strong>s Indep. Director 2008<br />

Ian Pratt Indep. Director 1998<br />

Richard Stacker Alt. Exec. Dir & CEO 2004<br />

(Note*: Jo<strong>in</strong>ed either <strong>Charter</strong> <strong>Hall</strong> or Macquarie)<br />

Lonsec notes that the CHDPML Board is currently<br />

comprised of three <strong>in</strong>dependent directors which<br />

accounts for 50% of the representatives. The<br />

Chairman is now an <strong>in</strong>dependent.<br />

Biographies of all the Directors and Senior Executives<br />

are detailed <strong>in</strong> the Product Disclosure Statement.<br />

Executive Team & Other Resources<br />

The Trust will have access to the experienced <strong>Charter</strong><br />

<strong>Hall</strong> senior executive team, <strong>in</strong>clud<strong>in</strong>g a dedicated<br />

Fund Manager for the Trust (Steven Bennett).<br />

The <strong>Charter</strong> <strong>Hall</strong> Group has a total staff of about 280<br />

property (development, leas<strong>in</strong>g, and transaction<br />

services), funds management and f<strong>in</strong>ance/back office<br />

professionals. The <strong>Charter</strong> <strong>Hall</strong> funds management<br />

team currently consists of 15 people, with direct<br />

support available from 135 „full-time equivalent‟ staff.<br />

3.3. Investment Style<br />

<strong>Charter</strong> <strong>Hall</strong> is a high conviction real estate manager<br />

that places emphasis on active management, both <strong>in</strong><br />

its <strong>in</strong>dividual asset hold<strong>in</strong>gs and portfolio allocations<br />

(relative to peer-group and market benchmarks). The<br />

organisation is vertically <strong>in</strong>tegrated, where significant<br />

resources are allocated to all aspects of the property<br />

funds management process.<br />

<strong>As</strong> an <strong>in</strong>vestment manager, <strong>Charter</strong> <strong>Hall</strong> forms a clear<br />

view on the property markets it believes to offer the<br />

highest prospective rental growth over a three-toseven<br />

year term. The Group uses its own proprietary<br />

research and market <strong>in</strong>telligence ga<strong>in</strong>ed from its<br />

national presence. A recent addition is Chris Freeman<br />

(formerly of Savills) as Head of Research for <strong>Charter</strong><br />

<strong>Hall</strong>.<br />

The Group also places significant importance on its<br />

relationships with tenants <strong>in</strong> order to maximise tenant<br />

retention.<br />

On average, the Group favours long-lease duration<br />

assets and aims to reta<strong>in</strong> high weighted average lease<br />

expiries relative to its peer-group <strong>in</strong> both listed and<br />

unlisted markets. Where short-lease durations are<br />

considered, they are typically the result of an arbitrage<br />

opportunity where assets are materially under-rented<br />

or where there is a re-position<strong>in</strong>g opportunity.<br />

The team is performance focused, with all <strong>Charter</strong> <strong>Hall</strong><br />

funds reta<strong>in</strong><strong>in</strong>g a significant performance component to<br />

their respective fee structures, align<strong>in</strong>g the <strong>in</strong>terests of<br />

Management with that of <strong>in</strong>vestors.<br />

This does result from time-to-time <strong>in</strong> the Group tak<strong>in</strong>g<br />

a contrary view to consensus market op<strong>in</strong>ion and<br />

forecasts, where it believes a mis-pric<strong>in</strong>g event has<br />

occurred dur<strong>in</strong>g a property market cycle.<br />

3.4. Related Party Transactions<br />

Acquisition Process<br />

Initial f<strong>in</strong>ancial analysis is undertaken by <strong>Charter</strong> <strong>Hall</strong><br />

to see if the property meets all of its acquisition checklist<br />

criteria. A proposal and Heads of Agreement is put<br />

before the board of CHDPML for approval to proceed<br />

to due diligence.<br />

Management of the Related Party Process<br />

Lonsec notes that the Group has developed its<br />

‘<strong>Charter</strong> <strong>Hall</strong> Managed Funds Conflict Protocols’ to<br />

manage conflicts of <strong>in</strong>terests that may arise dur<strong>in</strong>g<br />

acquisitions by implement<strong>in</strong>g the follow<strong>in</strong>g procedures:<br />

<strong>As</strong>set transaction prices must be supported by<br />

<strong>in</strong>dependent valuations;<br />

All acquisition terms must reflect normal<br />

commercial terms; and<br />

All executive directors of the RE will be required<br />

to absta<strong>in</strong> from vot<strong>in</strong>g on proposed acquisitions/<br />

divestments.<br />

Conflicts of <strong>in</strong>terest will be assessed by the <strong>Charter</strong><br />

<strong>Hall</strong> Compliance Manager and if necessary, referred<br />

to the RE‟s board. Under the policy, the RE may be<br />

required to disclose conflicts of <strong>in</strong>terest to <strong>in</strong>vestors.<br />

With the property currently fully owned by another<br />

<strong>Charter</strong> <strong>Hall</strong> fund, each party has their own<br />

negotiat<strong>in</strong>g team, with separate due diligence<br />

undertaken, <strong>in</strong>clud<strong>in</strong>g <strong>in</strong>dependent valuations<br />

obta<strong>in</strong>ed. A price was negotiated <strong>in</strong> November 2011<br />

<strong>in</strong>-l<strong>in</strong>e with CHDPML‟s <strong>in</strong>dependent valuation (which<br />

also allowed for the $1.9m reimbursement of the<br />

payout of half of the Hatch rental <strong>in</strong>centives).<br />

Lonsec Limited ABN 56 061 751 102 AFSL No. 246842 Participant of ASX Group<br />

This <strong>in</strong>formation must be read <strong>in</strong> conjunction with the Warn<strong>in</strong>g, Disclaimer, and Disclosure at the end of this document<br />

13

<strong>Charter</strong> <strong>Hall</strong> Direct 144 Stirl<strong>in</strong>g Street Trust<br />

The vendor fund (CPOF) Investment Committee<br />

approved the transaction unanimously as required and<br />

this was approved by a separate Investor Committee.<br />

Furthermore, <strong>Charter</strong> <strong>Hall</strong> Group board also oversaw<br />

the process as it was <strong>in</strong>volved <strong>in</strong> the underwrit<strong>in</strong>g.<br />

The transaction capitalisation rate of 8.5% compares<br />

to the 8.0% capitalisation rate when CPOF purchased<br />

the property <strong>in</strong> August 2006 for $31.55m.<br />

Co-<strong>in</strong>vestment <strong>in</strong> Trust by <strong>Charter</strong> <strong>Hall</strong> Group<br />

<strong>Charter</strong> <strong>Hall</strong>‟s aim is to have a co-<strong>in</strong>vestment <strong>in</strong> its<br />

funds of between 0-10%, which aligns the Group with<br />

the <strong>in</strong>terests of other <strong>in</strong>vestors. Given that CHG has<br />

underwritten 49.9% of the equity issue, there is a<br />

possibility that it will reta<strong>in</strong> an <strong>in</strong>terest <strong>in</strong> the CHD 144<br />

Stirl<strong>in</strong>g St Trust.<br />

3.5. Manager’s Previous Performance<br />

Non-Wholesale (‘Retail Investor’) Funds<br />

The table on p15 provides a summary of the<br />

performance history of <strong>Charter</strong> <strong>Hall</strong> funds for mostly<br />

„non-wholesale‟ or „retail‟ <strong>in</strong>vestors.<br />

<strong>Charter</strong> <strong>Hall</strong> has achieved some good<br />

performances from its CHIF series of funds over<br />

various periods dur<strong>in</strong>g the <strong>last</strong> 10-15 years.<br />

Some of the funds that came across from<br />

Macquarie and other more recently established<br />

open-end funds have underperformed their<br />

relevant <strong>in</strong>dices.<br />

Two funds (DIF & 130 Stirl<strong>in</strong>g St) have started to<br />

record strong positive returns and outperformed<br />

benchmarks.<br />

All funds have delivered consistent attractive<br />

<strong>in</strong>come yields <strong>in</strong> l<strong>in</strong>e with their focus towards „retail‟<br />

<strong>in</strong>vestors.<br />

Wholesale Funds<br />

Lonsec also notes that <strong>Charter</strong> <strong>Hall</strong> acts as the RE for<br />

several active wholesale funds spread across the<br />

opportunistic and core property sectors. While Lonsec<br />

has not had access to the data for these funds, an<br />

analysis of their performance has been provided by the<br />

Manager.<br />

CH Opportunity Fund Series (1997 to June 2012)<br />

The series spans five closed-end opportunistic funds:<br />

Gross realised IRR of all projects is 28% pa (over<br />

the 15 year history of the series).<br />

CHOF4 is on track for a 13% pa (gross) total<br />

return, which ranks it well relative to opportunistic<br />

real estate funds <strong>in</strong> Australia for a 2005 <strong>in</strong>ception<br />

date.<br />

CHOF5 (2007 <strong>in</strong>ception date) is forecast to<br />