download - Data Book 2012

download - Data Book 2012

download - Data Book 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

20<br />

Egypt<br />

60<br />

40<br />

20<br />

Areas of operation<br />

0<br />

Gas<br />

Scarab Saffron<br />

Sapphire<br />

Saurus<br />

Sequoia<br />

Rashid -1,-2,-3<br />

BG Group net production (mmboe)<br />

58.1<br />

54.1<br />

49.4<br />

2009 2010 2011<br />

Oil & liquids<br />

ALEXANDRIA<br />

SimSat P2<br />

Solar<br />

Serpent<br />

IDKU<br />

Egyptian LNG Trains 1 & 2<br />

CAIRO<br />

Africa, Central and South Asia<br />

<strong>Data</strong> <strong>Book</strong> <strong>2012</strong><br />

Simian Sienna<br />

SimSat P1<br />

Silva<br />

Mina-1<br />

Sienna-Up<br />

Rashid North<br />

DAMIETTA LNG<br />

EGYPT<br />

www.bg-group.com BG Group<br />

A global portfolio<br />

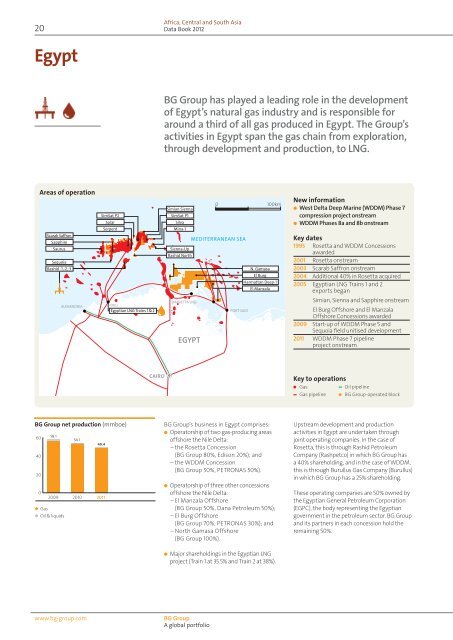

BG Group has played a leading role in the development<br />

of Egypt’s natural gas industry and is responsible for<br />

around a third of all gas produced in Egypt. The Group’s<br />

activities in Egypt span the gas chain from exploration,<br />

through development and production, to LNG.<br />

0 100km<br />

MEDITERRANEAN SEA<br />

PORT SAID<br />

N. Gamasa<br />

El Burg<br />

Harmattan Deep-1<br />

El Manzala<br />

BG Group’s business in Egypt comprises:<br />

● Operatorship of two gas-producing areas<br />

offshore the Nile Delta:<br />

– the Rosetta Concession<br />

(BG Group 80%, Edison 20%); and<br />

– the WDDM Concession<br />

(BG Group 50%, PETRONAS 50%).<br />

● Operatorship of three other concessions<br />

offshore the Nile Delta:<br />

– El Manzala Offshore<br />

(BG Group 50%, Dana Petroleum 50%);<br />

– El Burg Offshore<br />

(BG Group 70%, PETRONAS 30%); and<br />

– North Gamasa Offshore<br />

(BG Group 100%).<br />

● Major shareholdings in the Egyptian LNG<br />

project (Train 1 at 35.5% and Train 2 at 38%).<br />

New information<br />

● West Delta Deep Marine (WDDM) Phase 7<br />

compression project onstream<br />

● WDDM Phases 8a and 8b onstream<br />

Key dates<br />

1995 Rosetta and WDDM Concessions<br />

awarded<br />

2001 Rosetta onstream<br />

2003 Scarab Saffron onstream<br />

2004 Additional 40% in Rosetta acquired<br />

2005 Egyptian LNG Trains 1 and 2<br />

exports began<br />

Key to operations<br />

Gas<br />

Gas pipeline<br />

Simian, Sienna and Sapphire onstream<br />

El Burg Offshore and El Manzala<br />

Offshore Concessions awarded<br />

2009 Start-up of WDDM Phase 5 and<br />

Sequoia field unitised development<br />

2011 WDDM Phase 7 pipeline<br />

project onstream<br />

Oil pipeline<br />

BG Group-operated block<br />

Upstream development and production<br />

activities in Egypt are undertaken through<br />

joint operating companies. In the case of<br />

Rosetta, this is through Rashid Petroleum<br />

Company (Rashpetco) in which BG Group has<br />

a 40% shareholding, and in the case of WDDM,<br />

this is through Burullus Gas Company (Burullus)<br />

in which BG Group has a 25% shareholding.<br />

These operating companies are 50% owned by<br />

the Egyptian General Petroleum Corporation<br />

(EGPC), the body representing the Egyptian<br />

government in the petroleum sector. BG Group<br />

and its partners in each concession hold the<br />

remaining 50%.

Partners (%)<br />

Rosetta Concession*<br />

Rashid Petroleum Company<br />

WDDM Concession*<br />

Burullus Gas Company<br />

25<br />

40<br />

BG Group Edison<br />

* BG Group operator<br />

10<br />

50<br />

80<br />

20<br />

50<br />

50<br />

25 50<br />

EGPC PETRONAS<br />

E&P<br />

Rosetta Concession<br />

Rosetta started production in 2001 and supplies<br />

Egypt’s domestic market. In 2004, BG Group<br />

acquired a further 40% interest in Rosetta.<br />

Sequoia<br />

The unitised development (Rosetta<br />

Phase 4/WDDM Phase 6) of the Sequoia<br />

field (BG Group 62.99%) which lies across<br />

the boundary of the WDDM and Rosetta<br />

Concessions was sanctioned in 2008. It consists<br />

of six sub-sea wells: three wells on each of<br />

WDDM and Rosetta which are tied back to<br />

existing infrastructure. First gas came onstream<br />

in 2009, with production delivered to both<br />

the domestic and export markets.<br />

WDDM Concession<br />

Since 1994, BG Group and partners have<br />

discovered 14 gas fields: Scarab, Saffron,<br />

Simian, Sienna, Sapphire, Serpent, Saurus,<br />

Sequoia, SimSat-P1 and SimSat-P2. Additional<br />

development leases were granted in 2007<br />

for the Solar, Sienna-Up, Mina-1 and<br />

Silva discoveries.<br />

WDDM supplies gas to the domestic market,<br />

Egyptian LNG at Idku and the third-party<br />

Damietta LNG plant.<br />

Scarab Saffron<br />

Scarab Saffron started production in 2003.<br />

The field supplies gas to the domestic market<br />

and was the first deep water sub-sea<br />

development in Egypt. These facilities consist<br />

of eight sub-sea wells connected to a sub-sea<br />

manifold, in turn connected by pipelines to<br />

an onshore processing terminal. Electrical<br />

and hydraulic lines connect the wells to the<br />

onshore control room. The fields are located<br />

approximately 90 kilometres from the shore<br />

and in water depths of more than 700 metres.<br />

Concession Field<br />

Simian, Sienna and Sapphire<br />

The Simian and Sienna fields produced first<br />

gas in 2005, for supply to Egyptian LNG Train 1<br />

at Idku. The Sapphire field produced first gas<br />

in 2005, for supply to Egyptian LNG Train 2.<br />

The Simian, Sienna and Sapphire fields are<br />

located in WDDM approximately 120 kilometres<br />

offshore Idku, near Alexandria, in the<br />

Mediterranean Sea. The facilities consist of<br />

16 sub-sea wells tied into the existing WDDM<br />

gas gathering network and a shallow water<br />

control platform. The onshore processing<br />

facilities form part of the Idku Gas Hub where<br />

the Egyptian LNG facilities are located.<br />

WDDM additional phases<br />

The WDDM fields have undergone a number of<br />

development phases to maximise hydrocarbon<br />

recovery. Phase 4 brought seven additional<br />

wells onstream during 2008, while Phase 6<br />

added three Sequoia wells in 2009.<br />

In 2009, BG Group started incremental<br />

gas production through the WDDM Phase 5<br />

compression project. The project included<br />

installation of two onshore gas turbine-driven<br />

compression sets, new absorption towers<br />

and associated equipment to extend plateau<br />

production from WDDM reservoirs. The<br />

project was designed to boost the pressure<br />

of processed gas into the grid, allowing<br />

field operations at lower pressures.<br />

The Group started execution of the Phase 7<br />

additional third pipeline and compression<br />

project in 2010. Phase 7 comprises a new<br />

68 kilometre, 36-inch offshore pipeline with<br />

associated onshore gas receiving facilities,<br />

a slug-catcher, adjacent to the two existing<br />

WDDM pipelines, and five new compressors.<br />

Incremental gas through the 36-inch pipeline<br />

came onstream in 2011 and the compression<br />

plant came into operation in January <strong>2012</strong>.<br />

BG Group<br />

A global portfolio<br />

BG Group<br />

interest (%) Supplying DCQ gross<br />

Rosetta Rosetta 80 Domestic market 345 mmscfd<br />

WDDM Scarab Saffron 50 Domestic market 750 mmscfd<br />

WDDM 1 Scarab Saffron 50 Damietta LNG (Union<br />

Fenosa JV Co SEGAS)<br />

WDDM Simian, Sienna,<br />

Sapphire, Sequoia<br />

WDDM Simian, Sienna,<br />

Sapphire, Sequoia<br />

1 BG Group and PETRONAS lift the corresponding volume of LNG.<br />

21<br />

150 mmscfd<br />

50 Egyptian LNG Train 1 565 mmscfd<br />

50 Egyptian LNG Train 2 565 mmscfd<br />

Phase 8a, comprising the drilling, completion<br />

and tie-back of an additional nine sub-sea wells<br />

across WDDM came onstream in late 2011.<br />

In June <strong>2012</strong>, gas production from the<br />

Phase 8b deep water development project<br />

came onstream. Phase 8b is an extension of<br />

the existing deep water sub-sea infrastructure<br />

and will tie in eight sub-sea wells by the end<br />

of <strong>2012</strong>. With the completion of the Phase 8a<br />

and 8b projects, the WDDM Concession will<br />

have a total of 51 sub-sea wells.<br />

WDDM Phase 9 is currently being assessed<br />

and is planned to include additional infill wells,<br />

new development wells and further workover<br />

programmes in order to continue development<br />

of the concession.<br />

El Manzala Offshore and El Burg<br />

Offshore Concessions<br />

In 2005, BG Group signed the El Burg Offshore<br />

(EBO) and El Manzala Offshore (EMO) concession<br />

agreements for the exploration of gas and oil<br />

with the Egyptian Natural Gas Holding Company<br />

(EGAS). Exploration drilling on EBO and EMO<br />

commenced in 2008.<br />

In 2010, BG Group farmed-out a 50% stake<br />

in the EMO concession to Dana Petroleum.<br />

BG Group retains 50% in EMO. The Zonda<br />

well was drilled in 2011 on EMO but failed to<br />

discover commercial hydrocarbons. A two-well<br />

programme on EBO commenced in <strong>2012</strong>. The<br />

first well, Harmattan Deep-1, was declared a<br />

discovery in July, while the high impact Notus<br />

well is expected to be drilled in late <strong>2012</strong>.<br />

North Gamasa Offshore Concession<br />

In 2009, BG Group was awarded 100% of Block 1<br />

(North Gamasa Offshore). The block covers an<br />

area of 281 square kilometres and is located<br />

20 kilometres from the coast in shallow water.<br />

The concession agreement formalising the<br />

award was signed in early 2010. 3D seismic<br />

acquisition was completed in 2010.<br />

www.bg-group.com<br />

Africa, Central and South Asia

22<br />

WDDM: integrated upstream and downstream<br />

Africa, Central and South Asia<br />

<strong>Data</strong> <strong>Book</strong> <strong>2012</strong><br />

Gas supply Liquefaction output LNG purchase<br />

Train 1 (start date 2005)<br />

565 mmscfd<br />

– WDDM<br />

Gas<br />

BG Group 50%<br />

Train 2 (start date 2005)<br />

565 mmscfd<br />

– WDDM<br />

Gas<br />

BG Group 50%<br />

Train 1 – 3.6 mtpa<br />

Tolling plant<br />

BG Group 35.5%<br />

PETRONAS 35.5%<br />

EGPC 12%<br />

EGAS 12%<br />

GDF SUEZ 5%<br />

Train 2 – 3.6 mtpa<br />

Tolling plant<br />

Upstream Liquefaction output Downstream<br />

LNG<br />

Egyptian LNG<br />

BG Group and partners supply Trains 1 and 2<br />

of Egyptian LNG with gas from the Simian,<br />

Sienna, Sapphire and Sequoia fields in WDDM.<br />

Together, these trains have a productive<br />

capacity of 7.2 mtpa of LNG.<br />

The 3.6 mtpa productive capacity of Train 1 has<br />

been sold to GDF SUEZ under a 20-year SPA.<br />

The first LNG cargo was lifted in May 2005.<br />

The 3.6 mtpa productive capacity of Train 2 has<br />

been sold to BGGM, a wholly owned BG Group<br />

subsidiary which is operated by GEMS, under<br />

a 20-year agreement. BGGM may deliver this<br />

output to its capacity at Lake Charles in the USA<br />

or divert to other markets as part of its flexible<br />

portfolio approach. The first LNG cargo was<br />

lifted in September 2005.<br />

BG Group 38%<br />

PETRONAS 38%<br />

EGPC 12%<br />

EGAS 12%<br />

www.bg-group.com BG Group<br />

A global portfolio<br />

LNG<br />

GDF SUEZ 100%<br />

LNG<br />

BG Group 100%<br />

The Egyptian LNG facilities, located at Idku,<br />

comprise the two LNG production trains<br />

and include the common facilities such<br />

as storage tanks, loading jetty and utilities.<br />

Egyptian LNG Company owns both the<br />

Egyptian LNG site and common facilities.<br />

Its sister company, The Egyptian Operating<br />

Company for Natural Gas Liquefaction Projects<br />

(Opco) (BG Group 35.5%) undertakes the<br />

operation of all trains and common facilities.<br />

El Beheira Natural Gas Liquefaction Company<br />

(Train 1 Co.) (BG Group 35.5%) owns Train 1<br />

and Idku Natural Gas Liquefaction Company<br />

(Train 2 Co.) (BG Group 38%) owns Train 2.

Tunisia<br />

16<br />

12<br />

Areas of operation<br />

BG Group net production (mmboe)<br />

8<br />

4<br />

0<br />

ALGERIA<br />

Gas<br />

12.7<br />

16.0<br />

14.6<br />

2009 2010 2011<br />

Oil & liquids<br />

TUNISIA TUNISIA<br />

Hannibal plant<br />

Hasdrubal plant<br />

LPG facility<br />

E&P<br />

Miskar<br />

Gas from the Miskar field (100% BG Group)<br />

is processed at the BG Group-operated<br />

Hannibal plant and sold into the Tunisian gas<br />

system. BG Group has a gas sales contract with<br />

the Tunisian state electricity and gas company,<br />

Société Tunisienne de l’Electricité et du Gaz<br />

(STEG), which gives BG Group the right to<br />

supply up to 230 mmscfd from Miskar on<br />

TUNIS<br />

BG Group is the largest producer of gas in Tunisia,<br />

supplying over 60% of Tunisia’s domestic gas production<br />

through the Miskar and Hasdrubal operations.<br />

BIZERTE<br />

LA SKHIRA<br />

GABÈS<br />

SFAX<br />

SOUSSE<br />

GULF OF GABÈS<br />

BG Group<br />

A global portfolio<br />

0 200km<br />

MEDITERRANEAN SEA<br />

SICILY<br />

Amilcar<br />

Miskar<br />

Hasdrubal<br />

a long-term basis. Offshore compression<br />

was commissioned in 2005 to maintain the<br />

production plateau of the field. Six infill wells<br />

have been drilled between 2007 and 2010,<br />

with a workover campaign completed in 2011.<br />

A 60 kilometre condensate pipeline was<br />

completed LIBYA in 2007 to transport Miskar<br />

condensate from Hannibal to the La Skhira<br />

storage terminal. The condensate is mainly<br />

exported to the international market.<br />

Hasdrubal<br />

Hasdrubal (BG Group 50%, Entreprise<br />

Tunisienne d’Activités Pétrolières (ETAP) 50%)<br />

came onstream in 2009.<br />

The Hasdrubal onshore gas processing facility<br />

(BG Group 50%, ETAP 50%) and LPG production<br />

facility (100% BG Group) have been built<br />

adjacent to the Hannibal plant. Gas is sold to<br />

STEG while liquids and LPG are exported or<br />

sold in the local market. Production is delivered<br />

from three gas wells and one oil well through<br />

an unmanned offshore platform to dedicated<br />

New information<br />

● LPG pipelines start-up<br />

Key dates<br />

1989 Tenneco assets acquired<br />

1996 Miskar field first production<br />

2009 Hasdrubal field first production<br />

Key to operations<br />

Gas<br />

Oil<br />

Gas pipeline<br />

Oil pipeline<br />

23<br />

BG Group-operated block<br />

offtake facilities. Condensate from Hasdrubal is<br />

transported to the La Skhira storage terminal<br />

through the Hannibal condensate pipeline.<br />

The condensate is mainly exported to the<br />

international market. A BG Group 100%-owned<br />

LPG storage terminal has been constructed<br />

in Gabès to receive and export butane and<br />

propane. Two 6-inch 130 kilometre parallel<br />

pipelines commissioned in 2011 are used to<br />

deliver LPG to the terminal from Hasdrubal.<br />

Amilcar permit<br />

BG Group is operator and joint permit<br />

holder with ETAP, the Tunisian state-owned<br />

company, of the 1 016 square kilometre Amilcar<br />

exploration permit, offshore Sfax in the Gulf<br />

of Gabès. This permit expired in December 2011<br />

and a one year extension has been applied<br />

for and has received Directorate General of<br />

Energy Ministry and Hydrocarbon Consultative<br />

Committee approval, with the decree<br />

publication pending.<br />

www.bg-group.com<br />

Africa, Central and South Asia

24<br />

Tanzania<br />

Areas of operation<br />

TANZANIA<br />

E&P<br />

In 2010, BG Group completed a farm-in to<br />

Blocks 1, 3 and 4, offshore southern Tanzania.<br />

BG Group acquired 60% of Ophir Energy’s<br />

interests in each of the offshore blocks.<br />

Blocks 1, 3 and 4 cover approximately<br />

20 850 square kilometres of the Mafia Deep<br />

Offshore Basin and northern portion of the<br />

Rovuma Basin.<br />

In 2010, two gas discoveries were made in<br />

Block 4: Pweza-1, located approximately<br />

85 kilometres offshore southern Tanzania<br />

and in a water depth of around 1 400 metres;<br />

and Chewa-1, approximately 80 kilometres<br />

offshore southern Tanzania in a water<br />

depth of around 1 300 metres.<br />

In 2011, the Chaza-1 gas discovery was made,<br />

located in Block 1 approximately 18 kilometres<br />

offshore southern Tanzania in a water depth<br />

MTWARA<br />

MOZAMBIQUE<br />

Africa, Central and South Asia<br />

<strong>Data</strong> <strong>Book</strong> <strong>2012</strong><br />

www.bg-group.com BG Group<br />

A global portfolio<br />

BG Group entered Tanzania in 2010, and is the<br />

operator of offshore Blocks 1, 3 and 4, in which<br />

it has a 60% interest.<br />

Chewa-1<br />

Block 4<br />

Pweza-1<br />

Block 3<br />

Papa-1<br />

Block 1<br />

Mzia-1<br />

Jodari-1<br />

Chaza-1<br />

0 100km<br />

INDIAN<br />

OCEAN<br />

of around 950 metres. The discovery is<br />

approximately 200 kilometres south of<br />

the Pweza and Chewa discoveries.<br />

A 3 250 square kilometre 3D seismic survey<br />

was acquired in Blocks 3 and 4, and a second<br />

3D survey of 1 850 square kilometres was<br />

acquired in Block 1.<br />

In addition, BG Group received approval<br />

from the government of Tanzania for it<br />

to take over the role of operator of<br />

Blocks 1, 3 and 4, effective from July 2011.<br />

In <strong>2012</strong>, there has been further exploration<br />

success. The Jodari-1 gas discovery is located<br />

in Block 1 approximately 39 kilometres<br />

offshore Tanzania in a water depth of<br />

around 1 150 metres. With this success,<br />

mean total resources from the first four<br />

Tanzanian discoveries are approaching<br />

some 7 trillion cubic feet of gas.<br />

New information<br />

● Jodari-1 gas discovery in Block 1<br />

● Mzia-1 gas discovery in Block 1<br />

● 2 500 square kilometres of 3D seismic<br />

acquired in Block 1<br />

● Papa-1 gas discovery in Block 3<br />

Key dates<br />

2010 BG Group farmed into Blocks 1, 3 and 4<br />

Two gas discoveries in Block 4<br />

2011 First gas discovery in Block 1<br />

BG Group became operator of<br />

Blocks 1, 3 and 4<br />

Key to operations<br />

Gas BG Group-operated block<br />

Further, the Mzia-1 gas discovery is located in<br />

Block 1, approximately 24 kilometres north of<br />

Jodari-1 in water depths of around 1 600 metres.<br />

Mzia-1 is the first Cretaceous discovery in<br />

Tanzania for BG Group and opens a new<br />

play fairway within the Group’s acreage.<br />

The Papa-1 gas discovery is located<br />

approximately 100 kilometres offshore<br />

Tanzania and 53 kilometeres south-east of<br />

the Pweza-1 discovery, in water depths of<br />

around 2 180 metres. It is the first well drilled<br />

in Block 3 and BG Group’s second discovery<br />

in the deeper Cretaceous section.<br />

In addition, a 2 500 square kilometre<br />

3D seismic survey was acquired on Block 1<br />

exploring the potential continuation of the<br />

Tertiary basin floor fan prospectivity in the<br />

Rovuma basin found in Mozambique.

Kenya Madagascar<br />

BG Group entered Kenya in 2011,<br />

acquiring an interest in offshore<br />

Blocks L10A and L10B.<br />

Areas of operation<br />

TANZANIA<br />

Key to operations<br />

BG Group-operated block<br />

KENYA<br />

MOMBASA<br />

PEMBA ISLAND<br />

0 100km<br />

INDIAN<br />

OCEAN<br />

L10A<br />

L10B<br />

E&P<br />

In 2011, BG Group signed Production Sharing Contracts with the<br />

government of Kenya for two offshore exploration blocks – L10A<br />

and L10B. BG Group is operator on both blocks and holds a 40%<br />

equity interest in Block L10A (Cove Energy 25%, Premier Oil 20%,<br />

Pancontinental 15%) and a 45% interest in Block L10B (Premier<br />

Oil 25%, Cove Energy 15%, Pancontinental 15%). In line with the<br />

initial work programme commitment, 2D and 3D seismic data<br />

acquisition commenced in late 2011 and will continue to be<br />

processed during <strong>2012</strong>, with a view to drilling a first exploration<br />

well in 2013.<br />

Blocks L10A and L10B together cover an area of more than<br />

10 400 square kilometres in the southern portion of the<br />

Lamu Basin, located in water depths ranging from around<br />

200 metres to in excess of 1 900 metres.<br />

BG Group<br />

A global portfolio<br />

ETHIOPIA<br />

SOMALIA<br />

Areas of operation<br />

SOUTH<br />

AFRICA<br />

TANZANIA<br />

Key to operations<br />

Gas pipeline<br />

Oil pipeline<br />

KENYA<br />

MOZAMBIQUE<br />

Majunga Offshore Profond<br />

MADAGASCAR<br />

ANTANANARIVO<br />

BG Group non-operated block<br />

0 1 000km<br />

25<br />

BG Group owns a 30% interest in<br />

the Majunga Offshore Profond<br />

exploration block in Madagascar.<br />

E&P<br />

BG Group (30%) partners with ExxonMobil (50% and operator),<br />

SK Innovation (10%) and PVEP Corp (10%) in the Majunga Offshore<br />

Profond exploration block.<br />

The block covers around 15 840 square kilometres in water depths<br />

ranging from around 200 metres to in excess of 3 000 metres,<br />

offshore the north-west coast of Madagascar. The block is believed<br />

to be oil-prone and it forms part of a largely unexplored frontier basin.<br />

www.bg-group.com<br />

Africa, Central and South Asia

26<br />

Nigeria<br />

Areas of operation<br />

PORTO NOVO<br />

ABEOKUTA<br />

LAGOS<br />

IBADAN<br />

OPL 284-DO<br />

AKURE<br />

ESCRAVOS<br />

OPL 286-DO<br />

E&P<br />

In 2007, BG Group entered into a<br />

Production Sharing Contract (PSC) and<br />

associated downstream Memorandum<br />

of Understanding for Block OPL 286-DO<br />

(BG Group 66% and operator) with the<br />

Nigerian National Petroleum Corporation<br />

(NNPC). The first exploration period of the<br />

PSC concluded in March <strong>2012</strong> and BG Group<br />

has elected not to proceed into the second<br />

exploration period for the block. In 2009,<br />

BG Group acquired a 45% participating interest<br />

in Block OPL 284-DO. The first exploration<br />

period for this PSC concluded in May <strong>2012</strong><br />

and BG Group has decided not to proceed<br />

into the second exploration period for<br />

the block.<br />

Africa, Central and South Asia<br />

<strong>Data</strong> <strong>Book</strong> <strong>2012</strong><br />

BENIN<br />

CITY<br />

www.bg-group.com BG Group<br />

A global portfolio<br />

BG Group commenced business development<br />

activities in Nigeria in 2004. The Group has interests<br />

in two offshore blocks and purchases LNG supply.<br />

NIGERIA<br />

PORT<br />

HARCOURT<br />

NIGERIA<br />

LNG<br />

0 100km<br />

CALABAR<br />

LNG<br />

In 2006, BG Group commenced taking<br />

delivery under a 20-year SPA for 2.3 mtpa<br />

LNG from Nigeria LNG Trains 4 and 5,<br />

located on Bonny Island.<br />

LUBA<br />

In 2007, BG Group signed a SPA with Nigeria<br />

LNG for the acquisition of 2.25 mtpa of LNG<br />

for a 20-year term that will be produced by<br />

Nigeria LNG’s proposed Train 7 project on<br />

Bonny Island.<br />

In May <strong>2012</strong>, BG Group gave notice to NNPC<br />

and its partners of its withdrawal from the<br />

Olokola LNG project.<br />

Key dates<br />

2006 Contracted LNG deliveries from<br />

Nigeria LNG Trains 4/5 began<br />

2007 SPA signed for Nigeria LNG Train 7<br />

PSC and associated downstream<br />

MoU signed for OPL 286-DO<br />

2009 Farm-in to OPL 284-DO<br />

Key to operations<br />

Gas<br />

Oil<br />

Gas pipeline<br />

Oil pipeline<br />

BG Group-operated block<br />

BG Group non-operated block

Algeria Areas of PA<br />

SPAIN SPAIN SPAIN SPAIN<br />

MOROCCO MOROCCO MOROCCO MOROCCO<br />

Hassi Ba Hamou<br />

RM-1<br />

Key to operations<br />

Gas<br />

Oil<br />

BG Group holds an interest in,<br />

and is operator of, the Hassi Ba<br />

Hamou (HBH) permit.<br />

Areas of operation Areas of operation<br />

Gas pipeline<br />

Oil pipeline<br />

MEDITERRANEAN<br />

SEA<br />

ALGIERS<br />

A L G E R I A<br />

A L G E R I A<br />

EL GOLEA<br />

ALGERIA ALGERIA<br />

Proposed gas pipeline<br />

0 500km 0 50km<br />

BG Group-operated block<br />

TUNISIA TUNISIA TUNISIA TUNISIA<br />

E&P<br />

BG Group entered Algeria through an agreement with Gulf Keystone<br />

in 2006 to acquire a 36.75% interest in the HBH permit (originally<br />

Blocks 317b, 322b3, 347b, 348 and 349b). Gulf Keystone retained<br />

38.25% and Sonatrach, the Algerian national oil and gas company,<br />

held the remaining 25%.<br />

In 2011, Gulf Keystone’s withdrawal from the permit was approved,<br />

resulting in BG Group holding a 65% interest and Sonatrach holding<br />

35%. The permit, in central Algeria, originally covered 18 380 square<br />

kilometres and contains the HBH gas discovery. BG Group has drilled<br />

a total of nine wells in the HBH permit to date. In 2009, the partners<br />

entered the two-year second exploration period and relinquished 30%<br />

of the original block area. In this second phase, the RM-1 discovery<br />

was appraised. At the end of the second exploration phase, another<br />

relinquishment was made, reducing the size of the permit to<br />

2 359 square kilometres. In 2010, the partners entered into an<br />

exploration extension period running to September <strong>2012</strong>.<br />

BG Group<br />

A global portfolio<br />

LIBYA LIBYA LIBYA LIBYA<br />

Offshore Gaza<br />

Gaza Marine<br />

Key to operations<br />

Gas<br />

BG Group owns a 90% interest<br />

in, and is operator of, the<br />

offshore Gaza Marine licence.<br />

BG Group-operated block<br />

EGYPT<br />

MEDITERRANEAN SEA<br />

ISRAEL<br />

GAZA<br />

E&P<br />

BG Group is operator of an exploration licence covering the entire marine<br />

area offshore the Gaza Strip. BG Group drilled two successful wells in<br />

2000 (Gaza Marine-1 and Gaza Marine-2) and resources are estimated<br />

to be around 1 tcf. In 2001, a technical review recommended a sub-sea<br />

development and pipeline to an onshore processing terminal. In 2002,<br />

an outline Development Plan was approved by the Palestinian Authority.<br />

BG Group holds 90% equity in the licence, which would be reduced to<br />

60% if the Consolidated Contractors Company (its current 10% partner<br />

in the licence) and the Palestine Investment Fund exercise their options<br />

at development sanction.<br />

In 2007, BG Group withdrew from negotiations with the government<br />

of Israel for the sale of gas from the Gaza Marine field to Israel. In 2008,<br />

BG Group closed its office in Israel.<br />

27<br />

www.bg-group.com<br />

LEBANON<br />

Africa, Central and South Asia

BLACK SEA<br />

28<br />

Kazakhstan<br />

50<br />

40<br />

30<br />

20<br />

10<br />

Areas of operation<br />

BG Group net production (mmboe)<br />

0<br />

UKRAINE<br />

Gas<br />

NOVOROSSIYSK<br />

41.5<br />

37.8 37.4<br />

2009 2010 2011<br />

Oil & liquids<br />

CPC<br />

RUSSIA<br />

Africa, Central and South Asia<br />

<strong>Data</strong> <strong>Book</strong> <strong>2012</strong><br />

Atyrau Samara<br />

pipeline<br />

Karachaganak<br />

-to-CPC pipeline<br />

BOLSHOI CHAGAN<br />

CPC<br />

ASTRAKHAN<br />

CASPIAN SEA<br />

www.bg-group.com BG Group<br />

A global portfolio<br />

BG Group has been active in Kazakhstan for 20 years.<br />

It is joint operator of the giant Karachaganak gas<br />

condensate field, where it has a 40-year concession,<br />

and is a shareholder in the Caspian Pipeline Consortium.<br />

0 400km<br />

AKTAU<br />

Karachaganak<br />

ATYRAU<br />

ORENBURG<br />

KAZAKHSTAN<br />

TENGIZ<br />

E&P<br />

Karachaganak<br />

Karachaganak, discovered in 1979, is one of<br />

the world’s largest gas and condensate fields.<br />

Located in north-west Kazakhstan, it holds<br />

estimated hydrocarbons initially in place of<br />

9 billion bbls of condensate and 48 tcf of<br />

gas, with estimated gross reserves of over<br />

2.4 billion bbls of condensate and 16 tcf of gas.<br />

Production from the Karachaganak field<br />

began in 1984. Since the signing of the Final<br />

Production Sharing Agreement (FPSA) in<br />

1997, the Karachaganak partners have made<br />

substantial investment in wells, facilities and<br />

pipelines. In addition to its size, Karachaganak<br />

presents the operators with formidable<br />

challenges due to extreme climate swings<br />

(+/- 40 degrees centigrade) and the<br />

requirement to re-inject high pressure sour<br />

gas. BG Group’s share of production from<br />

Karachaganak in 2011 was 37.4 mmboe.<br />

New information<br />

● Binding settlement agreement resulting in<br />

KazMunaiGas joining the contractor group<br />

Key dates<br />

1997 Karachaganak FPSA signed<br />

2001 CPC fully operational<br />

2003 First liquids from new<br />

Karachaganak facilities<br />

2004 Phase II Karachaganak<br />

development completed<br />

First exports via Novorossiysk<br />

on the Black Sea<br />

2006 Oil exports commenced via the<br />

Atyrau Samara pipeline<br />

2008 Upstream and downstream<br />

cooperation agreements<br />

with KazMunaiGas signed<br />

2010 CPC expansion project sanctioned<br />

2011 Start-up of the fourth liquids<br />

stabilisation train<br />

Key to operations<br />

Gas and Oil/Condensate<br />

Gas pipeline<br />

Oil pipeline<br />

The FPSA envisaged a phased development<br />

programme. Phase 2, which came onstream<br />

in 2004, involved investment to enhance the<br />

existing facilities, construction of new gas and<br />

liquids processing and gas injection facilities,<br />

work-over of more than 100 wells, construction<br />

of a 120 MW power station and a new<br />

650 kilometre pipeline to connect the field<br />

to the CPC pipeline at Atyrau.<br />

Most of the liquids are exported to the west<br />

(87% in 2011), with some oil and all raw gas sold<br />

locally and into Russia. Since 2004, oil exports<br />

are mainly via the CPC pipeline and, since 2006,<br />

additional oil exports are routed via the Atyrau<br />

Samara pipeline leading into the Russian<br />

Transneft system, enabling sales to achieve<br />

international prices.<br />

In 2011, a fourth liquids stabilisation train<br />

commenced operation. The project increases<br />

stabilisation capacity by 2.57 million tonnes<br />

a year (mtpa).

access to<br />

Partners Karachaganak (%)<br />

BG Group (joint operator) 29.25<br />

Eni (joint operator) 29.25<br />

Chevron 18.0<br />

LUKOIL 13.50<br />

KazMunaiGas 10.00<br />

In June <strong>2012</strong>, a settlement agreement between<br />

the Republic of Kazakshtan (the Republic) and<br />

the Karachaganak partners was completed.<br />

Under the terms of the agreement, which is<br />

effective from 28 June <strong>2012</strong>, the Republic has<br />

acquired a 10% interest in the FPSA from the<br />

consortium for $2.0 billion cash and $1.0 billion<br />

non-cash consideration (pre-tax) including<br />

the final and irrevocable settlement of<br />

all cost recovery claims, with each of the<br />

contracting companies’ equity shares<br />

reducing proportionately. The Republic’s<br />

interest is now held by a subsidiary of the<br />

national oil company, KazMunaiGas (KMG).<br />

The consideration under the agreement also<br />

includes the allocation of an additional 2 mtpa<br />

capacity in the CPC export pipeline over the<br />

remaining life of the FPSA, bringing total<br />

capacity for the use of the Karachaganak<br />

project to 10 mtpa on completion of the<br />

CPC expansion project, expected in 2015.<br />

BG Group and its partners are working<br />

with the Republic to define the next phase<br />

of development.<br />

KazMunaiGas agreements<br />

In 2008, BG Group announced an agreement<br />

with KMG and KMG subsidiary KazMunaiGas<br />

Exploration and Production (KMG EP) to<br />

cooperate in exploring a range of upstream<br />

opportunities. The agreement set out the<br />

principles of a joint study to identify potential<br />

opportunities in specific areas in Kazakhstan<br />

and other countries. In 2010, KMG EP acquired<br />

a 35% interest in the P1722 licence in the UK<br />

North Sea, which contains the White Bear<br />

prospect, the first official venture under this<br />

agreement. Drilling on the prospect began in<br />

May <strong>2012</strong>.<br />

Karachaganak export routes and capacity<br />

Atyrau Samara<br />

3.3 mtpa<br />

CPC<br />

8.1 mtpa*<br />

Stabilised oil<br />

Un-stabilised oil<br />

Gas<br />

A second, downstream, cooperation<br />

agreement was signed with KMG to examine<br />

ways to increase gas utilisation in Kazakhstan.<br />

As a follow through to this agreement,<br />

BG Group also signed a cooperation<br />

agreement with JSC KazTransGas (KTG) on<br />

implementation of a pilot project to convert<br />

vehicles in Almaty to compressed natural gas<br />

(CNG). The CNG pilot project is aimed at<br />

increasing gas usage and improving the<br />

environment by reducing vehicle emissions.<br />

BG Group in partnership with KTG opened<br />

the first CNG station in Almaty in 2010 and<br />

currently a fleet of 200 CNG buses operate<br />

in the Almaty city.<br />

Partners Karachaganak (%)<br />

KARACHAGANAK<br />

FIELD<br />

Orenburg<br />

8.4 bcm<br />

Orenburg<br />

4 mtpa<br />

Gas<br />

re-injection<br />

Small Refinery<br />

0.6 mtpa<br />

Capacity 2011 * Firm capacity of 6.5 mtpa plus access to<br />

additional capacity.<br />

T&D<br />

Shareholders CPC (%)<br />

Caspian Pipeline Consortium (CPC)<br />

The CPC was formed to build a pipeline system<br />

to transport oil from western Kazakhstan to<br />

the Black Sea near Novorossiysk in Russia. The<br />

pipeline system, which commenced operations<br />

along its full 1 500 kilometre length in 2001,<br />

consists of a new-build line, new marine<br />

terminal facilities near Novorossiysk BG Group (joint and operator) 29.25<br />

an upgraded pipeline. The Eni system (joint operator) currently 29.25<br />

has a design capacity of 28.2 Chevron mtpa. 18.0<br />

BG Group<br />

Russian government<br />

Kazakh government<br />

Chevron<br />

LUKARCO<br />

ExxonMobil<br />

RosneftShell<br />

LUKOIL 13.50<br />

CPC Company<br />

Kaz MunaiGas 10.00<br />

Eni<br />

2.00<br />

24.00<br />

19.00<br />

15.00<br />

12.50<br />

7.50<br />

7.50<br />

7.00<br />

2.00<br />

Oryx 1.75<br />

BG Group has a 2% equity share in the pipeline<br />

but is entitled to 2.75 mtpa (55 000 bopd) of<br />

capacity (around 10% of the total), which is<br />

used to transport liquids from Karachaganak.<br />

Karachaganak, operating via the Karachaganak<br />

Petroleum Operating Company (KPO),<br />

began delivering liquids into CPC in 2004.<br />

In 2011, 7.8 million tonnes of liquids from<br />

Karachaganak was transported via CPC<br />

(BG Group 2.1 million tonnes).<br />

KPV 1.75<br />

BG Group<br />

A global portfolio<br />

29<br />

In 2010, the CPC shareholders sanctioned<br />

the CPC expansion project, which will more<br />

than double capacity in three phases, with<br />

completion expected in 2015. Total capacity<br />

will increase to 67 mtpa. Following expansion,<br />

BG Group’s entitlement will rise to<br />

3.0 mtpa (60 000 bopd). BG Group and<br />

the Karachaganak partners also have the<br />

opportunity to capture capacity unused by<br />

other shareholders. The expansion project<br />

includes the addition of 10 pump stations<br />

in Russia and Kazakhstan, six crude oil storage<br />

tanks near Novorossiysk and a third single-point<br />

mooring at the CPC Marine Terminal.<br />

www.bg-group.com<br />

Partners K<br />

BG Group<br />

Eni (joint o<br />

Chevron 1<br />

Africa, Central and South Asia

30<br />

India<br />

18<br />

15<br />

12<br />

9<br />

6<br />

3<br />

0<br />

Areas of operation<br />

Gas<br />

INDIA 1<br />

KAKINADA<br />

INDIA<br />

KG-DWN-2009/1 (A)<br />

Mukta<br />

ARABIAN SEA<br />

KG-DWN-2009/1 (B)<br />

KG-OSN-2004/1<br />

Tapti<br />

GULF OF CAMBAY<br />

CUTTACK<br />

BHUBANESHWAR<br />

PURI<br />

MN-DWN-2002/02<br />

BG Group net production (mmboe)<br />

13.7<br />

2009 2010 2011<br />

Oil & liquids<br />

11.2 11.2<br />

INDIA 2<br />

Africa, Central and South Asia<br />

<strong>Data</strong> <strong>Book</strong> <strong>2012</strong><br />

AHMEDABAD<br />

ANKLESHWAR<br />

HAZIRA<br />

Panna<br />

MUMBAI<br />

VADODARA<br />

SURAT<br />

www.bg-group.com BG Group<br />

A global portfolio<br />

BG Group has a significant presence across the gas chain<br />

in India. The Group is seeking to play a greater role in<br />

India’s growing natural gas sector by developing its<br />

upstream position and expanding its LNG portfolio.<br />

1<br />

BHARUCH<br />

HVJ pipeline<br />

Gujarat Gas<br />

Tapti gas pipeline<br />

2<br />

Mahanagar Gas<br />

INDIA<br />

0 100km<br />

E&P<br />

BG Group has held a 30% interest in the<br />

Mid and South Tapti gas fields and the<br />

Panna/Mukta oil and gas fields since 2002.<br />

In June <strong>2012</strong>, the PMT JV announced reaching<br />

the landmark achievement of crossing the<br />

500 mmboe of oil and gas production from<br />

the PMT fields. Enhanced recovery from the<br />

PMT fields is planned to continue through<br />

incremental development of the existing<br />

fields via well intervention and infill drilling<br />

campaigns, as well as evaluating new projects<br />

New information<br />

● HoA signed for LNG supply to GSPC for up<br />

to 2.5 mtpa<br />

Key dates<br />

1995 Mahanagar Gas Ltd (MGL) formed<br />

1997 Majority stake in GGCL acquired<br />

2002 30% participating interest in the<br />

Panna/Mukta and Mid and South<br />

Tapti (PMT) fields acquired<br />

2008 Agreement signed by BG Group with<br />

GAIL to take PMT gas<br />

2010 PSC for Block KG-DWN-2009/1 signed<br />

2011 Identified as qualifying bidder for<br />

MB-DWN-2010/1<br />

Key to operations<br />

Gas<br />

Oil<br />

Gas pipeline<br />

Oil pipeline<br />

BG Group-operated block<br />

BG Group non-operated block<br />

and further development opportunities in<br />

such fields. BG Group and its partners are<br />

pursuing a drilling campaign in <strong>2012</strong> and 2013<br />

at the PMT fields.<br />

Under India’s New Exploration Licensing Policy<br />

(NELP) 6 licensing round in 2006, BG Group<br />

acquired a 45% interest in exploration block<br />

KG-OSN-2004/1 in the Krishna Godavari<br />

(KG) Basin. Oil and Natural Gas Corporation<br />

Limited (ONGC) holds the remaining 55% and is<br />

operator. In 2008, BG Group entered a farm-in<br />

agreement with ONGC to acquire a 25% interest

in exploration block MN-DWN-2002/02<br />

in the Mahanadi Basin on the east coast<br />

of India. However, BG Group has decided<br />

to exit these two blocks. This arrangement will<br />

be subject to Government of India (GoI) approval.<br />

In the NELP 8 licensing round, a consortium led<br />

by BG Group (30% and operator), was awarded<br />

an exploration block KG-DWN-2009/1 in deep<br />

water in the KG Basin.<br />

The NELP 9 licensing round was launched<br />

in October 2010. A consortium led by BG Group<br />

(50% and operator) has been identified as the<br />

qualifying bidder for an exploration block<br />

MB-DWN-2010/1 offshore the west coast<br />

of India. The award of the contract is awaiting<br />

approval from GoI.<br />

T&D<br />

Gujarat Gas Company Limited (GGCL)<br />

BG Group has a 65.12% controlling stake in<br />

GGCL. It is India’s largest private sector natural<br />

gas distribution company in terms of sales<br />

volume. BG Group is evaluating the potential<br />

sale of its interest in GGCL.<br />

GGCL continues to steadily increase its<br />

customer base. At the end of June <strong>2012</strong>,<br />

GGCL served close to 360 000 residential,<br />

commercial and industrial customers and<br />

fuelled more than 180 000 natural gas vehicles<br />

(NGVs) with compressed natural gas (CNG).<br />

In 2011, its distribution sales volumes were<br />

1 246 mmcm. With the declining profile of<br />

indigenous supplies, GGCL is increasingly<br />

purchasing significant volumes of LNG<br />

to fulfil the demand of its customers and<br />

enable growth.<br />

The Ministry of Petroleum and Natural<br />

Gas clarified GGCL’s status as an entity<br />

authorised by the Central Government in<br />

August 2008. This authorisation covers the<br />

cities of Ankleshwar, Bharuch and Surat.<br />

The downstream regulator (PNGRB) is<br />

currently processing GGCL’s authorisation<br />

application for identified areas in the Surat<br />

and Bharuch districts.<br />

Mahanagar Gas Ltd (MGL)<br />

MGL is based in India’s commercial capital,<br />

Mumbai. It is India’s largest gas distribution<br />

company in terms of size of customer base.<br />

BG Group and GAIL (India) each have a 49.75%<br />

stake in MGL, with the residual stake held<br />

by the government of Maharashtra.<br />

Licence BG Group (%) Partners (%)<br />

Panna/Mukta and Tapti 30 ONGC 40, Reliance Industries Limited (RIL) 30<br />

KG-OSN-2004/1 45* ONGC 55<br />

MN-DWN-2002/02 25* ONGC 75<br />

KG-DWN-2009/1 30 ONGC 45, Oil India Limited 15, AP Gas Infrastructure 10<br />

* BG Group is pursuing exit arrangements for these blocks.<br />

MGL’s 2011 volumes rose 11% to 700 mmcm.<br />

This volume growth was underpinned by<br />

growth in all market segments, particularly<br />

CNG and commercial, as well as the expansion<br />

of MGL’s network to other neighbouring towns<br />

of Greater Mumbai.<br />

As at the end of June <strong>2012</strong>, MGL served over<br />

525 000 residential, commercial and industrial<br />

customers and fuelled over 250 000 vehicles<br />

with CNG from over 150 CNG stations.<br />

MGL has been extending its pipeline network<br />

beyond Greater Mumbai, into neighbouring<br />

areas of Taloja, Kalyan and Ambernath.<br />

LNG<br />

In 2009, BG India Energy Solutions Private<br />

Limited (BGIES), a wholly owned subsidiary<br />

of BG Group, commenced midstream gas<br />

marketing operations in India to undertake<br />

wholesale marketing and distribution of<br />

natural gas.<br />

BGIES continues to pursue LNG business<br />

opportunities with existing and new potential<br />

counterparties to source gas in India, and to<br />

secure global LNG supplies from BG Group’s<br />

flexible LNG portfolio. At the end of 2011,<br />

BG Group had supplied 35 LNG cargoes to India.<br />

In 2011, BG Group announced it had signed<br />

a Heads of Agreement (HoA) with Gujarat<br />

State Petroleum Corporation (GSPC) for the<br />

supply of up to 2.5 mtpa of LNG for up to<br />

20 years beginning as early as 2014. Discussions<br />

on the fully termed Sale and Purchase<br />

Agreement are continuing. This agreement<br />

would bring essential new supplies of natural<br />

gas to India and add another important<br />

new dimension to BG Group’s expanding<br />

global LNG business.<br />

BG Group<br />

A global portfolio<br />

31<br />

www.bg-group.com<br />

Africa, Central and South Asia

32<br />

Thailand<br />

10<br />

Areas of operation<br />

BG Group net production (mmboe)<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Gas<br />

8.7<br />

9.8<br />

9.9<br />

2009 2010 2011<br />

Oil & liquids<br />

ANDAMAN SEA<br />

MYANMAR<br />

E&P<br />

Bongkot Gas Field<br />

BG Group has a 22.22% interest in the<br />

Bongkot field in the Gulf of Thailand. The field<br />

is operated by PTT Exploration and Production<br />

(PTTEP). In June <strong>2012</strong>, the Bongkot South Field<br />

completed a performance test during which<br />

the Bongkot Concession passed, for the first<br />

time, the significant milestone of producing<br />

over 1 bcf of sales gas per day from the Bongkot<br />

North and Bongkot South fields combined.<br />

RATCHABURI<br />

Africa, Central and South Asia<br />

<strong>Data</strong> <strong>Book</strong> <strong>2012</strong><br />

Block 9A<br />

KHANOM<br />

Bongkot<br />

THAILAND<br />

BANGKOK<br />

RAYONG<br />

www.bg-group.com BG Group<br />

A global portfolio<br />

BG Group’s investment in Thailand is focused<br />

on upstream activities, including an interest in<br />

the large offshore Bongkot field, which supplies<br />

approximately 20% of the country’s gas demand.<br />

Blocks 7, 8, 9<br />

GULF OF<br />

THAILAND<br />

0 250km<br />

CAMBODIA<br />

BG Group combined net production amounted<br />

to around 46 400 boed.<br />

The Bongkot North development consists of:<br />

a central complex for gas gathering, processing,<br />

0 export and accommodation; 200km a condensate<br />

floating storage and offloading vessel; and<br />

27 remote wellhead platforms. Production<br />

commenced in 1993 and daily gas production<br />

has risen and been sustained at over<br />

600 mmscfd through a phased programme<br />

of field development.<br />

The completion of development Phase 3H<br />

has contributed new production from three<br />

wellhead platforms (WP 23, 24 and 25). Progress<br />

continues on Phase 3J, with the installation<br />

of a further two wellhead platforms that are<br />

due to come onstream by the end of <strong>2012</strong>.<br />

BG Group and its partners continue to explore<br />

further opportunities to extend the Bongkot<br />

North production plateau. Programmes of well<br />

intervention, infill drilling and booster<br />

compression have been implemented to<br />

improve hydrocarbon recovery and an active<br />

New information<br />

● Bongkot South production commenced<br />

Key dates<br />

1990 Participation and Operating<br />

Agreement with partners entered into<br />

1993 Bongkot first production<br />

2001 Memorandum of Understanding (MoU)<br />

between Thailand and Cambodia for a<br />

Joint Development Area<br />

2007 Supplementary Petroleum Concession<br />

Agreements signed<br />

2009 Increased equity interest in Blocks 7, 8<br />

and 9 by 16.67% to 66.67%<br />

Key to operations<br />

Gas<br />

Oil<br />

Gas Sales Agreement for Bongkot<br />

South signed<br />

Gas pipeline<br />

Oil pipeline<br />

Gas and Oil/Condensate<br />

BG Group-operated block<br />

BG Group non-operated block<br />

programme of exploration drilling is underway<br />

to discover reserves for further incremental<br />

phases of development.<br />

Bongkot South is located some 70 kilometres<br />

to the south of Bongkot North and involves the<br />

development of further reserves through new<br />

standalone facilities with processing capacity of<br />

350 mmscfd and 15 000 barrels of condensate<br />

per day. Production commenced in the second<br />

quarter of <strong>2012</strong> and at plateau Bongkot South will<br />

deliver some 14 000 boed net to BG Group. Gas<br />

from the project is exported via a new-build spur<br />

line while condensate is exported to the floating<br />

storage and offloading vessel at Bongkot North.<br />

Production is sold to PTT Public Company.<br />

Blocks 7, 8 and 9<br />

BG Group is the operator of Blocks 7, 8 and 9<br />

in the Gulf of Thailand (BG Group 66.67%),<br />

in an area subject to overlapping claims by<br />

Thailand and Cambodia. Activity in these blocks<br />

is suspended until these claims are resolved.<br />

BG Group also has an Overriding Royalty<br />

Agreement covering production from Block 9a.

China Singapore<br />

YANGPU<br />

DONGFANG<br />

DANZHOU<br />

DONGFANG TERMINAL<br />

SANYA<br />

Key to operations<br />

Gas<br />

Oil<br />

BG Group entered China in<br />

2006 and owns interests in<br />

two blocks.<br />

Areas of operation<br />

Gas pipeline<br />

CHINA<br />

HAIKOU<br />

GUANGZHOU<br />

MACAU HONG KONG<br />

Lingshui 22-1-1<br />

64/11<br />

63/16 Qiongdongnan Basin<br />

BG Group-operated block<br />

Pipeline proposed or<br />

under construction<br />

E&P<br />

BG Group is the operator of deep water Block 64/11 and shallow water<br />

Block 63/16 in the Qiongdongnan Basin. The PSCs have a seven-year<br />

exploration and appraisal (E&A) phase and a 20-year production sharing<br />

period after entering development. BG Group carries 100% interests in both<br />

blocks during the E&A phase, and China National Offshore Oil Corporation<br />

(CNOOC) has the right to take up to 51% interest in any field development.<br />

The two blocks, which cover 10 169 square kilometres, are relatively<br />

unexplored and, should commercial discoveries be made, are well placed<br />

to supply the potential high growth markets of southern China.<br />

In 2010, BG Group announced a discovery on Block 64/11 after the Lingshui 22-1-1<br />

exploration well, the first drilled by BG Group in China, encountered gas-bearing<br />

sands. Further 3D seismic acquisition in Block 64/11 was completed in 2011,<br />

the results from which, along with the results of the discovery well, are being<br />

evaluated before determining next activities. Further 3D seismic acquisition<br />

in Block 63/16 is planned for late <strong>2012</strong>.<br />

In February <strong>2012</strong>, BG Group relinquished Block 53/16 after assessing the<br />

results of the Yongle 2-1-1 exploration well which was drilled in 2011.<br />

LNG<br />

In 2010, BG Group signed a sales contract with CNOOC, focused on the<br />

Queensland Curtis LNG project in Australia. The contract sets out the<br />

basis on which CNOOC will purchase 3.6 mtpa of LNG for a period of<br />

20 years (see page 35 for full details).<br />

0 250km 0 250km<br />

BG Group<br />

A global portfolio<br />

Areas of operation<br />

MALAYSIA<br />

SUMATRA<br />

SINGAPORE<br />

33<br />

BG Group has been appointed as<br />

the aggregator of LNG demand for<br />

the Singapore market and runs its<br />

Asia-Pacific activities from here.<br />

LNG<br />

In 2008, the Energy Market Authority (EMA) of Singapore appointed<br />

BG Group as the aggregator of LNG demand for the Singapore market.<br />

BG Group will be responsible for supplying up to 3 mtpa of LNG for<br />

up to 20 years. Initial deliveries are expected to begin in 2013 upon<br />

completion of the LNG import terminal, which is located on Jurong Island<br />

in Singapore. BG Group and the EMA signed the Aggregator Agreement<br />

in 2009.<br />

Commencing in 2010, BG Group has signed gas sales contracts with<br />

a variety of customers in Singapore, including six large scale power<br />

generation companies. The total gas sold by August <strong>2012</strong> was<br />

approximately 2.7 mtpa for up to 20 years.<br />

BG Group will source LNG supply for Singapore from its large, growing<br />

and diversified flexible portfolio. It is envisaged that BG Group’s proposed<br />

QCLNG facility in Australia will serve as one of the sources of supply<br />

for Singapore.<br />

BG Group has had an office in Singapore for over 15 years.<br />

www.bg-group.com<br />

Africa, Central and South Asia