Daniel Ferreira - LSE - London School of Economics and Political ...

Daniel Ferreira - LSE - London School of Economics and Political ...

Daniel Ferreira - LSE - London School of Economics and Political ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

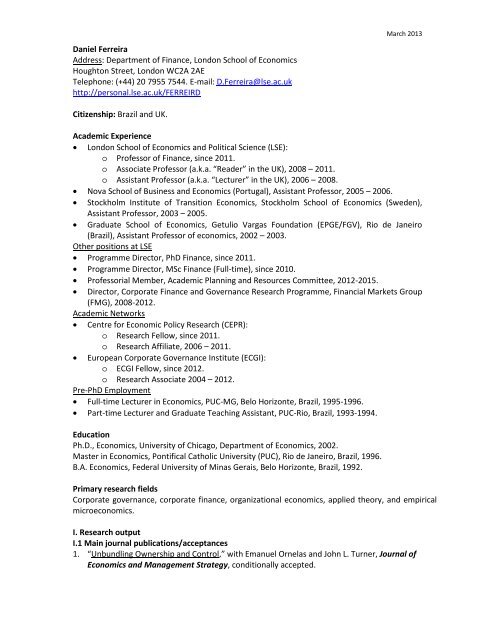

<strong>Daniel</strong> <strong>Ferreira</strong><br />

Address: Department <strong>of</strong> Finance, <strong>London</strong> <strong>School</strong> <strong>of</strong> <strong>Economics</strong><br />

Houghton Street, <strong>London</strong> WC2A 2AE<br />

Telephone: (+44) 20 7955 7544. E-mail: D.<strong>Ferreira</strong>@lse.ac.uk<br />

http://personal.lse.ac.uk/FERREIRD<br />

Citizenship: Brazil <strong>and</strong> UK.<br />

March 2013<br />

Academic Experience<br />

• <strong>London</strong> <strong>School</strong> <strong>of</strong> <strong>Economics</strong> <strong>and</strong> <strong>Political</strong> Science (<strong>LSE</strong>):<br />

o Pr<strong>of</strong>essor <strong>of</strong> Finance, since 2011.<br />

o Associate Pr<strong>of</strong>essor (a.k.a. “Reader” in the UK), 2008 – 2011.<br />

o Assistant Pr<strong>of</strong>essor (a.k.a. “Lecturer” in the UK), 2006 – 2008.<br />

• Nova <strong>School</strong> <strong>of</strong> Business <strong>and</strong> <strong>Economics</strong> (Portugal), Assistant Pr<strong>of</strong>essor, 2005 – 2006.<br />

• Stockholm Institute <strong>of</strong> Transition <strong>Economics</strong>, Stockholm <strong>School</strong> <strong>of</strong> <strong>Economics</strong> (Sweden),<br />

Assistant Pr<strong>of</strong>essor, 2003 – 2005.<br />

• Graduate <strong>School</strong> <strong>of</strong> <strong>Economics</strong>, Getulio Vargas Foundation (EPGE/FGV), Rio de Janeiro<br />

(Brazil), Assistant Pr<strong>of</strong>essor <strong>of</strong> economics, 2002 – 2003.<br />

Other positions at <strong>LSE</strong><br />

• Programme Director, PhD Finance, since 2011.<br />

• Programme Director, MSc Finance (Full-time), since 2010.<br />

• Pr<strong>of</strong>essorial Member, Academic Planning <strong>and</strong> Resources Committee, 2012-2015.<br />

• Director, Corporate Finance <strong>and</strong> Governance Research Programme, Financial Markets Group<br />

(FMG), 2008-2012.<br />

Academic Networks<br />

• Centre for Economic Policy Research (CEPR):<br />

o Research Fellow, since 2011.<br />

o Research Affiliate, 2006 – 2011.<br />

• European Corporate Governance Institute (ECGI):<br />

o ECGI Fellow, since 2012.<br />

o Research Associate 2004 – 2012.<br />

Pre-PhD Employment<br />

• Full-time Lecturer in <strong>Economics</strong>, PUC-MG, Belo Horizonte, Brazil, 1995-1996.<br />

• Part-time Lecturer <strong>and</strong> Graduate Teaching Assistant, PUC-Rio, Brazil, 1993-1994.<br />

Education<br />

Ph.D., <strong>Economics</strong>, University <strong>of</strong> Chicago, Department <strong>of</strong> <strong>Economics</strong>, 2002.<br />

Master in <strong>Economics</strong>, Pontifical Catholic University (PUC), Rio de Janeiro, Brazil, 1996.<br />

B.A. <strong>Economics</strong>, Federal University <strong>of</strong> Minas Gerais, Belo Horizonte, Brazil, 1992.<br />

Primary research fields<br />

Corporate governance, corporate finance, organizational economics, applied theory, <strong>and</strong> empirical<br />

microeconomics.<br />

I. Research output<br />

I.1 Main journal publications/acceptances<br />

1. “Unbundling Ownership <strong>and</strong> Control,” with Emanuel Ornelas <strong>and</strong> John L. Turner, Journal <strong>of</strong><br />

<strong>Economics</strong> <strong>and</strong> Management Strategy, conditionally accepted.

2. “Incentives to Innovate <strong>and</strong> the Decision to Go Public or Private,” with Gustavo Manso <strong>and</strong><br />

André Silva, Review <strong>of</strong> Financial Studies, forthcoming.<br />

3. “Who Gets to the Top? Generalists versus Specialists in Managerial Organizations,” with<br />

Raaj K. Sah, RAND Journal <strong>of</strong> <strong>Economics</strong>, Winter 2012, 43(4), 577-601.<br />

• Lead article.<br />

4. “Board Structure <strong>and</strong> Price Informativeness,” with Miguel <strong>Ferreira</strong> <strong>and</strong> Clara Raposo, Journal<br />

<strong>of</strong> Financial <strong>Economics</strong>, March 2011, 99(3), 523-545.<br />

• Egon Zehnder Prize for the best paper in the ECGI working paper series, 2008.<br />

5. “Moderation in Groups: Evidence from Betting on Ice Break-ups in Alaska,” with Renée<br />

Adams, Review <strong>of</strong> Economic Studies, July 2010, 77(3), 882–913.<br />

6. “What Determines the Composition <strong>of</strong> Banks' Loan Portfolios? Evidence from Transition<br />

Countries,” with Ralph de Haas <strong>and</strong> Anita Taci, Journal <strong>of</strong> Banking <strong>and</strong> Finance, February<br />

2010, 34(2), 388-398.<br />

7. “Women in the Boardroom <strong>and</strong> their Impact on Governance <strong>and</strong> Performance,” with Renée<br />

Adams, Journal <strong>of</strong> Financial <strong>Economics</strong>, November 2009, 94(2), 291-309.<br />

• Fourth most cited JFE article since 2009 (according to publisher).<br />

8. “Underst<strong>and</strong>ing the Relationship Between Founder CEOs <strong>and</strong> Firm Performance,” with<br />

Renée Adams <strong>and</strong> Heitor Almeida, Journal <strong>of</strong> Empirical Finance, January 2009, 16(1), 136-<br />

150.<br />

• Most cited JEF article since 2009 (according to publisher).<br />

9. “Do Directors Perform for Pay?,” with Renée Adams, Journal <strong>of</strong> Accounting <strong>and</strong> <strong>Economics</strong>,<br />

September 2008, 46(1), 154-171.<br />

10. “One Share-One Vote: The Empirical Evidence,” with Renée Adams, Review <strong>of</strong> Finance,<br />

2008, 12(1), 51-91.<br />

11. “A Theory <strong>of</strong> Friendly Boards,” with Renée Adams, Journal <strong>of</strong> Finance, February 2007, 62(1),<br />

217-250.<br />

• Emerald Citation <strong>of</strong> Excellence Award, 2011.<br />

• Egon Zehnder Prize for the best paper in the ECGI working paper series, 2006.<br />

• Second most cited Journal <strong>of</strong> Finance paper since 2007 (according to publisher).<br />

12. “Corporate Strategy <strong>and</strong> Information Disclosure,” with Marcelo Rezende, RAND Journal <strong>of</strong><br />

<strong>Economics</strong>, Spring 2007, 38(1), 164-184.<br />

13. “Options Can Induce Risk Taking for Arbitrary Preferences,” with Luis Braido, Economic<br />

Theory, April 2006, 27(3), 513-522.<br />

14. “Powerful CEOs <strong>and</strong> their Impact on Corporate Performance,” with Renée Adams <strong>and</strong> Heitor<br />

Almeida, Review <strong>of</strong> Financial Studies, Winter 2005, 18(4), 1403-1432.<br />

• Reprinted in Fundamentals <strong>of</strong> Corporate Governance, T. Clarke <strong>and</strong> M. Rama (eds.),<br />

2007.<br />

2

15. “Biased Managers, Organizational Design, <strong>and</strong> Incentive Provision,” with C. Costa <strong>and</strong> H.<br />

Moreira, <strong>Economics</strong> Letters, March 2005, 86(3), 379-385.<br />

16. “Democracy <strong>and</strong> the Variability <strong>of</strong> Economic Performance,” with Heitor Almeida, <strong>Economics</strong><br />

<strong>and</strong> Politics, November 2002, 14(3), 225-257 (lead article).<br />

I.2 Special issue papers (refereed)<br />

17. “Regulatory Pressure <strong>and</strong> Bank Directors’ Incentives to Attend Board Meetings,” with Renée<br />

Adams, International Review <strong>of</strong> Finance, Special issue: Governance, Policy, <strong>and</strong> the Crisis.<br />

June 2012, 12(2), 227-248.<br />

18. “Strong Managers, Weak Boards?” with Renée Adams, CESifo Economic Studies, September-<br />

November 2009, 55 (3-4), 482-514, Special issue on Executive Pay.<br />

I.3 Book Chapters<br />

19. “Corporate Boards in Europe: Size, Independence, <strong>and</strong> Gender Diversity,” with Tom<br />

Kirchmaier, to appear in Governing Corporate Europe Post-Crisis: Facts, Context <strong>and</strong><br />

Reforms, M. Belcredi <strong>and</strong> G. Ferrarini (Eds), Cambridge University Press, forthcoming.<br />

20. “Corporate Strategy <strong>and</strong> Investment Decisions,” Chapter 2 in Capital Budgeting Valuation:<br />

Financial Analysis for Today’s Investment Projects, Baker, H.K., <strong>and</strong> P. English (eds.), John<br />

Wiley & Sons, 2011, pp. 19-35.<br />

21. “Board Diversity,” Chapter 12 in Corporate Governance: A Synthesis <strong>of</strong> Theory, Research,<br />

<strong>and</strong> Practice, Anderson, R. <strong>and</strong> H.K. Baker (eds.), John Wiley & Sons, 2010, pp. 225-242.<br />

22. “Banking in Transition,” with R. de Haas, A. Taci, <strong>and</strong> P. Wachtel, chapter 4 in Transition<br />

Report 2006: Finance in Transition, European Bank for Reconstruction <strong>and</strong> Development,<br />

2006.<br />

I.4 Working papers <strong>and</strong> in progress (selected)<br />

23. “Competition <strong>and</strong> Organizational Change,” with Thomas Kittsteiner, R&R, Management<br />

Science.<br />

24. “Shareholder Empowerment <strong>and</strong> Bank Bailouts,” with David Kershaw, Tom Kirchmaier, <strong>and</strong><br />

Edmund Schuster.<br />

25. “Corporate investment <strong>and</strong> changes in CEO stock option grants,” with Vasiliki Athanasakou<br />

<strong>and</strong> Lisa Goh.<br />

26. “Boards <strong>of</strong> Banks,” with Tom Kirchmaier <strong>and</strong> <strong>Daniel</strong> Metzger.<br />

27. “Competitive Poaching <strong>and</strong> the Misallocation <strong>of</strong> Talent,” with Radoslawa Nikolowa.<br />

28. “A Theory <strong>of</strong> the Evolution <strong>of</strong> Executive Labor Markets,” with Radoslawa Nikolowa.<br />

29. “Capital Structure <strong>and</strong> Board Structure,” with Miguel <strong>Ferreira</strong> <strong>and</strong> Beatriz Mariano.<br />

3

II. Pr<strong>of</strong>essional service<br />

II.1 Ad hoc referee<br />

Journal <strong>of</strong> Finance, Journal <strong>of</strong> Financial <strong>Economics</strong>, Review <strong>of</strong> Financial Studies, American<br />

Economic Review, Econometrica, Journal <strong>of</strong> <strong>Political</strong> Economy, Review <strong>of</strong> Economic Studies, The<br />

Accounting Review, Management Science (Finance, Business Strategy, <strong>and</strong> Behavioral <strong>Economics</strong><br />

Departments), Proceedings <strong>of</strong> the National Academy <strong>of</strong> Sciences, Review <strong>of</strong> Finance, Journal <strong>of</strong><br />

Financial Intermediation, RAND Journal <strong>of</strong> <strong>Economics</strong>, Journal <strong>of</strong> <strong>Economics</strong> <strong>and</strong> Management<br />

Strategy, Journal <strong>of</strong> Law, <strong>Economics</strong>, <strong>and</strong> Organization, Journal <strong>of</strong> the European Economic<br />

Association, Economic Journal, Journal <strong>of</strong> Banking <strong>and</strong> Finance, Journal <strong>of</strong> Corporate Finance,<br />

Economica, European Financial Management, Contemporary Accounting Research, European<br />

Accounting Review, Economic Policy, European Journal <strong>of</strong> Finance, <strong>Economics</strong> <strong>of</strong> Transition,<br />

Corporate Governance: An International Review, Journal <strong>of</strong> the Japanese <strong>and</strong> International<br />

Economies.<br />

Grants reviewer: Economic <strong>and</strong> Social Research Council (UK), Research Grants Council <strong>of</strong> Hong<br />

Kong, Institute <strong>of</strong> Chartered Accountants in Engl<strong>and</strong> <strong>and</strong> Wales, AXA research grants.<br />

II.2 Editorial service<br />

• Associate editor, European Financial Management, 2007-<br />

• Associate editor, Brazilian Review <strong>of</strong> Finance (Revista Brasileira de Finanças), 2006-<br />

II.3 Conference organization/reviewing<br />

• Program committee: Paris Spring Corporate Finance Conference, 2011 <strong>and</strong> 2012.<br />

• Co-organizer, FMG conference on “Managers, Incentives, <strong>and</strong> Organizational Structure:<br />

Latest research <strong>and</strong> implications for the financial services industry,” FMG/<strong>LSE</strong>, 26-27 th June<br />

2009.<br />

• Scientific committee: “Private Equity <strong>and</strong> Corporate Governance,” ESSEC Business <strong>School</strong><br />

Paris, France, October 24-25, 2008.<br />

• Organizing committee: “Corporate Governance in Emerging Markets,” Istanbul, Turkey, 16-<br />

17 th November 2007.<br />

• Program committee: “Latest Developments in Corporate Governance,” <strong>London</strong> Business<br />

<strong>School</strong>, 2-3 rd September 2007.<br />

• Program committee or paper reviewer: European Finance Association (2011, 2010, 2009),<br />

Financial Management Association (2012, 2011, 2010), Latin American <strong>and</strong> Caribbean<br />

Economic Association meeting (2008), Portuguese Finance Network Conference (2006),<br />

Brazilian Finance Association Meeting (2004), Latin American Meeting <strong>of</strong> the Econometric<br />

Society (Panama, 2003), Brazilian Econometrics Society Meeting (2010, 2003).<br />

III. Awards <strong>and</strong> Grants<br />

• Elected Fellow <strong>of</strong> ECGI, 2012.<br />

• Winner <strong>of</strong> Emerald Citation <strong>of</strong> Excellence award, 2011, for paper “A Theory <strong>of</strong> Friendly<br />

Boards,” for papers with proven impact since publication.<br />

• Two-time winner (2006 <strong>and</strong> 2008) <strong>of</strong> the Egon Zehnder Prize for best paper in the European<br />

Corporate Governance Institute’s working paper series.<br />

• PI for FMG Grant from Emittenti Titoli, 2011-2012.<br />

• Co-director <strong>of</strong> the FMG team in the research grant from AXA Research Programme on Risk<br />

Management <strong>and</strong> Regulation <strong>of</strong> Financial Institutions, 2009-2011 (8 team members).<br />

• FCT (Portugal’s Research Council) research grant for project “The use <strong>of</strong> information in firms<br />

<strong>and</strong> markets,” 2008-2010 (4 team members).<br />

• FCT (Portugal’s Research Council) research grant for project “corporate governance,<br />

performance <strong>and</strong> capital markets,” 2007-2010 (8 team members).<br />

4

• Egide grant, U. Nova de Lisboa, 2005-2006.<br />

• Bank <strong>of</strong> Sweden Tercentenary Foundation grant, January 2004-December 2005 (joint with R.<br />

Adams <strong>and</strong> M. Giannetti).<br />

• Third place in the national exam for admission to graduate studies in economics (the ANPEC<br />

Exam) in 1993, Brazil.<br />

IV. Non-academic impact (selected)<br />

IV.1 Invited speaker at practitioner/policy conferences or events<br />

• Main Speaker, Center for Corporate Governance, UC: "What do we know about corporate<br />

boards?" Santiago, Chile, June 2012.<br />

• Main speaker, European Bank for Reconstruction <strong>and</strong> Development Seminar: "What do we<br />

know about corporate boards?" <strong>London</strong>, September 2010.<br />

• Invited speaker, Workshop on Corporate Governance in the Financial Sector in the EU,<br />

National Bank <strong>of</strong> Belgium, Brussels, July 2010.<br />

• Invited panel member, International Corporate Governance Network, 2010 Annual<br />

Conference, Toronto (June 2010).<br />

• Invited speaker, Copenhagen Conference on Control Enhancing Mechanisms, September<br />

2007.<br />

IV.2 Policy activities<br />

• Expert witness for the UK Treasury Select Committee inquiry on Women in the City. Invited<br />

to give oral evidence <strong>and</strong> answer questions from MPs in the House <strong>of</strong> Commons (UK<br />

Parliament). (October 2009).<br />

• Team member <strong>of</strong> ECGI, ISS consortium analyzing the issue <strong>of</strong> “one-share, one-vote” for the<br />

European Commission. (2006/2007).<br />

• Consultant to the European Bank for Reconstruction <strong>and</strong> Development. Topic: Banking in<br />

transition economies. (2006)<br />

IV.3 Newspaper articles<br />

• “If women ruled boards,” invited comment, The Sunday Telegraph, August 9, 2009,<br />

(Business, page 4).<br />

IV.4 Media coverage <strong>of</strong> research papers<br />

Featured, mentioned or discussed in The Wall Street Journal, The Economist, Financial Times,<br />

The Times (with interview fragments), Guardian (with interview fragments), Financial Director<br />

Magazine (with interview fragments), Daily Telegraph, Daily Express, Boston Globe (with<br />

interview fragments), El Mercurio (Chile, with interview fragments), Australian Associated Press,<br />

Courier Mail, The Australian, China Daily, Irish Herald, Scotl<strong>and</strong> on Sunday, BBC News (on line),<br />

Board IQ, Management Issues (with interview fragments), Management Today, Human<br />

Resources Magazine, Press Trust <strong>of</strong> India, The New Zeal<strong>and</strong> Herald, Berlingske Nyhedsmagasin,<br />

NK (Norway), Politiken (Denmark), <strong>and</strong> many others.<br />

V. Academic presentations<br />

V.1 Invited seminar presentations<br />

• 2012-13: Boston University, University <strong>of</strong> Southern California, Board <strong>of</strong> Governors <strong>of</strong> the<br />

Federal Reserve System (Washington, DC), Bocconi University (<strong>Economics</strong> Dept.), Rotterdam<br />

(<strong>Economics</strong> Dept.), U. Paris Dauphine, Duisenberg <strong>School</strong> <strong>of</strong> Finance (Amsterdam), São Paulo<br />

<strong>School</strong> <strong>of</strong> <strong>Economics</strong>, U. <strong>of</strong> Nottingham, University <strong>of</strong> St. Gallen.<br />

• 2011-12: Tilburg U., Rotterdam, Frankfurt.<br />

5

• 2010-11: Arizona State University, Imperial College, Oxford, Lancaster, HEC Paris, Paris<br />

Dauphine, ESSEC Business <strong>School</strong>, Vienna Graduate <strong>School</strong> <strong>of</strong> Finance, Mannheim, BI-Oslo,<br />

Porto, ISCTE Lisbon.<br />

• 2009-10: Zurich, Pompeu Fabra, Stockholm <strong>School</strong> <strong>of</strong> <strong>Economics</strong>, Queen Mary (<strong>Economics</strong><br />

Dept.), Exeter, Stockholm University (<strong>Economics</strong> Dept.), University <strong>of</strong> Lausanne, European<br />

Bank for Reconstruction <strong>and</strong> Development, Financial Services Authority (FSA).<br />

• 2008-09: U. <strong>of</strong> Illinois-Urbana, Michigan State U., U. <strong>of</strong> Iowa, Warwick Business <strong>School</strong>, Cass<br />

Business <strong>School</strong>, U. <strong>of</strong> Alicante, CERGE-EI (Prague), U. <strong>of</strong> Aberdeen, U. <strong>of</strong> Munich.<br />

• 2007-08: U. <strong>of</strong> Maryl<strong>and</strong>, Tilburg U., U. <strong>of</strong> Mannheim, U. Carlos III (Madrid), U. <strong>of</strong> Edinburgh,<br />

Manchester Business <strong>School</strong>, U. <strong>of</strong> Bristol, <strong>and</strong> ESCP-EAP (Paris).<br />

• Earlier (selected): Imperial College, U. <strong>of</strong> Cologne, Fondazione Collegio Carlo Alberto (U. <strong>of</strong><br />

Turin), Helsinki <strong>School</strong> <strong>of</strong> <strong>Economics</strong> <strong>and</strong> the Swedish <strong>School</strong> <strong>of</strong> <strong>Economics</strong>, U. Nova de<br />

Lisboa, Uppsala University, Ente Einaudi (Rome), U. <strong>of</strong> Rochester, Harvard Business <strong>School</strong>,<br />

UC San Diego, U. <strong>of</strong> Texas-Dallas.<br />

V.2 Papers in conferences (selected)<br />

UBC Winter Finance Conference (2013), Columbia Law <strong>School</strong>/Oxford conference on<br />

Governance after the Crisis (2012), American Finance Association (2011, 2004), Argentum/SIFR<br />

Conference on Private Equity (2010), European Summer Symposium in Financial Markets –<br />

Gerzensee (2010), European Finance Association (2012, 2010, 2008, 2004), Madrid Conference<br />

on Governance <strong>and</strong> Regulation <strong>of</strong> Financial Institutions (2010), MBS corporate finance<br />

conference (2008), Corporate Governance <strong>and</strong> Politics <strong>of</strong> Finance (Hitotsubashi U., Tokyo, 2008),<br />

Econometric Society North-American winter meeting (2008, 2007), Econometric Society World<br />

meeting (2010), NBER corporate finance (2001), NBER corporate governance (2003), American<br />

Economic Association (2005), Econometric Society European meeting (2006, 2004, 2003),<br />

Econometric Society summer meeting (2003), European Economic Association (2010, 2004,<br />

2003), European Winter Finance Meeting (2006), MIT Sloan-Lisbon Workshop (2007), Northern<br />

Finance Association (2002), Oxford Corporate Governance Conference (2005), INSEAD Family<br />

Firms conference (2004), Financial Management Association (2005), European Financial<br />

Management Association (2006), International Industrial Organization Conference (2006, 2004).<br />

Paper discussions: 25+, including WFA, AFA, EFA, etc.<br />

V.3 Invited/special/keynote talks at academic conferences<br />

• Finance UC Conference, Santiago, Chile, June 2012.<br />

• Rotterdam conference on Governance <strong>and</strong> Executive Compensation, May 2012.<br />

• Tilburg Accounting Spring Camp, March 2012.<br />

• Brazilian Econometrics meeting, Foz do Iguaçu, December 2011.<br />

• Brazilian Finance Association meeting, Rio de Janeiro, July 2011.<br />

• Corporate Governance Conference, Toulouse Business <strong>School</strong>, June 2009.<br />

• CESifo Workshop on Executive Pay, Venice, Italy, July 2008.<br />

• International Tor Vergata Conference on Banking <strong>and</strong> Finance in Rome, December 2007.<br />

• Brazilian Finance Association meeting, São Paulo, July 2007.<br />

• Roundtable panelist at the European Financial Management Symposium on “Corporate<br />

Governance <strong>and</strong> Shareholder Activism,” Milan, Italy, May 2007.<br />

VI. Visiting academic positions<br />

• Visiting Fellow, Department <strong>of</strong> <strong>Economics</strong>, European University Institute, Florence, Italy,<br />

September 2010.<br />

• Visiting Pr<strong>of</strong>essor, Department <strong>of</strong> <strong>Economics</strong>, University <strong>of</strong> São Paulo, Brazil, 2004.<br />

6

• Visiting Pr<strong>of</strong>essor, PUC, Department <strong>of</strong> <strong>Economics</strong>, Rio de Janeiro, Brazil, 2001.<br />

VII. Teaching experience<br />

At <strong>LSE</strong><br />

Program type Course title<br />

Master programs in Finance Corporate Finance, Applied Corporate Finance<br />

Master programs in Management Incentives <strong>and</strong> Governance in Organizations<br />

PhD Empirical Finance<br />

Executive Education Corporate Finance <strong>and</strong> Strategy, Financial Management<br />

Summer <strong>School</strong> Strategic Management, Organizational Strategy<br />

Previously (outside <strong>LSE</strong>), also taught Corporate Finance (executive, MBA, PhD), International<br />

Finance (MBA), Introductory Finance (undergraduate), Industrial Organization (PhD),<br />

Organizational <strong>Economics</strong> (MSc, PhD), Microeconomics (undergraduate, MSc), Mathematics<br />

(undergraduate), Econometrics (undergraduate).<br />

Ph.D. Students<br />

As main advisor or co-advisor:<br />

• <strong>Daniel</strong> Metzger (PhD <strong>Economics</strong>, <strong>LSE</strong>) – placed at Stockholm <strong>School</strong> <strong>of</strong> <strong>Economics</strong>,<br />

Department <strong>of</strong> Finance, 2011.<br />

• Cláudia Custódio (PhD Management, <strong>LSE</strong>) – placed at Arizona State University, Department<br />

<strong>of</strong> Finance, 2010.<br />

• Min Park, (PhD Management, <strong>LSE</strong>), in progress.<br />

• Jing Zeng (PhD Finance, <strong>LSE</strong>), in progress.<br />

• Gennaro Catapano (PhD Finance, <strong>LSE</strong>), in progress.<br />

• Yiqing Lu (PhD Finance, <strong>LSE</strong>), in progress.<br />

• Adeline Pelletier (PhD Management, <strong>LSE</strong>), in progress.<br />

As job market referee:<br />

• Dragana Cvijanović (PhD Finance, <strong>LSE</strong>) – placed at HEC Paris, Department <strong>of</strong> Finance, 2011;<br />

now at U. <strong>of</strong> North Carolina, Chapel Hill.<br />

• Alberta Di Giuli (PhD Finance, Bocconi) – placed at ISCTE Business <strong>School</strong>, Department <strong>of</strong><br />

Finance, 2008 (main job market advisor; un<strong>of</strong>ficial advisor); now at ESCP-EAP (Paris).<br />

External examiner for PhD dissertations: <strong>London</strong> Business <strong>School</strong>, University <strong>of</strong> New South<br />

Wales.<br />

MSc/MA dissertations supervised: <strong>LSE</strong> (20+), Getulio Vargas Foundation (2).<br />

External examiner for MSc/MA dissertations: Getulio Vargas Foundation, PUC-Rio, Ibmec-Rio,<br />

ISCTE (Lisbon).<br />

VIII. Personal<br />

Born in 1970 (Florianópolis, Brazil). Grew up in Rio de Janeiro <strong>and</strong> Belo Horizonte. Married to<br />

Ana Beatriz Galvão (since 2005). UK citizen since 2012. Native Portuguese speaker.<br />

7