185% of the Federal Poverty Level is: Financial Group ... - DHS home

185% of the Federal Poverty Level is: Financial Group ... - DHS home

185% of the Federal Poverty Level is: Financial Group ... - DHS home

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FSML – 52B<br />

02/01/09 Food Stamp Program E – Categorical Eligibility for Food Stamps E - 3<br />

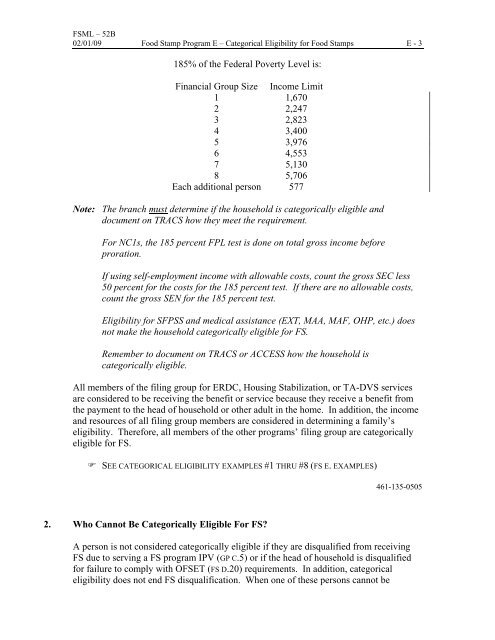

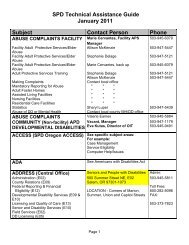

<strong>185%</strong> <strong>of</strong> <strong>the</strong> <strong>Federal</strong> <strong>Poverty</strong> <strong>Level</strong> <strong>is</strong>:<br />

<strong>Financial</strong> <strong>Group</strong> Size Income Limit<br />

1 1,670<br />

2 2,247<br />

3 2,823<br />

4 3,400<br />

5 3,976<br />

6 4,553<br />

7 5,130<br />

8 5,706<br />

Each additional person 577<br />

Note: The branch must determine if <strong>the</strong> household <strong>is</strong> categorically eligible and<br />

document on TRACS how <strong>the</strong>y meet <strong>the</strong> requirement.<br />

For NC1s, <strong>the</strong> 185 percent FPL test <strong>is</strong> done on total gross income before<br />

proration.<br />

If using self-employment income with allowable costs, count <strong>the</strong> gross SEC less<br />

50 percent for <strong>the</strong> costs for <strong>the</strong> 185 percent test. If <strong>the</strong>re are no allowable costs,<br />

count <strong>the</strong> gross SEN for <strong>the</strong> 185 percent test.<br />

Eligibility for SFPSS and medical ass<strong>is</strong>tance (EXT, MAA, MAF, OHP, etc.) does<br />

not make <strong>the</strong> household categorically eligible for FS.<br />

Remember to document on TRACS or ACCESS how <strong>the</strong> household <strong>is</strong><br />

categorically eligible.<br />

All members <strong>of</strong> <strong>the</strong> filing group for ERDC, Housing Stabilization, or TA-DVS services<br />

are considered to be receiving <strong>the</strong> benefit or service because <strong>the</strong>y receive a benefit from<br />

<strong>the</strong> payment to <strong>the</strong> head <strong>of</strong> household or o<strong>the</strong>r adult in <strong>the</strong> <strong>home</strong>. In addition, <strong>the</strong> income<br />

and resources <strong>of</strong> all filing group members are considered in determining a family’s<br />

eligibility. Therefore, all members <strong>of</strong> <strong>the</strong> o<strong>the</strong>r programs’ filing group are categorically<br />

eligible for FS.<br />

SEE CATEGORICAL ELIGIBILITY EXAMPLES #1 THRU #8 (FS E. EXAMPLES)<br />

2. Who Cannot Be Categorically Eligible For FS?<br />

461-135-0505<br />

A person <strong>is</strong> not considered categorically eligible if <strong>the</strong>y are d<strong>is</strong>qualified from receiving<br />

FS due to serving a FS program IPV (GP C.5) or if <strong>the</strong> head <strong>of</strong> household <strong>is</strong> d<strong>is</strong>qualified<br />

for failure to comply with OFSET (FS D.20) requirements. In addition, categorical<br />

eligibility does not end FS d<strong>is</strong>qualification. When one <strong>of</strong> <strong>the</strong>se persons cannot be

FSML – 52B<br />

E - 4 Food Stamp Program E – Categorical Eligibility for Food Stamps 02/01/09<br />

categorically eligible, <strong>the</strong> case must not be coded as categorically eligible on <strong>the</strong><br />

computer.<br />

SEE CATEGORICAL ELIGIBILITY EXAMPLE #11 (FS E. EXAMPLES)<br />

3. How Long Is a Household Categorically Eligible?<br />

Households determined categorically eligible due to household income less than<br />

185 percent <strong>of</strong> FPL and <strong>the</strong> receipt <strong>of</strong> <strong>the</strong> pamphlet on TANF information and referral<br />

services are categorically eligible for <strong>the</strong> entire certification period unless an OFSET<br />

(FS D.20) or IPV (GP C.5) d<strong>is</strong>qualification <strong>is</strong> applied or a change in circumstances <strong>is</strong><br />

reported indicating <strong>the</strong> income exceeds 185 percent <strong>of</strong> FPL (FS E.1). In addition, th<strong>is</strong><br />

determination, <strong>the</strong> Resource Guide for Low-Income Families (<strong>DHS</strong> 3400), and narration<br />

must happen at each certification and recertification.<br />

If categorical eligibility <strong>is</strong> based on eligibility for specific programs and <strong>the</strong> eligibility for<br />

that program ends, categorical eligibility does not continue. Review and determine if<br />

categorical eligibility ex<strong>is</strong>ts ano<strong>the</strong>r way, such as, household under 185 percent <strong>of</strong> FPL.<br />

If yes, give <strong>DHS</strong> 3400 and narrate.<br />

Remember to change <strong>the</strong> categorical eligibility coding in <strong>the</strong> CAT EL field from “Y” or<br />

“C” to “N” when categorical eligibility ends. The household may move from one related<br />

program to ano<strong>the</strong>r. For example, a TANF family may gain employment and begin to<br />

receive ERDC. When <strong>the</strong>re <strong>is</strong> a change from one program to ano<strong>the</strong>r, determine<br />

categorical eligibility based on <strong>the</strong> new program. In <strong>the</strong> example <strong>of</strong> a TANF family<br />

moving to ERDC, <strong>the</strong> CAT EL coding should change from “Y” to “C.”<br />

Former TANF families who ended TANF due to employment are eligible for Transition<br />

services for 12 months after <strong>the</strong>ir TANF ends. Housing Stabilization <strong>is</strong> approved for a<br />

12-month period in which <strong>the</strong> household may continue to receive benefits as needed.<br />

TA-DVS <strong>is</strong> approved for a three-month period in which <strong>the</strong> household may continue to<br />

receive TA-DVS benefits as needed. Therefore, <strong>the</strong> households receiving benefits or<br />

services from <strong>the</strong>se programs are considered categorically eligible for <strong>the</strong> full 3-month or<br />

12-month period.<br />

4. Eligibility Factors<br />

In creating categorical eligibility for FS, Congress assumed that certain eligibility factors<br />

were met in <strong>the</strong> program that made <strong>the</strong> individual categorically eligible. Therefore, if<br />

<strong>the</strong>y are verified in <strong>the</strong> o<strong>the</strong>r program, <strong>the</strong>y are verified for FS also. The eligibility<br />

factors that are assumed met and not used in determining FS eligibility for categorically<br />

eligible individuals are: SSN (FS D.7), residency (FS D.2), resources (FS F.3), and <strong>the</strong><br />

sponsored alien (NC A.3) information. Workers are required to look at SSN, residency<br />

and sponsored alien information if <strong>the</strong>y have not been verified in <strong>the</strong> categorical program.