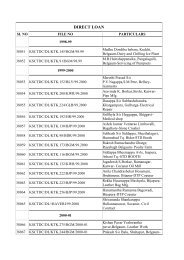

ANNEXURE - II (Para 172) - Karnataka State at NIC

ANNEXURE - II (Para 172) - Karnataka State at NIC

ANNEXURE - II (Para 172) - Karnataka State at NIC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

71<br />

1 ADHESIVES OF ALL KINDS INCL. GUM,<br />

GLUE,ADHESIVE SOLUTION,GUM PASTE,LAPPING<br />

COMPOUND,LIQUID M-SEAL EPOXY, SHELLAC,<br />

VULCANISING SOLUTION AND ADHESIVE,SELF<br />

ADHESIVE TAPES,GUM AND GUMMED TAPES &<br />

RESIN.<br />

2 AEROPLANES,HELICOPTERS,JET PLANES,<br />

GLIDERS AND ALL TYPES OF FLYING MACHINES<br />

(OTHER THAN BALLOONS) AND PARTS &<br />

ACCESSORIES THEREOF.<br />

3 AGARBATHI<br />

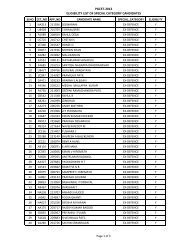

<strong>ANNEXURE</strong> - <strong>II</strong> (<strong>Para</strong> <strong>172</strong>)<br />

PROPOSED MODIFICATIONS IN SALES TAX RATES<br />

A. SECOND SCHEDULE:<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

4 AGRICULTURAL IMPLEMENTS-CULTIVATORS,<br />

DISC & MOULD BOARD PLOUGHS,LAND<br />

LEVELLERS,CAGE WHEELS, DISC HARROWS,SUB<br />

SOILERS, RIDGERS, SHOVELS,SEED SOWING<br />

EQUPTS,BLADE HARROW, ROTAVATOR,<br />

COMBINED HARVESTOR,POST-HOLE DIGGER,<br />

ROTARY DITCHER ,CHAFF CUTTERS & PARTS,<br />

ACCESSORIES THEREOF.<br />

5 AIR COOLERS,AIR CONDITIONERS, AIR<br />

CONDITIONING PLANTS,COLD STORAGE PLANTS<br />

AND EQUIPMENTS, PARTS AND ACCESSORIES<br />

THEREOF.<br />

6 ALUMINIUM - ALUMINIUM FOILS, ALUMINIUM<br />

OXIDE, ALUMINIUM GRAINS, ALUMINIUM<br />

POWDER, ALUMINIUM TAPE<br />

7 ALUMINIUM BARS, RODS, ROUNDS,<br />

SQUARES,FLATS, OCTAGONS AND HEXAGONS<br />

15<br />

15<br />

4<br />

4<br />

20<br />

12<br />

12

72<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

8 ALUMINIUM SEMIS(INGOTS,SLABS,BLOCKS AND<br />

BILLETS)<br />

9 ALUMINIUM SHEETS,CIRCLES,HOOPS,STRIPS<br />

AND ROLLS<br />

10 ALUMINIUM STRUCTURALS, ANGLES,<br />

JOISTS,CHANNELS,TEES,SHEETS PILING<br />

SECTIONS, Z SECTIONS<br />

11 ALUMINIUM TUBES (ROUNDS AND SQUARES)OF<br />

ALL DIAMETERS AND LENGTHS INCL.TUBE<br />

FITTINGS<br />

12 ALUMINIUM UTENSILS OTHER THAN SPECIFIED<br />

ELSEWHERE<br />

13 ALUMINIUM WIRE RODS AND WIRES ROLLED OR<br />

DRAWN<br />

14 ANIMAL FEED AND FEED SUPPLEMENTS -<br />

POULTRY,CATTLE,PIG,FISH,FISH MEAL, PRAWN,<br />

SHRIMPS<br />

15 ARC CARBONS<br />

16 ARECANUT<br />

17 ARMS (GUNS,REVOLVERS,RIFLES AND PISTOLS)<br />

& AMMUNITION<br />

18 ARTICLES MADE OF CANE OTHER THAN<br />

FURNITURE<br />

19 ASPHALT SHEETS<br />

20 AUDIO AND VIDEO BLANK CASETTES<br />

21 AUDIO AND VIDEO MAGNETIC TAPES<br />

22 AUDIO AND VIDEO RECORDED CASETTES<br />

4<br />

12<br />

12<br />

12<br />

4<br />

12<br />

2<br />

12<br />

4<br />

20<br />

8<br />

12<br />

12<br />

12<br />

12

73<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

23 BAMBOO - ARTICLES MADE OF BAMBOO OTHER<br />

THAN FURNITURE<br />

24 BAMBOO - WHOLE OR SPLIT<br />

25 BATTERIES AND PARTS EXCL.DRY CELLS AND<br />

DRY CELL BATTERIES<br />

26 BEARINGS - BALL OR ROLLER BEARINGS OF ALL<br />

KINDS<br />

27 BEEDI LEAVES<br />

28 BICYCLES, TANDEM CYCLES, CYCLES<br />

COMBINATIONS, CYCLE-RICKSHAWS,<br />

PERAMBULATORS, CHILDREN’S TRICYCLES &<br />

PARTS, INCL. THEIR TYRES, TUBES AND FLAPS<br />

29 BLASTING GUN POWDER AND OTHER<br />

MECHA<strong>NIC</strong>AL EXPLOSIVES<br />

30 BONE MEAL<br />

31 BRASS ARTICLES, BRASS RODS, ROUNDS,<br />

SQUARES & FLATS<br />

32 BRASS CIRCLES,SHEETS AND STRIPS<br />

33 BRASS UTENSILS (KITCHENWARE)<br />

34 BREAD AND BUN<br />

35 BRICKS OF ALL KINDS, OTHER THAN COUNTRY<br />

BRICKS (REFRACTORY BRICKS AND THE LIKE)<br />

36 BRONZE ARTICLES, BRONZE RODS, SQUARES &<br />

FLATS<br />

37 BRONZE UTENSILS(KITCHENWARE)<br />

38 BULLION AND SPECIE<br />

8<br />

8<br />

15<br />

12<br />

4<br />

4<br />

4<br />

4<br />

12<br />

12<br />

8<br />

4<br />

4<br />

12<br />

8<br />

1

39 BUTTER AND GHEE<br />

40 CAKES AND BISCUITS<br />

41 CAMPHOR OF ALL KINDS<br />

42 CANDLES<br />

43 CANE WHOLE OR SPLIT<br />

44 CARPETS<br />

45 CASHEW (RAW)<br />

46 CASHEW KERNEL<br />

47 CASHEW SHELL OIL<br />

74<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

48 CASSETTE TAPE RECORDERS (AUDIO AND<br />

VIDEO)PARTS AND ACCES.<br />

49 CASTOR OIL OTHER THAN THOSE QUALIFYING<br />

AS TOILET GOODS<br />

50 CEMENT<br />

51 CEMENT CONCRETE MIXTURE<br />

52 CEREALS & PULSES - FLOUR & HUSKS OF<br />

PULSES, PARCHED RICE, RICE SOJI,BEATEN<br />

RICE,BRAN OR RICE, WHEAT AND POHA, ATTA,<br />

MAIDA AND SOJI OF WHEAT<br />

53 CEREALS & PULSES - PULSES (WHETHER WHOLE<br />

OR SEPARATED AND WHETHER WITH OR<br />

WITHOUT HUSK) OTHER THAN IN IV SCH.<br />

54 CEREALS AND PULSES - CHUNNI OF PULSES<br />

55 CEREALS AND PULSES - FLOUR AND SOJI OF<br />

MAIZE, GRITS AND FLAKES OF MAIZE, BRAN OF<br />

MAIZE AND MAIZE PRODUCTS<br />

12<br />

15<br />

4<br />

4<br />

8<br />

20<br />

4<br />

4<br />

4<br />

15<br />

4<br />

15<br />

12<br />

2<br />

1<br />

2<br />

4

75<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

56 CEREALS AND PULSES - FRIED GRAM<br />

57 CHARCOAL<br />

58 CHEESE<br />

59 CHEMICAL FERTILIZER MIXTURES WHICH HAVE<br />

NOT SUFFERED TAX<br />

60 CHEMICAL FERTILIZERS<br />

61 CHEMICALS OF ALL KINDS INCLUDING COPPER<br />

SULPHATE, CAUSTIC SODA, DYES & SULPHUR<br />

62 CHICORY<br />

63 CHINAWARE,PORCELAINWARE AND STONEWARE<br />

ARTICLES<br />

64 CIGAR AND CIGARETTE CASES,LIGHTERS AND<br />

TOBACCO PIPES<br />

65 CIGARETTE FILTERS<br />

66 CINEMATOGRAPHIC,PHOTOGRAPHIC & OTHER<br />

CAMERAS, PROJECTORS, ENLARGERS, LENSES,<br />

PARTS AND ACCES TO SUCH CAMERAS,<br />

CINETOGRAPHIC PROJECTORS & ENLARGERS,<br />

PLATES AND CLOTH REQUIRED FOR USE<br />

THEREWITH.<br />

67 CLOCKS,TIME PIECES AND WATCHES OF ALL<br />

KINDS & PARTS, STRAPS, CHAINS, BRACELETS<br />

(OTHER THAN THOSE MADE OF NOBLE METALS)<br />

68 COCOA PODS,BEANS AND POWDER<br />

69 COCONUT OIL SOLD UNDER BRAND NAME<br />

2<br />

4<br />

12<br />

4<br />

4<br />

4<br />

4<br />

15<br />

15<br />

12<br />

15<br />

15<br />

4<br />

20

76<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

70 COFFEE - FRENCH COFFEE<br />

71 COFFEE INCLUDING COFFEE BEANS & COFFEE<br />

SEEDS<br />

72 COFFEE INSTANT<br />

73 COFFEE POWDER EXCLUDING FRENCH<br />

COFFEE,INSTANT COFFEE AND COFFEE DRINK<br />

74 COIR PRODUCTS - RUBBERISED COIR PRODUCTS<br />

75 COIR PRODUCTS, EXCEPT COIR ROPE, FIBRE,<br />

YARN<br />

76 COMPUTER CLEANING KIT<br />

77 COMPUTER CONSUMABLES NAMELY -<br />

STATIONERY, FLOPPY DISKS, CD-ROMS, DAT<br />

TAPES, PRINTER RIBBONS, PRINTER<br />

CARTRIDGES AND CARTRIDGE TAPES<br />

78 COMPUTER PERIPHERALS - ALL KINDS OF<br />

PRINTERS AND THEIR PARTS NAMELY DOT<br />

MATRIX, INK JET, LASER, LINE, LINE MATRIX AND<br />

THE LIKE<br />

79 COMPUTER PERIPHERALS - TERMINALS,<br />

SCANNERS, MULTIMEDIA KITS, PLOTTERS,<br />

MODEMS AND THEIR PARTS<br />

80 COMPUTER SOFTWARE<br />

81 COMPUTERS OF ALL KINDS NAMELY MAIN<br />

FRAME,MINI,PERSONAL, MICRO COMPUTERS<br />

AND THE LIKE CONSISTING OF MONITOR,<br />

KEYBOARD, MOUSE AND DRIVES (FLOPPY,<br />

CARTRIDGE TAPE,CD-ROM,DAT),HARD DISKS<br />

AND THEIR PARTS<br />

82 CONFECTIONERY<br />

4<br />

4<br />

15<br />

8<br />

12<br />

4<br />

4<br />

4<br />

4<br />

4<br />

4<br />

4<br />

15

77<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

83 CONTAINERS - GLASS JARS AND CARBOYS<br />

84 CONTAINERS - METALLIC GAS CYLINDERS<br />

85 CONTAINERS - PAPER BOXES, FOLDING<br />

CARTONS, PAPER BAGS, CARRIER BAGS,<br />

CARDBOARD AND CORRUGATED BOXES<br />

86 CONTAINERS - PLASTIC,POLYVINYL CHLORIDE<br />

AND POLYTHENE BOTTLES, JARS, BOXES,<br />

CRATES, CANS,CARBOYS, DRUMS, BAGS (OTHER<br />

THAN WOVEN SACKS)<br />

87 CONTAINERS - WOODEN BOXES,CRATES,CASKS<br />

AND CONTAINERS<br />

88 CONTAINERS -PLASTIC WOVEN SACKS<br />

89 CONTAINERS -TIN PLATE,STEEL & ALUMINIUM<br />

DRUMS & CRATES,ALUMINIUM TUBES &<br />

COLLAPSIBLE TUBES<br />

90 COOKING GAS OTHER THAN LPG<br />

91 COPPER ARTICLES,COPPER RODS, ROUNDS,<br />

SQUARES & FLATS<br />

92 COPPER CIRCLES, SHEETS AND STRIPS<br />

9 3 COPPER INGOTS AND COPPER WIRE OTHER THAN<br />

INSULATED WIRE<br />

94 COPPER UTENSILS (KITCHENWARE)<br />

95 COTTON BEDS, COTTON PILLOWS, COTTON<br />

QUITS AND THIER COVERS MADE OF COTTON<br />

96 COTTON WASTE<br />

97 COTTON YARN WASTE<br />

4<br />

4<br />

4<br />

4<br />

4<br />

4<br />

4<br />

12<br />

12<br />

12<br />

4<br />

8<br />

8<br />

4<br />

4

98 CROCKERY<br />

78<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

99 CUTLERY AND TABLE AND HOUSEHOLD<br />

GLASSWARE<br />

100 DEODORANTS, DISINFECTANTS & GERMICIDES<br />

101 DE-OILED CAKE<br />

102 DICTAPHONES AND OTHER SIMILAR APPARATUS<br />

FOR RECORDING SOUND AND PARTS<br />

103 DIESEL ENGINES, PARTS AND ACCESSORIES<br />

THEREOF<br />

104 DRUGGETS AND DURRIES<br />

105 DRY CELLS AND DRY CELL BATTERIES<br />

106 EDIBLE OIL - REFINED<br />

107 EDIBLE OIL -NON REFINED<br />

108 EDIBLE OILS - HYDROGENATED OILS AND<br />

COOKING MEDIUM (VANASPATHI)<br />

109 ELECTRICAL GOODS - ELECTRICAL BULBS<br />

110 ELECTRICAL GOODS -ELECTRICAL<br />

EARTHENWARE AND PORCELAIN<br />

111 ELECTRICAL GOODS -GRINDERS, MIXERS,<br />

BLENDERS,HAIR DRYERS, SHAVERS. HEATERS,<br />

COOKING RANGES ,BOILERS, OVENS,HOT<br />

PLATES,COIL STOVES, GEYSERS, FLOOR<br />

POLISHERS, JUICE EXTRACTORS,CREAM<br />

WHIPPERS, EGG BEATERS, IRONERS,MASSAGE<br />

APPARTUS, KETTLES,SAUCEPAN,ROOM<br />

HEATERS, ETC.<br />

15<br />

15<br />

12<br />

4<br />

12<br />

12<br />

12<br />

15<br />

4<br />

4<br />

4<br />

12<br />

12<br />

15

79<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

112 ELECTRICAL GOODS- TRANSFORMERS,<br />

TRANSMISSION WIRES AND TOWERS, ACSR<br />

CONDUCTORS AND CABLES<br />

113 ELECTRICAL GOODS- WASHING MACHINES,<br />

VACUUM CLEANERS, AIR CIRCULATORS AND<br />

VOLTAGE STABLISERS<br />

114 ELECTRICAL GOODS, INSTRUMENTS AND<br />

APPARATUS (OTHER THAN <strong>II</strong>-E2-I) INCL. FANS,<br />

TUBELIGHTS, PARTS & ACCESSORIES<br />

115 ELECTRODES OF ALL KINDS - WELDING,<br />

GRAPHITE INCLUDING ANODES,WELDING &<br />

SOLDERING RODS, SOLDERING WIRES<br />

116 ELECTRO<strong>NIC</strong> GOODS, PARTS AND ACCESSORIES,<br />

OTHER THAN MENTIONED ELSEWHERE<br />

117 FAX MACHINES AND PARTS AND ACCESSORIES<br />

118 FIBREGLASS SHEETS & ARTICLES MADE OF<br />

FIBRE GLASS EXCLUDING HELMETS<br />

119 FILMS - CINEMATOGRAPHIC<br />

120 FILMS - PHOTOGRAPHIC FILMS INCL.<br />

PHOTOGRAPHIC PAPER<br />

121 FILMS - X-RAY FILMS<br />

122 FIRE FIGHTING EQUIPMENTS AND DEVICES<br />

123 FIREWOOD<br />

124 FIREWORKS<br />

125 FOAMED RUBBER,PLASTIC FOAM AND OTHER<br />

SYNTHETIC ARTICLES SUCH AS SHEETS,<br />

CUSHIONS, PILLOWS, MATTRESSES<br />

15<br />

15<br />

12<br />

12<br />

12<br />

12<br />

12<br />

8<br />

8<br />

8<br />

12<br />

4<br />

15<br />

15

80<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

126 FOLDING UMBRELLAS AND PARTS<br />

127 FOOD & NON ALCOHOLI DRINKS - INSTANT MIX<br />

IN LIQUID, POWDER OR CRYSTAL FORM -<br />

JAMOON,IDLI,ICE -CREAM,JELLY MIX,<br />

ETC.;SAMBHAR & RASAM, MASALA, CURRY<br />

POWDERS & PASTES, SOFT DRINK<br />

CONCENTRATE<br />

128 FOOD & NON ALCOHOLIC DRINKS - AERATED<br />

WATER INCL. SOFT DRINKS, EXCL.SOFT DRINK<br />

CONCENTRATE<br />

129 FOOD & NON ALCOHOLIC DRINKS - INCL.<br />

SWEETMEATS SOLD IN PLACES OTHER THAN<br />

STAR HOTELS<br />

130 FOOD &NON ALCOHOLIC DRINKS - SOLD IN<br />

THREE,FOUR AND FIVE STAR HOTELS<br />

RECOGNISED BY TOURISM DEPT.,GOVT.OF INDIA<br />

131 FOOD &NON ALCOHOLIC DRINKS - BABY FOODS<br />

INCL. MILK POWDER<br />

132 FOOD &NON ALCOHOLIC DRINKS - READY TO<br />

SERVE,PROCESSED,SEMI-COOKED,SEMI-<br />

PROCESSED,FRUITS(NOT DRY FRUITS),DRIED<br />

VEGETABLES,FRUIT&VEGETABLE SOLD IN TINS<br />

ETC.<br />

133 FOOD AND NON ALCOHOLIC DRINKS - SOYA MILK<br />

134 FOOD AND NON ALCOHOLIC DRINKS - MEAT AND<br />

DRESSED CHICKEN SOLD IN SEALED<br />

CONTAINERS<br />

135 FOOD PRESERVATIVES,FOOD COLOURS AND<br />

FOOD FLAVOURING ESSENCES<br />

136 FOOTWEAR<br />

2<br />

15<br />

15<br />

12<br />

20<br />

15<br />

15<br />

10<br />

8<br />

12<br />

12

81<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

137 FOOTWEAR POLISHERS (SHOE CARE KIT, SHOE<br />

LACES)<br />

138 FOREST PRODUCTS - NUXVOMICA,RITA,<br />

SOAPNUT, ANTWAL,HALEELA, HARDA FRUITS<br />

AND SEEDS,KAADU SEEGE BARK,MARDI<br />

DEVIDEVI, MYROBALAN BARKS, ROUSA GRASS,<br />

TAMALA PATRA<br />

139 FURNACE OIL,TRANSFORMER OIL AND<br />

COOLANTS<br />

140 FURNITURE - STEEL FURNITURE AND MOULDED<br />

FURNITURE<br />

141 FURNITURE OF ALL KINDS(OTHER THAN STEEL<br />

FURNITURE AND MOULDED FURNITURE) OF ANY<br />

MATERIAL, INCL. IN KNOCKDOWN CONDITION,<br />

TREASURE CHESTS, SAFES, PARTS &<br />

ACCESSORIES<br />

142 FURS AND SKINS (OTHER THAN IN IV SCH) AND<br />

ARTICLES MADE THEREFROM BUT EXCL. THOSE<br />

FALLING UNDER ANY OTHER ENTRY<br />

143 GALVANISED IRON BUCKETS<br />

144 GARDEN AND BEACH UMBRELLAS AND PARTS<br />

145 GLASS SHEETS AND ARTICLES EXCL.GLASS<br />

BOTTLES,TABLE AND HOUSEHOLD GLASSWARE,<br />

GLASS MIRROR, GLASS AMPULES<br />

146 GLYCERINE<br />

147 GOLD THREAD OF ALL KINDS INCL.METALLIC<br />

(YARN,JARI YARN,PLASTIC YARN),POLYSTER FILM<br />

YARN AND RADIANT YARN<br />

148 GOTTA AND NAKKI<br />

12<br />

8<br />

15<br />

15<br />

15<br />

15<br />

8<br />

12<br />

15<br />

8<br />

4<br />

4

82<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

149 GRAMOPHONES INCL. RADIO GRAMOPHONES<br />

AND PARTS AND ACCES.<br />

150 GRAMOPHONES RECORDS, COMPACT DISCS<br />

INCL. GRAMOPHONE NEEDLES<br />

151 GUNNY BAGS, BARDANS, BATARS, HESSIAN<br />

CLOTH AND JUTE TWINE<br />

152 GYPSUM<br />

153 HANDICRAFTS OF BRASS,BRONZE,COPPER<br />

&OTHER METALS,BIDARIWARE,HAND MADE<br />

ITEMS (POTTERY, STONE CRAFTED, MARBLE,<br />

WOOD, LAMPS). ART WORKS,DOKRA<br />

ITEMS,COCONUT SHELL,CONCH, SHELL, PALM<br />

LEAF,PAPIERMACHE, SCREWPINE, STRAW,WOOD<br />

CARVINGS&FIGURES,WOOD INLAID ARTICLES<br />

154 HARDWARE - BOLTS, BOLTENDS, RIVETS, NUTS,<br />

HINGES, SCREWS (HOOKS, RINGS, STUDDINGS,<br />

SELF-TAPPED), DOOR CLOSERS,WHEELS,<br />

BLOCKS, CLAMPS, GUNMETAL FITTINGS,<br />

CURTAIN RODS, GRINDING STONES, LOCKS &<br />

PADLOCKS OF ALL KINDS,WASHERS,SPRINGS,<br />

GLASS& STEEL WOOL, ABRASIVES, NAILS<br />

155 HARDWARE - METALLIC BARBED WIRE,WIRE<br />

MESH,PLASTER MESHES AND METALLIC WIRE<br />

NETTINGS<br />

156 HARDWARE - PAINT BRUSHES<br />

157 HARDWARE -FITTINGS OF DOORS,WINDOWS AND<br />

FURNITURE(OF BASE METAL OR ALLOY)<br />

158 HEAD CLEANERS (ALL KINDS) OF AUDIO AND<br />

VIDEO CASETTE PLAYERS AND RECORDERS AND<br />

LUBRICANTS SPECIALLY USED IN ELECTRO<strong>NIC</strong><br />

GOODS<br />

12<br />

12<br />

4<br />

4<br />

12<br />

12<br />

12<br />

12<br />

12<br />

12

159 HELMETS<br />

83<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

160 HOSIERY (EXCEPT HOSIERY CLOTH IN LENGTHS)<br />

OF ALL KINDS<br />

161 HUSKS - CASHEW, CASHEW SHELL, COCONUT<br />

SHELL, COFFEE, GROUNDNUT, GROUNDNUT<br />

SHELL, MAIZE<br />

162 ICE, ICE FRUIT, ICE CANDIES, ICE CREAM OF ALL<br />

KINDS<br />

163 IMITATION JEWELLERY<br />

164 INDIAN MUSICAL INSTRUMENTS,PARTS &<br />

ACCESSORIES THEREOF<br />

165 INDUSTRIAL GASES - OXYGEN, ACETYLENE,<br />

NITROGEN ETC.<br />

166 INKS OF ALL KINDS<br />

167 INSECTICIDES, PESTICIDES, RODENTICIDES,<br />

FUNGICIDES, WEEDICIDES, HERBICIDES AND<br />

PLANT REGULATORS AND PLAN GROWTH<br />

NUTRIENTS EXCL. COPPER SULPHATE<br />

168 IVORY AND SANDLEWOOD ARTICLES<br />

169 JAGGERY (GUR)<br />

170 JEWELLERY - ARTICLES MADE OF GOLD AND<br />

SILVER, WHETHER OR NOT STUDDED WITH<br />

PRECIOUS OR SEMI-PRECIOUS STONES<br />

171 JUTE-CUM-POLYPROPYLENE COVERINGS<br />

<strong>172</strong> KEROSENE (EXCLUDING KEROSENE SOLD<br />

UNDER PDS)<br />

8<br />

4<br />

4<br />

15<br />

4<br />

4<br />

15<br />

12<br />

4<br />

15<br />

1<br />

2<br />

12<br />

15

84<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

173 KIRANA GOODS - METHI, POPPY SEEDS (KASKAS),<br />

CORIANDER (DHANIYA) JEERA, SOMPH, KATHA,<br />

AZWAN, KESAR, KABAB CHINI, BHOJUR PHOOL,<br />

TEJPATHA, JAPATRI, NUTMEG, KALHOOVU, WET<br />

& DRY DATES, SAIGO, KHARBHUJ SEEDS &<br />

BRANDED HONEY<br />

174 KIRANA GOODS - CARDAMOM, PEPPER,<br />

CINNAMON, DALCHINNY, CLOVES<br />

175 KIRANA GOODS - DRY FRUITS<br />

INCL.ALMONDS,WALNUTS AND PISTA<br />

176 KIRANA GOODS - CUMMIN SEEDS (JEERA), AND<br />

TAMARIND<br />

177 KITCHENWARE & UTENSILS MADE OF ALUMINUM<br />

OR NON-FERROUS METALS WITH STICK<br />

RESISTANT COATINGS<br />

178 KITCHENWARE COATED WITH HEAT RESISTANT<br />

COATINGS FOR COOKING & SERVING<br />

179 LAMINATED PACKING MATERIALS - HESSIAN<br />

BASED,POLYTHENE,HIGH DENSITY POLYTHENE<br />

BASED, BITUMINISED WATERPROOF PAPER<br />

180 LAMINATED,IMPREGNATED OR COATED<br />

MATTING MATERIALS - LINOLEUM, PVC(VINYL)<br />

USED FOR FLOOR COVERINGS(OTHER THAN<br />

TILES)<br />

181 LEATHER GOODS (OTHER THAN THE GOODS<br />

FALLING UNDER V SCH.NO.16<br />

182 LIFTS WHETHER OPERATED BY ELECTRICITY OR<br />

HYDRAULIC POWER<br />

183 LIME INCLUDING LIME STONES<br />

184 LOTTERY TICKETS<br />

8<br />

8<br />

8<br />

4<br />

12<br />

12<br />

4<br />

15<br />

15<br />

15<br />

4<br />

20

85<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

185 MACHINERY - AGRICULTURAL - PARTS AND<br />

ACCES. OF TRACTORS AND POWER TILLERS,<br />

TRAILERS, EXCLUDING TYRES, TUBES & FLAPS<br />

186 MACHINERY - AGRICULTURAL - TRACTORS<br />

187 MACHINERY - AGRICULTURAL - TRACTORS AND<br />

POWER TILLERS TRAILERS<br />

188 MACHINERY - AGRICULTURAL- PARTS & ACCES.<br />

OF TRACTORS,POWER TILLERS INCL.ENGINES<br />

AND PARTS EXCL.BATTERIES, TYRES,TUBES AND<br />

FLAPS OF TRACTORS<br />

189 MACHINERY - EARTH MOVERS, DUMPERS,<br />

DIPPERS BULLDOZERS AND THE LIKE<br />

190 MACHINERY - HANDLOOMS PARTS AND ACCES.<br />

191 MACHINERY - PARTS AND ACCES.OF EARTH<br />

MOVERS OTHER THAN DIESEL ENGINE PARTS,<br />

TYRES, BATTERIES, TUBES & FLAPS<br />

192 MACHINERY - SEWING MACHINES PARTS AND<br />

ACCES.<br />

193 MACHINERY - SPRINKLERS AND DRIP IRRIGATION<br />

EQUIPMENTS USED FOR AGRICULTURE OR<br />

HORTICULTURE PURPOSES, PARTS AND<br />

ACCESSSORIES THEREOF<br />

194 MACHINERY - TOOLS & WEAR PARTS USED IN<br />

INDUSTRIAL MACHINERY SUCH AS TWIST<br />

DRILLS,TAPS,REAMERS,CUTTERS,DIES,GRINDING<br />

WHEELS, BUTTON BITS, TUNGSTEN,CARBIDE<br />

WEAR PARTS,CERAMIC INDUSTRIAL WEAR PARTS<br />

& LIKE<br />

195 MACHINERY - WEIGHING MACHINES OF ALL<br />

KINDS<br />

196 MACHINERY -AGRICULTURAL - POWER TILLERS<br />

4<br />

4<br />

4<br />

4<br />

8<br />

2<br />

12<br />

12<br />

4<br />

8<br />

12<br />

0

86<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

197 MACHINERY- MACHINERIES (ALL KINDS) & PARTS<br />

AND ACCESSORIES, EXCEPT THOSE FALLING<br />

UNDER OTHER ITEMS AND SPECIFIED<br />

ELSEWHERE<br />

198 MAIZE PRODUCTS - MAIZE STARCH, LIQUID<br />

GLUCOSE, DEXTROSE MONO HYDRATE, MALTO<br />

DEXTRINE, GLUCOSE “”D””, MAIZE GLUTEN,<br />

MAIZE GERM, MAIZE OIL, HYDROL, CORN STEEP<br />

LIQUOR<br />

199 MAN MADE OR SYNTHETIC STAPLE FIBRES,FIBRE<br />

YARN OR FILAMENT YARN OF ALL KINDS<br />

200 MARBLE SLABS, TILES AND ARTICLES MADE OF<br />

MARBLE<br />

201 MEDICINAL AND PHARMACEUTICAL<br />

PREPARATIONS<br />

202 MEDICINAL PLANTS, ROOTS,HERBS AND BARKS<br />

USED IN THE PREPARATION OF AYURVEDIC<br />

MEDICINES<br />

203 MERCURY<br />

204 METAL CAPS EXCLDING METAL LAMP CAPS<br />

205 METAL LAMP CAPS<br />

206 MILL YARN (ALL KINDS) EXCLUDING COTTON<br />

YARN, SPUN SILK YARN, FILATURE SILK AND<br />

THOSE FALLING UNDER ANY OTHER ENTRY.<br />

207 MINERAL WATER, DISTILLED WATER OR ANY<br />

OTHER PROCESSED WATER<br />

208 MOLASSES<br />

209 MOSQUITO REPELLANTS, DEVICES,PARTS &<br />

ACCESSORIES<br />

12<br />

4<br />

4<br />

20<br />

12<br />

4<br />

12<br />

4<br />

4<br />

4<br />

15<br />

25<br />

12

87<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

210 MOTOR SPIRITS - PETROL INCLUDING AVIATION<br />

FUEL<br />

211 MOTOR SPIRITS NOT FALLING UNDER ITEM<br />

ABOVE.<br />

212 MOTOR VEHICLES - ANY OTHER MOTOR<br />

VEHICLES NOT COVERED BY SCH <strong>II</strong>-M-13-<br />

I,<strong>II</strong>,<strong>II</strong>I,IV,V,VI<br />

213 MOTOR VEHICLES - BODIES BUILT ON MOTOR<br />

VEHICLE CHASSIS<br />

214 MOTOR VEHICLES - JEEPS,TREKKERS AND<br />

VANS(PETROL DRIVEN)<br />

215 MOTOR VEHICLES - LIGHT DIESEL VEHICLES<br />

216 MOTOR VEHICLES - MOTOR CARS INCLUDING<br />

MOTOR TAXI CABS<br />

217 MOTOR VEHICLES - MOTOR CYCLES<br />

INCL.SCOOTERS, MOTERETTES, MOPEDS AND<br />

CYCLE COMBINATIONS<br />

218 MOTOR VEHICLES - MOTOR LORRIES INCLUDING<br />

MOTOR OMNI BUSES<br />

219 MOTOR VEHICLES - PARTS & ACCES.,<br />

EXCL.RUBBER & OTHER TYRES, TUBES & FLAPS,<br />

BATTERIES AND DIESEL ENGINE AND ITS PARTS<br />

220 MOTOR VEHICLES - PARTS AND ACCESSORIES-<br />

SPARK PLUGS<br />

221 MOTOR VEHICLES - THREE WHEELER MOTOR<br />

VEHICLES(AUTORICKSHAWS)<br />

222 MOTOR VEHICLES PARTS & ACCESSORIES -<br />

CHASSIS OF MOTOR VEHICLES<br />

30 (Effective<br />

r<strong>at</strong>e to<br />

be notified)<br />

25 (Effective<br />

r<strong>at</strong>e to<br />

be notified)<br />

12<br />

12<br />

12<br />

12<br />

12<br />

12<br />

12<br />

12<br />

12<br />

12<br />

12

88<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

223 MUSICAL INSTRUMENTS, PARTS & ACCESSORIES<br />

THEREOF NOT COVERED BY ITEM 165 ABOVE.<br />

224 NEWSPRINT<br />

225 NON-FERROUS CASTINGS AND ALLOYS<br />

226 OIL CAKE<br />

227 OILS - AGARBATHI, CITRODARA, CITRONELLA,<br />

CLOVE, DAVANA, LEMON GRASS, NATURAL<br />

ESSENTIAL,RUBBER SEED, NILGIRI OIL OTHER<br />

THAN THOSE SPECIFIED ELSEWHERE IN THE<br />

SCHEDULE<br />

228 OPIUM,GANJA, BHANG AND OTHER NARCOTICS<br />

229 OPTICAL GOODS - BINOCULARS,OPERA GLASSES,<br />

TELESCOPES,MICROSCOPES, PARTS AND<br />

ACCES.(LENS CARE SOLUTION)<br />

230 OPTICAL GOODS - SPECTACLES, LENSES &<br />

FRAMES INCL.PARTS AND ACCES.<br />

231 PAINTS - ACRYLIC PAINTS AND COLOURS,PLASTIC<br />

EMULSION PAINTS AND ALL KINDS OF LACQUERS<br />

232 PAINTS, COLOURS, VARNISHES, PIGMENTS,<br />

POLISHER, INDIGO, ENAMEL, PUTTY, BALE OIL,<br />

WHITE OIL, TURPENTINE, THINNERS, AND<br />

PRIMERS,LIGHT MINERAL OIL, METAL POLISHING<br />

COMPOUND, PATTIES<br />

233 PAN MASALA<br />

234 PAPER PULP<br />

235 PAPERS OF ALL KINDS INCLUDING AMMONIA<br />

PAPER, BLOTTING PAPER, CARBON PAPER,<br />

CELLOPHANE, PVC COATED PAPER, STENCIL<br />

PAPER, WATER PROOF PAPER, ART BOARDS,<br />

15<br />

4<br />

8<br />

4<br />

4<br />

25<br />

12<br />

12<br />

15<br />

15<br />

25<br />

8<br />

8

89<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

CARD BOARDS, CORRUGATED BOARDS, DUPLEX<br />

BOARDS, PULP BOARDS, STRAW BOARDS,<br />

TRIPLEX BOARDS; STUDENT NOTE BOOKS AND<br />

THE LIKE, BUT EXCLUDING PHOTOGRAPHIC<br />

PAPER<br />

236 PARTS AND ACCESSORIES OF CASETTES<br />

237 PENS OF ALL KINDS INCLUDING REFILLS<br />

238 PETROLEUM PRODUCT - LIQUEFIED PETROLEUM<br />

GAS<br />

239 PETROLEUM PRODUCT- BRAKE FLUID,<br />

LUBRICATING OIL (GREASE,SOLVENT OILS),<br />

PETROLEUM JELLY, SPRAY OIL,METHANOL,<br />

AROMAX, MOSQUITO LARVICIDAL OIL,LOW<br />

SULPHUR,GLASS CLEANER, BENZENE, TOULENE,<br />

SHELL HEXANE,SPECIAL BOILING POINT SPIRIT<br />

240 PETROLEUM PRODUCTS - ASPHALT (BITUMEN)<br />

241 PETROLEUM PRODUCTS- NAPTHA<br />

242 PHOTO FRAMES AND PHOTO MOUNTS<br />

243 PIPES TUBES AND FITTINGS OF IRON(NOT<br />

FALLING UNDER FOURTH SCH.) CEMENT,<br />

STONEWARE AND ASBESTOS, CEMENT<br />

GRILLS,PITCH FIBRE PIPE<br />

244 PLASTIC GOODS - HIGH DENSITY POLYTHENE,<br />

LOW DENSITY POLYTHENE,RIGID POLYVINYL<br />

CHLORIDE PIPES AND FITTINGS EXCLD. CONDUIT<br />

PIPES AND ITS FITTINGS<br />

245 PLASTIC GOODS - PLASTIC GRANULES<br />

12<br />

12<br />

12<br />

15<br />

15<br />

12<br />

12<br />

12<br />

4<br />

4

90<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

246 PLASTIC GOODS - PLASTIC SHEETS & ARTICLES<br />

MADE FROM ALL KINDS OF PLASTIC INCL.<br />

POLYTHENE, POLYVINYL CHLORIDE,<br />

POLYPROPYLENE, POLYSTYRENE<br />

247 PLAYING CARDS OF EVERY DESCRIPTION<br />

248 PRECIOUS STONES - DIAMONDS, EMERALDS,<br />

RUBIES, REAL PERALS, SAPPIRES & ARTICLES IN<br />

WHICH SUCH PRECIOUS STONES ARE SET<br />

249 PRESSURE COOKERS PARTS AND ACCES.<br />

250 PRINTED MATERIALS OTHER THAN BOOKS<br />

MEANT FOR READING<br />

251 PUMPSETS WITH ELECTRIC MOTORS OR OIL<br />

ENGINES OF NOT MORE THAN 10 HP<br />

252 PUMPSETS WITH OIL ENGINES OF MORE THAN<br />

10 HP<br />

253 PUMPSETS WITH ELECTRIC MOTORS OF MORE<br />

THAN 10 HP<br />

254 RAIL COACHES AND PARTS AND ACCESSSORIES<br />

THEREOF<br />

255 RAW SILK AND SILK YARN IMPORTED FROM<br />

OUTSIDE THE COUNTRY<br />

256 RAYON GRADE PULP OR ANY OTHER PULP OUT<br />

OF WHICH MAN MADE OR SYNTHETIC STAPLE<br />

FIBRES OR FIBRE YARN OR FILAMENT YARN ARE<br />

MADE<br />

257 RAZOR AND RAZOR BLADES<br />

258 READYMADE GARMENTS (OTHER THAN HOSIERY<br />

OF ALL KINDS) MADE OUT OF ANY MATERIAL<br />

WHETHER USED AS REGULAR WEAR OR CASUAL<br />

15<br />

12<br />

2<br />

12<br />

8<br />

4<br />

12<br />

12<br />

12<br />

8<br />

8<br />

15<br />

8

91<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

WEAR INCLUDING CAPS, NECK TIES,BOWS,BABY<br />

DIAPERS,BABY NAPPIES<br />

259 REFRACTORY BRICKS AND THE LIKE<br />

260 REFRIGERATORS INCUDING DEEP FREEZERS<br />

BOTTLE COOLERS AND WATER COOLERS AND<br />

THE LIKE AND PARTSTHEREOF<br />

261 RICE BRAN OIL<br />

262 ROLLING SHUTTERS AND COLLAPSIBLE GATES<br />

WHETHER OPERATED MANUALLY,<br />

MECHA<strong>NIC</strong>ALLY OR ELECTRICALLY AND THEIR<br />

PARTS<br />

263 ROOFING,LIGHT ROOFING AND FALSE ROOFING<br />

MATERIALS INCLUDING CEMENT, ASBESTOS<br />

SHEETS, ASPHALT, HARD & SOFT BOARDS,<br />

PLYWOODS, VENEERED BOARDS & PANELS,<br />

LAMINATED SHEETS BUT EXCLUDING THOSE<br />

SPECIFIED ELSEWHERE.<br />

264 ROSEWOOD ARTICLES<br />

265 RAW RUBBER NAMELY, LATEX IN LIQUID OR<br />

SHEET FORM<br />

266 RUBBER PLATES,SHEETS AND STRIPS<br />

UNHARDENED WHETHER VULCANISED OR NOT<br />

AND WHETHER COMBINED WITH TEXTILE<br />

MATERIAL OR OTHERWISE<br />

267 RUBBER - PIPING AND TUBING OF UNHARDENED<br />

VULCANISED RUBBER<br />

268 RUBBER - TRANSMISSION,CONVEYOR OR<br />

ELEVATOR BELTS OR BELTING OF VULCANISED<br />

RUBBER WHETHER COMBINED WITH ANY<br />

TEXTILE MATERIAL OR OTHERWISE<br />

4<br />

20<br />

4<br />

12<br />

12<br />

15<br />

12<br />

15<br />

15<br />

15

92<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

269 RUBBER - SYNTHETIC RUBBER INCLUDING<br />

BUTADIENE, ACRYLONITRILE,STYRENE<br />

BUTADIENE, BUTYL RUBBER, SYNTHETIC<br />

RUBBER LATEX INCLUDING PRE-VULCANISED<br />

SYNTHETIC RUBBER LATEX<br />

270 RUBBER ARTICLES THAT IS ARTICLES MADE<br />

WHOLLY OF RUBBER(OTHER THAN SPECIFIED<br />

SPECIFIED ELSEWHERE)<br />

271 RUBBER AND OTHER TYRES,TUBES AND FLAPS<br />

OTHER THAN THOSE FALLING UNDER FOURTH<br />

SCHEDULE AND THOSE SPECIFIED ELSEWHERE.<br />

272 SAND, CLAY, FIRECLAY, COAL ASH, COAL BOILER<br />

ASH, COAL CINDER ASH, COAL POWDER,<br />

CLINKER<br />

273 SANDAL WOOD OIL<br />

274 SANITARY FITTINGS OF EVERY DESCRIPTION<br />

EXCL.PIPES AND FITTINGS OF STONEWARE,<br />

CEMENT AND IRON AND STEEL<br />

275 SANITARY TOWELS, SANITARY NAPKINS,<br />

BELTLESS NAPKINS AND TAMPONS, DISPOSABLE<br />

DIAPERS<br />

276 SCENTED SUPARI<br />

277 SCRAP OF BASE METALS AND ALLOYS, AND<br />

SCRAP OF ALL KINDS OTHER THAN SPECIFIED<br />

ELSEWHERE<br />

278 SEWING THREAD<br />

279 SLOTTED ANGLES AND READY TO ASSEMBLE<br />

PARTS OF STEEL RACKS<br />

280 SOAPS - DETERGENT CAKES, DETERGENT<br />

12<br />

15<br />

12<br />

8<br />

4<br />

15<br />

12<br />

12<br />

4<br />

4<br />

15<br />

12

93<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

POWDERS AND DETERGENT LIQUIDS AND<br />

LAUNDRY BRIGHTENERS, STAIN BUSTERS, STAIN<br />

REMOVERS.<br />

281 SOAPS - SHAMPOO IN LIQUID AND GEL FORM,<br />

INCLUDING HERBAL AND MEDICINAL<br />

PREPARATIONS<br />

282 SOAPS - TOILET SOAPS(INTENDED FOR BATHING<br />

PURPOSES)<br />

283 SOAPS - WASHING SOAPS INCLUDING SOAP<br />

FLAKES, SOAP POWDERS<br />

284 SOUND TRANSMITTING EQUIPMENTS INCLUDING<br />

LOUD SPEAKERS AND PARTS EXCLUDING<br />

TELEPHONES AND ITS PARTS<br />

285 SPORTS GOODS (INDOOR AND OUTDOOR)<br />

INCLUDING BODY BUILDING EQUIPMENTS,<br />

TROPHIES, MEDALS, SHIELDS BUT EXCLUDING<br />

WEARING APPARELS<br />

286 STAINLESS STEEL ARTICLES OTHER THAN<br />

SPECIFIED ELSEWHERE<br />

287 STARCH, LAUNDRY AND TEXTILE STARCH (ALL<br />

KINDS)<br />

288 STATIONERY ARTICLES - ACCOUNT BOOKS,<br />

PAPER ENVELOPES, DIARIES CALENDERS, RACE<br />

CARDS, CATALOGUES, GREETING CARDS,<br />

INVITATION CARDS, HUMOUR & PICTURE POST<br />

CARDS, SPECIAL OCCASION CARDS, PHOTO &<br />

STAMP ALBUMS<br />

289 STATIONERY ARTICLES - CLIP BOARDS, CLUTCH<br />

PENCIL, BLACK LEAD, DATE STAMPS, DUSTERS,<br />

INDEX FILE CLIPS, POKERS, OFFICE FILES OF ALL<br />

KINDS, PAPER CUTTER, BLACKBOARD,<br />

BLACKBOARD DUSTERS<br />

15<br />

15<br />

12<br />

12<br />

4<br />

12<br />

4<br />

12<br />

12

94<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

290 STATIONERY ARTICLES - OFFICE DESK<br />

MATERIALS INCLUDING PUNCHINGMACHINES<br />

AND STAPLER MACHINES<br />

291 STATIONERY ARTICLES-PAPER PINS,PEN<br />

STANDS, PENCIL LEAD,PENCIL SHARPENERS,<br />

PERMANENT MARKERS, REFILL LEADS, STAMP<br />

RACKS, STAPLER PINS, RULERS OF ALL KINDS,<br />

GULLI PENS AND PIN STUDS<br />

292 STEEL DOOR FRAMES, STEEL DOORS, STEEL<br />

WINDOW FRAMES, STEEL SHUTTERS<br />

293 STONES - CUDDAPAH STONES SLABS AND TILES<br />

POLISHED<br />

294 STONES - CUDDAPAH STONES SLABS AND TILES<br />

UNPOLISHED<br />

295 STONES - GRANITE - POLISHED<br />

296 STONES - GRANITE - UNPOLISHED<br />

297 STONES - GRANITE -CHIPS<br />

298 STONES - SHAHABAD STONES SLABS AND TILES<br />

299 STOVES - GAS & KEROSENE ,BARBECUES,<br />

CHARCOAL OVEN, TANDOOR STOVE, PARTS AND<br />

ACCESSORIES THEREOF<br />

300 SUGAR AND SUGAR PREPARATIONS EXCLUDING<br />

SUCH SUGAR AND SUGAR PREPARATIONS AS ARE<br />

COVERED, DESCRIBED OR SPECIFIED<br />

ELSEWHERE IN ANY OF THE SCHEDULES.<br />

301 SUGAR IMPORTED FROM OUTSIDE THE<br />

COUNTRY<br />

12<br />

12<br />

12<br />

8<br />

8<br />

20<br />

20<br />

20<br />

8<br />

12<br />

4<br />

15

95<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

302 SUIT CASES,BRIEF CASES,ATTACHE CASES,<br />

DESPATCH CASES INCLUDING THOSE MADE OF<br />

LEATHER BUT EXCLUDING STEEL TRUNKS<br />

303 SUNGLASSES, GOGGLES,LENSES & FRAMES<br />

INCLUDING ATTACHMENTS,PARTS &<br />

ACCESSORIES THEREOF<br />

304 SURGICAL & DENTAL INSTRUMENTS - TOOLS &<br />

AIDS (ELECTRICAL & ELECTRO<strong>NIC</strong> EQPTS &<br />

APPLIANCES; SYRINGES & NEEDLES, OPER.<br />

THEA. EQPTS, SURGICAL COTTON WOOL,STETH.,<br />

ENEMA&BED PANS, SURGICAL GLOVES,<br />

ABDOMINAL BELTS,CERVICAL COLLARS,<br />

OPER.SUITS, DENTAL CHAIRS ETC.<br />

305 SYNTHETIC GEMS<br />

306 TABULATING AND CALCULATING MACHINES,<br />

(INCLUDING ALL TYPES OF MECH. & ELECT.<br />

CALCULATORS), DUPLICATING & RONEO<br />

MACHINES, PARTS & ACCESSORIES THEREOF<br />

307 TAILORING MATERIALS - NEEDLES , SCISSORS ,<br />

HOOKS, BUTTONS,ZIPS,BUCKLES,MEASURING<br />

TAPE STICK, COLLARS & COLLAR BONE,HORN<br />

BUTTONS,INDENT HOOKS / EYES,JEAN<br />

BUTTONS,KNITTING PINS, LONGSTITCH KIT,M S<br />

COATED BUTTON/STARS,ZIP FASTNERS,<br />

ZIPPERS,CUFF LINKS,CROCHET HOOKS<br />

308 TAMARIND SEEDS<br />

309 TANNING BARKS<br />

310 TEA - SOLD UNDER BRAND NAME<br />

311 TEA - OTHER THAN THE ABOVE<br />

15<br />

12<br />

12<br />

15<br />

12<br />

12<br />

4<br />

12<br />

15<br />

12

96<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

312 TELEPHONES OF EVERY DESCRIPTION<br />

INCLUDING CELLULAR PHONES AND THEIR<br />

PARTS<br />

313 TELEPRINTERS AND THEIR PARTS<br />

314 TELEVISION SETS AND COMPONENTS PARTS AND<br />

ACCESSORIES THEREOF<br />

315 TEXTILES AND FABRICS BUT EXCLUDING SUCH<br />

TEXTILES AND FABRICS AS ARE COVERED,<br />

DESCRIBED OR SPECIFIED ELSEWHERE IN ANY<br />

OF THE SCHEDULES.<br />

316 TEXTILES AND FABRICS IMPORTED FROM<br />

OUTSIDE THE COUNTRY<br />

317 TILES - CERAMIC AND GLAZED FLOOR AND WALL<br />

TILES<br />

318 TILES - MOSAIC TILES AND CHIPS<br />

319 TILES - ROOFING TILES INCLUDING RIDGES<br />

MADE OF CLAY AND CLAY DECORATIVE TILES<br />

320 TILES - ROOFING TILES OTHER THAN COUNTRY<br />

TILES<br />

321 TILES - OTHER THAN ITEMS COVERED BY ABOVE<br />

ENTRIES.<br />

322 TILES- JOINTING POWDER (OTHER THAN<br />

CEMENT) AND SITU MIXTURE FOR LAYING TILES<br />

AND CHIPS SPECIFIED ABOVE.<br />

323 TOBACCO PRODUCTS IMPORTED FROM OUTSIDE<br />

THE COUNTRY<br />

324 TOBACCO PRODUCTS INCLUDING GUTKHA AND<br />

THE LIKE, BUT EXCLUDING SUCH PRODUCTS AS<br />

ARE SPECIFIED ELSEWHERE IN ANY OF THE<br />

SCHEDULES.<br />

4<br />

15<br />

15<br />

8<br />

15<br />

15<br />

15<br />

4<br />

12<br />

15<br />

15<br />

15<br />

25

97<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

325 TOILET ARTICLES (WHETHER MEDICATED OR<br />

NOT THAT IS TO SAY) - PERFUMES,<br />

EUDECOLOGNE, SOLID COLOGNES,BEAUTY<br />

BOXES,FACE PACKS,CLEANSING LIQUIDS,<br />

MOISTURISERS,MAKE-UP ARTICLES (NOT<br />

INCLUDING TALCUM POWER, COMPLEXTION<br />

ROUGE,BLEACHING AGENTS,HAIR DYES, HAIR<br />

SPRAYERS, HAIR REMOVERS, HAIR<br />

CREAMS,LIPSTICK,NAIL POLISHERS AND<br />

WARNISHES,POLISH REMOVER,EYE LINERS,<br />

AFTER SHAVE LOTIONS AND BODY<br />

DEODORANTS.<br />

326 TOILET ARTICLES- OTHER THAN SPECIFIED<br />

ABOVE AND SUCH OTHER ARTICLES AS MAY BE<br />

SPECIFIED BY THE STATE GOVT. BY<br />

NOTIFICATION IN THE OFFICIAL GAZETTE.<br />

327 TOOLS - SPANNERS, SCREW DRIVERS, FILES,<br />

CUTTING PLIERS, HAMMERS,CLOW<br />

HAMMER,HAND FORGE AND THE LIKE(<br />

MANUALLY OPERATED)<br />

328 TOYS - ELECTRO<strong>NIC</strong> TOYS<br />

329 TOYS OF ALL KINDS (EXCLUDING ELECTRO<strong>NIC</strong><br />

AND ELECTRICALLY OPERATED TOYS)<br />

330 TYPEWRITER - KANNADA<br />

331 TYPEWRITER - OTHER THAN KANNADA, PARTS &<br />

ACCESSORIES, INCLUDING TYPEWRITER RIBBON<br />

332 VACCUM FLASKS AND THERMOWARE ARTICLES<br />

AND THEIR REFILLS<br />

333 VALVES OF ALL KINDS OTHER THAN THOSE<br />

GENERALLY USED AS PARTS OF MOTOR<br />

VEHICLES<br />

20<br />

20<br />

12<br />

15<br />

8<br />

2<br />

12<br />

12<br />

12

98<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

334 VEGETABLE NON-EDIBLE OILS OTHER THAN<br />

SPECIFIED ELSEWHERE - NON-REFINED<br />

335 VEGETABLE NON-EDIBLE OILS OTHER THAN<br />

SPECIFIED ELSEWHERE - REFINED<br />

336 WASHED COTTON SEED OIL<br />

337 WATER AND WEATHER PROOFING COMPOUNDS<br />

338 WATER METERS<br />

339 WATER STORAGE TANKS MADE OF FIBRE<br />

GLASS,PLASTIC OR SYNTHETIC MATERIALS,<br />

WATER TANKS MADE OF ALUMINIUM<br />

340 WAXES OF ALL KINDS<br />

341 WEIGHTS AND MEASURES<br />

342 PAGERS AND ITS PARTS<br />

343 WIRELESS RECEPTION INSTRUMENTS,<br />

APPARATUS AND COMPONENTS THEREOF<br />

INCLUDING ALL ELECTRO<strong>NIC</strong> VALVES,<br />

ACCUMULATORS, AMPLIFERS, LOUD SPEAKERS<br />

WHICH ARE NOT SPECIFICALLY DESIGNED FOR<br />

PURPOSES OTHER THAN WIRELESS RECEPTION<br />

344 WOOD OF ALL KINDS INCLUDING EUCALYPTUS,<br />

CASUARINA, HALWANA, TIMBER OF ANY SHAPE,<br />

FORM OR SIZE INCLUDING DOOR FRAMES,<br />

WINDOW FRAMES AND SHUTTERS<br />

345 X-RAY APPARATUS & EQUIPMENTS, MEDICAL<br />

IMAGING, DIAGONOSTIC & THERAPEUTIC<br />

EQUIPMENTS<br />

346 YEAST - DRY, WET AND COMPRESSED<br />

347 ZINC,LEAD & CADMIUM<br />

4<br />

4<br />

4<br />

15<br />

12<br />

12<br />

12<br />

12<br />

15<br />

15<br />

12<br />

12<br />

8<br />

4

99<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

B. THIRD SCHEDULE:<br />

1 ORES - BAUXITE,CHROMITE,IRON,MANGANESE<br />

AND OTHERS, INCL. LUMPS AND FINES<br />

2 COFFEE BEANS AND COFFEE SEEDS (WHETHER<br />

RAW OR ROASTED) PURCHASED BY COFFEE<br />

CURERS<br />

3 RAW WOOL<br />

4 SUGARCANE WHEN PURCHASED BY A<br />

MANUFACTURER OF JAGGERY WHOSE TOTAL<br />

TURNOVER IN A YEAR EXCEEDS RUPEES FIVE<br />

LAKHS<br />

5 SUGARCANE WHEN PURCHASED BY<br />

MANUFACTURER OF SUGARCANE SYRUP<br />

(PROCESSED)<br />

C. FOURTH SCHEDULE:<br />

1 BARLEY<br />

2 COAL INCLUDING COKE IN ALL ITS FORMS BUT<br />

EXCLUDING CHARCOAL<br />

3 COTTON YARN, BUT NOT INCLUDING COTTON<br />

YARN WASTE<br />

4 COTTON, ALL KINDS, EXCL. COTTON WASTE<br />

5 CRUDE OIL<br />

6 HIDES AND SKINS, WHETHER IN A RAW OR<br />

DRESSED STATE<br />

7 IRON & STEEL<br />

8 JUTE<br />

4<br />

4<br />

4<br />

4<br />

8<br />

4<br />

4<br />

4<br />

4<br />

4<br />

4<br />

4<br />

4

100<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

9 OIL SEED - COCONUTS (COPRA), EXCL. TENDER<br />

COCONUTS<br />

10 OIL SEED - COTTON SEED<br />

11 OIL SEED - GROUNDNUT OR PEANUT INCL.<br />

GROUNDNUT OR PEANUT SEED<br />

1 2 OIL SEED - SESAMUM OR TIL (GINGELLY), KUSUM<br />

(KARDI), SAFFLOWER, NIGER(RAMTIL), CASTOR,<br />

KARANJA, PONGAM, HONGE AND NEEM OR VEPA<br />

13 OIL SEED - SOYABEAN, RAPE SEED, MUSTARD,<br />

LINSEED, SUNFLOWER, MAHUA, ILLUPAI, IPPI,<br />

PUNNA, UNDI, KOKUM, SAL, TUNG & REDPALM<br />

14 PULSES -WHOLE OR SEPARATED, WITH OR<br />

WITHOUT HUSK-GRAM OR GULAB GRAM, TUR OR<br />

ARHAR,MOONG OR GREEN GRAM, MASUR OR<br />

LENTHIL, URAD OR BLACK GRAM, MOTH,LAKH<br />

OR KHESARI<br />

15 SCRAP - IRON,CAST IRON,RUNNER AND IRON<br />

SKULL - IN ALL FORMS INCL. STEEL SKULL<br />

TURNINGS AND BORINGS<br />

16 SUGAR INCLUDING KHANDASARI SUGAR AND<br />

SUGAR PREPARATIONS<br />

17 TEXTILES AND FABRICS (U/S 5(4))<br />

18 TOBACCO PRODUCTS (DECLARED GOODS)<br />

D. SIXTH SCHEDULE:<br />

1 WORKS CONTRACTS - PIPE LAYING, ETC.<br />

2 WORKS CONTRACTS - CIVIL, ETC.,<br />

4<br />

4<br />

4<br />

4<br />

4<br />

1<br />

4<br />

4<br />

4<br />

4<br />

4<br />

12

E. SEVENTH SCHEDULE:<br />

LEASING OF GOODS<br />

101<br />

Sl. Name of the Commodity Proposed<br />

No. R<strong>at</strong>e of<br />

Tax (%)<br />

F. UNSCHEDULED GOODS INCLUDING GLASS<br />

BOTTLES<br />

4<br />

12

102<br />

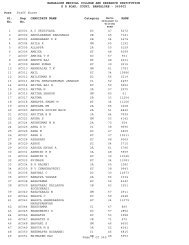

<strong>ANNEXURE</strong> <strong>II</strong>I (<strong>Para</strong> 191)<br />

I.T. PRODUCTS PROPOSED FOR 4% TAX REDUCTION<br />

1) Electronic diaries and parts and accessories thereof.<br />

2) DC Micromotors / Stepper motors of an output not<br />

exceeding 37.5 w<strong>at</strong>ts and parts thereof.<br />

3) Electrical capacitors, fixed, variable or adjustable (Pre-set)<br />

and parts thereof.<br />

4) Electrical resistors (including rheost<strong>at</strong>s and<br />

5)<br />

potentiometers), other than he<strong>at</strong>ing resistors.<br />

Printed Circuits.<br />

6) Electronic Integr<strong>at</strong>ed Circuits and Micro-assemblies.<br />

7) Optical Fibre Cables.<br />

8) Optical fibre and optical fibre bundles and cables<br />

9) Liquid Crystal Devices, Fl<strong>at</strong> Panel display devices and parts<br />

thereof.<br />

<strong>ANNEXURE</strong> - IV (<strong>Para</strong> 200)<br />

LIST OF CANTEEN STORES PROPOSED TO BE TAXED AT<br />

REGULAR RATES<br />

(1) Television sets, audio and video cassette players and<br />

recorders, Disc players and music systems.<br />

(2) Refriger<strong>at</strong>ors, air-conditioners and air coolers.<br />

(3) Microwave appliances, electronic / electric gas stoves, grills<br />

and hobs.<br />

(4) Cameras and projectors and its accessories<br />

(5) Motorcycles, scooters, motor-cars, mopeds and motor cycle<br />

combin<strong>at</strong>ions.<br />

(6) Washing machines and dish washers.

103<br />

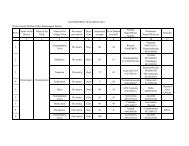

<strong>ANNEXURE</strong> - V (<strong>Para</strong> 195)<br />

PROPOSED COMPOSITION RATES FOR LOTTERIES<br />

Sl. Type of draw Present R<strong>at</strong>e per Proposed<br />

No. draw r<strong>at</strong>e per draw<br />

1. Weekly draw Rs. 20,000 Rs. 15,000<br />

2. Fortnightly draw Rs. 60,000 Rs. 40,000<br />

3. Monthly draw Rs. 1,00,000 Rs. 70,000<br />

4. Special / Festival<br />

Bumper draw Rs. 4,00,000 Rs, 1,75,000<br />

<strong>ANNEXURE</strong> - VI (<strong>Para</strong> 204)<br />

PROPOSED LIST OF IMPORTED ELECTRO<strong>NIC</strong> GOODS<br />

EXIGIBLE TO LUXURY TAX:<br />

i) Television sets<br />

ii) Telephones of every description including cellular phones<br />

iii) Audio and Video cassette / disks players and recorders<br />

iv) Photographic and video cameras<br />

v) Music and home the<strong>at</strong>re systems; speakers<br />

vi) Electronic toys and games<br />

vii) Electronic clocks, time pieces and w<strong>at</strong>ches<br />

viii) Electronic calcul<strong>at</strong>ors<br />

ix) Digital diaries<br />

x) Musical instruments.

104<br />

<strong>ANNEXURE</strong> - V<strong>II</strong> (<strong>Para</strong> 209)<br />

I. Proposed modific<strong>at</strong>ions in Betting Tax.<br />

On Course Off- Course Gymkhana<br />

Existing R<strong>at</strong>e 20% 15% 20%<br />

Suggested R<strong>at</strong>e 25% 20% 25%<br />

<strong>II</strong>. The proposed modified composition amounts:<br />

Bangalore Turf Club - Rs. 840 lakhs<br />

Mysore Race Club - Rs. 31.5 lakhs