Bullshit Free Guide to Iron Condors - Options trading IQ

Bullshit Free Guide to Iron Condors - Options trading IQ

Bullshit Free Guide to Iron Condors - Options trading IQ

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

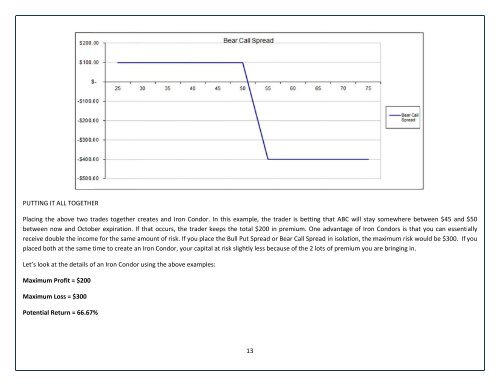

PUTTINGG<br />

IT ALL TOGETHE ER<br />

Placing tthe<br />

above two tr rades <strong>to</strong>gether creates c and <strong>Iron</strong> Condor. In this example, e the traader<br />

is betting thhat<br />

ABC will stayy<br />

somewhere between<br />

$45 and $50<br />

betweenn<br />

now and Oc<strong>to</strong>b ber expiration. If that occurs, the trader keeps the<br />

<strong>to</strong>tal $200 in ppremium.<br />

One addvantage<br />

of <strong>Iron</strong>n<br />

<strong>Condors</strong> is thatt<br />

you can essenti ially<br />

receive ddouble<br />

the incom me for the same amount<br />

of risk. If you place the Bu ull Put Spread or BBear<br />

Call Spread in isolation, the mmaximum<br />

risk woould<br />

be $300. If you<br />

placed both<br />

at the same time t <strong>to</strong> create an n <strong>Iron</strong> Condor, your<br />

capital at risk slightly s less because<br />

of the 2 lots oof<br />

premium you are bringing in.<br />

Let’s look<br />

at the details of f an <strong>Iron</strong> Condor using the above examples:<br />

Maximum<br />

Profit = $200<br />

Maximum<br />

Loss = $300<br />

Potentiaal<br />

Return = 66.67% %<br />

13