Bullshit Free Guide to Iron Condors - Options trading IQ

Bullshit Free Guide to Iron Condors - Options trading IQ

Bullshit Free Guide to Iron Condors - Options trading IQ

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

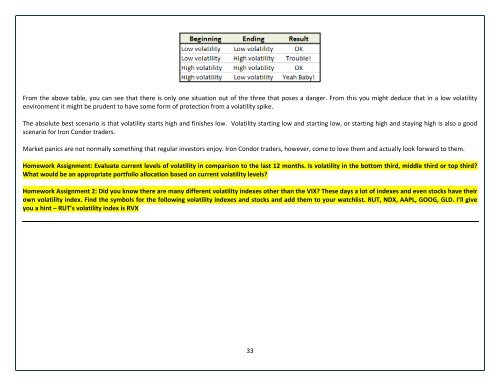

From the above table, you can see that there is only one situation out of the three that poses a danger. From this you might deduce that in a low volatility<br />

environment it might be prudent <strong>to</strong> have some form of protection from a volatility spike.<br />

The absolute best scenario is that volatility starts high and finishes low. Volatility starting low and starting low, or starting high and staying high is also a good<br />

scenario for <strong>Iron</strong> Condor traders.<br />

Market panics are not normally something that regular inves<strong>to</strong>rs enjoy. <strong>Iron</strong> Condor traders, however, come <strong>to</strong> love them and actually look forward <strong>to</strong> them.<br />

Homework Assignment: Evaluate current levels of volatility in comparison <strong>to</strong> the last 12 months. Is volatility in the bot<strong>to</strong>m third, middle third or <strong>to</strong>p third?<br />

What would be an appropriate portfolio allocation based on current volatility levels?<br />

Homework Assignment 2: Did you know there are many different volatility indexes other than the VIX? These days a lot of indexes and even s<strong>to</strong>cks have their<br />

own volatility index. Find the symbols for the following volatility indexes and s<strong>to</strong>cks and add them <strong>to</strong> your watchlist. RUT, NDX, AAPL, GOOG, GLD. I’ll give<br />

you a hint – RUT’s volatility index is RVX<br />

33