1998 Fall Tour Seminar - Martin Armstrong

1998 Fall Tour Seminar - Martin Armstrong

1998 Fall Tour Seminar - Martin Armstrong

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Princeton Economics<br />

International<br />

<strong>1998</strong><br />

<strong>Fall</strong> <strong>Tour</strong>

Economic Confidence Model tm<br />

Defining the global business cycle<br />

Success of PEI Global Market Approach<br />

July 20th, <strong>1998</strong><br />

April 1st, 1994<br />

Dec 29th, 1989<br />

October 19th, 1987<br />

August 1985

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model<br />

tm<br />

Defining the global business cycle

Economic Confidence Model<br />

Back Testing<br />

through History<br />

tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

US 1929<br />

Bubble Top<br />

Defining the global business cycle<br />

Period Doubling<br />

Effect of last 2 years<br />

sign of a Bubble Top

Economic Confidence Model tm<br />

Period Doubling<br />

Effect of last 2 years<br />

sign of a Bubble Top<br />

Defining the global business cycle<br />

Tokyo 1989<br />

Bubble Top

Economic Confidence Model tm<br />

Period Doubling<br />

Effect of last 2 years<br />

sign of a Bubble Top<br />

Defining the global business cycle<br />

US advance was<br />

30% of that in<br />

Europe for 98<br />

European Bubble Top of <strong>1998</strong>

Economic Confidence Model tm<br />

Defining the global business cycle<br />

Today’s problems have<br />

been caused by the<br />

disruption to global<br />

capital flows thanks<br />

to the:<br />

G7<br />

IMF<br />

World Bank<br />

BIS<br />

Euro<br />

Politicians

Economic Confidence Model tm<br />

Defining the global business cycle<br />

After the Plaza Accord in<br />

Sept 1985 & birth of G5,<br />

we warned President Reagan<br />

that G5 would cause a<br />

Crash in 1987 and that<br />

currency manipulation<br />

should not be used to<br />

influence trade.

Economic Confidence Model tm<br />

Defining the global business cycle<br />

The Crash of 1987<br />

was caused by G5<br />

currency<br />

manipulation<br />

that set in motion a<br />

capital repatriation<br />

from Japan that led<br />

to the Bubble Top<br />

formation in 1989 as<br />

foreign capital<br />

concentrated also in<br />

Japan

Economic Confidence Model tm<br />

Defining the global business cycle<br />

87 Crash caused by 40%<br />

decline in US dollar by<br />

G5 which sparked<br />

major selling of $ assets

Economic Confidence Model tm<br />

As capital returned to Japan<br />

Bubble Top form with the<br />

1989.95 turning point<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle<br />

Following the<br />

1989.95 turning<br />

point, the next<br />

4.3 year period on<br />

the model marked a<br />

global shift in<br />

capital flows toward<br />

Southeast Asia<br />

in particular. This<br />

flow of capital then<br />

created a Bubble<br />

Top in most of these<br />

markets.

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle

Economic Confidence Model tm<br />

Defining the global business cycle<br />

Capital Flows reached<br />

record highs in 1989 for<br />

Indonesia & Taiwan

Economic Confidence Model tm<br />

Defining the global business cycle<br />

With the Mexican<br />

Crisis, Southeast<br />

Asia reached its peak<br />

in 1994 and capital<br />

began to shift back to<br />

the West. It would<br />

also be during this<br />

next wave when<br />

capital flows into<br />

Russia multiplied<br />

thanks to hints of<br />

undying support<br />

from the IMF.

Economic Confidence Model tm<br />

Defining the global business cycle<br />

US market reached<br />

a precise low on<br />

April 1st, 1994 in<br />

conjunction with the<br />

Economic<br />

Confidence Model<br />

Turning Point<br />

1994.25

Economic Confidence Model tm<br />

Defining the global business cycle<br />

12 waves of 8.6 months = 8.6 years

Economic Confidence Model tm<br />

Defining the global business cycle<br />

As the half-cycle<br />

approached on<br />

May 25th, 1996<br />

(1996.4), we at last<br />

achieved a 2 month<br />

correction similar in<br />

timing to that of the<br />

1987 Crash. This<br />

turning point<br />

produced a high and<br />

as such a hint of<br />

what would come on<br />

July 20th, <strong>1998</strong>

Economic Confidence Model tm<br />

Defining the global business cycle<br />

The final period<br />

moving into <strong>1998</strong>.55<br />

(July 20th, <strong>1998</strong>), the<br />

market performed<br />

precisely according<br />

to its 8.6 month<br />

component structure

Economic Confidence Model<br />

tm<br />

Defining the global business cycle<br />

Gov’t Intervention using Interest Rates Never Works

Economic Confidence Model tm<br />

Defining the global business cycle<br />

The volatility in<br />

foreign exchange<br />

will be the driving<br />

force behind the<br />

major capital<br />

flows worldwide<br />

between 1999 and<br />

2016 as we once<br />

again face the<br />

turmoil of Sovereign<br />

Debt Defaults

Economic Confidence Model tm<br />

Defining the global business cycle<br />

Dollar/Yen reached<br />

high in 1995 but the<br />

continued economic<br />

decline for 26 years<br />

from 1989.95<br />

(2015.75) will be<br />

likely unless a Yearend<br />

closing above<br />

144.80 takes place for<br />

<strong>1998</strong> Year-End

Economic Confidence Model tm<br />

Defining the global business cycle<br />

Dollar support<br />

lies at 110, 107 and<br />

103-104<br />

with major<br />

historical support<br />

at 100.83 and a<br />

monthly close below<br />

this will signal a<br />

economic depression<br />

In Japan

Economic Confidence Model tm<br />

Defining the global business cycle<br />

Currency hedging<br />

will be the only<br />

means of<br />

surviving the<br />

Years ahead for<br />

Volatility will rise<br />

with political<br />

mismanagement

Economic Confidence Model tm<br />

Defining the global business cycle<br />

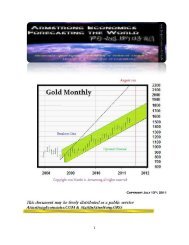

- - - - - - Outlook - - - - - -<br />

<strong>1998</strong> = Collapse of Russia<br />

1999 = Low Gold & Oil<br />

2000 = Technology Bubble<br />

(Like Railroads in 1907)<br />

2002 = Bottom US Share Market<br />

2007 = Real Estate Bubble, Oil hits $100<br />

2009 = Start of Sovereign Debt Crisis<br />

2011-15 = Japan Economic Decline<br />

EURO begins to crack due to debt crisis<br />

2015.75 = Sovereign Debt Big Bang