STATE OF NEW YORK 2 0 1 2 ... - Wyoming County

STATE OF NEW YORK 2 0 1 2 ... - Wyoming County

STATE OF NEW YORK 2 0 1 2 ... - Wyoming County

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

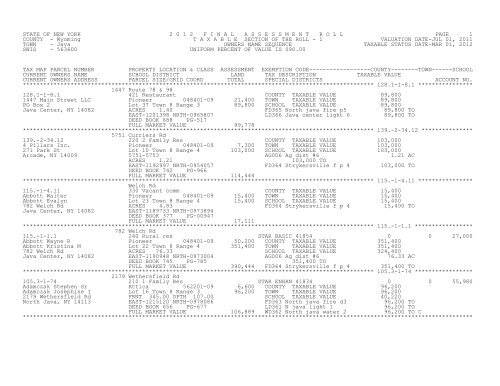

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 1<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 128.1-1-8.1 ****************<br />

1447 Route 78 & 98<br />

128.1-1-8.1 421 Restaurant COUNTY TAXABLE VALUE 89,800<br />

1447 Main Street LLC Pioneer 048401-09 21,400 TOWN TAXABLE VALUE 89,800<br />

PO Box 2 Lot 37 Town 8 Range 3 89,800 SCHOOL TAXABLE VALUE 89,800<br />

Java Center, NY 14082 ACRES 1.40 FD365 North java fire p5 89,800 TO<br />

EAST-1201398 NRTH-0965807 LD366 Java center light 6 89,800 TO<br />

DEED BOOK 688 PG-517<br />

FULL MARKET VALUE 99,778<br />

******************************************************************************************************* 139.-2-34.12 ***************<br />

5751 Curriers Rd<br />

139.-2-34.12 220 2 Family Res COUNTY TAXABLE VALUE 103,000<br />

4 Pillars Inc. Pioneer 048401-09 7,300 TOWN TAXABLE VALUE 103,000<br />

271 Park St Lot 10 Town 8 Range 4 103,000 SCHOOL TAXABLE VALUE 103,000<br />

Arcade, NY 14009 5751-5753 AG006 Ag dist #6 1.21 AC<br />

ACRES 1.21 103,000 TO<br />

EAST-1192997 NRTH-0954057 FD364 Strykersville f p 4 103,000 TO<br />

DEED BOOK 742 PG-966<br />

FULL MARKET VALUE 114,444<br />

******************************************************************************************************* 115.-1-4.11 ****************<br />

Welch Rd<br />

115.-1-4.11 330 Vacant comm COUNTY TAXABLE VALUE 15,400<br />

Abbott Walter Pioneer 048401-09 15,400 TOWN TAXABLE VALUE 15,400<br />

Abbott Evalyn Lot 23 Town 8 Range 4 15,400 SCHOOL TAXABLE VALUE 15,400<br />

782 Welch Rd ACRES 4.83 FD364 Strykersville f p 4 15,400 TO<br />

Java Center, NY 14082 EAST-1189733 NRTH-0973894<br />

DEED BOOK 377 PG-00947<br />

FULL MARKET VALUE 17,111<br />

******************************************************************************************************* 115.-1-1.1 *****************<br />

782 Welch Rd<br />

115.-1-1.1 240 Rural res STAR BASIC 41854 0 0 27,000<br />

Abbott Wayne R Pioneer 048401-09 50,200 COUNTY TAXABLE VALUE 351,400<br />

Abbott Kristina M Lot 22 Town 8 Range 4 351,400 TOWN TAXABLE VALUE 351,400<br />

782 Welch Rd ACRES 76.33 SCHOOL TAXABLE VALUE 324,400<br />

Java Center, NY 14082 EAST-1190948 NRTH-0973004 AG006 Ag dist #6 76.33 AC<br />

DEED BOOK 745 PG-785 351,400 TO<br />

FULL MARKET VALUE 390,444 FD364 Strykersville f p 4 351,400 TO<br />

******************************************************************************************************* 105.3-1-74 *****************<br />

2179 Wethersfield Rd<br />

105.3-1-74 210 1 Family Res STAR ENHAN 41834 0 0 55,980<br />

Adamczak Stephen Sr Attica 562201-09 6,600 COUNTY TAXABLE VALUE 96,200<br />

Adamczak Josephine I Lot 16 Town 8 Range 3 96,200 TOWN TAXABLE VALUE 96,200<br />

2179 Wethersfield Rd FRNT 345.00 DPTH 107.00 SCHOOL TAXABLE VALUE 40,220<br />

North Java, NY 14113 EAST-1215120 NRTH-0978086 FD363 North java fire d3 96,200 TO<br />

DEED BOOK 656 PG-677 LD361 N java light 1 96,200 TO<br />

FULL MARKET VALUE 106,889 WD362 North java water 2 96,200 TO C<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 2<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 138.-1-26.1 ****************<br />

5512 Michigan Rd<br />

138.-1-26.1 240 Rural res STAR BASIC 41854 0 0 27,000<br />

Addesa James J Pioneer 048401-09 53,100 COUNTY TAXABLE VALUE 186,300<br />

Addesa Margaret M Lot 34 Town 8 Range 4 186,300 TOWN TAXABLE VALUE 186,300<br />

5512 Michigan Rd ACRES 96.71 SCHOOL TAXABLE VALUE 159,300<br />

Arcade, NY 14009 EAST-1182764 NRTH-0957190 AG006 Ag dist #6 96.71 AC<br />

DEED BOOK 664 PG-880 186,300 TO<br />

FULL MARKET VALUE 207,000 FD364 Strykersville f p 4 186,300 TO<br />

******************************************************************************************************* 138.-1-26.2 ****************<br />

5482 Michigan Rd<br />

138.-1-26.2 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Addesa Joseph C Pioneer 048401-09 8,100 COUNTY TAXABLE VALUE 116,100<br />

Addesa Diane L Lot 34, Twp 8, Range 4 116,100 TOWN TAXABLE VALUE 116,100<br />

5482 Michigan Rd ACRES 1.80 SCHOOL TAXABLE VALUE 89,100<br />

Arcade, NY 14009 EAST-1184675 NRTH-0957330 AG006 Ag dist #6 1.80 AC<br />

DEED BOOK 674 PG-808 116,100 TO<br />

FULL MARKET VALUE 129,000 FD364 Strykersville f p 4 116,100 TO<br />

******************************************************************************************************* 140.-2-31.1 ****************<br />

Stinson Rd<br />

140.-2-31.1 311 Res vac land COUNTY TAXABLE VALUE 7,100<br />

Agen Linda M Pioneer 048401-09 7,100 TOWN TAXABLE VALUE 7,100<br />

Kremblas Donna L Lot 25 Town 8 Range 3 7,100 SCHOOL TAXABLE VALUE 7,100<br />

2782 Eggert Rd ACRES 4.29 AG006 Ag dist #6 4.29 AC<br />

Tonawanda, NY 14150 EAST-1208268 NRTH-0953331 7,100 TO<br />

DEED BOOK 668 PG-248 FD365 North java fire p5 7,100 TO<br />

FULL MARKET VALUE 7,889<br />

******************************************************************************************************* 140.8-5-21 *****************<br />

Block E<br />

140.8-5-21 260 Seasonal res STAR BASIC 41854 0 0 27,000<br />

Allard Abel Pioneer 048401-09 5,600 COUNTY TAXABLE VALUE 33,600<br />

110 Hillcrest Dr Lot 19 Town 8 Range 3 33,600 TOWN TAXABLE VALUE 33,600<br />

Arcade, NY 14009 Java Lake Park Lot 63-68 SCHOOL TAXABLE VALUE 6,600<br />

FRNT 180.00 DPTH 80.00 FD365 North java fire p5 33,600 TO<br />

EAST-1210701 NRTH-0959543<br />

DEED BOOK 735 PG-162<br />

FULL MARKET VALUE 37,333<br />

******************************************************************************************************* 138.-1-20 ******************<br />

5796 Michigan Rd<br />

138.-1-20 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Almeter Anthony Pioneer 048401-09 5,100 COUNTY TAXABLE VALUE 115,300<br />

Almeter Linda Lot 33 Town 8 Range 4 115,300 TOWN TAXABLE VALUE 115,300<br />

5796 Michigan Rd FRNT 137.65 DPTH 195.00 SCHOOL TAXABLE VALUE 88,300<br />

Arcade, NY 14009 EAST-1184816 NRTH-0952717 AG006 Ag dist #6 .00 AC<br />

DEED BOOK 380 PG-00665 115,300 TO<br />

FULL MARKET VALUE 128,111 FD364 Strykersville f p 4 115,300 TO<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 3<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 138.-1-21.2 ****************<br />

Michigan Rd<br />

138.-1-21.2 311 Res vac land COUNTY TAXABLE VALUE 1,500<br />

Almeter Anthony B Pioneer 048401-09 1,500 TOWN TAXABLE VALUE 1,500<br />

Almeter Linda R Lot 33 Town 8 Range 4 1,500 SCHOOL TAXABLE VALUE 1,500<br />

Box 185A Michigan Rd FRNT 122.00 DPTH 270.00 AG006 Ag dist #6 .00 AC<br />

Arcade, NY 14009 EAST-1184530 NRTH-0952709 1,500 TO<br />

DEED BOOK 611 PG-00136 FD364 Strykersville f p 4 1,500 TO<br />

FULL MARKET VALUE 1,667<br />

******************************************************************************************************* 105.3-1-15 *****************<br />

2077 Perry Rd<br />

105.3-1-15 210 1 Family Res AGED C/T 41801 30,000 30,000 0<br />

Almeter JoAnne Attica 562201-09 3,800 STAR ENHAN 41834 0 0 55,980<br />

Almeter Patrick J Lot 24 Town 8 Range 3 75,000 COUNTY TAXABLE VALUE 45,000<br />

2077 Perry Rd life use;Joanne Almeter TOWN TAXABLE VALUE 45,000<br />

North Java, NY 14113 FRNT 130.00 DPTH 123.50 SCHOOL TAXABLE VALUE 19,020<br />

EAST-1212603 NRTH-0978038 FD365 North java fire p5 75,000 TO<br />

DEED BOOK 680 PG-645 LD361 N java light 1 75,000 TO<br />

FULL MARKET VALUE 83,333 WD362 North java water 2 75,000 TO C<br />

******************************************************************************************************* 116.-1-26 ******************<br />

Beaver Meadow Rd<br />

116.-1-26 312 Vac w/imprv COUNTY TAXABLE VALUE 13,600<br />

Amoia Michael Pioneer 048401-09 8,000 TOWN TAXABLE VALUE 13,600<br />

Joseph Amoia Lot 29 Town 8 Range 3 13,600 SCHOOL TAXABLE VALUE 13,600<br />

6550 E Eden Rd ACRES 1.73 AG006 Ag dist #6 1.73 AC<br />

Hamburg, NY 14075 EAST-1209146 NRTH-0968595 13,600 TO<br />

DEED BOOK 738 PG-306 FD365 North java fire p5 13,600 TO<br />

FULL MARKET VALUE 15,111<br />

******************************************************************************************************* 140.8-3-31 *****************<br />

Summerset Dr<br />

140.8-3-31 311 Res vac land COUNTY TAXABLE VALUE 300<br />

Amrhein Jody J Pioneer 048401-09 300 TOWN TAXABLE VALUE 300<br />

10 Traver Pl Lot 19 Town 8 Range 3 300 SCHOOL TAXABLE VALUE 300<br />

Perry, NY 14530 Java Lake Park Lot 57 Blk FD365 North java fire p5 300 TO<br />

FRNT 39.57 DPTH 80.08<br />

EAST-1210204 NRTH-0958734<br />

DEED BOOK 665 PG-117<br />

FULL MARKET VALUE 333<br />

******************************************************************************************************* 140.8-7-46 *****************<br />

187 Beechwood Ave<br />

140.8-7-46 260 Seasonal res COUNTY TAXABLE VALUE 34,500<br />

Ananiadis Saia Pioneer 048401-09 3,700 TOWN TAXABLE VALUE 34,500<br />

Ananiadis William Lot 19 Town 8 Range 3 34,500 SCHOOL TAXABLE VALUE 34,500<br />

91 E Caralier Java Lake Park 186-188 FD365 North java fire p5 34,500 TO<br />

Cheektowaga, NY 14227 FRNT 75.00 DPTH 80.00<br />

EAST-1212157 NRTH-0960165<br />

DEED BOOK 715 PG-520<br />

FULL MARKET VALUE 38,333<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 4<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 102.-3-40 ******************<br />

4225 Route 78<br />

102.-3-40 210 1 Family Res COUNTY TAXABLE VALUE 154,800<br />

Anderson Ernest J Jr Pioneer 048401-09 13,900 TOWN TAXABLE VALUE 154,800<br />

Anderson Kathleen A Lot 24 Town 8 Range 4 154,800 SCHOOL TAXABLE VALUE 154,800<br />

150 Bent Trail Dr Lot 32 Town 8 Range 4 AG006 Ag dist #6 10.00 AC<br />

Southlake, TX 76042 FRNT 175.00 DPTH 154,800 TO<br />

ACRES 10.00 FD364 Strykersville f p 4 154,800 TO<br />

EAST-0538570 NRTH-0978215<br />

DEED BOOK 691 PG-705<br />

FULL MARKET VALUE 172,000<br />

******************************************************************************************************* 103.-2-1.1 *****************<br />

Route 78<br />

103.-2-1.1 120 Field crops COUNTY TAXABLE VALUE 84,300<br />

Anderson Ernest J Jr Pioneer 048401-09 84,300 TOWN TAXABLE VALUE 84,300<br />

Anderson Kathleen A Lot 24 Town 8 Range 4 84,300 SCHOOL TAXABLE VALUE 84,300<br />

150 Bent Trail Dr Lot 32 Town 8 Range 4 AG006 Ag dist #6 163.14 AC<br />

Southlake, TX 76092 ACRES 163.14 84,300 TO<br />

EAST-1189657 NRTH-0979250 FD364 Strykersville f p 4 84,300 TO<br />

DEED BOOK 443 PG-00138<br />

FULL MARKET VALUE 93,667<br />

******************************************************************************************************* 140.8-8-10 *****************<br />

South Pkwy<br />

140.8-8-10 311 Res vac land COUNTY TAXABLE VALUE 500<br />

Andrews Robert Pioneer 048401-09 500 TOWN TAXABLE VALUE 500<br />

9360 Greiner Rd Lot 19 Town 8 Range 3 500 SCHOOL TAXABLE VALUE 500<br />

Clarence, NY 14031 Java Lake Park Lot 45 Blk FD365 North java fire p5 500 TO<br />

FRNT 70.52 DPTH 85.79<br />

EAST-1212241 NRTH-0958131<br />

DEED BOOK 670 PG-795<br />

FULL MARKET VALUE 556<br />

******************************************************************************************************* 139.-1-13 ******************<br />

5712 Curriers Rd<br />

139.-1-13 210 1 Family Res COUNTY TAXABLE VALUE 85,800<br />

Andrzejewski Dana J Pioneer 048401-09 2,500 TOWN TAXABLE VALUE 85,800<br />

5712 Curriers Rd Lot 18 Town 8 Range 4 85,800 SCHOOL TAXABLE VALUE 85,800<br />

Arcade, NY 14009 FRNT 103.90 DPTH 117.60 FD364 Strykersville f p 4 85,800 TO<br />

EAST-1192789 NRTH-0954620<br />

DEED BOOK 641 PG-364<br />

FULL MARKET VALUE 95,333<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 5<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 105.3-2-41 *****************<br />

4305 Route 98<br />

105.3-2-41 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Anger Leo J Attica 562201-09 3,100 COUNTY TAXABLE VALUE 67,000<br />

4305 Rt 98 Lot 15 Town 8 Range 3 67,000 TOWN TAXABLE VALUE 67,000<br />

North Java, NY 14113 FRNT 75.00 DPTH 167.00 SCHOOL TAXABLE VALUE 40,000<br />

EAST-1214426 NRTH-0976996 FD363 North java fire d3 67,000 TO<br />

DEED BOOK 731 PG-369 LD361 N java light 1 67,000 TO<br />

FULL MARKET VALUE 74,444 WD362 North java water 2 67,000 TO C<br />

******************************************************************************************************* 105.3-2-28 *****************<br />

2174 Wethersfield Rd<br />

105.3-2-28 210 1 Family Res 458ACOM CT 41131 18,000 9,000 0<br />

Anger Richard C Attica 562201-09 5,700 STAR BASIC 41854 0 0 27,000<br />

Anger Patricia M Lot 15 Town 8 Range 3 84,000 COUNTY TAXABLE VALUE 66,000<br />

2174 Wethersfield Rd ACRES 0.65 TOWN TAXABLE VALUE 75,000<br />

North Java, NY 14113 EAST-1214975 NRTH-0977906 SCHOOL TAXABLE VALUE 57,000<br />

DEED BOOK 451 PG-00014 FD363 North java fire d3 84,000 TO<br />

FULL MARKET VALUE 93,333 LD361 N java light 1 84,000 TO<br />

WD362 North java water 2 84,000 TO C<br />

******************************************************************************************************* 105.3-2-29 *****************<br />

Wethersfield Rd<br />

105.3-2-29 312 Vac w/imprv COUNTY TAXABLE VALUE 5,700<br />

Anger Richard C Attica 562201-09 2,000 TOWN TAXABLE VALUE 5,700<br />

Anger Patricia M Lot 15 Town 8 Range 3 5,700 SCHOOL TAXABLE VALUE 5,700<br />

2174 Wethersfield Rd FRNT 152.00 DPTH 40.00 FD363 North java fire d3 5,700 TO<br />

North Java, NY 14113 EAST-1215127 NRTH-0977966 LD361 N java light 1 5,700 TO<br />

DEED BOOK 633 PG-793 WD362 North java water 2 5,700 TO C<br />

FULL MARKET VALUE 6,333<br />

******************************************************************************************************* 139.-2-23 ******************<br />

Chaffee Rd<br />

139.-2-23 331 Com vac w/im COUNTY TAXABLE VALUE 30,000<br />

Arcade & Attica Railroad Corp. Pioneer 048401-09 20,000 TOWN TAXABLE VALUE 30,000<br />

278 Main St Lot 10 Town 8 Range 4 30,000 SCHOOL TAXABLE VALUE 30,000<br />

Arcade, NY 14009 FRNT 55.00 DPTH 222.00 AG006 Ag dist #6 1.00 AC<br />

ACRES 1.00 30,000 TO<br />

EAST-1195253 NRTH-0955025 FD364 Strykersville f p 4 30,000 TO<br />

DEED BOOK 691 PG-849<br />

FULL MARKET VALUE 33,333<br />

******************************************************************************************************* 102.-3-18 ******************<br />

4217 Route 78<br />

102.-3-18 240 Rural res STAR BASIC 41854 0 0 27,000<br />

Ash Michael Pioneer 048401-09 26,800 COUNTY TAXABLE VALUE 165,000<br />

Ash Susan Lot 32 Town 8 Range 4 165,000 TOWN TAXABLE VALUE 165,000<br />

4217 Main St ACRES 13.31 SCHOOL TAXABLE VALUE 138,000<br />

Java Village, NY 14083 EAST-1186723 NRTH-0978914 AG006 Ag dist #6 13.31 AC<br />

DEED BOOK 520 PG-00136 165,000 TO<br />

FULL MARKET VALUE 183,333 FD364 Strykersville f p 4 165,000 TO<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 6<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 139.-2-18.1 ****************<br />

1285 Chaffee Rd<br />

139.-2-18.1 240 Rural res STAR BASIC 41854 0 0 27,000<br />

Asquith Frank W Pioneer 048401-09 35,800 COUNTY TAXABLE VALUE 183,400<br />

Asquith Mary Susan Lot 2 Town 8 Range 4 183,400 TOWN TAXABLE VALUE 183,400<br />

1285 Chaffee Rd ACRES 40.40 BANK CTS** SCHOOL TAXABLE VALUE 156,400<br />

Arcade, NY 14009 EAST-1198057 NRTH-0956887 AG006 Ag dist #6 40.40 AC<br />

DEED BOOK 597 PG-00151 183,400 TO<br />

FULL MARKET VALUE 203,778 FD364 Strykersville f p 4 183,400 TO<br />

******************************************************************************************************* 140.8-5-8 ******************<br />

148 Greenwood Dr<br />

140.8-5-8 260 Seasonal res COUNTY TAXABLE VALUE 28,500<br />

Atzrott Kenneth E Pioneer 048401-09 3,100 TOWN TAXABLE VALUE 28,500<br />

Gaskin Janice A Lot 19 Town 8 Range 3 28,500 SCHOOL TAXABLE VALUE 28,500<br />

128 Beech Rd Java Lake Park Lot 148-14 FD365 North java fire p5 28,500 TO<br />

East Aurora, NY 14052 FRNT 60.00 DPTH 80.00<br />

EAST-1211093 NRTH-0959742<br />

DEED BOOK 654 PG-916<br />

FULL MARKET VALUE 31,667<br />

******************************************************************************************************* 140.8-8-27 *****************<br />

S Lakeshore Dr<br />

140.8-8-27 260 Seasonal res COUNTY TAXABLE VALUE 48,800<br />

Augustyn Richard H Pioneer 048401-09 3,700 TOWN TAXABLE VALUE 48,800<br />

760 Ellicott St Lot 19 Town 8 Range 3 48,800 SCHOOL TAXABLE VALUE 48,800<br />

Buffalo, NY 14210 Lot 7-8 B-G FD365 North java fire p5 48,800 TO<br />

FRNT 68.08 DPTH 80.00<br />

EAST-1212013 NRTH-0958575<br />

DEED BOOK 565 PG-00049<br />

FULL MARKET VALUE 54,222<br />

******************************************************************************************************* 116.-1-10.1 ****************<br />

Welch Rd<br />

116.-1-10.1 312 Vac w/imprv COUNTY TAXABLE VALUE 25,000<br />

Bagley Bonnie A Attica 562201-09 14,000 TOWN TAXABLE VALUE 25,000<br />

1844 Welch Rd Lot 31 Town 8 Range 3 25,000 SCHOOL TAXABLE VALUE 25,000<br />

North Java, NY 14113 ACRES 21.94 AG006 Ag dist #6 21.94 AC<br />

EAST-1209663 NRTH-0975513 25,000 TO<br />

DEED BOOK 643 PG-83 FD365 North java fire p5 25,000 TO<br />

FULL MARKET VALUE 27,778<br />

******************************************************************************************************* 116.-1-10.2 ****************<br />

1844 Welch Rd<br />

116.-1-10.2 210 1 Family Res 458ACOM CT 41131 18,000 9,000 0<br />

Bagley James Attica 562201-09 9,600 458A DIS C 41142 28,920 0 0<br />

Bagley Bonnie Lot 31, Town 8, Range 3 96,400 458A DIS T 41143 0 18,000 0<br />

1844 Welch Rd ACRES 2.83 STAR BASIC 41854 0 0 27,000<br />

North Java, NY 14113 EAST-1209339 NRTH-0976008 COUNTY TAXABLE VALUE 49,480<br />

DEED BOOK 621 PG-689 TOWN TAXABLE VALUE 69,400<br />

FULL MARKET VALUE 107,111 SCHOOL TAXABLE VALUE 69,400<br />

FD365 North java fire p5 96,400 TO<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 7<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 105.3-2-11 *****************<br />

2122 Perry Rd<br />

105.3-2-11 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Baker Debra J Attica 562201-09 2,500 COUNTY TAXABLE VALUE 68,000<br />

2122 Perry Rd Lot 23 Town 8 Range 3 68,000 TOWN TAXABLE VALUE 68,000<br />

N. Java, NY 14113 FRNT 58.00 DPTH 163.00 SCHOOL TAXABLE VALUE 41,000<br />

EAST-1213946 NRTH-0977876 FD363 North java fire d3 68,000 TO<br />

DEED BOOK 718 PG-372 LD361 N java light 1 68,000 TO<br />

FULL MARKET VALUE 75,556 WD362 North java water 2 68,000 TO C<br />

******************************************************************************************************* 140.8-4-21 *****************<br />

Midland Dr<br />

140.8-4-21 260 Seasonal res COUNTY TAXABLE VALUE 17,000<br />

Ballaro Jeremy J Pioneer 048401-09 4,300 TOWN TAXABLE VALUE 17,000<br />

490 Lakewood Dr Lot 19 Town 8 Range 3 17,000 SCHOOL TAXABLE VALUE 17,000<br />

Snyder, NY 14226 Java Lake Park Lot 114-11 FD365 North java fire p5 17,000 TO<br />

FRNT 90.00 DPTH 80.00<br />

EAST-1210761 NRTH-0959265<br />

DEED BOOK 728 PG-508<br />

FULL MARKET VALUE 18,889<br />

******************************************************************************************************* 141.-1-14.11 ***************<br />

Youngers Rd<br />

141.-1-14.11 312 Vac w/imprv COUNTY TAXABLE VALUE 37,500<br />

Baney Eric Pioneer 048401-09 14,200 TOWN TAXABLE VALUE 37,500<br />

5420 Youngers Rd Lot 3 Town 8 Range 3 37,500 SCHOOL TAXABLE VALUE 37,500<br />

North Java, NY 14113 ACRES 24.87 AG006 Ag dist #6 24.87 AC<br />

EAST-1221040 NRTH-0959115 37,500 TO<br />

DEED BOOK 497 PG-00234 FD365 North java fire p5 37,500 TO<br />

FULL MARKET VALUE 41,667<br />

******************************************************************************************************* 141.-1-14.12 ***************<br />

5420 Youngers Rd<br />

141.-1-14.12 240 Rural res STAR BASIC 41854 0 0 27,000<br />

Baney Eric D Pioneer 048401-09 19,900 COUNTY TAXABLE VALUE 58,000<br />

5420 Youngers Rd Lot 3 Town 8 Range 3 58,000 TOWN TAXABLE VALUE 58,000<br />

North Java, NY 14113 ACRES 11.94 SCHOOL TAXABLE VALUE 31,000<br />

EAST-1220342 NRTH-0958651 AG006 Ag dist #6 11.94 AC<br />

DEED BOOK 465 PG-00034 58,000 TO<br />

FULL MARKET VALUE 64,444 FD365 North java fire p5 58,000 TO<br />

******************************************************************************************************* 152.-1-11.2 ****************<br />

Java Lake Rd<br />

152.-1-11.2 322 Rural vac>10 COUNTY TAXABLE VALUE 34,000<br />

Bank Kimberly M Pioneer 048401-09 34,000 TOWN TAXABLE VALUE 34,000<br />

Bank Michael W Lot 17 Town 8 Range 3 34,000 SCHOOL TAXABLE VALUE 34,000<br />

10201 Colby Rd ACRES 41.62 AG006 Ag dist #6 41.62 AC<br />

Darien Center, NY 14040 EAST-1211632 NRTH-0951959 34,000 TO<br />

DEED BOOK 725 PG-416 FD365 North java fire p5 34,000 TO<br />

FULL MARKET VALUE 37,778<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 8<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 140.-1-2 *******************<br />

5369 Route 98<br />

140.-1-2 210 1 Family Res STAR ENHAN 41834 0 0 55,980<br />

Banks Robert J Pioneer 048401-09 6,500 COUNTY TAXABLE VALUE 92,000<br />

Banks Maureen J Lot 35 Town 8 Range 3 92,000 TOWN TAXABLE VALUE 92,000<br />

5369 Route 98 FRNT 161.00 DPTH 228.50 SCHOOL TAXABLE VALUE 36,020<br />

Java Center, NY 14082 BANK TRANS AG006 Ag dist #6 .00 AC<br />

EAST-1201024 NRTH-0959065 92,000 TO<br />

DEED BOOK 655 PG-329 FD365 North java fire p5 92,000 TO<br />

FULL MARKET VALUE 102,222<br />

******************************************************************************************************* 104.-2-31.1 ****************<br />

1927 Welch Rd<br />

104.-2-31.1 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Baratta Stephen M Attica 562201-09 12,800 COUNTY TAXABLE VALUE 169,000<br />

Baratta Jeannie K Lot 23 Town 8 Range 3 169,000 TOWN TAXABLE VALUE 169,000<br />

1927 Welch Rd ACRES 5.12 BANK CTS** SCHOOL TAXABLE VALUE 142,000<br />

North Java, NY 14113 EAST-1210498 NRTH-0977444 AG006 Ag dist #6 5.12 AC<br />

DEED BOOK 670 PG-233 169,000 TO<br />

FULL MARKET VALUE 187,778 FD365 North java fire p5 169,000 TO<br />

******************************************************************************************************* 128.-1-13.211 **************<br />

1614 Route 78 & 98<br />

128.-1-13.211 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Barber Jerry L Pioneer 048401-09 9,700 COUNTY TAXABLE VALUE 85,000<br />

Barber Lesley M Lot 36 Town 8 Range 3 85,000 TOWN TAXABLE VALUE 85,000<br />

1614 Route 78 & 98 ACRES 2.96 BANK CTS** SCHOOL TAXABLE VALUE 58,000<br />

Java, NY 14082 EAST-1204751 NRTH-0965409 FD365 North java fire p5 85,000 TO<br />

DEED BOOK 735 PG-766<br />

FULL MARKET VALUE 94,444<br />

******************************************************************************************************* 127.-1-53.2 ****************<br />

Curriers Rd<br />

127.-1-53.2 322 Rural vac>10 COUNTY TAXABLE VALUE 12,800<br />

Barber Kenneth Pioneer 048401-09 12,800 TOWN TAXABLE VALUE 12,800<br />

9380 Southwind Cir Lot 19,27 Town 8 Range 4 12,800 SCHOOL TAXABLE VALUE 12,800<br />

Holland, NY 14080 ACRES 20.00 AG006 Ag dist #6 20.00 AC<br />

EAST-1189315 NRTH-0960582 12,800 TO<br />

DEED BOOK 531 PG-00232 FD364 Strykersville f p 4 12,800 TO<br />

FULL MARKET VALUE 14,222<br />

******************************************************************************************************* 139.-2-53.2 ****************<br />

5615 Curriers Rd<br />

139.-2-53.2 270 Mfg housing STAR BASIC 41854 0 0 27,000<br />

Barber Kenneth Pioneer 048401-09 5,500 COUNTY TAXABLE VALUE 78,000<br />

Barber Edith Lot 10 T8 R4 78,000 TOWN TAXABLE VALUE 78,000<br />

5615 Curriers Rd FRNT 245.00 DPTH 107.00 SCHOOL TAXABLE VALUE 51,000<br />

Arcade, NY 14009 EAST-1192950 NRTH-0955292 AG006 Ag dist #6 .00 AC<br />

DEED BOOK 473 PG-00256 78,000 TO<br />

FULL MARKET VALUE 86,667 FD364 Strykersville f p 4 78,000 TO<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 9<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 114.-1-36.1 ****************<br />

4846 Michigan Rd<br />

114.-1-36.1 210 1 Family Res 458A WAR C 41122 10,800 0 0<br />

Barber Raymond Pioneer 048401-09 13,000 458A WAR T 41123 0 5,400 0<br />

Barber Joan Lot 29 Town 8 Range 4 98,000 STAR ENHAN 41834 0 0 55,980<br />

4846 Michigan Rd ACRES 3.79 COUNTY TAXABLE VALUE 87,200<br />

Arcade, NY 14009 EAST-1186334 NRTH-0969584 TOWN TAXABLE VALUE 92,600<br />

DEED BOOK 374 PG-00828 SCHOOL TAXABLE VALUE 42,020<br />

FULL MARKET VALUE 108,889 AG006 Ag dist #6 3.79 AC<br />

98,000 TO<br />

FD364 Strykersville f p 4 98,000 TO<br />

******************************************************************************************************* 114.-1-29.12 ***************<br />

Whaley Rd<br />

114.-1-29.12 311 Res vac land COUNTY TAXABLE VALUE 19,700<br />

Barber Raymond G Pioneer 048401-09 19,700 TOWN TAXABLE VALUE 19,700<br />

Barber Joan I L-29 T-8 R-4 19,700 SCHOOL TAXABLE VALUE 19,700<br />

4846 Michigan Rd ACRES 18.16 AG006 Ag dist #6 18.16 AC<br />

Arcade, NY 14009 EAST-1185596 NRTH-0969328 19,700 TO<br />

DEED BOOK 639 PG-881 FD364 Strykersville f p 4 19,700 TO<br />

FULL MARKET VALUE 21,889<br />

******************************************************************************************************* 140.-2-4 *******************<br />

Summerset Dr<br />

140.-2-4 260 Seasonal res COUNTY TAXABLE VALUE 45,600<br />

Barnas Bronislaus A Pioneer 048401-09 11,500 TOWN TAXABLE VALUE 45,600<br />

Barnas Patricia A Lot 27 Town 8 Range 3 45,600 SCHOOL TAXABLE VALUE 45,600<br />

55 Naples Dr ACRES 1.77 AG006 Ag dist #6 1.77 AC<br />

West Seneca, NY 14224 EAST-1209677 NRTH-0958955 45,600 TO<br />

DEED BOOK 646 PG-639 FD365 North java fire p5 45,600 TO<br />

FULL MARKET VALUE 50,667<br />

******************************************************************************************************* 140.8-7-13 *****************<br />

Block F<br />

140.8-7-13 311 Res vac land COUNTY TAXABLE VALUE 200<br />

Barnas Bronislaus A Pioneer 048401-09 200 TOWN TAXABLE VALUE 200<br />

Barnas Patricia A Lot 19 Town 8 Range 3 200 SCHOOL TAXABLE VALUE 200<br />

55 Naples Dr Java Lake Park Lot 121 Bl FD365 North java fire p5 200 TO<br />

West Seneca, NY 14224 FRNT 30.00 DPTH 80.00<br />

EAST-1211796 NRTH-0959891<br />

DEED BOOK 646 PG-639<br />

FULL MARKET VALUE 222<br />

******************************************************************************************************* 152.-1-12.2 ****************<br />

5891 Java Lake Rd<br />

152.-1-12.2 210 1 Family Res COUNTY TAXABLE VALUE 97,600<br />

Barnes Martha M Pioneer 048401-09 13,000 TOWN TAXABLE VALUE 97,600<br />

5923 Java Lake Rd Lot 17, Twp 8,Range 3 97,600 SCHOOL TAXABLE VALUE 97,600<br />

Arcade, NY 14009 ACRES 8.80 AG006 Ag dist #6 8.80 AC<br />

EAST-1213644 NRTH-0951530 97,600 TO<br />

DEED BOOK 675 PG-536 FD365 North java fire p5 97,600 TO<br />

FULL MARKET VALUE 108,444<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 10<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 152.-1-12.11 ***************<br />

Java Lake Rd<br />

152.-1-12.11 322 Rural vac>10 COUNTY TAXABLE VALUE 27,300<br />

Barnes Martha M Pioneer 048401-09 27,300 TOWN TAXABLE VALUE 27,300<br />

5923 Java Lake Rd Lot 17 Town 8 Range 3 27,300 SCHOOL TAXABLE VALUE 27,300<br />

Arcade, NY 14009 ACRES 23.15 AG006 Ag dist #6 23.15 AC<br />

EAST-1212711 NRTH-0951559 27,300 TO<br />

DEED BOOK 680 PG-465 FD365 North java fire p5 27,300 TO<br />

FULL MARKET VALUE 30,333<br />

******************************************************************************************************* 153.-1-3.21 ****************<br />

5923 Java Lake Rd<br />

153.-1-3.21 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Barnes Martha M Pioneer 048401-09 16,900 COUNTY TAXABLE VALUE 79,000<br />

5923 Java Lake Rd Lot 17, Town 8 Range 3 79,000 TOWN TAXABLE VALUE 79,000<br />

Arcade, NY 14009 ACRES 8.80 SCHOOL TAXABLE VALUE 52,000<br />

EAST-1213608 NRTH-0951148 AG006 Ag dist #6 8.80 AC<br />

DEED BOOK 591 PG-00105 79,000 TO<br />

FULL MARKET VALUE 87,778 FD365 North java fire p5 79,000 TO<br />

******************************************************************************************************* 104.-2-19 ******************<br />

Humbert Rd<br />

104.-2-19 311 Res vac land COUNTY TAXABLE VALUE 6,700<br />

Barone Dominic L Attica 562201-09 6,700 TOWN TAXABLE VALUE 6,700<br />

Barone Debra J Lot 32 Town 8 Range 3 6,700 SCHOOL TAXABLE VALUE 6,700<br />

261 S Swain St ACRES 4.14 AG006 Ag dist #6 4.14 AC<br />

Batavia, NY 14020 EAST-1209445 NRTH-0978285 6,700 TO<br />

DEED BOOK 743 PG-131 FD365 North java fire p5 6,700 TO<br />

FULL MARKET VALUE 7,444<br />

******************************************************************************************************* 140.8-5-28 *****************<br />

5406 Java Lake Rd<br />

140.8-5-28 260 Seasonal res COUNTY TAXABLE VALUE 36,000<br />

Barr Cynthea J Pioneer 048401-09 5,900 TOWN TAXABLE VALUE 36,000<br />

19 Gil Ln Lot 19 Town 8 Range 3 36,000 SCHOOL TAXABLE VALUE 36,000<br />

Depew, NY 14043 Java Lake Park Lot 9-10 B FD365 North java fire p5 36,000 TO<br />

FRNT 66.16 DPTH 103.50<br />

EAST-1211426 NRTH-0959486<br />

DEED BOOK 684 PG-73<br />

FULL MARKET VALUE 40,000<br />

******************************************************************************************************* 152.-1-11.1 ****************<br />

5848 Java Lake Rd<br />

152.-1-11.1 240 Rural res 458A COM C 41132 18,000 0 0<br />

Barron Jeremy Pioneer 048401-09 36,400 458A COM T 41133 0 9,000 0<br />

5848 Java Lake Rd Lot 17 Town 8 Range 3 170,800 STAR BASIC 41854 0 0 27,000<br />

Arcade, NY 14009 ACRES 41.78 BANK TRANS COUNTY TAXABLE VALUE 152,800<br />

EAST-1211552 NRTH-0952552 TOWN TAXABLE VALUE 161,800<br />

DEED BOOK 689 PG-49 SCHOOL TAXABLE VALUE 143,800<br />

FULL MARKET VALUE 189,778 AG006 Ag dist #6 41.78 AC<br />

170,800 TO<br />

FD365 North java fire p5 170,800 TO<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 11<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 139.-1-20 ******************<br />

5798 Curriers Rd<br />

139.-1-20 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Barrow Jeannine Pioneer 048401-09 7,500 COUNTY TAXABLE VALUE 71,500<br />

5798 Curriers Rd Lot 17 Town 8 Range 4 71,500 TOWN TAXABLE VALUE 71,500<br />

Arcade, NY 14009 ACRES 1.37 SCHOOL TAXABLE VALUE 44,500<br />

EAST-1192735 NRTH-0953140 FD364 Strykersville f p 4 71,500 TO<br />

DEED BOOK 602 PG-00245<br />

FULL MARKET VALUE 79,444<br />

******************************************************************************************************* 114.-1-5 *******************<br />

4407 Elm Rd<br />

114.-1-5 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Barrow Kevin Pioneer 048401-09 15,400 COUNTY TAXABLE VALUE 118,100<br />

4407 Elm Rd Lot 31 Town 8 Range 4 118,100 TOWN TAXABLE VALUE 118,100<br />

Java Village, NY 14083 ACRES 7.34 SCHOOL TAXABLE VALUE 91,100<br />

EAST-1188227 NRTH-0975793 AG006 Ag dist #6 7.34 AC<br />

DEED BOOK 683 PG-278 118,100 TO<br />

FULL MARKET VALUE 131,222 FD364 Strykersville f p 4 118,100 TO<br />

******************************************************************************************************* 140.8-5-17 *****************<br />

130 Greenwood Dr<br />

140.8-5-17 260 Seasonal res COUNTY TAXABLE VALUE 31,500<br />

Barry Kevin R Pioneer 048401-09 6,500 TOWN TAXABLE VALUE 31,500<br />

Barry Brenda L Lot 19 Town 8 Range 3 31,500 SCHOOL TAXABLE VALUE 31,500<br />

241 Chairfactory Rd Java Lake Park 110-112,12 FD365 North java fire p5 31,500 TO<br />

Elma, NY 14059 FRNT 120.00 DPTH 160.00<br />

EAST-1210519 NRTH-0959684<br />

DEED BOOK 722 PG-401<br />

FULL MARKET VALUE 35,000<br />

******************************************************************************************************* 114.-1-27.1 ****************<br />

4752 Curriers Rd<br />

114.-1-27.1 120 Field crops AG LAND 41720 9,594 9,594 9,594<br />

Bartz Allan P Pioneer 048401-09 34,000 COUNTY TAXABLE VALUE 103,006<br />

Bartz Debra A Lot 29,30 Town Range 112,600 TOWN TAXABLE VALUE 103,006<br />

3551 Bartz Rd ACRES 53.25 SCHOOL TAXABLE VALUE 103,006<br />

Strykersville, NY 14145 EAST-1188080 NRTH-0969080 AG006 Ag dist #6 53.25 AC<br />

DEED BOOK 680 PG-256 112,600 TO<br />

MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 125,111 FD364 Strykersville f p 4 112,600 TO<br />

UNDER AGDIST LAW TIL 2016<br />

******************************************************************************************************* 105.3-2-30.11 **************<br />

2157 East Ave<br />

105.3-2-30.11 210 1 Family Res COUNTY TAXABLE VALUE 78,200<br />

Bartz Edward Attica 562201-09 5,500 TOWN TAXABLE VALUE 78,200<br />

4450 Route 98 Lot 15 Town 8 Range 3 78,200 SCHOOL TAXABLE VALUE 78,200<br />

North Java, NY 14113 FRNT 243.00 DPTH 97.50 FD363 North java fire d3 78,200 TO<br />

EAST-1214699 NRTH-0977503 LD361 N java light 1 78,200 TO<br />

DEED BOOK 521 PG-00245 WD362 North java water 2 78,200 TO C<br />

FULL MARKET VALUE 86,889<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 12<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 117.-1-5 *******************<br />

4450 Route 98<br />

117.-1-5 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Bartz Edward Attica 562201-09 3,700 COUNTY TAXABLE VALUE 81,000<br />

Lefort Brian L Lot 23 Town 8 Range 3 81,000 TOWN TAXABLE VALUE 81,000<br />

4450 Rt 98 Life Use Edw Bartz SCHOOL TAXABLE VALUE 54,000<br />

North Java, NY 14113 FRNT 175.00 DPTH 90.00 AG006 Ag dist #6 .00 AC<br />

BANK HSBCM 81,000 TO<br />

EAST-1214234 NRTH-0974356 FD365 North java fire p5 81,000 TO<br />

DEED BOOK 672 PG-881<br />

FULL MARKET VALUE 90,000<br />

******************************************************************************************************* 105.3-2-37 *****************<br />

2156 East Ave<br />

105.3-2-37 220 2 Family Res COUNTY TAXABLE VALUE 61,800<br />

Bartz Edward F Attica 562201-09 2,100 TOWN TAXABLE VALUE 61,800<br />

Bartz Michelle A Lot 15 Town 8 Range 3 61,800 SCHOOL TAXABLE VALUE 61,800<br />

4450 Route 98 FRNT 65.00 DPTH 125.00 FD363 North java fire d3 61,800 TO<br />

North Java, NY 14113 EAST-1214602 NRTH-0977369 LD361 N java light 1 61,800 TO<br />

DEED BOOK 663 PG-79 WD362 North java water 2 61,800 TO C<br />

FULL MARKET VALUE 68,667<br />

******************************************************************************************************* 138.-1-13.11 ***************<br />

630 Nichols Rd<br />

138.-1-13.11 283 Res w/Comuse STAR BASIC 41854 0 0 27,000<br />

Bartz Lawrence J Pioneer 048401-09 29,500 COUNTY TAXABLE VALUE 107,500<br />

Bartz Nancy C Lot 26 Town 8 Range 4 107,500 TOWN TAXABLE VALUE 107,500<br />

18 Chaffee Rd ACRES 6.95 SCHOOL TAXABLE VALUE 80,500<br />

Chaffee, NY 14030 EAST-1186172 NRTH-0954661 AG006 Ag dist #6 6.95 AC<br />

DEED BOOK 647 PG-937 107,500 TO<br />

FULL MARKET VALUE 119,444 FD364 Strykersville f p 4 107,500 TO<br />

******************************************************************************************************* 138.-1-14.11 ***************<br />

Nichols Rd<br />

138.-1-14.11 322 Rural vac>10 COUNTY TAXABLE VALUE 19,300<br />

Bartz Lawrence J Pioneer 048401-09 19,300 TOWN TAXABLE VALUE 19,300<br />

Bartz Nancy C Lot 26 Town 8 Range 4 19,300 SCHOOL TAXABLE VALUE 19,300<br />

630 Nichols Rd ACRES 17.56 AG006 Ag dist #6 17.56 AC<br />

Arcade, NY 14009 EAST-1186816 NRTH-0954490 19,300 TO<br />

DEED BOOK 718 PG-815 FD364 Strykersville f p 4 19,300 TO<br />

FULL MARKET VALUE 21,444<br />

******************************************************************************************************* 128.1-1-21 *****************<br />

1434 Route 78 & 98<br />

128.1-1-21 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Bartz Rodney Pioneer 048401-09 3,100 COUNTY TAXABLE VALUE 52,800<br />

1434 Main St Lot 36 Town 8 Range 3 52,800 TOWN TAXABLE VALUE 52,800<br />

Java Center, NY 14082 FRNT 58.70 DPTH 190.00 SCHOOL TAXABLE VALUE 25,800<br />

EAST-1201118 NRTH-0965486 FD365 North java fire p5 52,800 TO<br />

DEED BOOK 657 PG-162 LD366 Java center light 6 52,800 TO<br />

FULL MARKET VALUE 58,667<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 13<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 114.-1-9.32 ****************<br />

Route 78<br />

114.-1-9.32 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 14<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 114.-1-49.112 **************<br />

309 Holland Rd<br />

114.-1-49.112 210 1 Family Res STAR ENHAN 41834 0 0 55,980<br />

Baumann Gerhard J Pioneer 048401-09 13,800 COUNTY TAXABLE VALUE 157,100<br />

Kelley Marlene S Lot 38 Town 8 Range 4 157,100 TOWN TAXABLE VALUE 157,100<br />

309 Holland Rd ACRES 5.86 SCHOOL TAXABLE VALUE 101,120<br />

Arcade, NY 14009 EAST-1180935 NRTH-0972190 AG006 Ag dist #6 5.86 AC<br />

DEED BOOK 745 PG-490 157,100 TO<br />

FULL MARKET VALUE 174,556 FD364 Strykersville f p 4 157,100 TO<br />

******************************************************************************************************* 140.8-3-60 *****************<br />

Morningside Dr<br />

140.8-3-60 260 Seasonal res COUNTY TAXABLE VALUE 25,400<br />

Bayer Robert B Pioneer 048401-09 5,500 TOWN TAXABLE VALUE 25,400<br />

5484 Java Lake Rd Lot 19 Town 8 Range 3 25,400 SCHOOL TAXABLE VALUE 25,400<br />

Arcade, NY 14009 Java Lake Park Lot 52-56 FD365 North java fire p5 25,400 TO<br />

FRNT 150.00 DPTH 80.08<br />

EAST-1210266 NRTH-0958658<br />

DEED BOOK 726 PG-59<br />

FULL MARKET VALUE 28,222<br />

******************************************************************************************************* 128.-2-5.11 ****************<br />

Route 78<br />

128.-2-5.11 582 Camping park COUNTY TAXABLE VALUE 89,000<br />

Beaver Meadow Lake Inc Pioneer 048401-09 57,800 TOWN TAXABLE VALUE 89,000<br />

1911 Route 78 Lot 21 Town 8 Range 3 89,000 SCHOOL TAXABLE VALUE 89,000<br />

Java Center, NY 14082 ACRES 76.53 AG006 Ag dist #6 76.53 AC<br />

EAST-1211168 NRTH-0967224 89,000 TO<br />

FULL MARKET VALUE 98,889 FD365 North java fire p5 89,000 TO<br />

******************************************************************************************************* 152.-1-4 *******************<br />

5859 Route 98 47 PCT <strong>OF</strong> VALUE USED FOR EXEMPTION PURPOSES<br />

152.-1-4 240 Rural res 458ACOM CT 41131 9,001 9,000 0<br />

Beck Alice Pioneer 048401-09 38,700 458ADIS CT 41141 18,001 18,000 0<br />

5859 Rte 98 Lot 33 Town 8 Range 3 76,600 STAR ENHAN 41834 0 0 55,980<br />

Arcade, NY 14009 ACRES 66.20 COUNTY TAXABLE VALUE 49,598<br />

EAST-1203524 NRTH-0950639 TOWN TAXABLE VALUE 49,600<br />

DEED BOOK 290 PG-00393 SCHOOL TAXABLE VALUE 20,620<br />

FULL MARKET VALUE 85,111 AG006 Ag dist #6 66.20 AC<br />

76,600 TO<br />

FD365 North java fire p5 76,600 TO<br />

******************************************************************************************************* 104.-2-17.12 ***************<br />

1895 Welch Rd<br />

104.-2-17.12 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Beck Joseph R Attica 562201-09 12,100 COUNTY TAXABLE VALUE 151,600<br />

McCabe Kelly A Lot 38 Range 3 Town 8 151,600 TOWN TAXABLE VALUE 151,600<br />

1895 Welch Rd ACRES 4.67 SCHOOL TAXABLE VALUE 124,600<br />

North Java, NY 14113 EAST-1210334 NRTH-0977105 AG006 Ag dist #6 4.67 AC<br />

DEED BOOK 705 PG-180 151,600 TO<br />

FULL MARKET VALUE 168,444 FD365 North java fire p5 151,600 TO<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 15<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 126.-1-11.11 ***************<br />

5297 Michigan Rd<br />

126.-1-11.11 240 Rural res STAR BASIC 41854 0 0 27,000<br />

Becker Albert L Pioneer 048401-09 72,200 COUNTY TAXABLE VALUE 160,900<br />

Papineau-Becker Linda Y Lot 27,28,35 Town 8 Range 160,900 TOWN TAXABLE VALUE 160,900<br />

5297 Michigan Rd ACRES 147.02 BANK WFHM* SCHOOL TAXABLE VALUE 133,900<br />

Arcade, NY 14009 EAST-1187090 NRTH-0961919 AG006 Ag dist #6 147.02 AC<br />

DEED BOOK 689 PG-951 160,900 TO<br />

FULL MARKET VALUE 178,778 FD364 Strykersville f p 4 160,900 TO<br />

******************************************************************************************************* 114.-1-33 ******************<br />

Michigan Rd<br />

114.-1-33 311 Res vac land COUNTY TAXABLE VALUE 400<br />

Becker Joseph M Pioneer 048401-09 400 TOWN TAXABLE VALUE 400<br />

Becker Kristen E Lot 29 Town 8 Range 4 400 SCHOOL TAXABLE VALUE 400<br />

657 Perry Rd FRNT 50.00 DPTH 275.00 AG006 Ag dist #6 .00 AC<br />

Strykersville, NY 14145 EAST-1185859 NRTH-0968667 400 TO<br />

DEED BOOK 677 PG-114 FD364 Strykersville f p 4 400 TO<br />

FULL MARKET VALUE 444<br />

******************************************************************************************************* 114.-1-34 ******************<br />

4871 Michigan Rd<br />

114.-1-34 210 1 Family Res COUNTY TAXABLE VALUE 73,600<br />

Becker Joseph M Pioneer 048401-09 7,200 TOWN TAXABLE VALUE 73,600<br />

Becker Kristen E Lot 29 Town 8 Range 4 73,600 SCHOOL TAXABLE VALUE 73,600<br />

657 Perry Rd Life Use Ernest Dawson AG006 Ag dist #6 1.17 AC<br />

Strykersville, NY 14145 FRNT 235.00 DPTH 395.00 73,600 TO<br />

ACRES 1.17 FD364 Strykersville f p 4 73,600 TO<br />

EAST-1185960 NRTH-0968735<br />

DEED BOOK 677 PG-114<br />

FULL MARKET VALUE 81,778<br />

******************************************************************************************************* 138.-1-22.2 ****************<br />

5702 Michigan Rd<br />

138.-1-22.2 220 2 Family Res STAR BASIC 41854 0 0 27,000<br />

Becker Roy Pioneer 048401-09 12,900 COUNTY TAXABLE VALUE 115,300<br />

5702 Michigan Rd Lot 34 Town 8 Range 4 115,300 TOWN TAXABLE VALUE 115,300<br />

Arcade, NY 14009 ACRES 5.23 BANK CTS** SCHOOL TAXABLE VALUE 88,300<br />

EAST-1184747 NRTH-0954415 AG006 Ag dist #6 5.23 AC<br />

DEED BOOK 702 PG-607 115,300 TO<br />

FULL MARKET VALUE 128,111 FD364 Strykersville f p 4 115,300 TO<br />

******************************************************************************************************* 138.-1-17 ******************<br />

5711 Michigan Rd<br />

138.-1-17 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Becker Shannon Pioneer 048401-09 12,200 COUNTY TAXABLE VALUE 60,300<br />

5711 Michigan Rd Lot 26 Town 8 Range 4 60,300 TOWN TAXABLE VALUE 60,300<br />

Java, NY 14009 ACRES 4.74 SCHOOL TAXABLE VALUE 33,300<br />

EAST-1185235 NRTH-0954136 AG006 Ag dist #6 4.74 AC<br />

DEED BOOK 717 PG-575 60,300 TO<br />

FULL MARKET VALUE 67,000 FD364 Strykersville f p 4 60,300 TO<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 16<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 128.-1-12 ******************<br />

1644 Route 78 & 98<br />

128.-1-12 210 1 Family Res STAR ENHAN 41834 0 0 55,980<br />

Becker Shirley Pioneer 048401-09 7,600 COUNTY TAXABLE VALUE 84,400<br />

1644 Route 78 Lot 36 Town 8 Range 3 84,400 TOWN TAXABLE VALUE 84,400<br />

Java Center, NY 14082 ACRES 1.43 SCHOOL TAXABLE VALUE 28,420<br />

EAST-1205329 NRTH-0965560 AG006 Ag dist #6 1.43 AC<br />

DEED BOOK 437 PG-00167 84,400 TO<br />

FULL MARKET VALUE 93,778 FD365 North java fire p5 84,400 TO<br />

******************************************************************************************************* 103.-2-3.1 *****************<br />

Minkel Rd<br />

103.-2-3.1 120 Field crops COUNTY TAXABLE VALUE 99,600<br />

Becker Shirley M Pioneer 048401-09 71,800 TOWN TAXABLE VALUE 99,600<br />

Minkel Charles Lot 24 Town 8 Range 4 99,600 SCHOOL TAXABLE VALUE 99,600<br />

776 Minkel Rd ACRES 101.28 AG006 Ag dist #6 101.28 AC<br />

Strykersville, NY 14145 EAST-1190974 NRTH-0980991 99,600 TO<br />

DEED BOOK 731 PG-171 FD364 Strykersville f p 4 99,600 TO<br />

FULL MARKET VALUE 110,667<br />

******************************************************************************************************* 127.-1-43.12 ***************<br />

5299 Curriers Rd<br />

127.-1-43.12 270 Mfg housing STAR BASIC 41854 0 0 27,000<br />

Beckley Donna Pioneer 048401-09 6,700 COUNTY TAXABLE VALUE 28,900<br />

Windsor Richard A Jr Lot 11 Town 8 Range 4 28,900 TOWN TAXABLE VALUE 28,900<br />

5299 Curriers Rd FRNT 107.57 DPTH 362.00 SCHOOL TAXABLE VALUE 1,900<br />

Arcade, NY 14009 EAST-1193071 NRTH-0960920 AG006 Ag dist #6 .00 AC<br />

DEED BOOK 621 PG-520 28,900 TO<br />

FULL MARKET VALUE 32,111 FD364 Strykersville f p 4 28,900 TO<br />

******************************************************************************************************* 115.-1-25.2 ****************<br />

1030 Pit Rd<br />

115.-1-25.2 220 2 Family Res 458A COM C 41132 18,000 0 0<br />

Beechler Brandon Hall Pioneer 048401-09 10,000 458A COM T 41133 0 9,000 0<br />

Beechler Stephen D Lot 13,14 Town 8 Range 4 132,000 STAR BASIC 41854 0 0 27,000<br />

PO Box 102 ACRES 2.79 COUNTY TAXABLE VALUE 114,000<br />

Java Center, NY 14082 EAST-1195812 NRTH-0969002 TOWN TAXABLE VALUE 123,000<br />

DEED BOOK 737 PG-966 SCHOOL TAXABLE VALUE 105,000<br />

MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 146,667 AG006 Ag dist #6 2.79 AC<br />

UNDER AGDIST LAW TIL 2015 132,000 TO<br />

FD364 Strykersville f p 4 132,000 TO<br />

******************************************************************************************************* 115.-1-25.1 ****************<br />

Pit Rd<br />

115.-1-25.1 120 Field crops AG LAND 41720 0 0 0<br />

Beechler Stephen D Pioneer 048401-09 40,400 COUNTY TAXABLE VALUE 57,400<br />

Beechler Janet L Lot 13,14 Town 8 Range 4 57,400 TOWN TAXABLE VALUE 57,400<br />

5190 Curriers Rd ACRES 64.91 SCHOOL TAXABLE VALUE 57,400<br />

Arcade, NY 14009 EAST-1195611 NRTH-0969967 AG006 Ag dist #6 64.91 AC<br />

DEED BOOK 672 PG-805 57,400 TO<br />

MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 63,778 FD364 Strykersville f p 4 57,400 TO<br />

UNDER AGDIST LAW TIL 2016<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 17<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 127.-1-9.2 *****************<br />

Curriers Rd (W)<br />

127.-1-9.2 311 Res vac land COUNTY TAXABLE VALUE 2,100<br />

Beechler Stephen D Pioneer 048401-09 2,100 TOWN TAXABLE VALUE 2,100<br />

Beechler Janet L Lot 20,Twp 8, R-4 2,100 SCHOOL TAXABLE VALUE 2,100<br />

5190 Curriers Rd ACRES 1.52 AG006 Ag dist #6 1.52 AC<br />

Arcade, NY 14009 EAST-1191994 NRTH-0962748 2,100 TO<br />

DEED BOOK 645 PG-619 FD364 Strykersville f p 4 2,100 TO<br />

FULL MARKET VALUE 2,333<br />

******************************************************************************************************* 127.-1-10 ******************<br />

5190 Curriers Rd<br />

127.-1-10 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Beechler Stephen D Pioneer 048401-09 7,400 COUNTY TAXABLE VALUE 127,800<br />

Beechler Janet L Lot 20 Town 8 Range 4 127,800 TOWN TAXABLE VALUE 127,800<br />

5190 Curriers Rd ACRES 1.31 SCHOOL TAXABLE VALUE 100,800<br />

Arcade, NY 14009 EAST-1192188 NRTH-0962664 AG006 Ag dist #6 1.31 AC<br />

DEED BOOK 614 PG-00902 127,800 TO<br />

FULL MARKET VALUE 142,000 FD364 Strykersville f p 4 127,800 TO<br />

******************************************************************************************************* 115.-1-27 ******************<br />

1044 Pit Rd<br />

115.-1-27 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Beechler Timothy P Pioneer 048401-09 7,800 COUNTY TAXABLE VALUE 64,100<br />

13341 Day Rd Lot 13 Town 8 Range 4 64,100 TOWN TAXABLE VALUE 64,100<br />

Holland, NY 14080 ACRES 1.59 SCHOOL TAXABLE VALUE 37,100<br />

EAST-1194684 NRTH-0969468 AG006 Ag dist #6 1.59 AC<br />

DEED BOOK 728 PG-159 64,100 TO<br />

FULL MARKET VALUE 71,222 FD364 Strykersville f p 4 64,100 TO<br />

******************************************************************************************************* 115.-1-40.3 ****************<br />

Route 78<br />

115.-1-40.3 311 Res vac land COUNTY TAXABLE VALUE 4,900<br />

Beechler Timothy P Pioneer 048401-09 4,900 TOWN TAXABLE VALUE 4,900<br />

Beechler Krista Lot 13, Twp 8, Range 4 4,900 SCHOOL TAXABLE VALUE 4,900<br />

1044 Pit Rd ACRES 5.46 AG006 Ag dist #6 5.46 AC<br />

Java Center, NY 14082 EAST-1194585 NRTH-0969057 4,900 TO<br />

DEED BOOK 744 PG-694 FD364 Strykersville f p 4 4,900 TO<br />

FULL MARKET VALUE 5,444<br />

******************************************************************************************************* 140.8-7-27.1 ***************<br />

273 Pine Grove Ave<br />

140.8-7-27.1 260 Seasonal res COUNTY TAXABLE VALUE 24,900<br />

Bennett Jeffrey W Pioneer 048401-09 6,000 TOWN TAXABLE VALUE 24,900<br />

Bennett Gail Lot 19 Town 8 Range 3 24,900 SCHOOL TAXABLE VALUE 24,900<br />

677 Reba Rd Lots 271,272,273,274 & 27 FD365 North java fire p5 24,900 TO<br />

Landing, NJ 07850-0263 FRNT 150.00 DPTH 80.00<br />

EAST-1211957 NRTH-0960384<br />

DEED BOOK 652 PG-389<br />

FULL MARKET VALUE 27,667<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 18<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 117.-1-24 ******************<br />

Sheer Rd<br />

117.-1-24 311 Res vac land COUNTY TAXABLE VALUE 3,100<br />

Bennett Ronald P Attica 562201-09 3,100 TOWN TAXABLE VALUE 3,100<br />

Bennett Terry A Lot 15 Town 8 Range 3 3,100 SCHOOL TAXABLE VALUE 3,100<br />

Two North Main St ACRES 1.24 AG006 Ag dist #6 1.24 AC<br />

Holland, NY 14080 EAST-1215581 NRTH-0974475 3,100 TO<br />

DEED BOOK 712 PG-413 FD365 North java fire p5 3,100 TO<br />

FULL MARKET VALUE 3,444<br />

******************************************************************************************************* 140.8-4-41 *****************<br />

5428 Java Lake Rd<br />

140.8-4-41 260 Seasonal res COUNTY TAXABLE VALUE 33,600<br />

Benz Marion Pioneer 048401-09 5,600 TOWN TAXABLE VALUE 33,600<br />

Marion Benz Living Trust Lot 19 Town 8 Range 3 33,600 SCHOOL TAXABLE VALUE 33,600<br />

4493 S Buffalo St Java Lake Park Lot 9-10 B FD365 North java fire p5 33,600 TO<br />

Orchard Park, NY 14127 FRNT 65.38 DPTH 100.00<br />

EAST-1211573 NRTH-0959100<br />

DEED BOOK 747 PG-629<br />

FULL MARKET VALUE 37,333<br />

******************************************************************************************************* 139.-1-11 ******************<br />

956 Chaffee Rd<br />

139.-1-11 210 1 Family Res COUNTY TAXABLE VALUE 116,800<br />

Bergman Martin G Pioneer 048401-09 3,600 TOWN TAXABLE VALUE 116,800<br />

Bergman Holly S Lot 18 Town 8 Range 4 116,800 SCHOOL TAXABLE VALUE 116,800<br />

956 Chaffee Rd ACRES 0.35 BANK ARTS* FD364 Strykersville f p 4 116,800 TO<br />

Arcade, NY 14009 EAST-1192700 NRTH-0954691<br />

DEED BOOK 626 PG-929<br />

FULL MARKET VALUE 129,778<br />

******************************************************************************************************* 126.-1-8.12 ****************<br />

5237 Michigan Rd<br />

126.-1-8.12 242 Rurl res&rec STAR BASIC 41854 0 0 27,000<br />

Beutel Michael J Pioneer 048401-09 20,900 COUNTY TAXABLE VALUE 150,300<br />

Beutel Michelle A Lot 28, Twp8,r4 150,300 TOWN TAXABLE VALUE 150,300<br />

5237 Michigan Rd ACRES 13.35 SCHOOL TAXABLE VALUE 123,300<br />

Arcade, NY 14009 EAST-1187121 NRTH-0962941 AG006 Ag dist #6 13.35 AC<br />

DEED BOOK 746 PG-823 150,300 TO<br />

FULL MARKET VALUE 167,000 FD364 Strykersville f p 4 150,300 TO<br />

******************************************************************************************************* 126.-1-8.13 ****************<br />

Michigan Rd<br />

126.-1-8.13 311 Res vac land COUNTY TAXABLE VALUE 50<br />

Beutel Michael J Pioneer 048401-09 50 TOWN TAXABLE VALUE 50<br />

Beutel Michelle A Lot 28,Twp8,r4 50 SCHOOL TAXABLE VALUE 50<br />

5237 Michigan Rd Part Of Row 126.-1-8.12 AG006 Ag dist #6 .00 AC<br />

Arcade, NY 14009 FRNT 175.00 DPTH 2.00 50 TO<br />

EAST-1184991 NRTH-0962486 FD364 Strykersville f p 4 50 TO<br />

DEED BOOK 746 PG-823<br />

FULL MARKET VALUE 56<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 19<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 140.8-2-4.1 ****************<br />

101 Morningside Dr<br />

140.8-2-4.1 260 Seasonal res COUNTY TAXABLE VALUE 35,800<br />

Beyer Raymond C Pioneer 048401-09 6,400 TOWN TAXABLE VALUE 35,800<br />

1960 Sheridan Dr 3 L-19 T-8 R-3 35,800 SCHOOL TAXABLE VALUE 35,800<br />

Buffalo, NY 14223 Java Lake Park lot96-101 FD365 North java fire p5 35,800 TO<br />

FRNT 180.00 DPTH 80.00<br />

EAST-1211108 NRTH-0958574<br />

DEED BOOK 710 PG-827<br />

FULL MARKET VALUE 39,778<br />

******************************************************************************************************* 126.-1-11.21 ***************<br />

5354 Michigan Rd 93 PCT <strong>OF</strong> VALUE USED FOR EXEMPTION PURPOSES<br />

126.-1-11.21 240 Rural res 458A WAR C 41122 10,800 0 0<br />

Bishoff Ronald R Pioneer 048401-09 19,800 458A WAR T 41123 0 5,400 0<br />

5354 Michigan Rd L-35/27 T-8 R-4 108,300 STAR BASIC 41854 0 0 27,000<br />

Arcade, NY 14009 ACRES 23.05 COUNTY TAXABLE VALUE 97,500<br />

EAST-1184328 NRTH-0960255 TOWN TAXABLE VALUE 102,900<br />

DEED BOOK 639 PG-684 SCHOOL TAXABLE VALUE 81,300<br />

FULL MARKET VALUE 120,333 AG006 Ag dist #6 23.05 AC<br />

108,300 TO<br />

FD364 Strykersville f p 4 108,300 TO<br />

******************************************************************************************************* 138.-1-9.112 ***************<br />

5543 Michigan Rd<br />

138.-1-9.112 105 Vac farmland COUNTY TAXABLE VALUE 156,000<br />

Blasdell Philip J Pioneer 048401-09 15,900 TOWN TAXABLE VALUE 156,000<br />

Blasdell Angela R Lot 26, Twp 8, R4 156,000 SCHOOL TAXABLE VALUE 156,000<br />

5543 Michigan Rd ACRES 12.72 AG006 Ag dist #6 12.72 AC<br />

Arcade, NY 14009 EAST-1185616 NRTH-0955951 156,000 TO<br />

DEED BOOK 744 PG-422 FD364 Strykersville f p 4 156,000 TO<br />

FULL MARKET VALUE 173,333<br />

******************************************************************************************************* 140.8-3-19 *****************<br />

102 Summerset<br />

140.8-3-19 260 Seasonal res COUNTY TAXABLE VALUE 36,900<br />

Blazejewski Mark S Pioneer 048401-09 2,900 TOWN TAXABLE VALUE 36,900<br />

Rzeszut Barbara Lot 19 Town 8 Range 3 36,900 SCHOOL TAXABLE VALUE 36,900<br />

43 Newell Av Java Lake Park Lot 102 Bl FD365 North java fire p5 36,900 TO<br />

Lancaster, NY 14086 FRNT 61.03 DPTH 81.72<br />

EAST-1211540 NRTH-0958909<br />

DEED BOOK 675 PG-244<br />

FULL MARKET VALUE 41,000<br />

******************************************************************************************************* 140.8-7-75 *****************<br />

Block F<br />

140.8-7-75 311 Res vac land COUNTY TAXABLE VALUE 200<br />

Blizzard James Pioneer 048401-09 200 TOWN TAXABLE VALUE 200<br />

Mary Sue Asquith Lot 19 Town 8 Range 3 200 SCHOOL TAXABLE VALUE 200<br />

1285 Chaffee Rd Java Lake Park Lot 250 Bl FD365 North java fire p5 200 TO<br />

Arcade, NY 14009 FRNT 30.00 DPTH 80.00<br />

EAST-1212463 NRTH-0960006<br />

DEED BOOK 421 PG-00192<br />

FULL MARKET VALUE 222<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 20<br />

COUNTY - <strong>Wyoming</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Java OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 563600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 090.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 140.8-7-77 *****************<br />

Maplewood Ave<br />

140.8-7-77 311 Res vac land COUNTY TAXABLE VALUE 200<br />

Blizzard James Pioneer 048401-09 200 TOWN TAXABLE VALUE 200<br />

Mary Sue Asquith Lot 19 Town 8 Range 3 200 SCHOOL TAXABLE VALUE 200<br />

1285 Chaffee Rd Java Lake Park Lot 252 Bl FD365 North java fire p5 200 TO<br />

Arcade, NY 14009 FRNT 30.00 DPTH 80.00<br />

EAST-1212461 NRTH-0960064<br />

DEED BOOK 421 PG-00192<br />

FULL MARKET VALUE 222<br />

******************************************************************************************************* 139.-1-18 ******************<br />

5754 Curriers Rd<br />

139.-1-18 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Boese Richard A Pioneer 048401-09 8,000 COUNTY TAXABLE VALUE 91,300<br />

Boese Patricia A Lot 18 Town 8 Range 4 91,300 TOWN TAXABLE VALUE 91,300<br />

5754 Curriers Rd 541/198 SCHOOL TAXABLE VALUE 64,300<br />

Arcade, NY 14009 FRNT 130.00 DPTH 158.50 FD364 Strykersville f p 4 91,300 TO<br />

ACRES 1.69<br />

EAST-1192608 NRTH-0953832<br />

DEED BOOK 684 PG-438<br />

FULL MARKET VALUE 101,444<br />

******************************************************************************************************* 128.-2-32.12 ***************<br />

1904 Route 78<br />

128.-2-32.12 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Boldt Walter R Pioneer 048401-09 8,200 COUNTY TAXABLE VALUE 78,600<br />

Boldt Sharon L Lot 20 Town 8 Range 3 78,600 TOWN TAXABLE VALUE 78,600<br />

1904 Route 78 ACRES 1.86 SCHOOL TAXABLE VALUE 51,600<br />

Java, NY 14082 EAST-1210481 NRTH-0965445 AG006 Ag dist #6 1.86 AC<br />

DEED BOOK 687 PG-742 78,600 TO<br />

FULL MARKET VALUE 87,333 FD365 North java fire p5 78,600 TO<br />

******************************************************************************************************* 129.-1-8 *******************<br />

4874 Route 98<br />

129.-1-8 210 1 Family Res STAR BASIC 41854 0 0 27,000<br />

Bookmiller James R Pioneer 048401-09 5,600 COUNTY TAXABLE VALUE 100,700<br />

4874 Rt 78 Lot 21 Town 8 Range 3 100,700 TOWN TAXABLE VALUE 100,700<br />

North Java, NY 14113 By Will SCHOOL TAXABLE VALUE 73,700<br />

FRNT 100.00 DPTH 275.00 AG006 Ag dist #6 .00 AC<br />

EAST-1214067 NRTH-0967378 100,700 TO<br />

DEED BOOK 637 PG-79 FD365 North java fire p5 100,700 TO<br />

FULL MARKET VALUE 111,889<br />