MITI Weekly Bulletin (Volume 139) - 26 April 2011

MITI Weekly Bulletin (Volume 139) - 26 April 2011

MITI Weekly Bulletin (Volume 139) - 26 April 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INSIDE THIS ISSUE:<br />

ECONOMIC TRENDS ECONOMIC DEVELOPMEnTS<br />

Malaysia - Manufacturing Sector<br />

Performance,February <strong>2011</strong> ....................................1<br />

Sales and Exports, February (2010 to <strong>2011</strong>) ...........1<br />

Sales of Products, January to February <strong>2011</strong> .........2<br />

<strong>Weekly</strong> Number of PCOs and Export Value:<br />

AANZFTA, AIFTA, GSP & ATIGA Scheme ..............2<br />

MJEPA & MPCEPA .................................................3<br />

ACFTA, AKFTA, AJCEP & MNZFTA .......................3<br />

<strong>Weekly</strong> Price Trend of Commodities ...........................4<br />

<strong>Weekly</strong> Commodity Prices ...........................................4<br />

Highest & Lowest Prices 2010/<strong>2011</strong>:<br />

Crude Petroleum & Crude Palm Oil......................4<br />

ECONOMIC TRENDS<br />

YAB PM’s Official Visit to Seoul ...................................5<br />

Compulsory Licensing .................................................5<br />

Investments in the Manufacturing and Manufacturing<br />

Related Services Sectors ............................................6<br />

<strong>MITI</strong> Captures - Worldwide ................................6<br />

LETTERS TO THE EDITOR .............................................. 7<br />

YOUR FEEDBACK PLEASE! .....................................................8<br />

BUSINESS OPPORTUNITIES ............................................ 8<br />

IMPORT ENQUIRIES FROM INTERNATIONAL<br />

COMPANIES .................................................................... 8<br />

DOING BUSINESS IN PHILIPPINES .............................10<br />

UPCOMING EVENTS ......................................................10<br />

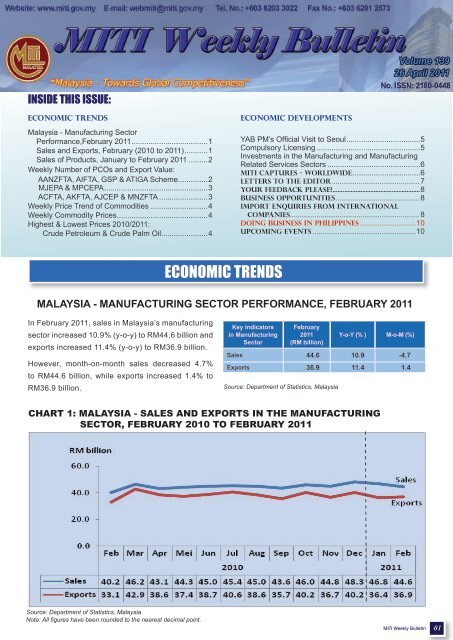

MALAYSIA - MANUFACTURING SECTOR PERFORMANCE, FEBRUARY <strong>2011</strong><br />

In February <strong>2011</strong>, sales in Malaysia’s manufacturing<br />

sector increased 10.9% (y-o-y) to RM44.6 billion and<br />

exports increased 11.4% (y-o-y) to RM36.9 billion.<br />

However, month-on-month sales decreased 4.7%<br />

to RM44.6 billion, while exports increased 1.4% to<br />

RM36.9 billion.<br />

Source: Department of Statistics, Malaysia<br />

Note: All figures have been rounded to the nearest decimal point.<br />

Key indicators<br />

in Manufacturing<br />

Sector<br />

February<br />

<strong>2011</strong><br />

(RM billion)<br />

Source: Department of Statistics, Malaysia<br />

Y-o-Y (% ) M-o-M (%)<br />

Sales 44.6 10.9 -4.7<br />

Exports 36.9 11.4 1.4<br />

CHART 1: MALAYSIA - SALES AND EXPORTS IN THE MANUFACTURING<br />

SECTOR, FEBRUARY 2010 TO FEBRUARY <strong>2011</strong><br />

<strong>Volume</strong> <strong>139</strong><br />

<strong>26</strong> <strong>April</strong> <strong>2011</strong><br />

<strong>MITI</strong> <strong>Weekly</strong> <strong>Bulletin</strong> 01

CHART 2: MALAYSIA - SALES OF MANUFACTURED PRODUCTS, JANUARY TO<br />

FEBRUARY <strong>2011</strong><br />

Source: Department of Statistics, Malaysia<br />

Note: All figures have been rounded to the nearest decimal point<br />

CHART 3: MALAYSIA - WEEKLY NUMBER OF PCOs AND EXPORT VALUE UNDER<br />

AANZFTA, AIFTA, GSP & ATIGA SCHEME, FEBRUARY TO APRIL <strong>2011</strong><br />

Source: <strong>MITI</strong><br />

Note : The preference giving countries under the GSP scheme are members of the European Union, Norway, Switzerland, Belarus, the Russian<br />

Federation and Turkey.<br />

•<br />

•<br />

PCO : Preferential Certificate of Origin<br />

AANZFTA: ASEAN-Australia-New Zealand Free Trade AIFTA: ASEAN-India Free Trade Agreement<br />

Agreement<br />

• GSP: Generalised System of Preference<br />

• ATIGA: ASEAN Trade in Goods Agreement<br />

•<br />

No Products Sales (RM bil.) % Share<br />

1 Chemicals & Chemical Products 33.2 36.3<br />

2 E & E 24.7 27.0<br />

3 Metals 6.5 7.1<br />

4 Transport Equipment 5.8 6.3<br />

5 Processed Food & Beverages 4.6 5.0<br />

6 Wood and Wood Products 3.2 3.5<br />

7 Rubber Products 2.3 2.5<br />

8 Non-Metallic Mineral Products 2.2 2.4<br />

9 Machinery & Equipment 1.5 1.6<br />

10 Textiles & Apparel 1.2 1.3<br />

11 Medical Devices 0.2 0.2<br />

12 Others 6.0 6.6<br />

Total<br />

91.4 100.0<br />

<strong>MITI</strong> <strong>Weekly</strong> <strong>Bulletin</strong> 02

CHART 4: MALAYSIA - WEEKLY NUMBER OF PCOs AND EXPORT VALUE<br />

UNDER MJEPA & MPCEPA, FEBRUARY TO APRIL <strong>2011</strong><br />

Source: <strong>MITI</strong><br />

Note : • MJEPA: Malaysia-Japan Economic Partnership Agreement • MPCEPA: Malaysia-Pakistan Closer Economic Partnership Agreement<br />

CHART 5: MALAYSIA - WEEKLY NUMBER OF PCOs AND EXPORT VALUE UNDER<br />

ACFTA, AKFTA, AJCEP & MNZFTA, FEBRUARY TO APRIL <strong>2011</strong><br />

Source: <strong>MITI</strong><br />

•<br />

ACFTA: ASEAN-China Free Trade Agreement<br />

Note : AKFTA: ASEAN-Korea Free Trade Agreement<br />

• AJCEP: ASEAN-Japan Comprehensive Economic Partnership MNZFTA: Malaysia-New Zealand Free Trade Agreement<br />

•<br />

•<br />

<strong>MITI</strong> <strong>Weekly</strong> <strong>Bulletin</strong> 03

CHART 6: WEEKLY COMMODITIES PRICE TREND, JANUARY TO APRIL <strong>2011</strong><br />

Sources: <strong>MITI</strong>, Malaysia Palm Oil Board and Bloomberg<br />

TABLE 1: WEEKLY COMMODITY PRICES<br />

Crude Petroleum<br />

(per bbl)<br />

Crude Palm Oil<br />

(per MT)<br />

Raw Sugar<br />

(per MT)<br />

Iron Ore (Pellet)<br />

(per MT)<br />

Scrap Iron HMS 1&2<br />

(80:20 mix) (per MT)<br />

TABLE 2: HIGHEST & LOWEST PRICES 2010/<strong>2011</strong><br />

Crude Petroleum<br />

(US$ per bbl)<br />

Crude Palm Oil<br />

(US$ per MT)<br />

As at<br />

22 <strong>April</strong> <strong>2011</strong><br />

(US$)<br />

Compiled by: <strong>MITI</strong><br />

Note: All figures have been rounded to the nearest decimal point.<br />

<strong>2011</strong> 2010<br />

Highest Lowest Current Highest Lowest<br />

111.7<br />

(22 <strong>April</strong>)<br />

1,3<strong>26</strong>.0<br />

(11 February)<br />

% Change from<br />

15 <strong>April</strong> <strong>2011</strong><br />

85.6<br />

(28 January)<br />

1,120.5<br />

(22 <strong>April</strong>)<br />

As at<br />

15 <strong>April</strong> <strong>2011</strong><br />

(US$)<br />

111.7<br />

(22 <strong>April</strong>)<br />

1,120.5<br />

(22 <strong>April</strong>)<br />

2010* (US$) 2009* (US$) 2008* (US$)<br />

111.7 3.3 108.1 68.0-91.4 35.0-81.0 30.3-145.3<br />

1,120.5 3.0 1,155.0 896.6 683.0 949.0<br />

639.8 0.8 634.9 594.6 412.3 305.0<br />

220.0 Unchanged 220.0 162.3 108.5 196.7<br />

495.0 (High)<br />

485.0 (Low)<br />

Unchanged<br />

Unchanged<br />

495.0 (High)<br />

485.0 (Low)<br />

393.1 <strong>26</strong>1.7 500.0<br />

Sources: <strong>MITI</strong>, Malaysia Palm Oil Board, Malaysian Iron and Steel Industry Federation (MISIF), Bloomberg and Czarnikow Group<br />

Note: * Average price in the year except otherwise indicated<br />

Figures are rounded to the nearest decimal point<br />

March <strong>2011</strong> domestic price range for:<br />

i. Billets : RM2,250 - RM2,400 per MT<br />

ii. Steel bars : RM2,000 - RM2,500 per MT<br />

91.4<br />

(31 December)<br />

1,<strong>26</strong>3.0<br />

(31 December)<br />

68.0<br />

(21 May)<br />

767.0<br />

(5 February)<br />

<strong>MITI</strong> <strong>Weekly</strong> <strong>Bulletin</strong> 04

YAB Perdana Menteri (YAB PM) made an official<br />

visit to Seoul, the Republic of Korea (ROK) from 4-6<br />

<strong>April</strong> <strong>2011</strong> upon the invitation by his counterpart, H.E.<br />

Lee Myung-bak, the President of ROK. It was also to<br />

reciprocate the visit of the President of ROK to Malaysia<br />

in December 2010. The visit was successful in further<br />

strengthening and enhancing economic, trade and<br />

investment relations with the ROK.<br />

During the visit, YAB PM chaired a Business Luncheon<br />

attended by 33 potential Korean investors and delivered<br />

a keynote address at the Seminar on “Business<br />

Opportunities in Malaysia” participated by 332 Korean<br />

businessmen. At the Seminar, YAB PM also witnessed<br />

the exchange of a MoU between the National Chamber<br />

of Commerce and Industry, Malaysia (NCCIM) and the<br />

Korean Chamber of Commerce and Industry (KCCI) to<br />

establish a Joint Business Council.<br />

A total of 155 individual business matchings were held<br />

involving sectors such as palm oil, renewable energy,<br />

green technology, biotechnology, automotive parts<br />

and components, financial services and advanced<br />

electronics. Total investments worth RM5 billion were<br />

proposed in silicon metal for solar cells and solar panels,<br />

Under the Trade-related Aspects of Intellectual Property<br />

Rights (TRIPs) Agreement, patent-holders are given<br />

protection for the use of their patents. However,<br />

Articles 30 and 31 of TRIPs provide exceptions with<br />

strict conditions, procedures and limitations that allow<br />

a Government to use a patent or to authorise a third<br />

party to use a patent/licence without the consent of the<br />

patent-holder. This is known as ‘compulsory licensing’.<br />

Though TRIPs does not explicitly lay down the grounds<br />

for compulsory licensing, it is noted that in Articles 7<br />

and 8 of TRIPs, WTO Members are allowed to make<br />

provisions in their intellectual property laws to protect<br />

public health and nutrition for the purposes of social<br />

and economic welfare. Thus, compulsory licensing is a<br />

non-permanent measure instituted only when needed<br />

for the protection of public health.<br />

Article 31 of TRIPs stipulates the conditions, procedures<br />

and limitations of compulsory licensing:<br />

• authorisation given must be considered on its own<br />

merit.<br />

• the Government or third party must have made<br />

efforts to obtain authorisation from the patent-holder<br />

ECONOMIC DEVELOPMENTS<br />

YAB PM’s OFFICIAL VISIT TO SEOUL<br />

COMPULSORY LICENSING<br />

biomass, petrochemicals, hotel and distributive trade.<br />

Y.B. Dato’ Sri Mustapa Mohamed (YBM <strong>MITI</strong>) who was<br />

in YAB PM’s delegation to Seoul, had the opportunity to:<br />

• call on H.E. Choi Joong-kyung, Minister of<br />

Knowledge Economy, to discuss ways to widen and<br />

deepen economic, trade and investment relations<br />

between both countries including collaboration in<br />

industrial development;<br />

• call on H.E Kim Joon-hoon, Minister of Trade, to<br />

discuss the proposed Malaysia-Korea Free Trade<br />

Agreement (MKFTA). Both countries agreed to<br />

undertake separate feasibility studies within a year;<br />

and<br />

• visit Dongbu HiTek Co. Ltd., the largest analog<br />

foundry in ROK which manufactures intergrated<br />

circuits for mobile handset and flat panel LCD. The<br />

company has expressed interest to collaborate with<br />

Silterra Malaysia.<br />

After the exchange of MoU documents, the Malaysian<br />

and Korean chapters of the Joint Business Council<br />

held the first meeting in Seoul. Among others, both<br />

sides agreed to collaborate in potential sectors such as<br />

pharmaceutical, automotive and green technology.<br />

on reasonable commercial terms and conditions<br />

but no authorisation was given within a reasonable<br />

time;<br />

• the use of compulsory licensing is non-exclusive<br />

and non-assignable to another party;<br />

• it is only for supply to domestic market;<br />

• it can be terminated at any time when the condition<br />

for such use no longer exists;<br />

• the patent-holder must be compensated adequately<br />

by taking into account the economic value of the<br />

authorisation.<br />

Compulsory licensing has been used only by developing<br />

countries such as Brazil, India, Malaysia and Thailand<br />

for generic drugs manufacture mainly to produce<br />

antiretroviral drugs for AIDS treatment.<br />

However, developing countries are likely to face<br />

difficulties in using compulsory licensing, as developed<br />

countries are stipulating conditions and restrictions<br />

beyond TRIPs, under free trade agreements. There are<br />

FTAs that impose “data exclusivity” clauses to restrict<br />

the use of patent holders’ test data as the basis for<br />

granting safety approval of generic drugs.<br />

<strong>MITI</strong> <strong>Weekly</strong> <strong>Bulletin</strong> 05

INVESTMENTS IN THE MANUFACTURING AND MANUFACTURING<br />

RELATED SERVICES SECTORS<br />

From January to February <strong>2011</strong>, a total of 132 projects<br />

were approved with investments amounting to RM6.8<br />

billion. Of this, RM2.4 billion (35.3%) were foreign<br />

investments and RM4.4 billion (64.7%) domestic<br />

investment. A total of 79 projects were new projects with<br />

RM2.9 billion (42.7%) investments and 53 expansions/<br />

diversification projects of RM3.9 billion (57.3%)<br />

investments.<br />

Main areas of domestic investments:<br />

• transportation equipment (RM2.6 billion);<br />

• electrical and electronic products (RM568 million);<br />

• basic metal products (RM413.9 million);<br />

• chemicals and chemical products (RM319.2 million);<br />

• food manufacturing (RM191.8 million);<br />

• wood and wood-based products (RM56.6 million);<br />

and<br />

• machinery (RM55 million).<br />

Main areas of foreign investments:<br />

• basic metal products (RM866.6 million);<br />

• food manufacturing (RM607.3 million);<br />

• electrical and electronic products (RM346.8 million);<br />

• transportation equipment (RM152 million);<br />

• scientific and measuring equipment (RM127.5<br />

million);<br />

• non-metallic mineral products (RM64.5 million); and<br />

• chemicals and chemical products (RM51.7 million).<br />

Major sources of foreign investments:<br />

• Singapore (RM776.6 million);<br />

• Republic of Korea (RM719.5 million);<br />

• Hong Kong (RM180 million);<br />

• France (RM135.5 million); and<br />

• Australia (RM105 million).<br />

Johor recorded the largest amount of approved<br />

investments due to investments in marine repairs,<br />

marine conversions, engineering and construction<br />

projects.<br />

Approved investments by location:<br />

• Johor (RM2.99 billion);<br />

• Selangor (RM1.76 billion);<br />

• Pulau Pinang (RM651.9 million);<br />

• Sarawak (RM370.8 million); and<br />

• Melaka (RM<strong>26</strong>4.5 million).<br />

<strong>MITI</strong> CAPTURES - WORLDWIDE<br />

1. ASEAN: AMRO MAY ‘REPLACE’ IMF FINANCIAL ROLE<br />

The ASEAN+3 Macroeconomic and<br />

Research Offices (AMRO) will commence<br />

operation in early May this year to<br />

undertake surveillance functions in the<br />

region.<br />

AMRO, which will function like the<br />

International Monetary Fund (IMF), will<br />

perform a key regional surveillance<br />

function for the use of the US$120 billion<br />

Chiang Mai Initiative Multilateralization<br />

(CMIM) currency swap facility. It will<br />

become a body that will supervise financial<br />

development in the region and provide<br />

early warning for member countries<br />

that need support. The headquarters<br />

of the regional surveillance body is in<br />

Singapore and co-chaired by Japan<br />

and China.<br />

The regional surveillance role for the<br />

CMIM was previously handled by the<br />

Asian Development Bank and ASEAN<br />

Secretariat.<br />

AMRO members comprise of 10<br />

ASEAN member countries and the plus<br />

2. ASEAN: MOVES A STEP CLOSER TO MARKET INTEGRATION<br />

Seven stock exchanges from ASEAN<br />

member countries have launched a new<br />

joint website promoting the region’s blue<br />

chip equities to global investors.<br />

Members of the joint website, branded<br />

the “ASEAN Exchanges”, are Viet Nam’s<br />

Hanoi Stock Exchange and Hochiminh<br />

Stock Exchange, Bursa Malaysia, the<br />

Indonesia Stock Exchange, the Philippine<br />

Stock Exchange, Singapore Exchange<br />

and the Stock Exchange of Thailand.<br />

The ASEAN Exchanges website,<br />

www.aseanexchanges.org, features<br />

a product called “ASEAN Stars”. The<br />

website provides 210 blue chip stocks<br />

ranked by “investability” in terms of<br />

market capitalisation and liquidity.<br />

ASEAN member countries agreed for<br />

freer capital movement among member<br />

countries in an attempt to prepare for<br />

Manufacturing-related Services Sectors<br />

A total of 16 regional establishment projects were<br />

approved with investments totaling RM8.8 million,<br />

consisting of nine Representative Offices (RM5.2<br />

million) and seven Regional Offices (RM3.6 million).<br />

For the period January to February <strong>2011</strong>, 10 new<br />

projects were approved for support services valued at<br />

RM148.2 million, consisting of RM145.8 million (98.4%)<br />

of domestic investments and RM2.4 million (1.6%) of<br />

foreign investments.<br />

three nations (Japan, China, Republic of<br />

Korea).<br />

Republic of Korea contributed US$19.2<br />

billion or 16% of the US$120 billion fund.<br />

China and Japan each provided 32%<br />

while ASEAN members provided the<br />

remaining 20%.<br />

Indonesia, Malaysia, Singapore and<br />

Thailand each contributed US$4.77<br />

billion into the CMIM liquidity protection<br />

fund, while the Philippines contributed<br />

US$2.68 billion.<br />

the planned 2015 ASEAN Economic<br />

Community, through which financial<br />

activities, including the capital market and<br />

the stock exchanges, would be linked and<br />

integrated with one another. ASEAN had a<br />

combined market capitalisation of US$1.8<br />

trillion as of January <strong>2011</strong>, the eighth<br />

highest in the world, with total listed firms<br />

numbering over 3,000 companies and a<br />

market of more than 538 million people.<br />

<strong>MITI</strong> <strong>Weekly</strong> <strong>Bulletin</strong> 06

3. INDONESIA: MINISTER ASKS FOR FTA DELAY<br />

Industry Minister MS Hidayat has asked<br />

for a postponement of the ASEAN,<br />

Australia, and New Zealand Free Trade<br />

Agreement (AANZFTA) to allow for<br />

further study. The study is important to<br />

avoid the emergence of problems.<br />

Hidayat cited the ASEAN-China Free<br />

Trade Agreement as an example, saying<br />

it resulted in losses to a number of<br />

4. THAILAND: THAI EXPORTS FOR <strong>2011</strong> EXPECTED TO RISE BY 12%<br />

The Ministry of Commerce, Thailand<br />

(MOC) recently revised the Kingdom’s<br />

export growth target for <strong>2011</strong> from 10% to<br />

12%. The Ministry estimated the value of<br />

export growth is at US$219 billion.<br />

Thailand’s exports to ASEAN is expected<br />

to rise by 23%. Other Asian markets that<br />

would drive Thailand exports this year<br />

include China (20%) and India (18%).<br />

MOC expects the cross border trade<br />

between Thailand and its neighbouring<br />

countries including Cambodia, Laos,<br />

Myanmar, and Malaysia to increase by<br />

5. INDIA: ‘TOO BIG TOO IGNORE’<br />

The US, Japan, Germany, France, UK,<br />

India and China will face deeper scrutiny<br />

from their peers in the G-20 due to their<br />

importance to the world economy. This<br />

is to ensure their policies do not derail<br />

global expansion that is believed to be<br />

strong enough to absorb recent shocks.<br />

The seven countries have a gross<br />

domestic product greater than 5 % of<br />

the Group of 20 nations’ economy, thus<br />

imbalances in individual economies<br />

such as large trade gaps may harm<br />

global growth.<br />

6. INDIA: GDP TO GROW AT A ROBUST 8.8% IN FISCAL 2012<br />

The Centre for Monitoring Indian Economy<br />

(CMIE) in its latest monthly review of the<br />

country’s economy projected India’s GDP<br />

to continue to grow at a brisk pace of 8.8%<br />

in <strong>2011</strong>-2012 (FY 2012). In FY <strong>2011</strong>, real<br />

GDP is estimated to have grown by 9%<br />

during the fiscal year.<br />

The domestic environment is conducive<br />

for growth and private final consumption<br />

expenditure is projected to grow by a<br />

How to reach us:<br />

local industries, such as textiles and<br />

textile products, footwear, electronics,<br />

furniture, toys, machinery, steel and<br />

cosmetics. Government figures show<br />

reduced production between 25 and<br />

60% while domestic sales, profit and<br />

manpower fell between 10% and 25%.<br />

Indonesia’s increased wariness has<br />

delayed a free-trade agreement<br />

22%. Thailand’s exports to emerging<br />

markets such as Russia, the group of<br />

the Commonwealth of Independent<br />

States, Africa and Latin America are<br />

also expected to significantly grow this<br />

year.<br />

Thailand foresees that other countries<br />

like United States, the EU and Japan<br />

would also contribute to the growth of<br />

Thai exports since the governments<br />

of these countries will inject huge<br />

revolving capital into their economies,<br />

enabling them to expand trade and<br />

healthy 7.5% and gross fixed capital<br />

formation by 14.6%.<br />

The agricultural and allied sector is<br />

projected to grow by 3.1%, on top of<br />

the 5.1% growth estimated in 2010-<br />

<strong>2011</strong>. The industrial sector, including<br />

construction, is projected to grow by<br />

9.4% during <strong>2011</strong>-12, as compared to<br />

8.5% estimated in 2010-<strong>2011</strong>.<br />

Activities in the construction sector are<br />

LETTERS TO THE EDITOR<br />

between ASEAN, Australia and New<br />

Zealand. The AANZFTA came into effect<br />

on Jan. 1, 2010, for Australia, New<br />

Zealand, Brunei, Myanmar, Malaysia,<br />

the Philippines, Singapore and Viet Nam.<br />

Thailand followed soon after, while Laos<br />

and Cambodia ratified the agreement in<br />

November. Indonesia is the only signatory<br />

that has yet to ratify the agreement.<br />

investment.<br />

Agriculture products is said to be the<br />

product that would reap benefits because<br />

of rising commodity prices. The products<br />

that will drive the country’s exports<br />

include rice and cassava. Exports of rice<br />

are expected to rise by 5% to 9.5 million<br />

tonnes with the average price projected<br />

to increase to US$600 per tonnes from<br />

US$578 in 2010. Cassava exports are<br />

expected to reach 6.9 million tonnes this<br />

year with a value of 70 billion baht (RM7<br />

billion).<br />

G-20 officials will work with the IMF<br />

to study the countries’ policies before<br />

informing leaders which ones are<br />

aggravating imbalances, and what<br />

measures can be taken to correct them.<br />

expected to be pushed-up as projects<br />

worth US$180 billion are scheduled to be<br />

commissioned in FY 2012, as compared<br />

to US$79 billion in FY <strong>2011</strong>. Growth in<br />

the services sector and its segments is<br />

projected to moderate marginally in <strong>2011</strong>-<br />

2012. The services sector is projected to<br />

expand by 9.9% during <strong>2011</strong>-2012, as<br />

compared to an estimated 10.2% in 2010-<br />

<strong>2011</strong>.<br />

Click the link below for any comments on articles in this issue. Letters may be edited for reasons of space<br />

and clarity. <strong>MITI</strong> <strong>Weekly</strong> <strong>Bulletin</strong> (MWB) reserves the right to edit and to republish letters as reprints.<br />

http://www.miti.gov.my/cms_matrix/form.jsp?formId=c1148fbf-c0a81573-3a2f3a2f-1380042c<br />

<strong>MITI</strong> <strong>Weekly</strong> <strong>Bulletin</strong> 07

Dear Readers,<br />

TENDER BIDS<br />

Title of tender<br />

3/<strong>2011</strong>(4)<br />

Country : Qatar<br />

IMPORT ENQUIRIES FROM INTERNATIONAL COMPANIES<br />

AGRICULTURAL PRODUCE<br />

GREENFISH INTERNATIONAL<br />

297 Kwangam-Dong<br />

Hanam-Si, Kyeonggi-Do<br />

Korea<br />

Tel : 82 2 4732 586<br />

Fax : 82 2 473 2774<br />

Email : gf-jin@hanmail.net<br />

Contact : Mr. Min Joo Jin<br />

President<br />

Product(s) : Shrimp<br />

W WING YIP & BROTHERS TRADING GROUP LTD<br />

375 Nechells Park Road<br />

Birmingham B7 5NT<br />

United Kingdom<br />

Tel : 44 121 327 6618<br />

Fax : 44 121 328 7890<br />

BUSINESS OPPORTUNITIES<br />

DETAILS<br />

: Bidding Information:<br />

Upcoming Infrastructure Contracts In Qatar: Invitation projects bidding by Qatar’s<br />

Public Works Authority (Ashghal) for 2 packages of projects.<br />

Closing Date : 23 May <strong>2011</strong> (Monday)<br />

YOUR FEEDBACK PLEASE!<br />

The <strong>MITI</strong> <strong>Weekly</strong> <strong>Bulletin</strong> (MWB) Secretariat is seeking your feedback for improving the <strong>Bulletin</strong>.<br />

Kindly click the link below:<br />

http://www.miti.gov.my/cms_matrix/form.jsp?formId=b50b9180-c0a81573-53d953d9-910af7e5<br />

(a) Lusail Expressway project<br />

(b) Expressway project besides the Lusail mixed-use development and Pearl Real-Estate<br />

Development<br />

Summary : Qatar’s Public Works Authority (Ashghal) has invited contractors to submit bids by 23 May<br />

<strong>2011</strong> for the first package of the estimated US$700 million Lusail Expressway project. The<br />

road will run from the Arch roundabout to the area surrounding the Ritz Carlton hotel in Doha.<br />

The first package will be 5.8km in length and will have about 16 lanes, some of which will be<br />

two or three levels. The expressway will also include three major interchanges, slip roads,<br />

underpasses and bicycle lanes. Construction work will take 36 months to complete.<br />

The second package, which has not yet been tendered will run besides the Lusail mixed-use<br />

development and the Pearl real-estate development. The expressway will be about 12km long.<br />

Qatar’s Public Works Authority (Ashghal) is to provide project management services for the<br />

Doha Expressway and other major road projects over the next five years. Ashghal is also<br />

planning to appoint another project management consultant for local and minor road projects<br />

management consultant for local and minor road projects.<br />

From <strong>2011</strong>-12, Ashghal plans to tender 13 road projects that total 344km in length. This<br />

programme will include the 15 km-long packages 11 of the Doha Expressway and the 107km<br />

New Orbital Highway. From 2012-14, Doha plans to build new roads totalling 136km in length.<br />

Further information could be obtained from the Qatar’s Public Works Authority (Ashghal)<br />

official website: http://www.ashghal.gov.qa/English/Pages/default.aspx<br />

Email : brian.yip@wingyip.com<br />

Website : www.wingyip.com<br />

Contact : Mr. Brian Yip<br />

Product(s) : Frozen Poultry & Meat<br />

BEVERAGES<br />

STRATEGIC CATERING CO. LTD<br />

102, 7th Floor, Soi Aree<br />

Sklongton, Klongtoey<br />

10110 Bangkok<br />

Thailand<br />

Tel : 662 <strong>26</strong>1 44016<br />

Fax : 662 <strong>26</strong>1 4407<br />

Email : somchai@strategiccatering.com<br />

Website : www.strategiccatering.com<br />

Contact : Mr. Somchai Chancharoensin<br />

Product(s) : Health Food Drink<br />

<strong>MITI</strong> <strong>Weekly</strong> <strong>Bulletin</strong> 08

IMPORT ENQUIRIES FROM INTERNATIONAL COMPANIES (CONT’D)<br />

WELLNESS ESTHER LTD PART<br />

235 Moo 10 E-san Tambol, Muangburiram<br />

31000 Buriram, Thailand<br />

Tel : 662 4469 0246<br />

Fax : 662 4469 0246<br />

Email : skk_2501@yahoo.com<br />

Website : www.wellnessesther.com<br />

Contact : Mr. Yai Kumklang<br />

Product(s) : Health Fruit Drink<br />

BUILDING CONSTRUCTION MATERIAL &<br />

HARDWARE<br />

RICHELIEU HARDWARE<br />

No. 2-800 Wilson Avenue Kitchener<br />

N2C 0A2, Ontario, Canada<br />

Tel : 519 578 3770<br />

Fax : 519 742 5683<br />

Email : jweiler@onwardhardware.com<br />

Website : www.onwardhardware.com<br />

Contact : Mr. Jim Weiler<br />

Products Manager<br />

Product(s) : Bolts, Nuts, Hinges and Nails<br />

TECHNO COMMERCE LTD<br />

12 Beechcrift 17 Street Georges<br />

Birmingham<br />

West Midlands B15 3TP<br />

United Kingdom<br />

Tel : 44 121 270 6583<br />

Email : m.hadge@techno-commerce.com<br />

Website : www.techno-commerce.com.<br />

Contact : Dr. Mel Hadge<br />

Product(s) : Wire & Cable<br />

ELECTRICAL & ELECTRONIC PARTS AND<br />

COMPONENTS<br />

SCHNEIDER (THAILAND) LTD<br />

44/1 Rungrojthanakul Building 15 Floor<br />

Ratchdapisek Road<br />

10320 Bangkok, Thailand<br />

Tel : 662 617 5500<br />

Fax : 662 617 5501<br />

Email : helpdesk@th.schneider-electric.com<br />

Website : www.schneider-electric.co.th<br />

Contact : Mr. John Adrien Giifish<br />

Product(s) : Wire & Cable<br />

Y. D. KIM INTL. INC<br />

7th Floor, Dongyung Building, 824-19, Yeoksam-Dang<br />

Gangnam-Gu, Seoul<br />

Korea<br />

Tel : 82 8 5565 067<br />

Fax : 82 2 5571 644<br />

Email : pk325@netsgo.com<br />

ydkim1990@hanmail.net<br />

Contact : Mr. HB Kim<br />

Product(s) : High Frequency Transformer &<br />

Inductor<br />

FASHION ACCESSORIES AND TEXTILES<br />

GNC CONTACTLENS<br />

1287-1, Beommul-Dong<br />

Susung-Gu, Daegu-Si<br />

Korea<br />

Tel : 82 53 782 3344<br />

Fax : 82 53 783 4949<br />

Email : kevin2865@naver.com<br />

Contact : Mr. Kevin Choi<br />

Product(s) : Contact Lens<br />

SAM HAENG TRADING COMPANY<br />

50-57, Namchang-Dong,<br />

Joong-Gu, Seoul<br />

Korea<br />

Tel : 82 53 757 5859<br />

Fax : 82 53 753 7605<br />

Email : eyewear1@kornet.net<br />

Contact : Mr. Nam Ki Kim<br />

Product(s) : Eyewear, Sunglasses<br />

FURNITURE<br />

SUNSET INTERNATIONAL TRADE<br />

297 Getty Avenue Paterson<br />

07503 New Jersey<br />

United States of America<br />

Tel : 973 357 1115<br />

Fax : 973 357 1771<br />

Email : mbilici@sunsetfurniture.us<br />

Website : www.sunsetfurniture.com<br />

Contact : Mr. Mehmet Bilici<br />

Product(s) : Living Room Furniture<br />

THE BED SHOP CARLISLE.COM<br />

Paton House 9 Victoria Viaduct<br />

Carlisle, Cumbria CA3 8AN<br />

United Kingdom<br />

Tel : 44 1228 558 855<br />

Fax : 44 1228 558 855<br />

Email : sales@thebedshopcarlisle.com<br />

Website : www.thebedshopcarlisle.com<br />

Contact : Mr. Louise O’brien<br />

Product(s) : Bedroom Furniture<br />

Dining Furniture<br />

Chair & Sofa<br />

HOUSEHOLD PRODUCTS<br />

APOLO UTENSILIOS PROFISSIONAIS<br />

Rua Bucuituba, 1566<br />

03276-010 Sao Paulo<br />

Brazil<br />

Tel : 55 11 2154 6057<br />

Email : apolo@apolo.pratarias.com.br<br />

Website : www.apolopratarias.com.br<br />

Contact : Mr. Rogerio C.<br />

Product(s) : Kitchenware<br />

INTERLINE BRANDS INC<br />

801 W Bay Street Jacksonville<br />

32204 Florida<br />

United States of America<br />

Tel : 904 421 1400<br />

Fax : 904 388 273<br />

Email : mallen@interlinebrands.com<br />

Website : www.interlinebrands.com<br />

Contact : Mr. Mark Allen<br />

Director of Global Sourcing<br />

Product(s) : Aerosol Spray<br />

<strong>MITI</strong> <strong>Weekly</strong> <strong>Bulletin</strong> 09

IMPORT ENQUIRIES FROM INTERNATIONAL COMPANIES (CONT’D)<br />

PREPARED FOOD<br />

SLADE GORTON & CO. INC<br />

One Centerpointe Drive Suite No. 445 La Palma<br />

California 90623<br />

United States of America<br />

Tel : 714 676 4200<br />

Fax : 714 676 4201<br />

Email : patty.monge@sladegorton.com<br />

Website : www.sladegorton.com<br />

Contact : Mr. Patte Monge<br />

Director<br />

Product(s) : Processed Shrimp<br />

DOING BUSINESS IN PHILIPPINES<br />

W WING YIP & BROTHERS TRADING GROUP LTD<br />

375 Nechells Park Road<br />

Birmingham B7 5NT<br />

United Kingdom<br />

Tel : 44 121 327 6618<br />

Fax : 44 121 328 7890<br />

Email : brian.yip@wingyip.com<br />

Website : www.wingyip.com<br />

Contact : Mr. Brian Yip<br />

Product(s) : Pasta, Noodles and Pancakes<br />

Sauces and Paste<br />

Spices and Condiments<br />

The Department of Trade and Industry, Philippines website contains relevant information with regards to doing<br />

business in the country: http://www.dti.gov.ph/splash.php<br />

For the Business Process Outsourcing industry, can be found at following weblinks:<br />

1. http://www.cict.gov.ph (Commission on Information and Communications Technology)<br />

2. www.bpap.com.ph (Business Processing Association of the Philippines)<br />

Investment Promotion Agencies (IPAs) providing various investment incentives can be visit at following weblinks:<br />

1. www.boi.gov.ph (Board of Investments of DTI)<br />

2. www.peza.gov.ph (Philippine Economic Zone Authority)<br />

3. www.sbma.gov.ph (Subic Bay Metropolitan Authority)<br />

4. www.clark.com.ph (Clark Development Corporation)<br />

MATRADE<br />

UPCOMING EVENTS<br />

EVENTS CONDUCTED IN ENGLISH<br />

TRADE FAIRS<br />

Event Name Event Description<br />

OFFSHORE EUROPE <strong>2011</strong><br />

Venue: Aberdeen Exhibition &<br />

Conference Centre<br />

Aberdeen,<br />

UNITED KINGDOM<br />

Date : 06 - 08 Sep <strong>2011</strong><br />

Closing Date : 02 May <strong>2011</strong><br />

The SPE Offshore Europe conference and<br />

exhibition attracts global audience ranging<br />

from engineers, technical specialists,<br />

industry leaders and experts. The event<br />

is held primarily to discuss various issues<br />

specifically in the upstream industry. SPE<br />

Offshore Europe is a multi-faceted event<br />

which reflects the E & P community’ s<br />

desire for continuous learning, showcasing<br />

the innovation, solutions and tools required<br />

to compete in an accelerating technology<br />

race in an increasingly complex business.<br />

Target<br />

Group<br />

Malaysian<br />

companies<br />

Contact<br />

Hamizah Zainun<br />

hamizah@matrade.gov.my<br />

<strong>MITI</strong> <strong>Weekly</strong> <strong>Bulletin</strong> 10

FINE FOOD AUSTRALIA<br />

Venue: Sydney Convention<br />

Exhibition Centre<br />

Sydney<br />

AUSTRALIA<br />

Date : 05 - 08 Sep <strong>2011</strong><br />

Closing Date : 05 May <strong>2011</strong><br />

MALAYSIA SOLO FAIR,<br />

PHNOM PENH, CAMBODIA<br />

Venue: Naga World Hotel<br />

Phnom Penh<br />

CAMBODIA<br />

Date : 13 - 15 Jul <strong>2011</strong><br />

Closing Date : 29 May <strong>2011</strong><br />

WHO’s NEXT <strong>2011</strong><br />

Venue: FRANCE<br />

Date : 03 - 06 Sep <strong>2011</strong><br />

Closing Date : 31 May <strong>2011</strong><br />

SPECIALISED MARKETING MISSIONS<br />

Mission Target Group Contact<br />

Specialised Marketing Mission on Construction Services and<br />

Building Materials to Erbil, Iraq (in conjunction with Project Iraq<br />

<strong>2011</strong>)<br />

City: Erbil<br />

Date : 19 - 22 Sep <strong>2011</strong><br />

Closing Date : 29 Jul <strong>2011</strong><br />

TRADE FAIRS (CONT’D)<br />

Fine Food Australia brings together buyers<br />

and decision makers from food, drink<br />

and equipment from around the world.<br />

Exhibitors have the unique opportunity<br />

to interact with thousands of retail and<br />

foodservice buyers face to face. It’s a<br />

proven way to generate new business.<br />

The solo exhibition organized by MATRADE<br />

is aimed at providing the participants an<br />

opportunity to interact with manufacturers,<br />

traders, importers, distributors and<br />

government officials. Your participation will<br />

expose your company to the requirements;<br />

the challenges, competition and most<br />

importantly the opportunities present in<br />

the Cambodian market and prepare your<br />

company for the full implementation of AFTA.<br />

The main areas of interests for Malaysian<br />

products would be in the construction<br />

material sectors, pharmaceuticals,<br />

personal care and toiletries’, construction<br />

machinery, automotive, household<br />

electrical and household products.<br />

This year will be MATRADE’s fourth<br />

participation in this fair. WHO’s NEXT<br />

Paris is a specialised international fashion<br />

trade show which is integrated in the<br />

‘Paris Capital of Creation’ programme.<br />

WHO’s NEXT has managed to strengthen<br />

its international linkages, featuring over<br />

50% international brands of total brands in<br />

the show. A mix of countries, colours and<br />

styles, the WHO’S NEXT fashion shows<br />

convey valuable information about fashion<br />

and are creativity vectors.<br />

Malaysian<br />

companies<br />

Malaysian<br />

companies<br />

Malaysian<br />

companies<br />

Malaysian<br />

companies<br />

Hamizah Zainun<br />

hamizah@matrade.gov.my<br />

Mohamed Hafiz Md Shariff<br />

mdhafiz@matrade.gov.my<br />

Haliza Mazlin Abdul Halim<br />

haliza.m@matrade.gov.my<br />

Adli Ishak<br />

adli@matrade.gov.my<br />

“Experts can prattle on about money and economic theory all they<br />

want, but let’s face it, we are the economy”<br />

Paul Clitheroe - Australian Financial Author<br />

MINISTRY OF INTERNATIONAL TRADE AND INDUSTRY<br />

Block 8 & 10, Government Office Complex, Jalan Duta, 50622 Kuala Lumpur, Malaysia<br />

Tel No: +603 6203 3022 Fax No: +603 6201 2573<br />

Email: webmiti@miti.gov.my Website: www.miti.gov.my<br />

<strong>MITI</strong> <strong>Weekly</strong> <strong>Bulletin</strong> 11