Stonegate Realtor Book

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A LOOK AT WHAT HIP CAN DO FOR YOU<br />

Let’s illustrate what HIP can do for a Listing Agent:<br />

• Increase sales prices, resulting in growth of sales commissions<br />

• Reduce overall days to sell (DOM)<br />

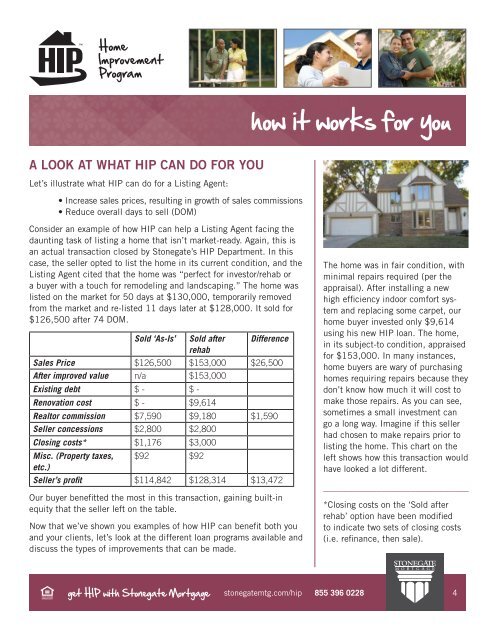

Consider an example of how HIP can help a Listing Agent facing the<br />

daunting task of listing a home that isn’t market-ready. Again, this is<br />

an actual transaction closed by <strong>Stonegate</strong>’s HIP Department. In this<br />

case, the seller opted to list the home in its current condition, and the<br />

Listing Agent cited that the home was “perfect for investor/rehab or<br />

a buyer with a touch for remodeling and landscaping.” The home was<br />

listed on the market for 50 days at $130,000, temporarily removed<br />

from the market and re-listed 11 days later at $128,000. It sold for<br />

$126,500 after 74 DOM.<br />

Sold ‘As-Is’ Sold after<br />

rehab<br />

Difference<br />

Sales Price $126,500 $153,000 $26,500<br />

After improved value n/a $153,000<br />

Existing debt $ - $ -<br />

Renovation cost $ - $9,614<br />

<strong>Realtor</strong> commission $7,590 $9,180 $1,590<br />

Seller concessions $2,800 $2,800<br />

Closing costs* $1,176 $3,000<br />

Misc. (Property taxes,<br />

etc.)<br />

$92 $92<br />

Seller’s profit $114,842 $128,314 $13,472<br />

Our buyer benefitted the most in this transaction, gaining built-in<br />

equity that the seller left on the table.<br />

Now that we’ve shown you examples of how HIP can benefit both you<br />

and your clients, let’s look at the different loan programs available and<br />

discuss the types of improvements that can be made.<br />

how it works for you<br />

The home was in fair condition, with<br />

minimal repairs required (per the<br />

appraisal). After installing a new<br />

high efficiency indoor comfort system<br />

and replacing some carpet, our<br />

home buyer invested only $9,614<br />

using his new HIP loan. The home,<br />

in its subject-to condition, appraised<br />

for $153,000. In many instances,<br />

home buyers are wary of purchasing<br />

homes requiring repairs because they<br />

don’t know how much it will cost to<br />

make those repairs. As you can see,<br />

sometimes a small investment can<br />

go a long way. Imagine if this seller<br />

had chosen to make repairs prior to<br />

listing the home. This chart on the<br />

left shows how this transaction would<br />

have looked a lot different.<br />

______________________________<br />

*Closing costs on the ‘Sold after<br />

rehab’ option have been modified<br />

to indicate two sets of closing costs<br />

(i.e. refinance, then sale).<br />

get HIP with <strong>Stonegate</strong> Mortgage stonegatemtg.com/hip 855 396 0228 4