Revised Minimum Wages Notification November 2012

Revised Minimum Wages Notification November 2012

Revised Minimum Wages Notification November 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

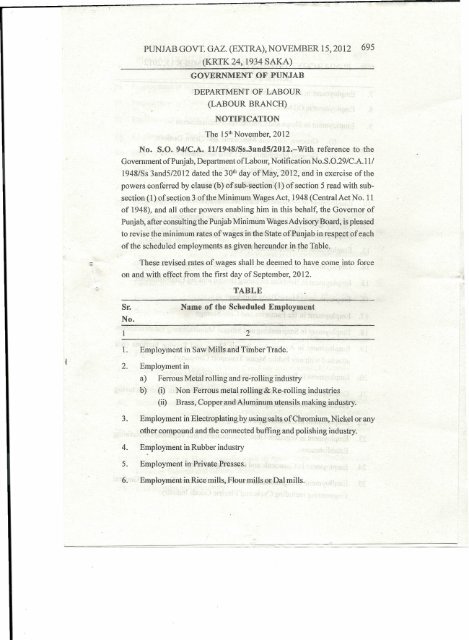

PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15,<strong>2012</strong> 695<br />

(KRTK 24, 1934 SAKA)<br />

GOVERNMENT OF PUNJAB<br />

DEPARTMENT OF LABOUR<br />

(LABOUR BRANCH)<br />

NOTIFICATION<br />

The 15 th <strong>November</strong>, <strong>2012</strong><br />

No. S.O. 94/C.A. 1111948/Ss.3and5/<strong>2012</strong>.-With reference to the<br />

Government of Punjab, Department of Labour, <strong>Notification</strong> No.S.O.29/C.A.1l/<br />

1948/Ss 3andS/20I2 dated the 30 th day of May, <strong>2012</strong>, and in exercise of the<br />

powers conferred by clause (b) of sub-section (1) of section 5 read with sub-<br />

section (1) of section 3 of the <strong>Minimum</strong> <strong>Wages</strong> Act, 1948 (Central Act No. 11<br />

of 1948), and all other powers enabling him in this behalf, the Governor of<br />

Punjab, after consulting the Punjab <strong>Minimum</strong> <strong>Wages</strong> Advisory Board, is pleased<br />

to revise the minimum rates of wages in the State of Punjab in respect of each<br />

of the scheduled employments as given hereunder in the Table.<br />

;;; These revised rates of wages shall be deemed to have come into force<br />

on and with effect from the first day of September, <strong>2012</strong>.<br />

~ TABLE<br />

Sr.<br />

No.<br />

Name of the Scheduled Employment<br />

1. Employment in Saw Mills and Timber Trade.<br />

2. Employment in<br />

a) Ferrous Metal rolling and re-rolling industry<br />

b) (i) Non Ferrous metal rolling & Re-rolling industries<br />

2<br />

(ii) Brass, Copper and Aluminum utensils making industry.<br />

3. Employment in Electroplating by using salts of Chromium, Nickel or any<br />

other compound and the connected buffing and polishing industry.<br />

4. Employment in Rubber industry<br />

5. Employment in Private Presses.<br />

6. Employment in Rice mills, Flour mills or Dal mills.

696 PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15, <strong>2012</strong><br />

(KRTK 24, 1934 SAKA)<br />

7. Employment in Ayurvedic and Unani-Pharmacies,<br />

8. Employment in Oil Mills.<br />

9. Employment in Shops and Commercial establishments i-<br />

(i)<br />

(ii)<br />

Grocers, Karyana Merchants and Grain Dealers. ,<br />

General Merchants and Cloth Merchants<br />

(iii) Commission Agents/ Bankers.<br />

(iv) Furniture Dealers or Manufacturers<br />

10. Employment in Foundries with or without attached Machine Shops.<br />

11. Employment in Cotton Ginning and Pressing Factories.<br />

12. Employment in Scientific Industry.<br />

13. Employment in Public Motor Transport Industry.<br />

14. Employment in Surgical and Clinical Instrument making Industries.<br />

, -<br />

15. Employment in Bakeries including Biscuit making Establishments.<br />

16. Employment in Motor-Body Builders<br />

17. Employment in Ice Factories and Cold Storage<br />

18. Employment in Soap making and Silicate Manufacturing Establishments<br />

19. Employment in Automobile Repair Shops and Service Stations (not<br />

attached with any Public Motor Transport Company).<br />

20. - Employment in Petroleum Supply Station Establishments.<br />

21. Employment in Milk Processing and Mill Products Manufacturing<br />

Establishments excluding Halwai Shops.<br />

22. Employment in Cement-Pipe making Industries.<br />

23. Employment in Vegetable Ghee Manufacturing and Vegetable Oil Refining<br />

Establishments.<br />

24. Employment in Chemicals and Distilling Industry<br />

25. Employment in Agricultural Implements Machine Tools and General<br />

Engineering including Cycle andElectric Goods Industry. _

PUNJAB GOVT. GAZ. (EXTRA),_NOVEMBER 15,<strong>2012</strong> 697<br />

(KRTK 24, 1934 SAKA)<br />

26. Employment in Textile Industries.<br />

27. Employment in Cinema Industry.<br />

28. Employment in Sports Goods Industry.<br />

29. Employment in Tanneries and Leather Manufacturers.<br />

30. Employment in Contractor's establishments of the Forest Department.<br />

31. Employment in Local Authority.<br />

32. Employment in Stone Breaking or Stone Crushing.<br />

33. Employment in Hotels, Restaurants, Tea Stalls & Halwaies.<br />

34. Employment in Ahatas attached to wine and Liquor Shops or Employment<br />

in Ahatas attached to Beverages Shops except Soft Drinks and<br />

Carbonated Water.<br />

35. Employment in Manufacture of Pulp Papers and Paper Board and Straw<br />

- Boards including News Print.<br />

36. . Employment in Starch Manufacturing.<br />

37. Employment in Dealers in Footwear and TravelGoods like Suitcases,<br />

Bags etc.<br />

38. Employment in Private Education Institutions.<br />

39. Employment in Manufacturing and Refining of Sugar (Vaccum Pan Sugar<br />

Factories).<br />

40. Employment in Dealers in Tent, Crockery and Household Goods.<br />

41. Employment in Brick-kiln Industry.<br />

42. Employment in Dealers dealing in Steel Trunks, Drums, Steel Safes,<br />

Vaults and Almirahs, Sanitary and Plumbing fixtures and fitting of metals.<br />

43. Employment in Private Hospitals, Clinics, Dispensaries, Nursing Homes<br />

and Medical Shops.<br />

44. Employment -in Hair Dressing such as those done by Barbers, Hair<br />

Dressing Saloons and Beauty Shops.<br />

45. Employment in Agriculture.

698 PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15,<strong>2012</strong><br />

(KRTK 24, 1934 SAKA)<br />

46. Employment in Dealers in Medicines and Chemicals. .<br />

47. Employment in Dealers in Photographic and Optical Goods.<br />

48. Employment in Tailors and Readymade Garments Manufacturers<br />

49. Employment in Forestry and Logging<br />

50. Employment in Dealers in Electrical and Electrical goods including Radio,<br />

Television, Gramophones, Public Address Equipments and Watch, Clock<br />

and Repair Shops.<br />

51. Employment in Dealers in Book Sellers, Stationers and Book Binders.<br />

52. Employment in Utensil Shops.<br />

53. Employment in Laundries, Services and Cleaning and Dyeing plants.<br />

54. Employment in Construction and Maintenance of Roads or Building<br />

Operations.<br />

55. Employment in Operation of Tube Wells Industry.<br />

56. Employment in Public Works Department (Public Health)<br />

57. Employment in Public Works Department (Irrigation Branch)<br />

58. Employment in Manufacturing Process as defined under Section 2 (k)<br />

of the Factories Act, 1948.<br />

59. Employment in Establishments as defined under Section 2(1) (viii) of the<br />

Punjab Shops and Commercial Establishments Act, 1958.<br />

60. Employment in Potteries, Ceramics and Refractory Industry.<br />

61. Employment in Government Offices or Boards or Corporations or Semi-<br />

Government Undertakings and Other Organization or Establishments<br />

for which the rates were earlier fixed by the respective Deputy<br />

Commissioners but not by the Appropriate Government under the<br />

<strong>Minimum</strong> <strong>Wages</strong> Act, 1948.<br />

62. Employment in Security Agencies.<br />

63. Employment in Sweeping and Cleaning, but excluding the activities<br />

prohibited under the Employment of Manual Scavengers and Construction<br />

of Dry Latrines (Prohibition) Act, 1993

z<br />

PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15,<strong>2012</strong> 699<br />

(KRTK 24, 1934 SAKA)<br />

64. Employment in house as a Domestic Worker.<br />

65. Employment in Toll Plaza Establishments.<br />

66. Employment in Malls and Shopping Complexes Establishments<br />

67. Employment in Wine and Liquor Shops Establishments.<br />

68. Employment in Ornament Making, Polishing, Repairing and" Selling<br />

Establishments.<br />

69. Employment in the Shops and Commercial Establishments situated outside<br />

the Municipal and Notified Area Committees limits.<br />

\<br />

70. Employment in Zoo and Places where Caring of Wild animals is done.<br />

71. Employment in Building and Other Construction Work Establishments<br />

as defined in clause (d) of sub-section (1) of section 2 of the Building<br />

and Other Construction Workers (Regulation of Employment and<br />

Conditions of Service) Act, 1996.<br />

MINIMUM WAGES FOR ALL EMPLOYMENTS EXCEPT<br />

EMPLOYMENT NO. 28, 29, 41, 45 AND 48 ARE GIVEN BELOW:-<br />

Sr. Categoriesof Ratesofminimumwagesw.e.f.1.9.<strong>2012</strong><br />

No. employees Monthly(Rs.)Daily(Rs.) Hourly(Rs.)<br />

(Roundedofftonext (Roundedofftonext<br />

highermultipleof 10 highermultipleof 10<br />

paise) paise)<br />

1. Unskilled 5200/- 200.00 25.00<br />

2. Semi-skilled 5980/- 230.00 28.80<br />

3. Skilled 6877/- 264.50 33.10<br />

4. Highlyskilled 7909/- 304.20 38.10<br />

5. Staff- CategoryA 10,370/- 398.90 49.90<br />

6. Staff-CategoryB 8700/- 334.70 41.90<br />

7. Staff-CategoryC 7200/- 277.00 34.70<br />

8. Staff- CategoryD 6000/- 230.80 28.90

700 PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15,<strong>2012</strong><br />

(KRTK24, 1934 SAKA)<br />

<strong>Minimum</strong> wages of Staff Categories from A to D as mentioned in<br />

the table above at serial numbers 5 to 8 shall be applicable only to<br />

scheduled employments under the government of Punjab, the local<br />

authority and the Boards, Corporations or any agency (by whatever<br />

name it is called) under the control of the government of Punjab in r<br />

respect of the staff employed through outsourcing or employed casually<br />

or on daily wages.<br />

Revision of rates for the Employment No. 28 i.e. Sports Goods Industry,<br />

Employment No. 29 i.e. Tanneries and Leather Manufactures and<br />

Employment No. 48 i.e. Tailoring units:- To calculate the Piece Rate<br />

<strong>Wages</strong> for these employments in semi-skilled category and skilled category,<br />

the rates fixed/revised vide notification no. S.O.2/C.A.ll / 1948/S.5/2009 dated<br />

06.01.2009 in respect ofthese employments, shall be multiplied with a multiplier<br />

of 1.6634 and 1.7503 respectively by rounding off to next higher multiple of<br />

ten paise; e.g.<br />

Semi Skilled<br />

for making of lappas I) Rs.14.04 x 1.6634 = Rs. 23.40 per dozen double.<br />

II) Rs. 7.50 x 1.6634 = Rs. 12.50 per dozen double<br />

The Un-Skilled employees who work with the same employer for ten years<br />

continuously shall be placed in the Semi-Skilled Category and for converting<br />

their wages into the Semi -Skilled Category multiplier of 1.15 shall be applied<br />

and rounded off to next higher multiple often paise.<br />

Skilled<br />

for stitching of half cup I) Rs.45.92 x 1.7503 = Rs. 80.40 per dozen.<br />

II) Rs.61.62 x 1.7503 = Rs. 107.90 per dozen<br />

for gents/ladies coat III) Rs:309.42 x 1.7503 = Rs.541.60<br />

for gents shirt IV) Rs.60.19 x 1.7503 = Rs. 105.40<br />

The Semi-Skilled employees who work with the same employer for five years<br />

continuously shall be placed in the Skilled Category and for converting their<br />

wages into the Skilled Category multiplier of 1.15 shall be applied and rounded<br />

offto next higher multiple often paise. '-

c<br />

·PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15,<strong>2012</strong> 701<br />

(KRTK 24, 1934 SAKA)<br />

These examples are illustrative and not exhaustive in nature.<br />

Rate of neutralization for the employment No. 28 Sports Goods<br />

I~dustry, employment No. 29 Tanneries and Leather Manufacturers<br />

and employment No. 48 Tailoring Units:-<br />

"<br />

The conversion factor of neutralization is 1.375 per point. Hence the rate of<br />

neutralization for piece rate categories for the above employments will be as<br />

under.-<br />

e.g. 1. for making of lappas Paise 2.80 x 1.375 = Paise 3.85<br />

2. for Pishori type frontier Paise 11.71 x 1.375 = Paise 16.10<br />

pattern chappal<br />

3. Jar gents shirt Rs.I0Alx 1.375 = Rs.14.31<br />

4. for petticoat Rs.1.76 x.1.375 = Rs.2.42<br />

These examples a~e illustrative and not exhaustive in nature.<br />

No.41 - BRICK KILN INDUSTRY<br />

Serial - Categories<br />

No.<br />

t 2<br />

L Pathera:<br />

Category 'A' Skilled<br />

(a) Moulding ofBricks-<br />

(b) Moulding of tiles<br />

\ -<br />

<strong>Minimum</strong> rates or wages<br />

3<br />

Piece rate wages rounded off to<br />

next higher multiple of ten paise<br />

(a) Rs. 434.70 per 10QObricks<br />

including Jamadari Commission<br />

(b) Rs. 492.80 per 1000 tiles moulded<br />

including Jamadari Commission<br />

OR<br />

(a) Rs. 404.60 per 1000 bricks moulded<br />

without Jamadari Commission<br />

(See note 1 below) .,.<br />

(b) Rs.465.40 per 1000 tiles moulded<br />

without Jamadari Commission.

702 PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15,<strong>2012</strong><br />

(KRTK 24, 1934 SAKA)<br />

2. Bharai Wala(loading of (a) Rs.164.20 per 1000 bricks loaded<br />

bricks into kiln) in kiln provided the distance from<br />

3. Chunai Wala (Placing of<br />

bricks into kiln vessel).<br />

4 Keri Wale<br />

5 (a) Mistry<br />

(b)Coalman<br />

(c) Jalaiwala (burning<br />

of bricks<br />

6 NikasiWala<br />

7. Jamadar (other than those<br />

employed on Commission<br />

basis)<br />

field to the kiln is tip to 400 meters.<br />

Beyond this distance, an additional<br />

wages of Rs.12.20 paise per 1000<br />

bricks for every additional 100<br />

meters or part thereof shall be paid.<br />

These rates will be applicable to the<br />

Donkeys/Khacher, loader, Rehri<br />

Jhota, Thela etc.(Animal driven).<br />

(b) Rs.139.30 loading by the tempo,<br />

truck etc. (Mechanical driven) or<br />

any other vehicles up to 1000<br />

meters. Beyond this distance an<br />

additional wages of Rs.8.70 for<br />

1000 bricks for every additional 400<br />

meters or part thereof shall be paid.<br />

(c) Rs.114.90 per 1000 bricks loaded<br />

or unloaded in trucks/ trolleys.<br />

Rs. 31.20 per 1000 bricks<br />

Rs.27.30 per 1000 bricks over which<br />

the keri is spread.<br />

Rs.82.10 per. 1000 bricks burnt by a<br />

batch offour persons.one ofthem being<br />

a mistry who will get Rs.44.40 per day<br />

more than the rest of batch (See note 2<br />

below)<br />

Rs.l 09.40 per 1000 bricks taken out of<br />

the kiln vessel.<br />

Rs.5200.00<br />

..

Note:-<br />

PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15, <strong>2012</strong> 703<br />

(KRTK 24, 1934 SAKA)<br />

1. Jamadar or Pathera as employed on monthly wages will not be entitled<br />

to Jamadari Commission either payable by the owner or the patheras ..<br />

2. After working out of the daily earning of the batch of 4 workers per day,<br />

the first eleven rupees and forty paise shall be given to the Mistry and<br />

the balance shall be equally divided amongst the four workers. The owner<br />

shall also provide free of cost utensils and fuel to the Mistry Incharge of<br />

the batch of 4 workmen at serial No.S or in lieu thereof shall pay him<br />

Rs.705.40 per month.<br />

Serial Categories <strong>Minimum</strong> rates or neutralization<br />

No.<br />

1 2 3<br />

l. Pathera (moulding of Bricks) Rs. 63.25 paise per 1000 bricks moulded<br />

per point.<br />

. 2. Bharai Wala (loading of Rs. 21.39 paise per 1000 bricks moulded<br />

into kiln) per point.<br />

3. Chunai Wala (placing of Rs. 5.72 paise per 1000 bricks placed<br />

bricks into kiln) in the kiln per point.<br />

4. Keri Wala Rs. 3.91 paise per 1000 bricks per point. .<br />

5. (a) Coalman Rs. 10.47 paise per 1000 bricks burnt by<br />

(b) Jalai Wala (burning batch offour persons including Mistry<br />

of Bricks) per point.<br />

6. Nikasi Wala Rs. 10.47 paise per 1000 bricks taken<br />

No. 45 - AGRICULTURE<br />

Sr. Category<br />

No.<br />

out of the kiln vessel per point.<br />

<strong>Minimum</strong> rates of wages per<br />

mensem rounded off to next higher<br />

multiple of ten paise<br />

1 2 3<br />

1. Attached Labour<br />

(whole time servant)<br />

Rs.39945.80 consolidated per annum<br />

with meals or food grains equivalent<br />

thereof.

704 PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15,2011<br />

(KRTK 24, 1934 SAKA)<br />

2. Ploughing Embanking, Rs.210.00 per day without meals or<br />

Sowing and Manuring Rs.184.80 per day with meals<br />

3. Transplanting of Rice :<br />

(a) Japanese method. Rs.273.30 per Kanal with meals.<br />

(b) Traditional method Rs.114.80.per Kanal with meals<br />

4. Weeding Rs:210.00 per day without meals<br />

OR<br />

Rs.184~80 per day with meals.<br />

5 Irrigation Rs.21 0.00 per day without meals<br />

OR<br />

Rs.184.80 per day with meals.<br />

6. Harvesting of Wheat One bhari per day or 1I2Oth of<br />

harvested wheat or cash equivalent<br />

thereof.<br />

7. Thrashing of Wheat . Rs.263.90 per day without meals.<br />

OR·<br />

Rs.219AO per day with meals.<br />

8. Winnowing including 1/20 of winnowed grains.<br />

carriage of grains and<br />

stocking ofbhusa<br />

9. Jhoka (for stocker employed 1.25 kg gur per 40 kg. of gur produced.<br />

on Gur making)<br />

10. Picking of Cotton. 1/16th of the Kapas picked<br />

OR<br />

Rs. 5.70 per kg.<br />

11. Picking of chillies. 1/10th of the chillies picked.<br />

12. Thrashing of Paddy 8 kg per quintal of paddy thrashed.

PUNJAB GOVT. GAZ. ~EXTRA), NOVEMBERI5, <strong>2012</strong> 705<br />

13." Harvesting of groundnut or<br />

any other crop other than<br />

wheat.<br />

(KRTK 24, 1934 SAKA)<br />

Rs.21 0.00 per day without meals.<br />

OR<br />

Rs. 184.80 per day with meals.<br />

14: 'Other Operation Rs.210.00 per day without meals<br />

(a) Semi Skilled<br />

OR<br />

Rs. 184.80 per day with meals.<br />

The Un-Skilled employees who work with the same employer for ten<br />

years continuously shall be placed in the Semi-Skilled Category and for<br />

converting their wages into the Sem i-Skilled Category multiplier of 1.15<br />

shall be applied.<br />

(b) Skilled<br />

The Semi-Skilled employees who work with the same employer for five<br />

years continuously shall be placed in the Skilled Category and for<br />

converting their wages into the Skilled Category multiplier of 1.15 shall<br />

be applied.<br />

Note:- l.A.-The hourly wages and overtime wages shall be paid as laid down<br />

NOTES:<br />

in the <strong>Minimum</strong> <strong>Wages</strong> Act, 1948 and the Rules framed thereunder.<br />

1. Definition of Classification of Workers<br />

(a) Unskilled "Unskilled" work is one, which involves simple operation<br />

requiring little or no skill on the job.<br />

Some of the commonly used designations in various<br />

sch~dul~d e.mployments are as under:<br />

Gate Keeper; Peon, Chowkidar, Sweeper (without<br />

machine or electric gadget), Rickshaw Puller, Poster<br />

" Paster, Board Boy, Gardener, Rehriwala, Labourer, under<br />

Matriculate peon, helper, waterman, Oil man, Beldar,<br />

Masalchi, Kneader; Guide, Pantry man, Hawker,

706 PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15, <strong>2012</strong><br />

(KRTK 24, 1934 SAKA)<br />

Lab boy, Mazdoor, Loader- Unloader, Ward boy,<br />

Operation Theater Helper, Lady Ward Attendant,<br />

Laundry man.<br />

These designations are illustrative and not<br />

exhaustive in nature.<br />

(b) Semi-skilled "Semi-Skilled Work" is one which involves some degree<br />

of skill or competence acquired through experience<br />

on the job and which is capable of being performed<br />

under the supervision or guidance of a skilled employee<br />

and includes unskilled supervisory work.<br />

OR<br />

A person having a certificate course or equivalent<br />

diploma in that particular trade from an ITI. A trainee<br />

or an apprentice who has completed his training under<br />

the Apprenticeship Act, 1961 will also be considered as<br />

a Semi-skilled worker.<br />

OR<br />

Un-Skilled employees who work with the same employer<br />

for ten years continuously shall be placed in the Semi-<br />

Skilled Category.<br />

Some of the commonly used designations of Semi Skilled<br />

employees in various scheduled employments are as<br />

under:<br />

Sweeper who has experience of two years or those<br />

sweepers who use electrical machine like vacuum<br />

cleaner etc. Kinariwala, Assistant Machine man,<br />

Assistant Mistry, Assistant Electrician, Assistant Welder,<br />

Assistant Fitter, Junior Operator, Assistant Moulder,<br />

Boiler Attendant, Assistant Bearer, Assistant Halwai,<br />

Book Binder, Book Stitcher, Brusher, Washer, Assistant<br />

Wireman, Shaver, Buffer, Assistant Mixer Man, Weaver,

I·<br />

PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15, <strong>2012</strong> 707<br />

(KRTK 24, 1934 SAKA)<br />

Assistant Achar Murabba Maker, E.C.G./E.E.G./X-ray<br />

Attendant etc.<br />

These designations are illustrative and not<br />

exhaustive in nature.<br />

(c) Skilled "Skilled Work" means work which involves skill or<br />

competence acquired through experience on the job or<br />

through training as an apprentice in a technical or<br />

vocational institute.<br />

OR<br />

A person who has a diploma of three years from any<br />

Polytechnic College in a particular trade shall be treated<br />

as a Skilled worker and it also includes a trained security<br />

guard, light vehicle driver and a conductor as defined in<br />

Motor Vehicle Act, 1988.<br />

OR<br />

Semi-skilled employees who work with the same<br />

employer for five years continuously shall be placed in<br />

the Skilled Category.<br />

Some of the commonly used designations of skilled<br />

employees in various scheduled employments are as<br />

under:<br />

Security Guard (Persons who have obtained training<br />

under Rule 5 (1) of the Punjab Private Security Agencies<br />

(Regulation) Rules, 2007, Sewerman, Concrete and<br />

Mixer, Daffedar, Head Mali, Head Survey Khalasi, Tar<br />

Sprayer, Bajri Spreader, Boiler Man, Hammer Man,<br />

Jumper Man, Hobee Driver, Thatcher, Boatman, Glass<br />

Blower, Grinding Man, Mason, Electroplater, Electrician,<br />

Pump Attendant, Welder, Wireman, Turner, Gratuation<br />

Man, Candy Plant Operator, Refrigeration Mechanic,<br />

Moulder, Machine man, Engineer (Diploma Holder),<br />

Chief Chemist, Rigger, Spinning Master, Black Smith,

708 PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15,<strong>2012</strong><br />

(KRTK 24, 1934 SAKA)<br />

Carpenter, Camera Man, Die Maker, Video Film Maker,<br />

Photographer, Auxiliary Nurse-cum-Midwife(ANM),<br />

Assistant Dispenser, Junior Radiographer, Floor Washer,<br />

White Washer, Painter, Polish man, Buffing man, Cutter,<br />

Tailor, Artist, Lathe man, Design cutter, Clerk, Time,<br />

Keeper, Salesman, Office Assistant, Storekeeper,<br />

Accountant, Steno-typist, Data Entry Operator,<br />

Computer Operator.<br />

These designations are illustrative and not<br />

exhaustive in nature.<br />

(d) Highly skilled "Highly Skilled Work" means a work which calls for a<br />

degree of perfection and full competence in the<br />

performance of certain tasks including clerical work<br />

acquired through intensive technical or professional<br />

training or practical work experience for certain<br />

reasonable. period and also requires of an worker to<br />

assume full responsibility for the judgement or decision<br />

involved in the execution of these tasks.<br />

OR<br />

A person who has been duly declared a graduate in<br />

Engineering or in any other special or other professional<br />

trade from a Govt. recognized institution, Board or<br />

University.<br />

Some of the commonly used designations of Highly<br />

skilled employees in various scheduled employments are<br />

asunder:<br />

Security Su-pervisor (who has obtained training as per<br />

syllabus approved by Department of Technical Education<br />

and Industrial Training vide their letter dated 6.8.2009),<br />

Graduate in any discipline or an under graduate with<br />

Diploma/Certificate Course in Stenography or Diploma<br />

in Computer Applications/Accountancy or Supervisory<br />

Staff who have to take independent decisions, Graduate

PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15,<strong>2012</strong> 709<br />

(e) Staff Category A<br />

(KRTK 24, 1934"SAKA)<br />

Clerk, Sweeping machine operator or sewerman with<br />

two years experience; heavy vehicle drivers i.e. truck,<br />

tempo, tractor, bus, bulldozer, Crane operator, road<br />

rollers and. Harvester combine Operator, Loco shunt<br />

operator, Dozer operator, JCB operators, Radiographer,<br />

Assistant Opthamalic Technician, Audiology Technician,<br />

X-ray/E.C.G./E.E.G., Pharmacist, Lady Health Visitor,<br />

Nursing Superintendent, Staff Nurse, Dietician, Medical<br />

Social Worker, Demonstrator, Deputy Chief Pharmacist,<br />

House Surgeon, Radiology Superintendent, Brick Layer,<br />

Stone Chistler, Water Pump Driver, Diesel/ Electric<br />

Mixer Driver, Plumber, Well Sinker, Plasterer etc.<br />

A person having a Post Graduation Degree/MBA/<br />

Marketing/Finance/Human Resources Development and<br />

or Company Secretary or equivalent or any professional<br />

degree.<br />

Category B<br />

Graduate in any discipline or an under Graduate with<br />

Diploma/Certificate Course in Stenography or Diploma<br />

in Computer Applications/Accountancy or supervisory<br />

staff who have to take independent decisions.<br />

Category C<br />

A person who is above matriculate but not graduate<br />

or undergraduate with certificate of Steno typist!<br />

Computer Application/Data Entry Operator or<br />

Accountancy. It includes timekeeper, salesman,<br />

Assistant and storekeeper.<br />

Category D<br />

Any Class-Tv employee (casual, through contractor or<br />

on contract basis who is matriculate.

710 PUNJAB GOVT. GAZ. (EXTRA),NOVEMBER 15,<strong>2012</strong><br />

(KRTK 24, 1934 SAKA)<br />

2. The above minimum rates of wages are linked with Consumer Price<br />

Index Numbers (State Series 1987 = 100) with average Consumer Price<br />

Index Numbers of all centres of the last six months being 658 ending<br />

August, <strong>2012</strong> as the base. Neutralization will be provided at the rate of<br />

Rs.8.25 per point in the case of monthly rated employees, 32 paise per<br />

point in case of daily rated employees and 4.00 paise per point in case of<br />

hourly rated employees on the rise or fall of the Consumer Price Index<br />

Number (Punjab Series). Adjustment of wages will be made after an<br />

interval of six months, i.e. on 1st March and 1st September of every<br />

year taking the average of Consumer Price Index Numbers of all the<br />

centres for the last six months from the aforesaid dates for which<br />

Consumer Price Index Numbers are compiled by the Punjab Government.<br />

Firstadjustment to be made with effect from Ist March, 2013.<br />

3. The minimum wages fixed/revised shall be the basic rates of wages.<br />

4. In case of employees employed in employments at Sr.No.33, 34 and 64,<br />

if they are provided twomeals, two times tea and lodging, they will get<br />

Rs. 1765/-1ess than the minimum wages fixed for their categories and if<br />

they get two meals and two times tea without lodging they will get<br />

Rs. 500/-less than other employees in their category who are not getting<br />

meals, tea and lodging.<br />

5. Any increase or decrease in the minimum wages due to fall and rise in<br />

.the cost of living index number shall be known as Variable Dearness<br />

Allowance (VDA) which will be merged in the basic rate of wages on<br />

the 1st day of March and September in such a way that the total minimum<br />

wage remains rounded off to next higher multiple often paise.<br />

6. No employer is permitted to bifurcate the minimum wage fixed by the<br />

Government of Punjab.<br />

7. There will be no difference between wages for men and women<br />

employees and amongst adult, adolescent, disabled and child employees.<br />

8. The minimum rates of wages shall not fall below the notified level even<br />

if the Consumer Price Index Number falls below the level pertaining to<br />

the base period.

PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15,<strong>2012</strong> 711<br />

(KRTK 24, 1934 SAKA)<br />

9. The revised wages are for working on normal working days i.e. 8 hours<br />

working for an adult and four and half hours working for a child where<br />

permitted to work under the provisions of Child Labour (Prohibition and<br />

Regulation) Act 1986. Hourly wage shall be calculated by dividing the<br />

daily normal working day wage (or Daily wage) by working hours of an<br />

adult or a child.<br />

10. Classification or categories of employees shall be as specified or defined<br />

in clause-I of the above Notes. Similar nature of work shall fall in a<br />

particular classification or category. In case of any difference of opinion<br />

about the category or classification of an employee, the decision of the<br />

Authority appointed under Section 20(1) of the <strong>Minimum</strong> <strong>Wages</strong> Act,<br />

1948 shall be final.<br />

11. If due to new definition of categories" an employee who was earlier<br />

placed in a higher category but now falls in a lower category, the employee<br />

will continue to get the wages of his earlier category and in no case the<br />

':- wages of such employee can be reduced, e.g. a person who was earlier<br />

placed in a skilled category but due to new definition of skilled worker<br />

given in clause-I, he comes in the semi skilled category, he will continue<br />

to get the minimum wages fixed for the skilled category. However, if a<br />

worker who was earlier placed in a lower category but due to new<br />

definition of categories, comes in the higher category, he shall get the<br />

minimum wages for that higher category.<br />

12. If an employee employed in any scheduled employment is not specifically<br />

mentioned by the name of its trade or job under any of the categories/<br />

classes in this notification or in earlier notifications fixing or revising<br />

minimum rate of wages, even then such employee shall be paid minimum<br />

wages of the category of the class where he can be most accurately<br />

placed. In case of disagreement about a category or classification of an<br />

employee, the decision of the Authority appointed under Section 20( 1) of<br />

the <strong>Minimum</strong> <strong>Wages</strong> Act, 1948 shall be final.<br />

13. In-case any new employment in the schedule is added by the State<br />

Government by issuing notification under Section 27 of the <strong>Minimum</strong><br />

<strong>Wages</strong> Act, 1948, the minimum wages fixed/revised by the Government<br />

from time to time shall also be applicable on those employments.

712 PuNJAB GOVT. GAZ.(EXTRA), NOVEMBER 15,<strong>2012</strong><br />

(KRTK 24, 1934 SAKA) ,<br />

14. The daily minimum wage has been calculated after dividing the monthly<br />

minimum wage of that category by 26. In case dueto absence of an<br />

employee, wages for a day are to be deducted from the salary of an<br />

employee, the daily wage shall be calculated by dividing the monthly<br />

wage of that category by 30. The minimum daily rates of wages of ,<br />

employee,S include the wages of weekly! substituted rest day,<br />

15. <strong>Wages</strong> for apprentice are to be regulated under theApprentice Act, 1961<br />

(No.520f1961)<br />

16. Trainee/learner can be paid 75% of the wage of the category for which<br />

he is being given training or minimum wages for the unskilled worker<br />

which ever is more only for six months or for the period of histraining<br />

'which ever is less but thereafter he will be given wage of his category in<br />

which he/she is1was given training. No employer is permitted to engage<br />

an unskilled employee as a trainee/learner. The unskilled employee will<br />

be paid wage of his category.<br />

17. The revised rates of minimum wages are also applicable to employees<br />

employed by the contractors or through outsourcing arrangements. The<br />

. occupier/manager of a factory under the Factories Act, 1~~8, the principal<br />

employer under the Contract Labour, (Regulation and Abolition).Act,<br />

1970 or the employer of the Scheduled employment will be responsible<br />

to ensure the payment of minimum rates of wages to the contract<br />

labourers.<br />

18. <strong>Minimum</strong> wages fixed by the Government will not be applicable to the<br />

. establishments which are already paying higher than the wages fixed by<br />

the Government. However, the employer will be liable to pay the minimum<br />

wages as and when wages paid by him fall short of the minimum-wages<br />

so fixed by the Government.<br />

~- .. - -<br />

19. An employer may link the above revised minimum wage tothe production<br />

but in no case the wage of an average employee shall fall below the<br />

existing minimum wage in their category. Where such production-linked<br />

wages are introduced, to provide work, raw materials and power would<br />

be the responsibility of that employer.

PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15,<strong>2012</strong> 713<br />

(KRTK 24, 1934 SAKA)<br />

20. In case any establishment belonging to the State of Punjab has any<br />

branch in any other State or Union Territory, the employees working in<br />

. those branches shall be paid the minimum rates of wagesfixed by that<br />

State/Union Territory for their category or minimum rates fixed by the<br />

State of Punjab for that category whichever is higher. This will be<br />

applicable only on Government Undertakings, Boards, Corporations etc.<br />

where workers are employed on casual basis or on contract or through<br />

contractor or through service provider or outsourcing agency.<br />

21. In case of piece rated employees, the wage for the weekly/substituted<br />

rest day shall be the average daily wage earned during the previous<br />

month.<br />

22. The revised daily rate of an employee is inclusive of the wage for his<br />

weekly/substituted rest day.<br />

23. The revised minimum wages are not a bar to employer in giving higher<br />

wages than those fixed by this notification, keeping in view the skill and<br />

experience of an employee.<br />

24. An employee who works for one hour or more in a day on ajob which<br />

involves high degree of risk like underground work in bore-wells, tunnels,<br />

sewerage pipes etc., works at a height of 30 feet or above from the<br />

ground level or work in zoo and places where caring of wild animals is<br />

done, shall be paid 25% higher wages of their respective category for<br />

that day. In case of a dispute whether a particular work involves high<br />

degree of risk or not, the same shall be decided by the Authority<br />

appointment under Section 20(1 ) of the <strong>Minimum</strong> <strong>Wages</strong> Act, 1948 whose<br />

decision shall be final.<br />

ONLY FOR SUGAR INDUSTRY IN ADDITION TO ABOVE<br />

25. The employees of this employment shall be paid wages as per the<br />

recommendations of the Sugar <strong>Wages</strong> Board or as fixed under the<br />

<strong>Minimum</strong> <strong>Wages</strong> Act, 1948, whichever is higher.

714 PUNJAB GOVT. GAZ. (EXTRA), NOVEMBER 15,<strong>2012</strong><br />

(KRTK24, 1934 SAKA)<br />

26. The employments, which are not covered under the recommendations<br />

of the Sugar <strong>Wages</strong> Board, shall be paid such wages, as are fixed<br />

under the <strong>Minimum</strong> <strong>Wages</strong> Act, 1948.<br />

0087111-<strong>2012</strong>IPb. Govt. Press, S.A.S. Nagar<br />

R.C. NAYYAR,<br />

Principal Secretary to Government of Punjab,<br />

Department of Labour.