ING Secured Income Insurance RP - ING Vysya Life Insurance

ING Secured Income Insurance RP - ING Vysya Life Insurance

ING Secured Income Insurance RP - ING Vysya Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Page 1<br />

<strong>ING</strong> <strong>Secured</strong> <strong>Income</strong> <strong>Insurance</strong> <strong>RP</strong><br />

General:<br />

This illustration has been prepared by <strong>ING</strong> <strong>Vysya</strong> <strong>Life</strong> <strong>Insurance</strong> Company Limited. It does not purport to be a contract of insurance<br />

and does not in any way create any rights or obligations.<br />

The Plan:<br />

<strong>ING</strong> <strong>Secured</strong> <strong>Income</strong> <strong>Insurance</strong> <strong>RP</strong> is your ideal savings tool for long term financial goals. In addition to ensuring systematic savings<br />

it also ensures financial protection for your family in case of any unfortunate and unforeseeable event. This plan is a non linked<br />

participating life insurance product of the company. The policyholder opts for the Sum Assured and Policy Term. The company may<br />

declare bonuses, which get added to the sum assured and are paid at death of the life assured or maturity of the policy.<br />

This product is available in 2 options ‘Base’ and ‘Economy’. The differences between Base Option and Economy Option are detailed<br />

in Section ‘Economy Option’ later in this document.<br />

The plan provides various benefits described later in this document.<br />

Plan Benefits:<br />

1. Death Benefit:<br />

This plan ensures that in case of death of the life assured, the family not just gets the Sum Assured but also gets an assured income<br />

for next 5 years equal to 120% of Sum Assured (which is payable on a monthly basis). Thus, the death benefit is Sum Assured +<br />

Family <strong>Income</strong> Benefit + Vested Bonus, if any + Terminal Bonus, if any.<br />

Family <strong>Income</strong> Benefit: On the unfortunate event of death of the life assured, if the <strong>Life</strong> Assured has completed 18 years of age<br />

as on the date of death, <strong>ING</strong> <strong>Life</strong> will pay 2% of Sum Assured every month for the 5 years following the death of the life assured.<br />

This means a total payout of 120% of Sum Assured (2% for 60 months). This comes in addition to the Sum Assured, Vested Bonus,<br />

if any, and Terminal Bonus, if any, that are paid in lump sum on death. The first installment of Family <strong>Income</strong> Benefit will be paid<br />

immediately on death.<br />

In case of death of the life assured at age less than 18 years, instead of a monthly income, the Family <strong>Income</strong> Benefit will be payable<br />

in lump sum and the amount would be equal to 100% of the Sum Assured.<br />

Family <strong>Income</strong> Benefit is available only with Base option.<br />

2. Maturity Benefit:<br />

At the maturity of the policy, <strong>ING</strong> <strong>Life</strong> will pay the Sum Assured, plus Vested Bonus, if any, plus Terminal Bonus, if any.<br />

3. Bonus:<br />

Bonuses represent your share in the profits of company’s participating fund. Bonus is calculated on the Sum Assured in the<br />

policy. Bonuses are therefore not guaranteed and are based on fund’s performance. <strong>ING</strong> <strong>Secured</strong> <strong>Income</strong> <strong>Insurance</strong> <strong>RP</strong> provides<br />

two kinds of bonuses:<br />

• Simple Reversionary Bonus: <strong>ING</strong> <strong>Life</strong> may declare bonus on a yearly basis as a percentage of Sum Assured, which will be<br />

attached to your policy and will be paid at death or maturity of the policy, whichever is earlier.<br />

• Terminal Bonus: <strong>ING</strong> <strong>Life</strong> may also declare a Terminal Bonus from 10th policy year and is payable at maturity of policy or<br />

death of the <strong>Life</strong> assured.

Page 2<br />

<strong>ING</strong> <strong>Secured</strong> <strong>Income</strong> <strong>Insurance</strong> <strong>RP</strong><br />

Surrender:<br />

If at least three full years premiums have been paid, and after three policy years have been completed, this policy may be surrendered<br />

for a Special Surrender Value, which is determined by the company from time to time.<br />

The amount payable on surrender is higher of the Special Surrender Value or the Guaranteed Surrender Value, after deduction of<br />

any loans under the Policy. Guaranteed Surrender Value will be calculated as:<br />

For Base Option:<br />

Before payment of full five years premium: 30% of the total premiums paid up to the date of surrender excluding first year<br />

premium, extra premiums and rider premiums, if any.<br />

After payment of full five years premium: 50% of the total premiums paid up to the date of surrender excluding first year<br />

premium, extra premiums and rider premiums, if any.<br />

For Economy Option:<br />

30% of the total premiums paid up to the date of surrender excluding first year premium, extra premiums and rider premiums, if any.<br />

All benefits under the policy shall automatically terminate upon payment of Special Surrender Value.<br />

Taxation:<br />

The illustration table mentioned later in this document, ignores the impact of the provisions of the <strong>Income</strong> Tax Act 1961 (‘Act’).<br />

This plan may entitle you to certain tax benefits on your premiums as well as on your maturity value.<br />

U/s 80C of the <strong>Income</strong> Tax Act 1961 on your premiums<br />

U/s 10(10D) of the <strong>Income</strong> Tax Act 1961 on your maturity proceeds of the policy*<br />

*Please note that tax benefits are subject to changes in Tax Laws and we would urge you to consult your tax advisor for specific tax<br />

related advice before you invest in this policy. Service Tax and Education Cess as applicable from time to time will be additionally<br />

levied.<br />

Economy Option:<br />

While <strong>ING</strong> <strong>Secured</strong> <strong>Income</strong> <strong>Insurance</strong> <strong>RP</strong> offers you a host of benefits, but for someone looking for a basic savings plan can go for<br />

the Economy Option. The Economy Option offers only basic protection and savings feature as set out in this table:<br />

Death Benefit<br />

Sum Assured, plus Vested Bonus, if any, plus Terminal Bonus, if any.<br />

Family <strong>Income</strong> Benefit is not payable under the Economy Option.<br />

Maturity Benefit Sum Assured, plus Vested Bonus, if any, plus Terminal Bonus, if any.<br />

Bonus Simple Reversionary Bonus and Terminal Bonus.<br />

Guaranteed Surrender<br />

Value<br />

Tax Benefits Available<br />

The Guaranteed Surrender Value throughout the plan will remain at 30% of the total<br />

premiums paid excluding first year's premium, extra premiums and rider premiums, if any.

Page 3<br />

<strong>ING</strong> <strong>Secured</strong> <strong>Income</strong> <strong>Insurance</strong> <strong>RP</strong><br />

Statutory Warning: Some benefits are guaranteed and some benefits are variable with returns based on the future performance<br />

of your insurer carrying on life insurance business. If your policy offers guaranteed returns, then these will be clearly marked<br />

“guaranteed” in the illustration table on this page. If your policy offers variable returns, then the illustrations on this page will show<br />

two different rates of assumed future investment returns. These assumed rates of returns are not guaranteed and they are not the<br />

upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future<br />

investment performance.<br />

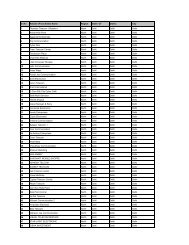

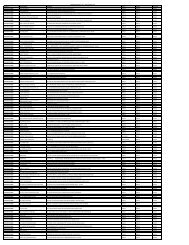

The below illustration is for base option:<br />

Policy Name <strong>ING</strong> <strong>Secured</strong> <strong>Income</strong> <strong>Insurance</strong> <strong>RP</strong> Sum Assured ` 3,11,207<br />

Name of the Proposer Mr. XYZ Premium Payment Mode Annual<br />

Age of the <strong>Life</strong> Insured 35 Years Policy Term 20 Years<br />

Annualized Premium ` 20,000 Premium Paying Term 20 Years<br />

Age Policy<br />

year<br />

Annual<br />

Premium<br />

(`)<br />

Guaranteed<br />

Sum Assured<br />

(`)<br />

Non Guaranteed Accrued<br />

Simple Reversionary<br />

Bonus @ 6%<br />

(`)<br />

Non Guaranteed Accrued<br />

Simple Reversionary<br />

Bonus @ 10%<br />

(`)<br />

Non Guaranteed<br />

Terminal<br />

Bonus @ 6%<br />

(`)<br />

Non Guaranteed<br />

Terminal<br />

Bonus @ 10%<br />

(`)<br />

35 1 20,000 3,11,207 10,114 23,341<br />

36 2 20,000 3,11,207 20,228 46,681<br />

37 3 20,000 3,11,207 30,343 70,022<br />

38 4 20,000 3,11,207 40,457 93,362<br />

39 5 20,000 3,11,207 50,571 1,16,703<br />

40 6 20,000 3,11,207 60,685 1,40,043<br />

41 7 20,000 3,11,207 70,800 1,63,384<br />

42 8 20,000 3,11,207 80,914 1,86,724<br />

43 9 20,000 3,11,207 91,028 2,10,065<br />

44 10 20,000 3,11,207 1,01,142 2,33,405<br />

45 11 20,000 3,11,207 1,11,256 2,56,746<br />

46 12 20,000 3,11,207 1,21,371 2,80,086<br />

47 13 20,000 3,11,207 1,31,485 3,03,427<br />

48 14 20,000 3,11,207 1,41,599 3,26,767<br />

49 15 20,000 3,11,207 1,51,713 3,50,108<br />

50 16 20,000 3,11,207 1,61,828 3,73,448<br />

51 17 20,000 3,11,207 1,71,942 3,96,789<br />

52 18 20,000 3,11,207 1,82,056 4,20,129<br />

53 19 20,000 3,11,207 1,92,170 4,43,470<br />

54 20 20,000 3,11,207 2,02,284 4,66,810 39,212 47,926<br />

Note:<br />

1. The illustration above explains the benefits and features of the proposed policy and is not a contract or representation of any<br />

guarantee or warranty.<br />

2. The name of the product does not in any way indicate the quality of the product, its future prospects or returns.<br />

3. Service Tax and Education Cess are levied on the premiums as per applicable tax laws and the same is subject to changes in the<br />

tax laws in future.<br />

4. The Death, Surrender and Maturity Benefits mentioned under the guaranteed column are guaranteed subject to the<br />

policy terms and conditions and that all premiums being paid on time and bonuses are not guaranteed and depend on<br />

fund’s performance.<br />

5. Rider Premiums are not a part of the illustration.

Page 4<br />

<strong>ING</strong> <strong>Secured</strong> <strong>Income</strong> <strong>Insurance</strong> <strong>RP</strong><br />

6. The above information is indicative of the terms and conditions, warranties and exceptions contained in the policy terms and<br />

conditions of <strong>ING</strong> <strong>Secured</strong> <strong>Income</strong> <strong>Insurance</strong> <strong>RP</strong>.<br />

7. <strong>ING</strong> <strong>Vysya</strong> <strong>Life</strong> <strong>Insurance</strong> Company Limited is only the name of the <strong>Insurance</strong> Company and <strong>ING</strong> <strong>Secured</strong> <strong>Income</strong> <strong>Insurance</strong> <strong>RP</strong><br />

is only the name of the product and does not in any way indicate the quality of the product, its future prospects or returns.<br />

8. The purpose of this Benefit Illustration is only to provide a general overview about this policy. The information herein is indicative<br />

of the terms, conditions, warranties and exceptions contained in the Policy Terms and Conditions of <strong>ING</strong> <strong>Secured</strong> <strong>Income</strong> <strong>Insurance</strong><br />

<strong>RP</strong>. Please read this benefit illustration in conjunction with the product brochure, Policy Terms and Conditions/Rider Terms and<br />

Conditions to understand the Terms & Conditions & Exclusions carefully before concluding the sale.<br />

9. In the event of any inconsistency/ambiguity between the terms contained herein and the Policy Terms and Conditions, the Policy<br />

Terms and Conditions shall prevail.<br />

Section 41: Prohibition of Rebate:<br />

1) No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out or renew or<br />

continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of<br />

the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or<br />

continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or<br />

the tables of the insurer.<br />

2) Any person making default in complying with the provision of this section shall be punishable with fine, which may extend to<br />

five hundred rupees.<br />

Section 45: Non Disclosure:<br />

Under the provisions of section 45 of the <strong>Insurance</strong> Act, 1938, the company is entitled to repudiate the policy on the ground<br />

that a statement made in the proposal or in any report of a medical officer or referee or friend of the insured or any other<br />

document leading to the issue of the policy was inaccurate or false, before the expiry of 2 years from the effective date of the<br />

policy, and thereafter that if such false or inaccurate statement was related to a material matter or suppressed facts which it was<br />

material to disclose and that it was fraudulently made by the policyholder and that the policyholder knew at the time of making<br />

it that the statement was false or material to disclose.

Page 5<br />

<strong>ING</strong> <strong>Secured</strong> <strong>Income</strong> <strong>Insurance</strong> <strong>RP</strong><br />

To know more about this product, please contact our nearest Branch<br />

or call us at 1800- 419-8228 or SMS SIP to 5676770 or visit www.inglife.co.in<br />

<strong>Insurance</strong> is the subject matter of the solicitation.<br />

UIN: 114N060V01 ; Accidental Death Benefit Rider (ADB) UIN: 114C003V01; Accidental Death Disability and Dismemberment Benefit Rider (ADDDB): 114C002V01; <strong>ING</strong> Term <strong>Life</strong> Rider: UIN 114B007V01;<br />

URN: ILI/COLL/2011/326; <strong>ING</strong> Critical Illness Rider UIN No. 114B009V01, <strong>ING</strong> Critical Illness Limited Pay Rider UIN No. 114B008V01; For more details on risk factors, terms and conditions, please read the<br />

sales brochure of the mentioned product before concluding the sale. <strong>ING</strong> <strong>Vysya</strong> <strong>Life</strong> <strong>Insurance</strong> Co. Ltd., Registration No.114, Regd. & Corporate Office: ’<strong>ING</strong> <strong>Vysya</strong> House’, 5th Floor, No.22, M. G. Road,<br />

Bangalore-560 001, India. Tel: 080-25328000. Fax : 080-25559764.