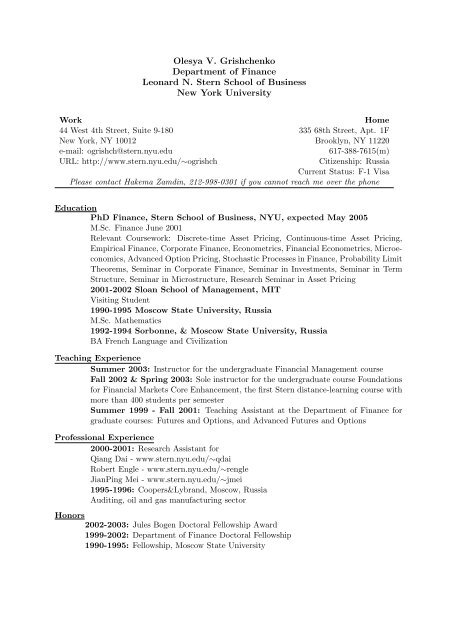

Olesya V. Grishchenko Department of Finance Leonard N. Stern ...

Olesya V. Grishchenko Department of Finance Leonard N. Stern ...

Olesya V. Grishchenko Department of Finance Leonard N. Stern ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Olesya</strong> V. <strong>Grishchenko</strong><br />

<strong>Department</strong> <strong>of</strong> <strong>Finance</strong><br />

<strong>Leonard</strong> N. <strong>Stern</strong> School <strong>of</strong> Business<br />

New York University<br />

Work Home<br />

44 West 4th Street, Suite 9-180 335 68th Street, Apt. 1F<br />

New York, NY 10012 Brooklyn, NY 11220<br />

e-mail: ogrishch@stern.nyu.edu 617-388-7615(m)<br />

URL: http://www.stern.nyu.edu/∼ogrishch Citizenship: Russia<br />

Current Status: F-1 Visa<br />

Please contact Hakema Zamdin, 212-998-0301 if you cannot reach me over the phone<br />

Education<br />

PhD <strong>Finance</strong>, <strong>Stern</strong> School <strong>of</strong> Business, NYU, expected May 2005<br />

M.Sc. <strong>Finance</strong> June 2001<br />

Relevant Coursework: Discrete-time Asset Pricing, Continuous-time Asset Pricing,<br />

Empirical <strong>Finance</strong>, Corporate <strong>Finance</strong>, Econometrics, Financial Econometrics, Microeconomics,<br />

Advanced Option Pricing, Stochastic Processes in <strong>Finance</strong>, Probability Limit<br />

Theorems, Seminar in Corporate <strong>Finance</strong>, Seminar in Investments, Seminar in Term<br />

Structure, Seminar in Microstructure, Research Seminar in Asset Pricing<br />

2001-2002 Sloan School <strong>of</strong> Management, MIT<br />

Visiting Student<br />

1990-1995 Moscow State University, Russia<br />

M.Sc. Mathematics<br />

1992-1994 Sorbonne, & Moscow State University, Russia<br />

BA French Language and Civilization<br />

Teaching Experience<br />

Summer 2003: Instructor for the undergraduate Financial Management course<br />

Fall 2002 & Spring 2003: Sole instructor for the undergraduate course Foundations<br />

for Financial Markets Core Enhancement, the first <strong>Stern</strong> distance-learning course with<br />

more than 400 students per semester<br />

Summer 1999 - Fall 2001: Teaching Assistant at the <strong>Department</strong> <strong>of</strong> <strong>Finance</strong> for<br />

graduate courses: Futures and Options, and Advanced Futures and Options<br />

Pr<strong>of</strong>essional Experience<br />

2000-2001: Research Assistant for<br />

Qiang Dai - www.stern.nyu.edu/∼qdai<br />

Robert Engle - www.stern.nyu.edu/∼rengle<br />

JianPing Mei - www.stern.nyu.edu/∼jmei<br />

1995-1996: Coopers&Lybrand, Moscow, Russia<br />

Auditing, oil and gas manufacturing sector<br />

Honors<br />

2002-2003: Jules Bogen Doctoral Fellowship Award<br />

1999-2002: <strong>Department</strong> <strong>of</strong> <strong>Finance</strong> Doctoral Fellowship<br />

1990-1995: Fellowship, Moscow State University

WORKING PAPERS<br />

Internal vs External Habit Formation: The relative importance for asset pricing,<br />

Job Market Paper<br />

Abstract: Asset pricing models with habit formation use either “catching up with Joneses”<br />

(external habit formation) or “time-nonseparable” (internal habit formation) preference<br />

specifications. In this paper I present a generalized asset pricing model that structurally<br />

nests both types <strong>of</strong> habit formation.<br />

I derive the asset pricing implications <strong>of</strong> this model and confront them with the observed<br />

consumption and asset return data to determine the relative importance <strong>of</strong> “catching up<br />

with Joneses” and internal habit formation. In other words, to what extent does an individual<br />

consumer’s preference depend on her own consumption history as opposed to the<br />

aggregate consumption history?<br />

I test the model using US postwar seasonally adjusted quarterly data on consumption expenditures,<br />

Fama-French portfolio and Treasury long-term bond portfolio returns <strong>of</strong> different<br />

horizons.<br />

Using long-horizon returns, I show that internal habit formation with a sufficiently long<br />

history <strong>of</strong> consumption realizations is more consistent with observed asset and bond returns<br />

than “catching up with Joneses” preferences. These results have important implications for<br />

researchers attempting to provide microeconomic foundations <strong>of</strong> habit formation.<br />

Empirical Investigation <strong>of</strong> Consumption Based Asset Pricing Models with<br />

Stochastic Internal Habit, with Qiang Dai<br />

Abstract: A consumption-based asset pricing model with stochastic habit formation is<br />

econometrically estimated and tested using generalized method <strong>of</strong> moments. The model<br />

departs from existing models with deterministic internal habit (e.g., Dunn, Singleton (1986),<br />

Ferson, Constantinides (1993), and Heaton (1995)) by introducing shocks to the coefficients<br />

in the distributed lag specification <strong>of</strong> consumption habit and consequently an additional<br />

shock to the marginal rate <strong>of</strong> substitution. The stochastic shocks to the consumption habit<br />

are persistent and provide an additional source <strong>of</strong> time-variation in expected returns. Using<br />

Treasury bond returns and broad equity market index returns, we show that stochastic<br />

internal habit formation models resolve the dichotomy between autocorrelation properties<br />

<strong>of</strong> stochastic discount factor and those <strong>of</strong> expected returns and provide better explanation<br />

<strong>of</strong> time-variation in expected returns compared to models with either deterministic habit<br />

or stochastic external habit.<br />

Private Information and Corporate Governance in Emerging Markets, with<br />

JianPing Mei and Lubomir Litov<br />

Abstract: We apply the theoretical framework <strong>of</strong> Llorente, Michaely, Saar, and Wang (2002)<br />

to analyze the relation between daily volume and first-order return autocorrelation for<br />

individual stocks in emerging markets. We find strong evidence <strong>of</strong> return continuation<br />

following high volume days, suggesting the presence <strong>of</strong> private information trading for many<br />

emerging market stocks. We discover that private information trading is especially strong<br />

around major corporate event dates. In addition, we find stocks that provide better investor<br />

protection and information disclosure exhibit less private information trading. These results<br />

suggest return autocorrelation and trading volume carry useful information about corporate<br />

governance in emerging market.<br />

2

Pr<strong>of</strong>essional Presentations<br />

Private Information and Corporate Governance in Emerging Markets<br />

- <strong>Department</strong> <strong>of</strong> <strong>Finance</strong>, <strong>Stern</strong>, NYU, March 2002<br />

- VIII International <strong>Finance</strong> Conference in Georgia Tech, GA, April 2002<br />

- EFMA meetings, London, UK, June 2002<br />

- EFA meetings, Berlin, Germany, August 2002<br />

- WFA meetings, Los Cabos, Mexico, June 2003<br />

Asset Pricing in the Production Economy subject to Monetary Shocks<br />

- <strong>Finance</strong> Seminar Series, H<strong>of</strong>stra University, NY, November 2002<br />

- VI Conference <strong>of</strong> Swiss Financial Society, Zurich, Switzerland, April 2003<br />

- Blaise Pascal International Conference on Financial Modeling, Paris, France, July 2003<br />

Empirical Investigation <strong>of</strong> Consumption Based Asset Pricing Models with<br />

Stochastic Internal Habit<br />

- <strong>Department</strong> <strong>of</strong> <strong>Finance</strong> Seminar, <strong>Stern</strong>, NYU, April 2003<br />

- <strong>Department</strong> <strong>of</strong> <strong>Finance</strong> Seminar, <strong>Stern</strong>, NYU, November 2003<br />

- IV Annual Trans-Atlantic Doctoral Conference at LBS, London, UK, May 2004<br />

- AEA meetings, Philadelphia, January 2005<br />

Internal vs External Habit Formation: The relative importance for asset pricing<br />

- <strong>Department</strong> <strong>of</strong> <strong>Finance</strong> Seminar, <strong>Stern</strong>, NYU, November 2004<br />

Discussant<br />

- EFMA meetings, London, UK, June 2002<br />

- EFA meetings, Berlin, Germany, August 2002<br />

Research Interests<br />

Asset Pricing Theory, General Equilibrium Theory, Portfolio Choice,<br />

International <strong>Finance</strong>, Macro-<strong>Finance</strong><br />

Teaching Interests<br />

Undergraduate: Foundations <strong>of</strong> Financial Markets, Financial Management<br />

Graduate: Asset Pricing Theory, Empirical <strong>Finance</strong>, Continuous-time <strong>Finance</strong><br />

Computer Skills<br />

Operating Systems: Linux, Windows XP/NT/98/2k<br />

Development: EViews, Gauss, LaTeX, HTML, Limdep, Matlab, Mathematica<br />

Pr<strong>of</strong>essional Membership<br />

American <strong>Finance</strong> Association<br />

Financial Management Association<br />

Languages<br />

Russian - native, English - fluent<br />

French - fluent, Spanish - working knowledge<br />

3

References<br />

Qiang Dai (dissertation co-chair) 919-962-7182 Qiang Dai@unc.edu<br />

<strong>Department</strong> <strong>of</strong> <strong>Finance</strong><br />

Kenan Flagler Business School<br />

University <strong>of</strong> North Carolina<br />

Marti Subrahmanyam (dissertation co-chair) 212-998-0348 msubrahm@stern.nyu.edu<br />

<strong>Department</strong> <strong>of</strong> <strong>Finance</strong><br />

<strong>Stern</strong> School <strong>of</strong> Business, New York University<br />

Stephen Brown 212-998-0306 sbrown@stern.nyu.edu<br />

<strong>Department</strong> <strong>of</strong> <strong>Finance</strong><br />

<strong>Stern</strong> School <strong>of</strong> Business, New York University<br />

Kose John 212-998-0337 kjohn@stern.nyu.edu<br />

<strong>Department</strong> <strong>of</strong> <strong>Finance</strong><br />

<strong>Stern</strong> School <strong>of</strong> Business, New York University<br />

Robert Whitelaw 212-998-0338 rwhitela@stern.nyu.edu<br />

<strong>Department</strong> <strong>of</strong> <strong>Finance</strong><br />

<strong>Stern</strong> School <strong>of</strong> Business, New York University<br />

November 21, 2004<br />

4