Download PDF - Everest Kanto Cylinder Ltd.

Download PDF - Everest Kanto Cylinder Ltd.

Download PDF - Everest Kanto Cylinder Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THREATS (T)<br />

1. Domestic CNG growth dependent on Government<br />

policies and plans<br />

The growth in CNG cylinder market for storage and<br />

transportation of CNG would be dependent on government<br />

plans and initiatives to switch over to alternative fuel.<br />

However, with natural gas being made available in most<br />

parts of the country and rising cost of fuels, it is expected<br />

that the Government policies would continue to be<br />

progressive favoring CNG as a fuel. This would lead to an<br />

accelerated growth in the CNG cylinder industry.<br />

2. Slowdown in the Indian automobile industry negatively<br />

impacts the Company’s growth<br />

OEMs and retrofitters are the major customers of EKC’s CNG<br />

cylinders in the automobile sector. Any slowdown in cylinder<br />

off take from OEMs in India will adversely affect EKC’s<br />

operations / production plans. However, demand from other<br />

global markets helped in offsetting the slowdown in the<br />

Indian auto sector.<br />

3. Volatile steel prices<br />

Seamless steel tube (primary raw material) prices have<br />

stabled in the year gone by thereby limiting the impact on<br />

bottomline. EKC successfully unwound the high cost<br />

inventory by end of Q1, 2010-11 and realigned its<br />

procurement policies in order to ensure that the benefits of<br />

lower procurement cost are achieved while at the same<br />

time, inputs are available at the right time for operations.<br />

4. Fluctuation in Foreign Currency<br />

Since EKC has significant imports as well as exports, any<br />

foreign currency fluctuations might affect the results or<br />

performance of the Company.<br />

There has been a marked change in the exchange rate<br />

between INR and Euro and INR and USD in the recent<br />

years and these currencies may continue to fluctuate<br />

significantly in future as well. Accordingly, the Company’s<br />

operating results have been and will continue to be impacted<br />

by fluctuations in the exchange rate between the Indian<br />

rupee and the Euro and the Indian rupee and the US dollar,<br />

as well as exchange rates with other foreign currencies.<br />

The Company’s treasury function actively tracks the<br />

movements in foreign currencies and has an internal risk<br />

management policy of proactively hedging exposures. As<br />

per the internal guidelines, the Company has been<br />

judiciously hedging its net exposures on regular basis<br />

through forward cover contracts and Options.<br />

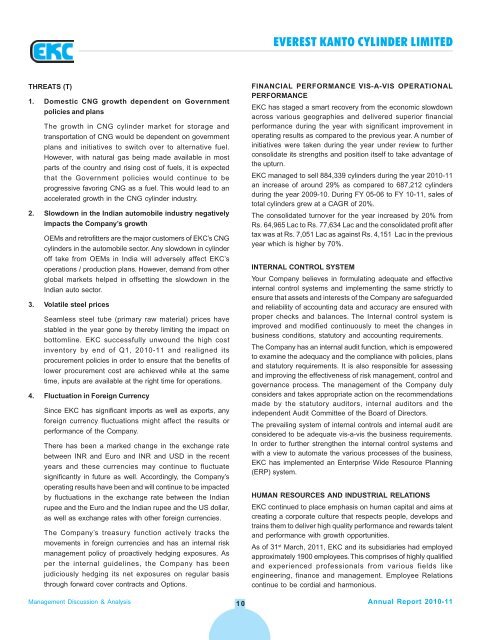

EVEREST KANTO CYLINDER LIMITED<br />

FINANCIAL PERFORMANCE VIS-A-VIS OPERATIONAL<br />

PERFORMANCE<br />

EKC has staged a smart recovery from the economic slowdown<br />

across various geographies and delivered superior financial<br />

performance during the year with significant improvement in<br />

operating results as compared to the previous year. A number of<br />

initiatives were taken during the year under review to further<br />

consolidate its strengths and position itself to take advantage of<br />

the upturn.<br />

EKC managed to sell 884,339 cylinders during the year 2010-11<br />

an increase of around 29% as compared to 687,212 cylinders<br />

during the year 2009-10. During FY 05-06 to FY 10-11, sales of<br />

total cylinders grew at a CAGR of 20%.<br />

The consolidated turnover for the year increased by 20% from<br />

Rs. 64,965 Lac to Rs. 77,634 Lac and the consolidated profit after<br />

tax was at Rs. 7,051 Lac as against Rs. 4,151 Lac in the previous<br />

year which is higher by 70%.<br />

INTERNAL CONTROL SYSTEM<br />

Your Company believes in formulating adequate and effective<br />

internal control systems and implementing the same strictly to<br />

ensure that assets and interests of the Company are safeguarded<br />

and reliability of accounting data and accuracy are ensured with<br />

proper checks and balances. The Internal control system is<br />

improved and modified continuously to meet the changes in<br />

business conditions, statutory and accounting requirements.<br />

The Company has an internal audit function, which is empowered<br />

to examine the adequacy and the compliance with policies, plans<br />

and statutory requirements. It is also responsible for assessing<br />

and improving the effectiveness of risk management, control and<br />

governance process. The management of the Company duly<br />

considers and takes appropriate action on the recommendations<br />

made by the statutory auditors, internal auditors and the<br />

independent Audit Committee of the Board of Directors.<br />

The prevailing system of internal controls and internal audit are<br />

considered to be adequate vis-a-vis the business requirements.<br />

In order to further strengthen the internal control systems and<br />

with a view to automate the various processes of the business,<br />

EKC has implemented an Enterprise Wide Resource Planning<br />

(ERP) system.<br />

HUMAN RESOURCES AND INDUSTRIAL RELATIONS<br />

EKC continued to place emphasis on human capital and aims at<br />

creating a corporate culture that respects people, develops and<br />

trains them to deliver high quality performance and rewards talent<br />

and performance with growth opportunities.<br />

As of 31st March, 2011, EKC and its subsidiaries had employed<br />

approximately 1900 employees. This comprises of highly qualified<br />

and experienced professionals from various fields like<br />

engineering, finance and management. Employee Relations<br />

continue to be cordial and harmonious.<br />

Management Discussion & Analysis Annual Report 2010-11<br />

10