Download PDF - Everest Kanto Cylinder Ltd.

Download PDF - Everest Kanto Cylinder Ltd.

Download PDF - Everest Kanto Cylinder Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

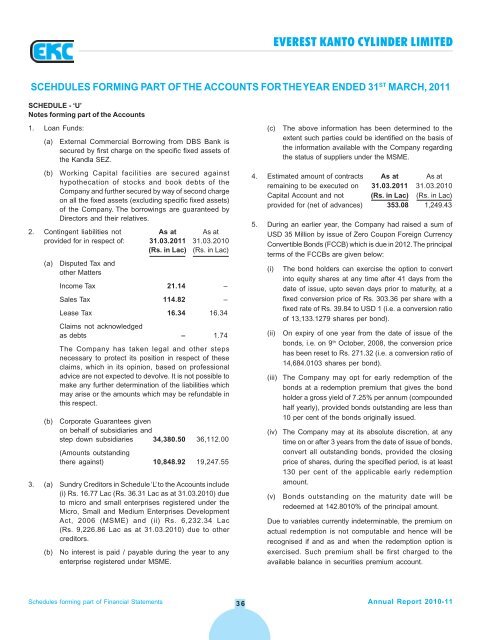

SCHEDULE - ‘U’<br />

Notes forming part of the Accounts<br />

1. Loan Funds:<br />

(a) External Commercial Borrowing from DBS Bank is<br />

secured by first charge on the specific fixed assets of<br />

the Kandla SEZ.<br />

(b) Working Capital facilities are secured against<br />

hypothecation of stocks and book debts of the<br />

Company and further secured by way of second charge<br />

on all the fixed assets (excluding specific fixed assets)<br />

of the Company. The borrowings are guaranteed by<br />

Directors and their relatives.<br />

2. Contingent liabilities not As at As at<br />

provided for in respect of: 31.03.2011 31.03.2010<br />

(Rs. in Lac) (Rs. in Lac)<br />

(a) Disputed Tax and<br />

other Matters<br />

Income Tax 21.14 –<br />

Sales Tax 114.82 –<br />

Lease Tax 16.34 16.34<br />

Claims not acknowledged<br />

as debts – 1.74<br />

The Company has taken legal and other steps<br />

necessary to protect its position in respect of these<br />

claims, which in its opinion, based on professional<br />

advice are not expected to devolve. It is not possible to<br />

make any further determination of the liabilities which<br />

may arise or the amounts which may be refundable in<br />

this respect.<br />

(b) Corporate Guarantees given<br />

on behalf of subsidiaries and<br />

step down subsidiaries 34,380.50 36,112.00<br />

(Amounts outstanding<br />

there against) 10,848.92 19,247.55<br />

3. (a) Sundry Creditors in Schedule ‘L’ to the Accounts include<br />

(i) Rs. 16.77 Lac (Rs. 36.31 Lac as at 31.03.2010) due<br />

to micro and small enterprises registered under the<br />

Micro, Small and Medium Enterprises Development<br />

Act, 2006 (MSME) and (ii) Rs. 6,232.34 Lac<br />

(Rs. 9,226.86 Lac as at 31.03.2010) due to other<br />

creditors.<br />

(b) No interest is paid / payable during the year to any<br />

enterprise registered under MSME.<br />

EVEREST KANTO CYLINDER LIMITED<br />

SCEHDULES FORMING PART OF THE ACCOUNTS FOR THE YEAR ENDED 31 ST MARCH, 2011<br />

(c) The above information has been determined to the<br />

extent such parties could be identified on the basis of<br />

the information available with the Company regarding<br />

the status of suppliers under the MSME.<br />

4. Estimated amount of contracts As at As at<br />

remaining to be executed on 31.03.2011 31.03.2010<br />

Capital Account and not (Rs. in Lac) (Rs. in Lac)<br />

provided for (net of advances) 353.08 1,249.43<br />

5. During an earlier year, the Company had raised a sum of<br />

USD 35 Million by issue of Zero Coupon Foreign Currency<br />

Convertible Bonds (FCCB) which is due in 2012. The principal<br />

terms of the FCCBs are given below:<br />

(i) The bond holders can exercise the option to convert<br />

into equity shares at any time after 41 days from the<br />

date of issue, upto seven days prior to maturity, at a<br />

fixed conversion price of Rs. 303.36 per share with a<br />

fixed rate of Rs. 39.84 to USD 1 (i.e. a conversion ratio<br />

of 13,133.1279 shares per bond).<br />

(ii) On expiry of one year from the date of issue of the<br />

bonds, i.e. on 9 th October, 2008, the conversion price<br />

has been reset to Rs. 271.32 (i.e. a conversion ratio of<br />

14,684.0103 shares per bond).<br />

(iii) The Company may opt for early redemption of the<br />

bonds at a redemption premium that gives the bond<br />

holder a gross yield of 7.25% per annum (compounded<br />

half yearly), provided bonds outstanding are less than<br />

10 per cent of the bonds originally issued.<br />

(iv) The Company may at its absolute discretion, at any<br />

time on or after 3 years from the date of issue of bonds,<br />

convert all outstanding bonds, provided the closing<br />

price of shares, during the specified period, is at least<br />

130 per cent of the applicable early redemption<br />

amount.<br />

(v) Bonds outstanding on the maturity date will be<br />

redeemed at 142.8010% of the principal amount.<br />

Due to variables currently indeterminable, the premium on<br />

actual redemption is not computable and hence will be<br />

recognised if and as and when the redemption option is<br />

exercised. Such premium shall be first charged to the<br />

available balance in securities premium account.<br />

Schedules forming part of Financial Statements Annual Report 2010-11<br />

36