Tax Guide for U.S. Citizens and Resident Aliens Abroad

Tax Guide for U.S. Citizens and Resident Aliens Abroad

Tax Guide for U.S. Citizens and Resident Aliens Abroad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

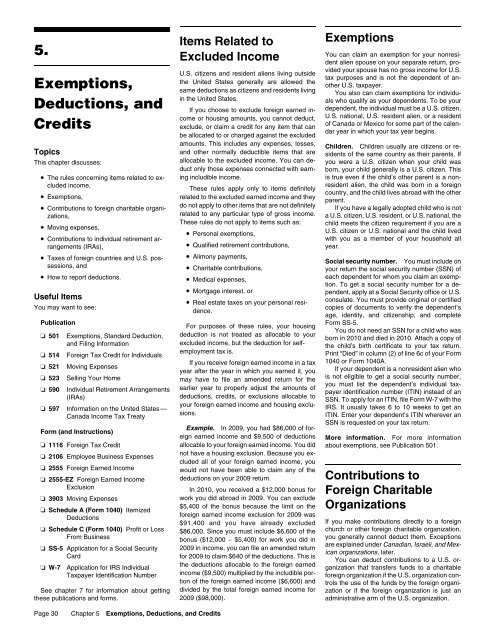

Items Related to Exemptions<br />

Excluded Income dent alien spouse on your separate return, pro-<br />

5. You can claim an exemption <strong>for</strong> your nonresi-<br />

Exemptions,<br />

Deductions, <strong>and</strong><br />

Credits<br />

U.S. citizens <strong>and</strong> resident aliens living outside<br />

the United States generally are allowed the<br />

same deductions as citizens <strong>and</strong> residents living<br />

in the United States.<br />

If you choose to exclude <strong>for</strong>eign earned income<br />

or housing amounts, you cannot deduct,<br />

exclude, or claim a credit <strong>for</strong> any item that can<br />

be allocated to or charged against the excluded<br />

vided your spouse has no gross income <strong>for</strong> U.S.<br />

tax purposes <strong>and</strong> is not the dependent of an-<br />

other U.S. taxpayer.<br />

You also can claim exemptions <strong>for</strong> individu-<br />

als who qualify as your dependents. To be your<br />

dependent, the individual must be a U.S. citizen,<br />

U.S. national, U.S. resident alien, or a resident<br />

of Canada or Mexico <strong>for</strong> some part of the calendar<br />

year in which your tax year begins.<br />

Topics<br />

This chapter discusses:<br />

amounts. This includes any expenses, losses,<br />

<strong>and</strong> other normally deductible items that are<br />

allocable to the excluded income. You can deduct<br />

only those expenses connected with earn-<br />

Children. Children usually are citizens or re-<br />

sidents of the same country as their parents. If<br />

you were a U.S. citizen when your child was<br />

born, your child generally is a U.S. citizen. This<br />

• The rules concerning items related to exing includible income.<br />

is true even if the child’s other parent is a non-<br />

cluded income,<br />

• Exemptions,<br />

• Contributions to <strong>for</strong>eign charitable organi-<br />

zations,<br />

• Moving expenses,<br />

• Contributions to individual retirement arrangements<br />

(IRAs),<br />

These rules apply only to items definitely<br />

related to the excluded earned income <strong>and</strong> they<br />

do not apply to other items that are not definitely<br />

related to any particular type of gross income.<br />

These rules do not apply to items such as:<br />

• Personal exemptions,<br />

• Qualified retirement contributions,<br />

resident alien, the child was born in a <strong>for</strong>eign<br />

country, <strong>and</strong> the child lives abroad with the other<br />

parent.<br />

If you have a legally adopted child who is not<br />

a U.S. citizen, U.S. resident, or U.S. national, the<br />

child meets the citizen requirement if you are a<br />

U.S. citizen or U.S. national <strong>and</strong> the child lived<br />

with you as a member of your household all<br />

year.<br />

• <strong>Tax</strong>es of <strong>for</strong>eign countries <strong>and</strong> U.S. possessions,<br />

<strong>and</strong><br />

• Alimony payments,<br />

• Charitable contributions,<br />

Social security number. You must include on<br />

your return the social security number (SSN) of<br />

• How to report deductions.<br />

Useful Items<br />

You may want to see:<br />

• Medical expenses,<br />

• Mortgage interest, or<br />

• Real estate taxes on your personal residence.<br />

each dependent <strong>for</strong> whom you claim an exemption.<br />

To get a social security number <strong>for</strong> a dependent,<br />

apply at a Social Security office or U.S.<br />

consulate. You must provide original or certified<br />

copies of documents to verify the dependent’s<br />

age, identity, <strong>and</strong> citizenship, <strong>and</strong> complete<br />

Publication<br />

❏ 501 Exemptions, St<strong>and</strong>ard Deduction,<br />

<strong>and</strong> Filing In<strong>for</strong>mation<br />

❏ 514 Foreign <strong>Tax</strong> Credit <strong>for</strong> Individuals<br />

❏ 521 Moving Expenses<br />

❏ 523 Selling Your Home<br />

❏ 590 Individual Retirement Arrangements<br />

(IRAs)<br />

❏ 597 In<strong>for</strong>mation on the United States—<br />

Canada Income <strong>Tax</strong> Treaty<br />

Form (<strong>and</strong> Instructions)<br />

For purposes of these rules, your housing<br />

deduction is not treated as allocable to your<br />

excluded income, but the deduction <strong>for</strong> self-<br />

employment tax is.<br />

If you receive <strong>for</strong>eign earned income in a tax<br />

year after the year in which you earned it, you<br />

may have to file an amended return <strong>for</strong> the<br />

earlier year to properly adjust the amounts of<br />

deductions, credits, or exclusions allocable to<br />

your <strong>for</strong>eign earned income <strong>and</strong> housing exclusions.<br />

Example. In 2009, you had $86,000 of <strong>for</strong>eign<br />

earned income <strong>and</strong> $9,500 of deductions<br />

Form SS-5.<br />

You do not need an SSN <strong>for</strong> a child who was<br />

born in 2010 <strong>and</strong> died in 2010. Attach a copy of<br />

the child’s birth certificate to your tax return.<br />

Print “Died” in column (2) of line 6c of your Form<br />

1040 or Form 1040A.<br />

If your dependent is a nonresident alien who<br />

is not eligible to get a social security number,<br />

you must list the dependent’s individual tax-<br />

payer identification number (ITIN) instead of an<br />

SSN. To apply <strong>for</strong> an ITIN, file Form W-7 with the<br />

IRS. It usually takes 6 to 10 weeks to get an<br />

ITIN. Enter your dependent’s ITIN wherever an<br />

SSN is requested on your tax return.<br />

More in<strong>for</strong>mation. For more in<strong>for</strong>mation<br />

❏ 1116 Foreign <strong>Tax</strong> Credit allocable to your <strong>for</strong>eign earned income. You did about exemptions, see Publication 501.<br />

❏ 2106 Employee Business Expenses<br />

❏ 2555 Foreign Earned Income<br />

❏ 2555-EZ Foreign Earned Income<br />

not have a housing exclusion. Because you excluded<br />

all of your <strong>for</strong>eign earned income, you<br />

would not have been able to claim any of the<br />

deductions on your 2009 return. Contributions to<br />

Exclusion In 2010, you received a $12,000 bonus <strong>for</strong> Foreign Charitable<br />

❏ 3903 Moving Expenses<br />

❏ Schedule A (Form 1040) Itemized<br />

Deductions<br />

❏ Schedule C (Form 1040) Profit or Loss<br />

From Business<br />

❏ SS-5 Application <strong>for</strong> a Social Security<br />

Card<br />

❏ W-7 Application <strong>for</strong> IRS Individual<br />

<strong>Tax</strong>payer Identification Number<br />

work you did abroad in 2009. You can exclude<br />

$5,400 of the bonus because the limit on the<br />

<strong>for</strong>eign earned income exclusion <strong>for</strong> 2009 was<br />

$91,400 <strong>and</strong> you have already excluded<br />

$86,000. Since you must include $6,600 of the<br />

bonus ($12,000 − $5,400) <strong>for</strong> work you did in<br />

2009 in income, you can file an amended return<br />

<strong>for</strong> 2009 to claim $640 of the deductions. This is<br />

the deductions allocable to the <strong>for</strong>eign earned<br />

income ($9,500) multiplied by the includible portion<br />

of the <strong>for</strong>eign earned income ($6,600) <strong>and</strong><br />

Organizations<br />

If you make contributions directly to a <strong>for</strong>eign<br />

church or other <strong>for</strong>eign charitable organization,<br />

you generally cannot deduct them. Exceptions<br />

are explained under Canadian, Israeli, <strong>and</strong> Mexican<br />

organizations, later.<br />

You can deduct contributions to a U.S. or-<br />

ganization that transfers funds to a charitable<br />

<strong>for</strong>eign organization if the U.S. organization controls<br />

the use of the funds by the <strong>for</strong>eign organi-<br />

See chapter 7 <strong>for</strong> in<strong>for</strong>mation about getting divided by the total <strong>for</strong>eign earned income <strong>for</strong> zation or if the <strong>for</strong>eign organization is just an<br />

these publications <strong>and</strong> <strong>for</strong>ms. 2009 ($98,000).<br />

administrative arm of the U.S. organization.<br />

Page 30 Chapter 5 Exemptions, Deductions, <strong>and</strong> Credits