Rothschild Bank AG Zurich - Rothschild | Private Banking & Trust

Rothschild Bank AG Zurich - Rothschild | Private Banking & Trust

Rothschild Bank AG Zurich - Rothschild | Private Banking & Trust

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

D Consolidation, Accounting<br />

and Valuation Principles<br />

General Principles<br />

The consolidated financial statements have been prepared in accordance with the Swiss <strong>Bank</strong> Accounting<br />

Guidelines of the Swiss Financial Market Supervisory Authority (B<strong>AG</strong>-FINMA).<br />

The Group accounts present a true and fair view of the financial position of the Group, and of the results of<br />

its operations and its cash flows in compliance with the accounting rules applicable for banks.<br />

Consolidated Companies<br />

Subsidiaries are entities controlled by the <strong>Bank</strong>. Control exists when the Group has the power, directly or<br />

indirectly, usually based on a participation of over 50 % of voting capital, to govern the financial and operating<br />

policies of an entity so as to obtain benefits from its activities. The financial statements of subsidiaries are<br />

included in the consolidated financial statements from the date that control commences until the date that<br />

control ceases.<br />

Method of Consolidation<br />

The Group’s capital consolidation is prepared in accordance with the Purchase Method.<br />

Change in the Scope of Consolidation<br />

<strong>Rothschild</strong> Gestión S.A., Madrid, was liquidated during the financial year 2009/10 and is therefore no longer<br />

part of the consolidated companies. There were no other changes in the scope of consolidation.<br />

Accounting and Recording of Transactions<br />

All transactions effected up to and including the balance sheet date are accounted for on the trade date and<br />

are, from this date on, stated and assessed according to the principles laid out below.<br />

Foreign Currency Translation of the Financial Statements<br />

Income statements of foreign entities are translated into the Group’s reporting currency at average exchange<br />

rates for the period and their balance sheets are translated at the exchange rate at the end of the period. Foreign<br />

exchange differences arising from the translation are recognised directly as a separate component of equity. On<br />

disposal of a foreign entity, these translation differences are recognised in the income statement as part of the<br />

gain or loss on sale.<br />

Transactions in foreign currencies are translated at the foreign exchange rate prevailing at the date of the<br />

transaction. Monetary assets and liabilities denominated in foreign currencies at the balance sheet date are<br />

translated into Swiss Francs at the foreign exchange rate ruling at the balance sheet date. Foreign exchange<br />

differences are recognised in the income statement. Non-monetary assets and liabilities denominated in foreign<br />

currencies that are stated at fair value are translated at the foreign exchange rates ruling at the dates the fair<br />

value was determined.<br />

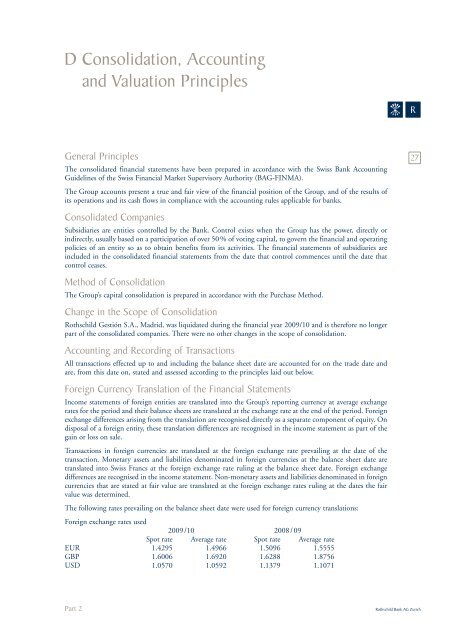

The following rates prevailing on the balance sheet date were used for foreign currency translations:<br />

Foreign exchange rates used<br />

2009 /10 2008 / 09<br />

Spot rate Average rate Spot rate Average rate<br />

EUR 1.4295 1.4966 1.5096 1.5555<br />

GBP 1.6006 1.6920 1.6288 1.8756<br />

USD 1.0570 1.0592 1.1379 1.1071<br />

Part 2<br />

R<br />

27<br />

<strong>Rothschild</strong> <strong>Bank</strong> <strong>AG</strong> <strong>Zurich</strong>