Rothschild Bank AG Zurich - Rothschild | Private Banking & Trust

Rothschild Bank AG Zurich - Rothschild | Private Banking & Trust

Rothschild Bank AG Zurich - Rothschild | Private Banking & Trust

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements<br />

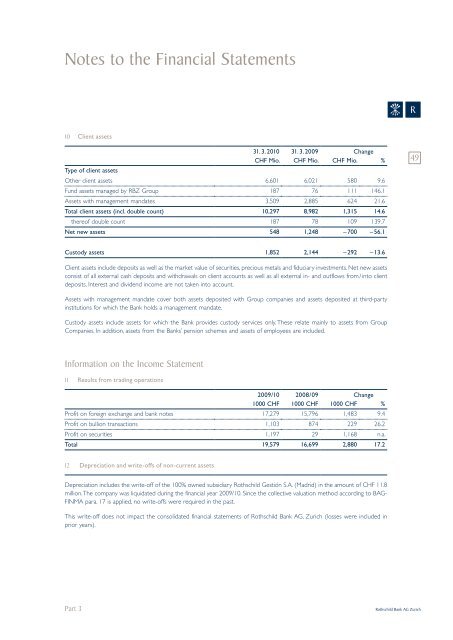

10 Client assets<br />

Type of client assets<br />

Information on the Income Statement<br />

31. 3. 2010 31. 3. 2009 Change<br />

CHF Mio. CHF Mio. CHF Mio. %<br />

Other client assets 6,601 6,021 580 9.6<br />

Fund assets managed by RBZ Group 187 76 111 146.1<br />

Assets with management mandates 3,509 2,885 624 21.6<br />

Total client assets (incl. double count) 10,297 8,982 1,315 14.6<br />

thereof double count 187 78 109 139.7<br />

Net new assets 548 1,248 – 700 – 56.1<br />

Custody assets 1,852 2,144 – 292 – 13.6<br />

Client assets include deposits as well as the market value of securities, precious metals and fiduciary investments. Net new assets<br />

consist of all external cash deposits and withdrawals on client accounts as well as all external in- and outflows from / into client<br />

deposits. Interest and dividend income are not taken into account.<br />

Assets with management mandate cover both assets deposited with Group companies and assets deposited at third-party<br />

institutions for which the <strong>Bank</strong> holds a management mandate.<br />

Custody assets include assets for which the <strong>Bank</strong> provides custody services only. These relate mainly to assets from Group<br />

Companies. In addition, assets from the <strong>Bank</strong>s’ pension schemes and assets of employees are included.<br />

11 Results from trading operations<br />

2009/10 2008/09 Change<br />

1000 CHF 1000 CHF 1000 CHF %<br />

Profit on foreign exchange and bank notes 17,279 15,796 1,483 9.4<br />

Profit on bullion transactions 1,103 874 229 26.2<br />

Profit on securities 1,197 29 1,168 n.a.<br />

Total 19,579 16,699 2,880 17.2<br />

12 Depreciation and write-offs of non-current assets<br />

Depreciation includes the write-off of the 100% owned subsidiary <strong>Rothschild</strong> Gestión S.A. (Madrid) in the amount of CHF 11.8<br />

million. The company was liquidated during the financial year 2009/10. Since the collective valuation method according to B<strong>AG</strong>-<br />

FINMA para. 17 is applied, no write-offs were required in the past.<br />

This write-off does not impact the consolidated financial statements of <strong>Rothschild</strong> <strong>Bank</strong> <strong>AG</strong>, <strong>Zurich</strong> (losses were included in<br />

prior years).<br />

Part 3 <strong>Rothschild</strong> <strong>Bank</strong> <strong>AG</strong> <strong>Zurich</strong><br />

R<br />

49