(54) ACCOUNTING & CONTROL SYSTEMS - AAT

(54) ACCOUNTING & CONTROL SYSTEMS - AAT

(54) ACCOUNTING & CONTROL SYSTEMS - AAT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

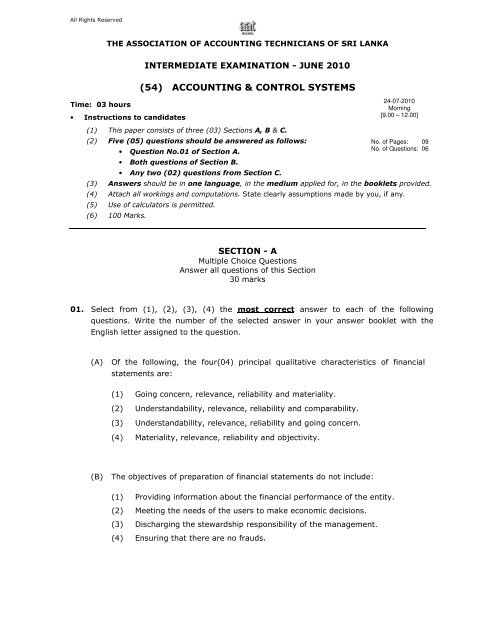

All Rights Reserved<br />

Time: 03 hours<br />

THE ASSOCIATION OF <strong>ACCOUNTING</strong> TECHNICIANS OF SRI LANKA<br />

• Instructions to candidates<br />

INTERMEDIATE EXAMINATION - JUNE 2010<br />

(<strong>54</strong>) <strong>ACCOUNTING</strong> & <strong>CONTROL</strong> <strong>SYSTEMS</strong><br />

(1) This paper consists of three (03) Sections A, B & C.<br />

(2) Five (05) questions should be answered as follows:<br />

• Question No.01 of Section A.<br />

• Both questions of Section B.<br />

• Any two (02) questions from Section C.<br />

(3) Answers should be in one language, in the medium applied for, in the booklets provided.<br />

(4) Attach all workings and computations. State clearly assumptions made by you, if any.<br />

(5) Use of calculators is permitted.<br />

(6) 100 Marks.<br />

SECTION - A<br />

Multiple Choice Questions<br />

Answer all questions of this Section<br />

30 marks<br />

01. Select from (1), (2), (3), (4) the most correct answer to each of the following<br />

questions. Write the number of the selected answer in your answer booklet with the<br />

English letter assigned to the question.<br />

(A) Of the following, the four(04) principal qualitative characteristics of financial<br />

statements are:<br />

(1) Going concern, relevance, reliability and materiality.<br />

(2) Understandability, relevance, reliability and comparability.<br />

(3) Understandability, relevance, reliability and going concern.<br />

(4) Materiality, relevance, reliability and objectivity.<br />

(B) The objectives of preparation of financial statements do not include:<br />

(1) Providing information about the financial performance of the entity.<br />

(2) Meeting the needs of the users to make economic decisions.<br />

(3) Discharging the stewardship responsibility of the management.<br />

(4) Ensuring that there are no frauds.<br />

24-07-2010<br />

Morning<br />

[9.00 – 12.00]<br />

No. of Pages: 09<br />

No. of Questions: 06

(C) Need for accounting arises:<br />

(1) Because limited resources should be accounted and controlled.<br />

(2) For historical purposes.<br />

(3) For purposes of satisfying the employees needs.<br />

(4) To facilitate audit.<br />

(D) Accounting standards when adopted in preparation of financial statements will<br />

ensure:<br />

(1) Comparability of financial statements of different entities.<br />

(2) There is no fraud.<br />

(3) To facilitate the work of internal auditor.<br />

(4) None of the above.<br />

(E) Which one of the following transactions results in the change of working capital?<br />

(1) Cash discount received on cash purchases.<br />

(2) Revaluation of the closing stock.<br />

(3) Maturing of a short-term investment.<br />

(4) None of the above.<br />

(F) The main objective of providing for depreciation of assets in the accounts is:<br />

(1) To earn a profit at the time of disposal of assets.<br />

(2) To ensure proper charge against the profit earned by the use of assets.<br />

(3) To calculate income tax accurately.<br />

(4) To understate profits and avoid payment of taxes.<br />

(G) When valuing closing stock, if the stock does not include goods sent on sale or<br />

return basis for Rs.50,000/- with a markup of 25% on cost, the gross profit of<br />

the company will be:<br />

(1) Understated by Rs.50,000/-. (2) Understated by Rs.40,000/-.<br />

(3) Not affected. (4) Overstated by Rs.50,000/-.<br />

2

(H) AB Ltd. a VAT registered company, purchased raw materials from Plastics (Pvt)<br />

Ltd. The details of the purchase tax invoice relating to the purchase are as<br />

follows:<br />

Of the following, the correct set of accounting entries to record the above<br />

purchase is:<br />

3<br />

Dr.<br />

Rs.’000<br />

(1) Purchase Account 1,000<br />

Cr.<br />

Rs.’000<br />

Plastic (Pvt) Ltd. 1,000<br />

(2) Purchase Account 1,120<br />

Plastic (Pvt) Ltd. 1,120<br />

(3) Purchase Account 1,000<br />

VAT Control Account 120<br />

Plastic (Pvt) Ltd. 1,120<br />

(4) Purchase Account 1,000<br />

VAT Control Account 120<br />

Plastic (Pvt) Ltd. 1,000<br />

VAT Payable Account 120<br />

(I) The balance in the bank statement shows Rs.230,000/- as at the end of a<br />

month, while the cash book bank balance on the same day was Rs.130,000/-.<br />

On perusal it was found that the bank has given credit for interest amounting to<br />

Rs.100,000/- and debited Rs.10,000/- being withholding tax for the month. An<br />

erroneous credit of Rs.12,500/- by the bank, and debit tax of Rs.2,500/-<br />

charged by the bank were included in the bank statement. The adjusted cash<br />

book balance at the end of the month should be:<br />

(1) Rs.230,000/-. (2) Rs.217,500/-. (3) Rs.132,500/-. (4) Rs.120,000/-.<br />

(J) The following information is given with regard to a particular company at the end<br />

of a year. Inventory - Rs.20,000/-, Accounts Receivable - Rs.25,000/-, Cash<br />

Balance - Rs.35,000/-, Accounts Payable - Rs.12,000/-, Bank Overdraft -<br />

Rs.28,000/-.<br />

Based on the above information, the Quick Asset Ratio and Working Capital of<br />

the company, respectively, are:<br />

Rs.’000<br />

2,500 kg of plastic pallets at Rs.400/- per kg 1,000<br />

Add: VAT at 12% 120<br />

Total 1,120<br />

(1) 3 : 2 and Rs.40,000/-. (2) 3 : 2 and Rs.20,000/-<br />

(3) 2 : 1 and Rs.40,000/-. (4) 2 : 1 and Rs.20,000/-

(K) Internal audit is intended to be:<br />

(1) A component of the internal control system of the entity.<br />

(2) The flying squad of the management.<br />

(3) Part of the accounting activity of the entity.<br />

(4) None of the above.<br />

(L) The item which is not considered as fraud out of the following:<br />

(1) Manipulation, falsification or alteration of records or documents.<br />

(2) Misappropriation of assets.<br />

(3) Mathematical or clerical mistakes in the accounting data.<br />

(4) Suppression of the effects of transactions from records or documents.<br />

(M) Which of the following is not a feature in internal control?<br />

(1) Internal check.<br />

(2) Internal audit.<br />

(3) Submitting of an annual report for Best Annual Report Award competition.<br />

(4) Attendance time recorder.<br />

(N) Internal auditor of a public company is appointed by:<br />

(1) Board of Directors of the company.<br />

(2) Shareholders at the Annual General Meeting.<br />

(3) External auditors of the company.<br />

(4) Government.<br />

(O) Segregation of duties is:<br />

(1) A method of cost cutting.<br />

(2) A method to minimize unemployment.<br />

(3) A method of identifying efficiency of employees.<br />

(4) A method of internal control.<br />

4<br />

(02 marks each, Total 30 marks)

SECTION - B<br />

Compulsory Questions<br />

Answer both questions of this Section<br />

50 marks<br />

02. (A) What constitutes “Stated Capital” as defined by the Companies Act No. 07 of<br />

2007. (02 marks)<br />

(B) As per Section 148 of the Companies Act No. 07 of 2007, every company shall<br />

keep accounting records which correctly record and explain the company’s<br />

transactions, and it is an offence not to comply with the said requirement.<br />

Who are the two(02) parties held responsible for keeping of accounting records?<br />

(02 marks)<br />

(C) The following Trial Balance was extracted from the books of account of Luxmi<br />

(Pvt) Ltd. as at 31 st March 2009:<br />

Dr.<br />

Cr.<br />

Rs.’000 Rs.’000<br />

Sales - 10,000<br />

Cost of sales 7,500 -<br />

Other income - 1,500<br />

Administration Expenses 1,200 -<br />

Distribution Expenses 500 -<br />

Other Operating Expenses 200 -<br />

Finance Expenses 100 -<br />

Plant & Equipment, at cost / Revaluation 5,000 -<br />

Provision for depreciation, as at 01 st April 2008 - 2,000<br />

Long term Investments - Government Bonds 1,200 -<br />

Inventories, as at 31 st March 2009 2,100 -<br />

Accounts Receivables / Accounts Payables 3,200 2,400<br />

Bank balance - 210<br />

Cash in hand 450 -<br />

Stated Capital - Ordinary Shares (300,000 shares) - 3,500<br />

Dividends paid 900 -<br />

Plant & Equipment Revaluation Reserve as at 01 st April 2008 - 1,600<br />

12% Debentures - 650<br />

Retained Earnings - 300<br />

Difference in Trial Balance - 190<br />

Total 22,350 22,350<br />

The following additional information is provided:<br />

(1) The double entries passed in the ledger included the following erroneous<br />

entries. It was observed that the narrations in each case were correctly<br />

written.<br />

Dr. Cr.<br />

Rs. Rs.<br />

Sales 140,000 -<br />

Accounts Receivable<br />

(Recording credit sales of Rs.140,000)<br />

40,000<br />

Accounts Payable 320,000 -<br />

Cash<br />

(Settlement of creditors of Rs.230,000)<br />

- 230,000<br />

The difference in the Trial Balance has been caused as a result of these<br />

errors.<br />

5

(2) The following expenses were accrued as at 31 st March 2009:<br />

Rs.<br />

Audit fees 50,000<br />

Electricity 5,000<br />

Directors fee 40,000<br />

(3) Although the Board of Directors made the following decisions, required<br />

entries for the current year have not been incorporated into the books of<br />

account.<br />

• To incorporate the current value of Plant & Equipment of<br />

Rs.2,500,000/- determined by a professional valuar as at 01 st April<br />

2008 into the books of account. Depreciation charge is 15% per<br />

annum on revalued value.<br />

• To write-off two debtors totalling Rs.380,000/-, and to maintain a<br />

general provision for doubtful debts at 4% of the balance remaining<br />

trade debtors (You may assume that the entire Accounts Receivables<br />

was made up of trade debtors).<br />

• To rectify the valuation of closing Inventories and thereby reduce the<br />

value to Rs.2,000,000/- from Rs.2,100,000/-.<br />

(4) The month end balance appearing in the bank statement received for the<br />

month of March 2009 was in agreement with the cashbook bank balance.<br />

However, when matching the entries it was revealed that the following<br />

entries were unrecorded in the cashbook.<br />

• Interest income of Rs.200,000/- on call deposits held in March 2009<br />

was not entered in the cash book.<br />

• Debit tax of Rs.23,000/- for the month of March 2009 has not been<br />

entered in the cash book.<br />

• Overdraft interest of Rs.177,000/- for the month of March 2009 has<br />

not been incorporated into the cash book.<br />

(5) The payment cheques of the annual interest on Debentures for the financial<br />

year 2008/09 have been released on 31 st March 2009. However, those<br />

have not been recorded in the books of account as at 31 st March 2009.<br />

(6) Tax liability for the year was estimated as Rs.250,000/-.<br />

You are required to prepare, the following for the use of the management:<br />

(a) Income Statement of the company for the year ended 31 st March 2009.<br />

(12 marks)<br />

(b) A Balance Sheet as at 31 st March 2009. (09 marks)<br />

(Total 25 marks)<br />

6

03. Kamal, Nimal & Sunil were partners sharing profits and losses in the ratio of<br />

3 : 2 : 1. The Trial balance of the partnership as at 31 st March 2010 was as follows:<br />

Dr. Cr.<br />

Rs.’000 Rs.’000<br />

Capital Accounts - Kamal - 300<br />

Nimal - 200<br />

Sunil - 100<br />

Current Accounts - Kamal - 100<br />

Nimal 50 -<br />

Sunil - 70<br />

Land, at cost 600 -<br />

Building, at cost 800 -<br />

Motor vehicles, at cost<br />

Provisions for Depreciation - 01<br />

700 -<br />

st April 2009<br />

Building - 350<br />

Motor vehicles - 400<br />

Inventories as at 01 st April 2009 350 -<br />

Accounts Receivable / Accounts Payable 150 530<br />

Provision for doubtful debts - 01 st April 2009 - 40<br />

Purchases 1,800 -<br />

Sales - 3,170<br />

Administration Expenses 400 -<br />

Distribution Expenses 50 -<br />

Financial and other Expenses 180 -<br />

Cash and bank balances 130 -<br />

Goodwill 50 -<br />

5,260 5,260<br />

Sunil retired from the partnership on 30 th September 2009. New profit / loss sharing<br />

ratio of Kamal and Nimal was agreed as 3 : 2 after Sunil’s retirement.<br />

It was provided in the partnership deed that any retiring partner should be entitled to<br />

a share of the goodwill of the firm to be calculated at 2½ times of the average profits<br />

of the last three years, ended on 31 st March.<br />

The following additional information is provided:<br />

(1) Partners agreed to increase the provision for doubtful debts up to Rs.60,000/-<br />

and adjust the entries in the profit and loss in the first six months. All other<br />

income and expenses are considered to have been distributed evenly over the<br />

year, unless otherwise specifically stated.<br />

(2) The amount due to Sunil on his retirement was agreed to be transferred to a<br />

loan account in his name, and annual interest at 10% should be paid to Sunil.<br />

(3) The profits for the three years ended 31 st March 2009, 2008 and 2007 were<br />

Rs.120,000/-, Rs.200,000/- and Rs.220,000/- respectively.<br />

(4) Partners decided not to continue with the goodwill account in the books and<br />

write it off in the new profit & loss sharing ratio.<br />

7

(5) Depreciation should be provided for the assets at the following rates on cost:<br />

Buildings 05% per annum<br />

Motor vehicles 20% per annum<br />

(6) Cash balance shown in the Trial Balance includes an IOU chit from Kamal who<br />

drew cash of Rs.3,000/- on 01 st January 2010. This has to be treated as<br />

drawings.<br />

(7) Value of closing inventories on 31 st March 2010 was Rs.240,000/- (market value<br />

was Rs.255,000/-).<br />

(8) Partners are entitled to the following salaries:<br />

Kamal - Rs.2,000/- per month<br />

Nimal - Rs.1,000/- per month<br />

Sunil - Rs.2,500/- per month (upto the time of retirement)<br />

Books of account were continued till the end of the year, and the Trial Balance<br />

given was extracted from the books on 31 st March 2010. No accounting entries<br />

were made to incorporate the above matters.<br />

You are required to prepare:<br />

(a) Trading, Profit and Loss and Appropriation Accounts of the partnership in<br />

columnar form for the two six months periods ending 30 th September 2009, and<br />

31 st March 2010 respectively. (12 marks)<br />

(b) Capital accounts and current accounts of Partners in columnar form for the year<br />

ended 31 st March 2010. (05 marks)<br />

(c) Balance Sheet of partnership as at 31 st March 2010. (08 marks)<br />

(Total 25 marks)<br />

SECTION - C<br />

Answer any two (02) questions only from this Section<br />

20 marks<br />

04. (A) Mention two(02) objectives of an Internal Control System. (02 marks)<br />

(B) List three(03) limitations of an Internal Control System. (03 marks)<br />

(C) Briefly explain the meanings of:<br />

(a) Fraud, and<br />

(b) Error. (02 marks)<br />

(D) Give three(03) examples of fraud that an Auditor may commonly detect in<br />

respect of cash or cheques. (03 marks)<br />

(Total 10 marks)<br />

8

05. (A) Distinguish, in point form, Internal Audit from External Audit. (05 marks)<br />

(B) Briefly explain five(05) types of Internal Controls. (05 marks)<br />

(Total 10 marks)<br />

06. Following information was extracted from the books of Alpha Sports Club for the<br />

year ended 31 st March 2010.<br />

(1) Subscription received during the year Rs.150,000/-.<br />

Subscription outstanding as at 31 st March 2009 Rs.20,000/-.<br />

Subscription outstanding as at 31 st March 2010 Rs.40,000/-.<br />

Subscription received in advance as at 31 st March 2009 Rs.30,000/-.<br />

Subscription received in advance as at 31 st March 2010 Rs.20,000/-.<br />

(2) During the year a sum of Rs.50,000/- was invested in a “Sports Fund” and the<br />

interest received on that investment Rs.1,000/-.<br />

(3) Opening stock of sports equipment as at 01 st April 2009 was Rs.20,000/-.<br />

Purchases of sports equipment during the year 2009/2010 on credit basis was<br />

Rs.60,000/-, and on cash basis was Rs.30,000/-. Stock of sports equipment as<br />

at 31 st March 2010 was Rs.40,000/-. Sale of scrapped sports equipment during<br />

the year was Rs.5,000/-. Sports equipment were for internal use of the Club.<br />

(4) In connection with the inauguration of the Tennis Court, the club on its own<br />

printed a souvenir. Printing expenses of Rs.1,000/- remained unpaid as at<br />

31 st March 2010. Amount due from the advertisers was Rs.15,000/- on account<br />

of this souvenir. The Club has already received Rs.25,000/- on account of<br />

advertisements.<br />

(5) The following expenses have been incurred and paid during the year:<br />

Salaries Rs.20,000/-<br />

Printing and stationery Rs.15,000/-<br />

(6) Cash balance as at 01 st April 2009 was Rs.5,000/-.<br />

You are required to prepare, for the year ended 31 st March 2010:<br />

(a) Receipts and Payments account, and, (04 marks)<br />

(b) Income and Expenditure account, (06 marks)<br />

of Alpha Sports Club. (Total 10 marks)<br />

- o0o -<br />

9