Read more - Auriant Mining

Read more - Auriant Mining

Read more - Auriant Mining

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Production costs all over the world vary considerably, depending<br />

whether it is a case of mines or open-cast, how<br />

deep down the gold deposits are, the type and characteristics<br />

of ore bodies and the gold content. According to GFMS,<br />

the average stated cash production costs for commercial<br />

information-producing larger western mining companies<br />

amounted to 492 USD/oz in 2009, which was an increase<br />

of 6% compared to 2008.<br />

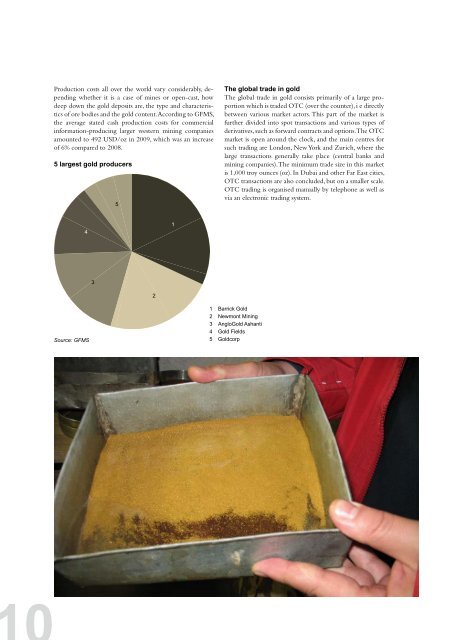

5 largest gold producers<br />

4<br />

Source: GFMS<br />

3<br />

5<br />

2<br />

1<br />

The global trade in gold<br />

The global trade in gold consists primarily of a large proportion<br />

which is traded OTC (over the counter), i e directly<br />

between various market actors. This part of the market is<br />

further divided into spot transactions and various types of<br />

derivatives, such as forward contracts and options. The OTC<br />

market is open around the clock, and the main centres for<br />

such trading are London, New York and Zurich, where the<br />

large transactions generally take place (central banks and<br />

mining companies). The minimum trade size in this market<br />

is 1,000 troy ounces (oz). In Dubai and other Far East cities,<br />

OTC transactions are also concluded, but on a smaller scale.<br />

OTC trading is organised manually by telephone as well as<br />

via an electronic trading system.<br />

1 Barrick Gold<br />

2 Newmont <strong>Mining</strong><br />

3 AngloGold Ashanti<br />

4 Gold Fields<br />

5 Goldcorp