Read more - Auriant Mining

Read more - Auriant Mining

Read more - Auriant Mining

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

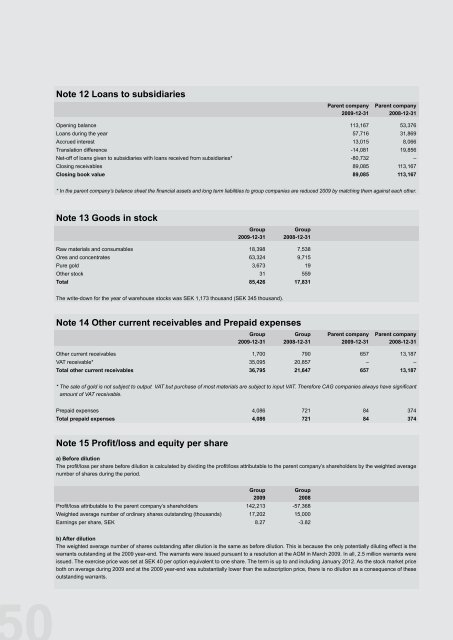

Note 12 Loans to subsidiaries<br />

Parent company<br />

2009-12-31<br />

Parent company<br />

2008-12-31<br />

Opening balance 113,167 53,376<br />

Loans during the year 57,716 31,869<br />

Accrued interest 13,015 8,066<br />

Translation difference -14,081 19,856<br />

Net-off of loans given to subsidiaries with loans received from subsidiaries* -80,732 –<br />

Closing receivables 89,085 113,167<br />

Closing book value 89,085 113,167<br />

* In the parent company’s balance sheet the fi nancial assets and long term liabilities to group companies are reduced 2009 by matching them against each other.<br />

Note 13 Goods in stock<br />

Group<br />

2009-12-31<br />

Group<br />

2008-12-31<br />

Raw materials and consumables 18,398 7,538<br />

Ores and concentrates 63,324 9,715<br />

Pure gold 3,673 19<br />

Other stock 31 559<br />

Total 85,426 17,831<br />

The write-down for the year of warehouse stocks was SEK 1,173 thousand (SEK 345 thousand).<br />

Note 14 Other current receivables and Prepaid expenses<br />

Group<br />

2009-12-31<br />

Group<br />

2008-12-31<br />

Parent company<br />

2009-12-31<br />

Parent company<br />

2008-12-31<br />

Other current receivables 1,700 790 657 13,187<br />

VAT receivable* 35,095 20,857 – –<br />

Total other current receivables 36,795 21,647 657 13,187<br />

* The sale of gold is not subject to output VAT but purchase of most materials are subject to input VAT. Therefore CAG companies always have signifi cant<br />

amount of VAT receivable.<br />

Prepaid expenses 4,086 721 84 374<br />

Total prepaid expenses 4,086 721 84 374<br />

Note 15 Profi t/loss and equity per share<br />

a) Before dilution<br />

The profi t/loss per share before dilution is calculated by dividing the profi t/loss attributable to the parent company’s shareholders by the weighted average<br />

number of shares during the period.<br />

Group<br />

2009<br />

Group<br />

2008<br />

Profi t/loss attributable to the parent company’s shareholders 142,213 -57,368<br />

Weighted average number of ordinary shares outstanding (thousands) 17,202 15,000<br />

Earnings per share, SEK 8.27 -3.82<br />

b) After dilution<br />

The weighted average number of shares outstanding after dilution is the same as before dilution. This is because the only potentially diluting effect is the<br />

warrants outstanding at the 2009 year-end. The warrants were issued pursuant to a resolution at the AGM in March 2009. In all, 2.5 million warrants were<br />

issued. The exercise price was set at SEK 40 per option equivalent to one share. The term is up to and including January 2012. As the stock market price<br />

both on average during 2009 and at the 2009 year-end was substantially lower than the subscription price, there is no dilution as a consequence of these<br />

outstanding warrants.