Credit Opinion: Banca Sella Holding - Gruppo Banca Sella

Credit Opinion: Banca Sella Holding - Gruppo Banca Sella

Credit Opinion: Banca Sella Holding - Gruppo Banca Sella

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

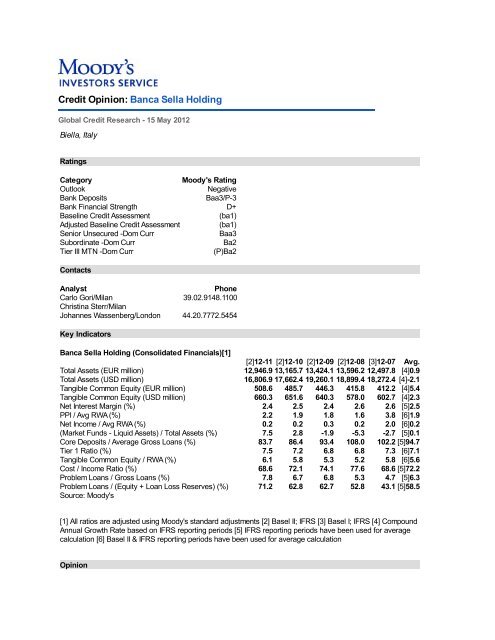

<strong>Credit</strong> <strong>Opinion</strong>: <strong>Banca</strong> <strong>Sella</strong> <strong>Holding</strong><br />

Global <strong>Credit</strong> Research - 15 May 2012<br />

Biella, Italy<br />

Ratings<br />

Category Moody's Rating<br />

Outlook Negative<br />

Bank Deposits Baa3/P-3<br />

Bank Financial Strength D+<br />

Baseline <strong>Credit</strong> Assessment (ba1)<br />

Adjusted Baseline <strong>Credit</strong> Assessment (ba1)<br />

Senior Unsecured -Dom Curr Baa3<br />

Subordinate -Dom Curr Ba2<br />

Tier III MTN -Dom Curr (P)Ba2<br />

Contacts<br />

Analyst Phone<br />

Carlo Gori/Milan 39.02.9148.1100<br />

Christina Sterr/Milan<br />

Johannes Wassenberg/London 44.20.7772.5454<br />

Key Indicators<br />

<strong>Banca</strong> <strong>Sella</strong> <strong>Holding</strong> (Consolidated Financials)[1]<br />

[2]12-11 [2]12-10 [2]12-09 [2]12-08 [3]12-07 Avg.<br />

Total Assets (EUR million) 12,946.9 13,165.7 13,424.1 13,596.2 12,497.8 [4]0.9<br />

Total Assets (USD million) 16,806.9 17,662.4 19,260.1 18,899.4 18,272.4 [4]-2.1<br />

Tangible Common Equity (EUR million) 508.6 485.7 446.3 415.8 412.2 [4]5.4<br />

Tangible Common Equity (USD million) 660.3 651.6 640.3 578.0 602.7 [4]2.3<br />

Net Interest Margin (%) 2.4 2.5 2.4 2.6 2.6 [5]2.5<br />

PPI / Avg RWA (%) 2.2 1.9 1.8 1.6 3.8 [6]1.9<br />

Net Income / Avg RWA (%) 0.2 0.2 0.3 0.2 2.0 [6]0.2<br />

(Market Funds - Liquid Assets) / Total Assets (%) 7.5 2.8 -1.9 -5.3 -2.7 [5]0.1<br />

Core Deposits / Average Gross Loans (%) 83.7 86.4 93.4 108.0 102.2 [5]94.7<br />

Tier 1 Ratio (%) 7.5 7.2 6.8 6.8 7.3 [6]7.1<br />

Tangible Common Equity / RWA (%) 6.1 5.8 5.3 5.2 5.8 [6]5.6<br />

Cost / Income Ratio (%) 68.6 72.1 74.1 77.6 68.6 [5]72.2<br />

Problem Loans / Gross Loans (%) 7.8 6.7 6.8 5.3 4.7 [5]6.3<br />

Problem Loans / (Equity + Loan Loss Reserves) (%)<br />

Source: Moody's<br />

71.2 62.8 62.7 52.8 43.1 [5]58.5<br />

[1] All ratios are adjusted using Moody's standard adjustments [2] Basel II; IFRS [3] Basel I; IFRS [4] Compound<br />

Annual Growth Rate based on IFRS reporting periods [5] IFRS reporting periods have been used for average<br />

calculation [6] Basel II & IFRS reporting periods have been used for average calculation<br />

<strong>Opinion</strong>

RECENT CREDIT DEVELOPMENTS<br />

On 14 May 2012 <strong>Banca</strong> <strong>Sella</strong>'s (<strong>Sella</strong>) standalone bank financial strength rating (BFSR) were downgraded to D+<br />

(mapping to a standalone credit assessment of ba1) from C-/baa2 and the bank's long- and short-term deposit<br />

ratings to Baa3/Prime-3 from Baa1/Prime-2. The outlook is negative.<br />

The standalone BFSR's downgrade captures <strong>Sella</strong>'s weak internal capital generation, low capital and modest asset<br />

quality, together exposing <strong>Sella</strong>'s vulnerability under our stress scenario.<br />

However, we note the bank's above-average retail funding and revenue diversification. <strong>Sella</strong>'s funding profile shows<br />

lower-than peers reliance on wholesale market funds (the adjusted liquidity ratio stands at negative 1.1%), with a<br />

low reliance on foreign investors. Due to restricted market access, <strong>Sella</strong>'s reliance on ECB funding has however<br />

increased whereas our liquidity-gap analysis over a 12 month horizon suggests a lower than peers dependence on<br />

ECB funding. Profitability, although modest, has deteriorated less than Italian peers.<br />

In combination, these factors have largely contributed to the downgrade of <strong>Sella</strong>'s standalone BFSR.<br />

<strong>Sella</strong>'s long term global local currency (GLC) deposit rating is Baa3, based on our expectation of a moderate<br />

probability of systemic support.<br />

SUMMARY RATING RATIONALE<br />

<strong>Sella</strong>'s D+ standalone bank financial strength rating (BFSR), mapped to a standalone credit assessment of ba1,<br />

reflects the bank's modest profitability, asset quality, capital and the impact of restricted and costly access to market<br />

funding, mitigated by above average retail funding and revenue diversification.<br />

<strong>Sella</strong>'s long term global local currency (GLC) deposit rating is Baa3, based on our expectation of a moderate<br />

probability of systemic support.<br />

Rating Drivers<br />

- Low capital adequacy relative to the deteriorating asset quality<br />

- Modest efficiency and profitability<br />

- Restricted and costly access to market funding, mitigated by retail funding above the Italian average<br />

- Corporate governance constrained by the family ownership<br />

- Above average revenue diversification<br />

Rating Outlook<br />

The outlook is negative reflecting the challenging operating environment and uncertainty regarding future market<br />

access.<br />

What Could Change the Rating - Up<br />

Although we do not see any upside pressure on the rating, we would consider an upgrade following a substantial<br />

improvement in financial profile with (i) core Tier 1 above 8%; (ii) cost-to-income ratio below 65%; and (iii) problem<br />

loans below 5% of loans, on a sustainable basis.<br />

What Could Change the Rating - Down<br />

Negative pressure on the rating would develop if <strong>Sella</strong>'s financial condition failed to improve, including (i) core Tier 1<br />

below 8%; or (ii) problem loans above the Italian loan average or (iii) continued restricted market access.<br />

Recent Results<br />

In 2011 the bank reported net income of EUR 16 million. Tier 1 was 7.5%.<br />

DETAILED RATING CONSIDERATIONS

Pressure on profitability<br />

<strong>Sella</strong>'s consolidated revenue composition remains high quality. In line with the bank's strategy of reinforcing its<br />

presence in the asset management and payment systems businesses, <strong>Sella</strong> has a relatively high percentage of<br />

more stable non-interest income (51% of operating revenues), largely from asset management and payment<br />

systems, which appear sustainable.<br />

Pre-provision income and net income were modest relative to average risk-weighted assets in 2011 (2.2% and 0.2%<br />

annualised respectively). This was largely attributable to the bank's weak efficiency and high loan loss provisions of<br />

127bp. To address <strong>Sella</strong>'s weak efficiency, management has been restructuring over the past few years reducing the<br />

number of its subsidiaries, merging and liquidating subsidiaries and by differing the subdivision of activities among<br />

its subsidiaries. Some activities have been outsourced to India and Romania in order to improve the weak efficiency<br />

metrics and reduce administrative costs.<br />

We recognise that progress has been made, although, we believe that <strong>Sella</strong>'s medium size implies limited economies<br />

of scale. In our opinion, one of the bank's greatest challenges will be to balance its requirement for continuous<br />

investments (in growth, controls, compliance and IT) with the need to improve its cost structure. In 2011 the cost-toincome<br />

ratio was a high 69%, given the need to continue to invest and lower revenues.<br />

Asset-side vulnerability<br />

We view <strong>Sella</strong>'s capital level as low in view of the high level of problem loans. Because of its ownership structure,<br />

<strong>Sella</strong> does not benefit from the potentially wider access to listed companies' capital. Growth is generally limited to<br />

internal capital generation - which is also low - although supported by consistently prudent dividend payouts at 10%<br />

(zero this year).<br />

The Tier 1 ratio stood at 7.5% in 2011, which is sufficient to withstand expected losses, although not in our stressed<br />

scenario. In this respect, we understand that management is targeting significantly higher levels over the medium<br />

term, mainly through non-core asset disposals. Capital is a key driver for the bank's rating.<br />

Despite significant lending growth in the past, consolidated lending still represented a relatively low 70% of total<br />

assets in 2011, which is in line with the bank's strategy to focus on non-asset intensive businesses such as asset<br />

management. However gross problem loans, represented a high 7.8% of loans and 71% of equity and loan loss<br />

reserves in 2011. Gross problem loans include non-performing loans (sofferenze), watchlist (incagli), including only<br />

an estimate of those 90+ days overdue, restructured (ristrutturati) and past due loans (scaduti). There is modest and<br />

reducing concentration of non-performing loans to the local textile industry, which has been experiencing difficulties<br />

for some time. Strengthening risk management practices did not prevent an increase of problem loans in 2011.<br />

Challenges caused by more expensive funding access<br />

<strong>Sella</strong> enjoys a large and above average retail deposit base, with deposits constituting approximately three quarters<br />

of the funding base. The average liquidity ratio in 2011 remained one of the best in Italy, highlighting liquid assets<br />

structurally above wholesale funds. An internal policy caps the consolidated loan-to-deposit ratio. Unlike other<br />

banks, new branches do not normally develop loans before deposits. We consider ample access to retail funding as<br />

a key competitive advantage under the current difficult market conditions. Nevertheless, there is a risk that restricted<br />

and costly market access will continue for an extended period. As a result, uncertainty regarding when the bank will<br />

again be able to fund itself regularly -- and on an economic basis -- is a key credit risk and an important rating driver.<br />

Corporate governance constrains the bank's risk positioning<br />

The full ownership by the family, which designates all board members, constrains corporate governance and,<br />

potentially, risk management independence and controls compared to a listed bank. This, in turn, constrains the<br />

bank's overall risk positioning, although to improve corporate governance, several measures aimed at<br />

counterbalancing the <strong>Sella</strong> family have been implemented. While we do not have current concerns, potentially a<br />

weaker corporate governance structure in a challenging operating environment can lead to heightened risks, as<br />

evidenced by recent extraordinary administrations by the regulator. This could give rise to greater transition risk for<br />

the ratings.<br />

Diversified franchise<br />

<strong>Sella</strong> has market shares of approximately 5.3% and 3.6% for deposits and loans respectively in the Piedmont region

as of December 2011. <strong>Sella</strong> is a commercial bank operating with households and SMEs and specialises in business<br />

areas with high expected growth rates and relatively high returns, such as payment systems (where it enjoyed a<br />

market share of 7.2% on the transactions with credit cards on POS installed by the bank (acquiring) and of 2.2% on<br />

transactions related to credit cards issued by the bank (issuing)), private banking and its Internet banking operation,<br />

which ranks among the leaders in Italy.<br />

The bank is wholly owned by the <strong>Sella</strong> family, which designates all board members. To improve corporate<br />

governance, several measures aimed at counterbalancing the <strong>Sella</strong> family have been implemented. Management's<br />

current strategy involves prudent organic growth to absorb increasing compliance costs.<br />

Challenging operating environment<br />

The operating environment in Italy has become increasingly difficult for banks in recent months. This includes (i) the<br />

effects of the country re-entering recession following the severe recession in 2009; (ii) the expected impact of the<br />

government's austerity measures (taken to protect its own balance sheet); and (iii) the restricted and costly marketfunding<br />

access.<br />

Global Local Currency Deposit Rating (Joint Default Analysis)<br />

We assign Baa3 deposit and debt ratings to <strong>Sella</strong>. The ratings incorporate <strong>Sella</strong>'s standalone credit assessment of<br />

ba1 and a moderate probability of systemic support, resulting in one-notch uplift of the deposit rating from the<br />

standalone credit assessment.<br />

Bank Financial Strength Rating<br />

Bank Financial Strength Ratings<br />

Moody's Bank Financial Strength Ratings (BFSRs) represent Moody's opinion of a bank's intrinsic safety and<br />

soundness and, as such, exclude certain external credit risks and credit support elements that are addressed by<br />

Moody's Bank Deposit Ratings. Bank Financial Strength Ratings do not take into account the probability that the<br />

bank will receive such external support, nor do they address risks arising from sovereign actions that may interfere<br />

with a bank's ability to honor its domestic or foreign currency obligations. Factors considered in the assignment of<br />

Bank Financial Strength Ratings include bank-specific elements such as financial fundamentals, franchise value,<br />

and business and asset diversification. Although Bank Financial Strength Ratings exclude the external factors<br />

specified above, they do take into account other risk factors in the bank's operating environment, including the<br />

strength and prospective performance of the economy, as well as the structure and relative fragility of the financial<br />

system, and the quality of banking regulation and supervision.<br />

Global Local Currency Deposit Rating<br />

A deposit rating, as an opinion of relative credit risk, incorporates the Bank Financial Strength Rating as well as<br />

Moody's opinion of any external support. Specifically, Moody's Bank Deposit Ratings are opinions of a bank's ability<br />

to repay punctually its deposit obligations. As such, Moody's Bank Deposit Ratings are intended to incorporate those<br />

aspects of credit risk relevant to the prospective payment performance of rated banks with respect to deposit<br />

obligations, and includes: intrinsic financial strength, sovereign transfer risk (in the case of foreign currency deposit<br />

ratings), and both implicit and explicit external support elements. Moody's Bank Deposit Ratings do not take into<br />

account the benefit of deposit insurance schemes which make payments to depositors, but they do recognize the<br />

potential support from schemes that may provide assistance to banks directly.<br />

According to Moody's joint default analysis (JDA) methodology, the global local currency deposit rating of a bank is<br />

determined by the incorporation of external elements of support into the bank's Baseline <strong>Credit</strong> Assessment. In<br />

calculating the GLC rating for a bank, the JDA methodology also factors in the rating of the support provider, in the<br />

form of the local currency deposit ceiling for a country, Moody's assessment of the probability of systemic support for<br />

the bank in case a stress situation occurs and the degree of dependence between the issuer rating and the LCDC.<br />

Foreign Currency Deposit Rating<br />

Moody's ratings on foreign currency bank obligations derive from the bank's local currency rating for the same class<br />

of obligation. The implementation of JDA for banks can lead to a high local currency ratings for certain banks, which<br />

could also produce high foreign currency ratings. Nevertheless, it should be reminded that foreign currency deposit<br />

ratings are in all cases constrained by the country ceiling for foreign currency bank deposits. This may result in the

assignment of a different, and typically lower, rating for the foreign currency deposits relative to the bank's rating for<br />

local currency obligations.<br />

Foreign Currency Debt Rating<br />

Foreign currency debt ratings are derived from the bank's local currency debt rating. In a similar way to foreign<br />

currency deposit ratings, foreign currency debt obligations may also be constrained by the country ceiling for foreign<br />

currency bonds and notes, however, in some cases the ratings on foreign currency debt obligations may be allowed<br />

to pierce the foreign currency ceiling. A particular mix of rating factors are taken into consideration in order to assess<br />

whether a foreign currency bond rating pierces the country ceiling. They include the issuer's global local currency<br />

rating, the foreign currency government bond rating, the country ceiling for bonds and the debt's eligibility to pierce<br />

that ceiling.<br />

About Moody's Bank Financial Strength Scorecard<br />

Moody's bank financial strength model (see scorecard below) is a strategic input in the assessment of the financial<br />

strength of a bank, used as a key tool by Moody's analysts to ensure consistency of approach across banks and<br />

regions. The model output and the individual scores are discussed in rating committees and may be adjusted up or<br />

down to reflect conditions specific to each rated entity.<br />

Rating Factors<br />

<strong>Banca</strong> <strong>Sella</strong> <strong>Holding</strong><br />

Rating Factors [1] A B C D E Total Score Trend<br />

Qualitative Factors (50%) D+<br />

Factor: Franchise Value D Neutral<br />

Market Share and Sustainability x<br />

Geographical Diversification x<br />

Earnings Stability x<br />

Earnings Diversification [2]<br />

Factor: Risk Positioning D Neutral<br />

Corporate Governance [2] -- -- -- -- --<br />

- Ownership and Organizational Complexity -- -- -- -- --<br />

- Key Man Risk -- -- -- -- --<br />

- Insider and Related-Party Risks -- -- -- -- --<br />

Controls and Risk Management x<br />

- Risk Management x<br />

- Controls x<br />

Financial Reporting Transparency x<br />

- Global Comparability x<br />

- Frequency and Timeliness x<br />

- Quality of Financial Information x<br />

<strong>Credit</strong> Risk Concentration -- -- -- -- --<br />

- Borrower Concentration -- -- -- -- --<br />

- Industry Concentration -- -- -- -- --<br />

Liquidity Management x<br />

Market Risk Appetite x<br />

Factor: Operating Environment D Neutral<br />

Economic Stability x<br />

Integrity and Corruption x<br />

Legal System x<br />

Financial Factors (50%) D<br />

Factor: Profitability D Neutral

PPI / Average RWA - Basel II 1.99%<br />

Net Income / Average RWA - Basel II 0.26%<br />

Factor: Liquidity C Neutral<br />

(Mkt funds-Liquid Assets) / Total Assets 2.80%<br />

Liquidity Management x<br />

Factor: Capital Adequacy C Neutral<br />

Tier 1 Ratio - Basel II 7.19%<br />

Tangible Common Equity / RWA - Basel II 5.73%<br />

Factor: Efficiency D Neutral<br />

Cost / Income Ratio 71.57%<br />

Factor: Asset Quality E+ Neutral<br />

Problem Loans / Gross Loans 7.11%<br />

Problem Loans / (Equity + LLR) 65.56%<br />

Lowest Combined Score (15%) E+<br />

Economic Insolvency Override Neutral<br />

Aggregate Score D<br />

Assigned BFSR D+<br />

[1] - Where dashes are shown for a particular factor (or sub-factor), the score is based on non public information [2] -<br />

A blank score under Earnings diversification or Corporate Governance indicates the risk is neutral<br />

© 2012 Moody's Investors Service, Inc. and/or its licensors and affiliates (collectively,<br />

"MOODY'S"). All rights reserved.<br />

CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. ("MIS") AND ITS<br />

AFFILIATES ARE MOODY'S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT<br />

RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND<br />

CREDIT RATINGS AND RESEARCH PUBLICATIONS PUBLISHED BY MOODY'S ("MOODY'S<br />

PUBLICATIONS") MAY INCLUDE MOODY'S CURRENT OPINIONS OF THE RELATIVE<br />

FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE<br />

SECURITIES. MOODY'S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT<br />

MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY<br />

ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT<br />

ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK,<br />

MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS AND MOODY'S<br />

OPINIONS INCLUDED IN MOODY'S PUBLICATIONS ARE NOT STATEMENTS OF CURRENT<br />

OR HISTORICAL FACT. CREDIT RATINGS AND MOODY'S PUBLICATIONS DO NOT<br />

CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT RATINGS<br />

AND MOODY'S PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO<br />

PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. NEITHER CREDIT RATINGS NOR<br />

MOODY'S PUBLICATIONS COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY<br />

PARTICULAR INVESTOR. MOODY'S ISSUES ITS CREDIT RATINGS AND PUBLISHES<br />

MOODY'S PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH<br />

INVESTOR WILL MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS<br />

UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE.<br />

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT<br />

LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR

OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED,<br />

DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR<br />

ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY<br />

MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY'S PRIOR WRITTEN CONSENT.<br />

All information contained herein is obtained by MOODY'S from sources believed by it to be<br />

accurate and reliable. Because of the possibility of human or mechanical error as well as other<br />

factors, however, all information contained herein is provided "AS IS" without warranty of any kind.<br />

MOODY'S adopts all necessary measures so that the information it uses in assigning a credit<br />

rating is of sufficient quality and from sources Moody's considers to be reliable, including, when<br />

appropriate, independent third-party sources. However, MOODY'S is not an auditor and cannot in<br />

every instance independently verify or validate information received in the rating process. Under<br />

no circumstances shall MOODY'S have any liability to any person or entity for (a) any loss or<br />

damage in whole or in part caused by, resulting from, or relating to, any error (negligent or<br />

otherwise) or other circumstance or contingency within or outside the control of MOODY'S or any<br />

of its directors, officers, employees or agents in connection with the procurement, collection,<br />

compilation, analysis, interpretation, communication, publication or delivery of any such<br />

information, or (b) any direct, indirect, special, consequential, compensatory or incidental<br />

damages whatsoever (including without limitation, lost profits), even if MOODY'S is advised in<br />

advance of the possibility of such damages, resulting from the use of or inability to use, any such<br />

information. The ratings, financial reporting analysis, projections, and other observations, if any,<br />

constituting part of the information contained herein are, and must be construed solely as,<br />

statements of opinion and not statements of fact or recommendations to purchase, sell or hold any<br />

securities. Each user of the information contained herein must make its own study and evaluation<br />

of each security it may consider purchasing, holding or selling. NO WARRANTY, EXPRESS OR<br />

IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR<br />

FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH RATING OR OTHER OPINION OR<br />

INFORMATION IS GIVEN OR MADE BY MOODY'S IN ANY FORM OR MANNER WHATSOEVER.<br />

MIS, a wholly-owned credit rating agency subsidiary of Moody's Corporation ("MCO"), hereby<br />

discloses that most issuers of debt securities (including corporate and municipal bonds,<br />

debentures, notes and commercial paper) and preferred stock rated by MIS have, prior to<br />

assignment of any rating, agreed to pay to MIS for appraisal and rating services rendered by it<br />

fees ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policies and<br />

procedures to address the independence of MIS's ratings and rating processes. Information<br />

regarding certain affiliations that may exist between directors of MCO and rated entities, and<br />

between entities who hold ratings from MIS and have also publicly reported to the SEC an<br />

ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the<br />

heading "Shareholder Relations — Corporate Governance — Director and Shareholder Affiliation<br />

Policy."<br />

Any publication into Australia of this document is by MOODY'S affiliate, Moody's Investors Service<br />

Pty Limited ABN 61 003 399 657, which holds Australian Financial Services License no. 336969.<br />

This document is intended to be provided only to "wholesale clients" within the meaning of section<br />

761G of the Corporations Act 2001. By continuing to access this document from within Australia,<br />

you represent to MOODY'S that you are, or are accessing the document as a representative of, a<br />

"wholesale client" and that neither you nor the entity you represent will directly or indirectly<br />

disseminate this document or its contents to "retail clients" within the meaning of section 761G of<br />

the Corporations Act 2001.<br />

Notwithstanding the foregoing, credit ratings assigned on and after October 1, 2010 by Moody's<br />

Japan K.K. (“MJKK”) are MJKK's current opinions of the relative future credit risk of entities, credit<br />

commitments, or debt or debt-like securities. In such a case, “MIS” in the foregoing statements<br />

shall be deemed to be replaced with “MJKK”. MJKK is a wholly-owned credit rating agency

subsidiary of Moody's Group Japan G.K., which is wholly owned by Moody’s Overseas <strong>Holding</strong>s<br />

Inc., a wholly-owned subsidiary of MCO.<br />

This credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on<br />

the equity securities of the issuer or any form of security that is available to retail investors. It<br />

would be dangerous for retail investors to make any investment decision based on this credit<br />

rating. If in doubt you should contact your financial or other professional adviser.