monsanto-2012-annual-report

monsanto-2012-annual-report

monsanto-2012-annual-report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

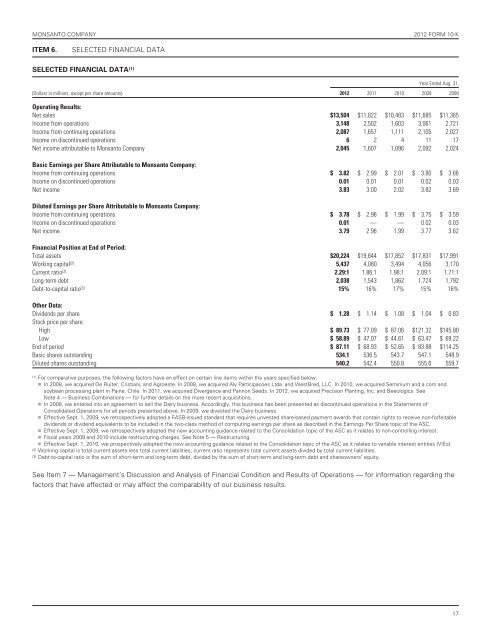

MONSANTO COMPANY <strong>2012</strong> FORM 10-K<br />

ITEM 6. SELECTED FINANCIAL DATA<br />

SELECTED FINANCIAL DATA (1)<br />

Year Ended Aug. 31,<br />

(Dollars in millions, except per share amounts) <strong>2012</strong> 2011 2010 2009 2008<br />

Operating Results:<br />

Net sales $13,504 $11,822 $10,483 $11,685 $11,365<br />

Income from operations 3,148 2,502 1,603 3,061 2,721<br />

Income from continuing operations 2,087 1,657 1,111 2,105 2,027<br />

Income on discontinued operations 6 2 4 11 17<br />

Net income attributable to Monsanto Company 2,045 1,607 1,096 2,092 2,024<br />

Basic Earnings per Share Attributable to Monsanto Company:<br />

Income from continuing operations $ 3.82 $ 2.99 $ 2.01 $ 3.80 $ 3.66<br />

Income on discontinued operations 0.01 0.01 0.01 0.02 0.03<br />

Net income 3.83 3.00 2.02 3.82 3.69<br />

Diluted Earnings per Share Attributable to Monsanto Company:<br />

Income from continuing operations $ 3.78 $ 2.96 $ 1.99 $ 3.75 $ 3.59<br />

Income on discontinued operations 0.01 — — 0.02 0.03<br />

Net income 3.79 2.96 1.99 3.77 3.62<br />

Financial Position at End of Period:<br />

Total assets $20,224 $19,844 $17,852 $17,831 $17,991<br />

Working capital (2) 5,437 4,080 3,494 4,056 3,170<br />

Current ratio (2) 2.29:1 1.86:1 1.98:1 2.09:1 1.71:1<br />

Long-term debt 2,038 1,543 1,862 1,724 1,792<br />

Debt-to-capital ratio (3) 15% 16% 17% 15% 16%<br />

Other Data:<br />

Dividends per share $ 1.28 $ 1.14 $ 1.08 $ 1.04 $ 0.83<br />

Stock price per share:<br />

High $ 89.73 $ 77.09 $ 87.06 $121.32 $145.80<br />

Low $ 58.89 $ 47.07 $ 44.61 $ 63.47 $ 69.22<br />

End of period $ 87.11 $ 68.93 $ 52.65 $ 83.88 $114.25<br />

Basic shares outstanding 534.1 536.5 543.7 547.1 548.9<br />

Diluted shares outstanding 540.2 542.4 550.8 555.6 559.7<br />

(1) For comparative purposes, the following factors have an effect on certain line items within the years specified below:<br />

In 2008, we acquired De Ruiter, Cristiani, and Agroeste. In 2009, we acquired Aly Participacoes Ltda. and WestBred, LLC. In 2010, we acquired Seminium and a corn and<br />

soybean processing plant in Paine, Chile. In 2011, we acquired Divergence and Pannon Seeds. In <strong>2012</strong>, we acquired Precision Planting, Inc. and Beeologics. See<br />

Note 4 — Business Combinations — for further details on the more recent acquisitions.<br />

In 2008, we entered into an agreement to sell the Dairy business. Accordingly, this business has been presented as discontinued operations in the Statements of<br />

Consolidated Operations for all periods presented above. In 2009, we divested the Dairy business.<br />

Effective Sept. 1, 2009, we retrospectively adopted a FASB-issued standard that requires unvested share-based payment awards that contain rights to receive non-forfeitable<br />

dividends or dividend equivalents to be included in the two-class method of computing earnings per share as described in the Earnings Per Share topic of the ASC.<br />

Effective Sept. 1, 2009, we retrospectively adopted the new accounting guidance related to the Consolidation topic of the ASC as it relates to non-controlling interest.<br />

Fiscal years 2009 and 2010 include restructuring charges. See Note 5 — Restructuring.<br />

Effective Sept. 1, 2010, we prospectively adopted the new accounting guidance related to the Consolidation topic of the ASC as it relates to variable interest entities (VIEs).<br />

(2) Working capital is total current assets less total current liabilities; current ratio represents total current assets divided by total current liabilities.<br />

(3) Debt-to-capital ratio is the sum of short-term and long-term debt, divided by the sum of short-term and long-term debt and shareowners’ equity.<br />

See Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations — for information regarding the<br />

factors that have affected or may affect the comparability of our business results.<br />

17