Branko Jelínek: Portrét vlajky II. / Porträt der Flagge II. / Portrait of the ...

Branko Jelínek: Portrét vlajky II. / Porträt der Flagge II. / Portrait of the ...

Branko Jelínek: Portrét vlajky II. / Porträt der Flagge II. / Portrait of the ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

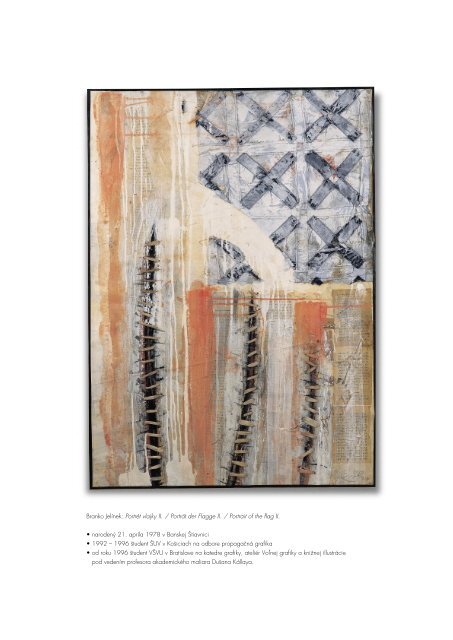

<strong>Branko</strong> <strong>Jelínek</strong>: <strong>Portrét</strong> <strong>vlajky</strong> <strong>II</strong>. / <strong>Porträt</strong> <strong>der</strong> <strong>Flagge</strong> <strong>II</strong>. / <strong>Portrait</strong> <strong>of</strong> <strong>the</strong> flag <strong>II</strong>.<br />

• naroden˘ 21. apríla 1978 v Banskej ·tiavnici<br />

• 1992 – 1996 ‰tudent ·UV v Ko‰iciach na odbore propagaãná grafika<br />

• od roku 1996 ‰tudent V·VU v Bratislave na katedre grafiky, ateliér Voºnej grafiky a kniÏnej illustrácie<br />

pod vedením pr<strong>of</strong>esora akademického maliara Du‰ana Kállaya.

Annual Report 1999<br />

45

46<br />

Dear clients and friends <strong>of</strong> ªUDOVÁ<br />

BANKA,<br />

The last year before <strong>the</strong> turn <strong>of</strong> <strong>the</strong> millennium,<br />

1999, is <strong>the</strong> eighth year <strong>of</strong><br />

operations for ªUDOVÁ BANKA. The<br />

year was also <strong>the</strong> year in which <strong>the</strong> Slovak<br />

government, following <strong>the</strong> parliamentary<br />

elections in September 1998,<br />

implemented measures aimed at stabilising<br />

<strong>the</strong> economy and regaining macro<br />

economic balance. As a result <strong>of</strong> <strong>the</strong>se<br />

measures <strong>the</strong>re was a slow down in<br />

economic growth, a significant increase<br />

in <strong>the</strong> rate <strong>of</strong> unemployment and consi<strong>der</strong>able<br />

problems in <strong>the</strong> entrepreneurial<br />

sector were experienced. However, significant<br />

progress was made in <strong>the</strong> process<br />

<strong>of</strong> restructuring state banks and in<br />

<strong>the</strong>ir preparation for <strong>the</strong> entry <strong>of</strong> strategic<br />

foreign investors.<br />

As would be expected, <strong>the</strong>se measures<br />

also influenced <strong>the</strong> business activities <strong>of</strong><br />

ªUDOVÁ BANKA. Although <strong>the</strong>re was a<br />

slow down in <strong>the</strong> growth <strong>of</strong> some <strong>of</strong> <strong>the</strong><br />

Bank’s key indicators (total assets, deposits,<br />

customer loans), it was not as significant<br />

as <strong>the</strong> slow down and, in certain<br />

cases decrease, experienced in <strong>the</strong> rest<br />

<strong>of</strong> <strong>the</strong> banking sector. ªUDOVÁ BAN-<br />

KA’s market share continued to grow<br />

during <strong>the</strong> year. To ensure that growth<br />

would not adversely impact <strong>the</strong> loan<br />

portfolio, <strong>of</strong> <strong>the</strong> Bank. There was strict<br />

adherence to <strong>the</strong> principles <strong>of</strong> prodential<br />

banking. The Bank’s strategy during<br />

this period was growth in quality.<br />

The growth in <strong>the</strong> Bank’s branch network<br />

continued during 1999. New<br />

branches were opened in Luãenec,<br />

Banská Bystrica and RuÏomberok. At<br />

<strong>the</strong> beginning <strong>of</strong> 2000, a branch was<br />

opened in Pre‰ov and sub-branches in<br />

<strong>the</strong> Bratislava region. ªUDOVÁ BANKA<br />

now has 21 branches. The expansion<br />

<strong>of</strong> <strong>the</strong> branch network to cover all <strong>the</strong><br />

important geographical areas <strong>of</strong> <strong>the</strong> Slovak<br />

Republic remains a key component<br />

<strong>of</strong> <strong>the</strong> Bank’s strategic commercial objectives<br />

for <strong>the</strong> coming year. The market<br />

positioning <strong>of</strong> ªUDOVÁ BANKA as a<br />

subsidiary <strong>of</strong> ÖVAG - a regional European<br />

bank - proved to be correct. Current<br />

trends towards globalisation, especially<br />

in <strong>the</strong> banking and insurance sectors,<br />

creates even more market opportunities<br />

for regional banks focusing on<br />

small and medium-size enterprises and<br />

private banking.<br />

As a result <strong>of</strong> <strong>the</strong> Bank’s objective to diversify<br />

its range <strong>of</strong> services to private<br />

and corporate sectors, <strong>the</strong> Bank’s licence<br />

was amended to include mortgage<br />

lending and <strong>the</strong> sale <strong>of</strong> insurance products.<br />

Following from <strong>the</strong>se amendments,<br />

<strong>the</strong> previously announced cooperation<br />

with VV AG and with OVVV<br />

came to fruition.<br />

A Word from <strong>the</strong> Managing Board<br />

From left:<br />

Karl Mayr-Kern, Wolfgang Siller, Jozef Kollár, Alexan<strong>der</strong> Bayr<br />

A significant contribution was made by<br />

<strong>the</strong> Information Technology Department<br />

in <strong>the</strong> smooth transition from 1999 to<br />

2000. Of great importance for <strong>the</strong><br />

Bank in 2000 is <strong>the</strong> successful completion<br />

<strong>of</strong> <strong>the</strong> electronic banking project.<br />

Looking towards <strong>the</strong> future, pressures on<br />

margins, declining yields from state securities<br />

and upward pressure on operational<br />

costs (especially human resources)<br />

will require <strong>the</strong> Bank to adapt. This will<br />

be accomplished mainly through improvement<br />

and increased quality and innovation<br />

in banking products and in <strong>the</strong><br />

long-term investment in human resources.<br />

The Bank would like to express its gratitude<br />

towards all staff members <strong>of</strong><br />

ªUDOVÁ BANKA, its clients, business<br />

partners and sharehol<strong>der</strong>s. We believe<br />

that you will remain committed to a financial<br />

institution that combines foreign<br />

know-how with a deep knowledge <strong>of</strong><br />

<strong>the</strong> Slovak market.<br />

ªUDOVÁ BANKA. TRUST IS COMMITMENT.

Highlights<br />

1999 1998 1997<br />

in SKK million in SKK million in SKK million<br />

Total assets 22,279 20,378 15,704<br />

Clients’ payables 17,580 16,386 12,139<br />

Clients’ receivables 6,160 7,377 5,790<br />

Operating pr<strong>of</strong>its 944 927 685<br />

Operating costs 598 459 411<br />

Earnings from ordinary activities 227 265 197<br />

Number <strong>of</strong> employees 483 417 338<br />

Number <strong>of</strong> branches 20 16 13<br />

47<br />

Annual Report 1999

48<br />

President<br />

Klaus Thalhammer<br />

Deputy General Director<br />

Vice-Chairman <strong>of</strong> <strong>the</strong> Management Board<br />

Österreichische Volksbanken-AG.,<br />

Vienna<br />

Vice-Chairman<br />

Ekkehard Fügl<br />

Head <strong>of</strong> Foreign Payments Dept.<br />

Österreichische Volksbanken-AG., Vienna<br />

since 15.4.1999<br />

Peter Weiß<br />

Director, Consultant<br />

Österreichische Volksbanken-AG., Vienna<br />

till 15.4.1999<br />

Members<br />

Zdenko Alexy<br />

Advisor<br />

Stock Exchange, j.s.c., Bratislava<br />

Ugo Fatini<br />

General Management Advisor<br />

Banca Popolare di Vicenza, Italy<br />

till 13.4.2000<br />

Andrej Glatz<br />

Director<br />

Motorcar Wiesenthal & Co.,<br />

Bratislava<br />

Andrej Hrádocký<br />

Physician<br />

Trenčín<br />

till 13.4.2000<br />

Hans Janeschitz<br />

Director<br />

Österreichische Volksbanken-AG., Vienna<br />

Pierre Klein<br />

Vicepresident<br />

Chambre Syndicale des Banques Populaires,<br />

Paris<br />

Franz Lagler<br />

Director, Chairman <strong>of</strong> Board<br />

Volksbank Krems-Zwettl AG., Krems<br />

till 15.4.1999<br />

Karl Mayr-Kern<br />

Director, Chairman <strong>of</strong> Board<br />

Magyarországi Volksbank Rt., Hungary<br />

since 14.4.2000<br />

Rastislav Opaterný<br />

Commercial Lawyer<br />

Bratislava<br />

Hubert Piel<br />

Management Director<br />

Member <strong>of</strong> <strong>the</strong> Management Board<br />

WGZ-Bank, Düsseldorf<br />

till 15.4.1999<br />

Stephan Wolf<br />

Consultant<br />

Slovak Technical University<br />

Bratislava<br />

Gerhard Wöber<br />

Foreign Payments Dept.<br />

Österreichische Volksbanken-AG., Vienna<br />

since 15.4.1999<br />

Bank Management<br />

Supervisory Board Board <strong>of</strong> Directors<br />

Karl Mayr-Kern<br />

Director<br />

Chairman<br />

till 13.4.2000<br />

Jozef Kollár<br />

Director<br />

Vice-Chairman<br />

till 13.4.2000<br />

Chairman<br />

since 14.4.2000<br />

Matthäus Thun-Hohenstein<br />

Director<br />

Member<br />

till 10.12.1999<br />

Wolfgang Siller<br />

Director<br />

Member<br />

since 15.4.1999<br />

Alexan<strong>der</strong> Bayr<br />

Director<br />

Member<br />

since 10.12.1999

Senior Executives<br />

Departments Hol<strong>der</strong>s <strong>of</strong> procuration<br />

Jana Krempová<br />

Director<br />

Economics Dept.<br />

Jana Kudláčová<br />

Director<br />

Treasury Dept.<br />

Jarmila Pašteková<br />

Director<br />

Administration and Supplies<br />

Oľga Rebrová<br />

Director<br />

Risk Management Dept.<br />

David Saleh<br />

Director<br />

Head <strong>of</strong> Branch Network<br />

Alexan<strong>der</strong> Spišiak<br />

Director<br />

Account Management Dept.<br />

Credit & Loans<br />

Lucia Šimková<br />

responsible to run <strong>the</strong> division<br />

Back Office<br />

Jaroslava Šuchová<br />

Director<br />

Head <strong>of</strong> International Division<br />

Sections<br />

Johannes Breitene<strong>der</strong><br />

Internal Audit<br />

Alena Huťanová<br />

Human Resources<br />

Ľubomír Nemček<br />

Director<br />

Legal Counsel<br />

Jaroslava Pribylincová<br />

Director<br />

Marketing and Publicity<br />

Alexan<strong>der</strong> Turan<br />

Building Projects<br />

Monika Zvarová<br />

Translations Dept.<br />

Alica Bobková<br />

Head <strong>of</strong> Credit Administration<br />

Ján Hargaš<br />

Senior Account Manager<br />

Peter Kníž<br />

Head <strong>of</strong> Dealing<br />

Irena Kobzová<br />

Head <strong>of</strong> Accounting & Statistics Dept.<br />

Štefan Prachár<br />

Head <strong>of</strong> Information Systems Dept.<br />

Ján Rašo<br />

Head <strong>of</strong> IT Development<br />

Milan Šikula<br />

Head <strong>of</strong> Documentary Payments<br />

Directors <strong>of</strong> Branches<br />

Jozef Boržík<br />

Director<br />

Prešov<br />

Elena Hegerová<br />

Director<br />

Banská Bystrica<br />

Stanislav Jakubík<br />

Director<br />

Trenčín<br />

Monika Ježková<br />

Director<br />

Žilina<br />

Ľudovít Korotnoky<br />

Director<br />

Košice<br />

Tatiana Krajmerová<br />

Director<br />

Nitra<br />

Roman Kurák<br />

Director<br />

Ružomberok<br />

Bystrík Mucha<br />

Director<br />

Poprad<br />

Ivan Oravský<br />

Director<br />

Bratislava, Motobanka<br />

Pavol Príhoda<br />

Director<br />

Galanta<br />

Nina Stankeová<br />

responsible for Branch Management<br />

Bratislava, Nám. SNP 15<br />

Marián Šimoňák<br />

Director<br />

Lučenec<br />

Sub-branches<br />

Július Bujdák<br />

Head<br />

Šaľa<br />

Miroslav Frič<br />

Head<br />

Bratislava, Špitálska 37<br />

Danica Gombošová<br />

Head<br />

Bratislava, Jesenského 2<br />

Rastislav Ilenčík<br />

Head<br />

Bratislava, Ľ. Fullu 62<br />

Gabriela Laluhová<br />

Head<br />

Bratislava, Trnavská 50/A<br />

Juraj Lóci<br />

Head<br />

Bratislava, Dulovo nám. 1<br />

Marián Miškeje<br />

Head<br />

Bratislava, Sch. Trnavského 14<br />

Katarína Sadloňová<br />

Director<br />

Bratislava, Vysoká 9<br />

Jozef Sloboda<br />

Head<br />

Bratislava, Haanova 12<br />

49<br />

Annual Report 1999

50<br />

ªudová Banka began trading in Slovakia<br />

in 1992. The main sharehol<strong>der</strong> is<br />

Österreichische Volksbaken-AG.<br />

(ÖVAG). O<strong>the</strong>r sharehol<strong>der</strong>s include<br />

GZB, WGZ-Bank, SGZ-Bank, members<br />

<strong>of</strong> <strong>the</strong> Austrian Volksbanken, group <strong>of</strong><br />

north Italian Volksbanken and individual<br />

Slovaksharehol<strong>der</strong>s.<br />

ÖVAG was established 1992 with <strong>the</strong><br />

founding <strong>of</strong> <strong>the</strong> Osterreichische Zentralgenossenschaftskasse<br />

as <strong>the</strong> umbrella<br />

organisation for a decentralised banking<br />

sector. ÖVAG is one <strong>of</strong> Austria’s<br />

ten largest banks and is owned by approximately<br />

60 Volksbanken with more<br />

than 600 branches. Additional sharehol<strong>der</strong>s<br />

are DG BANK Deutsche Genossenschaftsbank<br />

AG., VICTORIA<br />

Ruckversicherung AG., VICTORIA Versicherung<br />

AG. and Raiffeisen Zentralbank<br />

Osterreich AG.. With accumulated total<br />

assets in 1999 <strong>of</strong> approximately ATS<br />

400 billion and a total <strong>of</strong> 7,200 staff,<br />

<strong>the</strong> Austrian Volksbaken Group is one <strong>of</strong><br />

Austria’s most successful banking<br />

groups.<br />

ÖVAG has been active in Central and<br />

Eastern Europe for approximately 10<br />

years and provides pr<strong>of</strong>essional financial<br />

services through more than 1,000<br />

staff operating in a network <strong>of</strong> over 50<br />

branches in Croatia, Slovakia, Slovenia,<br />

<strong>the</strong> Czech Republic and Hungary.<br />

In addition, <strong>the</strong>re is a Volksbank in<br />

Malta and a representative <strong>of</strong>fice in<br />

Italy. In <strong>the</strong> course <strong>of</strong> 2000, subsidiaries<br />

will commence operations in Romania<br />

and Bosnia-Herzegovina.<br />

International Integration<br />

Co-operating through <strong>the</strong> international<br />

association <strong>of</strong> Volksbanken (CIBP) and<br />

its network <strong>of</strong> 42,000 banking outlets in<br />

<strong>the</strong> member states <strong>of</strong> Argentina, Belgium,<br />

Germany, France, Italy, Canada,<br />

Marocco, Spain, Turkey, Hungary,<br />

Great Britain and Japan and with <strong>the</strong><br />

stakes held by DG BANK in ÖVAG,<br />

ªUDOVÁ BANKA is able to <strong>of</strong>fer a<br />

worldwide presence in all major financial<br />

centres.<br />

Sharehol<strong>der</strong>s Share in %<br />

VBB-International Holding GmbH 71,7<br />

GZB 3,3<br />

WGZ-Bank 3,3<br />

SGZ-Bank 3,3<br />

Volksbank Donau-Weinland 0,2<br />

Nie<strong>der</strong>österreichische Landes- und Hypo<strong>the</strong>kenbank AG. 2,5<br />

Volksbank Ötscherland 1,7<br />

Volksbank Waldviertler Horn 0,2<br />

Banca Agricola Mantovana 3,4<br />

Banca Popolare dell’ Emilia Romagna 3,4<br />

VENETO BANCA 2,3<br />

Banca Popolare di Vicenza 2,3<br />

Small sharehol<strong>der</strong>s 2,4<br />

Toge<strong>the</strong>r 100,0%

Slovak Economy in 1999 and Prospects for 2000<br />

Slovak Economy in 1999<br />

Macroeconomic Imbalance<br />

The economic policy before 1999 was<br />

characterised by comparatively high<br />

growth with a parallel increase in both<br />

external and internal imbalances. In<br />

1998, <strong>the</strong> current account deficit as a<br />

percentage <strong>of</strong> GDP was over 10%,<br />

gross foreign debt exceeded 60% <strong>of</strong><br />

GDP and <strong>the</strong> budget deficit, including<br />

<strong>the</strong> public finance deficit was in excess<br />

<strong>of</strong> acceptable norms in mature economies.<br />

This was due to an economic policy<br />

which requided funds in excess <strong>of</strong><br />

available sources. Subsequent to <strong>the</strong> election<br />

in <strong>the</strong> autumn <strong>of</strong> 1998, <strong>the</strong> new<br />

government’s policies focused on ending<br />

adverse economic trends and regaining<br />

balance.<br />

GDP Decrease and Growing Unemployment<br />

A direct result <strong>of</strong> regaining balance in<br />

1999 was a decrease in GDP growth<br />

to 2% compared to 6% in <strong>the</strong> years<br />

1995 to 1997 and 4.4% in 1998.<br />

GDP growth prior to 1998 was amongst<br />

<strong>the</strong> highest in <strong>the</strong> transition economics<br />

<strong>of</strong> central and eastern Europe. The<br />

main source <strong>of</strong> this growth was foreign<br />

demand. With <strong>the</strong> slow-down in <strong>the</strong><br />

growth rate in <strong>the</strong> economy and <strong>the</strong><br />

delay in restructuring, <strong>the</strong> high level <strong>of</strong><br />

unemployment became critical. At <strong>the</strong><br />

end <strong>of</strong> 1999 unemployment reached<br />

<strong>the</strong> alarming level <strong>of</strong> 19%, which is a<br />

25% increase year-on-year.<br />

Government Measures - Rapid<br />

increase in inflation<br />

The government adopted measures in<br />

<strong>the</strong> first half <strong>of</strong> 1999 to address <strong>the</strong><br />

economic imbalances. This included <strong>the</strong><br />

introduction <strong>of</strong> a temporary 7% import<br />

surcharge, increases in excise taxes and<br />

VAT and also partial price <strong>der</strong>egulation.<br />

As a result <strong>of</strong> <strong>the</strong>se measures, year-onyear<br />

inflation increased to 14.2% in December<br />

1999 and <strong>the</strong> average inflation<br />

rate for <strong>the</strong> year increased to 10.6%.<br />

As a consequence <strong>of</strong> price <strong>der</strong>egulation,<br />

electricity, energy, natural gas, heating<br />

and telecommunication charges increased.<br />

Positive Change in Foreign<br />

Trade<br />

The deficit on <strong>the</strong> balance <strong>of</strong> payments<br />

decreased in 1999 by SKK 37.2 billion<br />

to SKK 45.7 billion compared to<br />

1998. The increased deficit in 1998<br />

had resulted in pressures on <strong>the</strong> Slovak<br />

Crown and on <strong>the</strong> reserves <strong>of</strong> <strong>the</strong> National<br />

Bank <strong>of</strong> Slovakia. The main factors<br />

that lead to <strong>the</strong> improvement in <strong>the</strong><br />

balance <strong>of</strong> payments were, firstly, a<br />

decrease in domestic demand, which<br />

resulted in a decrease in imports (yearon-year<br />

growth <strong>of</strong> 1.6%); and secondly,<br />

exports increased (year-on-year growth<br />

<strong>of</strong> 11.8%) as a result <strong>of</strong> <strong>the</strong> recovery <strong>of</strong><br />

<strong>the</strong> economies in <strong>the</strong> Euro zone.<br />

Restrictive Fiscal Policy - Lower<br />

Budgeted Public Debt<br />

The expansive fiscal policy <strong>of</strong> recent<br />

years was replaced by a restrictive fiscal<br />

policy in 1999. This resulted in <strong>the</strong><br />

deficit reaching, according to preliminary<br />

figures, 2% <strong>of</strong> GDP. As a result <strong>of</strong><br />

<strong>the</strong> drop in interest rates, <strong>the</strong> cost <strong>of</strong> financing<br />

<strong>the</strong> deficit also decreased. On<br />

1 January 2000 <strong>the</strong> corporate income<br />

tax rate was lowered from 40% to 29%.<br />

Forecast for 2000<br />

The stabilisation <strong>of</strong> <strong>the</strong> macro economy<br />

will continue in 2000. According to<br />

preliminary estimates, <strong>the</strong> growth in<br />

GDP will be between 1.7% and 2%.<br />

The high levels <strong>of</strong> unemployment will<br />

also continue. Reducing unemployment<br />

is dependent on long term economic<br />

growth and a fundamental restructuring<br />

that will impact at <strong>the</strong> micro economic<br />

level. The Government will continue with<br />

price <strong>der</strong>egulation, which will lead to a<br />

fur<strong>the</strong>r increase in <strong>the</strong> consumer price<br />

index. The continuing economic boom<br />

in OECD countries, which accounts for<br />

92 to 93% <strong>of</strong> Slovakia’s exports, will<br />

translate into a reduction in <strong>the</strong> trade<br />

deficit and o<strong>the</strong>r current external imbalances.<br />

Higher direct foreign investment<br />

is expected, especially after 2000. The<br />

Government has started with <strong>the</strong> long<br />

postponed restructuring <strong>of</strong> <strong>the</strong> economy,<br />

including <strong>the</strong> privatisiation <strong>of</strong> <strong>the</strong> large<br />

state-owned banks (V‰eobecná úverová<br />

banka, Slovenská sporiteºÀa and Investiãná<br />

a rozvojová banka). These banks<br />

are to be sold to foreign investors in<br />

2000 or 2001. A fur<strong>the</strong>r important<br />

event is <strong>the</strong> possible inclusion <strong>of</strong> Slovakia<br />

in <strong>the</strong> OECD. The decision will be<br />

taken at <strong>the</strong> end <strong>of</strong> April 2000.<br />

51<br />

Annual Report 1999

52<br />

Services Offered to Clients<br />

ªUDOVÁ BANKA expanded <strong>the</strong> range<br />

<strong>of</strong> services <strong>of</strong>fered. Private Banking is<br />

now available to high net worth clients.<br />

A comprehensive added-value service is<br />

provided for <strong>the</strong> client.<br />

With <strong>the</strong> aim <strong>of</strong> establishing relationships<br />

with clients from a young age, a<br />

new product, Account for <strong>the</strong> Youth,<br />

was introduced alongside <strong>the</strong> Children’s<br />

Deposit Book. The product <strong>of</strong>fers advantageous<br />

interest rates on personal current<br />

accounts for clients between 18<br />

and 25 years old and has <strong>the</strong> option to<br />

obtain <strong>the</strong> EURO 26+ Youth Card or<br />

<strong>the</strong> International ISIC Students card free<br />

<strong>of</strong> charge.<br />

ªUDOVÁ BANKA expanded card products<br />

to include, in addition to cards<br />

from EUROPAY and VISA, <strong>the</strong> prestigious<br />

Diners Club International card.<br />

The number <strong>of</strong> EUROPAY and VISA<br />

cards issued increased by 21% from<br />

last year and is now in excess <strong>of</strong><br />

27,000. This trend can also be seen in<br />

<strong>the</strong> increase in <strong>the</strong> number <strong>of</strong> EFT/POS<br />

terminals <strong>of</strong> <strong>the</strong> Bank’s partners and <strong>the</strong><br />

increase in <strong>the</strong> Bank’s ATMs. The total<br />

number <strong>of</strong> ATM transactions increased<br />

by 55% compared to last year.<br />

The introduction <strong>of</strong> <strong>the</strong> EURO also affected<br />

<strong>the</strong> Banks’activities in foreign trade<br />

and international co-operation. This<br />

lead to <strong>the</strong> extension and improvement<br />

in <strong>the</strong> quality <strong>of</strong> ªUDOVÁ BANKA’s network<br />

<strong>of</strong> correspondent banks to meet<br />

Development <strong>of</strong> Deposit during 1995 - 1999<br />

Bank Management Report<br />

clients’ foreign trade needs in most territories.<br />

As a result <strong>of</strong> trading partners requiring<br />

a higher level <strong>of</strong> certainty regarding<br />

foreign trade, documentary payments<br />

increased. The number <strong>of</strong> letters <strong>of</strong><br />

credit increased by more than 13%.<br />

(in SKK mill.) 1995 1996 1997 1998 1999<br />

Total 6,233 8,448 12,139 16,386 17,580<br />

18.000<br />

12.000<br />

6.000<br />

0<br />

1995 1996 1997 1998 1999<br />

Development <strong>of</strong> Deposit during 1999<br />

(in SKK mill.) 4.Q./98 1.Q./99 2.Q./99 3.Q./99 4.Q./99<br />

Saving and Depositcertificats 2,756 2,877 2,920 2,779 3,121<br />

Non-termtime 5,399 5,732 5,663 5,357 5,763<br />

Termtime 8,231 8,330 7,769 8,408 8,696<br />

Total 16,386 16,939 16,352 16,544 17,580<br />

Development <strong>of</strong> <strong>the</strong> Ratio <strong>of</strong> Foreign Currency and Slovak Crown Deposits<br />

(in SKK mill.) 4.Q./98 1.Q./99 2.Q./99 3.Q./99 4.Q./99<br />

Deposits in SKK 10,327 10,710 10,655 10,925 11,870<br />

Deposits in FC 6,059 6,229 5,697 5,619 5,710<br />

Total 16,386 16,939 16,352 16,544 17,580

Bank Management Report<br />

Deposits<br />

Absolute increments in savings, as well<br />

as in current accounts and in fixed-term<br />

accounts participated approximately in<br />

<strong>the</strong> same way in primary funds increments<br />

in <strong>the</strong> volume <strong>of</strong> SKK 1.2 billion.<br />

The transitional drop in total deposits in<br />

<strong>the</strong> 2nd quarter year was balanced by<br />

just as consi<strong>der</strong>able increments in deposits<br />

in <strong>the</strong> last quarter year. The Bank reached<br />

increments inflow in deposits, in<br />

spite <strong>of</strong> consi<strong>der</strong>able fall <strong>of</strong> interest rates<br />

on deposit type <strong>of</strong> products, what was<br />

<strong>the</strong> consequence <strong>of</strong> manifested confidence<br />

from <strong>the</strong> part <strong>of</strong> clients in stability<br />

<strong>of</strong> <strong>the</strong> Bank. The confidence <strong>of</strong> depositors<br />

in <strong>the</strong> Slovak currency is illustrated<br />

by decreased share <strong>of</strong> foreign exchange<br />

deposits in total deposits that declined<br />

from 37% at <strong>the</strong> beginning <strong>of</strong> <strong>the</strong><br />

year to 32.5% at <strong>the</strong> end <strong>of</strong> <strong>the</strong> year.<br />

Development <strong>of</strong> Primary and Secondary Deposits<br />

(in SKK mill.) 1995 1996 1997 1998 1999<br />

Primary Deposits 6,233 8,448 12,139 16,386 17,580<br />

Secondary Deposits 903 1,571 1,562 1,969 2,371<br />

Ratio Secondary Deposits 14% 19% 13% 12% 13%<br />

18.000<br />

12.000<br />

6.000<br />

0<br />

1995 1996 1997 1998 1999<br />

Development <strong>of</strong> <strong>the</strong> number <strong>of</strong> Deposits<br />

1996 1997 1998 1999<br />

Total 66,485 84,755 119,728 127,276<br />

130000<br />

104000<br />

78000<br />

52000<br />

26000<br />

0<br />

1996 1997 1998 1999<br />

53<br />

Annual Report 1999

54<br />

Credits<br />

Loans to customers were SKK 6.4 billion<br />

at year end. The number <strong>of</strong> loans provided<br />

increased slightly. To maintain a<br />

healthy credit portfolio, conservative risk<br />

policies were implemented. The Bank’s<br />

policy was aimed at providing credit<br />

products and improving <strong>the</strong> quality <strong>of</strong><br />

service provided to clients. The client<br />

focus is on successful small and mediumsized<br />

entrepreneurs in various sectors <strong>of</strong><br />

<strong>the</strong> economy to ensure proper diversification<br />

<strong>of</strong> credit risk. Also included in <strong>the</strong><br />

focus is <strong>the</strong> Top 100 Slovak companies<br />

who will use a wide range <strong>of</strong> products<br />

provided by <strong>the</strong> Bank.<br />

The maturity structure <strong>of</strong> <strong>the</strong> portfolio<br />

consists <strong>of</strong> 62% short-term credits, 32%<br />

medium-term credits and long-term credits<br />

6%.<br />

Strukture <strong>of</strong> Loans according<br />

do maturity terms<br />

as <strong>of</strong> December 31, 1999<br />

(excluding overdrafts)<br />

Short-term 62%<br />

Middle-term 32%<br />

Long-term 6%<br />

6 %<br />

62 %<br />

32 %<br />

Bank Management Report<br />

Development <strong>of</strong> <strong>the</strong> number <strong>of</strong> Loan accounts by <strong>the</strong> years 1995 - 1999<br />

1995 1996 1997 1998 1999<br />

Total 895 1,358 1,647 1,730 1,746<br />

1.800<br />

1.200<br />

600<br />

0<br />

1995 1996 1997 1998 1999<br />

Volume development <strong>of</strong> <strong>the</strong> granted Loans by <strong>the</strong> years 1995 - 1999<br />

(in SKK mill.) 1995 1996 1997 1998 1999<br />

8.000<br />

6.000<br />

4.000<br />

2.000<br />

0<br />

2,743 3,961 5,919 7,649 6,431<br />

1995 1996 1997 1998 1999

Bank Management Report<br />

Payments and Settlements<br />

The value and number <strong>of</strong> payments and<br />

settlements increased in 1999. Domestic<br />

payments and settlements exceeded<br />

two million which represents a 23% increase<br />

over <strong>the</strong> previous year. Home<br />

banking transactions increased by 34%<br />

<strong>of</strong> <strong>the</strong> total value <strong>of</strong> transactions. The<br />

value <strong>of</strong> foreign payments and settlements<br />

reached SKK 45 billion during<br />

<strong>the</strong> year.<br />

Treasury<br />

The money market gradually stabilised<br />

during 1999, with a decrease in price<br />

volatility. The only exception was <strong>the</strong> crisis<br />

during May which was caused by<br />

adverse movements in macro economic<br />

indicators and <strong>the</strong> uncertainty surrounding<br />

<strong>the</strong> out-come <strong>of</strong> <strong>the</strong> presidential elections.<br />

During this period <strong>the</strong> National<br />

Bank <strong>of</strong> Slovakia did not fix <strong>the</strong> BRIBOR<br />

reference rate and <strong>the</strong> short-term interest<br />

rate reached 50%. The exchange rate<br />

between <strong>the</strong> Slovak Crown and <strong>the</strong><br />

EURO weakened to 48.20. In <strong>the</strong> second<br />

half <strong>of</strong> <strong>the</strong> year <strong>the</strong> Slovak Crown<br />

gradually streng<strong>the</strong>ned to 42.30<br />

against <strong>the</strong> EURO, at which time <strong>the</strong><br />

National Bank <strong>of</strong> Slovakia intervened<br />

on <strong>the</strong> currency market. Trading on <strong>the</strong><br />

capital market stagnated over <strong>the</strong> course<br />

<strong>of</strong> 1999. In an effort to revive trading<br />

on <strong>the</strong> secondary market, <strong>the</strong> stock<br />

exchange organised <strong>the</strong> so-called market<br />

makers. Currently only state bonds<br />

are traded.<br />

The crises in <strong>the</strong> market have had a limited<br />

effect on <strong>the</strong> Bank, due to <strong>the</strong> stable<br />

primary funding sources. ªUDOVÁ<br />

BANKA streng<strong>the</strong>ned its position in <strong>the</strong><br />

market through active trading. Preparatory<br />

work was done throughout <strong>the</strong> year<br />

to ensure a proper transition with <strong>the</strong><br />

date change to <strong>the</strong> year 2000.<br />

Marketing<br />

The marketing department co-operated<br />

in <strong>the</strong> development <strong>of</strong> new products, <strong>the</strong><br />

sale <strong>of</strong> those products and assisted in<br />

improving <strong>the</strong> quality <strong>of</strong> service provided<br />

to clients.<br />

As in <strong>the</strong> past, <strong>the</strong> Bank focused sponsorships<br />

on <strong>the</strong> health care sector. Donations<br />

during <strong>the</strong> year totalled SKK 2.6<br />

million.<br />

Information Technology<br />

The main focus <strong>of</strong> <strong>the</strong> EDP department<br />

during <strong>the</strong> year was <strong>the</strong> ”Year 2000“<br />

issue and ensuring that <strong>the</strong>re was a<br />

smooth transition for both <strong>the</strong> main and<br />

support information technology systems.<br />

O<strong>the</strong>r tasks during <strong>the</strong> year included:<br />

• Installation <strong>of</strong> a backup computer<br />

center,<br />

• Upgrade <strong>of</strong> <strong>the</strong> main MIDAS information<br />

system,<br />

• Implementation <strong>of</strong> new applications<br />

in <strong>the</strong> Lotus Notes environment to improve<br />

communications and work organisation,<br />

• Implementation <strong>of</strong> new Homebanking<br />

program.<br />

Human Resources<br />

The Bank employed 483 people by <strong>the</strong><br />

end <strong>of</strong> 1999. The branch network increased<br />

from 16 branches in 1998 to<br />

21 branches at <strong>the</strong> beginning <strong>of</strong> 2000,<br />

an increase <strong>of</strong> 16% compared to <strong>the</strong><br />

previous year.<br />

The objective <strong>of</strong> ªUDOVÁ BANKA in<br />

<strong>the</strong> area <strong>of</strong> human resources and training<br />

is to provide continuous education<br />

and pr<strong>of</strong>essional development to employees<br />

through <strong>the</strong> LB-Academy.<br />

55<br />

Annual Report 1999

56<br />

Assets (in SKK ’000) Notes 58-60<br />

Balance Sheet as at 31 December 1999<br />

1999 1998 1997<br />

Cash on hand 498,397 377,046 450,658<br />

Balances with NBS 1,462,236 1,058,930 1,265,920<br />

Due from banks 4<br />

a) payable on demand 1,262,913 645,450 812,570<br />

b) o<strong>the</strong>r 6,956,118 6,328,034 3,406,947<br />

Due from customers 4<br />

8,219,031 6,973,484 4,219,517<br />

a) short-term 2,010,837 2,157,266 855,410<br />

b) medium-term 2,634,577 2,376,676 2,478,945<br />

c) long-term 440,857 523,291 555,822<br />

d) overdrafts 1,344,402 2,591,289 2,029,264<br />

6,430,673 7,648,522 5,919,441<br />

Provisions for nonstandard loans -271,125 -271,626 -129,808<br />

Values to be collected 270 240 495<br />

Securities 5 4,577,682 3,413,120 3,159,408<br />

Participations 58,062 46,473 34,394<br />

Accruals and prepaid expenses 485,686 377,447 109,267<br />

Tangible and intangible fixed assets 6 805,113 690,729 651,801<br />

O<strong>the</strong>r assets 12,864 63,813 23,130<br />

Total 22,278,889 20,378,178 15,704,223<br />

Liabilities (in SKK ’000)<br />

Due to banks 7<br />

a) payable on demand 126,261 66,983 24,630<br />

b) o<strong>the</strong>r 2,245,290 1,902,300 1,537,200<br />

Due to customers 7<br />

2,371,551 1,969,283 1,561,830<br />

a) payable on demand 5,762,915 5,399,153 4,414,356<br />

b) term deposits 8,986,712 8,299,948 4,908,380<br />

c) savings deposits 2,830,033 2,686,722 2,816,739<br />

17,579,660 16,385,823 12,139,475<br />

Accruals and deferred revenues 307,843 411,908 638,126<br />

O<strong>the</strong>r liabilities 236,302 105,187 104,194<br />

Reserves and reserve funds 9 513,704 374,672 320,274<br />

Share capital 670,000 670,000 670,000<br />

Retained pr<strong>of</strong>its 386,289 200,279 108,715<br />

Net pr<strong>of</strong>it for <strong>the</strong> year 213,540 261,026 161,609<br />

Total 22,278,889 20,378,178 15,704,223<br />

Prepared in using an The accompanying notes form an integral accounting regulations. part <strong>of</strong> <strong>the</strong> financial statements.<br />

exchange rate <strong>of</strong> USD/SKK 42,266<br />

as at December 31, 1999<br />

ªUDOVÁ BANKA, a. s.<br />

Board <strong>of</strong> Directors<br />

Bratislava, 21 February 2000<br />

Karl Mayr-Kern<br />

Chairman<br />

Jozef Kollár Wolfgang Siller<br />

Vice-Chairman Member

Pr<strong>of</strong>it & Loss Account for <strong>the</strong> year ended 31 December 1999<br />

Income (in SKK ’000) Notes 58-60<br />

1999 1998 1997<br />

Interest and related income from banks 679,299 961,385 784,385<br />

Interest and fees received from customers 1,277,716 1,284,465 848,773<br />

Foreign exchange revenues 4,595,920 6,736,959 1,677,657<br />

Income from o<strong>the</strong>r banking activities 384,209 300,551 93,618<br />

O<strong>the</strong>r income 273,951 172,462 129,138<br />

Total 7,211,095 9,455,822 3,533,571<br />

Expenses (in SKK ’000)<br />

Interest paid to banks 213,273 484,637 513,557<br />

Fees and commissions paid to banks 16,598 16,261 13,204<br />

Interest and fees paid to customers 1,318,688 1,264,476 725,756<br />

Foreign exchange expenses 4,275,966 6,448,561 1,416,665<br />

Personnel expenses 3 173,363 138,477 105,482<br />

General operating expenses 317,942 232,270 198,558<br />

Depreciation and provisions 473,889 445,583 208,033<br />

O<strong>the</strong>r expenses 207,836 164,531 170,695<br />

Income tax 0 0 20,012<br />

Net pr<strong>of</strong>it for <strong>the</strong> year 213,540 261,026 161,609<br />

Total 7,211,095 9,455,822 3,533,571<br />

Regrouped pr<strong>of</strong>it and loss account for 1999, 1998 and 1997 (in SKK ’000)<br />

Interest and related income from banks 679,299 961,385 784,385<br />

Interest and fees received from customers 1,277,716 1,284,465 848,773<br />

Interest and fees payable to banks -229,871 -500,898 -526,761<br />

Interest and fees payable to customers -1,318,688 -1,264,476 -725,756<br />

Net interest income 408,456 480,476 380,641<br />

Foreign exchange income (net) 319,954 288,398 260,992<br />

Income from securities (net) 383,898 298,576 90,782<br />

O<strong>the</strong>r operating income (net) -168,144 -140,527 -79,794<br />

Operating result 944,164 926,923 652,621<br />

General and administrative expenses -597,946 -459,357 -378,313<br />

Increase in general loan loss provision -125,540 -46,312 -21,426<br />

Increase in specific provisions for loans 6,400 -155,963 -54,473<br />

Decrease/Increase to o<strong>the</strong>r reserves -449 54 -56<br />

Income tax 10 0 0 -20,012<br />

Extraordinary income 4,658 4,769 55,245<br />

Extraordinary expenses -17,747 -9,088 -71,977<br />

Net Pr<strong>of</strong>it 213,540 261,026 161,609<br />

These figures have been obtained from<br />

<strong>the</strong> statutory Pr<strong>of</strong>it and Loss Account for<br />

<strong>the</strong> year ended 31 December 1999,<br />

prepared in accordance with Slovak<br />

accounting regulations.<br />

21 February 2000<br />

57<br />

Annual Report 1999

58<br />

1. General Information<br />

ªUDOVÁ BANKA, a. s. was incorporated<br />

and commenced trading in 1991.<br />

By 31 December 1999, <strong>the</strong> Bank had<br />

opened branches in Bratislava, Galanta,<br />

·aºa, Nitra, Poprad, Ko‰ice, Trenãín,<br />

Îilina, Luãenec, RuÏomberok and Banská<br />

Bystrica.<br />

The Bank has <strong>the</strong> following principal activities:<br />

• Maintenance <strong>of</strong> Slovak crown and foreign<br />

currency accounts<br />

• Domestic and foreign payments<br />

• Granting <strong>of</strong> loans<br />

• Money market activities in Slovak crowns<br />

and foreign curencies<br />

2. Accounting Policies<br />

The financial statements for <strong>the</strong> year<br />

ended 31 December 1999 were prepared<br />

in accordance with <strong>the</strong> relevant Slovak<br />

accounting regulations.<br />

a) Accounting Records<br />

The Bank maintains accounting records<br />

and prepares regular financial reports in<br />

accordance with regulations applicable<br />

to Slovak banks.<br />

b) Tangible and intangible fixed assets<br />

Tangible and intangible fixed assets are<br />

stated at acquisition cost less depreciation.<br />

Depreciation is provided using <strong>the</strong><br />

straight line method at rates set out in<br />

<strong>the</strong> current provisions <strong>of</strong> § 31 <strong>of</strong> Act<br />

286/1992 on Income Tax, with <strong>the</strong> exception<br />

<strong>of</strong> motor vehicles for which depreciation<br />

is provided using <strong>the</strong> reducing<br />

balance method at <strong>the</strong> current rate<br />

set out in <strong>the</strong> Act.<br />

c) Foreign currencies<br />

Foreign currency transactions are translated<br />

to Slovak Crowns in accordance<br />

with § 24 <strong>of</strong> Act 563/91 on Accounting<br />

using exchange rates prevailing on <strong>the</strong><br />

date <strong>of</strong> <strong>the</strong> transaction quoted by <strong>the</strong><br />

National Bank <strong>of</strong> Slovakia („NBS”). On<br />

31 December 1999 assets and liabilities<br />

denominated in foreign currencies were<br />

translated to Slovak Crowns using closing<br />

exchange rates quoted by <strong>the</strong> NBS.<br />

Notes to <strong>the</strong> Financial Statements<br />

d) Loans and advances<br />

Loans and advances to customers and<br />

banks are stated net <strong>of</strong> specific provisions.<br />

Such provisions are determined<br />

based on <strong>the</strong> classification <strong>of</strong> such loans<br />

and advances in accordance with <strong>the</strong><br />

guidelines issued by <strong>the</strong> NBS. In addition,<br />

a general reserve is made to cover<br />

losses which are present in <strong>the</strong> loan portfolio<br />

but which have not yet been specifically<br />

identified. This reserve is calculated<br />

in accordance with existing tax legislation.<br />

e) Securities<br />

Securities are stated at cost less provisions.<br />

Treasury bills are stated at nominal<br />

value. The differences between<br />

purchase cost and redemption value are<br />

amortized on a straight line basis to <strong>the</strong><br />

pr<strong>of</strong>it and loss account over <strong>the</strong> period<br />

to maturity. Specific provision is made<br />

for any diminution in value.

Notes to <strong>the</strong> Financial Statements<br />

3. Salaries and O<strong>the</strong>r Personnel Costs<br />

Salaries and o<strong>the</strong>r personnel costs include: (in SKK mill.) 1999 1998<br />

Salaries 131,516 104,267<br />

O<strong>the</strong>r 2,085 1,578<br />

Social security costs 39,762 32,632<br />

6. Tangible and Intangible Assets<br />

173,363 138,477<br />

Average number <strong>of</strong> employees during <strong>the</strong> year 424 366<br />

4. Loans and Advances<br />

Loans and Advances (SKK ’000) up to 3 m. up to 1 y. up to 5 y. over 5 y. 1999 1998<br />

Due from banks 1,262,913 1,262,913 645,450<br />

Term deposits 6,909,414 46,704 6,956,118 6,328,034<br />

Total banks 8,172,327 46,704 8,219,031 6,973,484<br />

Loans and advances to customers 2,500,462 897,687 2,601,666 430,858 6,430,673 7,648,522<br />

5. Securities<br />

Securities (SKK ’000) 1999 1998<br />

Treasury bills 1,580,000 900,000<br />

State bonds 2,411,436 1,520,348<br />

O<strong>the</strong>r bonds 586,246 992,772<br />

Total 4,577,682 3,413,120<br />

Movements during <strong>the</strong> year were as follows: (in SKK mill.)<br />

Land and Office<br />

Buildings equipment Vehicles S<strong>of</strong>tware Total<br />

Cost<br />

1. 1. 1999 440,577 374,384 15,131 71,177 901,269<br />

Additions 107,165 72,300 3,104 18,729 201,298<br />

31. 12. 1999<br />

Accumulated depreciation<br />

547,742 446,684 18,235 89,906 1,102,567<br />

1. 1. 1999 21,394 190,467 10,807 19,381 242,049<br />

Depreciation 12,116 54,325 2,333 20,215 88,989<br />

31. 12. 1999<br />

Net book value<br />

33,510 244,792 13,140 39,596 331,038<br />

1. 1. 1999 419,183 183,917 4,324 51,796 659,220<br />

31. 12. 1999 514,232 201,892 5,095 50,310 771,529<br />

In addition at 31 December 1999 <strong>the</strong> Bank had acquired assets at a cost <strong>of</strong> Sk 33,584 million which had not yet been put into use<br />

(1997: Sk 31,510 million).<br />

59<br />

Annual Report 1999

60<br />

7. Due to Banks and Customers<br />

In accordance with <strong>the</strong> Commercial Code, Act No. 513/91, 5% <strong>of</strong> <strong>the</strong> annual pr<strong>of</strong>it<br />

after taxation is transferred to <strong>the</strong> legal reserve fund. The transfer to <strong>the</strong> legal reserve<br />

fund in respect <strong>of</strong> 1999 will be made following approval <strong>of</strong> <strong>the</strong> Annual General Meeting.<br />

The revaluation difference arising on investments denominated in foreign currency<br />

is Sk 0,063 million.<br />

10. Taxation<br />

The pr<strong>of</strong>it before taxation for 1999 amounted<br />

to SKK 214 million. The tax computation<br />

resulted in a loss and <strong>the</strong>refore<br />

<strong>the</strong>re is no tax liability so <strong>the</strong> pr<strong>of</strong>it after<br />

taxation was SKK 214 million.<br />

11. Assets and Liabilities<br />

in Foreign Currencies<br />

Assets and liabilities denominated in foreign<br />

currencies included in <strong>the</strong> balance<br />

sheet were as follows:<br />

Notes to <strong>the</strong> Financial Statements<br />

Due to Banks and Customers (in SKK ’000) up to 3 m. up to 1 y. up to 5 y. over 5 y. 1999 1998<br />

Due to banks 126,261 126,261 66,983<br />

Term deposits 2,245,290 2,245,290 1,902,300<br />

Total banks 2,371,551 2,371,551 1,969,283<br />

Current accounts 5,762,915 5,762,915 5,399,153<br />

Term deposits 7,573,621 1,250,593 162,498 8,986,712 8,299,948<br />

Saving books 1,122,679 1,424,459 282,895 2,830,033 2,686,722<br />

Customers 14,459,215 2,675,052 445,393 17,579,660 16,385,823<br />

8. Contingent Liabilities<br />

The Bank has contingent liabilities<br />

arising from <strong>the</strong> provision <strong>of</strong> guarantees<br />

and letters <strong>of</strong> credit totalling SKK<br />

575 million.<br />

9. Reserves and Reserve funds<br />

a) Reserves<br />

At 31 December 1999 <strong>the</strong>re was a reserve<br />

<strong>of</strong> SKK 262 million, which was<br />

intended to cover general risks arising<br />

from banking activities. The reserve was<br />

calculated in accordance with sections 5<br />

and 8 <strong>of</strong> Act No. 610/92 on tax deductible<br />

reserves.<br />

b) Reserve Funds<br />

The reserve funds consist <strong>of</strong>:<br />

Reserve Funds (in SKK mill.)<br />

Legal Share O<strong>the</strong>r Total<br />

reserve premium reserve<br />

fund account fund<br />

1. 1. 1999 23,915 179,694 34,506 238,115<br />

Additions 13,052 13,052<br />

31. 12. 1999 36,967 179,694 34,506 251,167<br />

Assets and Liabilities in Foreign Currencies (in SKK mill.) 1999 1998<br />

Assets 6,315,306 6,124,514<br />

Liabilities 6,168,437 6,225,375

Cash flow<br />

(in SKK ’000) 1999 1998<br />

Cash flows from operating activities<br />

Pr<strong>of</strong>it on ordinary activities before tax 213,540 261,026<br />

Adjustments for:<br />

Provision for credit losses -6,400 155,963<br />

Reserve for general banking risks 125,991 46,239<br />

Depreciation 88,988 85,546<br />

Operating pr<strong>of</strong>it before changes in operating assets and liabilities 422,119 548,774<br />

(Increase)/decrease in operating assets<br />

Due from banks -628,084 -2,921,087<br />

Due from customers 1,217,849 -1,729,081<br />

O<strong>the</strong>r assets 50,635 -44,616<br />

Prepayments and accrued income -108,239 -268,180<br />

Increase/(decrease) in operating liabilities<br />

Due to banks 402,268 407,453<br />

Due to customers 1,193,837 4,246,348<br />

O<strong>the</strong>r liabilities 69,876 65,483<br />

Accruals and deferred income -42,826 -290,708<br />

Net cash flow from operating activities before income tax 2,577,435 14,386<br />

Income taxes paid 0 0<br />

Net cash flow from operating activities 2,577,435 14,386<br />

Cash flows from investing activities<br />

Purchase <strong>of</strong> participating interest -11,589 -12,079<br />

Purchase <strong>of</strong> tangible fixed assets -203,372 -124,474<br />

Fixed interest securities -478,379 -1,363,669<br />

Net cash flow from investing activities -693,340 -1,500,222<br />

Cash flows from financing activities<br />

(Decrease)/Increase in share capital and o<strong>the</strong>r capital funds -11 79<br />

Dividends paid -61,965 -61,965<br />

Net cash flow from financing activities -61,976 -61,886<br />

Net increase in cash and cash equivalents 1,822,119 -1,547,722<br />

Cash and cash equivalents at <strong>the</strong> beginning <strong>of</strong> <strong>the</strong> year 2,981,426 4,529,148<br />

Cash and cash equivalents at <strong>the</strong> end <strong>of</strong> <strong>the</strong> year 4,803,545 2,981,426<br />

61<br />

Annual Report 1999

62<br />

Report <strong>of</strong> <strong>the</strong> Auditors

Report <strong>of</strong> <strong>the</strong> Supervisory Board<br />

The Supervisory Board <strong>of</strong> ª U D O V Á B A N K A, a. s.<br />

at its meeting on April 13, 2000, reviewed <strong>the</strong> submitted<br />

financial statements for <strong>the</strong> year ended December 31, 1999 and came<br />

to <strong>the</strong> following conclusions:<br />

Pursuant to Section 21 (3) <strong>of</strong> <strong>the</strong> Articles <strong>of</strong> Association <strong>the</strong> Supervisory Board unanimously approves<br />

<strong>the</strong> financial statements for <strong>the</strong> financial year 1999 audited by KPMG Slovensko spol. s r.o., Bratislava.<br />

The Board <strong>of</strong> Directors proposed, <strong>the</strong> Supervisory Board has decided to submit<br />

to <strong>the</strong> General Assembly <strong>of</strong> ªUDOVÁ BANKA, a. s. to be held on April 13, 2000, <strong>the</strong> following<br />

distribution <strong>of</strong> pr<strong>of</strong>its for 1999 SKK 213,540,186.94<br />

• 5% contribution to Reserve Fund as required by Law SKK 10,677,010.00<br />

• Payment <strong>of</strong> dividends SKK 61,965,000.00<br />

ordinary shares (SKK 490,— /share)<br />

preference shares (SKK 487,50 /share)<br />

• Retained pr<strong>of</strong>it SKK 140,898,176.94<br />

General Management Director<br />

Klaus Thalhammer<br />

President <strong>of</strong> Supervisory Board<br />

Bratislava, April 13, 2000<br />

63<br />

Annual Report 1999