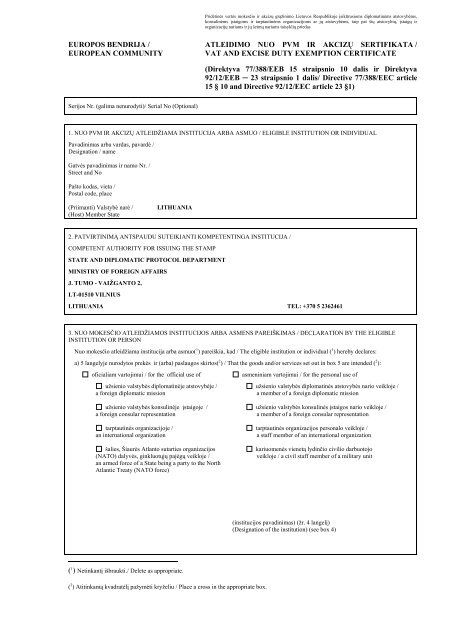

EUROPOS BENDRIJA / ATLEIDIMO NUO PVM IR AKCIZŲ ...

EUROPOS BENDRIJA / ATLEIDIMO NUO PVM IR AKCIZŲ ...

EUROPOS BENDRIJA / ATLEIDIMO NUO PVM IR AKCIZŲ ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Pridėtinės vertės mokesčio ir akcizų grąžinimo Lietuvos Respublikoje įsikūrusioms diplomatinėms atstovybėms,<br />

konsulinėms įstaigoms ir tarptautinėms organizacijoms ar jų atstovybėms, taip pat šių atstovybių, įstaigų ir<br />

organizacijų nariams ir jų šeimų nariams taisyklių priedas<br />

<strong>EUROPOS</strong> <strong>BENDRIJA</strong> / <strong>ATLEIDIMO</strong> <strong>NUO</strong> <strong>PVM</strong> <strong>IR</strong> <strong>AKCIZŲ</strong> SERTIFIKATA /<br />

EUROPEAN COMMUNITY VAT AND EXCISE DUTY EXEMPTION CERTIFICATE<br />

Serijos Nr. (galima nenurodyti)/ Serial No (Optional)<br />

(Direktyva 77/388/EEB 15 straipsnio 10 dalis ir Direktyva<br />

92/12/EEB ─ 23 straipsnio 1 dalis/ Directive 77/388/EEC article<br />

15 § 10 and Directive 92/12/EEC article 23 §1)<br />

1. <strong>NUO</strong> <strong>PVM</strong> <strong>IR</strong> <strong>AKCIZŲ</strong> ATLEIDŽIAMA INSTITUCIJA ARBA ASMUO / ELIGIBLE INSTITUTION OR INDIVIDUAL<br />

Pavadinimas arba vardas, pavardė /<br />

Designation / name<br />

Gatvės pavadinimas ir namo Nr. /<br />

Street and No<br />

Pašto kodas, vieta /<br />

Postal code, place<br />

(Priimanti) Valstybė narė / LITHUANIA<br />

(Host) Member State<br />

2. PATV<strong>IR</strong>TINIMĄ ANTSPAUDU SUTEIKIANTI KOMPETENTINGA INSTITUCIJA /<br />

COMPETENT AUTHORITY FOR ISSUING THE STAMP<br />

STATE AND DIPLOMATIC PROTOCOL DEPARTMENT<br />

MINISTRY OF FOREIGN AFFA<strong>IR</strong>S<br />

J. TUMO - VAIŽGANTO 2,<br />

LT-01510 VILNIUS<br />

LITHUANIA TEL: +370 5 2362461<br />

3. <strong>NUO</strong> MOKESČIO ATLEIDŽIAMOS INSTITUCIJOS ARBA ASMENS PAREIŠKIMAS / DECLARATION BY THE ELIGIBLE<br />

INSTITUTION OR PERSON<br />

Nuo mokesčio atleidžiama institucija arba asmuo( 1 ) pareiškia, kad / The eligible institution or individual ( 1 ) hereby declares:<br />

a) 5 langelyje nurodytos prekės ir (arba) paslaugos skirtos( 2 ) / That the goods and/or services set out in box 5 are intended ( 2 ):<br />

oficialiam vartojimui / for the official use of asmeniniam vartojimui / for the personal use of<br />

užsienio valstybės diplomatinėje atstovybėje / užsienio valstybės diplomatinės atstovybės nario veikloje /<br />

a foreign diplomatic mission a member of a foreign diplomatic mission<br />

užsienio valstybės konsulinėje įstaigoje / užsienio valstybės konsulinės įstaigos nario veikloje /<br />

a foreign consular representation a member of a foreign consular representation<br />

tarptautinės organizacijoje / tarptautinės organizacijos personalo veikloje /<br />

an international organization a staff member of an international organization<br />

šalies, Šiaurės Atlanto sutarties organizacijos kariuomenės vienetą lydinčio civilio darbuotojo<br />

(NATO) dalyvės, ginkluotųjų pajėgų veikloje / veikloje / a civil staff member of a military unit<br />

an armed force of a State being a party to the North<br />

Atlantic Treaty (NATO force)<br />

( 1 ) Netinkantį išbraukti./ Delete as appropriate.<br />

( 2 ) Atitinkamą kvadratėlį pažymėti kryželiu / Place a cross in the appropriate box.<br />

(institucijos pavadinimas) (žr. 4 langelį)<br />

(Designation of the institution) (see box 4)

) 5 langelyje apibūdintos prekės ir (ar) paslaugos atitinka atleidimo nuo <strong>PVM</strong> ir/ar akcizų sąlygas ir apribojimus, taikomus 1 langelyje<br />

paminėtoje priimančioje valstybėje narėje, ir /<br />

that the goods and/or services described at box 5 comply with the conditions and limitations applicable to VAT and Excise duty<br />

exemption in the host Member State mentioned in box 1, and<br />

c) čia pateikti duomenys nurodyti sąžiningai. Nuo mokesčio atleidžiama institucija arba asmuo įsipareigoja sumokėti valstybei narei, iš<br />

kurios išsiųstos prekės ir (ar) paslaugos, <strong>PVM</strong> ir/ar akcizo mokestį, kurį reikėtų sumokėti, jei šios prekės ir (ar) paslaugos netenkintų<br />

atleidimo nuo mokesčių sąlygų arba jei šios prekės ir (ar) paslaugos būtų vartojamos ne pagal paskirtį /<br />

that the information above is furnished in good faith. The eligible institution or individual hereby undertakes to pay the Member<br />

State from which the goods were dispatched, the VAT and/or excise duty which would be due if goods and/or services did not<br />

comply with the conditions of exemption, or if goods and/or services were not used in the matter intended.<br />

VILNIUS, May 2, 2007<br />

Vieta, data / Place, date Pasirašančiojo vardas, pavardė (pavadinimas)<br />

ir pareigos / Name and status of signatory<br />

………………………………………………<br />

Parašas / Signature<br />

4. PATV<strong>IR</strong>TINIMAS INSTITUCIJOS ANTSPAUDU (kai nuo mokesčio atleidžiamos prekės ir (ar) paslaugos skirtos asmeniniam<br />

vartojimui) / STAMP OF THE INSTITUTION (in case of exemption for personal use)<br />

VILNIUS / May 2, 2007<br />

Vieta, data / Place, date Pasirašančiojo vardas, pavardė (pavadinimas) ir pareigos /<br />

Name and status of signatory<br />

Antspaudas /<br />

Stamp<br />

….………………………………………………………..<br />

Parašas / Signature<br />

5. SIUNČIAMŲ PREKIŲ <strong>IR</strong> (AR) PASLAUGŲ, KURIAS PRAŠOMA ATLEISTI <strong>NUO</strong> <strong>PVM</strong> <strong>IR</strong>/AR <strong>AKCIZŲ</strong>, APRAŠYMAS /<br />

DESCRIPTION OF THE DISPATCHED GOODS AND/OR SERVICES, FOR WHICH THE EXEMPTION FROM VAT AND/OR<br />

EXCISE DUTY IS REQUESTED<br />

A. Duomenys apie įgaliotąjį akcizais apmokestinamų prekių sandėlio savininką/prekių ir/ar paslaugų tiekėją / Information about the<br />

authorized warehousekeeper / supplier of goods and/or services:<br />

1. Vardas, pavardė (pavadinimas) ir adresas /<br />

Name and address<br />

2. Valstybė narė /<br />

Member State<br />

3. Akcizo Nr. / <strong>PVM</strong> mokėtojo kodas<br />

VAT / excise payer number<br />

B. Duomenys apie prekes ir (ar) paslaugas / Information concerning the goods and / or services<br />

Nr.<br />

Išsamus prekių ir (ar) paslaugų<br />

apibūdinimas ( 3 ) (arba nuoroda į<br />

pridedamą užsakymo formą) / Detailed<br />

description of goods and/or services ( 3 )<br />

(or reference to the attached order form)<br />

Kiekis arba<br />

skaičius /<br />

Quantity or<br />

Vertė be <strong>PVM</strong> ir / ar akcizo<br />

mokesčio / Value excluding VAT<br />

and/or excise duty<br />

number vieneto vertė /<br />

Value per Unit<br />

bendra vertė /<br />

Total value<br />

Valiuta / Currency<br />

( 3 ) Neužpildytą langelio plotą išbraukti. Šis reikalavimas taip pat taikomas užsakymų formoms, jei jos pridedamos / Delete space not used.<br />

This obligation also applies if order forms are attached.

Bendra suma /<br />

Total value<br />

6. PRIIMANČIOS VALSTYBĖS NARĖS KOMPETENTINGOS INSTITUCIJOS PATV<strong>IR</strong>TINIMAS / CERTIFICATION BY THE<br />

COMPETENT AUTHORITY OF THE HOST MEMBER STATE<br />

5 langelyje aprašytos prekės ir (ar) paslaugos / the consigment of goods and/or services described in box 5<br />

visiškai / totally<br />

iki tam tikro kiekio ………………………………………………. (skaičius) ( 4 ) / up to a quantity of ….(number) ( 4 )<br />

atitinka atleidimo nuo <strong>PVM</strong> ir/ar akcizų sąlygas / meets the conditions for exemption from VAT and/or excise duty.<br />

VILNIUS, ……………………….… …………………………………………….………..<br />

Vieta, data / Place, date Pasirašančiojo vardas, pavardė (pavadinimas)<br />

ir pareigos / Name and status of signatory<br />

………….…………………………………………..<br />

Parašas / Signatory<br />

7. LEIDIMAS APSIEITI BE ANTSPAUDO / PERMISSION TO DISPENSE WITH STAMP (tik tuo atveju, kai nuo mokesčio atleidžiamos<br />

prekės skirtos oficialiam vartojimui / only in case of exemption for official use)<br />

Raštu Nr. / By letter No .………………………………………………………, pažymėtu / of …….………….………………….. data / date,<br />

(nurodyti rašto Nr./ reference to file) (nurodyti datą / date)<br />

…………………………………………………………....……………………. buvo suteiktas leidimas, kurį išdavė / has been permitted by<br />

(nurodyti nuo mokesčio atleidžiamos institucijos, kuriai suteiktas<br />

leidimas, pavadinimą) / (designation of eligible institution)<br />

………………………….………………………………, apsieiti be antspaudo 6 langelio apačioje / to dispense with the stamp under box 6.<br />

(priimančios valstybės kompetentingos institucijos pavadinimas)<br />

(designation of the competent authority in the host Member State)<br />

..………………………………………… ……….……………..……………………………………….………..<br />

Vieta, data / Place, date Pasirašančiojo vardas, pavardė (pavadinimas)<br />

ir pareigos / Name and status of signatory<br />

Antspaudas<br />

Stamp<br />

……………………………….<br />

Parašas / Signature<br />

( 4 ) Prekės ir (ar) paslaugos, kurioms netaikomas atleidimas nuo mokesčių, turėtų būti iš 5 langelio išbrauktos / Goods and/or services not<br />

eligible should be deleted in box 5.

Explanatory notes<br />

1. For the authorized warehousekeeper, this certificate serves as a supporting document for the<br />

tax exemption of the consignments of goods to eligible institutions/individuals referred to in<br />

Article 23 (1), of Directive 92/12/EEC. Accordingly, one certificate shall be drawn up for each<br />

warehousekeeper. Moreover, the warehousekeeper is required to keep this certificate as part of<br />

his records in accordance with the legal provisions applicable in his Member State.<br />

2. (a) The general specification of the paper to be used is as laid down in the Official Journal<br />

of the European Communities No C 164 of 1. 7. 1989.<br />

The paper is to be white for all copies and should be 210 millimetres by 297 millimetres with a<br />

maximum tolerance of 5 millimetres less or 8 millimetres more with regard to their length.<br />

The exemption certificate shall be drawn up in duplicate:<br />

- one copy to be kept by the consignor,<br />

- one copy to accompany the administrative accompanying document.<br />

(b) Any unused space in box 5.B is to be crossed out so that nothing can be added.<br />

(c) The document must be completed legibly and in a manner that makes entries indelible. No<br />

erasures or overwriting are permitted. It shall be completed in a language recognized by the<br />

host Member State.<br />

(d) If the description of the goods (box 5.B of the certificate) refers to a purchase order form<br />

drawn up in a language other than a language recognized by the host Member State, a<br />

translation must be attached by the eligible institution/individual.<br />

(e) On the other hand, if the certificate is drawn up in a language other than a language<br />

recognized by the Member State of the warehousekeeper, a translation of the information<br />

concerning the goods in box 5.B must be attached by the eligible institution/individual.<br />

(f) A recognized language means one of the languages officially in use in the Member State or<br />

any other official language of the Community which the Member State declares can be used<br />

for this purpose.<br />

3. By its declaration in box 3 of the certificate, the eligible institution/individual provides the<br />

information necessary for the evaluation of the request for exemption in the host Member<br />

State.<br />

4. By its declaration in box 4 of the certificate, the institution confirms the details in boxes 1<br />

and 3 (a) of the document and certifies that the eligible individual is a staff member of the<br />

institution.<br />

5. (a) The reference to the purchase order form (box 5.B of the certificate) must contain at least<br />

the date and order number. The order form should contain all the elements that figure at box 5<br />

of the certificate. If the certificate has to be stamped by the competent authority of the host<br />

Member State, the order form shall also be stamped.<br />

(b) The indication of the excise No as defined in Article 15 (a), paragraph 2 (a), of Directive<br />

92/12/EEC of the authorized warehousekeeper is optional.<br />

(c) The currencies should be indicated by means of a three-letter code in conformity with the

international ISOIDIS 4127 standard established by the International Standards Organization<br />

(1).<br />

6. The abovementioned declaration by the eligible institution/individual shall be authenticated<br />

at box 6 by the stamp of the competent authority of the host Member State. That authority can<br />

make its approval dependent on the agreement of another authority in its Member State. It is<br />

up to the competent tax authority to obtain such agreement.<br />

7. To simplify the procedure, the competent authority can dispense with the obligation on the<br />

eligible institution to ask for the stamp in the case of exemption for official use. The eligible<br />

institution should mention this dispensation at box 7 of the certificate.<br />

(1) As an indication, some codes relating to currencies currently used: BEF (Belgian franc),<br />

DEM (German mark), DKK (Danish kroner), ESP (Spanish peseta), FRF (French franc), GBP<br />

(Pound sterling), GRD (Greek drachma), IEP (Irish pound), ITL (Italian lire), LUF<br />

(Luxembourg franc), NLG (Dutch guilder), PTE (Portuguese escudo), ATS (Austrian<br />

schilling), FIM (Finnish mark), SEK (Swedish kroner), USD (United States dollar).