2004-2005 Annual Budget - Laredo Independent School District

2004-2005 Annual Budget - Laredo Independent School District

2004-2005 Annual Budget - Laredo Independent School District

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Laredo</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>Laredo</strong>, Texas<br />

<strong>2004</strong>-<strong>2005</strong> <strong>Annual</strong> <strong>Budget</strong><br />

For Fiscal Year<br />

September 1, <strong>2004</strong> – August 31, <strong>2005</strong><br />

Issued by:<br />

Jesus J. Amezcua, CPA, Chief Financial Officer<br />

Rosa Maria Torres, Director of Financial Management<br />

Jorgannie Garza, Accounting & <strong>Budget</strong> Facilitator

<strong>2004</strong>-<strong>2005</strong> ANNUAL BUDGET<br />

TABLE OF CONTENTS<br />

PAGE<br />

CITIZEN’S GUIDE TO OUR BUDGET.................................................................................................. v<br />

RECOGNITION ........................................................................................................................................ vi<br />

INTRODUCTORY SECTION<br />

Board of Trustees & Administrative Officials................................................................................. 1<br />

Consultants & Advisors ................................................................................................................... 2<br />

Executive Summary......................................................................................................................... 3<br />

Distinguished <strong>Budget</strong> Presentation Award .................................................................................... 16<br />

ORGANIZATIONAL SECTION<br />

About <strong>Laredo</strong> ISD.......................................................................................................................... 17<br />

Organizational Structure Chart ...................................................................................................... 18<br />

Our Mission, Vision, and Beliefs................................................................................................... 21<br />

Superintendent’s Priority Goals..................................................................................................... 22<br />

Goals and Objectives (Strategic Improvement Plan 2000-<strong>2005</strong>)................................................... 23<br />

The Financial Plan within the Strategic Plan................................................................................. 26<br />

<strong>Budget</strong> Administration and Financial Policies............................................................................... 27<br />

<strong>Budget</strong> Development Process ........................................................................................................ 35<br />

<strong>2004</strong>-<strong>2005</strong> <strong>Budget</strong> Calendar .......................................................................................................... 40<br />

<strong>2004</strong>-<strong>2005</strong> Tax Planning Calendar ................................................................................................ 43<br />

<strong>Budget</strong>ary Control & Basis of Accounting.................................................................................... 44<br />

FINANCIAL SECTION<br />

All Funds Structure Diagram......................................................................................................... 49<br />

Governmental Fund Types and Overall Summaries ...................................................................... 50<br />

General Funds ................................................................................................................................ 55<br />

General Operating Fund .......................................................................................................... 59<br />

Child Nutrition Program Fund ................................................................................................ 65<br />

Athletics Fund ......................................................................................................................... 69<br />

Special Revenue Funds.................................................................................................................. 72<br />

Debt Service Fund ......................................................................................................................... 84<br />

Debt Management Policies...................................................................................................... 88<br />

Legal Debt Limits.................................................................................................................... 90<br />

Capital Projects Funds ................................................................................................................... 91<br />

Capital Investment Plan........................................................................................................... 98<br />

INFORMATIONAL SECTION<br />

Major Revenue Sources – General Operating Fund and Debt Service Fund............................... 103<br />

Major Revenue Assumptions – General Operating Fund ............................................................ 107<br />

Trends and Forecasts.................................................................................................................... 108<br />

<strong>Budget</strong> Forecasts ......................................................................................................................... 110<br />

Appraisal Roll and Property Tax Values ..................................................................................... 115<br />

Comparison of Property Tax Rates and Tax Levies with Local Entities..................................... 116<br />

LISD Property Tax Rates and Tax Levies ................................................................................... 117<br />

LISD Property Tax Levies and Collections ................................................................................. 118<br />

i

Analysis of the <strong>Budget</strong>’s Effect on Taxpayers............................................................................. 120<br />

Ratio of <strong>Annual</strong> Debt Service Expenditures for General Bonded Debt to Total General<br />

Expenditures ................................................................................................................................ 121<br />

Outstanding Debt Amortization Schedules.................................................................................. 122<br />

Ratio of <strong>Annual</strong> Debt Service Expenditures for General Bonded Debt to Total Expenditures ... 124<br />

Ratio of Net General Bonded Debt to Net Bonded Debt per ADA ............................................. 125<br />

General Governmental Expenditures by Function....................................................................... 126<br />

General Governmental Expenditures per ADA by Function ....................................................... 127<br />

General Governmental Revenues by Source ............................................................................... 128<br />

General Governmental Revenues per ADA by Source................................................................ 129<br />

Administrative Cost Ratio............................................................................................................ 130<br />

Summary of Personnel................................................................................................................. 131<br />

Student Profile Historical Data and Projections .......................................................................... 134<br />

Student Enrollment Historical Data and Projections ................................................................... 136<br />

2003 TAKS Results and TAAS Testing Results History ............................................................ 137<br />

<strong>Annual</strong> Dropout and Attendance Rates........................................................................................ 142<br />

Student Demographics/Composition ........................................................................................... 143<br />

Community Profile ...................................................................................................................... 144<br />

Top Employers................................................................................................................ 146<br />

LISD Principal Taxpayers .............................................................................................. 146<br />

CAMPUS PROFILES<br />

Overview of Campuses Section ................................................................................................... 153<br />

<strong>2004</strong>-<strong>2005</strong> Campus Directory...................................................................................................... 154<br />

001 – Raymond & Tirza Martin High <strong>School</strong>.............................................................................. 155<br />

002 – J.W. Nixon High <strong>School</strong> .................................................................................................... 156<br />

003 – Dr. Leo Cigarroa High <strong>School</strong> ........................................................................................... 157<br />

004 – Vidal M. Treviño Communications & Fine Arts <strong>School</strong> ................................................... 158<br />

006 – Pregnancy, Education, and Parenting ................................................................................ 159<br />

007 – F.S. Lara Academy ............................................................................................................ 160<br />

041 – L.S. Christen Middle <strong>School</strong>.............................................................................................. 161<br />

042 – Lamar Middle <strong>School</strong> ........................................................................................................ 162<br />

043 – Joaquin Cigarroa Middle <strong>School</strong> ....................................................................................... 163<br />

044 – Memorial Middle <strong>School</strong> ................................................................................................... 164<br />

101 – Bruni Elementary <strong>School</strong>................................................................................................... 165<br />

102 – Buenos Aires Elementary <strong>School</strong> ...................................................................................... 166<br />

104 – Daiches Elementary <strong>School</strong> ............................................................................................... 167<br />

105 – Farias Elementary <strong>School</strong> .................................................................................................. 168<br />

106 – Heights Elementary <strong>School</strong>................................................................................................ 169<br />

107 – K. Tarver Elementary <strong>School</strong> ............................................................................................ 170<br />

108 – Leyendecker Elementary <strong>School</strong> ....................................................................................... 171<br />

109 – Macdonell Elementary <strong>School</strong>........................................................................................... 172<br />

110 – Milton Elementary <strong>School</strong> ................................................................................................. 173<br />

111 – Alma Pierce Elementary <strong>School</strong> ........................................................................................ 174<br />

112 – Ryan Elementary <strong>School</strong>.................................................................................................... 175<br />

115 – Santa Maria Elementary <strong>School</strong>......................................................................................... 176<br />

116 – Santo Niño Elementary <strong>School</strong>.......................................................................................... 177<br />

119 – D.D. Hachar Elementary <strong>School</strong>........................................................................................ 178<br />

120 – J.C. Martin Elementary <strong>School</strong>.......................................................................................... 179<br />

121 – Zachry Elementary <strong>School</strong>................................................................................................. 180<br />

122 – J. Kawas Elementary <strong>School</strong>.............................................................................................. 181<br />

ii

123 – Dovalina Elementary <strong>School</strong> ............................................................................................. 182<br />

124 – H. Ligarde Elementary <strong>School</strong>........................................................................................... 183<br />

125 – Sanchez/Ochoa Elementary <strong>School</strong> ................................................................................... 184<br />

DISTRICT DEPARTMENTS<br />

Departments Description ............................................................................................................. 185<br />

701 – Superintendent’s Office ..................................................................................................... 192<br />

702 – Board of Trustees............................................................................................................... 193<br />

703 – Tax Office .......................................................................................................................... 194<br />

726 – Risk Management .............................................................................................................. 195<br />

727 – Financial Management....................................................................................................... 196<br />

728 – Human Resources .............................................................................................................. 197<br />

729 – Procurement ....................................................................................................................... 199<br />

730 – Office of Communications................................................................................................. 200<br />

731 – Safety & Occupational Health ........................................................................................... 201<br />

732 – Student Services................................................................................................................. 202<br />

733 – Internal Auditor.................................................................................................................. 203<br />

735 – Hearings Officer................................................................................................................. 204<br />

736 – Fixed Assets....................................................................................................................... 205<br />

737 – Textbooks & Records Management................................................................................... 206<br />

800 – State Compensatory Education .......................................................................................... 207<br />

802 – State Bilingual.................................................................................................................... 208<br />

803 – JROTC ............................................................................................................................... 209<br />

804 – Office of Compliance......................................................................................................... 210<br />

805 – Fine Arts ............................................................................................................................ 211<br />

806 – Elementary Physical Education ......................................................................................... 212<br />

807 – At Risk Program ................................................................................................................ 213<br />

808 – English Language Arts....................................................................................................... 214<br />

809 – Project TEAMS.................................................................................................................. 215<br />

810 – Special Projects.................................................................................................................. 216<br />

811 – Instructional Technology ................................................................................................... 217<br />

812 – MED PREP Program ......................................................................................................... 218<br />

813 – Social Studies..................................................................................................................... 219<br />

834 – Secondary Instruction ........................................................................................................ 220<br />

835 – Elementary Instruction....................................................................................................... 221<br />

836 – Gifted and Talented............................................................................................................ 222<br />

838 – Career and Technology ...................................................................................................... 223<br />

839 – Administration ................................................................................................................... 224<br />

840 – Assessment......................................................................................................................... 225<br />

842 – Reading Program ............................................................................................................... 226<br />

844 – Dyslexia – Section 504 ...................................................................................................... 227<br />

845 – University Interscholastic League...................................................................................... 227<br />

873 – Crime Stoppers Program.................................................................................................... 228<br />

874 – Guidance & Counseling..................................................................................................... 229<br />

876 – Health Services .................................................................................................................. 230<br />

877 – Pupil Transportation........................................................................................................... 231<br />

878 – Athletics ............................................................................................................................. 232<br />

879 – Special Education............................................................................................................... 233<br />

881 – Library Services................................................................................................................. 234<br />

882 – Printing & Creative Services ............................................................................................. 235<br />

883 – Instructional Television ..................................................................................................... 236<br />

iii

885 – Postal Services ................................................................................................................... 237<br />

934 – Information Technology .................................................................................................... 238<br />

936 – Division of Operations....................................................................................................... 239<br />

937 – Support Services ................................................................................................................ 240<br />

938 – Construction....................................................................................................................... 241<br />

943 – Police ................................................................................................................................. 242<br />

946 – Child Nutrition Program .................................................................................................... 243<br />

SUPPLEMENTARY INFORMATION<br />

TEA <strong>2004</strong>-<strong>2005</strong> Summary of Finances ....................................................................................... 245<br />

Analysis of FIRST Rating Elements for the <strong>2004</strong>-<strong>2005</strong> <strong>Annual</strong> <strong>Budget</strong>..................................... 250<br />

Minimum Required Expense Analysis of the General Operating Fund by Program Intent ........ 251<br />

AEIS Comparison of <strong>District</strong> Profiles ......................................................................................... 252<br />

Comparison of Operating Costs of Peer <strong>District</strong>s using Refined ADA by Function................... 255<br />

Resolution Levying a Tax Rate.................................................................................................... 256<br />

Webb County Appraisal <strong>District</strong> Affidavit .................................................................................. 257<br />

Webb County Appraisal <strong>District</strong> Valuation................................................................................. 258<br />

Region One <strong>School</strong> <strong>District</strong>s Preliminary CPTD Values............................................................. 259<br />

Comparison of Region I <strong>School</strong> <strong>District</strong>’s Tax Rates & Tax Levy ............................................. 260<br />

ACRONYMS........................................................................................................................................... 261<br />

GLOSSARY ............................................................................................................................................ 262<br />

iv

WHAT IS A DISTRICT BUDGET?<br />

The district budget is an annually revised document that describes the financial performance and the<br />

detailed financial allocations made to maintain district operations for the proposed budget year.<br />

WHAT IS THE PURPOSE OF A BUDGET?<br />

The objective of the budget is to communicate the financial plan about district operations to the public,<br />

the <strong>Laredo</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong> (LISD) Board of Trustees, and all members of the organization<br />

for each budget year.<br />

WHAT ARE PROPERTY TAXES?<br />

Property taxes are funds that are levied, assessed, and collected annually (ad valorem taxes) for the further<br />

maintenance of public schools in the district and to pay bonds issued by the school district.<br />

WHAT IS A TAX RATE?<br />

It is the amount of dollars levied per $100 of taxable value (after exemptions). The resulting amount is<br />

called Ad Valorem Taxes.<br />

WHAT IS AD VALOREM TAX?<br />

Ad Valorem Tax is the Property Tax (after exemptions) that is placed on all the property within the<br />

district’s jurisdiction. The appraised value is determined by the Webb County Appraisal <strong>District</strong>.<br />

HOW ARE PROPERTY TAXES CALCULATED?<br />

The taxable value (after exemptions) divided by 100 and multiplied by the tax rate:<br />

Average Appraised Value $ 56,000<br />

Less Homestead Exemption 15,000<br />

Total Taxable Value $ 41,000<br />

LISD Tax Rate $ 1.4741<br />

CITIZEN’S GUIDE TO OUR BUDGET<br />

$41,000 = $410 x $1.4741 = $604.38 Total Property Tax Due<br />

$100<br />

WHAT IS THE EFFECT OF A ONE PENNY INCREASE IN TAXES FOR A RESIDENTIAL OWNER?<br />

$410 x $1.4841 = $608.48<br />

$608.48 - $604.38 = $4.10 per year.<br />

WHERE CAN I GET ADDITIONAL INFORMATION ABOUT LISD AND THE DISTRICT BUDGET?<br />

• L.I.S.D. Web Page: http://www.laredoisd.org/<br />

• L.I.S.D. Office of Financial Management: http://www.laredoisd.org/departments/finance<br />

• Chief Financial Officer – Jesus J. Amezcua, C.P.A.<br />

o Contact by E-Mail: jamezcua@laredoisd.org<br />

o Write LISD Office of Financial Management:<br />

<strong>Laredo</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong>/ C/O CFO<br />

1702 Houston St.<br />

<strong>Laredo</strong>, Texas 78040<br />

v

We would like to acknowledge and thank the following Financial Management Department individuals<br />

who greatly contributed to the development and publishing of the <strong>Laredo</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>2004</strong>-<strong>2005</strong> <strong>Annual</strong> <strong>Budget</strong>:<br />

Noemi Abrego<br />

Oralia Aguilar<br />

Jesus J. Amezcua<br />

Alicia Cardenas<br />

Jorgannie Garza<br />

RECOGNITION<br />

Adelfa Kazen<br />

Cesar Martinez<br />

Joe Martinez<br />

Mirta Piña<br />

Melissa Rangel<br />

Valerie Reyes<br />

Alfredo Rocha<br />

Belinda Salazar<br />

Rosa Maria Torres<br />

Michelle Zamora<br />

We would also like to recognize the Information Technology Department for providing numerous reports<br />

and queries that assisted in the development of this budget, the Human Resources and Tax Office<br />

Departments for making available all information we requested, and the Printing & Graphics Department<br />

for helping us design this year’s budget cover and the duplication of this budget document.<br />

vi

INTRODUCTORY SECTION – TABLE OF CONTENTS<br />

Board of Trustees and Administrative Officials ........................................................................................... 1<br />

Consultants & Advisors ................................................................................................................................ 2<br />

Executive Summary ...................................................................................................................................... 3<br />

GFOA Distinguished <strong>Budget</strong> Presentation Award ..................................................................................... 16

BOARD OF TRUSTEES<br />

Dennis D. Cantu, M.D. John Peter Montalvo George H. Beckelhymer Jesus J. Guerra<br />

President Vice President Secretary Parliamentarian<br />

<strong>District</strong> 5 <strong>District</strong> 3 <strong>District</strong> 4 <strong>District</strong> 7<br />

Jose A. Valdez Jorge Luis Rodriguez Guillermina Montes<br />

<strong>District</strong> 1 <strong>District</strong> 2 <strong>District</strong> 6<br />

ADMINISTRATIVE OFFICIALS<br />

Sylvia Bruni<br />

Superintendent of <strong>School</strong>s<br />

<strong>2004</strong>-<strong>2005</strong> BOARD OF TRUSTEES &<br />

ADMINISTRATIVE OFFICIALS<br />

Veronica F. Guerra Admin. Asst. for Curriculum & Instruction<br />

Jesus J. Amezcua, CPA Chief Financial Officer<br />

Elsa Arce Exec. Dir. for Student Services<br />

Don Schulte, Ed.D. Exec. Dir. for Human Resources<br />

Dr. Oscar Cartas Exec. Dir. for Plant Facilities/Support Services<br />

Marco Alvarado Director of Communications<br />

Rosaura Rodriguez Director for Testing & Instructional Programs<br />

Evaluations<br />

1

CONSULTANTS & ADVISORS<br />

Legal Counsel<br />

Kazen, Meurer & Perez, Attorneys-at-Law<br />

920 Hidalgo<br />

<strong>Laredo</strong>, Texas 78040<br />

Financial Advisor<br />

Estrada-Hinojosa<br />

Noe Hinojosa, Jr., Vice Chairman<br />

Bank One Center<br />

1717 Main Street 47th Floor, Lockbox 47<br />

Dallas, Texas 75201<br />

Bond Counsel<br />

Escamilla & Poneck, Inc.<br />

1200 South Texas Blvd.<br />

San Antonio, Texas 78205<br />

Delinquent Tax Attorney<br />

Kazen, Meurer & Perez, Attorneys-at-Law<br />

920 Hidalgo<br />

<strong>Laredo</strong>, Texas 78040<br />

<strong>Independent</strong> Auditors<br />

Padgett, Stratemann & Co., L.L.P.<br />

100 N.E. Loop 410, Suite 1100<br />

San Antonio, Texas 78216<br />

2

GFOA presented its Distinguished <strong>Budget</strong> Presentation Award to <strong>Laredo</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong> for<br />

the seventh consecutive year since the 1997-1998 fiscal year. We believe our current budget continues to<br />

conform to GFOA’s requirements and this year has been formatted to meet ASBO’s requirements for<br />

submission. We are respectfully submitting it to these organizations for evaluation and suggestions for<br />

improvement. This is the first year that we submit our <strong>Annual</strong> <strong>Budget</strong> to ASBO’s Meritorious <strong>Budget</strong><br />

Award Program.<br />

However, the primary purpose of this document is to provide timely and useful information concerning<br />

the past, current, and projected financial status of the <strong>District</strong>, in order to facilitate financial decisions that<br />

support the educational goals of the <strong>District</strong>. This budget’s focus is the improvement of the instructional<br />

program with the fiscal resources available to the district. This budget addresses the essential needs of the<br />

<strong>District</strong> by directing resources to those areas that will assist our staff in carrying out the mission of the<br />

school system.<br />

Within our budget, we have identified innovative programs and developed standards for all departments<br />

and campuses. The expectations are high, and this budget proposal provides funding for the improvement<br />

of student performance, staff performance and fiscal performance.<br />

In this budget, you will see our efforts to assure that this district achieves an exemplary school district<br />

status by:<br />

1. Implementing the Superintendent’s Priority Goals;<br />

2. Ensuring that there is accountability among staff members to improve student learning;<br />

3. Attracting and retaining qualified staff members;<br />

4. Maximizing resources and utilizing sound fiscal planning; and<br />

5. Communicating results and expectations throughout the educational system to all stakeholders.<br />

This budget document is the first step towards achieving these goals. It includes sound, prudent fiscal<br />

policies that will ensure the continuity of the district.<br />

ABOUT LAREDO INDEPENDENT SCHOOL DISTRICT<br />

The mission of <strong>Laredo</strong> ISD, as an educational partner with the City of <strong>Laredo</strong> and the larger global<br />

community, is to develop and educate our students by providing a relevant and challenging curriculum<br />

through innovative programs and effective use of resources in a safe and nurturing environment.<br />

<strong>2004</strong>-<strong>2005</strong> Superintendent’s Priority Goals:<br />

1. To establish and maintain an organizational climate that respects the dignity and worth of all<br />

people.<br />

2. To establish and maintain a safe environment for all students, employees, and visitors.<br />

3. To lead the district’s initiative toward continued improvement of academic performance for all<br />

students as measured by TAKS and other appropriate measures of student gain and to increase the<br />

number of students taking the SAT, ACT, AP and CATE.<br />

4. To implement programs and initiatives that will result in all healthy children reading on grade<br />

level by the third grade and in the measurable improvement of student reading skills at highergrade<br />

levels.<br />

5. To strengthen the instructional program by increasing emphasis on higher order thinking skills<br />

through the enhancement of staff development and the integration of technology.<br />

6. To improve our libraries by meeting or exceeding state standards for recognized status, which<br />

include staffing patterns, library collection ratio, the use of technology, up-to-date library<br />

collections and other criteria.<br />

<strong>2004</strong>-<strong>2005</strong> <strong>District</strong> <strong>Budget</strong> Executive Summary<br />

4

7. To effectively implement the district’s construction and facilities maintenance program and<br />

continue the implementation and monitoring of accountability measures to protect all district<br />

resources.<br />

8. To develop initiatives to integrate child nutrition programs into the curriculum to influence<br />

healthy life styles for all children.<br />

BUDGET PROCESS AND SIGNIFICANT CHANGES<br />

Legal Requirements in Preparing the <strong>Budget</strong><br />

The Texas Education Code requires that a local education agency prepare a budget of anticipated<br />

expenditures and revenues on or before August 20. The Board is required to adopt a budget before August<br />

31. The budget is filed with the Texas Education Agency according to the PEIMS data standards, which<br />

requires budget data to be submitted in October. <strong>District</strong>s are no longer required to file a copy with the<br />

County Clerk. The budget must be itemized in detail according to classification (object) and purpose of<br />

expenditure (function) and be prepared according to General Accepted Accounting Principles.<br />

The budget must be legally adopted before the adoption of the tax rate. The president of the Board of<br />

Trustees must call a public meeting of the Board of Trustees giving ten days public notice in a newspaper<br />

for the adoption of the budget. Any taxpayer in the district may be present and participate in the meeting.<br />

The budget must be adopted by the Board of Trustees, inclusive of budget amendments no later than<br />

August 31. Minutes from the district board meetings will be used by the Texas Education Agency to<br />

record the adoption of and amendments to the budget.<br />

<strong>Budget</strong> Development Process<br />

The budget development process comprises three stages: planning, preparation, and evaluation. The first<br />

phase, planning, involves defining the mission, goals, and objectives of campuses, departments, and the<br />

<strong>District</strong>. Once these plans and programs have been established, the preparation phase of budgeting begins<br />

by allocating resources to support them. Evaluation is the last step of the <strong>District</strong>’s budget cycle, in which<br />

information is compiled and analyzed to assess the performance of each individual department and<br />

campus, as well as the <strong>District</strong> as a whole.<br />

The budgeting process for the <strong>Laredo</strong> ISD was initiated in November 2003, following the Texas<br />

Education Agency (TEA) legal requirements and preliminary funding estimates made by the Division of<br />

Finance. Individual, as well as group training workshops, were held with principals, department heads,<br />

and Site-Based Decision-Making (SBDM) committees to guide them in developing their budgets. Each<br />

campus received a basic allotment per student at the different programs to be used for supplies, materials,<br />

equipment, staff development, and other appropriate instructional costs.<br />

The Human Resources department played an important role assisting the Finance department in the<br />

budget process as they developed payroll budgets utilizing established staffing guidelines. Personnel<br />

units are allocated to each campus based on student enrollment following state mandated ratios, as<br />

applicable.<br />

Following this development process, a proposed annual budget was presented to the Board of Trustees<br />

and the citizens of <strong>Laredo</strong> in workshops and at regular meetings. In August 23 rd , the Board of Trustees<br />

approved the final budget which was implemented on September 1 st , <strong>2004</strong>.<br />

<strong>2004</strong>-<strong>2005</strong> <strong>District</strong> <strong>Budget</strong> Executive Summary<br />

5

Amending the <strong>Budget</strong><br />

The legal level of authority of the approved budget is at the functional area. Any increase or decrease in a<br />

functional area requires board approval. Periodically during the year, budget amendments are submitted<br />

to the board regarding these functional changes. All other changes are submitted by campuses and<br />

departments to the Finance Division for review and processing. In addition, all transfers over $10,000<br />

within the same function are reviewed and approved by the Superintendent or his designee.<br />

Significant Changes<br />

The overall budget development process did not experience significant changes for the <strong>2004</strong>-<strong>2005</strong> budget<br />

year. However, the overall appearance of the budget document did have a significant change. Careful<br />

consideration has been placed to previous reviewers comments. This budget document has been<br />

streamlined to make it more user-friendly. One of the major changes is the reduction in size, from two<br />

books to one book. In addition, the design and formatting is consistent throughout the entire document.<br />

STATE FUNDING FORMULAS AND LEGISLATIVE ISSUES<br />

The current state funding formulas were used to project the annual budget. No changes in the formulas are<br />

projected for <strong>2004</strong>-<strong>2005</strong>. A finance legislative session in the Spring <strong>2004</strong> did not yield a new funding<br />

mechanism; however, it is expected that the State will have a new school finance plan for the next<br />

legislative session. At stake are the elements of the current plan such as equitable and adequate funding<br />

for all districts. The Robin Hood Plan, as often referred, provides over 83% of its funding to <strong>Laredo</strong> ISD<br />

and over $8M gain in WADA funds for technology. Efforts are being implemented to provide information<br />

to the State Senator and State Representative on the impact of proposed legislative action for the<br />

upcoming Legislative Session in January <strong>2005</strong>.<br />

SUMMARY OF PROPOSED BUDGETS<br />

The following schedules present a comparison of the proposed expenditures for all Governmental Funds<br />

and a breakdown of the General Fund with the projected expenditures for the previous fiscal year.<br />

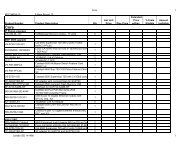

TOTAL BUDGETS FOR ALL GOVERNMENTAL FUNDS<br />

Projected <strong>Budget</strong> Proposed <strong>Budget</strong><br />

Fund 2003-<strong>2004</strong> <strong>2004</strong>-<strong>2005</strong> % Change<br />

General Funds $ 162,885,654 $ 165,116,781 1.37%<br />

Special Revenue Funds 40,327,129<br />

41,235,332 2.25%<br />

Debt Service Fund 14,542,080<br />

14,929,751 2.67%<br />

Capital Projects Funds 30,584,704<br />

49,894,364 63.14%<br />

Total Governmental Funds $ 248,339,567 $ 271,176,228 9.20%<br />

BREAKDOWN OF TOTAL BUDGETS FOR THE GENERAL FUND<br />

Projected <strong>Budget</strong> Proposed <strong>Budget</strong> Percent<br />

General Funds 2003-<strong>2004</strong> <strong>2004</strong>-<strong>2005</strong> Change<br />

General Operating Fund $ 150,975,952 $ 152,924,281 1.29%<br />

Child Nutrition Program Fund 10,837,595 11,302,500 4.29%<br />

Athletics Fund 848,905<br />

890,000 4.84%<br />

Public Property Finance Contractual Obligation (PPFCO) 223,202<br />

- -100.00%<br />

Total General Funds $ 162,885,654 $ 165,116,781 1.37%<br />

<strong>2004</strong>-<strong>2005</strong> <strong>District</strong> <strong>Budget</strong> Executive Summary<br />

6

PROJECTED FUND BALANCE<br />

For the <strong>2004</strong>-<strong>2005</strong> budget year we are estimating to use $3,988,748 from the General Operating Fund<br />

balance to fund $1,600,000 for capital outlay and $2,388,748 for other operating costs. Due to an<br />

increase in cost per WADA (Weighted Average Daily Attendance), we are recommending to designate<br />

$3,000,000 for risk of loss of WADA partner contracts. Therefore, we are projecting to end the fiscal<br />

year <strong>2004</strong>-<strong>2005</strong> with an estimated fund balance of $11,858,509 for the General Operating Fund. This<br />

represents a 37% decrease over our projected ending fund balance for fiscal year 2003-<strong>2004</strong>.<br />

2000-2001 2001-2002 2002-2003 2003-<strong>2004</strong> <strong>2004</strong>-<strong>2005</strong><br />

ACTUAL ACTUAL ACTUAL PROJECTED PROPOSED<br />

Revenues $ 121,839,711 $ 135,893,845 $ 139,854,883 $ 156,764,508 $ 156,836,261<br />

Expenditures 116,041,876 122,886,656 131,112,349 150,975,952 152,924,281<br />

Excess/(Deficiency) of Revenues<br />

Over/(Under) Expenditures 5,797,835 13,007,190 8,742,534 5,788,556 3,911,980<br />

Other Financing Sources (Uses) (4,398,538) (7,313,138) (7,521,110) (7,976,218) (7,900,728)<br />

Net Changes in Fund Balances 1,399,297 5,694,051 1,221,424 (2,187,662) (3,988,748)<br />

Fund Balance, Beginning 11,059,227 13,811,845 19,820,873 21,034,919 18,847,257<br />

Reserve for Designated Fund Balance -<br />

-<br />

-<br />

- 3,000,000<br />

Adjustment to Fund Balance 1,353,321 314,976 (7,378)<br />

-<br />

-<br />

Fund Balance, Ending $ 13,811,845 $ 19,820,873 $ 21,034,919 $ 18,847,257 $ 11,858,509<br />

BALANCED BUDGET<br />

GENERAL OPERATING FUND SELECTED ITEMS SUMMARY<br />

The operating budget for <strong>Laredo</strong> ISD shall be balanced. This means that for each fund, expenditures are<br />

not to exceed revenues plus available fund balances. If the fund balance is used, this cost must be a one<br />

time cost and not reoccurring, for example, capital expenditures. As you can see on the above summary,<br />

we are submitting a balanced budget for fiscal year <strong>2004</strong>-<strong>2005</strong>. Although our expenditures plus other<br />

financing uses totaling $160,825,009 exceeds our revenues of $156,836,261, our budget is considered to<br />

be balanced since the difference of $3,988,748 is being used from our projected excess funds for fiscal<br />

year 2003-<strong>2004</strong> for a one time cost. We believe that our budget represents a responsible and creative<br />

approach to the needs of the <strong>District</strong> within the available funds.<br />

ABOUT THE <strong>2004</strong>-<strong>2005</strong> DISTRICT BUDGET<br />

Below are a few highlights of the district that will provide you with a general overview of the basis of our<br />

assumptions and projections for the coming <strong>2004</strong>-<strong>2005</strong> fiscal year. In order to prepare the annual budget,<br />

<strong>Laredo</strong> ISD develops projections for enrollment, taxable value, collection rate, projection for state<br />

funding, and expenditure levels.<br />

EXPENDITURE LEVELS<br />

General Operating Fund – The <strong>2004</strong>-<strong>2005</strong> appropriation levels for the General Operating Fund are<br />

projected at $152,924,281 and estimated uses at $8,058,328, for a total of $160,982,609; this represents a<br />

1.28% or $2,030,439 increase over 2003-<strong>2004</strong> levels.<br />

<strong>2004</strong>-<strong>2005</strong> <strong>District</strong> <strong>Budget</strong> Executive Summary<br />

7

GENERAL OPERATING FUND EXPENDITURES BY OBJECT<br />

Projected Proposed<br />

<strong>Budget</strong> <strong>Budget</strong><br />

Object 2003-<strong>2004</strong> <strong>2004</strong>-<strong>2005</strong> % Change<br />

Salaries $ 135,745,981 $ 137,357,430 1.19%<br />

Contracted Services 5,959,570<br />

7,926,186 33.00%<br />

Supplies and Materials 2,744,383<br />

3,950,776 43.96%<br />

Other Operating Expenses 2,063,628<br />

2,285,922 10.77%<br />

Debt Service -<br />

75,000 -<br />

Capital Outlay 4,462,390<br />

1,328,967 -70.22%<br />

Other Uses (Transfers Out) 7,976,218<br />

8,058,328 1.03%<br />

Total General Operating Fund Exp. $ 158,952,170 $ 160,982,609 1.28%<br />

Ot h er<br />

Operating<br />

Expenses<br />

1%<br />

Supplies and<br />

Materials<br />

2%<br />

COMPARISON OF GENERAL OPERATING FUND EXPENDITURES BY OBJECT<br />

2003-<strong>2004</strong> General Oparating Fund<br />

Expenditures by Object<br />

Capital Outlay<br />

3%<br />

Ot h er Uses<br />

(Transfers<br />

Ou t )<br />

5%<br />

Co n t r act ed<br />

Ser vices<br />

4%<br />

Salaries<br />

85%<br />

<strong>2004</strong>-<strong>2005</strong> <strong>District</strong> <strong>Budget</strong> Executive Summary<br />

<strong>2004</strong>-<strong>2005</strong> General Operating Fund<br />

Expenditures by Object<br />

Capital Outlay<br />

0.83%<br />

Debt Service<br />

0.05%<br />

Ot h er<br />

Operating<br />

Expenses<br />

1.42%<br />

Supplies and<br />

Materials<br />

2.45%<br />

Ot h er Uses<br />

(Transfers<br />

Ou t )<br />

5%<br />

Contracted<br />

Ser vices<br />

4.92%<br />

Salaries<br />

85.32%<br />

Child Nutrition Program Fund – For <strong>2004</strong>-<strong>2005</strong>, the <strong>District</strong> budgeted $11,302,500 for the Child<br />

Nutrition Program, which is part of the General Fund. Revenues for this fund come primarily from the<br />

National <strong>School</strong> Lunch Program. This revenue is generated based on the number of meals served to<br />

children who qualify for a free or reduced meal. The <strong>2004</strong>-<strong>2005</strong> school year is projected to have a 5%<br />

increase in meals served; it is estimated to serve 3,507,265 lunches and 2,025,271 breakfasts meals.<br />

Revenues are projected to increase by 5% to $10,802,500.<br />

Athletics Fund – The Athletics Fund is part of the General Fund, accounting for expenditures associated<br />

with all sports programs at the middle school and high school levels. The major sources of revenue for<br />

this fund are gate receipts, which are budgeted at $210,000 for <strong>2004</strong>-<strong>2005</strong>. In addition, a transfer in of<br />

$680,000 from the General Operating Fund will help finance its operations. Fiscal year <strong>2004</strong>-<strong>2005</strong> has an<br />

expenditure budget of $890,000 for co-curricular and extracurricular activities.<br />

Debt Service Fund – The <strong>District</strong> budgeted $14,929,751 for <strong>2004</strong>-<strong>2005</strong>. Resources in the Debt Service<br />

Fund must be used to account for general long-term debt principal and interest for debt issues and other<br />

long-term debts for which a tax has been dedicated. The <strong>2004</strong>-<strong>2005</strong> budget experienced a 2.8 cent<br />

decrease in Interest and Sinking (I&S) taxes due to an increase in net taxable values (assessed value<br />

minus total exemptions) of over $180,000,000.<br />

Special Revenue Fund – Appropriations for this fund are restricted to, or designated for, specific<br />

purposes by a grantor. For <strong>2004</strong>-<strong>2005</strong>, the <strong>District</strong>’s appropriation is $41,235,332. (Note: The <strong>District</strong><br />

provides information to the Board of Trustees on all <strong>District</strong> grants, but they do not approve the budget<br />

for these funds.)<br />

8

Capital Projects Fund – For <strong>2004</strong>-<strong>2005</strong> the <strong>District</strong> is appropriating $49,894,364 for the repair,<br />

rehabilitation, renovation, and replacement of school facilities in Instructional Facilities Allotment (IFA)<br />

and Qualified Zone Academy Bonds (QZAB). It is important to note that this fund is a project budget.<br />

The $49,894,364 represents the amount of unspent, but committed funds as part of Phase I and II of the<br />

Capital Improvement Program.<br />

REVENUE LEVELS<br />

Revenue estimates are based upon a variety of demographic and tax information. Estimating revenue<br />

from the two major sources, state funding from the Foundation <strong>School</strong> Program (FSP) and local property<br />

taxes, are critical to the budget.<br />

The <strong>District</strong> estimates total General Operating Fund revenues of $156,836,261 for the <strong>2004</strong>-<strong>2005</strong> fiscal<br />

year. The state sources of revenue that support the General Operating Fund budget represents more than<br />

82% of all available sources of funding. Local sources of revenue constitute 17.25% and federal sources<br />

less than 1%. The recommended budget includes a decrease in local revenues of 6.42%, and an increase<br />

in State and federal revenues of 1.49% and 4.14%, respectfully, over 2003-<strong>2004</strong> estimates. The <strong>2004</strong>-<br />

<strong>2005</strong> state revenue projections are based on an estimated average daily attendance (ADA) of 22,000<br />

students.<br />

COMPARISON OF REVENUE SOURCES OF THE GENERAL OPERATING FUND<br />

Projected Proposed<br />

<strong>Budget</strong> <strong>Budget</strong><br />

Revenue Sources 2003-<strong>2004</strong> <strong>2004</strong>-<strong>2005</strong> % Change<br />

Local Sources $ 28,915,980 $ 27,059,920 -6.42%<br />

State Sources 126,971,822 128,863,341 1.49%<br />

Federal Sources 876,706<br />

913,000 4.14%<br />

Total General Fund $ 156,764,508 $ 156,836,261 0.05%<br />

Federal Sources<br />

State Sources<br />

Local Sources<br />

913,000<br />

876,706<br />

LOCAL REVENUES<br />

27,059,920<br />

28,915,980<br />

<strong>2004</strong>-<strong>2005</strong> <strong>District</strong> <strong>Budget</strong> Executive Summary<br />

2003-<strong>2004</strong> <strong>2004</strong>-<strong>2005</strong><br />

128,863,341<br />

126,971,822<br />

- 20,000,000 40,000,000 60,000,000 80,000,000 100,000,000 120,000,000 140,000,000<br />

Although revenues from current year taxes are expected to increase by 7.5% from an estimated<br />

$18,230,072 in 2003-<strong>2004</strong> to a projected $19,535,170 for <strong>2004</strong>-<strong>2005</strong>, overall local revenues are projected<br />

to decrease by 6.42%. This is mainly due to a projected decrease in the sale of weighted average daily<br />

attendance (WADA) to other school districts.<br />

Tax Rate – Based on the taxable value, the district must project the level of taxation that will generate<br />

adequate funds to (1) maximize state aid and (2) provide for funds to meet district obligations while<br />

9

keeping in mind the ability of local tax payers to pay their taxes. For the <strong>2004</strong>-<strong>2005</strong> school year, the<br />

Board of Trustees approved a <strong>District</strong> tax rate of $1.47411, which reflects a tax decrease of 2.8 cents for<br />

the interest and sinking fund and no increase/decrease for maintenance and operations over the 2003-<strong>2004</strong><br />

tax rate.<br />

1.60<br />

1.40<br />

1.20<br />

1.00<br />

0.80<br />

0.60<br />

0.40<br />

0.20<br />

0.00<br />

TOTAL TAX RATE<br />

2003-<strong>2004</strong> <strong>2004</strong>-<strong>2005</strong> Inc/(Dec)<br />

Maintenance and Operations $ 1.32291 $ 1.32291 $ -<br />

Interest and Sinking 0.17980 0.15120 (0.02860)<br />

Total General Fund $ 1.50271 $ 1.47411 $ (0.02860)<br />

$1.50 State &<br />

Local M&O<br />

Max Cap<br />

<strong>2004</strong>-<strong>2005</strong> <strong>District</strong> <strong>Budget</strong> Executive Summary<br />

LISD PROPERTY TAX RATE<br />

1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 <strong>2004</strong>-05<br />

I&S 0.1652 0.1911 0.2013 0.1987 0.1031 0.1031 0.1031 0.1798 0.1798 0.1512<br />

M&O 1.0000 1.0239 0.9837 1.0263 1.2229 1.2829 1.3229 1.3229 1.3229 1.3229<br />

Taxable Value – The taxable value for<br />

<strong>Laredo</strong> ISD has been stable over the last ten<br />

years. Minimum growth has been experienced<br />

of approximately $40 million increase in value<br />

per year. The Webb County Appraisal<br />

<strong>District</strong> certifies the taxable value from which<br />

the district begins to develop the estimates for<br />

local effort needed to generate state funds.<br />

The taxable value for the <strong>2004</strong>-<strong>2005</strong> fiscal<br />

year is $1,681,169,772 or an increase of<br />

$188,770,327 over the 2003-<strong>2004</strong> level.<br />

Billions<br />

Webb CAD Certified Taxable Values<br />

1.8<br />

1.7<br />

1.6<br />

1.5<br />

1.4<br />

1.3<br />

1.2<br />

1.1<br />

1.0<br />

Tax Collections – The collections percentage used to estimate the tax revenues is 92%; however, the<br />

<strong>District</strong>’s tax collections goal is 96%. This is a conservative approach given the history of the district and<br />

the projected tax increase. It should be noted that the projected increase for the PFC funding is<br />

approximately 4 cents. For <strong>2004</strong>-<strong>2005</strong>, LISD has the collected the related amount of taxes for the first<br />

payment. Payments beyond the first year will require a 4 cent increase in the maintenance and operations<br />

tax rate. The next graph summarizes tax collection efforts over the past 10 years; please note that the<br />

amounts are represented in millions.<br />

1996<br />

1997<br />

1998<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

<strong>2004</strong><br />

<strong>2005</strong><br />

10

MILLIONS<br />

-<br />

25<br />

20<br />

15<br />

10<br />

5<br />

1.5<br />

9.2<br />

1.8<br />

10.7 10.9 12.2<br />

<strong>2004</strong>-<strong>2005</strong> <strong>District</strong> <strong>Budget</strong> Executive Summary<br />

2.3<br />

CURRENT TAX COLLECTIONS<br />

2.5<br />

1.4<br />

1.4<br />

1.4<br />

15.1 16.5 17.4 17.8 19.0 20.2<br />

1995 1996 1997 1998 1999 2000 2001 2002 2003 (1) <strong>2004</strong> (1)<br />

I&S 1,518,507 1,759,768 2,312,601 2,502,927 1,380,957 1,366,311 1,385,293 2,391,480 2,613,432 2,317,734<br />

M&O 9,190,284 10,696,155 10,904,019 12,248,141 15,146,614 16,484,172 17,416,882 17,790,556 19,000,000 20,155,170<br />

1) Tax collections for 2003 & <strong>2004</strong> are estimated amounts.<br />

2) M&O represents the Maintenance and Operations rate for the district and I&S represents the Interest and<br />

Sinking for outstanding debt.<br />

WADA Revenues – The <strong>2004</strong>-<strong>2005</strong> school year will experience a reduction in WADA contracts.<br />

Revenues from WADA contracts for <strong>2004</strong>-<strong>2005</strong> are estimated to be $5,323,000. This represents a<br />

$3,155,922 or 37.22% reduction over 2003-<strong>2004</strong> WADA contracts revenues. The <strong>District</strong> currently<br />

partners with Deer Park ISD, La Porte ISD, Plano ISD, Texas City ISD, Sweeny ISD, and Spring Branch<br />

ISD under Chapter 41 of the Texas Education Code. The estimated cost per WADA for fiscal year <strong>2004</strong>-<br />

<strong>2005</strong> is $4,183, as shown on the chart below.<br />

2000-2001 2001-2002 2002-2003 2003-<strong>2004</strong> <strong>2004</strong>-<strong>2005</strong><br />

Average Daily Attendance 20,929 21,495 22,013 22,160 22,000<br />

Weighted ADA 30,978 31,939 32,738 32,963 32,660<br />

Estimated Cost per WADA $3,441 $3,873 $3,421 $3,518 $4,183<br />

STATE REVENUES<br />

Total state aid is the sum or the state’s share of Tier I and Tier II plus the Existing Debt Allotment (EDA)<br />

and the Instructional Facilities Allotment (IFA), plus other program aid which the state funds without<br />

requiring local matching. In <strong>2004</strong>-<strong>2005</strong>, the <strong>District</strong> is estimating to receive $133,897,055 in total State<br />

Aid for all funds. Total State Aid for the General Operating Fund for <strong>2004</strong>-<strong>2005</strong> is projected at<br />

$123,026,341 which is comprised of the Available <strong>School</strong> Fund (ASF), Foundation <strong>School</strong> Fund (FSF)<br />

and House Bill 1 (HB1) additional aid sources.<br />

The basic elements of the State funding formula have not changed for many years. Although State<br />

funding formulas are rather complicated, the basic calculations are as follows:<br />

Tier I State Aid – Basic Allotment – The purpose of Tier I funds is to fund the basic program; it allows<br />

an amount per student (currently $2,825) to each school district based on average daily attendance with<br />

additional weight given for special programs. This allotment was not changed during the 2003<br />

Legislative session. From the total Tier I allotment, a deduction is made for the local school district’s<br />

share based on the individual district’s property tax base multiplied by a constant tax levy of $0.86 per<br />

$100 of assessed taxable property value. The remainder represents the State’s share of Tier I funding.<br />

Under this methodology, a district’s wealth factors significantly into its share of state funding. The<br />

2.4<br />

2.6<br />

2.3<br />

11

higher the wealth per student, the higher the proportional deduction from the Tier I total. Therefore, as<br />

property wealth per student increases, State funding decreases. <strong>Laredo</strong> ISD is projecting Tier I State Aid<br />

of $75,171,321 (calculated by subtracting the local share of $12,248,824 from the total cost of Tier I of<br />

$87,420,145).<br />

Tier II State Aid – Basic Program Enrichment – The purpose of Tier II is to allow for the enrichment<br />

of the basic program; its idea is to ensure that school districts with low property values generate a<br />

guaranteed level of revenue with their tax effort. The calculation multiplies each cent of tax effort above<br />

$0.86 to a maximum of $0.64 times a district’s weighted average daily attendance times the current<br />

guaranteed yield amount. The guaranteed yield is currently set at $27.14. <strong>Laredo</strong> ISD is projecting Tier<br />

II State Aid of $41,298,542.<br />

HB1 (House Bill 1) – Additional Aid - Although the basic allotment and guaranteed yield amounts<br />

remained the same for the current biennium, the Legislature did approve additional funds to school<br />

districts. HB1 funds are paid at $110 per current year WADA. <strong>Laredo</strong> ISD is projected to receive<br />

$3,592,620 in additional State Aid, calculated by multiplying $110 times projected WADA amount of<br />

32,660.1793.<br />

Technology Allotment – With the passing of Senate Bill 1, school districts are receiving $30 per ADA<br />

for the purpose of (1) providing for the purchase by school districts of electronic textbooks or<br />

technological equipment that contributes to student learning; and (2) paying for training educational<br />

personnel directly involved in student learning in the appropriate use of electronic textbooks and for<br />

providing for access to technological equipment for instructional use. <strong>Laredo</strong> ISD is projecting $660,000<br />

in Technology Infrastructure Funds (TIF), (calculated by multiplying $30 times ADA of 22,000). This<br />

revenues are budgeted in the Technology Allotment Fund.<br />

Chapter 46 Existing Debt Allotment (EDA) State Aid – A new program to assist districts with the<br />

payment of their existing debt service was created beginning with the 1999-2000 school year. The<br />

Existing Debt Allotment program is similar to the Tier II funding structure. For eligibility purposes for<br />

this allotment, existing debt is debt for which the district levied an I&S tax for qualifying voter-approved<br />

debt. The <strong>2004</strong>-<strong>2005</strong> budget includes $2,326,320 for EDA funding, a 10.2% increase from 2003-<strong>2004</strong><br />

estimates.<br />

Chapter 46 Instructional Facilities Allotment (IFA) State Aid – A program was created beginning<br />

with the 1997-98 school year that may assist districts with the payment of newly created debt. The<br />

Instructional Facilities Allotment program is similar to the Existing Debt Allotment program. This<br />

guaranteed level matches annual debt up to a specified amount per ADA. There is a limited amount of<br />

funds available for this program. <strong>District</strong>s must apply for assistance, and all applicants are prioritized<br />

according to wealth per student. Funds are then awarded until the appropriation is exhausted. <strong>Laredo</strong><br />

ISD currently receives IFA funding and estimates to receive $7,884,394 for the <strong>2004</strong>-<strong>2005</strong> school year.<br />

This represents a decrease of $752,174, or 8.7% from 2003-<strong>2004</strong> estimates. This is due to the reduction<br />

in required debt service payments in <strong>2004</strong>-<strong>2005</strong>. The <strong>District</strong> also submitted an application for IFA<br />

funding for the Public Facilities Corporation (PFC). Funding is expected in the amount of $4.1 million to<br />

pay for new debt service requirements<br />

STUDENT ENROLLMENT & DEMOGRAPHICS<br />

<strong>Laredo</strong> ISD is an urban school district with 13 square miles. We are surrounded by a border to Mexico<br />

and one of the fastest growing districts in Texas, United ISD. We are comprised of 20 elementary<br />

schools, 4 middle schools, and 3 high schools. In addition, we also have one alternative education school,<br />

two magnet schools within two of the high schools (Magnet <strong>School</strong> for Engineering and Technology<br />

<strong>2004</strong>-<strong>2005</strong> <strong>District</strong> <strong>Budget</strong> Executive Summary<br />

12

Applications and the Health and Science Magnet <strong>School</strong>), and a separate Fine Arts and Communications<br />

Magnet <strong>School</strong>. For school year <strong>2004</strong>-<strong>2005</strong> we are projecting an enrollment of 26,600 students.<br />

LAREDO ISD ENROLLMENT DEMOGRAPHICS<br />

Demographics 2001 2002 2003 <strong>2004</strong> <strong>2005</strong> 28,000<br />

Number of Students 24,538 25,553 26,271 26,982 26,600 27,000<br />

Economically Disadvantaged 90.2% 92.0% 92.7% 93.0% 95.4%<br />

Bilingual Students 47.1% 52.8% 58.0% 62.6% 66.4%<br />

Career & Technology 17.3% 18.7% 22.1% 24.8% 23.0%<br />

Special Education 15.3% 15.8% 15.6% 14.4% 12.1%<br />

Gifted & Talented 8.1% 8.1% 7.6% 7.2% 7.0%<br />

PERFORMANCE MEASURES<br />

<strong>2004</strong>-<strong>2005</strong> <strong>District</strong> <strong>Budget</strong> Executive Summary<br />

26,000<br />

25,000<br />

24,000<br />

23,000<br />

The 76 th Texas Legislature mandated the implementation of a new statewide assessment, The Texas<br />

Assessment of Knowledge and Skills (TAKS) Test. The TAKS test was administered beginning in the<br />

2002-2003 school year and is a comprehensive examination that focuses on student reasoning and<br />

analytical skills in reading, mathematics, writing, science, and social studies. The TAKS was designed to<br />

be more difficult to pass than the previous Texas Assessment of Academic Skills Test (TAAS). Detailed<br />

scores of the <strong>District</strong> are presented in the Informational Section of this document; overall, the <strong>District</strong>’s<br />

results compared to the State and Region were as follows:<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

2003 TAKS RESULT COMPARISON<br />

ENG LANG ARTS READING MATHEMATICS WRITING SCIENCE SOCIAL STUDIES ALL TESTS<br />

OTHER <strong>2004</strong>-<strong>2005</strong> DISTRICT BUDGET HIGHLIGHTS<br />

2001<br />

2002<br />

2003<br />

<strong>2004</strong><br />

STATE<br />

REGION<br />

DISTRICT<br />

Teacher Salary Increases – The increase package includes a $2,000/$2,250 salary increase for<br />

employees in the teacher salary scale, which includes teachers, librarians, nurses, counselors, etc. In<br />

addition, the stipend for these employees who hold a Masters or Doctorate degree increased from $1,000<br />

to $2,000. The overall teacher salary raises increased payroll by $3,794,250 for school year <strong>2004</strong>-<strong>2005</strong>.<br />

Other Employees Salary Increases – For <strong>2004</strong>-<strong>2005</strong>, the Board of Trustees approved an increase of 3%<br />

in the Professional and Para-Professional pay plan’s minimum, mid-point, and maximum schedules. In<br />

<strong>2005</strong><br />

13

addition, Professional and Para-Professional employees were approved a 3% and 5% increase,<br />

respectively, from their midpoint levels or base salary, whichever is higher. The budget’s effect was<br />

$365,166 for Professionals and $1,228,240 for Para-Professionals. The total cost of salary increases for<br />

<strong>2004</strong>-<strong>2005</strong> is $1,593,406.<br />

Other Payroll Highlights – For fiscal year <strong>2004</strong>-<strong>2005</strong>, the Construction department’s personnel cost was<br />

shifted to the General Fund for a total effect of $508,000. In addition, PC Hardware Specialists received<br />

a $4,500 stipend for a total cost of $126,000. For fiscal year <strong>2004</strong>-<strong>2005</strong>, 105 new positions were created<br />

budgeted at $2,141,260. Most of the positions added belong to the Police Department, for <strong>2004</strong>-<strong>2005</strong> it<br />

was decided to contract police officers in-house rather than outsource to the City’s and Webb County’s<br />

<strong>School</strong> Resource Officers (SRO) program. Parents and community members have shared positive stories<br />

with our staff and feel confident that LISD is providing a safe environment at our schools. Furthermore,<br />

47 positions were reclassified (the pay grade changed) for a total budget effect of $282,058.<br />

NEW POSITIONS CREATED FOR <strong>2004</strong>-<strong>2005</strong><br />

Campus/Department Position FTE’s<br />

Estimated Cost<br />

w/o Benefits<br />

Martin High <strong>School</strong> Director/Magnet <strong>School</strong> 1.00<br />

Martin High <strong>School</strong> Bookkeeper 1.00<br />

Martin High <strong>School</strong> Counselor 1.00<br />

Cigarroa High <strong>School</strong> Director/Magnet <strong>School</strong> 1.00<br />

Cigarroa High <strong>School</strong> Bookkeeper 1.00<br />

Cigarroa High <strong>School</strong> Counselor 1.00<br />

Administration <strong>District</strong> Coordinator for Library/Media Svcs 1.00<br />

Fixed Assets and Custodial Serv Secretary 1.00<br />

Fixed Assets and Custodial Serv Data Specialist 1.00<br />

Textbooks and Records Management Substitute-Textbook Clerks 3.00<br />

Athletics Department Grounds keepers 2.00<br />

Police Department Security guards 65.00<br />

Police Department Police Officers 16.00<br />

Department of Instruction Elementary Reading Coordinator 1.00<br />

Department of Instruction Secondary Reading Coordinator 1.00<br />

<strong>District</strong>-Wide Teachers 8.00<br />

Total 105.00<br />

<strong>2004</strong>-<strong>2005</strong> <strong>District</strong> <strong>Budget</strong> Executive Summary<br />

$65,299<br />

17,800<br />

44,098<br />

65,299<br />

17,800<br />

44,098<br />

75,000<br />

27,246<br />

29,971<br />

34,431<br />

32,276<br />

713,570<br />

499,392<br />

57,490<br />

57,490<br />

360,000<br />

$2,141,260<br />

Employee Tuition Assistance Programs – For <strong>2004</strong>-<strong>2005</strong>, the <strong>District</strong> implemented an Employee<br />

Educational Assistance Program, intended to provide up to 12 hours per academic year toward in-state<br />

tuition, mandatory fees and book assistance. Eligible employees are assisted with the cost incurred once<br />

financial aid and other scholarships have been deducted. The program is available only for permanent<br />

eligible employees on a competitive basis. This incentive program will help the district retain highly<br />

qualified teachers and grow our own teachers among the para-professional ranks. In addition, employees<br />

pursuing other professions that benefit the district are encouraged to apply. The program is currently<br />

being funded for the Fall <strong>2004</strong> Semester through Summer Session II <strong>2005</strong>; program extension is subject<br />

to board approval and funds. The <strong>2004</strong>-<strong>2005</strong> budget for this program is $312,000. In addition, the<br />

<strong>District</strong> will continue with the GED and ESL tuition assistance program which is budgeted at $111,297.<br />

14

FINAL COMMENTS<br />

The preparation of the <strong>District</strong>’s budget is a coordination of many efforts from campuses, departments<br />

and the Division of Finance. Over the last 7 years, the district has received the Certificate of Achievement<br />

in <strong>Budget</strong> Reporting from the Government Finance Officer’s Association and we are certain that the<br />

district will continue on this path of excellence. We thank the <strong>Budget</strong> Team that coordinated the wealth of<br />

information before you and we look forward to your input and feedback on our financial plan.<br />

Respectfully,<br />

<strong>2004</strong>-<strong>2005</strong> <strong>District</strong> <strong>Budget</strong> Executive Summary<br />

15

ORGANIZATIONAL SECTION – TABLE OF CONTENTS<br />

About <strong>Laredo</strong> ISD....................................................................................................................................... 17<br />

Organizational Structure Chart ................................................................................................................... 18<br />

Our Mission, Vision, and Beliefs................................................................................................................ 21<br />

Superintendent’s Priority Goals................................................................................................................. 22<br />

Goals and Objectives (Strategic Improvement Plan 2000-<strong>2005</strong>)................................................................ 23<br />

The Financial Plan within the Strategic Plan .............................................................................................. 26<br />

<strong>Budget</strong> Administration and Financial Policies............................................................................................ 27<br />

<strong>Budget</strong> Development Process ..................................................................................................................... 35<br />

<strong>2004</strong>-<strong>2005</strong> <strong>Budget</strong> Calendar ....................................................................................................................... 40<br />

<strong>2004</strong>-<strong>2005</strong> Tax Planning Calendar ............................................................................................................. 43<br />

<strong>Budget</strong>ary Control & Basis of Accounting ................................................................................................. 44

<strong>Laredo</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong> is made up of students, parents, teachers, administrators and support<br />

staff, all working together in the pursuit of achieving excellence in education. At the <strong>Laredo</strong> ISD,<br />

learning is the key to a bright and successful future. By setting high standards, the district plays a crucial<br />

role in preparing the students to meet the challenges and demands of today's high-tech, multicultural work<br />

place.<br />

History<br />

ABOUT LAREDO ISD<br />

The <strong>Laredo</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong> has come a long way since being established more than a century<br />

ago. From a single room schoolhouse, to a district sprawling more than 13.83 square miles, the district is<br />

rich in history and tradition. The district reflects the colorful heritage and unique culture that make<br />

<strong>Laredo</strong>, Texas, a city like no other.<br />

The <strong>Laredo</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong> is made up of 30 educational institutions: 21 elementary schools,<br />

four middle schools, three high schools, and three magnet schools. The three magnet schools are the Vidal<br />

M. Treviño <strong>School</strong> of Communications and Fine Arts, Dr. Dennis D. Cantu Health Science Magnet<br />

<strong>School</strong>, and the Magnet <strong>School</strong> for Engineering and Technology Applications. The Treviño Magnet<br />

<strong>School</strong> offers talented students instruction in the areas of communications, music, dance, visual arts,<br />

drama, and academics. It was the city's first magnet school. The newly built Health and Science Magnet<br />

<strong>School</strong>, located at Martin High <strong>School</strong>, was designed to provide a solid foundation and a rigorous<br />

curriculum to prepare students pursuing health careers. The Magnet <strong>School</strong> for Engineering and<br />

Technology Applications, located at Cigarroa High <strong>School</strong>, was designed to provide an intensive<br />

curriculum to persuade students to pursue careers in the engineering and technology industries. In<br />

addition, the F. S. Lara Academy is the district's alternative education school.<br />