Stephen Grabiner - Richmond - The American International ...

Stephen Grabiner - Richmond - The American International ...

Stephen Grabiner - Richmond - The American International ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

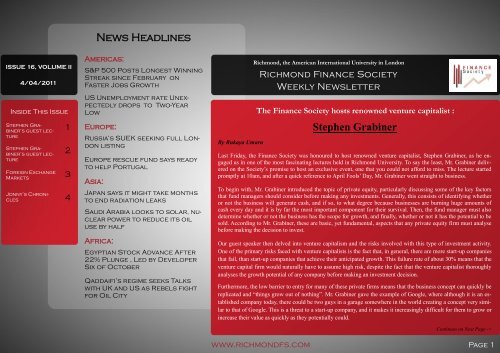

ISSUE 16, VOLUME II<br />

4/04/2011<br />

Inside This Issue<br />

<strong>Stephen</strong> <strong>Grabiner</strong>’s<br />

guest lecture<br />

<strong>Stephen</strong> <strong>Grabiner</strong>’s<br />

guest lecture<br />

Foreign Exchange<br />

Markets<br />

Jonny’s Chronicles<br />

1<br />

2<br />

3<br />

4<br />

News Headlines<br />

Americas:<br />

S&P 500 Posts Longest Winning<br />

Streak since February on<br />

Faster Jobs Growth<br />

US Unemployment rate Unexpectedly<br />

drops to Two-Year<br />

Low<br />

Europe:<br />

Russia’s SUEK seeking full London<br />

listing<br />

Europe rescue fund says ready<br />

to help Portugal<br />

Asia:<br />

Japan says it might take months<br />

to end radiation leaks<br />

Saudi Arabia looks to solar, nuclear<br />

power to reduce its oil<br />

use by half<br />

Africa:<br />

Egyptian Stock Advance After<br />

22% Plunge , Led by Developer<br />

Six of October<br />

Qaddaifi’s regime seeks Talks<br />

with UK and US as Rebels fight<br />

for Oil City<br />

By Rukaya Umaru<br />

<strong>Richmond</strong>, the <strong>American</strong> <strong>International</strong> University in London<br />

<strong>Richmond</strong> Finance Society<br />

Weekly Newsletter<br />

<strong>The</strong> Finance Society hosts renowned venture capitalist :<br />

<strong>Stephen</strong> <strong>Grabiner</strong><br />

Last Friday, the Finance Society was honoured to host renowned venture capitalist, <strong>Stephen</strong> <strong>Grabiner</strong>, as he engaged<br />

us in one of the most fascinating lectures held in <strong>Richmond</strong> University. To say the least, Mr. <strong>Grabiner</strong> delivered<br />

on the Society‟s promise to host an exclusive event, one that you could not afford to miss. <strong>The</strong> lecture started<br />

promptly at 10am, and after a quick reference to April Fools‟ Day, Mr. <strong>Grabiner</strong> went straight to business.<br />

To begin with, Mr. <strong>Grabiner</strong> introduced the topic of private equity, particularly discussing some of the key factors<br />

that fund managers should consider before making any investments. Generally, this consists of identifying whether<br />

or not the business will generate cash, and if so, to what degree because businesses are burning huge amounts of<br />

cash every day and it is by far the most important component for their survival. <strong>The</strong>n, the fund manager must also<br />

determine whether or not the business has the scope for growth, and finally, whether or not it has the potential to be<br />

sold. According to Mr. <strong>Grabiner</strong>, these are basic, yet fundamental, aspects that any private equity firm must analyse<br />

before making the decision to invest.<br />

Our guest speaker then delved into venture capitalism and the risks involved with this type of investment activity.<br />

One of the primary risks faced with venture capitalists is the fact that, in general, there are more start-up companies<br />

that fail, than start-up companies that achieve their anticipated growth. This failure rate of about 30% means that the<br />

venture capital firm would naturally have to assume high risk, despite the fact that the venture capitalist thoroughly<br />

analyses the growth potential of any company before making an investment decision.<br />

Furthermore, the low barrier to entry for many of these private firms means that the business concept can quickly be<br />

replicated and “things grow out of nothing”. Mr. <strong>Grabiner</strong> gave the example of Google, where although it is an established<br />

company today, there could be two guys in a garage somewhere in the world creating a concept very similar<br />

to that of Google. This is a threat to a start-up company, and it makes it increasingly difficult for them to grow or<br />

increase their value as quickly as they potentially could.<br />

www.richmondfs.com<br />

Continues on Next Page -><br />

Page 1

ISSUE 16, VOLUME II<br />

4/04/2011<br />

Inside This Issue<br />

<strong>Stephen</strong> <strong>Grabiner</strong>’s<br />

guest lecture<br />

<strong>Stephen</strong> <strong>Grabiner</strong>’s<br />

guest lecture<br />

Foreign Exchange<br />

MArkets<br />

Jonny’s Chronicles<br />

1<br />

2<br />

3<br />

4<br />

-> From Page 1<br />

To mitigate these risks, Mr. <strong>Grabiner</strong> suggested<br />

investing in companies which already have a<br />

considerable degree of value and those that have<br />

good management teams already in place. Furthermore,<br />

by incentivising staff and employees,<br />

the rate of growth can be expected to change<br />

positively. He gave the example of a company<br />

which offered holidays to Blackpool (a seaside<br />

town in Northwest England) to members of its<br />

management team. Once this holiday destination<br />

was changed to countries outside of the United<br />

Kingdom, the company subsequently experienced<br />

a growth in sales. In general, it is important<br />

to devise a method for steadily increasing<br />

the value of the company, so that it can then be<br />

sold at a considerably higher value.<br />

In fact, for Mr. <strong>Grabiner</strong> and his former company<br />

(Apax Partners), one of the first steps taken after<br />

making an investment is actually deciding upon<br />

the „exit strategy‟. As the name suggests, this includes<br />

outlining the potential buyers that Apax<br />

Partners can expect to sell the company to once<br />

they increase its value. Further, it is important<br />

how the company‟s potential will be perceived<br />

by the potential buyers - they would not like to<br />

purchase something which has outgrown its potential<br />

or it is a bad investment. Once this exit<br />

strategy is constructed, it is then the responsibility<br />

of each partner to monitor the growth of their<br />

investments.<br />

At Apax Partners, a monthly meeting takes<br />

places where each partner must inform the other<br />

<strong>Stephen</strong> <strong>Grabiner</strong><br />

partners of how their investments are performing<br />

– this could be an embarrassing process for a<br />

partner who‟s investment/company is not performing<br />

as well as they had targeted. Nonetheless,<br />

it makes each partner particularly focused<br />

and thorough in making investment decisions.<br />

Mr. <strong>Grabiner</strong>‟s speech was not only interesting,<br />

but also inspiring. <strong>The</strong>refore, students who suddenly<br />

looked at venture capitalism as a field they<br />

would like to explore also received some good<br />

advice from our guest speaker. He explained that<br />

the minimum requirement for entering the field<br />

involves the ability to construct complicated<br />

models (to help with analysing investment opportunities)<br />

– in fact, not very different from the<br />

skills you will pick up from taking Quantitative<br />

Models in Finance [QMF] with Dr. Ivan Cohen.<br />

However, he also referred to other key skills that<br />

may help to determine how successful you become<br />

within the field. This includes the ability to<br />

make these complicated models look easy, and<br />

the ability to conduct good interpersonal skills.<br />

<strong>The</strong>n, as a venture capitalist, you would need to<br />

decide on the best geographic location for enhancing<br />

your career.<br />

From Mr. <strong>Grabiner</strong>‟s perspective, South America<br />

(and in particular, Brazil) is one of the most exciting<br />

places to be because of the number of new,<br />

high-growth companies evolving in the region.<br />

He also suggested that China is another ideal location<br />

(as long as you can create a good relationship<br />

with the government), and India also has<br />

some potential (with the exception of its infra-<br />

www.richmondfs.com<br />

structure). In contrast, the UK and most parts of<br />

Europe have, in his opinion, exhausted most of<br />

their opportunities for the present point in time.<br />

“Europe is a wonderful old house which is about<br />

to fade away.” High unemployment and iflation<br />

are anticipated and this will eventually bring the<br />

standard of living down.<br />

At the end of the engaging lecture, Mr. <strong>Grabiner</strong><br />

accepted several questions, including a question<br />

asking about his perspective on being a venture<br />

capitalist in places like Russia and the Middle<br />

East. He gave interesting examples when answering<br />

all of his questions, and where possible,<br />

gave us examples from his past experiences. A<br />

written report of Mr. <strong>Grabiner</strong>‟s captivating lecture<br />

does no justice to the actual event; with special<br />

thanks to Dr. Cohen, the Finance Society is<br />

proud to have hosted such an inspiring lecture,<br />

by a venture capitalist who has worked with<br />

some of the most well-established companies in<br />

the world.<br />

<strong>Richmond</strong> Finance Society<br />

Weekly Newsletter<br />

Page 2

ISSUE 16, VOLUME II<br />

4/04/2011<br />

Inside This Issue<br />

<strong>Stephen</strong> <strong>Grabiner</strong>’s<br />

guest lecture<br />

<strong>Stephen</strong> <strong>Grabiner</strong>’s<br />

guest lecture<br />

Foreign Exchange<br />

MArkets<br />

Jonny’s Chronicles<br />

1<br />

2<br />

3<br />

4<br />

By: Boyan Pavlov<br />

Foreign Exchange Markets<br />

Major movers this week EUR/USD<br />

A big hit on Monday will be the Sentix Investor Confidence with predictions of more than 1 point lower. <strong>The</strong> expected market reaction is a negative<br />

gap with a rise in EUR to fill it up followed by a drop 30 minutes after (Sentix). However, 23:15 Monday however Ben Bernanke is leading a speech<br />

on financial stability, where it is the higher chance that the USD reacts negatively resulting in a higher EUR/USD.<br />

<strong>The</strong> two other big fundamental<br />

moves are on Thursday and Friday.<br />

Thursday due to the increase<br />

in the Minimum Bid<br />

Rate by 0.25%, which will result<br />

negatively on the banking<br />

system and force a short term<br />

shift in currency, followed by<br />

Friday when the German Trade<br />

Balance is again aimed at very<br />

high increases and as the last<br />

three times might not manage to<br />

reach its targets. Both days are<br />

big bear hits for the EUR, therefore<br />

a slowdown or a drop is<br />

expected at the end of the week.<br />

Technical analysis indicates a<br />

steady rise throughout the<br />

week, as the 1.44038 target has still not been reached. It is still not evident if the market has reached wave 3 of wave 3 or wave 5 of wave 3. If is irrelevant<br />

at this moment, as both provide the same directional analysis, which is the basic 161% Fibonacci at 1.44038.<br />

Positions:<br />

Entry BUY: 1.41483 (60%) / 1.40380 (40%)<br />

Collect Profit: 1.44038<br />

Stop: 20% at 1.38596 / 80% at 1.39763<br />

www.richmondfs.com<br />

<strong>Richmond</strong> Finance Society<br />

Weekly Newsletter<br />

Page 4

ISSUE 16, VOLUME II<br />

4/04/2011<br />

Inside This Issue<br />

<strong>Stephen</strong> <strong>Grabiner</strong>’s<br />

guest lecture<br />

<strong>Stephen</strong> <strong>Grabiner</strong>’s<br />

guest lecture<br />

Foreign Exchange<br />

Markets<br />

Jonny’s Chronicles<br />

1<br />

2<br />

3<br />

4<br />

By: Omar Elneser<br />

Review<br />

Jonny’s Chronicle<br />

Last week the market hit our first and second targets. We did not get filled at our entry level of 1299.5 but the market traded just one point above that. It is important<br />

to note that this is not a perfect science. We deal with<br />

probabilities of the likelihood of events developing so while<br />

hovering ±7 ticks, you look forward to entering the trade as<br />

long as you are comfortable with it. Last week was very good<br />

for stocks, especially in the US. We had solid unemployment<br />

data showing sings of recovery in the job market driven by the<br />

market sector this Friday. <strong>The</strong> unemployment rate in the US<br />

has now fallen to 8.8% in March with 216,000 jobs been<br />

added during that month.<br />

Strategy<br />

Looking ahead we think that this week the market will continue<br />

to push higher. <strong>The</strong> S&P 500 futures consolidated at levels<br />

between 1325 to 1320. Strong economic data from the US<br />

is likely to be a trigger for a continuing rally in the S&P. <strong>The</strong><br />

main concern is still unemployment but this rate have been<br />

decreasing consistently for the past months, which gives Bernanke‟s<br />

quantitative easing gamble credibility. While our indicators<br />

show that the market is long term overbought, we expect<br />

this rally to extend for a period of two weeks before a<br />

massive sell off.<br />

Alternative scenario<br />

Weekly Strategy<br />

Strategy Entry Stop First Target Second Target<br />

LONG 1320 1308 1338.5 1350<br />

MENA region tensions continue to be a concern, with Syria<br />

having internal problems now. Speculation on the severity of<br />

Japan‟s nuclear plants may drive the markets lower. Also, seeing the recent positive economic data in the US we may have speculation on whether the quantitative<br />

easing programme in the US should be discontinued earlier than expected or reduced.<br />

www.richmondfs.com<br />

<strong>Richmond</strong> Finance Society<br />

Weekly Newsletter<br />

Page 4

ISSUE 16, VOLUME II<br />

4/04/2011<br />

Inside This Issue<br />

<strong>Stephen</strong> <strong>Grabiner</strong>’s<br />

guest lecture<br />

<strong>Stephen</strong> <strong>Grabiner</strong>’s<br />

guest lecture<br />

Foreign Exchange<br />

Markets<br />

Jonny’s Chronicles<br />

1<br />

2<br />

3<br />

4<br />

Advisor: Dr. Ivan Cohen, Associate<br />

Professor of Finance in <strong>Richmond</strong>,<br />

the <strong>American</strong> <strong>International</strong> University<br />

in London<br />

Join the Society!<br />

We welcome you all to become members of the Finance Society. Contact any of the officers<br />

via school e-mail.<br />

Feel free to submit a piece of work or article you have written to the Finance Society Weekly<br />

Newsletter if you would like to be published to RUKAIYA.UMARU@students.richmond.ac.uk<br />

If you have any questions, comments or suggestions for the Finance Society or its weekly<br />

newsletter please send them to RUKAIYA.UMARU@students.richmond.ac.uk<br />

Chair: Rukaiya Umaru Vice-Chair: Ashmin John<br />

Treasurer: Dimitar Devedzhiev<br />

www.richmondfs.com<br />

Public Relations: Kári Olsen<br />

Editor: Adriana Krusheva<br />

DISCLAIMER:<br />

<strong>The</strong> Finance Society at <strong>Richmond</strong>, <strong>The</strong> <strong>American</strong> <strong>International</strong> University in London (hereinafter referred to as the “Society”) assumes no liability for any loss arising from any investment based on a recommendation,<br />

forecast, or other information supplied by any member of <strong>The</strong> Society, third party, or otherwise. All the information presented by the Society is intended for a purely educational purpose. It should not be<br />

considered any sort of investment advice. <strong>The</strong> global financial markets carry varying degrees of risk. Before deciding to invest in any asset you should carefully consider your investment objectives, level of experience,<br />

and risk appetite. You should seek advice from an independent financial advisor in order to fully understand the risks involved prior to making any investment.<br />

<strong>Richmond</strong> Finance Society<br />

Weekly Newsletter<br />

Page 5