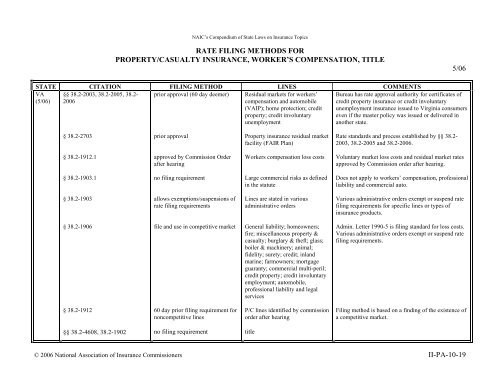

rate filing methods for property/casualty insurance, worker's

rate filing methods for property/casualty insurance, worker's

rate filing methods for property/casualty insurance, worker's

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

§ 38.2-2703<br />

§ 38.2-1912.1<br />

§ 38.2-1903.1<br />

§ 38.2-1903<br />

§ 38.2-1906<br />

§ 38.2-1912<br />

§§ 38.2-4608, 38.2-1902<br />

NAIC’s Compendium of State Laws on Insurance Topics<br />

RATE FILING METHODS FOR<br />

PROPERTY/CASUALTY INSURANCE, WORKER’S COMPENSATION, TITLE<br />

STATE CITATION FILING METHOD LINES COMMENTS<br />

VA §§ 38.2-2003, 38.2-2005, 38.2- prior approval (60 day deemer) Residual markets <strong>for</strong> workers’ Bureau has <strong>rate</strong> approval authority <strong>for</strong> certificates of<br />

(5/06) 2006<br />

compensation and automobile credit <strong>property</strong> <strong>insurance</strong> or credit involuntary<br />

(VAIP); home protection; credit unemployment <strong>insurance</strong> issued to Virginia consumers<br />

<strong>property</strong>; credit involuntary even if the master policy was issued or delivered in<br />

unemployment<br />

another state.<br />

prior approval<br />

approved by Commission Order<br />

after hearing<br />

no <strong>filing</strong> requirement<br />

allows exemptions/suspensions of<br />

<strong>rate</strong> <strong>filing</strong> requirements<br />

file and use in competitive market<br />

60 day prior <strong>filing</strong> requirement <strong>for</strong><br />

noncompetitive lines<br />

no <strong>filing</strong> requirement<br />

Property <strong>insurance</strong> residual market<br />

facility (FAIR Plan)<br />

Workers compensation loss costs<br />

Large commercial risks as defined<br />

in the statute<br />

Lines are stated in various<br />

administrative orders<br />

General liability; homeowners;<br />

fire; miscellaneous <strong>property</strong> &<br />

<strong>casualty</strong>; burglary & theft; glass;<br />

boiler & machinery; animal;<br />

fidelity; surety; credit; inland<br />

marine; farmowners; mortgage<br />

guaranty; commercial multi-peril;<br />

credit <strong>property</strong>; credit involuntary<br />

employment; automobile,<br />

professional liability and legal<br />

services<br />

P/C lines identified by commission<br />

order after hearing<br />

title<br />

Rate standards and process established by §§ 38.2-<br />

2003, 38.2-2005 and 38.2-2006.<br />

© 2006 National Association of Insurance Commissioners II-PA-10-19<br />

5/06<br />

Voluntary market loss costs and residual market <strong>rate</strong>s<br />

approved by Commission order after hearing.<br />

Does not apply to workers’ compensation, professional<br />

liability and commercial auto.<br />

Various administrative orders exempt or suspend <strong>rate</strong><br />

<strong>filing</strong> requirements <strong>for</strong> specific lines or types of<br />

<strong>insurance</strong> products.<br />

Admin. Letter 1990-5 is <strong>filing</strong> standard <strong>for</strong> loss costs.<br />

Various administrative orders exempt or suspend <strong>rate</strong><br />

<strong>filing</strong> requirements.<br />

Filing method is based on a finding of the existence of<br />

a competitive market.