CURRICULUM VITAE HAI LU (December 2011)

CURRICULUM VITAE HAI LU (December 2011)

CURRICULUM VITAE HAI LU (December 2011)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

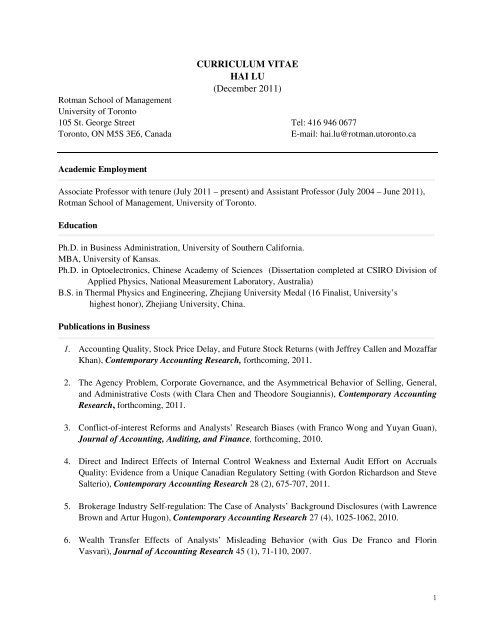

<strong>CURRICU<strong>LU</strong>M</strong> <strong>VITAE</strong><br />

<strong>HAI</strong> <strong>LU</strong><br />

(<strong>December</strong> <strong>2011</strong>)<br />

Rotman School of Management<br />

University of Toronto<br />

105 St. George Street Tel: 416 946 0677<br />

Toronto, ON M5S 3E6, Canada E-mail: hai.lu@rotman.utoronto.ca<br />

Academic Employment<br />

Associate Professor with tenure (July <strong>2011</strong> – present) and Assistant Professor (July 2004 – June <strong>2011</strong>),<br />

Rotman School of Management, University of Toronto.<br />

Education<br />

Ph.D. in Business Administration, University of Southern California.<br />

MBA, University of Kansas.<br />

Ph.D. in Optoelectronics, Chinese Academy of Sciences (Dissertation completed at CSIRO Division of<br />

Applied Physics, National Measurement Laboratory, Australia)<br />

B.S. in Thermal Physics and Engineering, Zhejiang University Medal (16 Finalist, University’s<br />

highest honor), Zhejiang University, China.<br />

Publications in Business<br />

1. Accounting Quality, Stock Price Delay, and Future Stock Returns (with Jeffrey Callen and Mozaffar<br />

Khan), Contemporary Accounting Research, forthcoming, <strong>2011</strong>.<br />

2. The Agency Problem, Corporate Governance, and the Asymmetrical Behavior of Selling, General,<br />

and Administrative Costs (with Clara Chen and Theodore Sougiannis), Contemporary Accounting<br />

Research, forthcoming, <strong>2011</strong>.<br />

3. Conflict-of-interest Reforms and Analysts’ Research Biases (with Franco Wong and Yuyan Guan),<br />

Journal of Accounting, Auditing, and Finance, forthcoming, 2010.<br />

4. Direct and Indirect Effects of Internal Control Weakness and External Audit Effort on Accruals<br />

Quality: Evidence from a Unique Canadian Regulatory Setting (with Gordon Richardson and Steve<br />

Salterio), Contemporary Accounting Research 28 (2), 675-707, <strong>2011</strong>.<br />

5. Brokerage Industry Self-regulation: The Case of Analysts’ Background Disclosures (with Lawrence<br />

Brown and Artur Hugon), Contemporary Accounting Research 27 (4), 1025-1062, 2010.<br />

6. Wealth Transfer Effects of Analysts’ Misleading Behavior (with Gus De Franco and Florin<br />

Vasvari), Journal of Accounting Research 45 (1), 71-110, 2007.<br />

1

o Reprinted in Volume 1 of Financial Accounting and Investment Management Edited by<br />

Werner De Bondt, in THE INTERNATIONAL LIBRARY OF CRITICAL WRITING IN<br />

FINANCIAL ECONOMICS Series, Ed. Richard Roll, Edward Elgar, Northampton, 2009.<br />

7. The Framing and Evaluation of Multiple Hypotheses (with Ted Mock, Arnie Wright, and Raj<br />

Srivastava), Asian-Pacific Journal of Accounting and Economics 15, 123-140, 2008.<br />

8. A Cost Variance Investigation Using Belief Functions (with Thomas Lin and Daniel O’Leary), in<br />

Applications of Management Science, 12. Eds. Kenneth Lawrence and Ronald Klimberg. Elsevier,<br />

Oxford, 2006.<br />

9. Structural Analysis of Audit Evidence Using Belief Functions (with Raj Srivastava), Fuzzy Set and<br />

Systems 131, 107-120, 2002.<br />

10. Virtual Auditing Agents: The Edgar Agent Challenge (with Alex Kogan, Kay Nelson, Raj<br />

Srivastava, and Miklos Vasarhelyi), Decision Support Systems 28, 241-253, 2000.<br />

o The project was funded by Ernst &Young LLP and the technology developed later was<br />

licensed to AdvanSoft International, Inc.<br />

Working Papers<br />

1. Investor Sentiment, Disagreement, and Return Predictability of Ownership Breadth (with Ling Cen<br />

and Liyan Yang), revise and resubmit (third round) at Management Science.<br />

2. Do Short Sellers Front-run Large Insider Sales? (with Mozaffar Khan), revise and resubmit at The<br />

Accounting Review.<br />

3. Rational Information Leakage (with Raffi Indjejikian and Liyan Yang), revise and resubmit at<br />

Management Science.<br />

4. Price Shocks, News Disclosures, and Asymmetric Drifts (with Kevin Wang and Xiaolu Wang).<br />

5. CEO’s Stock Option Timing Behaviors: New Evidence from Post-SOX and Post-Backdating-<br />

Scandal Era (with Wenli Huang).<br />

6. Is Sin always Sin? The Interaction Effect of Social Norms and Financial Performance on Market<br />

Participants’ Behavior (with Yanju Liu and Kevin Veenstra).<br />

7. Regulations and Brain Drain: Evidence from the Wall Street Star Analysts’ Career Choices (with<br />

Franco Wong and Yuyan Guan).<br />

8. Do Investors Delay Their Responses? An Investigation of Interdependence of the Information<br />

Content of Earnings Announcements and SEC Filings.<br />

2

Research Grants<br />

AIC Institute for Corporate Citizenship (2010-<strong>2011</strong>), Principal Investigator, $9,800.<br />

Social Sciences and Humanities Research Council (2008-<strong>2011</strong>), Principal Investigator, $97,800,<br />

CA-Queen’s Centre for Governance (2007-2008), Co-investigator, $10,000.<br />

CMA/CAAA Research Award (2007-2008), Principal Investigator, $8,000.<br />

Connaught Research Grant (2005-2007), Principal Investigator, $22,500.<br />

Connaught Start-up Research Grant (2004), Principal Investigator, $10,000.<br />

Teaching Experience<br />

Co-instructor, Ph.D. Pre-seminar of Accounting Workshop Series, 2005-2007.<br />

Guest Lecturer, Ph.D. Seminars of University of Toronto, 2008, 2009.<br />

PhD seminar “Market Participants (Analysts, Managers, and Investors) and Regulations”, Peking<br />

University, <strong>2011</strong>.<br />

Instructor and Course Coordinator, Management Accounting and Decision Making (Undergraduate core)<br />

University of Toronto, 2005 – 2010.<br />

Instructor, Core Concepts of Managerial Accounting (Undergraduate Core), USC, 2002.<br />

Teaching Assistant, Core Concepts of Financial Accounting, USC, 2001.<br />

Professional Service<br />

Editorial Board Member:<br />

Contemporary Accounting Research, 2010-2014.<br />

Referee:<br />

The Accounting Review<br />

Contemporary Accounting Research<br />

Review of Accounting Studies<br />

Journal of Accounting, Auditing and Finance<br />

Journal of Business Finance and Accounting<br />

Behavioral Research in Accounting<br />

International Journal of Accounting<br />

The Financial Review<br />

American Accounting Association Financial Accounting Mid-year Conference<br />

American Accounting Association Annual Conference<br />

Canadian Academic Accounting Association Annual Conference<br />

Social Sciences and Humanities Research Council Standard Grant Program<br />

Others:<br />

CMA Ontario Fair Exam Panel member, <strong>2011</strong>.<br />

Screening Judge of Entrepreneurship Competition of the <strong>2011</strong> National Business and Technology<br />

Conference.<br />

3

School Service<br />

Course Coordinator, Management Accounting, University of Toronto, 2006-<strong>2011</strong>.<br />

Co-organizer, University of Toronto Accounting Research Workshop Series, 2007-<strong>2011</strong>.<br />

Rotman Commerce Undergraduate Committee Member, University of Toronto, 2006 –<strong>2011</strong>.<br />

Accounting Area Recruiting Committee Member, University of Toronto, 2006-2010.<br />

Accounting Stream Curriculum Committee Member, 2007-2008.<br />

Ph.D. Dissertation Committee Member, Stephannie Larocque (Placement: Notre Dame, 2009), Yanju Liu<br />

(on-going), Kevin Veenstra (on-going).<br />

Ph.D. Defense Committee Member, Yuyan Guan (City University of Hong Kong, 2006), Yibin Zhou (UT<br />

Dallas, 2006), Xinghua Liang (McMaster, 2007), Surjit Tinaikar (Florida, 2007), Gauri Bhat (Washington<br />

U, 2008), Xiaohua Fang (Georgia State, 2010), Alastair Lawrence (UC Berkeley, <strong>2011</strong>).<br />

University of Toronto Excellence Award for Undergraduate Recipient Faculty Advisor (Kathy Qin, 2007,<br />

now at Harvard MBA program).<br />

Honors and Awards<br />

Best Paper Award, 31 st Annual Congress of European Accounting Association (Financial Accounting),<br />

Netherlands, 2008.<br />

Excellence in Teaching Award, Rotman School of Management, University of Toronto, 2005, 2006,<br />

2008-2010.<br />

SEC and Financial Reporting Institute Fellowship, 2003-2004.<br />

Fellowship, Marshall School of Business, USC, 1999-2003.<br />

Best Paper Award, 32nd Hawaii International Conference on System Sciences, 1999.<br />

Media Citations<br />

Featured in the Wall Street Journal on July 22 nd and September 30 th , 2008.<br />

Interviewed and featured in the cover story article of Investment Dealer Digest, March 5, 2007.<br />

Quantitative Strategy of Citigroup<br />

Dow Jones NewsPlus<br />

NASDAQ.com<br />

Morningstar.com<br />

Portfolio.com<br />

Seekingalpha.com<br />

CompensationStandards.com<br />

The Globe and Mail (Canada)<br />

Advisor.ca (Canada).<br />

Invited Presentations<br />

Public Speech: “Do Short Sellers Front-run Insider Sales?” The IIROC-DeGroote Luncheon Lecture<br />

Series organized by the Investment Industry Regulatory Organization of Canada (IIROC) and McMaster<br />

University, King Edward Hotel, Toronto, October, 2008.<br />

4

Workshop Presentations: University of Auckland, BlackRock Inc. (Equity Research Group), Boston<br />

University, University of Canterbury, Carnegie Mellon University, Chinese University of Hong Kong,<br />

City University of Hong Kong, Duke University, George Mason University, McGill University, MIT,<br />

University of Houston, University of Illinois at Urbana-Champaign, Peking University, University of<br />

Southern California, University of Toronto, Wilfred Laurier University, University of Wisconsin.<br />

Conference Presentations:<br />

AAA Financial Accounting Section (FARS) Conference, 2008, 2007, 2005.<br />

American Accounting Association Annual Conference, 2008, <strong>2011</strong>.<br />

Canadian Academic Accounting Association Annual Conference, 2007, <strong>2011</strong>.<br />

China International Conference in Finance, <strong>2011</strong>.<br />

European Accounting Association Annual Conference, 2008, <strong>2011</strong>.<br />

European Finance Association Annual Conference, 2009.<br />

Northern Finance Association Annual Conference, 2008.<br />

Second Toronto Accounting Research Conference, 2008.<br />

USC Alumni Research Symposium, 2008.<br />

30 th Anniversary Conference of the Journal of Banking and Finance, 2006.<br />

Conference Discussions:<br />

China International Conference in Finance, <strong>2011</strong>.<br />

o Discussion of “Access to Equity Markets, Corporate Investments and Stock Returns” by Sheridan<br />

Titman, John Wei, and Feixue Xie.<br />

CAAA Annual Conference, <strong>2011</strong>.<br />

o Discussion of “Book-to-Market Decomposition and the Accrual Anomaly” by Xiaoquan Jiang<br />

and Yunhao Chen.<br />

AAA Annual Conference, 2010.<br />

o Discussion of “Accrual Reversals, Earnings and Stock Returns” by Eric Allen, Chad Larson, and<br />

Richard Sloan.<br />

China International Conference in Finance, 2010.<br />

o Discussion of “Unusual News Events and the Cross-Section of Stock Returns” by Turan Bali,<br />

Anna Scherbina and Yi Tang.<br />

20 th Financial Economics and Accounting Conference, 2009.<br />

o Discussion of “The Relative Profitability of Analysts’ Stock Recommendations: What Role Does<br />

Investor Sentiment Play?” by Mark Bagnoli, Michael Clement, Michael Crawley, and Susan<br />

Watts.<br />

CAAA Annual Conference, 2009.<br />

o Discussion of “The Choice of Joint-Auditors and Earnings Quality: Evidence from French Listed<br />

Companies” by Sophie Marmousez.<br />

Asian Finance Association International Conference, 2008.<br />

o Discussion of “Private Contracting and Corporate Governance: Evidence from the Provision of<br />

Tag-Along Rights in an Emerging Market” by Morten Bennedsen, Kasper Nielsen, Thomas<br />

Nielsen.<br />

7 th London Business School Accounting Symposium, 2007.<br />

o Discussion of “Investor Recognition and Stock Returns” by Reuven Lehavy and Richard Sloan.<br />

5

CAAA Annual Conference, 2007.<br />

o Discussion of “The Adoption of Deferred Share Unit Plans for Outside Directors: Economic and<br />

Social Determinants” by Paul Andre, Shamer Khalil, and Michel Magnan.<br />

AAA Annual Conference, 2007.<br />

o Discussion of “Overreaction to Intra-Industry Information Transfer” by Jake Thomas and Frank<br />

Zhang<br />

o Discussion of “Information Externalities in Capital Markets: The Economic Determinants of<br />

Suppliers’ Stock Price Reaction to Their Major Customers’ Information Events” by Shail Pandit,<br />

Charles Wasley, and Tzachi Zach.<br />

o Discussion of “The Time Pattern of Earnings Information Arrival at the Market” by Myojung<br />

Cho.<br />

15 th Financial Economics and Accounting Conference, 2004.<br />

o Discussion of “Do Investors Overvalue Firms with Bloated Balance Sheets” by David Hirshleifer,<br />

Kewei Hou, Shew Hong Teoh, Yinglei Zhang.<br />

o Discussion of “What Are Stock Investors’ Actual Historical Returns” by Ilia Dichev.<br />

Invited Conferences<br />

Tel Aviv University Accounting Conference, 2010.<br />

London Business School Accounting Symposium, 2009.<br />

University of Minnesota Empirical Accounting Conference, 2009.<br />

Contemporary Accounting Research Conference, 2004-2010.<br />

University of Notre Dame CARE Conference, 2006-2008, 2010, <strong>2011</strong>.<br />

Professional Affiliation<br />

Member of American Accounting Association, American Finance Association, Canadian Academic<br />

Accounting Association.<br />

6