member handbook & Fee Schedule - Patelco Credit Union

member handbook & Fee Schedule - Patelco Credit Union

member handbook & Fee Schedule - Patelco Credit Union

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

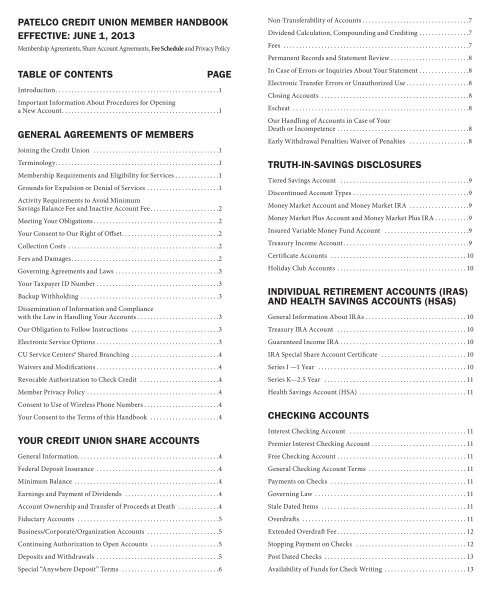

PATELCO CREDIT UNION MEMBER HANDBOOK<br />

EFFECTIVE: JUNE 1, 2013<br />

Membership Agreements, Share Account Agreements, <strong>Fee</strong> <strong>Schedule</strong> and Privacy Policy<br />

TABLE OF CONTENTS PAGE<br />

Introduction ....................................................1<br />

Important Information About Procedures for Opening<br />

a New Account ..................................................1<br />

GENERAL AGREEMENTS OF MEMBERS<br />

Joining the <strong>Credit</strong> <strong>Union</strong> ........................................1<br />

Terminology ....................................................1<br />

Membership Requirements and Eligibility for Services ..............1<br />

Grounds for Expulsion or Denial of Services .......................1<br />

Activity Requirements to Avoid Minimum<br />

Savings Balance <strong>Fee</strong> and Inactive Account <strong>Fee</strong> ......................2<br />

Meeting Your Obligations ........................................2<br />

Your Consent to Our Right of Offset ...............................2<br />

Collection Costs ................................................2<br />

<strong>Fee</strong>s and Damages ...............................................2<br />

Governing Agreements and Laws .................................3<br />

Your Taxpayer ID Number .......................................3<br />

Backup Withholding ............................................3<br />

Dissemination of Information and Compliance<br />

with the Law in Handling Your Accounts ..........................3<br />

Our Obligation to Follow Instructions ............................3<br />

Electronic Service Options .......................................3<br />

CU Service Centers® Shared Branching ............................4<br />

Waivers and Modifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4<br />

Revocable Authorization to Check <strong>Credit</strong> .........................4<br />

Member Privacy Policy ..........................................4<br />

Consent to Use of Wireless Phone Numbers ........................4<br />

Your Consent to the Terms of this Handbook ......................4<br />

YOUR CREDIT UNION SHARE ACCOUNTS<br />

General Information. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4<br />

Federal Deposit Insurance .......................................4<br />

Minimum Balance ..............................................4<br />

Earnings and Payment of Dividends ..............................4<br />

Account Ownership and Transfer of Proceeds at Death .............4<br />

Fiduciary Accounts .............................................5<br />

Business/Corporate/Organization Accounts .......................5<br />

Continuing Authorization to Open Accounts ......................5<br />

Deposits and Withdrawals .......................................5<br />

Special “Anywhere Deposit” Terms ...............................6<br />

Non-Transferability of Accounts ..................................7<br />

Dividend Calculation, Compounding and <strong>Credit</strong>ing ................7<br />

<strong>Fee</strong>s ...........................................................7<br />

Permanent Records and Statement Review .........................8<br />

In Case of Errors or Inquiries About Your Statement ................8<br />

Electronic Transfer Errors or Unauthorized Use ....................8<br />

Closing Accounts ...............................................8<br />

Escheat ........................................................8<br />

Our Handling of Accounts in Case of Your<br />

Death or Incompetence ..........................................8<br />

Early Withdrawal Penalties; Waiver of Penalties ...................8<br />

TRUTH-IN-SAVINGS DISCLOSURES<br />

Tiered Savings Account .........................................9<br />

Discontinued Account Types .....................................9<br />

Money Market Account and Money Market IRA ...................9<br />

Money Market Plus Account and Money Market Plus IRA ...........9<br />

Insured Variable Money Fund Account ...........................9<br />

Treasury Income Account ........................................9<br />

Certificate Accounts ...........................................10<br />

Holiday Club Accounts .........................................10<br />

INDIVIDUAL RETIREMENT ACCOUNTS (IRAS)<br />

AND HEALTH SAVINGS ACCOUNTS (HSAS)<br />

General Information About IRAs ................................10<br />

Treasury IRA Account .........................................10<br />

Guaranteed Income IRA ........................................10<br />

IRA Special Share Account Certificate ...........................10<br />

Series I —1 Year ...............................................10<br />

Series K—2.5 Year .............................................11<br />

Health Savings Account (HSA) ..................................11<br />

CHECKING ACCOUNTS<br />

Interest Checking Account .....................................11<br />

Premier Interest Checking Account ..............................11<br />

Free Checking Account .........................................11<br />

General Checking Account Terms ...............................11<br />

Payments on Checks ...........................................11<br />

Governing Law ................................................11<br />

Stale Dated Items ..............................................11<br />

Overdrafts ....................................................11<br />

Extended Overdraft <strong>Fee</strong> .........................................12<br />

Stopping Payment on Checks ...................................12<br />

Post Dated Checks .............................................13<br />

Availability of Funds for Check Writing ..........................13