James Montier, 2003, Behavioral Finance: Insights into Irrational ...

James Montier, 2003, Behavioral Finance: Insights into Irrational ...

James Montier, 2003, Behavioral Finance: Insights into Irrational ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

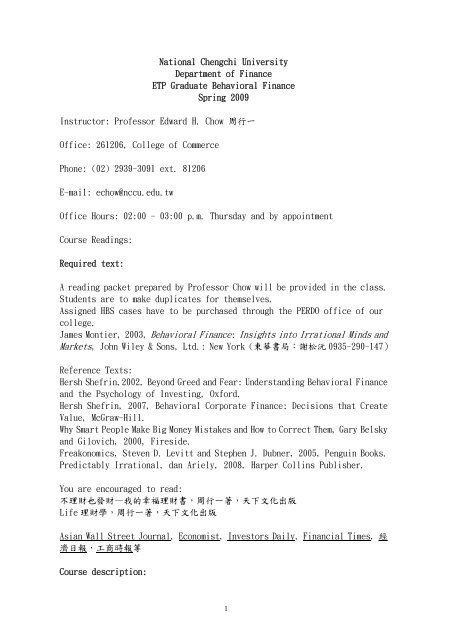

National Chengchi University<br />

Department of <strong>Finance</strong><br />

ETP Graduate <strong>Behavioral</strong> <strong>Finance</strong><br />

Spring 2009<br />

Instructor: Professor Edward H. Chow 周行一<br />

Office: 261206, College of Commerce<br />

Phone: (02) 2939-3091 ext. 81206<br />

E-mail: echow@nccu.edu.tw<br />

Office Hours: 02:00 - 03:00 p.m. Thursday and by appointment<br />

Course Readings:<br />

Required text:<br />

A reading packet prepared by Professor Chow will be provided in the class.<br />

Students are to make duplicates for themselves.<br />

Assigned HBS cases have to be purchased through the PERDO office of our<br />

college.<br />

<strong>James</strong> <strong>Montier</strong>, <strong>2003</strong>, <strong>Behavioral</strong> <strong>Finance</strong>: <strong>Insights</strong> <strong>into</strong> <strong>Irrational</strong> Minds and<br />

Markets, John Wiley & Sons, Ltd.: New York (東華書局:謝松沅 0935-290-147)<br />

Reference Texts:<br />

Hersh Shefrin,2002, Beyond Greed and Fear: Understanding <strong>Behavioral</strong> <strong>Finance</strong><br />

and the Psychology of Investing, Oxford.<br />

Hersh Shefrin, 2007, <strong>Behavioral</strong> Corporate <strong>Finance</strong>: Decisions that Create<br />

Value, McGraw-Hill.<br />

Why Smart People Make Big Money Mistakes and How to Correct Them, Gary Belsky<br />

and Gilovich, 2000, Fireside.<br />

Freakonomics, Steven D. Levitt and Stephen J. Dubner, 2005, Penguin Books.<br />

Predictably <strong>Irrational</strong>, dan Ariely, 2008, Harper Collins Publisher.<br />

You are encouraged to read:<br />

不理財也發財—我的幸福理財書,周行一著,天下文化出版<br />

Life 理財學,周行一著,天下文化出版<br />

Asian Wall Street Journal, Economist, Investors Daily, Financial Times, 經<br />

濟日報,工商時報等<br />

Course description:<br />

1

This course is designed to introduce <strong>Behavioral</strong> <strong>Finance</strong> to students.<br />

<strong>Behavioral</strong> finance is applied to all aspects of finance including investments<br />

and corporate finance. I expect you to have basic knowledge of corporate<br />

finance, investments and economics. An important part of this class is<br />

conducted through class discussion. In the first three lectures, an overview<br />

of behavioral biases that are related to finance will be overviewed. The<br />

behavioral biases related to finance include heuristic biases and frame<br />

dependence. The major heuristic biases include overconfidence,<br />

self-attribution, optimism, representativeness, anchoring and adjustment,<br />

conservatism, availability biases, and hindsight. Frame dependence includes<br />

loss aversion, ambiguity aversion, narrow framing, and mental accounts.<br />

Prospect theory, which is in contrast to expected utility theory, concerns<br />

itself with how decisions are actually made. It is based on the findings from<br />

experimental cognitive psychology. Prospect theory has two parts: a value<br />

function and a weighting function.<br />

Grading Structure (if students need to register in a course)<br />

Presentations 30%<br />

Participations and discussions 40%<br />

Term Paper 30%<br />

Students are required to present the assigned papers and to participate in<br />

the discussions. In addition, Students are required to write a term paper<br />

or a proposal. The term paper or proposal should be related to the topics<br />

covered in this course. The term paper or proposal could be either a<br />

replication of a published empirical paper (subject to approval by the<br />

instructor) or an original research topic.<br />

The flow of our discussion will basically follow the schedule below. My<br />

objective is very simple: to help you understand how behavioral finance is<br />

applied to investments and corporate finance. I will be the one who leads<br />

the discussion in class. However, I expect you to be very active in<br />

participating in the class discussion. A substantial part of your final<br />

grade (40%) will be determined by the quality of your participation, namely,<br />

the extent of your understanding of the class material, the quality of your<br />

discussion and the insight you provide to the class. You definitely will<br />

be called upon in each class to either discuss the class material or comment<br />

on a point in issue. You need to form work groups for all the work in this<br />

class. Each group consists of 3-4 students. In the fifth week you shall<br />

submit to me a one-page description of your topic. Please let me know why<br />

and how you are going to write the paper. In the final two meetings of the<br />

semester you need to present your paper in the class. The presentation time<br />

is 20 minutes, no more and no less. The paper needs to have the following<br />

components: the background of the paper, analysis of the issue,<br />

implications for readers, and references. I reserve the right to have a<br />

2

final examination. If the students perform well during the semester, then<br />

the final examination will be waved.<br />

Course outline<br />

1 Overview of Heuristic-Driven Biases, Frame Dependence, and Prospect Theory<br />

as well as an Introduction of Limits to Arbitrage<br />

Readings:<br />

Chpt. 1 and 2, <strong>Montier</strong><br />

Barberis, Nicholas, and Richard Thaler, <strong>2003</strong>, “A survey of behavior<br />

finance,” in Handbook of the Economics of <strong>Finance</strong>, G. Constantinides, M.<br />

Harris, and R. Stulz (ed.), North-Holland, Amsterdam.<br />

Fama, Eugene F., 1998, Market efficiency, long-term returns, and behavioral<br />

finance, Journal of Financial Economics 49, 283-306.<br />

Kahneman, D., <strong>2003</strong>, “Maps of bounded rationality: Psychology for behavioral<br />

economics,” American Economic Review 93, 1449-1475.<br />

Kahneman, Daniel, and Amos Tversky, 1979, Prospect theory: An analysis of<br />

decision under risk, Econometrica 47, 263-291.<br />

Malkiel, Burton G., <strong>2003</strong>, “The efficient market hypothesis and its<br />

critics,” Journal of Economic Perspective 17, 59-82.<br />

Shiller, Robert J., <strong>2003</strong>, “From Efficient Markets Theory to <strong>Behavioral</strong><br />

<strong>Finance</strong>,” Journal of Economic Perspective 17, 83-104.<br />

2 Overview of Heuristic-Driven Biases, Frame Dependence, and Prospect Theory<br />

as well as an Introduction of Limits to Arbitrage<br />

Readings:<br />

Same as above<br />

3 Overview of Heuristic-Driven Biases, Frame Dependence, and Prospect Theory<br />

as well as an Introduction of Limits to Arbitrage<br />

Readings:<br />

Same as above<br />

4 Limits of Arbitrage<br />

Readings:<br />

Chpt. 2, <strong>Montier</strong><br />

Ali, Ashiq, Lee-Seok Hwang, and Mark A. Trombley, <strong>2003</strong>, “Arbitrage risk and<br />

the book-tomarket anomaly,” Journal of Financial Economics 69, 355-373.<br />

Mitchell, M., T. Pulvino and E. Stafford (2002), “Limited arbitrage in<br />

equity markets,” Journal of <strong>Finance</strong> 57, 551−584.<br />

Ofek, Eli, Matthew Richardson, and Robert F. Whitelaw, 2004, “Limited<br />

arbitrage and short sales restrictions: Evidence from the options markets,”<br />

Journal of Financial Economics 74, 305-342.<br />

Owen A. Lamont and Richard H. Thaler (2004), “Can the market add and subtract?<br />

Mispricing in tech stock carve-outs,” Journal of Political Economy<br />

3

111:227−268.<br />

5 Limits of Arbitrage<br />

Readings:<br />

Same as above<br />

Remember to turn in your term paper proposal.<br />

6 Discuss your term paper proposal<br />

7 Style Investment<br />

Readings:<br />

Chpt. 3, <strong>Montier</strong><br />

Barberis, Nichole, Andrei. Shleifer and Jeffrey Wurgler, 2005,<br />

“Comovement,” Journal of Financial Economics 75, 283-317.<br />

Teo, Melvyn and Sung-Jun Woo, 2004, “Style effects in the cross-section of<br />

stock returns,” Journal of Financial Economics 74, 367-398.<br />

8 Stock Valuation<br />

Readings:<br />

Chpt. 4, <strong>Montier</strong><br />

9 Asset Allocation<br />

Readings:<br />

Chpt. 6, <strong>Montier</strong><br />

10 Corporate <strong>Finance</strong><br />

Readings:<br />

Chpt. 7, <strong>Montier</strong><br />

11 Applications of Prospect Theory (Empirical)<br />

Readings:<br />

Franzzini, Andrew, 2006, “The disposition effect and underreaction to<br />

news,” Journal of <strong>Finance</strong> 61, 2017-2046.<br />

Ljunqvist, Alexander and William Wilhelm, 2005, “Does prospect theory<br />

explain IPO market behavior?” Journal of <strong>Finance</strong> 60, 1759-1790.<br />

12 Trading behavior<br />

Barber, Brad M., and Terrance Odean, 2000, Trading is hazardous to your wealth:<br />

The common stock investment performance of individual investors,” Journal<br />

of <strong>Finance</strong> 55, 773-806.<br />

Elton, Edwin, Martin Gruber and Jeffrey A. Busse, 2004, “Are investors<br />

rational? Choices among index funds,” Journal of <strong>Finance</strong> 59, 261-288.<br />

13 Applications of <strong>Behavioral</strong> <strong>Finance</strong>: Security Design<br />

Case study: Shefrin, Hersh and Meir Statman, <strong>Behavioral</strong> Aspects of the Design<br />

4

and Marketing of Financial Products, Financial Management Summer 1993.<br />

123-134.<br />

14 Applications of <strong>Behavioral</strong> <strong>Finance</strong>: Advise for investors<br />

Kahneman, Daniel and Mark W. Riepe, Aspects of Investor Psychology: Beliefs,<br />

preferences, and biases investment advisors should know about, Journal of<br />

Portfolio Management Summer 1998, 52-65.<br />

Case study: Fisher, Kenneth L and Meir Statman, A <strong>Behavioral</strong> Framework for<br />

Time Diversification, Financial Analyst Journal May/June 1999, 88-97.<br />

15. Case Study: <strong>Behavioral</strong> <strong>Finance</strong> at JP Morgan, Malcolm Baker and Aldo Sesia<br />

Jr. (9-207-084)<br />

16 Term paper presentation<br />

17Term paper presentation<br />

I may invite speakers to give talks to you. To be announced.<br />

5