ANNUAL REPORT - ZEPPELIN GmbH

ANNUAL REPORT - ZEPPELIN GmbH

ANNUAL REPORT - ZEPPELIN GmbH

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2008<br />

<strong>ANNUAL</strong> <strong>REPORT</strong><br />

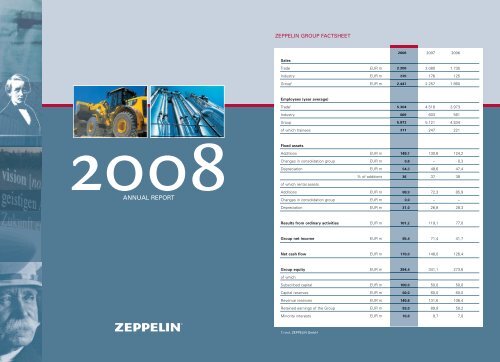

<strong>ZEPPELIN</strong> GROUP FACTSHEET<br />

Sales<br />

2008 2007 2006<br />

Trade EUR m 2.208 2.080 1.735<br />

Industry EUR m 239 176 125<br />

Group 1 EUR m 2.447 2.257 1.860<br />

Employees (year average)<br />

Trade 1 5.304 4.518 3.973<br />

Industry 669 603 561<br />

Group 5.973 5.121 4.534<br />

of which trainees 311 247 221<br />

Fixed assets<br />

Additions EUR m 149,7 130,6 124,2<br />

Changes in consolidation group EUR m 0,6 – - 0,3<br />

Depreciation EUR m 54,3 48,6 47,4<br />

of which rental assets<br />

% of additions 36 37 38<br />

Additions EUR m 88,9 72,3 85,9<br />

Changes in consolidation group EUR m 0,0 – –<br />

Depreciation EUR m 31,0 26,8 28,3<br />

Results from ordinary activities EUR m 101,2 119,1 77,0<br />

Group net income EUR m 65,4 71,4 41,7<br />

Net cash flow EUR m 170,0 148,0 126,4<br />

Group equity EUR m 394,4 341,1 273,6<br />

of which<br />

Subscribed capital EUR m 100,0 50,0 50,0<br />

Capital reserves EUR m 60,0 60,0 60,0<br />

Revenue reserves EUR m 140,6 131,6 106,4<br />

Retained earnings of the Group EUR m 83,0 89,9 50,2<br />

Minority interests EUR m 10,8 9,7 7,0<br />

1) incl. <strong>ZEPPELIN</strong> <strong>GmbH</strong>

<strong>ZEPPELIN</strong> GROUP CONTACTS<br />

<strong>ZEPPELIN</strong> GMBH<br />

Registered Office:<br />

Leutholdstraße 30<br />

88045 Friedrichshafen<br />

Germany<br />

Phone +49 7541 202-201<br />

Fax +49 7541 202-210<br />

Headquarters:<br />

Graf-Zeppelin-Platz 1<br />

85748 Garching bei München<br />

Germany<br />

Phone +49 89 320 00-0<br />

Fax +49 89 320 00-482<br />

E-Mail: zeppelin@zeppelin.com<br />

TRADING<br />

Zeppelin Baumaschinen <strong>GmbH</strong><br />

Graf-Zeppelin-Platz 1<br />

85748 Garching bei München<br />

Germany<br />

Phone +49 89 320 00-0<br />

Fax +49 89 320 00-482<br />

E-Mail: zeppelin@zeppelin.com<br />

MVS Zeppelin <strong>GmbH</strong> & Co. KG<br />

Graf-Zeppelin-Platz 1<br />

85748 Garching bei München<br />

Germany<br />

Phone +49 89 320 00-220<br />

Fax +49 89 320 00-222<br />

E-Mail: info@mvs-zeppelin.de<br />

Zeppelin Power Systems<br />

<strong>GmbH</strong> & Co. KG<br />

Ruhrstraße 158<br />

22761 Hamburg<br />

Germany<br />

Phone +49 40 853 151-0<br />

Fax +49 40 853 151-39<br />

E-Mail: powersystems@zeppelin.com<br />

This company is also your<br />

contact for:<br />

Zeppelin SkySails Sales & Service<br />

<strong>GmbH</strong> & Co. KG<br />

Hamburg, Germany<br />

Zeppelin Österreich <strong>GmbH</strong><br />

Zeppelinstraße 2<br />

2401 Fischamend, Austria<br />

Phone +43 2232 790-0<br />

Fax +43 2232 790-262<br />

E-Mail: marketing@zeppelin-cat.at<br />

Phoenix-Zeppelin, spol. s r.o.<br />

Lipova 72, 25170 Modletice<br />

Czech Republic<br />

Phone +420 26 6015-200<br />

Fax +420 26 6015-361<br />

E-Mail: info@p-z.cz<br />

This intermediate holding<br />

is also your contact for<br />

the following companies:<br />

Phoenix Zeppelin, spol. s r.o.<br />

Banskà Bystrica,<br />

Republic of Slovakia<br />

ČZ LOKO, a.s.<br />

eska T ebová, Czech Republic<br />

Zeppelin-Körös-Spedit Kft.<br />

Budapest, Hungary<br />

Zeppelin Polska Sp. z o.o.<br />

Warsaw, Poland<br />

Zeppelin International AG<br />

Chamerstraße 85,<br />

6300 Zug, Switzerland<br />

Phone +41 41 747 00 30<br />

Fax +41 41 747 00 31<br />

E-Mail: zeppelin@zeppelin-int.ch<br />

This intermediate holding<br />

is also your contact for<br />

the following companies:<br />

Zeppelin Armenia LLC<br />

Yerevan, Armenia<br />

Zeppelin Belarus OOO<br />

Minsk, Belarus<br />

Zeppelin Russland OOO<br />

Moscow, Russia<br />

Zeppelin Ukraine TOW<br />

Kiev, Ukraine<br />

Zeppelin Turkmenistan JV<br />

Ashgabat, Turkmenistan<br />

Repräsentanz Tadschikistan<br />

Dushanbe, Tajikistan<br />

Repräsentanz Usbekistan<br />

Tashkent, Uzbekistan<br />

INDUSTRY<br />

Zeppelin Silos & Systems <strong>GmbH</strong><br />

Leutholdstraße 108<br />

88045 Friedrichshafen,<br />

Germany<br />

Phone +49 7541 202-02<br />

Fax +49 7541 202-491<br />

E-Mail: zentral.fn@zeppelin.com<br />

This intermediate holding<br />

is also your contact for<br />

the following companies:<br />

Zeppelin Belgium N. V.<br />

Genk, Belgium<br />

Zeppelin Plast Tech S.r.l.<br />

Milan, Italy<br />

Zeppelin Systems Limited<br />

Nottingham, UK<br />

JMB Zeppelin Equipamentos<br />

Industriais Ltda.<br />

São Paulo, Brazil<br />

Zeppelin Systems USA Inc.<br />

Houston, U.S.A.<br />

Zeppelin Solid Technology<br />

(Beijing) Co. Ltd.<br />

Beijing, China<br />

Zeppelin Systems India Pvt. Ltd.<br />

Mumbai, India<br />

Zeppelin Gulf Co. Ltd.<br />

Juaymah, Saudi Arabia<br />

Zeppelin Technology<br />

Far East Pte. Ltd.<br />

Singapore<br />

Zeppelin Plastech Asia Pte. Ltd.<br />

Singapore<br />

Registered Office:<br />

Leutholdstraße 30<br />

88045 Friedrichshafen<br />

Germany<br />

Phone +49 7541 202-201<br />

Fax +49 7541 202-210<br />

<strong>ZEPPELIN</strong> GMBH<br />

zeppelin@zeppelin.com<br />

www.zeppelin.de<br />

Headquarters:<br />

Graf-Zeppelin-Platz 1<br />

85748 Garching bei München<br />

Germany<br />

Phone +49 89 320 00-0<br />

Fax +49 89 320 00-482

1 With Zeppelin SkySails<br />

Sales & Service <strong>GmbH</strong> & Co. KG<br />

2 With MVS Zeppelin Österreich <strong>GmbH</strong><br />

3 With ČZ LOKO, a. s., Tschechien<br />

4 Representation<br />

5 Representation in Moscow,<br />

Subsidiary in Turkey in foundation<br />

Zeppelin Baumaschinen <strong>GmbH</strong><br />

Garching bei München,<br />

Germany<br />

MVS Zeppelin <strong>GmbH</strong> & Co. KG<br />

Garching bei München,<br />

Germany<br />

Zeppelin Power Systems 1<br />

<strong>GmbH</strong> & Co. KG,<br />

Hamburg, Germany<br />

Zeppelin Österreich <strong>GmbH</strong> 2<br />

Fischamend (Vienna),<br />

Austria<br />

Phoenix-Zeppelin, spol. s r.o. 3<br />

Modletice (Prague),<br />

Czech Republic<br />

Phoenix Zeppelin, spol. s r.o.<br />

Banskà Bystrica,<br />

Republic of Slovakia<br />

Zeppelin Polska Sp. z o.o.<br />

Warsaw,<br />

Poland<br />

Zeppelin-Körös-Spedit Kft.,<br />

Budapest,<br />

Hungary<br />

<strong>ZEPPELIN</strong> GMBH<br />

Friedrichshafen, Germany<br />

TRADE DIVISION INDUSTRY DIVISION<br />

Zeppelin International AG<br />

Zug,<br />

Switzerland<br />

Zeppelin Russland OOO<br />

Moscow,<br />

Russia<br />

Zeppelin Ukraine TOW<br />

Kiev,<br />

Ukraine<br />

Zeppelin Armenia LLC<br />

Yerevan,<br />

Armenia<br />

Zeppelin Belarus OOO<br />

Minsk,<br />

Belarus<br />

Zeppelin Turkmenistan JV<br />

Ashgabat,<br />

Turkmenistan<br />

Zeppelin Tadschikistan 4<br />

Dushanbe,<br />

Tajikistan<br />

Zeppelin Usbekistan 4<br />

Taschkent,<br />

Uzbekistan<br />

Zeppelin Silos & Systems <strong>GmbH</strong> 5<br />

Friedrichshafen,<br />

Germany<br />

Zeppelin Belgium N. V.<br />

Genk,<br />

Belgium<br />

Zeppelin Plast Tech S.r.l.<br />

Milano,<br />

Italy<br />

Zeppelin Systems Limited<br />

Nottingham,<br />

UK<br />

JMB Zeppelin Equipamentos<br />

Industriais Ltda.<br />

São Paulo, Brazil<br />

Zeppelin Systems USA Inc.<br />

Houston,<br />

U.S.A.<br />

Zeppelin Solid Technology<br />

Co. Ltd.<br />

Beijing, China<br />

Zeppelin Systems India Pvt. Ltd.<br />

Mumbai,<br />

India<br />

Dated: April 2009<br />

Zeppelin Gulf Co. Ltd.<br />

Juaymah,<br />

Saudi Arabia<br />

Zeppelin Technology<br />

Far East Pte. Ltd.<br />

Singapore<br />

Zeppelin Plastech<br />

Asia Pte. Ltd.<br />

Singapore

<strong>ZEPPELIN</strong> GROUP: 190 LOCATIONS<br />

USA<br />

Houston<br />

GREAT BRITAIN<br />

Nottingham<br />

GERMANY<br />

Friedrichshafen | 3<br />

SWITZERLAND<br />

Zug<br />

GERMANY<br />

Munich | 119<br />

BELGIUM<br />

Genk<br />

BRAZIL<br />

São Paulo<br />

ITALY<br />

Milan<br />

POLAND<br />

Warsaw |2<br />

AUSTRIA<br />

Vienna | 5<br />

HUNGARY<br />

Budapest<br />

BELARUS<br />

Minsk<br />

CZECH REPUBLIC<br />

Prague | 12<br />

UKRAINE<br />

Kiev | 7<br />

SLOVAKIA<br />

Banskà Bystrica |5<br />

RUSSIA<br />

Moscow | 14<br />

SAUDI ARABIA<br />

Jubaii<br />

COUNTRY<br />

Location<br />

INDIA<br />

Mumbai<br />

RUSSIA<br />

Moscow<br />

SINGAPORE<br />

Singapore<br />

TURKEY<br />

Istanbul<br />

INDUSTRY DIVISION TRADE DIVISION<br />

TURKMENISTAN<br />

Ashgabat | 3<br />

ARMENIA<br />

Yerevan<br />

COUNTRY<br />

Main location | No. of locations<br />

CHINA<br />

Beijing<br />

UZBEKISTAN<br />

Tashkent | 4<br />

TAJIKISTAN<br />

Dushanbe

Contents<br />

Management Board 2<br />

Directors’ Report 3<br />

Supervisory Board Report 6<br />

Corporate Boards 8<br />

A Vision Creates Values<br />

A Century of Tradition, Change and Growth 10<br />

The Zeppelin Airship Era 12<br />

Overcoming Boundaries 14<br />

Phoenix from the Ashes 16<br />

Zeppelin Today 18<br />

Zeppelin Worldwide 20<br />

Creating Value for our Customers 22<br />

People Create Values 24<br />

Sustainability is our Legacy 26<br />

Innovating into the Future 28<br />

Innovations 2008<br />

First Diesel-Electric Powered Dozer 30<br />

Turn Wind into Profit 32<br />

Innovative Rentals 34<br />

Energy Efficiency in Logistics 36<br />

Groundbreaking Filter Technology 38<br />

Group Management Report<br />

1. Business and Economic Environment 42<br />

2. Business Development of the Company 45<br />

3. Results of Operations, Financial Position and Net Assets 53<br />

4. Subsequent Events 57<br />

5. Risk Report 57<br />

6. Outlook 62<br />

Group Financial Statement 67<br />

<strong>ZEPPELIN</strong> GROUP FACTSHEET (front cover)<br />

190 LOCATIONS (front cover, double page)<br />

<strong>ZEPPELIN</strong> GROUP CONTACTS (back cover)<br />

STRUCTURE (back cover, double page)

Ernst<br />

Susanek<br />

President and CEO<br />

Central Functions,<br />

Power Systems and<br />

Trading Companies<br />

ex Germany<br />

Management Board<br />

Alexander<br />

Bautzmann<br />

Finance<br />

and Property<br />

Management<br />

Directors’ Report<br />

The Zeppelin Group can look back on a strong 2008, even if worldwide economic turbulence in<br />

the wake of the US financial and real estate crisis also impacted on our business, notably in the<br />

last quarter of the fiscal year. Successfully flouting the trend, we still achieved the highest sales<br />

revenues and highest cash flow in the history of our company in 2008: the year in which the<br />

Zeppelin Foundation and Zeppelin Group celebrated their centenary. The huge effort of recent<br />

years in our drive for renewal and greater efficiency have paid off, enabling us to push our Return<br />

on Sales well above past averages. In total, the Zeppelin Group achieved a net cash flow of<br />

approximately €170 million in fiscal 2008 (2007: €148 million). At 4 percent (2007: 5.2 percent)<br />

our ROS is at an acceptable level. And, with Zeppelin being awarded an A+ rating by Creditreform<br />

2 2008 zeppelin annual report 3<br />

Michael<br />

Heidemann<br />

Sales, Service<br />

and Rentals<br />

Germany<br />

Peter<br />

Gerstmann<br />

Controlling and<br />

Industry Division<br />

Rating AG for the fourth year running, this confirms the effectiveness of our ongoing commitment<br />

to capitalize on market opportunities and apply strict cost discipline throughout our business.<br />

Group revenues rose by 8.4 percent to € 2.447 billion (2007: € 2.257 billion). We generated this<br />

growth under our own power, without significant acquisitions. Non-domestic revenues continued<br />

their steady growth as a percentage of overall earnings, rising from 45 to almost 50 percent in<br />

2008. Internationalization and diversification – a strong commitment at Zeppelin since the early<br />

1990s – enable us to spread risk better across a number of countries and markets. Through<br />

strength in innovation and proximity to the markets we serve, every company in the Zeppelin<br />

Group has managed to sustain or expand its competitive position.<br />

Despite the weakening of markets during the last quarter of 2008, our trading companies still<br />

succeeded in raising sales revenues for the entire year, up 6.1 percent over 2007. In total, we sold<br />

19,054 construction machines, engines and lift trucks (2007: 19,487), achieving retail revenues of<br />

€ 2.208 billion (2007: €2.080 billion). Activities outside Germany were particularly dynamic.<br />

At Zeppelin International AG, the intermediate holding which has overall stewardship of our<br />

non-EU trading activities, sales revenues soared by 47 percent compared to 2007. However,<br />

significant currency devaluation in Russia and Ukraine in recent months has impacted severely on.<br />

Jürgen-Philipp<br />

Knepper<br />

HR (Labor Director),<br />

Legal and Compliance

Directors’ Report<br />

the Group's operating results for the year. The German rentals company and Zeppelin Power Systems<br />

both displayed strong positive trends. With each area posting revenue growth of 8 percent<br />

in 2008, our expansion strategy for these two business sectors is showing through in results.<br />

We also took key strategic steps in 2008 for future expansion: we founded Zeppelin Rental <strong>GmbH</strong>,<br />

which will in future steer the entire rental activities of the Zeppelin Group, and acquired a shareholding<br />

in the Hamburg-based company SkySails <strong>GmbH</strong> & Co KG, which complements the Power<br />

Systems portfolio with wind propulsion for ships.<br />

The Zeppelin Industry business also had a very strong 2008, continuing its uninterrupted growth<br />

of preceding years. Sales revenues rose by 36 percent to € 239 million (2007: € 176 million),<br />

with international business accounting for 66 percent of this total (2007: 83 percent). A healthy volume<br />

of orders kept engineering and production working to capacity over the entire year, despite<br />

a distinct slowdown on the relevant markets towards the end of 2008 which is expected to continue<br />

through 2009. Our growth strategy in 2008 also included activities to expand our value chain<br />

and open up new markets: for example, we acquired an engineering company in India and founded<br />

a subsidiary in Turkey. In addition, the joint venture we founded in 2007 with a partner in<br />

Saudi Arabia (Zeppelin Gulf Co. Ltd.) took up operations successfully.<br />

Delivering business excellence for the benefit of our customers is our credo – the benchmark we<br />

set ourselves every single day. This is about constantly being ready for change both in products<br />

and processes, and placing a premium on innovation. In 2008 the Zeppelin Group companies have<br />

channeled major effort and commitment into living up to this credo. The new product generations<br />

of our Trading division, which we rolled out with our manufacturer partners, push innovation<br />

boundaries above all in terms of greater operational efficiency and reduced carbon emissions.<br />

With new advanced filter technologies, the Industry division likewise introduced innovation to<br />

the benefit of customers. On the process side we have continued to drive through improvements<br />

in all our companies, for example introducing a new IT system in the largest Zeppelin Group company,<br />

Zeppelin Baumaschinen <strong>GmbH</strong>. Already in productive operation, the new solution is firmly<br />

on track to raise our productivity and make communication at customer interfaces swifter and<br />

more efficient.<br />

Looking into the future, the development of the Zeppelin Group and its companies is subject to<br />

considerable risk in 2009. Our company has not escaped the fallout from the global economic<br />

crisis. With market volumes tumbling (in some cases the shrinkage is enormous) compared to the<br />

first months of fiscal 2008, and in the light of continuing currency risks in the countries of eastern<br />

Europe, our sales revenue and profits have been under strain in the first quarter of 2009. Accordingly,<br />

taking a critical view of projected market volumes, we predict that sales revenues could<br />

decline by as much as 20 percent, with a Return on Sales between 2 and 3 percent.<br />

Given the uncertainty in our external environment, we are focusing all the more on our own<br />

strengths, from which we can derive the power to sustain our position on highly competitive markets.<br />

These strengths are many and varied. Our ownership structure is a case in point: being<br />

a Foundation company, we have strong financial security. Our profits remain largely in the company<br />

even at such difficult times as this, and are reinvested to the benefit of our customers.<br />

In addition, having boosted our ROS in recent years, we are now cushioned financially. Another<br />

strength is the strategic success which the Zeppelin Group has enjoyed in recent years. We have<br />

invested in diversifying and internationalizing our business, significantly easing our long-standing<br />

dependence on the German construction industry. We are now market leaders in many of the<br />

countries and core businesses in which we operate, making us a powerful and reliable partner for<br />

our customers. A key advantage for the Zeppelin Trading division is that we have strong,<br />

innovative manufacturer partners on our side.<br />

We are particularly well positioned in terms of our employees, whose commitment and identification<br />

with the company and its goals are key to our success. This is the mainstay for the future<br />

also. To secure this vital potential, we will continue to promote a spirit of enterprise among our<br />

employees in every Group company – through cooperative management styles with decentralized,<br />

clearly defined responsibilities, continuous professional development, and fair appraisal and<br />

remuneration.<br />

On behalf of the management board, I would like to express a special thank-you to the employees<br />

of the Zeppelin Group for their all-out commitment and superlative achievement. Our thanks of<br />

course also go to our customers and business partners, also to the Supervisory Board and General<br />

Works’ Council for the constructive and positive working relationship.<br />

In 2009 the Zeppelin Group embarks on a new century of its history. The risks and challenges<br />

engendered by the current global crisis are of colossal proportions. Yet our confidence remains<br />

unbroken. Over the first hundred years of its history, Zeppelin’s totally customer-centric approach,<br />

resolve and vision, innovation and will to change have time and again given the company the<br />

ability to move ahead and forge new paths into the future.<br />

Ernst Susanek<br />

President and CEO<br />

<strong>ZEPPELIN</strong> <strong>GmbH</strong><br />

4 2008 zeppelin annual report 5

The supervisory board was given regular status and progress reports about the organization<br />

and financial situation of <strong>ZEPPELIN</strong> <strong>GmbH</strong> Group verbally and in writing by the management board<br />

throughout 2008. Three board meetings were convened, at which the supervisory board – with<br />

input from various decision papers, reports and presentations – consulted with the management<br />

board on the planning, profit, asset position, operating finances and risk exposure of the company<br />

and its affiliated enterprises, and exercised supervisory control over the management board<br />

on this basis. At a board summit at the end of November, some of supervisory board members<br />

received a detailed presentation and appraisal from an external economics expert about<br />

economic development in eastern Europe, and discussed with management of the major Group<br />

companies about developments and future perspectives of the Zeppelin Group against the backdrop<br />

of the financial and economic crisis. The long-term financing and bank policy of the Group<br />

were key issues in these discussions.<br />

The supervisory board consulted intensively on strategic and investment planning. Following<br />

discussion with the management board, the supervisory board took decisions on a range of<br />

initiatives which – by law, statute or the Rules of Procedure for the Supervisory Board – require<br />

supervisory board approval. These included decisions on increasing equity capital, appointments<br />

of managing directors in affiliated companies, and acquisition of shareholdings to round out the<br />

Group’s portfolio and geographical spread in both Trading and Industry divisions. The board also<br />

agreed to the acquisition of a shareholding in the venture company SkySails, which has developed<br />

a sail propulsion system for use in the marine sector to complement traditional power<br />

systems. By founding a joint venture with SkySails, Zeppelin secures excellent business opportunities<br />

particularly in the long term for global sales and service of this innovative, environmentfriendly<br />

system.<br />

The supervisory board also addressed issues pertaining to corporate risk management and the<br />

selection of auditors.<br />

Josef Büchelmeier,<br />

Chairman of the Supervisory Board<br />

Supervisory Board Review<br />

The future organizational development of the Zeppelin Group and its management structure, as<br />

well as aspects of succession planning for the <strong>ZEPPELIN</strong> <strong>GmbH</strong> management board, were discussed<br />

at a plenary session of the supervisory board and in several meetings of the personnel<br />

committee.<br />

We were saddened to hear of the death on April 8, 2008, of Dr. Bernd Wiedmann due to an<br />

accident. Dr. Wiedmann was Chairman of the supervisory board of <strong>ZEPPELIN</strong> <strong>GmbH</strong> from 1985<br />

until 2001, and from 1995 to 2005 Chairman of the supervisory board of Zeppelin Baumaschinen<br />

<strong>GmbH</strong>. His even-handed, composed stewardship of these two corporate boards earned him great<br />

respect and esteem. We shall honor his memory in gratitude for his achievements.<br />

The annual financial statement and directors’ report, and the Group consolidated statement and<br />

directors’ report of <strong>ZEPPELIN</strong> <strong>GmbH</strong> to December 31, 2008, were audited by Ernst & Young AG,<br />

Stuttgart, the auditors elected by the shareholders’ meeting and commissioned by the supervisory<br />

board. The auditors issued an unqualified opinion on each of the statements and reports.<br />

The auditors’ report was submitted to each member of the supervisory board. Prior to the<br />

supervisory board balance meeting, there were two additional meetings concerning the audit of<br />

accounts, attended by the auditors, the Chairman of the supervisory board and other members<br />

of the supervisory board. At the accounts review meeting of the supervisory board on April 29,<br />

2009, the auditors reported on key findings and results of the audit, which as agreed also<br />

encompassed the Group’s early-warning risk identification system.<br />

The supervisory board has reviewed and endorsed the 2008 annual financial statement and<br />

consolidated accounts submitted by the management board. The annual financial statement and<br />

consolidated accounts of <strong>ZEPPELIN</strong> <strong>GmbH</strong> as per December 31, 2008, have been approved; the<br />

annual closure is accordingly declared. The supervisory board elected to follow the proposals of<br />

the management board regarding the use of the retained earnings.<br />

The supervisory board thanks the Zeppelin staff, employee representatives and the members of<br />

the management board for their dedicated, conscientious work, which has yet again brought such<br />

success for the Group.<br />

Friedrichshafen, April 29, 2009<br />

Josef Büchelmeier<br />

Chairman of the Supervisory Board<br />

6 2008 zeppelin annual report 7

Corporate Boards<br />

Supervisory Board Management Board<br />

In accordance with Section 7 of the German Co-determination Act (MitbestG), the supervisory<br />

board is composed of the following members:<br />

Josef Büchelmeier<br />

(Chairman)<br />

Mayor of the City<br />

of Friedrichshafen<br />

Ralph Misselwitz*<br />

(Deputy Chairman)<br />

Field Services Master Craftsman,<br />

Chairman of Zeppelin Group<br />

General Works’ Council,<br />

Chairman of the General Works’ Council<br />

of Zeppelin Baumaschinen <strong>GmbH</strong><br />

Dipl.-Ing. Werner Baier<br />

Chairman of the Supervisory Board<br />

of Webasto AG Fahrzeugtechnik<br />

Manfred Enger*<br />

Service Technician,<br />

Zeppelin Baumaschinen <strong>GmbH</strong><br />

Heribert Hierholzer*<br />

Master Craftsman in Industry,<br />

Chairman of the Works’ Council<br />

of Zeppelin Silos & Systems <strong>GmbH</strong><br />

Dr. Werner Pöhlmann<br />

Lawyer, tax accountant,<br />

certified public auditor<br />

† died April 8, 2008<br />

Vincenzo Savarino*<br />

2nd authorized representative of IG Metall<br />

labor union, Friedrichshafen-Oberschwaben<br />

Univ.-Prof. Dr.-Ing. Dr.-Ing. e.h. Dieter Spath<br />

Director of Fraunhofer Institut<br />

für Arbeitswirtschaft und Organisation<br />

and of the Stuttgart University Institute<br />

for Work Science and Technology Management<br />

Sibylle Wankel*<br />

Lawyer at IG Metall labor union –<br />

Bavaria region management<br />

Dr. Bernd Wiedmann †<br />

Former Mayor of the City of Friedrichshafen<br />

Lawyer<br />

Univ.-Prof. Dr. Dr. h. c. mult. Horst Wildemann<br />

Chair of business administration and<br />

management, logistics and production<br />

at the Technical University of Munich<br />

Dipl.-Ing. Eckhard Zinke*<br />

Sales Director,<br />

Zeppelin Baumaschinen <strong>GmbH</strong><br />

* Employee representatives<br />

Ernst Susanek (President and CEO)<br />

Alexander Bautzmann<br />

Peter Gerstmann<br />

Michael Heidemann<br />

Jürgen-Philipp Knepper<br />

8 2008 zeppelin annual report 9

Ferdinand Count Zeppelin<br />

Airship pioneer and<br />

founder of our company<br />

“You only have to want it and<br />

belief it, then you will succeed.”<br />

A Vision Creates Values<br />

A Century of Tradition, Change and Growth<br />

On October 11, 2008, the City of Friedrichshafen and the Foundation companies <strong>ZEPPELIN</strong> <strong>GmbH</strong> and<br />

ZF Friedrichshafen AG came together in the Zeppelin airship hangar to celebrate the centenary of the<br />

Zeppelin Foundation and Luftschiffbau Zeppelin <strong>GmbH</strong>. The pictures and quotes on the following pages<br />

capture a few moments from this event.<br />

This was a celebration of our origins, and of the values which were engendered a century ago. But it was<br />

also a call to every shakeholder to sustain and promote these values for the coming generations.<br />

Every day we at Zeppelin work with passion and commitment to create lasting value – for our customers,<br />

our employees and our company.<br />

10 2008 zeppelin annual report 11

Günther H. Oettinger<br />

Minister President of the State<br />

of Baden-Württemberg<br />

“The development of airships was<br />

preceded by a grand vision: the<br />

dream of flight. In tiny steps, the<br />

toil and resolve of these pioneers<br />

and entrepreneurs transformed this<br />

age-old dream into reality. Their<br />

example reminds us how important,<br />

indeed essential, such visionaries<br />

are to progress. These are the people<br />

through which vague imaginings,<br />

ideas and hopes become reality.”<br />

A Vision Creates Values<br />

The Zeppelin Airship Era<br />

Ferdinand Count Zeppelin was born on July 8, 1838, in Constance. We know from his diary that as early as<br />

1874 he was already investigating the idea of building a “balloon vehicle for conveying mail, cargo and passengers.”<br />

The idea gradually came to fruition – and in 1892, he commissioned the engineer Theodor Kober<br />

with the task of drawing up the design for an airship. On August 31, 1895, the Count was granted the first<br />

patent for a dirigible airship with multiple, serially arranged gas cells. He embarked on the construction of his<br />

first airship in Manzell by Germany's Lake Constance on June 17, 1899, assisted by Dr. Ludwig Dürr, who<br />

later became chief designer and builder of all the Zeppelin airships. On July 2, 1900, the first Zeppelin airship,<br />

the LZ1, finally rose from its floating assembly hall into the evening sky above Lake Constance.<br />

On August 4, 1908, the LZ4 embarked upon its fateful 24-hour journey down the Rhine to Mainz. On the<br />

return flight, the LZ4 had to make a forced landing in Echterdingen due to engine damage. Shortly after<br />

landing, the airship was torn from its moorings by a storm. Out of control, it caught fire and burnt to nothing.<br />

Even though no one was seriously injured in the inferno, the accident would have meant the end of the<br />

airship project but for the spontaneous response from the public. Donations poured in from all over the country,<br />

amassing an impressive 6 million marks. It was this donation which enabled Count Zeppelin to continue his<br />

life's work. On September 8, 1908, he founded Luftschiffbau Zeppelin <strong>GmbH</strong>, and transferred his majority<br />

shareholding in this company to his newly established Zeppelin Foundation. The foundation’s declared<br />

purpose at the time was to assist efforts to promote airships and to deploy this technology for the purpose<br />

of science.<br />

12 2008 zeppelin annual report 13

Hans-Georg Härter<br />

Chief Executive Officer<br />

of ZF Friedrichshafen AG<br />

“The industrial enterprises<br />

founded here a century ago<br />

continued beyond the vision of<br />

their founder. They became –<br />

and remain – originators of a<br />

stream of innovations for other<br />

technologies and markets.”<br />

A Vision Creates Values<br />

Overcoming Boundaries<br />

For decades, the success of airship technology bred a charisma that transcended the boundaries of<br />

Germany and Europe.<br />

Count Zeppelin’s original airship company was also the rootstock of other enterprises which today are<br />

globally active, among them Maybach-Motorenbau (now MTU or Tognum AG), Dornier, and ZF Friedrichshafen<br />

AG, which like the Zeppelin Group is owned by the Zeppelin Foundation.<br />

To round out the picture, in 2001 a Zeppelin airship again took to the skies: that year the official permit was<br />

granted for the Zeppelin NT (New Technology), which blends the original rigid-airship design principle with<br />

modern aviation technology. The Zeppelin NT makes flying an unforgettable experience, and has carried over<br />

90,000 passengers since its maiden flight in 2001.<br />

All these enterprises, and not least the present-day Zeppelin Group, combine to put Friedrichshafen and the<br />

Lake Constance region well and truly on the map as one of Germany’s and Europe’s leading industrial<br />

centers. Our company is a significant part of the heritage of Ferdinand Count Zeppelin. And it is our responsibility<br />

to uphold his tradition in everything we do.<br />

14 2008 zeppelin annual report 15

Josef Büchelmeier<br />

Mayor of the City of Friedrichshafen,<br />

Chairman of the Zeppelin Foundation,<br />

Chairman of the Supervisory Board<br />

of <strong>ZEPPELIN</strong> <strong>GmbH</strong><br />

“Vision, strength, and the resolve<br />

to make technical progress happen<br />

– all embedded in a strong<br />

sense of social responsibility –<br />

these talents and characteristics<br />

of Count Zeppelin are the<br />

groundwork he laid for future<br />

generations. They have become<br />

a measure for each of his successors<br />

in the stewardship of the<br />

Zeppelin Group.”<br />

A Vision Creates Values<br />

Phoenix from the Ashes<br />

The Hindenburg accident in Lakehurst in 1937 and the outbreak of World War II brought the airship<br />

era to an abrupt end. Following the war, the forced liquidation on January 1, 1947, by the Allied<br />

military government spelt the ultimate demise of airship construction. The restriction would not be<br />

lifted for another nine years; meanwhile, the forced breakup of the Zeppelin Group left our company<br />

without production equipment or products.<br />

Yet the Zeppelin people remained true to their founder's legacy. The vision, courage to innovate and<br />

the steadfast will to succeed would once again become the driving forces to rebuild what once was.<br />

Two new enterprises, Metallwerk Friedrichshafen <strong>GmbH</strong> and Fahrzeug Instandsetzung <strong>GmbH</strong>,<br />

Friedrichshafen, embarked upon fresh ventures, including production of lightweight structures and<br />

large vessels for the chemicals industry, vehicle maintenance and antenna systems for Germany’s<br />

fledgling beam-radio network. The roots for the Trading division were put down in 1954, when<br />

Zeppelin secured rights in the Federal Republic of Germany for selling and servicing Caterpillar construction<br />

machines and engines. When the activities of Zeppelin Metallwerke <strong>GmbH</strong> merged with the<br />

Trading and Industry divisions in 1961, the present-day <strong>ZEPPELIN</strong> <strong>GmbH</strong> came into being. This farreaching<br />

decision created the structures which are still in place to this day.<br />

16 2008 zeppelin annual report 17

Ernst Susanek<br />

President and CEO<br />

of Luftschiffbau Zeppelin <strong>GmbH</strong><br />

and <strong>ZEPPELIN</strong> <strong>GmbH</strong><br />

“We can look back with pride and<br />

respect at what has been achieved -<br />

not least because one hundred years<br />

is evidence of constancy. Yet it equally<br />

demonstrates our company’s ability<br />

to adapt to permanent change.”<br />

A Vision Creates Values<br />

Zeppelin Today<br />

The Zeppelin Group is today organized into two business divisions: trading and industry. Both are well<br />

positioned strategically. Leaders in technology and top performers in the markets they serve, the divisions<br />

have healthy growth potential. The Zeppelin Trading division is Europe's largest sales, service and rental<br />

organization in the construction machine industry, and one of the largest in the world. The Friedrichshafenheadquartered<br />

Zeppelin Industry division is one of the world's largest providers of customized systems for<br />

conveying, storing, blending, dosing and weighing bulk solids, specializing in plastics and rubber and the tire<br />

industry.<br />

In 2008, the Zeppelin Group with its 6100-strong workforce (as per December 31, 2008) achieved a worldwide<br />

sales volume of some € 2.4 billion. In strategic terms this dynamic growth derives from total dedication<br />

to our customers, combined with pioneering innovation in construction machine and engine technology and<br />

in bulk solids handling technology – plus a systems philosophy by which we act as a one-stop source of<br />

business excellence for our customers. Over the last 15 years, we have also relentlessly pushed ahead in<br />

our drive to expand and internationalize the Zeppelin Group. We have remained so committed to this growth<br />

strategy not least because we have to overcome the boundaries of our markets in order to sustain our<br />

position in ever tougher competitive environments.<br />

Since 2001 Zeppelin has subjected itself to an annual external rating by Creditreform Rating AG, Neuss.<br />

On a scale from ‘AAA’ (the top rating) down to ‘D’, Zeppelin has never achieved worse than an ‘A’. In 2008,<br />

for the third year running, we were even awarded the rating ‘A+’<br />

18 2008 zeppelin annual report 19

“The legacy of Count Zeppelin<br />

lives on - both in his foundation<br />

and in the enterprises which he<br />

founded. Ventures of all sizes,<br />

from medium-sized enterprises<br />

to global corporations, have<br />

flourished on the strength of<br />

this legacy.”<br />

Günther H. Oettinger<br />

A Vision Creates Values<br />

Zeppelin Worldwide<br />

In the 1990s, as the partnership with Caterpillar strengthened and deepened, the Zeppelin Trading division<br />

began to expand internationally. We were successively awarded exclusive distribution rights for the Czech<br />

Republic and Slovakia (1991), Austria (1992), Ukraine (1996), Northwest Russia (1998), the states of<br />

Tajikistan, Turkmenistan and Uzbekistan in Central Asia (2001), Southwest Russia (2002), Belarus (2004) and<br />

Armenia (2005). By expanding into markets with promising opportunities we have put the Zeppelin Group<br />

on an excellent footing for future development. With new international outlets and branches opening<br />

regularly, we are continuing our drive to be as close to our customers as possible.<br />

Managed from the Friedrichshafen headquarters, the Zeppelin Industry division has in recent years also<br />

expanded its international presence and is now represented in all the world's major centers for the plastics<br />

processing and chemicals industry. As well as the parent plant in Friedrichshafen, the division has production<br />

facilities in Belgium, Brazil and since 2008 in Saudi Arabia, with another facility under development in<br />

Turkey. The Zeppelin Industry division also has engineering and sales companies in the UK, Italy, USA, India,<br />

Singapore, China and a representation in Moscow.<br />

Measured in terms of employee numbers, Germany is still the Zeppelin Group's major location. Our subsidiaries<br />

Zeppelin <strong>GmbH</strong> & Co. KG (rentals), Zeppelin Baumaschinen <strong>GmbH</strong> (sales and service), Zeppelin Power<br />

Systems <strong>GmbH</strong> & Co. KG (engines and power systems) and Zeppelin Silos & Systems <strong>GmbH</strong> (silos and<br />

conveying equipment) employ 53 percent of the group's workforce at over 120 sites throughout Germany.<br />

But the strongest expansion in recent years has taken place in our companies outside Germany, with the<br />

subsidiaries of Zeppelin International AG in eastern Europe leading the way.<br />

20 2008 zeppelin annual report 21

“For a century now, the Zeppelin<br />

Foundation and its companies<br />

have shown though their dedica-<br />

tion and creativity that the values<br />

which Zeppelin has engendered<br />

aren’t assets which can simply be<br />

owned. They have to be nourished<br />

and sustained by a steady stream of<br />

inventiveness.”<br />

Josef Büchelmeier<br />

A Vision Creates Values<br />

Creating Value for our Customers<br />

Zeppelin is committed to partnering with customers, taking care to align product and service portfolios to<br />

what our customers want. With innovative products and services, we strive to deliver the highest added<br />

value in the industry, and contribute to enhancing our customers’ own competitive strength – so reads the<br />

Zeppelin Group’s mission statement.<br />

Caterpillar construction machines work in every area of the mining and construction industries. There is a<br />

machine for every application: for mining, for constructing buildings, roads, bridges and tunnels, and for creating<br />

stunning landscapes. With our Caterpillar and MaK engines, SkySails wind-propulsion system, also with<br />

Hyster-brand lift trucks and handlers, we in turn make sure things keep moving. And when it comes to<br />

manufacturing, conveying, storing, blending, dosing and weighing powders and pellets for the chemicals,<br />

plastics and food industries and for rubber and tire manufacturers, the Zeppelin Industry division offers<br />

practice-tested technology and customized system solutions.<br />

Yet the Zeppelin systems philosophy is about more than innovative products. It embraces our commitment<br />

to offering customers the complete range of support and services associated with our machines and<br />

equipment. Through synergy effects we can achieve decisive benefits for our customers:<br />

• Innovative systems which are an exact fit for the customer’s particular demand profile<br />

• Economic investment<br />

• Fast availability of machines, plant and parts<br />

• Excellent operational efficiency<br />

22 2008 zeppelin annual report 23

24<br />

“Even a brief review of our company<br />

history makes abundantly<br />

clear that the success is down to<br />

the courage, resolve and vision of<br />

many, many people. People who<br />

even when things got tough could<br />

not be deterred from pursuing<br />

their dreams.”<br />

Ernst Susanek<br />

A Vision Creates Values<br />

People Create Values<br />

Our founder Ferdinand Count Zeppelin was a pioneer with the vision and sense of purpose to spur the people<br />

around him to highest achievement. Celebrated entrepreneurs at Zeppelin's side included Dr. Hugo Eckener,<br />

Claude Dornier, Alfred Count von Soden-Fraunhofen, Alfred Colsman, Ludwig Dürr and Karl Maybach. They<br />

all embodied Count Zeppelin's example but also had their own vision of purpose, and the skill, creativity and<br />

passion to turn their vision into reality. They all took up the challenge of enterprise and in turn motivated the<br />

people at their side. And highly successfully too, as evidenced not just by the Zeppelin Group today, but also<br />

by the numerous companies which emerged from the original airship venture.<br />

It is people who create values. We at Zeppelin know that our employees are the company's most important<br />

assets. Their ideas, their talents and the commitment they bring to their work are key to our success. To push<br />

the pace of innovation, increase productivity and, above all, be a totally customer-focused business, we have<br />

to give our employees the conditions they need to develop their strengths. Accordingly, we cultivate our<br />

talent, helping people stretch and fulfill their potential. Teamwork, exemplary leadership and the will to change<br />

are all central to our corporate culture.<br />

We uphold this culture in many ways: through our corporate mission statement, in which we have also<br />

defined a code of management practice, through regular and above all fair performance appraisals of every<br />

employee, and a wide range of opportunities for continuous professional development. We are assiduous in<br />

communicating corporate strategy and goals to our employees promptly and extensively through media such<br />

as our employee magazine Z intern; regular management summits, informal meetings and above all personal<br />

dialog are all integral to how we communicate within the company. Profit-sharing for employees, introduced<br />

at the largest Zeppelin Group company, Zeppelin Baumaschinen <strong>GmbH</strong>, over ten years ago now, helps<br />

encourage strong employee identification with the goals of our company.<br />

2008 zeppelin annual report 25

“Count Zeppelin’s vision of aviation<br />

brought progress not only in<br />

technology and business front.<br />

For Count Zeppelin, progress<br />

also meant social responsibility.<br />

His legacy lives on, both in the<br />

Zeppelin Foundation and in the<br />

ventures he founded.”<br />

Günther H. Oettinger<br />

A Vision Creates Values<br />

Sustainability is our Legacy<br />

Count Zeppelin was a visionary in many respects – not least as someone with a strong sense of citizenship.<br />

In establishing the Zeppelin Foundation in 1908 and transferring his company shares to the foundation, he was<br />

expressing his gratitude for the funds so generously donated by the German people following the tragic end<br />

of the LZ 4 airship in Echterdingen. He was also realizing a vision: to secure for future generations his ideas<br />

and ventures, and also to uphold his conviction that free enterprise must be tied to social responsibility. In<br />

terms of sustainability, our founder was years ahead of his time, and his legacy remains embedded in our<br />

corporate culture.<br />

We at Zeppelin consider that success comes with obligations, and corporate social responsibility is key to our<br />

understanding of what we are. Each year, we make over part of our profits to the Zeppelin Foundation, whose<br />

funds exclusively benefit non-profit and charitable causes. We also donate funds directly and have our own<br />

sponsorships in education, culture, social welfare and sport. Zeppelin University is a case in point. We founded<br />

and are among the main sponsors of this private, state-recognized university at which 600 young people<br />

are now studying Bachelor’s and Master's programs. We have also for many years sponsored the Friedrichshafen<br />

volleyball team. We staged a major fundraising drive in aid of the flood catastrophe in eastern<br />

Germany and the victims of the tsunami in South East Asia, and in 2008, for the Menschen für Menschen<br />

Ethiopia aid program founded by Karlheinz Böhm. And because arts and culture also answer to a basic human<br />

need, we also sponsor the Tyrol Opera and Concert Festival. The Zeppelin foundation and the Zeppelin<br />

Group - to which Zeppelin Wohlfahrt <strong>GmbH</strong> also belongs - have trailblazed an example for many other companies<br />

in Germany and far beyond its boundaries.<br />

We are proud to reaffirm this commitment as we embark upon a new century in our corporate history,<br />

always mindful that true corporate social responsibility can only have impact and build values if it is preceded<br />

by entrepreneurial success in all its many facets.<br />

26 2008 zeppelin annual report 27

“Technological vision, a robust<br />

business basis and people working<br />

together: that's what’s drives inno-<br />

vation – then and now.”<br />

Hans-Georg Härter<br />

A Vision Creates Values<br />

Innovating into the Future<br />

No other manufacturer of construction equipment and diesel engines comes anywhere near matching our<br />

partner Caterpillar’s investment in research and development of new products: close on US$ 5 million per<br />

day. Every year, a stream of new products reaffirms Caterpillar’s position as a world-beating innovator and<br />

market leader. Fuel efficiency, low emissions, driver comfort, ease of use, versatility of operation – all combine<br />

to guarantee excellent productivity and economy. As one of the largest Caterpillar dealers worldwide,<br />

Zeppelin plays a key role in the development of new machine and engine generations. Through ongoing<br />

contact with customers, our sales and service teams learn what customers are looking for, what solutions<br />

they need to drive their business. Accordingly, our organization partners actively with Caterpillar on numerous<br />

projects for developing new product generations.<br />

Development of innovative technology also enjoys top priority in the Zeppelin Industry division, enabling us<br />

to match and exceed the growing requirements of our customers for performance, innovation and quality.<br />

Our Technology Center works to enhance procedures for handling bulk solids, analyzing product features and<br />

testing alternative ways of processing to harvest data which can be channeled into new process technology.<br />

Our Friedrichshafen center plays an integral role in these efforts, and has been expanded several times in<br />

recent years. This testing plant, the largest of its kind in the world, tests handling procedures for bulk solids<br />

in powder and pellet form. This enables us to test and optimize plant configurations for plastics such as<br />

polyethylene or polypropylene as well as bulk solids for the rubber and tire industry such as carbon black and<br />

products for profile extrusion (PVC). So before making an investment decision, customers can witness the<br />

power and capability of the plants which we plan and manufacture.<br />

28 2008 zeppelin annual report 29

INNOVATIONS<br />

2008<br />

CAT TRACK-TYPE<br />

TRACTOR D7E<br />

With the world's first dieselelectric<br />

driven construction<br />

machine in the mid-range<br />

segment, Caterpillar offers<br />

unrivalled efficiency and environment-friendly<br />

operation.<br />

A Vision Creates Values<br />

First Diesel-Electric Powered Dozer<br />

In 2008, Caterpillar launched the first dozer with hybrid<br />

diesel-electric drive, the CAT D7E, once again writing history<br />

in engine and construction machine technology. The twin goals<br />

of this development were to drive down diesel consumption<br />

and reduce carbon emissions without compromising on performance.<br />

The outcome is a staggering 25 percent better<br />

fuel efficiency compared to predecessor models. Delivering<br />

compelling economy and environmental efficiency, the<br />

machine also requires fewer replaceable parts – 60 percent<br />

fewer on the D7E 60, for example.<br />

The decades of experience of our manufacturer partner<br />

Caterpillar in electric power systems and generators were all<br />

distilled into the development of this new drive technology.<br />

The 27-tonne class D7E is powered by a 175 kW Caterpillar<br />

engine. The track-type tractor is neither reliant on traditional<br />

mechanical power transmission with gear system and clutch,<br />

nor does it need a drive belt, because an electric engine can<br />

also drive components such as air conditioning and water<br />

pumps via a separate system. So there is no need even for<br />

a conventional dynamo. Even the differential-steering components<br />

are driven directly by the electric engine, ensuring<br />

excellent high-precision steering.<br />

This groundbreaking innovation is emblematic of Caterpillar’s<br />

commitment to sustainable development, helping customers<br />

cut costs and reduce emissions. Our manufacturer partner<br />

has embedded this goal in its Vision 2020: to lead the world<br />

on energy and environmental design, and on the criteria for<br />

“green building”.<br />

30 2008 zeppelin annual report 31

INNOVATIONS<br />

2008<br />

SKYSAILS<br />

Combining advanced diesel<br />

engine technology from MaK<br />

and Caterpillar with SkySails<br />

wind propulsion system,<br />

we are charting a fresh and<br />

promising course which is<br />

unprecedented in our industry.<br />

A Vision Creates Values<br />

Turn Wind into Profit<br />

Fuel efficiency and lower carbon emissions are key to raising<br />

competitive strength – also for the customers of Zeppelin<br />

Power Systems <strong>GmbH</strong> & Co KG. In the 15 kW to 16 MW<br />

range, Caterpillar and MaK engines (also part of the portfolio<br />

of our manufacturer partner) serve as main and auxiliary<br />

power systems in container ships, freighters, ferries, fishing<br />

vessels and cruise ships, as well as locomotives, construction<br />

machines, utility vehicles and other industrial machines.<br />

The CAT-driven power generators and the combined heat and<br />

power plants developed by Zeppelin Power Systems ensure<br />

reliable, efficient power delivery.<br />

Last year Zeppelin Power Systems acquired a shareholding<br />

in the Hamburg-based company SkySails <strong>GmbH</strong> & Co. KG,<br />

again enacting our commitment to offering customers –<br />

in this case marine customers – innovative solutions to help<br />

them raise productivity and do business more efficiently.<br />

The unique SkySails system is a wind-based propulsion<br />

system for ships. Depending on prevailing wind conditions,<br />

the huge sail can reduce annual fuel costs by between<br />

10 and 35 percent. As soon as the sail is up, the captain can<br />

throttle back on diesel engine power. Virtually any vessel can<br />

be retro-fitted or outfitted ex-works with SkySails as an<br />

auxiliary power system. If this technology were to be used<br />

consistently worldwide, we would be able to cut carbon<br />

emissions by over 150 million metric tons every year. In combining<br />

advanced MaK and Caterpillar diesel engine technology<br />

with SkySails propulsion, we are charting an unprecedented<br />

– and highly promising – course in our industry. Fully aligned<br />

with our strategy to pursue new market opportunities in the<br />

marine sector, this partnership also proudly upholds the tradition<br />

of innovation of our founder Ferdinand Count Zeppelin:<br />

dare to innovate, and believe in success.<br />

Another groundbreaking innovation from Caterpillar in recent<br />

years was ACERT – Advanced Combustion Emissions<br />

Reduction Technology – for engines. Comparable with earlier<br />

development milestones such as the turbo loader or chargeair<br />

cooling, ACERT has helped reduce emissions by up to<br />

50 percent over preceding engine generations with conventional<br />

technology. ACERT features multiple injection, optimized<br />

air management and advanced control electronics<br />

enabling interactive communication between the engine and<br />

other elements of the power system.<br />

32 2008 zeppelin annual report 33

INNOVATIONS<br />

2008<br />

CONSTRUCTION<br />

SITE TOUR<br />

This marketing tool earned<br />

MVS Zeppelin first prize in the<br />

European Rental Awards, beating<br />

competitors from all over Europe.<br />

A Vision Creates Values<br />

Innovative Rentals<br />

With the market in Europe worth € 32 billion in 2008 alone,<br />

European construction machine and equipment rentals offer<br />

excellent growth opportunities. An early mover into this segment,<br />

Zeppelin is now one of the largest rental companies in<br />

the industry. We opened our first rental outlets back in the<br />

early 1990s, and have been expanding coverage ever since.<br />

Our rental activities in Germany, where we are market leader,<br />

are managed by our subsidiary MVS Zeppelin <strong>GmbH</strong> & Co.<br />

KG. MVS Zeppelin operates over 110 rental outlets and offers<br />

customers a fleet of over 42,000 items of equipment:<br />

construction equipment and machines, work platforms,<br />

traffic and construction site security systems, room and<br />

sanitary cell systems and vehicles. The Zeppelin Group has<br />

also been assiduous in developing this business outside<br />

Germany, and continues to open new outlets in Austria, the<br />

Czech Republic, Slovakia and Russia. Every rental station has<br />

a clear visual identity because all bear the standardized brand<br />

identity The CAT Rental Store. Our rental activities will soon<br />

all be together under the stewardship of Zeppelin Rental<br />

<strong>GmbH</strong>, which we founded in 2008.<br />

MVS Zeppelin was proud to receive a very special accolade<br />

in 2008 from the European Rental Association. The “Site<br />

Tour 2007” campaign earned MVS Zeppelin first prize in the<br />

Best Rental Promotional Campaign at the European Rental<br />

Awards (the first to be held), beating competitors from all<br />

over Europe. The idea, which increased sales and created<br />

closer ties with customers, was targeted directly at the point<br />

of interest. Over 600 construction sites were visited by our<br />

special tour bus, styled in the Zeppelin corporate design. Also<br />

on board was the local station manager – to discuss ongoing<br />

and planned projects with customers directly on site and<br />

speak about the rental equipment they were likely to require.<br />

This innovative marketing instrument was a huge success,<br />

and the tour was repeated in 2008.<br />

Innovative ideas and flexibility, combined with state-of-theart,<br />

robust technology are part and parcel of the Zeppelin<br />

experience at all the group's rental companies. Every year,<br />

we invest large sums into fleet renewal. We also offer our<br />

customers a range of services such as special construction<br />

shops for professionals (Profi-Baushop), rentals complete<br />

with operators for large and special machines, delivery and<br />

pickup services, one-way rentals and all-in service and support.<br />

This is exactly what customers are entitled to expect<br />

from the number one in the rentals business.<br />

34 2008 zeppelin annual report 35

INNOVATIONS<br />

2008<br />

HYSTER JXN ELECTRIC<br />

FORKLIFT TRUCK<br />

The new four-wheel electric<br />

truck outperforms any other<br />

vehicle in its class on energy<br />

efficiency; thanks to its zeroturn<br />

radius it offers excellent<br />

maneuverability and stability.<br />

A Vision Creates Values<br />

Energy Efficiency in Logistics<br />

The need for energy efficiency is growing in importance<br />

everywhere – also in internal logistics. In 2008, a groundbreaking<br />

innovation was brought to market by our<br />

manufacturer partner the US-American NACCO Materials<br />

Handling Group: the new generation of Hyster electricpowered<br />

lift trucks boasts the industry’s lowest energy<br />

consumption and offers compelling productivity. The trucks<br />

are proof that carbon emissions can be reduced in logistics<br />

without necessarily compromising on cost efficiency.<br />

Two performance settings ensure the best balance between<br />

energy consumption and productivity. At the eLo setting<br />

(extra low energy consumption), the Hyster lift truck consumes<br />

on average 16 percent less energy than comparable<br />

equipment of other makes, without any loss of performance.<br />

At the HiP setting (high productivity), performance is<br />

substantially higher than competing equipment in the same<br />

class – but without a disproportionate increase in energy<br />

consumption. Fleet managers can also fine-tune the balance<br />

between performance and energy efficiency in operation by<br />

adjusting the consumption settings of the lift truck precisely<br />

to the conditions in which the machine will be operating,<br />

or to the capabilities of drivers – enabling drivers to focus<br />

exclusively on the task in hand. Another added-value feature<br />

is the zero-turn radius. This expanded turning functionality of<br />

Hyster four-wheel JXN forklift trucks provides virtually the<br />

same maneuverability as a three-wheel truck. Yet with four<br />

wheels, the vehicle is more flexible and precise in tight corners<br />

and offers greater stability, also on uneven surfaces.<br />

And, to raise productivity yet another notch, the new Hyster<br />

electric-powered trucks feature extra-large battery capacity<br />

and the fastest lifting speeds in their class.<br />

With 80 years of experience in design and production of<br />

warehouse vehicles, NACCO is the world's oldest manufacturer<br />

of lift trucks and a strong manufacturer partner of<br />

Zeppelin. Complementing the new electric-powered trucks,<br />

the most recent instance of NACCO’s strength as an innovator<br />

is the warehouse simulator. This software enables enterprises<br />

to run true-to-life simulations of all the processes in<br />

their warehouse and calculate how best to configure storage,<br />

deploy personnel and machines.<br />

36 2008 zeppelin annual report 37

INNOVATIONS<br />

2008<br />

HEPA FILTER<br />

Co-developed with the Karlsruhe<br />

Research Center, the HEPA filter<br />

(high performance particle filtration)<br />

offers one hundred times<br />

the performance of conventional<br />

filters.<br />

A Vision Creates Values<br />

Groundbreaking Filter Technology<br />

Every year, the Zeppelin Industry division invests in new,<br />

enhanced technology to expand its product portfolio and, in<br />

turn, its value chain of core competences: storing, conveying,<br />

blending and dosing bulk solids in powder and pellet form. In<br />

2008 the division again rolled out groundbreaking innovations.<br />

Last year we successfully launched our new filter technology<br />

product business. Having accumulated so much expertise in<br />

plant construction and experience along the plastics processing<br />

and production workflows, we were ideally positioned to<br />

optimize filter designs. We soon gained substantial market<br />

share with the new business. The Zeppelin Industry division’s<br />

filter portfolio, built for the full range of requirements on<br />

pneumatic conveying systems, now includes quite a variety<br />

(silo binvent filters, aspiration filters, safety and inline filters).<br />

The Zeppelin filter technology is also a groundbreaking<br />

innovation in other sectors: A HEPA filter (high performance<br />

particle filtration) co-developed with the Karlsruhe Research<br />

Center is now being prototyped in a biomass power plant.<br />

Offering one hundred times the performance of conventional<br />

filters, the new filter system could become the new standard<br />

for small-scale power stations and incinerator systems, opening<br />

up totally new markets for Zeppelin.<br />

In addition, a new pneumatic conveying system with a<br />

special bypass technique has been installed in the Zeppelin<br />

Technology Center to conduct trials. This expands our services<br />

to include other product groups. A specially developed<br />

process lock-gate has made its debut in productive operation<br />

in a customer plant, and our production achieved major<br />

progress in the development of a new welding technique for<br />

silos, which helps accelerate production times.<br />

38 2008 zeppelin annual report 39

Group Management Report<br />

40 2008 <strong>ZEPPELIN</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> 41

Group Management Report<br />

1. BUSINESS AND GENERAL CONDITIONS<br />

Economic background<br />

The Zeppelin Group has two divisions: Trade and<br />

Industry. The business activities in the Trade<br />

division consist of sales, services and rental of<br />

Caterpillar construction machines, Caterpillar<br />

construction machinery and diesel engines,<br />

MaK ship engines, Terex mining equipment and<br />

Hyster industrial trucks. Zeppelin is the exclusive<br />

sales partner of Caterpillar Inc., Peoria (IL/USA),<br />

in Germany and Austria, numerous countries in<br />

central and eastern Europe and central Asia.<br />

There is some overlap of the sales territory for<br />

industrial trucks. In this sector, Zeppelin has the<br />

exclusive sales rights for the brand Hyster of<br />

the US manufacturer NACCO Materials Handling,<br />

Mayfield Heights (OH/USA). All the companies<br />

in the Trade division are market leaders in<br />

their particular areas of the construction machinery<br />

business. The Company also sells a large<br />

number of add-on units as well as Claas and<br />

AGCO agricultural machinery and Ponsse<br />

forestry machines in some territories. Under<br />

the management of Zeppelin Power Systems<br />

<strong>GmbH</strong> & Co. KG, the sales and service of<br />

auxiliary wind propulsion systems for the manufacturer<br />

SkySails is currently being expanded.<br />

The business activity of the Industry division<br />

comprises the development and manufacture<br />

of silos and materials handling for the production<br />

and processing of high-quality bulk goods in<br />

the worldwide market for plastics, rubber and<br />

tires. In this area, Zeppelin is one of the leading<br />

suppliers. This field of business is managed by<br />

the interim holding Zeppelin Silos & Systems<br />

<strong>GmbH</strong> with registered offices in Friedrichshafen.<br />

The company is divided into the product<br />

areas manufacturing plants, processing plants,<br />

standard products and components and services.<br />

Overall economic development<br />

According to the International Monetary Fund,<br />

global GDP saw growth in real terms of 3.1%<br />

(prior year: 5.0%), a clear downturn in the global<br />

economy in 2008. The global economic slump<br />

was dominated by developments in the industrialized<br />

nations, which increasingly saw the<br />

effects of the financial and sub-prime crisis<br />

reflected in the real economy. The consequent<br />

property price deflation and general uncertainty<br />

unfolded in an economic environment which<br />

was set to enter a cool-down phase anyway<br />

after the boom of recent years.<br />

In the USA, the 1.1% increase in GDP achieved<br />

in 2008 (prior year: 2.0%) only partially reflects<br />

the collapse in growth of the final quarter. The<br />

strength of export trade coupled with a decrease<br />

in imports played a major role in softening the<br />

effects and improving the trade deficit overall.<br />

Monetary and in particular fiscal policies introduced<br />

quickly produced powerful results which<br />

helped contain the clear downturn. The Japanese<br />

economy has been heavily dependent on<br />

export trade in recent years and was particularly<br />

hard hit by the global economic slump, recording<br />

a decrease in GDP of 0.7% in 2008 compared<br />

to growth of 2.0% in the prior year.<br />

The economic development in the emerging<br />

countries of Asia, Latin America and central and<br />

eastern Europe initially seemed astonishingly<br />

stable and robust in the first year after the outbreak<br />

of the financial crisis. Most managed to<br />

escape the feared collapse in export trade at<br />

the beginning of 2008. In 2008 the Chinese<br />

economy showed the first signs of economic<br />

slowdown, however, instead of overheating as<br />

had been forecast. GDP growth of 9.0% was<br />

down on the prior year (13.0%) and failed to<br />

reach double digits for the first time in five<br />

years. The sharp increase in commodity prices<br />

buoyed the development in Brazil and Russia in<br />

the first half of the year. By late summer 2008<br />

there had been a complete turnaround in this<br />

situation, as these emerging economies also<br />

saw a slow-down in the wake of the global economic<br />

downturn.<br />

In the euro zone, the economic impetus also<br />

slowed in the course of 2008. Despite strong<br />

economic links between EU countries, the<br />

effects of the global economic slump were felt<br />

here nonetheless. At just 0.8%, the growth rate<br />

of GDP was well below the prior year figure of<br />

2.7%.<br />

Germany recorded GDP growth of 1.3% compared<br />

to 2.6% in 2007. An unexpectedly strong<br />

first quarter was followed by a delayed but all<br />

the more abrupt phase of weakness. The<br />

shockwaves from other countries reached the<br />

German economy, itself anyway entering a<br />

downturn. Knock-on effects from the sub-prime<br />

and financial crisis burdened the economy in<br />

the course of the year. Inflation increased<br />

considerably until the middle of the year as a<br />

result of huge price hikes for foodstuffs, raw<br />

materials and energy. Until recently, the<br />

German economy suffered a lack of internal<br />

impulses, such as from private consumption.<br />

This was not helped by the appreciation of the<br />

euro, which burdened export trade and indirectly<br />

investment by German companies.<br />

In the other countries in which Zeppelin’s Trade<br />

division has subsidiaries, business activity also<br />

developed negatively in 2008. Austria saw a<br />

drop in GDP growth from 3.1% to 1.7%. In the<br />

EU countries of central and eastern Europe, the<br />

slowdown in economic impetus which had<br />

already started in 2007 continued. The GDP<br />

growth of the Czech Republic fell for a second<br />

time in a row, from 6.5% in 2007 to 4.3%.<br />

Following rapid growth in recent years, the economic<br />

output of Slovakia slid from 10.4% to<br />

7.1%. The lively economy of the prior year was<br />

not repeated in Poland either, with growth of<br />

5.0% down from 6.7% in the prior year. The<br />

economic downturn was already palpable in<br />

Hungary in 2007 and continued, with GDP up<br />

just 0.9% on the prior year (1.3%).<br />

In Russia and Ukraine, economic growth tailed<br />

off considerably at 6.0% and 3.6% respectively<br />

(prior year: 8.1% and 6.9%). In the other CIS<br />

countries, Belarus and Armenia as well as the<br />

central Asian states Tajikistan, Turkmenistan<br />

and Uzbekistan, in which the Zeppelin Group<br />

also has subsidiaries and representative offices,<br />

the global economic turbulence did not weigh<br />

as heavily.<br />

42 2008 <strong>ZEPPELIN</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> 43

Group Management Report<br />

Market development - Trade<br />

Economic conditions put something of a damper<br />

on the sales markets of significance for the<br />

Zeppelin Group in 2008. While several submarkets<br />

developed positively in the first half of the<br />

year, a deterioration in the situation was seen in<br />

the third and – above all – fourth quarter across<br />

all industries.<br />

The construction industry in Germany, a key market<br />

for Zeppelin, emerged from a weak phase<br />

lasting several years, with moderate growth in<br />

the prior two years.<br />

This trend continued in the first quarter of 2008<br />

thanks to a good increase in investment in construction.<br />

As the year progressed, the industry<br />

developed negatively in the light of price hikes<br />

for construction materials and energy. Development<br />

was quite varied for the individual sectors,<br />

however. Residential housing was already showing<br />

weak development in 2007 and this continued<br />

(+ 2.1%). In contrast, commercial construction<br />

developed very strongly, acting as a<br />

crutch for the rest of the construction industry<br />

(+ 10.7%). Public spending on construction also<br />

boosted the positive development of the construction<br />

industry thanks to higher tax revenues<br />

(+ 4.6%). Incoming orders and order backlog fell<br />

considerably from 2008 onwards, reflecting the<br />

economy as a whole, albeit with something of a<br />

time delay. Nevertheless, investment in construction<br />

increased 3.0% (prior year: 1.8%) in<br />

real terms in 2008. In spite of the positive trend,<br />

demand for construction machinery fell to<br />

27,101 units (prior year: 32,763 units), a drop in<br />

growth from 19% in the 2007 to 17.3%. The<br />

downturn was especially felt in the rental sector,<br />

which had been buoyed by high levels of investment<br />

in rental assets but was affected across<br />

the board by a reluctance to invest in 2008.<br />

The Austrian construction industry also saw economic<br />

development slow down in the course of<br />

2008. In total, construction investment fell by<br />

2.8%. This development played a considerable<br />

role in the 9% decrease in demand for construction<br />

machinery compared to the prior year. The<br />

situation of the construction industry also deteriorated<br />

considerably in the Czech Republic and<br />

Slovakia in the second half of 2008. Gross investment<br />

in construction fell 5.6% (prior year: grew<br />

7.0%) in the Czech Republic, with Slovakia faring<br />

even worse with a 7% drop compared to 2007.<br />

In Poland, where Zeppelin sells industrial trucks<br />

only, the market for forklift tricks once again exhibited<br />

growth compared to 2007, albeit at a much<br />

lower rate of an estimated 10% to 15% in 2008<br />

compared to 50% in the prior year.<br />