Ravikumar Distilleries Ltd. (RKDL) IPO Price Band 56 ... - PARASRAM

Ravikumar Distilleries Ltd. (RKDL) IPO Price Band 56 ... - PARASRAM

Ravikumar Distilleries Ltd. (RKDL) IPO Price Band 56 ... - PARASRAM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Please Note: Retail Limit in this issue is ` 2 Lakhs (` 200,000)<br />

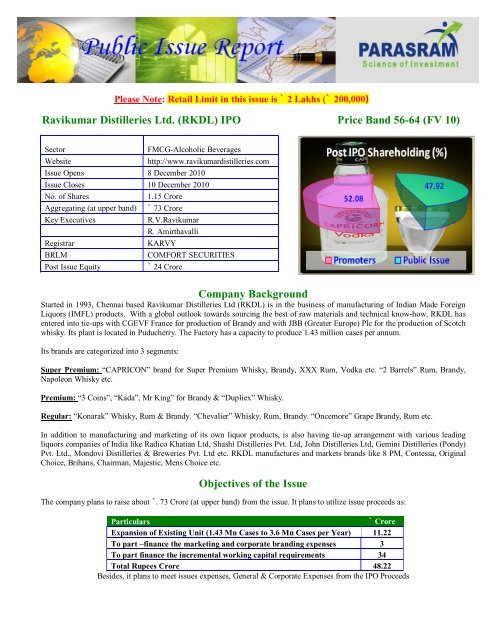

<strong>Ravikumar</strong> <strong>Distilleries</strong> <strong>Ltd</strong>. (<strong>RKDL</strong>) <strong>IPO</strong> <strong>Price</strong> <strong>Band</strong> <strong>56</strong>-64 (FV 10)<br />

Sector<br />

FMCG-Alcoholic Beverages<br />

Website http://www.ravikumardistilleries.com<br />

Issue Opens 8 December 2010<br />

Issue Closes 10 December 2010<br />

No. of Shares 1.15 Crore<br />

Aggregating (at upper band) ` 73 Crore<br />

Key Executives R.V.<strong>Ravikumar</strong><br />

R. Amirthavalli<br />

Registrar KARVY<br />

BRLM COMFORT SECURITIES<br />

Post Issue Equity ` 24 Crore<br />

Company Background<br />

Started in 1993, Chennai based <strong>Ravikumar</strong> <strong>Distilleries</strong> <strong>Ltd</strong> (<strong>RKDL</strong>) is in the business of manufacturing of Indian Made Foreign<br />

Liquors (IMFL) products. With a global outlook towards sourcing the best of raw materials and technical know-how, <strong>RKDL</strong> has<br />

entered into tie-ups with CGEVF France for production of Brandy and with JBB (Greater Europe) Plc for the production of Scotch<br />

whisky. Its plant is located in Puducherry. The Factory has a capacity to produce 1.43 million cases per annum.<br />

Its brands are categorized into 3 segments:<br />

Super Premium: “CAPRICON” brand for Super Premium Whisky, Brandy, XXX Rum, Vodka etc. “2 Barrels” Rum, Brandy,<br />

Napoleon Whisky etc.<br />

Premium: “3 Coins”, “Kada”, Mr King” for Brandy & “Dupliex” Whisky.<br />

Regular: “Konarak” Whisky, Rum & Brandy. “Chevalier” Whisky, Rum, Brandy. “Oncemore” Grape Brandy, Rum etc.<br />

In addition to manufacturing and marketing of its own liquor products, is also having tie-up arrangement with various leading<br />

liquors companies of India like Radico Khatian <strong>Ltd</strong>, Shashi <strong>Distilleries</strong> Pvt. <strong>Ltd</strong>, John <strong>Distilleries</strong> <strong>Ltd</strong>, Gemini <strong>Distilleries</strong> (Pondy)<br />

Pvt. <strong>Ltd</strong>., Mondovi <strong>Distilleries</strong> & Breweries Pvt. <strong>Ltd</strong> etc. <strong>RKDL</strong> manufactures and markets brands like 8 PM, Contessa, Original<br />

Choice, Brihans, Chairman, Majestic, Mens Choice etc.<br />

Objectives of the Issue<br />

The company plans to raise about `. 73 Crore (at upper band) from the issue. It plans to utilize issue proceeds as:<br />

Particulars ` Crore<br />

Expansion of Existing Unit (1.43 Mn Cases to 3.6 Mn Cases per Year) 11.22<br />

To part –finance the marketing and corporate branding expenses 3<br />

To part finance the incremental working capital requirements 34<br />

Total Rupees Crore 48.22<br />

Besides, it plans to meet issues expenses, General & Corporate Expenses from the <strong>IPO</strong> Proceeds

Highlights<br />

India with annual consumption of about 40 Million Cases is the 3 rd largest market in the world for Alcoholic Beverages.<br />

Alcohol industry is among the largest source of revenue of the State Exchequer, with gross amount paid about Rs. 25,000<br />

Crores. The Industry Net turnover is about Rs. 10,000 crores.<br />

Indian demographics are favorable to consumption of alcohol. Alcohol consumption begins at age 16-18 in India and<br />

peaks at 30-35. The 18-35 age groups in India is 300 Million and growing at 3.4% p.a. Coupled with growth in<br />

purchasing power, the industry is witnessing a sustained growth of 8-10% annually.<br />

Alcoholic beverages officially manufactured in India are categorized as BEER, Country Liquor (CL) and Indian Made<br />

Foreign Liquor (IMFL).<br />

IMFL production includes wines, whisky, rum, vodka, gin and brandy.<br />

In India, country liquor and IMFL (Indian-Made Foreign Liquor) cater for two quite different sectors of the liquor market.<br />

Country liquor is consumed in rural areas and by low income groups in urban areas. IMFL is consumed by the middle and<br />

high income groups, primarily in urban areas.<br />

However in the last decade cheap IMFL has been displacing country liquors, with a few states going so far as to ban the<br />

sales of country liquor resulting in a switch to IMFL by country liquor customers.<br />

There is stronger branding in IMFL than CL. CL is also produced illegally on large scale at individual, household and<br />

community level.<br />

IMFL industry is largely organized and it has growth by 12-15% in last 5 years (whereas CL industry has stagnated).<br />

IMFL can be sub divided into Brown Spirits (Whisky, Rum & Brandy) and White Spirits (Gin & Vodka). The major<br />

segment of IMFL include:<br />

Source: http://www.smartinvestor.in/ <strong>RKDL</strong> RHP<br />

Vodka has the smallest Share in overall IMFL presently but it is the fastest growing Segment. The growth rates across<br />

various categories is as:

<strong>RKDL</strong> is a small regional player mainly focused on markets of Tamil Nadu, Pondicherry, Andhra & Karnataka.<br />

It enjoys strong brand awareness in the region, with strong presence in fast growing Vodka segment.<br />

Besides, it also manufactures & markets popular brands of other leading Liquor makers.<br />

It has tie technical tie ups with 2 of the Europe based players, which open exports opportunity for the company.<br />

Financial Highlights<br />

` Crore FY 10 Q1 FY 2011 FY 11 E<br />

Total Income 50.23 13.93 <strong>56</strong>.42<br />

Operating Expenses 43.88 12.17 49.08<br />

PBDIT 6.35 1.76 7.33<br />

Interest & Bank Charges 2.79 0.73 2.9<br />

Depreciation 0.7 0.15 0.65<br />

PBT 2.86 0.88 3.78<br />

Tax 0.87 0.29 1.25<br />

PAT 1.99 0.59 2.54<br />

Other Adjustments 0 0 0.00<br />

Net Profit 1.99 0.59 2.54<br />

Equity (FV 10) 12.5 12.5 24<br />

EPS 1.59 0.47 1.06<br />

PE @ 64 40.20 135.59 60.58

Peerset Comparison<br />

` Crore (FY 10) <strong>RKDL</strong>** Empee Distillery Globus Spirit<br />

FY 10 Total Sales 50.23 874.36 385.5<br />

FY 10 PAT 1.99 15.41 28.92<br />

Equity 24 19.01 19.76<br />

Face Value 10 10 10<br />

EPS 0.83 8.11 14.64<br />

CMP 64 123 180<br />

PE 77.19 15.17 12.30<br />

Market Cap 154 234 3<strong>56</strong><br />

M Cap/Sales 3.06 0.27 0.92<br />

PAT (%) 3.96 1.76 7.50<br />

** <strong>RKDL</strong> Equity Post <strong>IPO</strong><br />

Risks<br />

Alcohol & Related industries are under strict Govt control.<br />

The industry is among the highly taxed, it is cash cow for many states with weak financial condition. With rising<br />

competition, higher taxes compress margins.<br />

It is a state subject and different states have their own regulations, any player that plans pan India operations has to deal<br />

with 28 different rules.<br />

The industry has negative social image. In some states like Gujarat, Mizoram etc. there is complete ban on alcoholic<br />

beverages.<br />

The size of <strong>RKDL</strong> is too small, with rising competition from domestic & Foreign players, it may find it very hard to<br />

expand.<br />

The issue looks over-priced given its bigger peers are at more attractive valuations.<br />

CARE has given the Issue low “2/5” Ratings for Poor Fundamentals.<br />

Valuation & Recommendation: Highly Risky<br />

<strong>RKDL</strong> is a small IMFL maker based in Tamil Nadu. The <strong>IPO</strong> Pricing looks steep, given better valuations of Peers and CARE’s<br />

low grading. It looks to be an effort to make hay of the excitement in Primary market. The issue is highly risky.<br />

For Internal Private Circulation Only<br />

Disclaimer: The information provided in the document is from publicly available data and other sources, which we believe are<br />

reliable. It also includes analysis and views expressed by our research team. The report is purely for information purposes and<br />

does not construe to be investment recommendation/advice. Investors should not solely rely on the information contained in this<br />

document and must make investment decisions based on their own investment objectives, risk profile and financial position.<br />

Efforts are made to try and ensure accuracy of data however, Shri Parasram Holdings Pvt. <strong>Ltd</strong>. and/or any of its affiliates and/or<br />

employees shall not be liable for loss or damage that may arise from any error in this document. This document is not for public<br />

distribution and should not be reproduced or redistributed without prior permission.

Shri Parasram Holdings Pvt. <strong>Ltd</strong>.<br />

SEBI Regn. No. NSE: INB/INF/INE- 230814036, BSE INB/INF 010814037, USE:INE<br />

270814036, MCX-SX No. INE 260814037,PMS-INP000002718, NSDL DP ID-IN302365,<br />

CDSL DP ID-58200. AMFI Regd No ARN 3<strong>56</strong>16,<br />

Shri Parasram Commodities Pvt. <strong>Ltd</strong>. FMC Regn. No. -NCDEX/TCM/CORP/0572, MCX/TCM/CORP/0828,<br />

For Further Information Please Contact at:<br />

Parasram House,<br />

B-7 Nimri Shopping Centre, Bharat Nagar,<br />

Ashok Vihar IV, Delhi – 110052 (India)<br />

+91.11.47000000<br />

Visit us @ www.parasramindia.com