toyota jidosha kabushiki kaisha toyota motor corporation - Big Three ...

toyota jidosha kabushiki kaisha toyota motor corporation - Big Three ...

toyota jidosha kabushiki kaisha toyota motor corporation - Big Three ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Table of Contents<br />

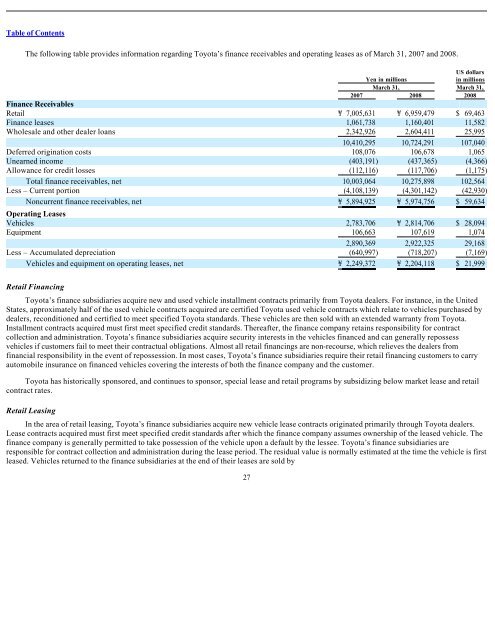

The following table provides information regarding Toyota’s finance receivables and operating leases as of March 31, 2007 and 2008.<br />

Retail Financing<br />

Toyota’s finance subsidiaries acquire new and used vehicle installment contracts primarily from Toyota dealers. For instance, in the United<br />

States, approximately half of the used vehicle contracts acquired are certified Toyota used vehicle contracts which relate to vehicles purchased by<br />

dealers, reconditioned and certified to meet specified Toyota standards. These vehicles are then sold with an extended warranty from Toyota.<br />

Installment contracts acquired must first meet specified credit standards. Thereafter, the finance company retains responsibility for contract<br />

collection and administration. Toyota’s finance subsidiaries acquire security interests in the vehicles financed and can generally repossess<br />

vehicles if customers fail to meet their contractual obligations. Almost all retail financings are non-recourse, which relieves the dealers from<br />

financial responsibility in the event of repossession. In most cases, Toyota’s finance subsidiaries require their retail financing customers to carry<br />

automobile insurance on financed vehicles covering the interests of both the finance company and the customer.<br />

Toyota has historically sponsored, and continues to sponsor, special lease and retail programs by subsidizing below market lease and retail<br />

contract rates.<br />

Retail Leasing<br />

In the area of retail leasing, Toyota’s finance subsidiaries acquire new vehicle lease contracts originated primarily through Toyota dealers.<br />

Lease contracts acquired must first meet specified credit standards after which the finance company assumes ownership of the leased vehicle. The<br />

finance company is generally permitted to take possession of the vehicle upon a default by the lessee. Toyota’s finance subsidiaries are<br />

responsible for contract collection and administration during the lease period. The residual value is normally estimated at the time the vehicle is first<br />

leased. Vehicles returned to the finance subsidiaries at the end of their leases are sold by<br />

27<br />

Yen in millions<br />

US dollars<br />

in millions<br />

March 31, March 31,<br />

2007 2008 2008<br />

Finance Receivables<br />

Retail ¥ 7,005,631 ¥ 6,959,479 $ 69,463<br />

Finance leases 1,061,738 1,160,401 11,582<br />

Wholesale and other dealer loans 2,342,926 2,604,411 25,995<br />

10,410,295 10,724,291 107,040<br />

Deferred origination costs 108,076 106,678 1,065<br />

Unearned income (403,191) (437,365) (4,366)<br />

Allowance for credit losses (112,116) (117,706) (1,175)<br />

Total finance receivables, net 10,003,064 10,275,898 102,564<br />

Less – Current portion (4,108,139) (4,301,142) (42,930)<br />

Noncurrent finance receivables, net ¥ 5,894,925 ¥ 5,974,756 $ 59,634<br />

Operating Leases<br />

Vehicles 2,783,706 ¥ 2,814,706 $ 28,094<br />

Equipment 106,663 107,619 1,074<br />

2,890,369 2,922,325 29,168<br />

Less – Accumulated depreciation (640,997) (718,207) (7,169)<br />

Vehicles and equipment on operating leases, net ¥ 2,249,372 ¥ 2,204,118 $ 21,999