MODULE CODE BEA3001 MODULE LEVEL 3 MODULE TITLE ...

MODULE CODE BEA3001 MODULE LEVEL 3 MODULE TITLE ...

MODULE CODE BEA3001 MODULE LEVEL 3 MODULE TITLE ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

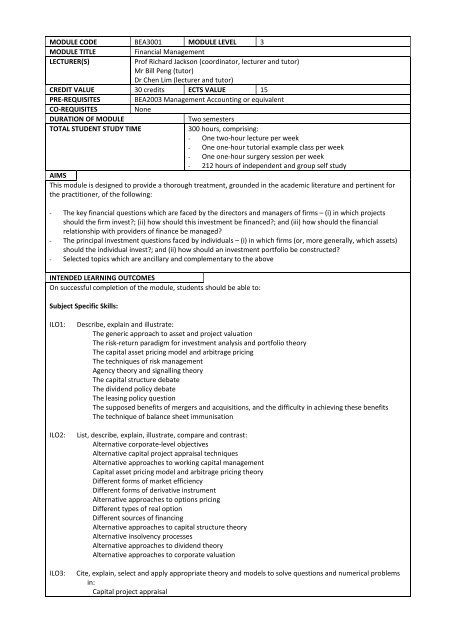

<strong>MODULE</strong> <strong>CODE</strong> <strong>BEA3001</strong> <strong>MODULE</strong> <strong>LEVEL</strong> 3<br />

<strong>MODULE</strong> <strong>TITLE</strong> Financial Management<br />

LECTURER(S) Prof Richard Jackson (coordinator, lecturer and tutor)<br />

Mr Bill Peng (tutor)<br />

Dr Chen Lim (lecturer and tutor)<br />

CREDIT VALUE 30 credits ECTS VALUE 15<br />

PRE-REQUISITES BEA2003 Management Accounting or equivalent<br />

CO-REQUISITES None<br />

DURATION OF <strong>MODULE</strong> Two semesters<br />

TOTAL STUDENT STUDY TIME 300 hours, comprising:<br />

- One two-hour lecture per week<br />

- One one-hour tutorial example class per week<br />

- One one-hour surgery session per week<br />

- 212 hours of independent and group self study<br />

AIMS<br />

This module is designed to provide a thorough treatment, grounded in the academic literature and pertinent for<br />

the practitioner, of the following:<br />

- The key financial questions which are faced by the directors and managers of firms – (i) in which projects<br />

should the firm invest?; (ii) how should this investment be financed?; and (iii) how should the financial<br />

relationship with providers of finance be managed?<br />

- The principal investment questions faced by individuals – (i) in which firms (or, more generally, which assets)<br />

should the individual invest?; and (ii) how should an investment portfolio be constructed?<br />

- Selected topics which are ancillary and complementary to the above<br />

INTENDED LEARNING OUTCOMES<br />

On successful completion of the module, students should be able to:<br />

Subject Specific Skills:<br />

ILO1: Describe, explain and illustrate:<br />

The generic approach to asset and project valuation<br />

The risk-return paradigm for investment analysis and portfolio theory<br />

The capital asset pricing model and arbitrage pricing<br />

The techniques of risk management<br />

Agency theory and signalling theory<br />

The capital structure debate<br />

The dividend policy debate<br />

The leasing policy question<br />

The supposed benefits of mergers and acquisitions, and the difficulty in achieving these benefits<br />

The technique of balance sheet immunisation<br />

ILO2: List, describe, explain, illustrate, compare and contrast:<br />

Alternative corporate-level objectives<br />

Alternative capital project appraisal techniques<br />

Alternative approaches to working capital management<br />

Capital asset pricing model and arbitrage pricing theory<br />

Different forms of market efficiency<br />

Different forms of derivative instrument<br />

Alternative approaches to options pricing<br />

Different types of real option<br />

Different sources of financing<br />

Alternative approaches to capital structure theory<br />

Alternative insolvency processes<br />

Alternative approaches to dividend theory<br />

Alternative approaches to corporate valuation<br />

ILO3: Cite, explain, select and apply appropriate theory and models to solve questions and numerical problems<br />

in:<br />

Capital project appraisal

Working capital management<br />

Portfolio theory<br />

Asset pricing<br />

Market efficiency<br />

Options pricing<br />

Cost of capital<br />

Capital structure<br />

Dividend policy<br />

Corporate valuation<br />

Lease evaluation<br />

International aspects of financial management<br />

Mergers and acquisitions<br />

Balance sheet immunisation<br />

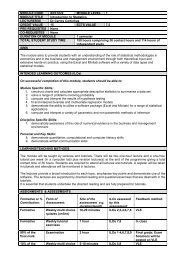

ILO4: Derive, criticise and challenge theoretical models for:<br />

Objective function of the firm<br />

Present value<br />

Working capital management<br />

Portfolio theory<br />

Complex covariance<br />

Capital asset pricing<br />

Value of an uncertain cash flow<br />

Capital asset pricing<br />

Option pricing via the Binomial method<br />

Put-call parity<br />

Value of the firm, cost of equity and weighted average cost of capital<br />

Value-relevance of dividend policy<br />

Balance sheet immunisation<br />

ILO5: Relate key financial issues one to another, to associated theory, to ‘real world’ evidence, and to the<br />

preferences and expectations of key stakeholders<br />

Core Academic Skills:<br />

ILO 6: (a) Develop powers of research in the academic literature and texts<br />

(b) Apply and criticise finance models in a ‘real world’ context<br />

(c) Develop powers of algebraic proof, derivation and criticism<br />

Personal and Key Skills<br />

ILO7: (a) Use information technology for information retrieval and numerical analysis<br />

(b) Build team skills in debating discussion topics and producing team solutions to problems<br />

(c) Build presentation skills in lecture / example class participation<br />

LEARNING/TEACHING METHODS<br />

Teaching and learning principally is organised into lectures, tutorial example classes and directed self-study. There<br />

are also regular surgery sessions to clear up student difficulties as they arise. Students are encouraged to work<br />

together in assimilating lecture material, preparing for tutorials and completing self-study assignments.<br />

All students are expected to attend all lectures and tutorials and complete all assigned work; and to attend surgery<br />

sessions as necessary. Much of the material will be covered by only one mode of delivery (lecture or tutorial or selfstudy).<br />

All material is potentially assessible, howsoever delivered.<br />

ASSIGNMENTS<br />

(Not for direct, summative assessment – see below for such)<br />

- Assigned work for each tutorial [ILOs 1, 2, 3, 4, 5, 6, 7]<br />

- Individual / group self-study assignments over the course of the two semesters [ILOs 1, 2, 3, 4, 5, 6, 7]<br />

ASSESSMENT<br />

- Two one-hour in-class multiple-choice tests (the first accounting for 5% module marks and the second for 15%<br />

module marks = 20% total) [ILO 3]

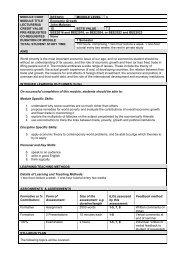

- One three-hour examination (accounting for 80% module marks) [ILOs 1, 2, 3, 4, 5]<br />

Should a re-sit be required for this module, it will be by means of one three-hour examination accounting for 100%<br />

module marks [ILOs 1, 2, 3, 4, 5]<br />

SYLLABUS PLAN<br />

1. Introductory topics<br />

2. Capital budgeting under conditions of certainty<br />

3. Working capital management<br />

4. Portfolio theory, capital asset pricing<br />

5. Capital budgeting under conditions of uncertainty<br />

6. Efficient markets<br />

7. Options pricing theory<br />

8. Sources of finance, cost of capital<br />

9. Capital structure<br />

10. Dividend policy<br />

11. Leasing<br />

12. Mergers and acquisitions<br />

13. Duration, convexity and balance sheet immunisation<br />

14. International aspects of financial management<br />

15. Aspects of risk and corporate valuation<br />

16. Review session<br />

INDICATIVE BASIC READING LIST<br />

The module recommended purchase text(s) (from which a number of the self-study assignments will be drawn) is:<br />

Brealey, R.A., Myers, S.C. and Allen, F. (2008), Principles of Corporate Finance, 9 th (International) Edition, McGraw-<br />

Hill.<br />

For wider reading, there are a large number of texts upon the subject areas of this module. Titles such as ‘Financial<br />

Management’, ‘Finance’, ‘Corporate Finance’, ‘Investments’, ‘Investment Analysis’ and similar may be found in the<br />

library and through any good book seller. Having the most up-to-date edition of such books is rarely important.<br />

Other materials / sources which you are expected to access and use during the module will be apprised to you<br />

during the module.<br />

RHGJ September 2008