assessing the “unilateral” effects on horizontal non-coordinated ...

assessing the “unilateral” effects on horizontal non-coordinated ...

assessing the “unilateral” effects on horizontal non-coordinated ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ASSESSING THE “UNILATERAL” EFFECTS ON<br />

HORIZONTAL NON-COORDINATED MERGER<br />

INTERNSHIP PROJECT REPORT<br />

SUBMITTED BY:<br />

ROOPIKA RASTOGI<br />

COMPANY SECRETARY<br />

UNDER GUIDANCE OF<br />

SH. P.K. PURWAR<br />

ADVISOR (COMBINATION DIVISION)<br />

1

NEW DELHI<br />

DISCLAIMER<br />

This dissertati<strong>on</strong> has been prepared by <str<strong>on</strong>g>the</str<strong>on</strong>g> author as an intern under <str<strong>on</strong>g>the</str<strong>on</strong>g> Internship programme of<br />

Competiti<strong>on</strong> Commissi<strong>on</strong> of India for academic purposes <strong>on</strong>ly. The views expressed are<br />

pers<strong>on</strong>al and do not reflect <str<strong>on</strong>g>the</str<strong>on</strong>g> view of <str<strong>on</strong>g>the</str<strong>on</strong>g> Commissi<strong>on</strong> in any manner. This report is <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

intellectual property of <str<strong>on</strong>g>the</str<strong>on</strong>g> Competiti<strong>on</strong> Commissi<strong>on</strong> and <str<strong>on</strong>g>the</str<strong>on</strong>g> same or any part <str<strong>on</strong>g>the</str<strong>on</strong>g>reof may not<br />

used in any manner whatsoever without express permissi<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> Commissi<strong>on</strong> in writing.<br />

2

ACKNOWLEDGMENT<br />

This dissertati<strong>on</strong> is an effort made by me with <str<strong>on</strong>g>the</str<strong>on</strong>g> astute guidance of my mentor, Mr. P.K Purvar<br />

Advisor (Combinati<strong>on</strong> Divisi<strong>on</strong>) of <str<strong>on</strong>g>the</str<strong>on</strong>g> Competiti<strong>on</strong> Commissi<strong>on</strong> of India. His valuable inputs<br />

and c<strong>on</strong>stant encouragement has inspired me to carry out this research fruitfully. He gave me his<br />

valuable time to discuss <str<strong>on</strong>g>the</str<strong>on</strong>g> facets of this topic and guided me towards an enlightening and<br />

holistic research.<br />

I also put <strong>on</strong> record my gratitude towards <str<strong>on</strong>g>the</str<strong>on</strong>g> librarian and <str<strong>on</strong>g>the</str<strong>on</strong>g> library staff, who have provided<br />

me help and access to all <str<strong>on</strong>g>the</str<strong>on</strong>g> resourceful material for my research. This dissertati<strong>on</strong> was not<br />

possible without <str<strong>on</strong>g>the</str<strong>on</strong>g> blessing of my parents and support of my family.<br />

I am indebted towards Competiti<strong>on</strong> Commissi<strong>on</strong> of India, for providing me an opportunity to<br />

have a learning experience.<br />

3

ACRONYMS<br />

CCI Competiti<strong>on</strong> Commissi<strong>on</strong> of India<br />

AAEC Appreciable Adverse Effect <strong>on</strong> Competiti<strong>on</strong><br />

DOJ Department of Justice<br />

EUMR European Merger Regulati<strong>on</strong><br />

FTC Federal Trade Commissi<strong>on</strong> (USA)<br />

HHI Herfindahl-Hirschman index<br />

M & A Merger and Acquisiti<strong>on</strong><br />

MRTP M<strong>on</strong>opolies restrictive trade practices<br />

SSNIP Small but significant and n<strong>on</strong>-transitory<br />

increase in price<br />

SLC Significantly Lessening Competiti<strong>on</strong><br />

SIEC Significantly Impede Effective Competiti<strong>on</strong><br />

OJ Official Journal<br />

4

TABLE OF CONTENTS<br />

TABLE OF CONTENTS PAGES<br />

DISCLAIMER 2<br />

ACKNOWLEDGEMENT 3<br />

ACRONYMS 4<br />

1. INTRODUCTION: WHY COMPETITION LAW 6-7<br />

2. PURPOSE OF A MERGER REGULATION<br />

2.1 Introducti<strong>on</strong><br />

2.2 Purpose underlying <str<strong>on</strong>g>the</str<strong>on</strong>g> Principles for Merger<br />

2.3 Kinds of Merger: A Comparative Study of Merger<br />

Regulati<strong>on</strong> in US EU and India<br />

2.4Internati<strong>on</strong>al Practice of Merger Regulati<strong>on</strong> -<br />

C<strong>on</strong>vergence and Divergence<br />

3. ECONOMIC CONCEPTS IN DETERMINING<br />

UNILATERAL EFFECTS OF MERGER<br />

3.1 General Principle: Unilateral Market Power<br />

3.2 Ec<strong>on</strong>omic Analysis of <str<strong>on</strong>g>the</str<strong>on</strong>g> Impact of Merger in<br />

Oligopolistic Market<br />

8- 18<br />

19 -25<br />

5

3.3 Illustrati<strong>on</strong> of unilateral <str<strong>on</strong>g>effects</str<strong>on</strong>g><br />

3.4 Ec<strong>on</strong>omic C<strong>on</strong>siderati<strong>on</strong> in Oligopolistic Market<br />

4. PRINCIPLES OF COMPETITION HARM ON NON-<br />

COORDINATED HORIZONTAL MERGER<br />

4.1 Introducti<strong>on</strong><br />

4.2 Techniques To Measure Degree of Substitutability<br />

4.3 Distincti<strong>on</strong> between Co-ordinated practice and N<strong>on</strong>-<br />

Coordinated practice<br />

4.4 Internati<strong>on</strong>al Practice in Merger – A Case Study EU,<br />

USA, UK<br />

5. INDIAN MERGER REGULATION<br />

5.1 Introducti<strong>on</strong><br />

5.2 Case Study: Evoluti<strong>on</strong> of Competiti<strong>on</strong> Policy in India<br />

5.3Jurisprudence Development: Agreement causing<br />

Appreciable Adverse Effect <strong>on</strong> Competiti<strong>on</strong><br />

5.4 Case Study of Combinati<strong>on</strong>: An Analysis<br />

26- 38<br />

39 – 49<br />

6. CONCLUSION 50 – 51<br />

7. BIBLIOGRAPHY 52- 54<br />

6

1. INTRODUCTION: WHY COMPETITION LAW?<br />

The belief that competiti<strong>on</strong> am<strong>on</strong>gst undertakings produces <str<strong>on</strong>g>the</str<strong>on</strong>g> best outcomes for society is a<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g>sis based <strong>on</strong> ec<strong>on</strong>omic <str<strong>on</strong>g>the</str<strong>on</strong>g>ory that employs models of perfect competiti<strong>on</strong> and m<strong>on</strong>opoly, and<br />

c<strong>on</strong>cepts of welfare and efficiency. It is possible for systems of competiti<strong>on</strong> law to pursue<br />

objectives o<str<strong>on</strong>g>the</str<strong>on</strong>g>r than <str<strong>on</strong>g>the</str<strong>on</strong>g> ec<strong>on</strong>omic <strong>on</strong>es of welfare and efficiency. Whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r <str<strong>on</strong>g>the</str<strong>on</strong>g>y should and, if<br />

so, what o<str<strong>on</strong>g>the</str<strong>on</strong>g>r objectives should be pursued is extremely c<strong>on</strong>troversial. The 3 central c<strong>on</strong>cepts<br />

used in competiti<strong>on</strong> law are market power, market definiti<strong>on</strong> and barriers to entry.<br />

Over <str<strong>on</strong>g>the</str<strong>on</strong>g> past <strong>on</strong>e and a half decade, with globalizati<strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> overall approach to ec<strong>on</strong>omic<br />

management in India has been revised towards greater market orientati<strong>on</strong>. Wide-ranging<br />

ec<strong>on</strong>omic reform measures have been undertaken. The government assuming <str<strong>on</strong>g>the</str<strong>on</strong>g> role of a<br />

facilitator ra<str<strong>on</strong>g>the</str<strong>on</strong>g>r than a c<strong>on</strong>troller and intervenes by excepti<strong>on</strong>. Ec<strong>on</strong>omic reforms have been<br />

undertaken in policies relating to industrial licensing, foreign trade, foreign investment,<br />

technology imports, financial sector, etc.<br />

These efforts towards ensuring a competitive ec<strong>on</strong>omy have got a fur<str<strong>on</strong>g>the</str<strong>on</strong>g>r impetus with <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

Government of India making ‘competiti<strong>on</strong>’ a law of immense importance with its increasing<br />

importance.<br />

In <str<strong>on</strong>g>the</str<strong>on</strong>g> present research, I would do a comprehensive study <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> unilateral <str<strong>on</strong>g>effects</str<strong>on</strong>g> <strong>on</strong> horiz<strong>on</strong>tal<br />

merger of <str<strong>on</strong>g>the</str<strong>on</strong>g> Competiti<strong>on</strong> policies in India and foreign jurisdicti<strong>on</strong> including UK, EU and USA<br />

with reference to Merger Regulati<strong>on</strong> (Secti<strong>on</strong> 5 & 6), EU Merger Regulati<strong>on</strong>, US Merger and<br />

UK Merger Regulati<strong>on</strong>. A comparative overview of unilateral <str<strong>on</strong>g>effects</str<strong>on</strong>g> or ‘Single Firm<br />

Dominance’ of Merger in EU, USA and India will be c<strong>on</strong>sidered and various ec<strong>on</strong>omic factor<br />

that need to be c<strong>on</strong>sidered and incorporated in Indian Merger Regulati<strong>on</strong>. This report discusses<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> likely impact of <str<strong>on</strong>g>the</str<strong>on</strong>g> inclusi<strong>on</strong> of unilateral <str<strong>on</strong>g>effects</str<strong>on</strong>g> analysis in Merger C<strong>on</strong>trol.<br />

First it gives a general introducti<strong>on</strong> to unilateral <str<strong>on</strong>g>effects</str<strong>on</strong>g> analysis in India and EC Merger<br />

C<strong>on</strong>trol regime, US Merger and illustrates <str<strong>on</strong>g>the</str<strong>on</strong>g> tentative differences in approach when compared<br />

with traditi<strong>on</strong>al dominance test. Sec<strong>on</strong>dly, <str<strong>on</strong>g>the</str<strong>on</strong>g> report examines merger examines cases in which<br />

7

<str<strong>on</strong>g>the</str<strong>on</strong>g> Commissi<strong>on</strong> has already undertaken effect type analysis. Building <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> above<br />

c<strong>on</strong>siderati<strong>on</strong>s, <str<strong>on</strong>g>the</str<strong>on</strong>g> report shall analyze <str<strong>on</strong>g>the</str<strong>on</strong>g> possible impact of <str<strong>on</strong>g>the</str<strong>on</strong>g> introducti<strong>on</strong> of unilateral<br />

<str<strong>on</strong>g>effects</str<strong>on</strong>g> analysis <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>duct and outcome of Merger C<strong>on</strong>trol proceedings. The report<br />

c<strong>on</strong>cludes that <str<strong>on</strong>g>the</str<strong>on</strong>g> Commissi<strong>on</strong> will make substantial use of <str<strong>on</strong>g>the</str<strong>on</strong>g> new “appreciable adverse effect<br />

<strong>on</strong> competiti<strong>on</strong>” test.<br />

Thus, in <str<strong>on</strong>g>the</str<strong>on</strong>g> end it can be said <str<strong>on</strong>g>the</str<strong>on</strong>g> Competiti<strong>on</strong> law upholds <str<strong>on</strong>g>the</str<strong>on</strong>g> workings of <str<strong>on</strong>g>the</str<strong>on</strong>g> free market<br />

ec<strong>on</strong>omy by policing <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>duct of firms as <str<strong>on</strong>g>the</str<strong>on</strong>g>y compete in <str<strong>on</strong>g>the</str<strong>on</strong>g> market. Since <str<strong>on</strong>g>the</str<strong>on</strong>g> incepti<strong>on</strong> of<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> Commissi<strong>on</strong>, it has relentlessly been adopting and working <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> decisi<strong>on</strong>s involving<br />

complex and difficult analysis within <str<strong>on</strong>g>the</str<strong>on</strong>g> stringent time period prescribed by <str<strong>on</strong>g>the</str<strong>on</strong>g> Competiti<strong>on</strong><br />

Act.<br />

8

2.1 Introducti<strong>on</strong><br />

2. PURPOSE OF MERGER CONTROL<br />

The purpose of merger c<strong>on</strong>trol is to enable competiti<strong>on</strong> authorities to regulate changes in market<br />

structure by deciding whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r two or more commercial companies may merge, combine or<br />

c<strong>on</strong>solidate <str<strong>on</strong>g>the</str<strong>on</strong>g>ir business into <strong>on</strong>e. It has been that <str<strong>on</strong>g>the</str<strong>on</strong>g> authorities are hostile to anti-competitive<br />

agreements c<strong>on</strong>cluded between independent undertakings.<br />

Mergers may raise severe competiti<strong>on</strong> c<strong>on</strong>cerns. In particular, <str<strong>on</strong>g>the</str<strong>on</strong>g>y may result in <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

undertakings acquiring or streng<str<strong>on</strong>g>the</str<strong>on</strong>g>ning a positi<strong>on</strong> of market power and, c<strong>on</strong>sequently, in an<br />

increase in <str<strong>on</strong>g>the</str<strong>on</strong>g> market price of <str<strong>on</strong>g>the</str<strong>on</strong>g> products or services <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> relevant market. However mergers<br />

also give <str<strong>on</strong>g>the</str<strong>on</strong>g> owner of a business <str<strong>on</strong>g>the</str<strong>on</strong>g> opportunity to sell it. Without this possibility, entrepreneurs<br />

might be reluctant to start a business. Also mergers provide many efficiency opportunities.<br />

The reas<strong>on</strong>s 1 for not making mergers unlawful per se or for not even coming anywhere near such<br />

a rule are plain. Widespread prohibiti<strong>on</strong> of merger would impose serious, if not intolerable,<br />

burdens up<strong>on</strong> owners of businesses who wished to liquidate <str<strong>on</strong>g>the</str<strong>on</strong>g>ir holdings for irreproachable<br />

pers<strong>on</strong>al reas<strong>on</strong>s. Moreover, ec<strong>on</strong>omic welfare is significantly served by maintaining a good<br />

market for capital assets. Most importantly, a policy of free transferability of capital assets tends<br />

to put <str<strong>on</strong>g>the</str<strong>on</strong>g>m in <str<strong>on</strong>g>the</str<strong>on</strong>g> hands of those who will use <str<strong>on</strong>g>the</str<strong>on</strong>g>m to <str<strong>on</strong>g>the</str<strong>on</strong>g>ir utmost ec<strong>on</strong>omic advantage, thus<br />

tending to maximize society’s total output of goods and services.<br />

Growth by merger …will often yield substantial ec<strong>on</strong>omies of scale – in producti<strong>on</strong>, research,<br />

distributi<strong>on</strong>, cost of capital and management. Entry by merger… may stimulate improved<br />

ec<strong>on</strong>omic performance in an industry characterized by oligopolistic lethargy and inefficiency.<br />

Finally, acquisiti<strong>on</strong> of diversified lines of business, by stabilizing profits, may minimize <str<strong>on</strong>g>the</str<strong>on</strong>g> risk<br />

of business failure and bankruptcy 2 .<br />

1 D. Turner, ‘C<strong>on</strong>glomerate Mergers and Secti<strong>on</strong> 7 of <str<strong>on</strong>g>the</str<strong>on</strong>g> Clayt<strong>on</strong> Act’(1965) 78 Harvard LR 1313,1317<br />

2 D. Turner, ‘C<strong>on</strong>glomerate Mergers and Secti<strong>on</strong> 7 of <str<strong>on</strong>g>the</str<strong>on</strong>g> Clayt<strong>on</strong> Act’(1965) 78 Harvard LR 1313,1317<br />

9

2.2 Purpose underlying <str<strong>on</strong>g>the</str<strong>on</strong>g> Principles for Merger<br />

A. The Motives for, and Advantages of, a Merger<br />

(i) Efficiency<br />

In many cases <str<strong>on</strong>g>the</str<strong>on</strong>g> parties will state that <str<strong>on</strong>g>the</str<strong>on</strong>g> main motivati<strong>on</strong> for <str<strong>on</strong>g>the</str<strong>on</strong>g>ir merger is that <str<strong>on</strong>g>the</str<strong>on</strong>g> merged<br />

entity will be more efficient. The entity may be able to exploit ec<strong>on</strong>omies of scale in producti<strong>on</strong>.<br />

Such ec<strong>on</strong>omies will be of particular importance in a market in which <str<strong>on</strong>g>the</str<strong>on</strong>g> cost of producti<strong>on</strong> of a<br />

product is high in comparis<strong>on</strong> to <str<strong>on</strong>g>the</str<strong>on</strong>g> size, or <str<strong>on</strong>g>the</str<strong>on</strong>g> anticipated size, of <str<strong>on</strong>g>the</str<strong>on</strong>g> market or where <str<strong>on</strong>g>the</str<strong>on</strong>g>re is a<br />

minimum efficient scale of producti<strong>on</strong>. The merger may also give rise to o<str<strong>on</strong>g>the</str<strong>on</strong>g>r operating<br />

efficiencies such as ec<strong>on</strong>omies of scope, marketing efficiencies, efficiencies arising from broader<br />

product lines, streamlining of <str<strong>on</strong>g>the</str<strong>on</strong>g> sale force efficiencies arising from integrati<strong>on</strong> of<br />

complementary activities or <str<strong>on</strong>g>the</str<strong>on</strong>g> ability to pool research and development skills.<br />

(ii) Barriers to Exit<br />

It has already been noted that few people would go to <str<strong>on</strong>g>the</str<strong>on</strong>g> trouble to set up a business if <str<strong>on</strong>g>the</str<strong>on</strong>g>y<br />

could not sell it when <str<strong>on</strong>g>the</str<strong>on</strong>g>y had enough or when <str<strong>on</strong>g>the</str<strong>on</strong>g>y wished to realize capital profits from it. In<br />

particular, many smaller business owners may wish to sell <str<strong>on</strong>g>the</str<strong>on</strong>g>ir business if no successor is<br />

available.<br />

(iii) Failing Undertakings, Unemployment and/or Industry Stability<br />

A merger may provide an escape route for a company facing an o<str<strong>on</strong>g>the</str<strong>on</strong>g>rwise inevitable liquidati<strong>on</strong>.<br />

In <str<strong>on</strong>g>the</str<strong>on</strong>g>se circumstances <str<strong>on</strong>g>the</str<strong>on</strong>g> possibility of selling <str<strong>on</strong>g>the</str<strong>on</strong>g> business to ano<str<strong>on</strong>g>the</str<strong>on</strong>g>r may mean that assets are<br />

kept in producti<strong>on</strong> that creditors, owners and employees are protected from adverse<br />

c<strong>on</strong>sequences of <str<strong>on</strong>g>the</str<strong>on</strong>g> undertaking failure and that stability is preserved in a critical industry<br />

sector.<br />

B. The Adverse C<strong>on</strong>sequence of Merger<br />

More important perhaps than focusing <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> benefits of a merger is <str<strong>on</strong>g>the</str<strong>on</strong>g> answer to <str<strong>on</strong>g>the</str<strong>on</strong>g> questi<strong>on</strong>:<br />

why should mergers be prohibited? When, and <strong>on</strong> what grounds , should a competiti<strong>on</strong> authority<br />

take steps to interfere with <str<strong>on</strong>g>the</str<strong>on</strong>g> market for corporate c<strong>on</strong>trol? Failure to agree <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g>se key issues<br />

was <strong>on</strong>e of <str<strong>on</strong>g>the</str<strong>on</strong>g> factors which seriously delayed <str<strong>on</strong>g>the</str<strong>on</strong>g> introducti<strong>on</strong> of any comprehensive systems of<br />

merger c<strong>on</strong>trol at <str<strong>on</strong>g>the</str<strong>on</strong>g> Community level.<br />

10

(1) Damaging effect <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> Competitive Structure of <str<strong>on</strong>g>the</str<strong>on</strong>g> Market<br />

There is an inherent danger that <str<strong>on</strong>g>the</str<strong>on</strong>g> undertakings may wish to merge in order to achieve<br />

or to streng<str<strong>on</strong>g>the</str<strong>on</strong>g>n <str<strong>on</strong>g>the</str<strong>on</strong>g>ir market power. Both horiz<strong>on</strong>tal and vertical merger may lead to<br />

dominance or <str<strong>on</strong>g>the</str<strong>on</strong>g> acquisiti<strong>on</strong> of market power.<br />

(2) A Fear of Big Business<br />

Mergers may cause o<str<strong>on</strong>g>the</str<strong>on</strong>g>r c<strong>on</strong>cerns apart from competiti<strong>on</strong> <strong>on</strong>es. It is believed that it<br />

would create large businesses which will have adverse impact for <str<strong>on</strong>g>the</str<strong>on</strong>g> freedom of society<br />

more generally. It is feared that too great an ec<strong>on</strong>omic c<strong>on</strong>centrati<strong>on</strong> is anti-democratic<br />

and restricts individual freedom and enterprise.<br />

(3) Special Sectors and Fear of Overseas C<strong>on</strong>trol<br />

It may be believed that tighter c<strong>on</strong>trol should be exercised over mergers which occur in<br />

particularly sensitive sectors. In <str<strong>on</strong>g>the</str<strong>on</strong>g>se sectors it might be thought that a broader range of<br />

factors should be taken into account whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r or not a merger operates in <str<strong>on</strong>g>the</str<strong>on</strong>g> public<br />

interest.<br />

2.3 Kinds of Merger: A Comparative Study of Merger Regulati<strong>on</strong> in US EU and India<br />

There are 3 kinds of merger between two firms<br />

1. Horiz<strong>on</strong>tal Mergers<br />

2. Vertical Mergers/C<strong>on</strong>glomerate Mergers<br />

1. Under <str<strong>on</strong>g>the</str<strong>on</strong>g> Horiz<strong>on</strong>tal Merger <str<strong>on</strong>g>the</str<strong>on</strong>g>re 2 practices wherein <str<strong>on</strong>g>the</str<strong>on</strong>g> firms abuse <str<strong>on</strong>g>the</str<strong>on</strong>g>ir market<br />

positi<strong>on</strong> through tacit collusi<strong>on</strong>/<strong>coordinated</strong> <str<strong>on</strong>g>effects</str<strong>on</strong>g> <strong>on</strong> a Horiz<strong>on</strong>tal Merger or unilateral<br />

Single firm Dominance through n<strong>on</strong>-<strong>coordinated</strong> merger<br />

2. Vertical Merger/N<strong>on</strong>-Horiz<strong>on</strong>tal Merger <str<strong>on</strong>g>the</str<strong>on</strong>g> authorities are c<strong>on</strong>cerned that <strong>on</strong>e of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

parties to such a merger has market power in at least <strong>on</strong>e market; vertical and c<strong>on</strong>glomerate<br />

mergers may harm competiti<strong>on</strong> through:<br />

- Foreclosure of a distinct upstream, downstream or related market; or<br />

11

- Changing <str<strong>on</strong>g>the</str<strong>on</strong>g> structure of competiti<strong>on</strong> <strong>on</strong> a market in such a way that <str<strong>on</strong>g>the</str<strong>on</strong>g> firms operating<br />

<strong>on</strong> it are likely to coordinate <str<strong>on</strong>g>the</str<strong>on</strong>g>ir behavior.<br />

The practice of anti-competitive merger c<strong>on</strong>duct can be analyzed in line of <str<strong>on</strong>g>the</str<strong>on</strong>g> above 3<br />

forms of merger. For simplificati<strong>on</strong> it can be seen that in case of horiz<strong>on</strong>tal mergers <str<strong>on</strong>g>the</str<strong>on</strong>g>re are<br />

2 practices ei<str<strong>on</strong>g>the</str<strong>on</strong>g>r <str<strong>on</strong>g>the</str<strong>on</strong>g> firm abuse <str<strong>on</strong>g>the</str<strong>on</strong>g>ir market positi<strong>on</strong> through tacit collusi<strong>on</strong> or <strong>coordinated</strong><br />

<str<strong>on</strong>g>effects</str<strong>on</strong>g> <strong>on</strong> a horiz<strong>on</strong>tal merger or unilateral single firm dominance/n<strong>on</strong>-<strong>coordinated</strong> merger.<br />

EUMR Law<br />

`With <str<strong>on</strong>g>the</str<strong>on</strong>g> adopti<strong>on</strong> of a new substantive test in <str<strong>on</strong>g>the</str<strong>on</strong>g> revised Merger Regulati<strong>on</strong>, and <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

publicati<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> European Commissi<strong>on</strong> Guidelines <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> assessment of horiz<strong>on</strong>tal merger<br />

(“EC Horiz<strong>on</strong>tal Merger Guidelines”). The substantive test under <str<strong>on</strong>g>the</str<strong>on</strong>g> ECMR is whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

merger would “significantly impede effective competiti<strong>on</strong>” in <str<strong>on</strong>g>the</str<strong>on</strong>g> comm<strong>on</strong> market or in a<br />

substantial part of it , in particular as a result of <str<strong>on</strong>g>the</str<strong>on</strong>g> creati<strong>on</strong> or streng<str<strong>on</strong>g>the</str<strong>on</strong>g>ning of a dominant<br />

positi<strong>on</strong>. The test came into force <strong>on</strong> May 1, 2004. The Commissi<strong>on</strong> has provided guidance<br />

<strong>on</strong> its approach to substantive issues under <str<strong>on</strong>g>the</str<strong>on</strong>g> ECMR by publishing guidelines <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

assessment of horiz<strong>on</strong>tal mergers (“Notice <strong>on</strong> Horiz<strong>on</strong>tal Mergers and Notice <strong>on</strong> N<strong>on</strong>-<br />

Horiz<strong>on</strong>tal Mergers”).<br />

The unilateral <str<strong>on</strong>g>effects</str<strong>on</strong>g> analysis is poised to become an integral part of merger review in <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

European Uni<strong>on</strong>. Notwithstanding <str<strong>on</strong>g>the</str<strong>on</strong>g> Commissi<strong>on</strong>’s insistence <strong>on</strong> a European terminology<br />

(“n<strong>on</strong>-<strong>coordinated</strong> ra<str<strong>on</strong>g>the</str<strong>on</strong>g>r than “unilateral <str<strong>on</strong>g>effects</str<strong>on</strong>g>”), <str<strong>on</strong>g>the</str<strong>on</strong>g> EC thus embraces a c<strong>on</strong>cept that has<br />

gained substantial tracti<strong>on</strong> in <str<strong>on</strong>g>the</str<strong>on</strong>g> US since its explicit recogniti<strong>on</strong> in <str<strong>on</strong>g>the</str<strong>on</strong>g> 1992 Horiz<strong>on</strong>tal<br />

Merger Guidelines as <strong>on</strong>e of a “substantial lessening of competiti<strong>on</strong>”(SLC) under S7 of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

Clayt<strong>on</strong> Act. This was a very interesting development as <str<strong>on</strong>g>the</str<strong>on</strong>g> Commissi<strong>on</strong> was hesitant to<br />

recommend any departure from <str<strong>on</strong>g>the</str<strong>on</strong>g> traditi<strong>on</strong>al dominance test in order to bring <str<strong>on</strong>g>the</str<strong>on</strong>g> EC<br />

Merger regime closer to <str<strong>on</strong>g>the</str<strong>on</strong>g> US SLC test.<br />

US Law<br />

Merger policy has shown several interesting new developments over <str<strong>on</strong>g>the</str<strong>on</strong>g> past years. The<br />

Horiz<strong>on</strong>tal Merger Guidelines 3 describe <str<strong>on</strong>g>the</str<strong>on</strong>g> principal analytical techniques and <str<strong>on</strong>g>the</str<strong>on</strong>g> main<br />

12

types of evidence <strong>on</strong> which <str<strong>on</strong>g>the</str<strong>on</strong>g> Agencies usually rely to predict whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r a horiz<strong>on</strong>tal merger<br />

may substantially lessen competiti<strong>on</strong>. The relevant statutory provisi<strong>on</strong>s include Secti<strong>on</strong> 7 of<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> Clayt<strong>on</strong> Act, 15 U.S.C. § 18, Secti<strong>on</strong>s 1 and 2 of <str<strong>on</strong>g>the</str<strong>on</strong>g> Sherman Act, 15 U.S.C. §§ 1, 2,<br />

and Secti<strong>on</strong> 5 of <str<strong>on</strong>g>the</str<strong>on</strong>g> Federal Trade Commissi<strong>on</strong> Act. Most particularly, Secti<strong>on</strong> 7 of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

Clayt<strong>on</strong> Act prohibits mergers if “in any line of commerce or in any activity affecting<br />

commerce in any secti<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> country, <str<strong>on</strong>g>the</str<strong>on</strong>g> effect of such acquisiti<strong>on</strong> may be substantially<br />

to lessen competiti<strong>on</strong>, or to tend to create a m<strong>on</strong>opoly.”<br />

A primary goal of <str<strong>on</strong>g>the</str<strong>on</strong>g> 2010 4 guidelines is to help <str<strong>on</strong>g>the</str<strong>on</strong>g> agencies identify and challenge<br />

competitively harmful mergers while avoiding unnecessary interference with mergers that<br />

ei<str<strong>on</strong>g>the</str<strong>on</strong>g>r be competitively beneficial or likely will have no competitive impact <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

marketplace. To accomplish this, <str<strong>on</strong>g>the</str<strong>on</strong>g> guidelines detail <str<strong>on</strong>g>the</str<strong>on</strong>g> techniques and main types of<br />

evidence <str<strong>on</strong>g>the</str<strong>on</strong>g> in <str<strong>on</strong>g>the</str<strong>on</strong>g> U.S., <str<strong>on</strong>g>the</str<strong>on</strong>g> policy principles have been modified to incorporate recent<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g>oretical developments in Industrial Organizati<strong>on</strong>, such as <str<strong>on</strong>g>the</str<strong>on</strong>g> analysis of oligopoly<br />

behavior and <str<strong>on</strong>g>the</str<strong>on</strong>g> role of efficiencies. This evoluti<strong>on</strong> is illustrated by <str<strong>on</strong>g>the</str<strong>on</strong>g> various revisi<strong>on</strong>s of<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> Merger Guidelines. At <str<strong>on</strong>g>the</str<strong>on</strong>g> same time, U.S. policy practice has shown significant<br />

changes. In particular, <str<strong>on</strong>g>the</str<strong>on</strong>g>re has been an increasing reliance <strong>on</strong> empirical methods and<br />

simulati<strong>on</strong> analysis. The evaluati<strong>on</strong> of mergers under Secti<strong>on</strong> 7 of <str<strong>on</strong>g>the</str<strong>on</strong>g> Clayt<strong>on</strong> Act is<br />

undergoing a significant shift. Both <str<strong>on</strong>g>the</str<strong>on</strong>g> courts and <str<strong>on</strong>g>the</str<strong>on</strong>g> federal antitrust agencies increasingly<br />

are requiring a fully articulated ec<strong>on</strong>omic basis for c<strong>on</strong>cluding that a merger likely will<br />

result in anticompetitive <str<strong>on</strong>g>effects</str<strong>on</strong>g>, and <str<strong>on</strong>g>the</str<strong>on</strong>g>y are reducing <str<strong>on</strong>g>the</str<strong>on</strong>g> strength of <str<strong>on</strong>g>the</str<strong>on</strong>g> presumpti<strong>on</strong> of<br />

illegality based solely <strong>on</strong> market c<strong>on</strong>centrati<strong>on</strong>, established in United States v. Philadelphia<br />

Nati<strong>on</strong>al Bank 5 . Accordingly, an increasing emphasis is now placed <strong>on</strong> "competitive <str<strong>on</strong>g>effects</str<strong>on</strong>g><br />

analysis," i.e., <str<strong>on</strong>g>the</str<strong>on</strong>g> evaluati<strong>on</strong> of market c<strong>on</strong>diti<strong>on</strong>s bey<strong>on</strong>d market c<strong>on</strong>centrati<strong>on</strong> that affect<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> likelihood that a proposed merger will result in adverse competitive <str<strong>on</strong>g>effects</str<strong>on</strong>g>.<br />

4 US Horiz<strong>on</strong>tal Merger Guidelines 2010<br />

5 374 U.S. 321 (1963). In <str<strong>on</strong>g>the</str<strong>on</strong>g> Supreme Court <str<strong>on</strong>g>the</str<strong>on</strong>g> trend away from reliance <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> presumpti<strong>on</strong> can be traced to United States v. General<br />

Dynamics Corp., 415 U.S. 486, 501(1974). In <str<strong>on</strong>g>the</str<strong>on</strong>g> lower courts this evoluti<strong>on</strong> can be observed in United States v. Waste Management, Inc., 743<br />

F.2d 976, 981 (2d Cir. 1984); United States v. Syufy Enters., 903 F.2d 659 (9th Cir. 1990); United States v. Baker Hughes Inc., 908 F.2d 981<br />

(D.C. Cir.1990), at Pg 731 F. Supp. 3 (D.D.C. 1990); United States v. Calmar Inc., 612 F. Supp. 1298,1307 (D.N.J. 1985).<br />

13

The latest revisi<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> federal antitrust agencies' Merger Guidelines is <str<strong>on</strong>g>the</str<strong>on</strong>g> most prominent<br />

indicati<strong>on</strong> of this shifting emphasis 6 . These potential adverse <str<strong>on</strong>g>effects</str<strong>on</strong>g> may be caused by<br />

coordinati<strong>on</strong> am<strong>on</strong>g competitors or unilateral c<strong>on</strong>duct by <str<strong>on</strong>g>the</str<strong>on</strong>g> merged firm. A significant<br />

ec<strong>on</strong>omic literature describes unilateral anticompetitive c<strong>on</strong>duct and <str<strong>on</strong>g>the</str<strong>on</strong>g> closely related<br />

subject of dominant firm behavior 7 .<br />

In Europe, policy principles have evolved more slowly, in part because of <str<strong>on</strong>g>the</str<strong>on</strong>g> shorter<br />

experience with European merger cases. But <strong>on</strong>ce <str<strong>on</strong>g>the</str<strong>on</strong>g> market is defined, <str<strong>on</strong>g>the</str<strong>on</strong>g> actual merger<br />

investigati<strong>on</strong> is still largely based <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> traditi<strong>on</strong>al criteri<strong>on</strong> of dominance, including <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

assessment of <str<strong>on</strong>g>the</str<strong>on</strong>g> market shares and qualitative criteria such as <str<strong>on</strong>g>the</str<strong>on</strong>g> easy of entry and buyer<br />

power.<br />

2.4 Internati<strong>on</strong>al Practice of Merger Regulati<strong>on</strong> - C<strong>on</strong>vergence and Divergence<br />

i) General Overview – EU Law<br />

In order to assess whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r or not <str<strong>on</strong>g>the</str<strong>on</strong>g> merger is compatible with <str<strong>on</strong>g>the</str<strong>on</strong>g> comm<strong>on</strong> market <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

Commissi<strong>on</strong> must determine whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r or not it would be SIEC (significantly impede effective<br />

competiti<strong>on</strong> )that is whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r <str<strong>on</strong>g>the</str<strong>on</strong>g> merger is <str<strong>on</strong>g>the</str<strong>on</strong>g> cause of SIEC. The creati<strong>on</strong> or <str<strong>on</strong>g>the</str<strong>on</strong>g> streng<str<strong>on</strong>g>the</str<strong>on</strong>g>ning<br />

of a dominant positi<strong>on</strong> is a primary form of such competitive harm’ and provides ‘an important<br />

indicati<strong>on</strong> as to <str<strong>on</strong>g>the</str<strong>on</strong>g> standard of competitive harm that is applicable when determining whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r a<br />

c<strong>on</strong>centrati<strong>on</strong> is likely to impede effective competiti<strong>on</strong> to a significant degree.’ 8 EU case laws<br />

and decisi<strong>on</strong>al practice clarify when mergers will lead to an SIEC. The Commissi<strong>on</strong>’s Horiz<strong>on</strong>tal<br />

Merger Guidelines are, <str<strong>on</strong>g>the</str<strong>on</strong>g>refore intended to provide a sound ec<strong>on</strong>omic framework for <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

assessment of horiz<strong>on</strong>tal c<strong>on</strong>centrati<strong>on</strong> with a view to determining whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r or not <str<strong>on</strong>g>the</str<strong>on</strong>g>y likely to<br />

be declared compatible with <str<strong>on</strong>g>the</str<strong>on</strong>g> comm<strong>on</strong> market.<br />

6<br />

U.S. Department of Justice and Federal Trade Commissi<strong>on</strong> Horiz<strong>on</strong>tal Merger Guidelines (1992), reprinted in 4 Trade Reg. Rep. (CCH) 13,104<br />

[hereinafter 1992 Guidelines].<br />

7<br />

IId . § 2.2. Note that <str<strong>on</strong>g>the</str<strong>on</strong>g> Guidelines describe <str<strong>on</strong>g>the</str<strong>on</strong>g> analysis of <strong>coordinated</strong> activity in terms of "<strong>coordinated</strong> interacti<strong>on</strong>" and "coordinati<strong>on</strong>," i.e., as<br />

what traditi<strong>on</strong>ally is referred to as "c<strong>on</strong>duct" or "behavior." Id. § 2.1. By c<strong>on</strong>trast, <str<strong>on</strong>g>the</str<strong>on</strong>g> Guidelines' analysis of unilateral anticompetitive c<strong>on</strong>duct is<br />

denominated as an analysis of unilateral "<str<strong>on</strong>g>effects</str<strong>on</strong>g>." Id. § 2.2.Never<str<strong>on</strong>g>the</str<strong>on</strong>g>less, <str<strong>on</strong>g>the</str<strong>on</strong>g> internal discussi<strong>on</strong> is properly characterized as an analysis of<br />

c<strong>on</strong>duct.Id. ("merging firms may find it profitable to alter <str<strong>on</strong>g>the</str<strong>on</strong>g>ir behavior unilaterally").<br />

8<br />

Available <strong>on</strong> DG Comp’s website<br />

14

N<strong>on</strong>-horiz<strong>on</strong>tal Merger guidelines are also published. These guidelines describe an analytical<br />

approach to be followed and do not provide a mechanical checklist requiring applicati<strong>on</strong> of all<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> menti<strong>on</strong>ed factors in each and every case. The Commissi<strong>on</strong> enjoys a degree of discreti<strong>on</strong> in<br />

determining whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r or not to take into account certain factors in a given case.<br />

In Airtours/plc v Commissi<strong>on</strong> 9 , <str<strong>on</strong>g>the</str<strong>on</strong>g> judgment established that in <str<strong>on</strong>g>the</str<strong>on</strong>g> absence of single firm<br />

dominance, <str<strong>on</strong>g>the</str<strong>on</strong>g> Commissi<strong>on</strong> was entitled to prohibit a merger <strong>on</strong>ly if it could establish that <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

criteria for <strong>coordinated</strong> <str<strong>on</strong>g>effects</str<strong>on</strong>g>. This decisi<strong>on</strong> was perceived to create certain ‘gap’ in <str<strong>on</strong>g>the</str<strong>on</strong>g> powers<br />

of <str<strong>on</strong>g>the</str<strong>on</strong>g> Commissi<strong>on</strong> which needed to be filled. The reas<strong>on</strong> was that merger in oligopolistic<br />

markets that did not create or streng<str<strong>on</strong>g>the</str<strong>on</strong>g>n a positi<strong>on</strong> for a single firm dominance and did not<br />

satisfy <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>on</strong>erous criteria necessary, might never<str<strong>on</strong>g>the</str<strong>on</strong>g>less harm <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>sumers. For this purpose<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> Commissi<strong>on</strong> introduced <str<strong>on</strong>g>the</str<strong>on</strong>g> clarificati<strong>on</strong> to <str<strong>on</strong>g>the</str<strong>on</strong>g> meaning of <str<strong>on</strong>g>the</str<strong>on</strong>g> term ‘dominance’ to include<br />

n<strong>on</strong>-<strong>coordinated</strong> <str<strong>on</strong>g>effects</str<strong>on</strong>g>.<br />

ii) Market Definiti<strong>on</strong> - Central Role of market definiti<strong>on</strong> under EU Law<br />

A proper definiti<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> relevant market is a necessary prec<strong>on</strong>diti<strong>on</strong> for any assessment of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

effect of c<strong>on</strong>centrati<strong>on</strong> <strong>on</strong> competiti<strong>on</strong>. 10 An ec<strong>on</strong>omic appraisal of <str<strong>on</strong>g>the</str<strong>on</strong>g> impact of merger <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

competitive process whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r or not it will SIEC requires as a starting point, that <str<strong>on</strong>g>the</str<strong>on</strong>g> relevant<br />

market is defined. The definiti<strong>on</strong> of a market is crucial to enable <str<strong>on</strong>g>the</str<strong>on</strong>g> Commissi<strong>on</strong> to attain<br />

meaningful informati<strong>on</strong> regarding <str<strong>on</strong>g>the</str<strong>on</strong>g> market power that <str<strong>on</strong>g>the</str<strong>on</strong>g> merged parties will acquire, to<br />

understand how competiti<strong>on</strong> operates <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> market and to make its competitive assessment. The<br />

purpose of market definiti<strong>on</strong> is to identify in a systematic way <str<strong>on</strong>g>the</str<strong>on</strong>g> competitive c<strong>on</strong>straints facing<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> merged entity. 11 Thus <str<strong>on</strong>g>the</str<strong>on</strong>g> main purpose of market definiti<strong>on</strong> is to identify in a systematic way<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> immediate competitive c<strong>on</strong>straints facing <str<strong>on</strong>g>the</str<strong>on</strong>g> merged entity. It is not an end in itself but a tool<br />

to identify situati<strong>on</strong>s where <str<strong>on</strong>g>the</str<strong>on</strong>g>re might be competiti<strong>on</strong> c<strong>on</strong>cerns’.<br />

9 Case T-342/99 [2002] E.C.R II-2585<br />

10 Cases C-68/94 and C-30/95, France v Commissi<strong>on</strong>, (SCPA) v Commissi<strong>on</strong> [1998] ECR I-1375 Para. 143<br />

11 Horiz<strong>on</strong>tal Merger Guidelines [2004] OJ C31/5 para.10<br />

15

US Law: Market Definiti<strong>on</strong> under Horiz<strong>on</strong>tal Merger Guidelines<br />

When <str<strong>on</strong>g>the</str<strong>on</strong>g> Agencies identify a potential competitive c<strong>on</strong>cern with a horiz<strong>on</strong>tal merger, market<br />

definiti<strong>on</strong> plays two roles. First, market definiti<strong>on</strong> helps specify <str<strong>on</strong>g>the</str<strong>on</strong>g> line of commerce and secti<strong>on</strong><br />

of <str<strong>on</strong>g>the</str<strong>on</strong>g> country in which <str<strong>on</strong>g>the</str<strong>on</strong>g> competitive c<strong>on</strong>cern arises. Sec<strong>on</strong>d, market definiti<strong>on</strong> allows <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

Agencies to identify market participants and measure market shares and market c<strong>on</strong>centrati<strong>on</strong>.<br />

The measurement of market shares and market c<strong>on</strong>centrati<strong>on</strong> is not an end in itself, but is useful<br />

to <str<strong>on</strong>g>the</str<strong>on</strong>g> extent it illuminates <str<strong>on</strong>g>the</str<strong>on</strong>g> merger’s likely competitive <str<strong>on</strong>g>effects</str<strong>on</strong>g>. Evidence of competitive<br />

<str<strong>on</strong>g>effects</str<strong>on</strong>g> can inform market definiti<strong>on</strong>, just as market definiti<strong>on</strong> can be informative regarding<br />

competitive <str<strong>on</strong>g>effects</str<strong>on</strong>g>. For example, evidence that a reducti<strong>on</strong> in <str<strong>on</strong>g>the</str<strong>on</strong>g> number of significant rivals<br />

offering a group of products causes prices for those products to raise significantly can itself<br />

establish that those products form a relevant market.<br />

Relevant Market: Under <str<strong>on</strong>g>the</str<strong>on</strong>g> US Merger Guideline, <str<strong>on</strong>g>the</str<strong>on</strong>g>re are tests that are involved to<br />

understand <str<strong>on</strong>g>the</str<strong>on</strong>g> relevant market<br />

a). The Hypo<str<strong>on</strong>g>the</str<strong>on</strong>g>tical M<strong>on</strong>opolist Test<br />

The Agencies employ <str<strong>on</strong>g>the</str<strong>on</strong>g> hypo<str<strong>on</strong>g>the</str<strong>on</strong>g>tical m<strong>on</strong>opolist test to evaluate whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r groups of products in<br />

candidate markets are sufficiently broad to c<strong>on</strong>stitute relevant antitrust markets. The test requires<br />

that a hypo<str<strong>on</strong>g>the</str<strong>on</strong>g>tical profit-maximizing firm, not subject to price regulati<strong>on</strong>, that was <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>on</strong>ly<br />

present and future seller of those products (“hypo<str<strong>on</strong>g>the</str<strong>on</strong>g>tical m<strong>on</strong>opolist”) likely would impose at<br />

least a small but significant and n<strong>on</strong>-transitory increase in price (“SSNIP”) <strong>on</strong> at least <strong>on</strong>e<br />

product in <str<strong>on</strong>g>the</str<strong>on</strong>g> market, including at least <strong>on</strong>e product sold by <strong>on</strong>e of <str<strong>on</strong>g>the</str<strong>on</strong>g> merging firms.<br />

When applying <str<strong>on</strong>g>the</str<strong>on</strong>g> hypo<str<strong>on</strong>g>the</str<strong>on</strong>g>tical m<strong>on</strong>opolist test to define a market around a product offered by<br />

<strong>on</strong>e of <str<strong>on</strong>g>the</str<strong>on</strong>g> merging firms, if <str<strong>on</strong>g>the</str<strong>on</strong>g> market includes a sec<strong>on</strong>d product, <str<strong>on</strong>g>the</str<strong>on</strong>g> Agencies will normally<br />

also include a third product if that third product is a closer substitute for <str<strong>on</strong>g>the</str<strong>on</strong>g> first product than is<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> sec<strong>on</strong>d product.<br />

b). Benchmark Prices and SSNIP Size<br />

The Agencies apply <str<strong>on</strong>g>the</str<strong>on</strong>g> SSNIP starting from prices that would likely prevail absent <str<strong>on</strong>g>the</str<strong>on</strong>g> merger.<br />

If prices are not likely to change absent <str<strong>on</strong>g>the</str<strong>on</strong>g> merger, <str<strong>on</strong>g>the</str<strong>on</strong>g>se benchmark prices can reas<strong>on</strong>ably be<br />

taken to be <str<strong>on</strong>g>the</str<strong>on</strong>g> prices prevailing prior to <str<strong>on</strong>g>the</str<strong>on</strong>g> merger. 5<br />

If prices are likely to change absent <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

merger, e.g., because of innovati<strong>on</strong> or entry, <str<strong>on</strong>g>the</str<strong>on</strong>g> Agencies may use anticipated future prices as<br />

16

<str<strong>on</strong>g>the</str<strong>on</strong>g> benchmark for <str<strong>on</strong>g>the</str<strong>on</strong>g> test. If prices might fall absent <str<strong>on</strong>g>the</str<strong>on</strong>g> merger due to <str<strong>on</strong>g>the</str<strong>on</strong>g> breakdown of pre-<br />

merger coordinati<strong>on</strong>, <str<strong>on</strong>g>the</str<strong>on</strong>g> Agencies may use those lower prices as <str<strong>on</strong>g>the</str<strong>on</strong>g> benchmark for <str<strong>on</strong>g>the</str<strong>on</strong>g> test.<br />

This methodology is used because normally it is possible to quantify “small but significant”<br />

adverse price <str<strong>on</strong>g>effects</str<strong>on</strong>g> <strong>on</strong> customers and analyze <str<strong>on</strong>g>the</str<strong>on</strong>g>ir likely reacti<strong>on</strong>s, not because price <str<strong>on</strong>g>effects</str<strong>on</strong>g><br />

are more important than n<strong>on</strong>-price <str<strong>on</strong>g>effects</str<strong>on</strong>g>. The Agencies most often use a SSNIP of five percent<br />

of <str<strong>on</strong>g>the</str<strong>on</strong>g> price paid by customers for <str<strong>on</strong>g>the</str<strong>on</strong>g> products or services to which <str<strong>on</strong>g>the</str<strong>on</strong>g> merging firms c<strong>on</strong>tribute<br />

value. However, what c<strong>on</strong>stitutes a “small but significant” increase in price, commensurate with<br />

a significant loss of competiti<strong>on</strong> caused by <str<strong>on</strong>g>the</str<strong>on</strong>g> merger, depends up<strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> nature of <str<strong>on</strong>g>the</str<strong>on</strong>g> industry<br />

and <str<strong>on</strong>g>the</str<strong>on</strong>g> merging firms’ positi<strong>on</strong>s in it, and <str<strong>on</strong>g>the</str<strong>on</strong>g> Agencies may accordingly use a price increase<br />

that is larger or smaller than five percent.<br />

c). Implementing <str<strong>on</strong>g>the</str<strong>on</strong>g> Hypo<str<strong>on</strong>g>the</str<strong>on</strong>g>tical M<strong>on</strong>opolist Test<br />

In c<strong>on</strong>sidering customers’ likely resp<strong>on</strong>ses to higher prices, <str<strong>on</strong>g>the</str<strong>on</strong>g> Agencies take into<br />

account any reas<strong>on</strong>ably available and reliable evidence, including, demand of customers,<br />

informati<strong>on</strong> from buyers, including surveys, c<strong>on</strong>duct of industry participants. These are<br />

few factors c<strong>on</strong>sidered essential in assessment.<br />

d) Product Market Definiti<strong>on</strong> with Targeted Customers<br />

If a hypo<str<strong>on</strong>g>the</str<strong>on</strong>g>tical m<strong>on</strong>opolist could profitably target a subset of customers for price increases, <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

Agencies may identify relevant markets defined around those targeted customers, to whom a<br />

hypo<str<strong>on</strong>g>the</str<strong>on</strong>g>tical m<strong>on</strong>opolist would profitably and separately impose at least a SSNIP. Markets to<br />

serve targeted customers are also known as price discriminati<strong>on</strong> markets. In practice, <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

Agencies identify price discriminati<strong>on</strong> markets <strong>on</strong>ly where <str<strong>on</strong>g>the</str<strong>on</strong>g>y believe <str<strong>on</strong>g>the</str<strong>on</strong>g>re is a realistic<br />

prospect of an adverse competitive effect <strong>on</strong> a group of targeted customers.<br />

Product Market Test<br />

Market definiti<strong>on</strong> focuses solely <strong>on</strong> demand substituti<strong>on</strong> factors, i.e., <strong>on</strong> customers’ ability and<br />

willingness to substitute away from <strong>on</strong>e product to ano<str<strong>on</strong>g>the</str<strong>on</strong>g>r in resp<strong>on</strong>se to a price increase or a<br />

corresp<strong>on</strong>ding n<strong>on</strong>-price change such as a reducti<strong>on</strong> in product quality or service. The resp<strong>on</strong>sive<br />

acti<strong>on</strong>s of suppliers are also important in competitive analysis. They are c<strong>on</strong>sidered in <str<strong>on</strong>g>the</str<strong>on</strong>g>se<br />

17

Guidelines in <str<strong>on</strong>g>the</str<strong>on</strong>g> secti<strong>on</strong>s addressing <str<strong>on</strong>g>the</str<strong>on</strong>g> identificati<strong>on</strong> of market participants, <str<strong>on</strong>g>the</str<strong>on</strong>g> measurement<br />

of market shares, <str<strong>on</strong>g>the</str<strong>on</strong>g> analysis of competitive <str<strong>on</strong>g>effects</str<strong>on</strong>g>, and entry.<br />

Market shares of different products in narrowly defined markets are more likely to capture <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

relative competitive significance of <str<strong>on</strong>g>the</str<strong>on</strong>g>se products, and often more accurately reflect competiti<strong>on</strong><br />

between close substitutes. As a result, properly defined antitrust markets often exclude some<br />

substitutes to which some customers might turn in <str<strong>on</strong>g>the</str<strong>on</strong>g> face of a price increase even if such<br />

substitutes provide alternatives for those customers. However, a group of products is too narrow<br />

to c<strong>on</strong>stitute a relevant market if competiti<strong>on</strong> from products outside that group is so ample that<br />

even <str<strong>on</strong>g>the</str<strong>on</strong>g> complete eliminati<strong>on</strong> of competiti<strong>on</strong> within <str<strong>on</strong>g>the</str<strong>on</strong>g> group would not significantly harm<br />

ei<str<strong>on</strong>g>the</str<strong>on</strong>g>r direct customers or downstream c<strong>on</strong>sumers. The hypo<str<strong>on</strong>g>the</str<strong>on</strong>g>tical m<strong>on</strong>opolist test is designed<br />

to ensure that candidate markets are not overly narrow in this respect.<br />

Under <str<strong>on</strong>g>the</str<strong>on</strong>g> US Guidelines <strong>on</strong> Horiz<strong>on</strong>tal Merger, eliminati<strong>on</strong> of competiti<strong>on</strong> between two firms<br />

that results from <str<strong>on</strong>g>the</str<strong>on</strong>g>ir merger may al<strong>on</strong>e c<strong>on</strong>stitute a substantial lessening of competiti<strong>on</strong>. Such<br />

unilateral <str<strong>on</strong>g>effects</str<strong>on</strong>g> are most apparent in a merger to m<strong>on</strong>opoly in a relevant market, but are by no<br />

means limited to that case. Whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r cognizable efficiencies resulting from <str<strong>on</strong>g>the</str<strong>on</strong>g> merger are likely<br />

to reduce or reverse adverse unilateral <str<strong>on</strong>g>effects</str<strong>on</strong>g> is addressed in <str<strong>on</strong>g>the</str<strong>on</strong>g> Guidelines.<br />

Geographic Market Definiti<strong>on</strong><br />

The arena of competiti<strong>on</strong> affected by <str<strong>on</strong>g>the</str<strong>on</strong>g> merger may be geographically bounded if geography<br />

limits some customers’ willingness or ability to substitute to some products, or some suppliers’<br />

willingness or ability to serve some customers. Both supplier and customer locati<strong>on</strong>s can affect<br />

this.<br />

In <str<strong>on</strong>g>the</str<strong>on</strong>g> absence of price discriminati<strong>on</strong> based <strong>on</strong> customer locati<strong>on</strong>, <str<strong>on</strong>g>the</str<strong>on</strong>g> Agencies normally define<br />

geographic markets based <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> locati<strong>on</strong>s of suppliers. In o<str<strong>on</strong>g>the</str<strong>on</strong>g>r cases, notably if price<br />

discriminati<strong>on</strong> based <strong>on</strong> customer locati<strong>on</strong> is feasible as is often <str<strong>on</strong>g>the</str<strong>on</strong>g> case when delivered pricing<br />

is comm<strong>on</strong>ly used in <str<strong>on</strong>g>the</str<strong>on</strong>g> industry, <str<strong>on</strong>g>the</str<strong>on</strong>g> Agencies may define geographic markets based <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

locati<strong>on</strong>s of customers.<br />

In c<strong>on</strong>sidering likely reacti<strong>on</strong>s of customers to price increases for <str<strong>on</strong>g>the</str<strong>on</strong>g> relevant product(s)<br />

imposed in a candidate geographic market, <str<strong>on</strong>g>the</str<strong>on</strong>g> Agencies c<strong>on</strong>sider any reas<strong>on</strong>ably available and<br />

18

eliable evidence, including: Shifts of customers purchases between different geographic<br />

locati<strong>on</strong>s in resp<strong>on</strong>se to relative changes in price or o<str<strong>on</strong>g>the</str<strong>on</strong>g>r terms and c<strong>on</strong>diti<strong>on</strong>s; <str<strong>on</strong>g>the</str<strong>on</strong>g> cost and<br />

difficulty of transporting <str<strong>on</strong>g>the</str<strong>on</strong>g> product, in relati<strong>on</strong> to its price; evidence <strong>on</strong> whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r sellers base<br />

business decisi<strong>on</strong>s <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> prospect of customers switching between geographic locati<strong>on</strong>s in<br />

resp<strong>on</strong>se to relative changes in price or o<str<strong>on</strong>g>the</str<strong>on</strong>g>r competitive variables; <str<strong>on</strong>g>the</str<strong>on</strong>g> costs and delays of<br />

switching from suppliers in <str<strong>on</strong>g>the</str<strong>on</strong>g> candidate geographic market to suppliers outside <str<strong>on</strong>g>the</str<strong>on</strong>g> candidate<br />

geographic market; and <str<strong>on</strong>g>the</str<strong>on</strong>g> influence of downstream competiti<strong>on</strong> faced by customers in <str<strong>on</strong>g>the</str<strong>on</strong>g>ir<br />

output markets.<br />

The US Merger Guidelines highlight <str<strong>on</strong>g>the</str<strong>on</strong>g> abovementi<strong>on</strong>ed tests in evaluating <str<strong>on</strong>g>the</str<strong>on</strong>g> relevant market<br />

and <str<strong>on</strong>g>the</str<strong>on</strong>g>n based <strong>on</strong> <str<strong>on</strong>g>effects</str<strong>on</strong>g> it looks into <str<strong>on</strong>g>the</str<strong>on</strong>g> thresholds to assess <str<strong>on</strong>g>the</str<strong>on</strong>g> anti-trust practice.<br />

19

3. ECONOMIC CONCEPTS IN DETERMIING UNILATERAL EFFECTS OF<br />

MERGER<br />

3.1 General Principle: Unilateral Market Power<br />

An individual firm has "unilateral" market power if it can raise price above <str<strong>on</strong>g>the</str<strong>on</strong>g> competitive level<br />

without inducing customers to reduce <str<strong>on</strong>g>the</str<strong>on</strong>g>ir purchases to a degree that makes <str<strong>on</strong>g>the</str<strong>on</strong>g> price increase<br />

unprofitable 12 . There are two broad categories of potential distincti<strong>on</strong>s between firms that<br />

support <str<strong>on</strong>g>the</str<strong>on</strong>g> ability of a firm to exercise unilateral market power-<br />

1. Cost differences and<br />

2. Differentiated products.<br />

A traditi<strong>on</strong>al ec<strong>on</strong>omic model 13 of unilateral anticompetitive behavior includes a dominant firm<br />

and a "fringe" of competitors producing a homogeneous product. In <str<strong>on</strong>g>the</str<strong>on</strong>g> assumpti<strong>on</strong>s of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

model <str<strong>on</strong>g>the</str<strong>on</strong>g> sole distincti<strong>on</strong> between <str<strong>on</strong>g>the</str<strong>on</strong>g> dominant firm and <str<strong>on</strong>g>the</str<strong>on</strong>g> fringe firms is that each fringe firm<br />

has a substantial cost disadvantage relative to <str<strong>on</strong>g>the</str<strong>on</strong>g> dominant firm. The dominant firm's profit-<br />

maximizing price is significantly above its marginal cost because fringe firms' cost disadvantage<br />

limits <str<strong>on</strong>g>the</str<strong>on</strong>g>ir ability to expand <str<strong>on</strong>g>the</str<strong>on</strong>g>ir sales at <str<strong>on</strong>g>the</str<strong>on</strong>g> price determined by <str<strong>on</strong>g>the</str<strong>on</strong>g> dominant firm. In<br />

Ec<strong>on</strong>omists 'jarg<strong>on</strong>, <str<strong>on</strong>g>the</str<strong>on</strong>g> "elasticity of fringe supply" is too low to c<strong>on</strong>strain <str<strong>on</strong>g>the</str<strong>on</strong>g> dominant firm to<br />

price competitively.<br />

Unilateral anticompetitive behavior also can occur in markets with differentiated products. Here,<br />

differences am<strong>on</strong>g competitors' products ra<str<strong>on</strong>g>the</str<strong>on</strong>g>r than differences in <str<strong>on</strong>g>the</str<strong>on</strong>g>ir costs enable a firm to<br />

exercise unilateral market power. Str<strong>on</strong>g customer preferences for a firm's product sometimes<br />

may imply that <str<strong>on</strong>g>the</str<strong>on</strong>g> reducti<strong>on</strong> in sales of that product resulting from raising price above <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

competitive level is insufficient to prevent that price elevati<strong>on</strong> from being profitable.<br />

12 1992 Guidelines, supra note 4, § 0.1. ("Circumstances may also permit a single firm, not a m<strong>on</strong>opolist, to exercise market power through<br />

unilateral or n<strong>on</strong>-<strong>coordinated</strong> c<strong>on</strong>duct <str<strong>on</strong>g>the</str<strong>on</strong>g> success of which does not rely <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>currence of o<str<strong>on</strong>g>the</str<strong>on</strong>g>r firms in <str<strong>on</strong>g>the</str<strong>on</strong>g> industry or <strong>on</strong> <strong>coordinated</strong><br />

resp<strong>on</strong>ses by those firms");.<br />

13 What Makes Merger Anti Competitive?:"Unilateral Effects" Analysis Under The 1992 Merger Guidelines Roscoe<br />

B.Starek III STEPHEN STOCKUM<br />

20

3.2 Ec<strong>on</strong>omic Analysis of <str<strong>on</strong>g>the</str<strong>on</strong>g> Impact of Merger in Oligopolistic Market<br />

This part focuses <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> ec<strong>on</strong>omic analysis of <str<strong>on</strong>g>the</str<strong>on</strong>g> impact of mergers <strong>on</strong> market power in<br />

oligopolistic industries.<br />

Competiti<strong>on</strong> in Oligopolistic Market -<br />

In this secti<strong>on</strong>, we c<strong>on</strong>sider what could be expected to result from competiti<strong>on</strong> between firms<br />

when each firm is reacting to market c<strong>on</strong>diti<strong>on</strong>s but is not expecting to influence <str<strong>on</strong>g>the</str<strong>on</strong>g> future<br />

behavior of o<str<strong>on</strong>g>the</str<strong>on</strong>g>r firms. If firms are producing <str<strong>on</strong>g>the</str<strong>on</strong>g> same good with <str<strong>on</strong>g>the</str<strong>on</strong>g> same technology <str<strong>on</strong>g>the</str<strong>on</strong>g>n, if<br />

many firms are effectively active 14 in <str<strong>on</strong>g>the</str<strong>on</strong>g> market, and absent tight capacity c<strong>on</strong>straints, <strong>on</strong>e<br />

would expect to see competitive prices and outputs (specifically with output priced at or close to<br />

marginal cost). C<strong>on</strong>versely, when <str<strong>on</strong>g>the</str<strong>on</strong>g>re are a limited number of firms, n<strong>on</strong>competitive outcomes<br />

may arise, particularly if <str<strong>on</strong>g>the</str<strong>on</strong>g> goods (or services) produced by different firms are not in fact<br />

identical, but are imperfect substitutes for each o<str<strong>on</strong>g>the</str<strong>on</strong>g>r, even while bel<strong>on</strong>ging to <str<strong>on</strong>g>the</str<strong>on</strong>g> same market.<br />

Study of Mergers in differentiated products –<br />

Ano<str<strong>on</strong>g>the</str<strong>on</strong>g>r important c<strong>on</strong>siderati<strong>on</strong> is where products are differentiated <strong>on</strong> a market; some will be<br />

closer substitutes for each o<str<strong>on</strong>g>the</str<strong>on</strong>g>r than o<str<strong>on</strong>g>the</str<strong>on</strong>g>rs. A merger between firms which produce products<br />

that are closer substitutes, is more likely to produce anti-competitive c<strong>on</strong>sequences.<br />

Potential variati<strong>on</strong>s in <str<strong>on</strong>g>the</str<strong>on</strong>g> closeness of competiti<strong>on</strong> between competing firms that arises from<br />

product or geographical differentiati<strong>on</strong> raises a number of additi<strong>on</strong>al complicati<strong>on</strong>s in applying<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> traditi<strong>on</strong>al approach to <str<strong>on</strong>g>assessing</str<strong>on</strong>g> whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r a merger gives to unilateral <str<strong>on</strong>g>effects</str<strong>on</strong>g>. It is argued that<br />

defining <str<strong>on</strong>g>the</str<strong>on</strong>g> relevant market is much more problematic in industries characterized by a high<br />

degree of differentiati<strong>on</strong>. Also interpreting market shares in highly differentiated industries is<br />

rendered more difficult since <str<strong>on</strong>g>the</str<strong>on</strong>g> very essence of competiti<strong>on</strong> between differentiated products<br />

implies that <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>sumers do not c<strong>on</strong>sider all products to be equally substitutable. Where this is<br />

14 This is unlikely in <str<strong>on</strong>g>the</str<strong>on</strong>g> presence of significant ec<strong>on</strong>omies of scale or scope; such ec<strong>on</strong>omies give rise to a<br />

“natural m<strong>on</strong>opoly” or oligopoly type of industry, in which <strong>on</strong>ly a small number of firms can be effectively<br />

21

<str<strong>on</strong>g>the</str<strong>on</strong>g> case, market shares provide a poor proxy for discriminating “close” competitors and “not so<br />

close” competitors.<br />

A merger between firms selling differentiated products may diminish competiti<strong>on</strong> by enabling<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> merged firm to profit by unilaterally raising <str<strong>on</strong>g>the</str<strong>on</strong>g> price of <strong>on</strong>e or both products above <str<strong>on</strong>g>the</str<strong>on</strong>g> pre-<br />

merger level. Some of <str<strong>on</strong>g>the</str<strong>on</strong>g> sales lost due to <str<strong>on</strong>g>the</str<strong>on</strong>g> price rise will merely be diverted to <str<strong>on</strong>g>the</str<strong>on</strong>g> product of<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> merger partner and, depending <strong>on</strong> relative margins; capturing such sales loss through merger<br />

may make <str<strong>on</strong>g>the</str<strong>on</strong>g> price increase profitable even though it would not have been profitable prior to <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

merger.<br />

3.3 Illustrati<strong>on</strong> of unilateral <str<strong>on</strong>g>effects</str<strong>on</strong>g><br />

The c<strong>on</strong>cept of ‘closeness’ of competiti<strong>on</strong> is illustrated in <str<strong>on</strong>g>the</str<strong>on</strong>g> following example. Suppose <str<strong>on</strong>g>the</str<strong>on</strong>g>re<br />

are four firms A, B, C and D each with sales of 100. Suppose that if A raises its price by 5<br />

percent, it will lose 20 percent, of its sales, which makes <str<strong>on</strong>g>the</str<strong>on</strong>g> price unprofitable. These sales<br />

would be diverted to <str<strong>on</strong>g>the</str<strong>on</strong>g> o<str<strong>on</strong>g>the</str<strong>on</strong>g>r three firms a shown below in Table. This table shows that 15<br />

c<strong>on</strong>sumers divert from A to B, three divert to C and two divert to D. In this sense, B is a closer<br />

competitor to A than ei<str<strong>on</strong>g>the</str<strong>on</strong>g>r C or D; <str<strong>on</strong>g>the</str<strong>on</strong>g> extent to which c<strong>on</strong>sumers would divert from A to B is<br />

understated by B’s market share. If A and B were to merge, <str<strong>on</strong>g>the</str<strong>on</strong>g>n an increase in <str<strong>on</strong>g>the</str<strong>on</strong>g> post –merger<br />

price of products supplied by A would lead to <str<strong>on</strong>g>the</str<strong>on</strong>g> combined firm, AB losing <strong>on</strong>ly to 5 units of<br />

sales. In c<strong>on</strong>sequence, increasing <str<strong>on</strong>g>the</str<strong>on</strong>g> price of A by 5% is more likely to be profitable than a<br />

merger between A and D, where <str<strong>on</strong>g>the</str<strong>on</strong>g> same increase in <str<strong>on</strong>g>the</str<strong>on</strong>g> price of products supplied by A would<br />

lead to <str<strong>on</strong>g>the</str<strong>on</strong>g> loss of 18 units of sale.<br />

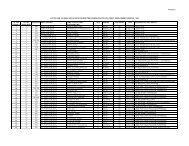

Firm Sales at current price(units) Sales if A raises price 5<br />

A 100 80<br />

percent<br />

B 100 115<br />

C 100 103<br />

D 100 102<br />

22

Merger of A+B 200 195<br />

This example illustrates that <str<strong>on</strong>g>the</str<strong>on</strong>g> degree to which a merger in a differentiated product market<br />

might result in a unilateral price increase depends <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> relative “closeness” of <str<strong>on</strong>g>the</str<strong>on</strong>g> merging<br />

firms to <strong>on</strong>e ano<str<strong>on</strong>g>the</str<strong>on</strong>g>r. Based <strong>on</strong> market shares al<strong>on</strong>e, B, C and D all appear to be providing an<br />

equally str<strong>on</strong>g competitive c<strong>on</strong>straint <strong>on</strong> A. However , examinati<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> diversi<strong>on</strong> of sales from<br />

A to <str<strong>on</strong>g>the</str<strong>on</strong>g>se firms shows that in this hypo<str<strong>on</strong>g>the</str<strong>on</strong>g>tical example, B provides a much str<strong>on</strong>g pre-merger<br />

competitive c<strong>on</strong>straint <strong>on</strong> A <str<strong>on</strong>g>the</str<strong>on</strong>g>n ei<str<strong>on</strong>g>the</str<strong>on</strong>g>r C or D since most of A’s lost sales went to B, indicating<br />

that A and B in some sense particularly ‘close’ competitors.<br />

It is important to understand that <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>cept of closeness of competiti<strong>on</strong> cannot be divorced<br />

entirely from an assessment of market shares. In this example B, is said to represent a<br />

particularly close competitor because of <str<strong>on</strong>g>the</str<strong>on</strong>g> proporti<strong>on</strong>ate of sales lost to B exceeds that<br />

predicted by market share al<strong>on</strong>e, <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> basis of market shares, we would predict that’s six to<br />

seven units would be diverted to B whereas in reality <str<strong>on</strong>g>the</str<strong>on</strong>g> number of units diverted would be 15.<br />

Assessing whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r two firms represent particularly close competitors is an empirical questi<strong>on</strong><br />

and cannot be determined solely with reference to physical or geographical attributes of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

firms 15 .<br />

3.4 Ec<strong>on</strong>omic C<strong>on</strong>siderati<strong>on</strong> in Oligopolistic Market<br />

There are various o<str<strong>on</strong>g>the</str<strong>on</strong>g>r factors which need to be c<strong>on</strong>sidered besides market power and<br />

market definiti<strong>on</strong>, <str<strong>on</strong>g>the</str<strong>on</strong>g>se are <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>on</strong>es which are not in <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>trol of merged entities.<br />

1. Countervailing Buyer Power<br />

The Horiz<strong>on</strong>tal guidelines stresses that a competitive c<strong>on</strong>straint can be exercised over possible<br />

n<strong>on</strong>-<strong>coordinated</strong> or <strong>coordinated</strong> anti-competitive <str<strong>on</strong>g>effects</str<strong>on</strong>g> identified not <strong>on</strong>ly by competitors but by<br />

customers with countervailing buyer power. Such a buyer may have incentive to credibly<br />

threaten to find an alternative source of supplier perhaps by changing supplier, vertically<br />

15 The Ec<strong>on</strong>omics of EC Competiti<strong>on</strong> Law C<strong>on</strong>cepts, Applicati<strong>on</strong> and Measurement (3 rd edn.,Sweet Maxwell,2010);S.<br />

Bishop and M.Walker<br />

23

integrating or persuading /sp<strong>on</strong>soring new entry, were <str<strong>on</strong>g>the</str<strong>on</strong>g> supplier to increase price. In such<br />

cases, <str<strong>on</strong>g>the</str<strong>on</strong>g> countervailing buyer power may neutralize <str<strong>on</strong>g>the</str<strong>on</strong>g> market power 16 of <str<strong>on</strong>g>the</str<strong>on</strong>g> parties.<br />

2. Entry, exit and potential competiti<strong>on</strong><br />

The sec<strong>on</strong>d aspect that must be accounted for is <str<strong>on</strong>g>the</str<strong>on</strong>g> impact of <str<strong>on</strong>g>the</str<strong>on</strong>g> merger <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> market<br />

structure.<br />

Potential competiti<strong>on</strong><br />