You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

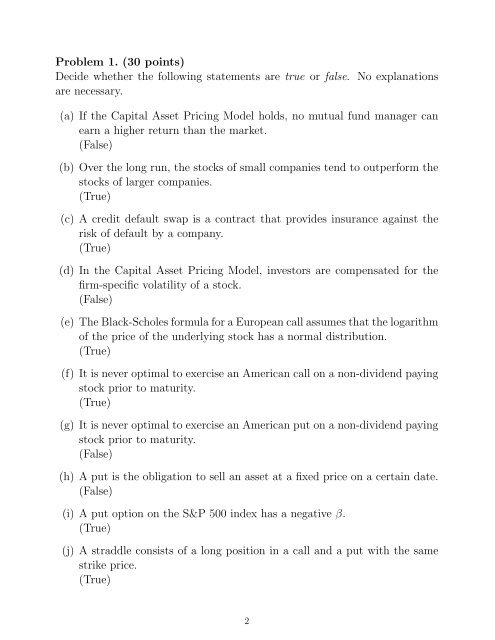

Problem 1. (30 points)<br />

Decide whether the following statements are true or false. No explanations<br />

are necessary.<br />

(a) If the Capital Asset Pricing Model holds, no mutual fund manager can<br />

earn a higher return than the market.<br />

(False)<br />

(b) Over the long run, the stocks of small companies tend to outperform the<br />

stocks of larger companies.<br />

(True)<br />

(c) A credit default swap is a contract that provides insurance against the<br />

risk of default by a company.<br />

(True)<br />

(d) In the Capital Asset Pricing Model, investors are compensated for the<br />

firm-specific volatility of a stock.<br />

(False)<br />

(e) The Black-Scholes formula for a European call assumes that the logarithm<br />

of the price of the underlying stock has a normal distribution.<br />

(True)<br />

(f) It is never optimal to exercise an American call on a non-dividend paying<br />

stock prior to maturity.<br />

(True)<br />

(g) It is never optimal to exercise an American put on a non-dividend paying<br />

stock prior to maturity.<br />

(False)<br />

(h) A put is the obligation to sell an asset at a fixed price on a certain date.<br />

(False)<br />

(i) A put option on the S&P 500 index has a negative β.<br />

(True)<br />

(j) A straddle consists of a long position in a call and a put with the same<br />

strike price.<br />

(True)<br />

2