Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

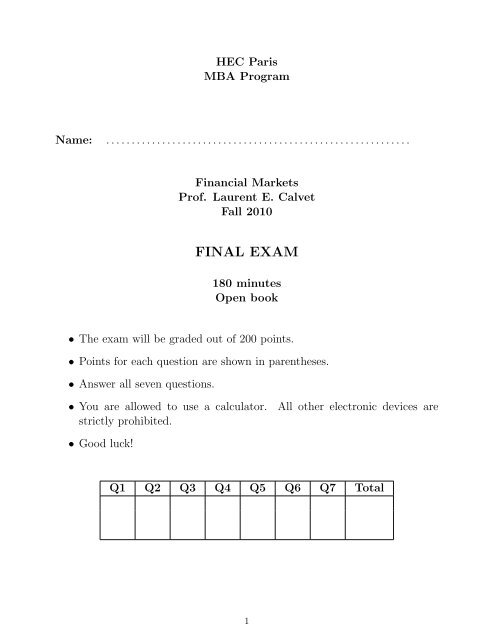

<strong>HEC</strong> <strong>Paris</strong><br />

MBA Program<br />

Name: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

Financial Markets<br />

Prof. Laurent E. Calvet<br />

Fall 2010<br />

<strong>FINAL</strong> <strong>EXAM</strong><br />

180 minutes<br />

Open book<br />

• The exam will be graded out of 200 points.<br />

• Points for each question are shown in parentheses.<br />

• Answer all seven questions.<br />

• You are allowed to use a calculator. All other electronic devices are<br />

strictly prohibited.<br />

• Good luck!<br />

Q1 Q2 Q3 Q4 Q5 Q6 Q7 Total<br />

1

Problem 1. (30 points)<br />

Decide whether the following statements are true or false. No explanations<br />

are necessary.<br />

(a) If the Capital Asset Pricing Model holds, no mutual fund manager can<br />

earn a higher return than the market.<br />

(False)<br />

(b) Over the long run, the stocks of small companies tend to outperform the<br />

stocks of larger companies.<br />

(True)<br />

(c) A credit default swap is a contract that provides insurance against the<br />

risk of default by a company.<br />

(True)<br />

(d) In the Capital Asset Pricing Model, investors are compensated for the<br />

firm-specific volatility of a stock.<br />

(False)<br />

(e) The Black-Scholes formula for a European call assumes that the logarithm<br />

of the price of the underlying stock has a normal distribution.<br />

(True)<br />

(f) It is never optimal to exercise an American call on a non-dividend paying<br />

stock prior to maturity.<br />

(True)<br />

(g) It is never optimal to exercise an American put on a non-dividend paying<br />

stock prior to maturity.<br />

(False)<br />

(h) A put is the obligation to sell an asset at a fixed price on a certain date.<br />

(False)<br />

(i) A put option on the S&P 500 index has a negative β.<br />

(True)<br />

(j) A straddle consists of a long position in a call and a put with the same<br />

strike price.<br />

(True)<br />

2

Problem 2. (20 points)<br />

Consider an economy with two possible states of the world, which occur with<br />

equal probability. Stocks A and B yield the following returns in each state:<br />

Return on stock A Return on stock B<br />

State 1 +40% +25%<br />

State 2 -10% -5%<br />

(a) Compute the expected returns on stocks A and B.<br />

Solution: The expected returns on the stocks are:<br />

E[rA] = (40% − 10%)/2 = 15%<br />

E[rB] = (25% − 5%)/2 = 10%<br />

(b) Compute the standard deviation of returns on A and B.<br />

Solution: The variance of the return on stock A is:<br />

V ar(rA) = [(0.25) 2 + (0.25) 2 ]/2 = (0.25) 2<br />

The standard deviation of stock A is therefore 25%.<br />

The variance of the return on stock B is:<br />

V ar(rB) = [(0.15) 2 + (0.15) 2 ]/2 = (0.15) 2 .<br />

The standard deviation of stock B is therefore σB = 15%.<br />

(c) Compute the covariance of the returns on A and B.<br />

Solution: The covariance is given by:<br />

Cov(rA, rB) = 0.5 × 0.25 × 0.15 + 0.5 × 0.25 × 0.15<br />

= 0.25 × 0.15<br />

= 0.0375.<br />

The above calculation implies that Cov(rA, rB) = σAσB.<br />

(d) Compute the correlation of the returns on A and B.<br />

Solution:<br />

Corr(rA, rB) = Cov(rA, rB)<br />

= 1.<br />

3<br />

σAσB

Problem 3. (30 points)<br />

You analyze the cash flows arising from the purchase of the equity of the<br />

<strong>HEC</strong>MBA Corporation. The company will liquidate after 2 years. It has no<br />

debt.<br />

• In the first year, it will pay either $10 million with 30% probability, or<br />

$1 million with 70% probability.<br />

• In the second year, it will pay either $20 million with 25% probability, or<br />

$3 million with 75% probability.<br />

Suppose the interest rate on both the 1-year and 2-year T-bonds is 3% per<br />

year (with yearly compounding), and you believe that the stock market has<br />

an expected return of 10%. Assume also that <strong>HEC</strong>MBA Corporation has a β<br />

coefficient of 1.7.<br />

(a) What is the expected return on the stock?<br />

Solution: We need to compute the discount rate E[R], and we are told<br />

that the risk-free rate rf = 3%, <strong>HEC</strong>MBA’s beta is β = 1.7, and the<br />

market expected return E[RMkt] = 10%. We use the formula<br />

E[R] = rf + β × (E[RMkt] − rf)<br />

= 0.03 + 1.7 × (0.10 − 0.03)<br />

= 14.90%.<br />

(b) According to the CAPM, what is the value of <strong>HEC</strong>MBA’s equity?<br />

Solution: According to the present value (PV) formula, the price of<br />

<strong>HEC</strong>MBA should be<br />

P = E[C1] E[C2]<br />

+<br />

1 + E[r] (1 + E[r]) 2.<br />

The expected cash flows after after the first quarter are<br />

E[C1] = 30% × $10m + 70% × $1m = $3.7m.<br />

The expected cash flows after after the second quarter are<br />

E[C2] = 25% × $20m + 75% × $3m = $7.25m.<br />

Then the price of Acme is given by the formula:<br />

P = E[C1] E[C2] $3.7m<br />

+ =<br />

1 + E[r] (1 + E[r]) 2 1.149<br />

4<br />

$7.25m<br />

+ = $8.71m.<br />

1.1492

Problem 4. (30 points)<br />

You are hedging the purchase of gold for your jewelry company. You have<br />

been requested to purchase 5 futures contracts to hedge your manufacturing<br />

needs in one year. Each contract is for 100 ounces of gold. The current spot<br />

price of gold is $1500 per ounce. The 1-year risk free rate is 3.5% in annual<br />

units with continuous compounding.<br />

(a) What is the price of one futures contract?<br />

Solution: By the cost of carry relationship, the futures price is:<br />

f0 = 100 × $1, 500 × e 0.035×1 = $155, 342.96<br />

(b) If the spot gold price, at the end of the contract, is $1600, was this hedge<br />

a good idea?<br />

Solution: The futures position is profitable since the spot price at ma-<br />

turity is larger than the initial futures price f0.<br />

(c) What was the profit or loss?<br />

Solution: The profit is:<br />

5 × ($160, 000 − $155, 342.96) = $23, 285.22.<br />

5

Problem 5. (30 points)<br />

Consider a 1-year European call on Apple with strike X = $320. The current<br />

stock price is S0 = $320. The stock has an annualized standard deviation of<br />

20% per year, and is not expected to pay a dividend during the life of the<br />

option. The continuously compounded interest rate is 5% per year.<br />

(a) Is the option in-, at-, or out-of-the-money?<br />

Solution: At the money since S0 = X.<br />

(b) Use the Black-Scholes formula to compute the call price.<br />

Solution: Since the option is at-the-money (S0 = X),<br />

reduces to<br />

We infer that<br />

d1 = ln[S0/(Xe −rT )] + σ 2 /2<br />

σ √ T<br />

d1 = (r + σ2 /2)T<br />

σ √ T<br />

= 0.35.<br />

d2 = d1 − σ √ T = 0.35 − 0.20 = 0.15.<br />

We find in the table that N(d1) = 0.6368 and N(d2) = 0.5596. The call<br />

price C0 is therefore<br />

or C0 = $33.44.<br />

$320 × 0.6368 − $320e −0.05×1 × 0.5596,<br />

(c) What is the price of the American call with identical characteristics?<br />

Solution: An American call on a non-dividend-paying-stock has the<br />

same value as the European call with the same characteristics, that is<br />

$33.44.<br />

(d) What is the price of the European put with the same characteristics?<br />

Solution: The put-call parity P0 = C0 − S0 + Xe −rT implies that the<br />

European put is worth<br />

P0 = 33.44 − 320 + 320e −0.05×1 = $17.84.<br />

(e) What is the price of a 1-year futures contract on the stock?<br />

Solution: The price of the 3-month futures is f = S0e rT = $320e 0.05×1 =<br />

$336.41.<br />

6

Problem 6. (30 points)<br />

A stock price is currently $100. Over each of the next two three-month periods<br />

it will either go up by 6% or down by 3%. The interest rate per period is 2%.<br />

(a) What is today’s value of a six-month European call with a strike of $102?<br />

Solution: The dynamics of the stock price is given by:<br />

S0 = $100<br />

<br />

Su = $106<br />

<br />

Sd = $97<br />

Suu = $112.36<br />

<br />

<br />

Sud = $102.82<br />

<br />

<br />

Sdd = $94.09<br />

The value of the call at the terminal dates is therefore:<br />

C0 =?<br />

<br />

<br />

Cu =?<br />

Cd =?<br />

At node u, the replicating portfolio contains<br />

unit of the stock, and<br />

B = Cu,u − ∆Su,u<br />

1 + rf<br />

∆ =<br />

= 10.36 − 1 × 112.36<br />

10.36 − 0.82<br />

112.36 − 102.82<br />

1.02<br />

Cuu = $10.36<br />

<br />

<br />

Cud = $0.82<br />

<br />

<br />

Cdd = $0<br />

= 1<br />

= − 102<br />

1.02<br />

= −$100.<br />

units of the riskless asset. The value of the call at node u is therefore:<br />

Cu = 1 × 106 − 100 = $6.<br />

At node d, the replicating portfolio contains<br />

∆ =<br />

0.82 − 0<br />

102.82 − 94.09<br />

7<br />

= 0.09393

units of the stock and<br />

B = Cd,u − ∆Sd,u<br />

1 + rf<br />

The call is worth:<br />

Hence<br />

= 0.82 − 0.0939 × 102.82<br />

1.02<br />

Cd = 0.09393 × 97 − 8.6645 = $0.4467.<br />

C0 =?<br />

<br />

<br />

Cu = $6<br />

Cd = $0.4467<br />

At node 0, the replicating portfolio contains<br />

∆ =<br />

6 − 0.4467<br />

106 − 97<br />

Cuu = $10.36<br />

<br />

<br />

<br />

Cud = $0.82<br />

<br />

Cdd = $0.00<br />

= 0.6170.<br />

= −$8.6645.<br />

units of the stock, and B = −$58.24 units of the riskless asset. The value<br />

of the call at node 0 is therefore:<br />

C0 = 0.6170 × 100 − 58.24 = $3.46.<br />

(b) What is the price of the American call with identical characteristics?<br />

Solution: The American call is also worth $3.46.<br />

(c) What is the price of the European put with the same characteristics?<br />

Solution: The put-call parity P0 = C0 − S0 + X/(1 + r) 2 implies that<br />

the European put is worth<br />

P0 = $3.46 − $100 + $102/(1.02 2 ) = $1.50.<br />

8

Problem 7. (30 points)<br />

Three put options on a stock have the same expiration date and strike prices<br />

of $55, $60, and $65. The market prices are $3, $5, and $8, respectively.<br />

(a) Explain how a butterfly spread can be created.<br />

Solution: We can create a butterfly spread by<br />

• Buying 1 put with strike price of $55<br />

• Selling 2 puts with strike price of $60<br />

• Buying 1 put with strike price of $65<br />

(b) How much does it cost today?<br />

Solution: The cost of the spread is:<br />

V0 = 1 × $3 − 2 × $5 + 1 × $8 = $1.<br />

(c) Compute the payoff of the strategy at the terminal date as a function of<br />

the final stock price ST .<br />

Solution: The payoff is:<br />

Thus,<br />

VT = (55 − ST )+ − 2(60 − ST )+ + (65 − ST )+.<br />

• if ST < $55, all puts are exercised at maturity and the payoff of the<br />

portfolio is VT = (55 − ST ) − 2(60 − ST ) + (65 − ST ) = 0;<br />

• if $55 ≤ ST ≤ $60, the payoff is VT = −2(60 − ST ) + (65 − ST ) =<br />

ST − 55;<br />

• if $60 ≤ ST ≤ $65, the payoff is VT = 65 − ST ;<br />

• if ST > $65, the payoff is VT = 0.<br />

(d) For what range of stock prices would the butterfly spread lead to a loss?<br />

Solution: The profit is:<br />

• −$1 if ST < $55;<br />

• ST − 56 if $55 ≤ ST ≤ $60;<br />

• 64 − ST if $60 ≤ ST ≤ $65;<br />

• −$1 if ST > $65.<br />

The butterfly spread therefore leads to a loss if the final stock price is<br />

either lower than $56 or higher than $64.<br />

9