You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Contents<br />

<strong>Indonesia</strong> Economic <strong>Update</strong> :<br />

Balance of Payment in 2011<br />

Fund Inflows and Foreign<br />

p.02<br />

Ownership In <strong>Indonesia</strong>n Capital<br />

Market<br />

p.08<br />

US EPA Statement About CPO<br />

“Failure”: Should We Worry?<br />

p.40<br />

Coal Market 2012: Future Remains<br />

Bright<br />

p.45<br />

Property Sector (Apartment)<br />

Outlook in 2012<br />

p.57<br />

<strong>Mandiri</strong> Leading Economic Index<br />

(LEI)<br />

p.64<br />

<strong>Indonesia</strong> Current Data (Table) p.67<br />

Chief Economist<br />

Destry Damayanti<br />

destry.damayanti@bankmandiri.co.id<br />

Analyst<br />

Faisal Rino Bernando<br />

Andry Asmoro<br />

M. Ajie Maulendra<br />

Nadia Kusuma Dewi<br />

Nurul Yuniataqwa Karunia<br />

Sindi Paramita<br />

Reny Eka Putri<br />

Ahmad Subhan Irani<br />

Andrian Bagus Santoso<br />

Publication Address:<br />

<strong>Bank</strong> <strong>Mandiri</strong> Head Office<br />

Office of Chief Economist<br />

18 th Floor, Plaza <strong>Mandiri</strong><br />

Jalan Jend. Gatot Subroto Kav.36-38<br />

Jakarta 12190, <strong>Indonesia</strong><br />

Phone: (62-21) 5245516 / 5272<br />

Fax: (62-21) 5210430<br />

Email:<br />

rino.bernando@bankmandiri.co.id<br />

andry.asmoro@bankmandiri.co.id<br />

ajie.maulendra@bankmandiri.co.id<br />

nadia.dewi@bankmandiri.co.id<br />

nurul.karunia@bankmandiri.co.id<br />

sindi.paramita@bankmandiri.co.id<br />

reny.putri@bankmandiri.co.id<br />

ahmad.subhan@bankmandiri.co.id<br />

andrian.bagus@bankmandiri.co.id<br />

See important disclaimer at the end of<br />

this material<br />

OFFICE OF CHIEF ECONOMIST<br />

March 2012<br />

<strong>Indonesia</strong> <strong>Update</strong><br />

<strong>Indonesia</strong> economic update : Balance of Payment in 2011<br />

<strong>Indonesia</strong>’s recorded deficit for the second consecutive quarter in its balance of<br />

payment, sending the full-year balance of payment surplus down to USD11.9 bn<br />

from USD30.3 bn in 2010. Interestingly, it was not caused by the trade balance as<br />

the trade surplus increased, but by increasing use of foreign services, notably<br />

transportations, and also higher income repatriation by foreign direct investment<br />

(FDI) investors.<br />

Fund Inflows and Foreign Ownership In <strong>Indonesia</strong>n Capital Market<br />

Increasing funds from domestic investors, foreign capital inflows coming into the<br />

domestic capital market are relatively also experiencing an upward trend. Although<br />

at the end of 2008 global financial market suffered from crisis and liquidity<br />

problems, causing a correction in the domestic capital market, in 2009 a recovery in<br />

the domestic financial market has occurred.<br />

The Development of Commercial <strong>Bank</strong>ing in <strong>Indonesia</strong><br />

Development of <strong>Indonesia</strong>’s banking system during 2011 still showed the maintained<br />

stability with the improved intermediary function, despite of amidst the financial<br />

market turmoil due to the influence of the global economic downturn. The solid<br />

domestic banking condition was still reflected in the high Capital Adequacy Ratio<br />

(CAR), which was far above the minimum of 8%, reached 16.1% by December 2011<br />

US EPA Statement About CPO “Failure”: Should We Worry?<br />

An agency in the United States (U.S.) engaged in the environment sector, namely<br />

EPA (Environmental Protection Agency) had issued an announcement related to its<br />

studies that biodiesel and renewable diesel produced from crude palm oil do not<br />

meet the environmentally friendly requirements. The EPA studies show that<br />

biodiesel produced from crude palm oil cannot reduce greenhouse gas emissions in<br />

a minimum amount of 20% as required in the U.S.<br />

Coal Market 2012: Future Remains Bright<br />

The global outlook for coal demand and supply in 2012 is marked by uncertainty.<br />

From the demand side, recovery from financial crisis has been fragile in many<br />

countries, casting doubt on future growth rates. But, the growth in developing<br />

countries – lead by China and India – will lead demand growth in recent years.<br />

Property Sector (Apartment) Outlook in 2012<br />

Development of the property sector is expected to continue in 2012. In 2012 the<br />

developers are starting to add the property projects, including residential such as<br />

apartments along with better economic conditions and increasing purchasing power.<br />

Security Ownership by the Types of Security Holders (January 2012 period)<br />

Corporate Individual<br />

533,291<br />

348,811<br />

174,589<br />

26,552<br />

Mutual<br />

Fund<br />

117,661<br />

227,162<br />

Securities<br />

Company Insurance<br />

14,507<br />

50,897<br />

105,947<br />

11,524<br />

Pension<br />

Fund<br />

55,025<br />

65,082<br />

49,906<br />

249,678<br />

3,979<br />

1,505<br />

Foreign Ownership (IDR bn) Local Ownership (IDR bn)<br />

Financial<br />

Institution Foundation Others Total<br />

1,630<br />

337,859<br />

1,056,533<br />

1,319,070

<strong>Indonesia</strong> Economic <strong>Update</strong> : Balance of Payment in 2011<br />

Aldian Taloputra (aldian.taloputra@mandirisek.co.id)<br />

<strong>Indonesia</strong>’s recorded deficit for the second consecutive<br />

quarter in its balance of payment, sending the full-year<br />

balance of payment surplus down to USD11.9 bn from<br />

USD30.3 bn in 2010.<br />

Specifically, the current account posted a deficit of USD0.94<br />

bn in 4Q11, swinging from a surplus at USD0.47 bn in 3Q11 as<br />

the trade balance surplus continued to narrow while foreign<br />

transportation needs resulted in a larger net outflow on<br />

overall services. For the full-year 2011, the current account<br />

surplus continued to drop from USD5.1 bn in 2010 to USD2.1<br />

bn. Interestingly, it was not caused by the trade balance as the<br />

trade surplus increased, but by increasing use of foreign<br />

services, notably transportations, and also higher income<br />

repatriation by foreign direct investment (FDI) investors.<br />

On the other hand, capital & financial account deficit<br />

narrowed in 4Q11 to USD1.4 bn from USD4.1 bn in the<br />

previous quarter. Surprisingly, the main cause for the net<br />

outflow was rising placement of funds by <strong>Indonesia</strong>ns on<br />

deposit and saving overseas, while foreign portfolio<br />

investment inflows posted a marginal result. For overall 2011,<br />

capital & financial account recorded a decline from USD26.6<br />

bn in 2010 to USD14.0 bn in 2011 with the source for the drop<br />

came from the public portfolio, in particular SBIs as it went<br />

from surplus to deficit last year. Nevertheless, we think most<br />

of the foreign outflows on SBI were intentionally done by <strong>Bank</strong><br />

<strong>Indonesia</strong>. On the other hand, FDI continued to record an<br />

increase of inflows last year lured by solid economic<br />

fundamentals.<br />

We believe <strong>Indonesia</strong>’s balance of payment surplus will<br />

continue to shrink this year. Current account is likely to chalk a<br />

deficit of around USD1.9 bn or 0.2% of GDP, on weaker<br />

exports, stronger import growth, and higher income<br />

repatriation by FDI investors. On the capital account side, we<br />

still believe <strong>Indonesia</strong> strong economic fundamentals, high<br />

yields, and improved sovereign ratings will continue to attract<br />

foreign investors. Other investments are likely to improve<br />

© Office of Chief Economist Page 2 of 68<br />

Page 2 of 68<br />

© Office of Chief Economist

ITEMS<br />

gradually as the central bank regulation on export and loan<br />

proceed repatriation is gradually implemented. Against this<br />

backdrop, we forecast the rupiah to weaken only slightly to<br />

IDR9,100/USD by YE12 vs. IDR9,068/USD end of last year.<br />

INDONESIA'S BALANCE OF PAYMENTS<br />

(millions of USD)<br />

2010 2011<br />

Q1 Q2 Q3 Q4 TOTAL<br />

I. CURRENT ACCOUNT 1,891 1,342 1,043 870 5,144 2,072 473 468 -944 2,069<br />

II. CAPITAL & FINANCIAL ACCOUNT 5,662 3,767 7,464 9,728 26,621 6,646 12,849 -4,107 -1,370 14,018<br />

III. TOTAL (I+II) 7,552 5,108 8,507 10,597 31,764 8,718 13,322 -3,639 -2,313 16,088<br />

IV. NET ERRORS & OMISSIONS -932 312 -1,552 692 -1,480 -1,052 -1,446 -321 -1,413 -4,232<br />

V. OVERALL BALANCE (III+IV)<br />

* Provisional figures<br />

** Very provisional figures<br />

6,620 5,420 6,955 11,289 30,284 7,666 11,876 -3,960 -3,726 11,856<br />

Figure 1. <strong>Indonesia</strong>’s balance of payment. (Source: <strong>Bank</strong> <strong>Indonesia</strong>)<br />

Q1* Q2* Q3* Q4** TOTAL<br />

<strong>Indonesia</strong>’s balance of payment recorded another deficit in<br />

the last quarter of 2011, recording the second consecutive<br />

deficit (see figure 1 and 2). Specifically, the current account<br />

turned into deficit for the first time since 4Q08 while capital<br />

account deficit narrowed from that in the 3Q11. Overall last<br />

year, balance of payment surplus shrank to USD11.9 bn from<br />

USD30.3 bn in 2010 driven by the decline on current and<br />

capital accounts.<br />

Specifically, current account posted a deficit of USD0.94 bn in<br />

4Q11, swinging from a surplus of USD0.47 bn in the previous<br />

quarter. We think the deficit was basically caused by two<br />

factors. First, it was due to lower trade surplus compared with<br />

in the 3Q11 as exports were dampened by lower commodity<br />

prices and decreasing global demand during the period. At the<br />

same time imports growth remained robust as investment<br />

activities continued to rise. Second, rising imports led to<br />

increasing transportation costs paid to foreign companies (see<br />

figure 2). Thus, they resulted in a deeper deficit on overall<br />

services as transportation services accounted for 74% of the<br />

total services in 2011.<br />

© Office of Chief Economist Page 3 of 68<br />

© Office of Chief Economist Page 3 of 68

Page 4 of 68<br />

As for the full 2011, the current account surplus continued to<br />

slump from USD5.1 bn in 2010 to USD2.1 bn (see figure 4).<br />

What is interesting is the full-year decline was not caused by<br />

international trade as trade surplus increased to USD35.5 bn<br />

in 2011 from USD30.6 bn in 2010. It seems that the lower<br />

surplus was driven by increasing use of foreign transportation<br />

services and increasing income repatriation of income by FDI<br />

investors (see figure 3).<br />

On the other side, capital & financial account registered an<br />

easing trend of deficit in 4Q11, amounting USD1.4 bn<br />

compared with the previous quarter at USD4.1 bn (see figure<br />

4). Surprisingly, the main cause for the net outflow was due to<br />

higher placement of funds by <strong>Indonesia</strong>ns outside the country.<br />

Meanwhile, foreign portfolio investment posted a marginal<br />

net inflow even after foreigners took their money out of<br />

maturing SBIs. We believe most of the foreign outflow on SBI’s<br />

was done intentionally by the central bank as they eliminate 3<br />

and 6 month SBI instrument causing impossible for foreigners<br />

to rollover it. Moreover, foreigners were more discouraged<br />

placing on the existing 9 month SBI instrument due to central<br />

bank’s holding period policy for the instrument (see figure 3).<br />

On the other hand, foreign flows to the stock market and<br />

government bonds swung from outflows to inflows. Whereas,<br />

foreign inflows to corporate bonds increased during the<br />

period. Despite the global economic uncertainty, foreign<br />

investors’ sentiment on the domestic financial market was<br />

better in fourth quarter than in the 3Q11. Meanwhile, FDI<br />

continued to increase lured by a solid economic fundamentals.<br />

For the full-year 2011, capital account & financial account<br />

recorded a decline USD26.6 bn in 2010 to USD14.0 bn in 2011<br />

amid global economic uncertainty. Foreign portfolio inflows<br />

significantly slid from USD15.7 bn in 2010 to USD5.6 bn. The<br />

essential source for the drop came from the public portfolio as<br />

foreign flows into SBI’s went from surplus of USD1.3 bn in<br />

2010 to net outflows of USD5.4 bn last year, in line with the<br />

central bank’s goal. On the other hand, foreign inflows to the<br />

government bonds were still positive but eased from USD12.2<br />

bn in 2010 to USD6.2 bn as foreign investors turned riskaverse<br />

in late August. Meanwhile, foreign direct investment<br />

continued to record an increase of inflows from USD13.8 bn to<br />

USD18.2 bn in 2011.<br />

© Office of Chief Economist Page 4 of 68<br />

© Office of Chief Economist

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

BOP (USD bn)-3qma<br />

IDR/USD-RHS (reverse report)<br />

We believe <strong>Indonesia</strong>’s balance of payment surplus will<br />

continue to shrink this year. Current account is likely to print a<br />

deficit of around USD1.9 bn or 0.2% of GDP, underpinned by<br />

weaker exports, stronger import growth, and higher income<br />

repatriation by FDI investors. On the capital account side, we<br />

still believe <strong>Indonesia</strong>’s strong economic fundamentals, high<br />

yields, and improved sovereign ratings will continue to attract<br />

foreign investors. However, rising risk aversion may dampen<br />

foreigners’ appetite on risky assets. Other investments are<br />

likely to improve gradually as the central bank regulation on<br />

mandatory repatriation of export and offshore loan proceeds<br />

is gradually implemented. Although there is no requirement to<br />

park such proceeds in the domestic banks for a specific time,<br />

we expect some of the ‘idle’ money will stay. Against this<br />

backdrop, we forecast the rupiah to weaken only slightly to<br />

IDR9,100/USD by YE12 vs. IDR9,068/USD end of last year.<br />

8,000<br />

8,500<br />

9,000<br />

9,500<br />

10,000<br />

10,500<br />

11,000<br />

11,500<br />

-2<br />

12,000<br />

3Q06 2Q07 1Q08 4Q08 3Q09 2Q10 1Q11 4Q11<br />

BOP items (USD bn)<br />

Figure 2. Lower BOP value has led weakening exchange rate (left figure). Higher transportation<br />

service driven from increasing imports (right figure). (Source: <strong>Bank</strong> <strong>Indonesia</strong>, CEIC)<br />

© Office of Chief Economist Page 5 of 68<br />

© Office of Chief Economist Page 5 of 68<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

1Q06<br />

3Q06<br />

1Q07<br />

Flows of transportation services<br />

Imports-RHS<br />

3Q07<br />

1Q08<br />

3Q08<br />

1Q09<br />

3Q09<br />

1Q10<br />

3Q10<br />

1Q11<br />

3Q11<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

© Office of Chief Economist Page 6 of 68<br />

Page 6 of 68<br />

BOP items (USD bn)<br />

Foreign income repatriation of FDI<br />

FDI<br />

2006 2007 2008 2009 2010 2011<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

-4<br />

Foreign flows in SBI (USD bn)<br />

Persistent foreign outflows in SBI was visible<br />

as foreigners could not rollover it due to BI's<br />

policies in SBI<br />

1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11<br />

Figure 3. Increasing income repatriation in line with raising FDI activity (left figure). Presistent<br />

foreign outflow due to BI’s policy (right figure). (Source: <strong>Bank</strong> <strong>Indonesia</strong>)<br />

© Office of Chief Economist

I. CURRENT ACCOUNT 1,891 1,342 1,043 870 5,144 2,072 473 468 -944 2,069<br />

A. Goods, net 6,954 6,848 7,593 9,232 30,628 8,684 9,637 9,586 7,440 35,347<br />

- Exports, fob. 35,088 37,444 39,712 45,830 158,074 45,818 51,797 52,476 51,382 201,473<br />

- Imports, fob. -28,134 -30,596 -32,119 -36,597 -127,447 -37,134 -42,160 -42,890 -43,941 -166,125<br />

1. Non Oil & Gas, net 5,812 5,881 6,605 9,097 27,395 8,628 10,551 9,085 7,013 35,277<br />

1.1. Exports, fob 28,511 30,298 32,763 37,845 129,416 37,092 42,307 42,168 41,626 163,193<br />

1.2. Imports, fob -22,699 -24,417 -26,158 -28,747 -102,021 -28,464 -31,756 -33,084 -34,613 -127,918<br />

2. Oil, net -1,663 -2,140 -1,991 -2,859 -8,653 -3,439 -5,098 -4,060 -3,712 -16,309<br />

2.1. Exports, fob 3,556 3,840 3,749 4,547 15,691 4,856 5,000 5,189 5,239 20,283<br />

2.2. Imports, fob -5,219 -5,980 -5,740 -7,406 -24,344 -8,295 -10,098 -9,249 -8,952 -36,594<br />

3. Gas, net 2,805 3,107 2,980 2,994 11,886 3,495 4,184 4,562 4,140 16,381<br />

3.1. Exports, fob 3,022 3,306 3,201 3,438 12,968 3,870 4,490 5,119 4,517 17,996<br />

3.2. Imports, fob -217 -200 -222 -444 -1,082 -375 -306 -557 -377 -1,615<br />

B. Services, net -2,106 -2,275 -2,155 -2,787 -9,324 -2,122 -3,379 -2,818 -3,503 -11,822<br />

1. Inflow 3,873 4,015 4,334 4,544 16,766 4,456 4,530 5,400 6,146 20,532<br />

2. Outflow -5,979 -6,291 -6,489 -7,331 -26,089 -6,578 -7,909 -8,218 -9,649 -32,354<br />

C. Income, net -4,038 -4,329 -5,547 -6,876 -20,790 -5,518 -6,747 -7,344 -6,058 -25,667<br />

1. Inflow 444 443 521 482 1,890 579 635 653 610 2,478<br />

2. Outflow -4,482 -4,772 -6,068 -7,357 -22,679 -6,097 -7,382 -7,997 -6,668 -28,144<br />

D. Current transfers, net 1,080 1,098 1,151 1,301 4,630 1,028 963 1,044 1,177 4,212<br />

1. Inflow 1,815 1,816 1,883 2,057 7,571 1,830 1,841 1,908 2,057 7,636<br />

2. Outflow -735 -718 -732 -756 -2,941 -802 -878 -864 -880 -3,424<br />

II. CAPITAL & FINANCIAL ACCOUNT 5,662 3,767 7,464 9,728 26,621 6,646 12,849 -4,107 -1,370 14,018<br />

A. CAPITAL ACCOUNT 18 2 4 26 50 1 0 0 0 1<br />

B. FINANCIAL ACCOUNT 5,644 3,765 7,460 9,702 26,571 6,645 12,849 -4,107 -1,370 14,017<br />

- Assets -3,601 -583 -4,748 2,031 -6,901 -3,298 -1,228 -4,399 -7,554 -16,479<br />

- Liabilities 9,244 4,347 12,208 7,672 33,471 9,943 14,076 292 6,185 30,496<br />

1. Direct investment 2,556 2,368 1,764 4,419 11,107 3,461 3,249 1,661 2,066 10,437<br />

1.1 Abroad -427 -982 -1,191 -64 -2,664 -1,529 -2,526 -1,350 -2,317 -7,722<br />

1.2 In <strong>Indonesia</strong> 2,983 3,350 2,955 4,483 13,771 4,990 5,775 3,011 4,383 18,159<br />

2. Portfolio investment 6,159 1,089 4,517 1,437 13,202 3,588 5,537 -4,665 -261 4,199<br />

2.1 Assets -409 -152 -1,597 -353 -2,511 -521 -731 154 -318 -1,416<br />

2.2 Liabilities 6,569 1,241 6,114 1,789 15,713 4,109 6,268 -4,819 57 5,615<br />

2.2.1 Public Sector 6,556 997 4,820 1,154 13,526 4,383 2,964 -4,270 -2,250 826<br />

2.2.2 Private Sector 13 244 1,295 636 2,187 -274 3,304 -549 2,306 4,788<br />

3. Other investment -3,072 308 1,179 3,846 2,262 -404 4,062 -1,103 -3,174 -619<br />

3.1 Assets -2,764 552 -1,960 2,447 -1,725 -1,248 2,029 -3,203 -4,919 -7,340<br />

3.2 Liabilities -308 -244 3,139 1,400 3,987 844 2,033 2,101 1,745 6,723<br />

3.2.1 Public Sector 147 -879 1,093 1,395 1,756 95 -1,402 -712 -240 -2,258<br />

3.2.2 Private Sector -455 636 2,046 5 2,231 749 3,435 2,813 1,985 8,981<br />

III. TOTAL (I+II) 7,552 5,108 8,507 10,597 31,764 8,718 13,322 -3,639 -2,313 16,088<br />

IV. NET ERRORS & OMISSIONS -932 312 -1,552 692 -1,480 -1,052 -1,446 -321 -1,413 -4,232<br />

V. OVERALL BALANCE (III+IV) 6,620 5,420 6,955 11,289 30,284 7,666 11,876 -3,960 -3,726 11,856<br />

* Provisional figures<br />

** Very provisional<br />

ITEMS<br />

INDONESIA'S BALANCE OF PAYMENTS<br />

(millions of USD)<br />

2010 2011<br />

Q1 Q2 Q3 Q4 TOTAL Q1* Q2* Q3* Q4** TOTAL<br />

Figure 4. <strong>Indonesia</strong>’s balance of payment. (Source: <strong>Bank</strong> <strong>Indonesia</strong>)<br />

© Office of Chief Economist Page 7 of 68<br />

© Office of Chief Economist Page 7 of 68

Fund Inflows and Foreign Ownership In <strong>Indonesia</strong>n Capital<br />

Market<br />

Reny Eka Putri (reny.putri@bankmandiri.co.id)<br />

…foreign fund<br />

inflows coming<br />

into the domestic<br />

capital market are<br />

relatively also<br />

experiencing an<br />

upward trend…<br />

Capital market has provided an important role in spurring the<br />

economic growth in <strong>Indonesia</strong>. In addition to the financial<br />

service industry, capital market is also a means for people to<br />

invest in various financial instruments, such as stocks, bonds,<br />

mutual funds and others. In addition to increasing funds from<br />

domestic investors, foreign capital inflows coming into the<br />

domestic capital market are relatively also experiencing an<br />

upward trend. Although at the end of 2008 global financial<br />

market suffered from crisis and liquidity problems, causing a<br />

correction in the domestic capital market, in 2009 a recovery<br />

in the domestic financial market has occurred. It can be seen<br />

from the performance of stock markets in the period of 2005-<br />

2009, in which the foreign capital inflows rose sharply in<br />

October-November 2008 when the acquisition of shares of<br />

listed companies by foreign investors and purchase of bluechip<br />

shares from banking and commodity sectors.<br />

Global Liquidity Direction<br />

Financial and economic crisis led the U.S. economy and some<br />

countries in Europe to have a weakening pressure.<br />

Country/Region 2010 2011E 2012F 2013F<br />

United States -471 -462 -391 -353<br />

Euro Area -61 -54 11 44<br />

Japan 196 107 110 118<br />

Other Mature Economies -21 -40 -37 -35<br />

Emerging Economies 363 360 264 58<br />

Latin America -47 -43 -88 -97<br />

Emerging Europe 0 -8 -26 -93<br />

Middle East/Africa 66 185 179 148<br />

Emerging Asia<br />

Note: E = Estimation, F = Forecast<br />

344 226 199 101<br />

Figure 5. Global Current Account (USD bn). Capital flows to emerging markets will still remain<br />

high compared to the United States, Europe, Japan and other mature economies. By 2012, the<br />

Current Account balance of emerging economies is estimated at USD264 billion (Source: The<br />

Institute of International Finance)<br />

© Office of Chief Economist Page 8 of 68<br />

Page 8 of 68<br />

© Office of Chief Economist

…the continued<br />

improvements in<br />

international<br />

confidence in<br />

<strong>Indonesia</strong><br />

encourage inflows<br />

of foreign funds…<br />

Unstable conditions in developed countries (Mature<br />

Economies) are believed to be able to attract foreign investors<br />

to transfer funds to developing countries (Emerging<br />

Economies), including <strong>Indonesia</strong>. The abundance of global<br />

liquidity as an implication of policies in the mature economies<br />

during the crisis and the continued improvements in<br />

international confidence in <strong>Indonesia</strong> encourage inflows of<br />

foreign funds into domestic financial markets primarily<br />

through portfolio investments.<br />

Based on a report from the Institute of International Finance,<br />

it is estimated the capital inflows to emerging markets will still<br />

remain high compared to the United States, Europe, Japan<br />

and other mature economies. For 2012, the Current Account<br />

balance in emerging economies is estimated at USD264 bn.<br />

261 258 249<br />

201<br />

208<br />

91<br />

488<br />

372<br />

Note: - Latin America (Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Peru, Venezuela)<br />

- Emerging Europe (Bulgaria, Czech Republic, Hungary, Poland, Romania, Russia, Turkey, Ukraine)<br />

- Middle East/Africa (Egypt, Lebanon, Morocco, Nigeria, Saudi Arabia, South Africa, UAE)<br />

- Emerging Asia (China, India, <strong>Indonesia</strong>, Malaysia, Philippines, South Korea, Thailand)<br />

Figure 6. Emerging Markets: Net Private Capital Inflows (USD bn). In 2012, capital inflows to the<br />

Emerging Asian countries are projected at USD287 billion and in 2013 will reach USD324 billion<br />

(Source: The Institute of International Finance)<br />

In terms of capital inflows for the entire Emerging Economies,<br />

a group of Emerging Asian countries, consisting of China, India,<br />

<strong>Indonesia</strong>, Malaysia, Philippines, South Korea and Thailand,<br />

are expected to gain greater inflows of funds compared to<br />

© Office of Chief Economist Page 9 of 68<br />

© Office of Chief Economist Page 9 of 68<br />

146<br />

73 64<br />

2010 2011E 2012F 2013F<br />

Latin America Emerging Europe Middle East/Africa Emerging Asia<br />

287<br />

272<br />

217<br />

80<br />

324

…<strong>Indonesia</strong> is a<br />

developing<br />

country that<br />

becomes a target<br />

of global<br />

investors…<br />

…the inflows of<br />

foreign funds are<br />

primarily through<br />

portfolio<br />

investments…<br />

© Office of Chief Economist Page 10 of 68<br />

Page 10 of 68<br />

countries in Latin America, Emerging Europe countries and<br />

Middle East / Africa. In 2012, capital inflows into Emerging<br />

Asia countries are projected at USD287 bn and in 2013 will<br />

reach USD324 bn.<br />

Capital inflows into <strong>Indonesia</strong>: Increased Sharply<br />

Recently, <strong>Indonesia</strong> is a developing country that becomes a<br />

target of global investors. Since the economic and financial<br />

crisis in developed countries, <strong>Indonesia</strong> and other developing<br />

countries become more attractive locations for foreign<br />

investors to invest their capitals. This condition is of course a<br />

momentum of its own for the domestic financial sector to the<br />

inflows of foreign funds to be properly managed and used to<br />

support the domestic economic growth.<br />

Over the last eight years, inflows of foreign funds (foreign<br />

capital inflows / financial account liabilities) had an increasing<br />

trend and reached its peak in 2010 at USD31.7 bn, up<br />

significantly by 65.5%YoY. The inflows of foreign funds are<br />

primarily through portfolio investments. Portfolio investment<br />

liabilities in 2010 reached USD15.7 bn (about 50% of the total<br />

inflows of foreign funds) or increased 1.5 times higher than in<br />

2009 at USD10.5 bn.<br />

During the period of 2004-2011, the decline in capital inflows<br />

occurred in 2008 just as the impact of the global financial crisis<br />

widespread. Further declines in commodity prices, a<br />

downward revision to demand from abroad and a potential of<br />

additional shocks to the domestic economy also affect the<br />

inflows of payment balance.<br />

Historically, with a longer period of time, <strong>Indonesia</strong>n financial<br />

account did not always have a surplus. In the period of 1980-<br />

1996 (before the crisis in 1998), the financial account was<br />

recorded to have a surplus at an average of USD4.88 bn per<br />

year. However, during the period of 1997-2003, the financial<br />

account had an average annual deficit of USD5.02 bn since the<br />

Asian financial crisis that began in July 1997 in Thailand, which<br />

ultimately affected the currency, stock and other asset prices<br />

in several Asian countries including <strong>Indonesia</strong>. This event is<br />

also often referred to as the 1998 monetary crisis in <strong>Indonesia</strong>.<br />

Furthermore, during the last eight years (2004-2011), the<br />

© Office of Chief Economist

-<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

(5)<br />

(10)<br />

(15)<br />

(USD bn)<br />

average annual financial account again had a surplus of<br />

USD6.04 bn.<br />

2004 2005 2006 2007 2008 2009 2010 2011<br />

Direct investment Portfolio investment<br />

Other Invesment Financial Account<br />

(USD bn)<br />

Figure 7. <strong>Indonesia</strong> Balance Of Payments. Over the last eight years (2004-2011), the average<br />

annual financial account again had a surplus of USD6.04 billion. (Source: <strong>Bank</strong> <strong>Indonesia</strong>)<br />

…the portfolio<br />

investments<br />

began to improve<br />

as marked by the<br />

initial high capital<br />

inflows into<br />

various<br />

investments…<br />

© Office of Chief Economist Page 11 of 68<br />

© Office of Chief Economist Page 11 of 68<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

-<br />

(5)<br />

(10)<br />

(15)<br />

The pressure of the debt crisis in Europe in 3Q11 triggered the<br />

high outflows of portfolio investments in the country.<br />

However, the pressure was reduced as the perception of<br />

foreign market participants that returned to be positive in<br />

4Q11. The capital outflows on the balance sheets that occur<br />

when foreign investors sell government stocks and bonds may<br />

occur at any time. It should be noted that the domestic<br />

market is quite sensitive to the flows of funds and ownership<br />

of assets by foreign investors.<br />

The portfolio investments began to improve in 4Q11<br />

compared to 3Q11 as marked by the initial high capital inflows<br />

into various investment instruments in the form of stock,<br />

government securities (SBN) and the issuance of USDdenominated<br />

sharia bonds (sukuk). Global liquidity factors and<br />

high positive perception of investors towards <strong>Indonesia</strong>’s<br />

macroeconomic stability (as reflected by the relatively strong<br />

economic growth, controlled inflation and exchange rate)

…better ratings to<br />

<strong>Indonesia</strong> also<br />

become a factor<br />

driving the inflows<br />

of foreign<br />

capital…<br />

© Office of Chief Economist Page 12 of 68<br />

Page 12 of 68<br />

support the increasing inflows of foreign funds mainly to the<br />

domestic investment instruments (portfolio).<br />

According to Asia Bond Monitor reported by Asian<br />

Development <strong>Bank</strong>, foreign holdings of Emerging East Asian<br />

Local Currency government bonds (as percentage of total<br />

bond holdings) continued to rise in all markets especially in<br />

<strong>Indonesia</strong>. Foreign holdings in <strong>Indonesia</strong> reached 30.87% in<br />

October 2011, higher than Malaysia (24.6%), Thailand (10.2%)<br />

and Japan (5.7%).<br />

Portfolio investments are encouraged by the development of<br />

<strong>Indonesia</strong>’s Sovereign Credit Rating<br />

A number of international rating agencies that puts better<br />

ratings to <strong>Indonesia</strong> also become a factor driving the inflows<br />

of foreign capital. The government anticipation that is<br />

considered appropriate in the face of global economic turmoil<br />

gets a positive response from the international community.<br />

On April 8, 2011, the Standard & Poor’s increase <strong>Indonesia</strong>’s<br />

debt rating to be BB+ from BB or one notch below the<br />

investment grade. The new rating is the highest since the<br />

financial crisis of 1997. The increase reflects the improved<br />

financial condition and liquidity of domestic markets, thus<br />

potentially widening the foreign capital inflows to <strong>Indonesia</strong> in<br />

the coming periods.<br />

On December 15, 2011, <strong>Indonesia</strong>’s sovereign credit (longterm<br />

debt) was also rated by an international rating agency,<br />

the Fitch Ratings, to be included in the investment grade<br />

category (becoming BBB- from BB+) with a stable outlook. The<br />

Fitch stated that the rise in rating was based on an assessment<br />

that reflected the country’s strong and resilient economic<br />

growth, low and continuously declining public debt ratio, a<br />

strong external liquidity and prudentially executed macro<br />

policy framework.<br />

The steps of the two rating agencies were followed by the<br />

Moody’s, which performed an upgraded rating to the<br />

<strong>Indonesia</strong>’s sovereign credit rating becoming Baa3 from Ba1<br />

on the last January 18, 2012.<br />

© Office of Chief Economist

Standard & Poor's<br />

Moody's Investor<br />

Service<br />

Fitch Rating<br />

Japan Credit Rating<br />

Rating & Investment<br />

Information<br />

08 Apr 2011 : BB BB+<br />

12 Mar 2010 : BB- BB<br />

26 Jul 2006 : B+ BB-<br />

18 Jan 2012 : Ba1 Baa3<br />

17 Jan 2011 : Ba2 Ba1<br />

16 Sep 2009 : Ba3 Ba2<br />

15 Dec 2011 : BB+ BBB-<br />

25 Jan 2010 : BB BB+<br />

14 Feb 2008 : BB- BB<br />

13 Jul 2010 : BB+ BBB-<br />

07 Jul 2009 : BB BB+<br />

06 Sep 2007 : BB- BB<br />

31 Oct 2007 : BB BB+<br />

12 Oct 2006 : BB- BB<br />

Agency Commentary : <strong>Indonesia</strong> continuing improvements in the government's<br />

balance sheet and external liquidity, againts a backdrop of a resilient economic<br />

performance and cautious fiscal management<br />

Agency Commentary : A more favorable assessment of <strong>Indonesia</strong>'s economic<br />

strength is underpinned by gains in investment spending, improved prospects for<br />

infrastructure development following key policy reforms and a well-managed<br />

financial system<br />

Agency Commentary : The upgrades reflect the country's strong and resilient<br />

economic growth, low and declining public debt ratios, strengthened external<br />

liquidity and a prudent overall macro policy framework<br />

Agency Commentary : <strong>Indonesia</strong>'s enhanced political and social stability along with<br />

the progress in democratization and decentralization. Sustainable economic growth<br />

outlook underpinned by solid domestic demand and alleviated public debt burden as<br />

a result of prudent fiscal management<br />

Agency Commentary : <strong>Indonesia</strong> economic structure, which depends substantially<br />

on domestic demand, cushioned the negative impact resulting from the drop in<br />

external demand that was triggered by the global recession<br />

Figure 8. <strong>Indonesia</strong>’s Upgraded Credit Rating. S&P, Moody’s, Fitch and JCR have all recently<br />

upgraded <strong>Indonesia</strong>’s credit rating based on <strong>Indonesia</strong>’s sustained strong economic growth<br />

(Source: Bloomberg)<br />

…our country has<br />

a conducive<br />

investment<br />

climate and<br />

strong<br />

macroeconomic<br />

fundamentals that<br />

have been<br />

successfully built<br />

by the<br />

government in the<br />

last 10 years…<br />

The World <strong>Bank</strong> also welcomed the rise in <strong>Indonesia</strong>’s<br />

sovereign debt rating because it believes that our country has<br />

a conducive investment climate and strong macroeconomic<br />

fundamentals that have been successfully built by the<br />

government in the last 10 years. A good macro policy<br />

framework and progress on structural reforms have made<br />

<strong>Indonesia</strong> generate a positive economic growth. This<br />

development is a momentum in order to encourage long term<br />

investments in infrastructure, regulatory certainty and<br />

transparency that are highly important to create jobs and a<br />

more inclusive growth of <strong>Indonesia</strong>. The position of<br />

<strong>Indonesia</strong>’s debt rating nowadays can be in aligned with<br />

Singapore, India, China and Brazil.<br />

The increasing role of foreign investors may increase liquidity<br />

and reduce the cost of capital (increasing investment), indeed;<br />

however, for developing countries like <strong>Indonesia</strong> it also should<br />

be wary to avoid the high volatility in capital markets. The<br />

inflows of funds into a large scale as the hot money may lead<br />

to withdrawal of funds on a large scale (sudden reversal) and<br />

may cause a severe shock to the domestic capital market<br />

instability.<br />

© Office of Chief Economist Page 13 of 68<br />

© Office of Chief Economist Page 13 of 68

…the share of<br />

foreign ownership<br />

on all traded<br />

investment<br />

instruments was<br />

accounted for<br />

55.5%, higher<br />

than the share of<br />

local ownership of<br />

44.5%...<br />

© Office of Chief Economist Page 14 of 68<br />

Page 14 of 68<br />

Increased Foreign Ownership Mainly in Equity Markets<br />

From year to year, the foreign ownership composition shows<br />

an increase compared to the domestic ownership. Based on<br />

the recent data obtained from Capital Market and Financial<br />

Institution Supervisory Agency (Bapepam-LK), as of January<br />

2012, the share of foreign ownership on all tradable<br />

investment instruments was accounted for 55.5%, higher than<br />

the share of local ownership of 44.5%. Nominally, the types of<br />

effects that are mostly owned by foreign parties include<br />

equity of IDR1,305,600 bn, followed by corporate bonds (IDR)<br />

reaching IDR7,425 bn. The high foreign composition in the<br />

stock market indicates that foreign investors tend to seek<br />

short-term profits by utilizing the domestic market liquidity.<br />

© Office of Chief Economist

Securities (IDR bn) Foreign Ownership Local Ownership Total Ownership<br />

Equity 1,305,600 876,115 2,181,715<br />

Corp. Bond (IDR) 7,425 136,940 144,365<br />

Corp. Bond (USD) 9 711 720<br />

Govt. Bond 570 12,424 12,995<br />

Warrant 1,492 3,013 4,505<br />

MTN (IDR) 1,447 10,083 11,530<br />

MTN (USD) 1,549 3,113 4,663<br />

Mutual Fund (IDR) 379 110 488<br />

Islamic Bond 589 7,217 7,806<br />

Sukuk 10 5,399 5,409<br />

Asset Backed Security 0 1,407 1,407<br />

Total 1,319,070 1,056,533 2,375,603<br />

Equity<br />

40.2%<br />

59.8%<br />

Corp.<br />

Bond<br />

(IDR)<br />

Corp.<br />

Bond<br />

(USD)<br />

94.9% 98.8% 95.6%<br />

Govt.<br />

Bond Warrant<br />

66.9%<br />

33.1%<br />

MTN<br />

(IDR)<br />

87.4%<br />

MTN<br />

(USD)<br />

66.8%<br />

33.2%<br />

Mutual<br />

Fund<br />

(IDR)<br />

22.5%<br />

77.5%<br />

Islamic<br />

Bond Sukuk<br />

92.5%<br />

5.1%<br />

1.3%<br />

4.4%<br />

12.6%<br />

7.5% 0.2%<br />

Foreign Ownership Local Ownership<br />

Asset<br />

Backed<br />

Security Total<br />

99.8% 100.0%<br />

Figure 9. Value and Ownership Composition in Various Instruments between Foreign and Local<br />

Investors by the End of January 2012. Nominally, the types of effects that are mostly owned by<br />

foreign parties include equity of IDR 1,305,600 billion, followed by corporate bonds (IDR)<br />

reaching IDR 7,425 billion. (Source: Bapepam-LK, CEIC)<br />

44.5%<br />

55.5%<br />

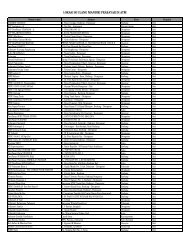

Meanwhile, based on the types of security holders, holdings in<br />

the domestic market by foreign investors are dominated by<br />

categories of corporate investors with the ownership of<br />

IDR348,811 bn and financial institutions with the ownership of<br />

IDR249,678 bn. Moreover, local investors mostly comprise of<br />

public companies with the ownership value of IDR533,291 bn,<br />

followed by individual investors with the ownership value of<br />

© Office of Chief Economist Page 15 of 68<br />

© Office of Chief Economist Page 15 of 68

Corporate Individual<br />

533,291<br />

348,811<br />

© Office of Chief Economist Page 16 of 68<br />

Page 16 of 68<br />

174,589<br />

26,552<br />

…the stock market<br />

transactions are<br />

more open and<br />

widely<br />

accessible…<br />

Mutual<br />

Fund<br />

117,661<br />

227,162<br />

IDR174,589 bn. This shows the interest of local retail investors<br />

in investing in the stock market is quite high.<br />

Securities<br />

Company Insurance<br />

14,507<br />

50,897<br />

105,947<br />

11,524<br />

Pension<br />

Fund<br />

Figure 10. Security Ownership by the Types of Security Holders (January 2012 period). Local<br />

investors mostly comprise of public companies with the ownership value of IDR533,291 billion,<br />

followed by individual investors with the ownership value of IDR174,589 billion. (Source:<br />

Bapepam-LK, CEIC)<br />

55,025<br />

65,082<br />

49,906<br />

249,678<br />

3,979<br />

1,505<br />

Foreign Ownership (IDR bn) Local Ownership (IDR bn)<br />

Financial<br />

Institution Foundation Others Total<br />

1,630<br />

337,859<br />

1,056,533<br />

1,319,070<br />

Stock Market Performance: Foreign Purchase Transaction is<br />

still high<br />

Viewing the development in the stock market, the JCI (Jakarta<br />

Composite Index) in <strong>Indonesia</strong> Stock Exchange also shows a<br />

rapid growth. The number of companies listed on the JCI<br />

increased to 442 companies as of February 2012 from 331<br />

companies in 2002. Market capitalization also shows a<br />

significant increase from about IDR268.4 tn at the end of 2002<br />

to IDR3,755.5 tn at the end of February 2012. This<br />

development shows that the stock market transactions are<br />

more open and widely accessible. People can diversify<br />

investments, not just save their assets into the banking sector.<br />

Simultaneously, the share of foreign investors that is also<br />

increasing in the stock market indicates the growing<br />

integration of <strong>Indonesia</strong>’s capital markets and money markets<br />

in the globalization era. The increase in <strong>Indonesia</strong>’s stock<br />

performance prospect rating by Morgan Stanley from<br />

underweight to equal weight in 2011 helped to strengthen<br />

investors’ interest to increase their holdings in the domestic<br />

stock market.<br />

© Office of Chief Economist

..ROE is<br />

estimated at<br />

28.8% of CSPI in<br />

2012, higher than<br />

the ROE in 2011 of<br />

28.4%...<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

(%)<br />

In addition, the amount of investment returns in the domestic<br />

stock market also illustrates the improved performance of<br />

listed companies as seen from the increasing market<br />

expectation to Return on Equity (ROE) of JCI to 28.8% in 2012,<br />

higher than the ROE in 2011 of 28.4%. The figure below shows<br />

the trend of the ratio of foreign sales and purchases to total<br />

transactions in the domestic stock market. During the period<br />

of 2004 to January 2012, the ratio of foreign purchases to total<br />

purchasing transactions is still quite high in the range of<br />

52.3%.<br />

Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12<br />

Foreign to Total Sales Ratio Foreign to Total Purchases Ratio<br />

Figure 11. Foreign Component of <strong>Indonesia</strong> Stock Exchange Share Trade. High uncertainty in<br />

the global market makes the domestic stock market fluctuative. During the period of 2004 to<br />

January 2012, the ratio of foreign purchases to total purchasing transactions is still quite high in<br />

the range of 52.3%. (Source: CEIC)<br />

The Development of Government Securities: Utilizing the<br />

Momentum & Managing the Risk<br />

Along with the development in the stock market, the inflows<br />

of foreign funds also come into the <strong>Indonesia</strong>’s bond market.<br />

Bond prices continue to improve and yield decreases. Low<br />

yield would provide an opportunity for <strong>Indonesia</strong> to utilize<br />

funds from the capital market with lower interest costs than<br />

those offered by banks.<br />

© Office of Chief Economist Page 17 of 68<br />

© Office of Chief Economist Page 17 of 68

(%)<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Figure 12. Development of the <strong>Indonesia</strong> Government Bond Yield. Along with the optimism on<br />

the domestic economy prospects, increasing foreign investor confidence can be seen from the<br />

improvement in risk perception and declining <strong>Indonesia</strong> government bond yield. (Source:<br />

Bloomberg)<br />

…the inflow of<br />

foreign funds that<br />

continues to<br />

increase in the<br />

government<br />

security market,<br />

which can pose its<br />

own risks…<br />

© Office of Chief Economist Page 18 of 68<br />

Page 18 of 68<br />

1-year yield<br />

5-year yield<br />

10-year yield<br />

20-year yield<br />

Jan-08 Jun-08 Nov-08 Apr-09 Sep-09 Feb-10 Jul-10 Dec-10 May-11 Oct-11 Mar-12<br />

Ownership of foreign investors in government securities (SBN)<br />

during the period of 2005-2011 is in an increasing trend. This<br />

shows the confidence of foreign investors to government<br />

bonds is increasingly strengthened based on the fiscal policies<br />

and sound and prudent government debt management.<br />

Some factors that make the <strong>Indonesia</strong>n bond market remain<br />

attractive to foreign investors include, among others,<br />

<strong>Indonesia</strong>’s economic growth that remains solid amid the<br />

economic slowdown in developed countries. <strong>Indonesia</strong><br />

managed to overcome the global crisis of 2008-2009 and<br />

increase the credibility in the eyes of foreign investors.<br />

However, a thing to wary is the inflow of foreign funds that<br />

continues to increase in the government security market,<br />

which can pose its own risks.<br />

Until the end of February 2012, foreign ownership reached<br />

30.2% of the total government securities. As a result, the<br />

domestic bond market will be more vulnerable to the global<br />

financial turmoil.<br />

© Office of Chief Economist

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

(IDR tn)<br />

0<br />

0<br />

Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12<br />

Total Tradable Govt. Securities Outstanding - lhs<br />

Foreign Holder of Tradable Govt. Securities Outstanding - lhs<br />

Foreign Holder to Total Tradable Govt. Securities Outstanding Ratio (%) - rhs<br />

Figure 13. Tradable Government Securities Outstanding (SBN) Development. Ownership of<br />

foreign investors in government securities (SBN) during the period of 2005-2011 is in an<br />

increasing trend. This shows the confidence of foreign investors to government bonds is<br />

increasingly strengthened based on the fiscal policies and sound and prudent government debt<br />

management (Source: CEIC)<br />

…in 2012 the<br />

types of<br />

government<br />

securities<br />

instruments have<br />

reached 12<br />

types…<br />

Resilience of the domestic financial market to the global<br />

financial and economic crisis makes foreign investors<br />

increasingly keen to increase the exposure in the government<br />

security market. The increasing foreign purchasing interest is<br />

also supported by macro factors and controllable fiscal risks,<br />

attractive returns and re-achievement of the investment<br />

grade. The current government security market coverage is<br />

also increasingly expanding with the instrument<br />

diversification. In 2002, the government security consists only<br />

of 3 instruments:<br />

1) Fixed Rate Bond (FR),<br />

2) Variable Rate Bond (VR) and<br />

3) Hedge Bond,<br />

But in 2012 the types of government securities instruments<br />

have reached 12 types, namely:<br />

1) Fixed Rate Bond (FR),<br />

2) Variable Rate Bond (VR),<br />

3) International Bond (IB) Bond,<br />

© Office of Chief Economist Page 19 of 68<br />

© Office of Chief Economist Page 19 of 68<br />

(%)<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5

…<strong>Bank</strong> <strong>Indonesia</strong><br />

issued a policy<br />

package in June<br />

2010 and Policy<br />

Package in<br />

December 2010 in<br />

an effort to<br />

manage the<br />

inflows of foreign<br />

funds…<br />

© Office of Chief Economist Page 20 of 68<br />

Page 20 of 68<br />

4) Retail Bond (ORI),<br />

5) Zero Coupon Bond (ZC),<br />

6) T-Bills (PN),<br />

7) Samurai Bond (RIJPY),<br />

8) Islamic Fixed Rate Bond (IFR),<br />

9) Retail Sukuk (SR),<br />

10) International Sukuk (SNI),<br />

11) Sharia T-Bills (SPN-S) and<br />

12) Project Based Sukuk (PBS)<br />

Foreign purchasing actions mainly occur in short and medium<br />

term government security instruments (including SPN/Surat<br />

Perbendaharaan Negara). Net purchases occurred at the SPN<br />

for USD0.5 bn during 4Q11, causing the share of foreign<br />

ownership of SPN increased to 46.0% from 39.6%.<br />

<strong>Bank</strong> <strong>Indonesia</strong> Policies & Foreign Ownership Development<br />

at <strong>Bank</strong> <strong>Indonesia</strong> Certificate (SBI)<br />

The outflows of foreign funds should still be concerned about<br />

to keep maintaining monetary stability and financial system.<br />

Therefore, there are some capital flow management policies<br />

made by <strong>Bank</strong> <strong>Indonesia</strong>, namely the Policy Package in June<br />

2010 and the Policy Package in December 2010. The first<br />

policy package, relating to the determination of SBI holding<br />

period of at least one month to hold capital traffics to SBI on a<br />

large scale (in-out) (which was later on May 13, 2011<br />

extended to six-month holding period). In addition, the<br />

policies also regulate the issuance of SBI with 9 month period<br />

and 12 month period. With the issuance of the Policy Package<br />

in June 2010, it is expected to strengthen the stability of the<br />

monetary and financial system to support the sustainable<br />

economic growth and at the same time reinforce the<br />

resilience in the face of any economic turmoil possibility.<br />

Meanwhile, further policy package in December 2010 aims to<br />

strengthen the monetary stability, promote the bank<br />

intermediation role, improve the banking resilience and<br />

strengthen the macro-prudential policy. Increased liability of<br />

Statutory Reserve Requirements (GWM/Giro Wajib Minimum)<br />

of foreign exchange gradually is done to strengthen the<br />

management of foreign capital flows by <strong>Bank</strong> <strong>Indonesia</strong><br />

© Office of Chief Economist

June - 2010<br />

Policy<br />

Package<br />

Dec - 2010<br />

Policy<br />

Package<br />

related to efforts to mitigate the risks to the reversal of large<br />

and sudden foreign capital flows.<br />

1. Improvements to the regulation on the Net Open Position<br />

(NOP)<br />

2. Introduction of the minimum one-month holding period<br />

(OMHP) for <strong>Bank</strong> <strong>Indonesia</strong> Certificates (SBI)<br />

3. Issuance of 9-month and 12-month <strong>Bank</strong> <strong>Indonesia</strong> Certificates<br />

(SBI)<br />

1. Reimposition of the limit on Daily Position of Short-Term <strong>Bank</strong><br />

External Borrowings to 30% of bank capital. This policy will<br />

come into force no later than the end of January 2011 with<br />

a 3-month transition period<br />

2. Phased increase in the foreign currency reserve requirement<br />

from 1.0% to 8.0% of foreign currency depositor funds:<br />

Phase I: raise the foreign currency reserve requirement from<br />

1.0% to 5.0%, effective from 1 March 2011<br />

Phase II: raise the foreign currency reserve requirement from<br />

5.0% to 8.0%, effective from 1 June 2011<br />

Figure 14. <strong>Bank</strong> <strong>Indonesia</strong> Policy for Management of Capital Flows in 2010. These policies are<br />

expected to strengthen the stability of the monetary and financial system to support the<br />

sustainable economic growth and at the same time strengthen the resilience in the face of the<br />

economic turmoil possibility. (Source: <strong>Bank</strong> <strong>Indonesia</strong>)<br />

Continuing the Policy Package in June 2010 and the Policy<br />

Package in December 2010, in 2011 a policy of 6-month<br />

holding period also applied (the extension of the SBI<br />

ownership by <strong>Bank</strong> <strong>Indonesia</strong> from originally one month to six<br />

months from May 13, 2011) and removal of SBI auction (for 1,<br />

3 and 6 months). After these policies, the liquidity of the SBI<br />

(<strong>Bank</strong> <strong>Indonesia</strong> Certificate) was reduced so that the<br />

placement of foreign funds decreased.<br />

This decrease had a positive impact on the economy, as <strong>Bank</strong><br />

<strong>Indonesia</strong> would like to encourage the inflows of foreign funds<br />

to come into long term investment instruments. Some of the<br />

foreign funds originally placed in the SBI were then<br />

transferred to other financial instruments, especially the<br />

government securities (SBN). The number of mature SBI also<br />

encourages the outflows of funds from the SBI.<br />

© Office of Chief Economist Page 21 of 68<br />

© Office of Chief Economist Page 21 of 68

(IDR tn)<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

24.1<br />

21.2<br />

16.7<br />

19.4<br />

© Office of Chief Economist Page 22 of 68<br />

Page 22 of 68<br />

12.2<br />

32.3<br />

32.3<br />

33.6<br />

27.4<br />

27.1<br />

20.4<br />

25.7<br />

23.0<br />

15.5<br />

18.0<br />

38.9<br />

37.9<br />

33.3<br />

33.1<br />

Jan-10 Jun-10 Nov-10 Apr-11 Sep-11 Feb-12<br />

32.0<br />

Total <strong>Bank</strong> <strong>Indonesia</strong> Certificate (SBI) Ownership - lhs<br />

Foreign <strong>Bank</strong> <strong>Indonesia</strong> Certificate (SBI) Ownership - lhs<br />

Foreign to Total SBI Ownership Ratio (%) - rhs<br />

Figure 15. Foreign Ownership in SBI (<strong>Bank</strong> <strong>Indonesia</strong> Certificate). The composition of foreign<br />

ownership of SBI fell to 6.5% in December 2011 compared to 27.4% in November 2011. In<br />

February 2012, the share of foreign ownership of SBI increased again to 8.1%. (Source: <strong>Bank</strong><br />

<strong>Indonesia</strong>, CEIC)<br />

…operation to<br />

transfer the<br />

outflow of funds<br />

caused the<br />

composition of<br />

foreign ownership<br />

of SBI decreased…<br />

27.4<br />

21.6<br />

15.5<br />

6.5<br />

7.2<br />

(%)<br />

50<br />

In the 4Q11, the net outflow of SBI transactions reached<br />

USD3.7 bn, which is higher than the 3Q11 of USD2.4 bn. The<br />

number of outstanding SBI has declined, for which <strong>Bank</strong><br />

<strong>Indonesia</strong> made an operation to transfer the outflow of funds<br />

from the short term SBI (which is the inflow of portfolio that is<br />

more susceptible to changes in the flow direction or turmoil in<br />

the market). This condition caused the composition of foreign<br />

ownership of SBI fell by 6.5% in December 2011 compared to<br />

27.4% in November 2011. By the end of February 2012, the<br />

share of foreign ownership of SBI increased again to 8.1%.<br />

Conclusions<br />

1. In the midst of Europe’s debt crisis and economic turmoil<br />

in the United States, the interest of foreign investors in<br />

<strong>Indonesia</strong>’s investment instruments remains high, driven<br />

by positive international perceptions to the domestic<br />

economy and attractive returns.<br />

8.1<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

© Office of Chief Economist<br />

5<br />

0

2. The Institute of International Finance estimates that<br />

capital inflows to emerging markets will still remain high<br />

compared to the United States, Europe, Japan and other<br />

mature economies. In 2012, capital inflows into Emerging<br />

Asia countries are projected at USD287 bn and in 2013 will<br />

reach USD324 bn.<br />

3. The portfolio investments began to improve in 4Q11<br />

compared to 3Q11 as marked by the initial high capital<br />

inflows into various investment instruments in the form of<br />

stock, government securities (SBN) and the issuance of<br />

USD-denominated sharia bonds (sukuk). Global liquidity<br />

factors and high positive perception of investors towards<br />

<strong>Indonesia</strong>’s macroeconomic stability support the<br />

increasing inflows of foreign funds mainly to the domestic<br />

investment instruments (portfolio).<br />

4. As of January 2012, the share of foreign ownership on all<br />

tradable investment instruments was accounted for<br />

55.5%, higher than the share of local ownership of 44.5%.<br />

Nominally, the types of effects that are mostly owned by<br />

foreign parties include equity of IDR1,305,600 bn,<br />

followed by corporate bonds (IDR) reaching IDR7,425 bn.<br />

5. Ownership of foreign investors in government securities<br />

(SBN) during the period of 2005-2011 is in an increasing<br />

trend. <strong>Indonesia</strong> managed to overcome the global crisis of<br />

2008-2009 and increase the credibility in the eyes of<br />

foreign investors. Until the end of January 2012, foreign<br />

ownership reached 32.1% of the total government<br />

securities.<br />

6. Operation of <strong>Bank</strong> <strong>Indonesia</strong> to transfer the outflow of<br />

funds from the short term SBI caused the composition of<br />

foreign ownership of SBI fell by 6.5% in December 2011<br />

compared to 27.4% in November 2011. By the end of<br />

February 2012, the share of foreign ownership of SBI<br />

increased again to 8.1%.<br />

© Office of Chief Economist Page 23 of 68<br />

© Office of Chief Economist Page 23 of 68

The Development of Commercial <strong>Bank</strong>ing in <strong>Indonesia</strong><br />

Nurul Yuniataqwa Karunia (nurul.karunia@bankmandiri.co.id)<br />

Development of <strong>Indonesia</strong>’s banking system during 2011 still<br />

showed the maintained stability with the improved<br />

intermediary function, despite of amidst the financial market<br />

turmoil due to the influence of the global economic downturn.<br />

The solid domestic banking condition was still reflected in the<br />

high Capital Adequacy Ratio (CAR), which was far above the<br />

minimum of 8%, reached 16.1% by December 2011, although<br />

the level of CAR decreased when compared to 2010, which<br />

reached 17.2%. Ratio of gross Non-Performing Loan (NPL) of<br />

commercial banking in <strong>Indonesia</strong> was also still good enough,<br />

equal to 2.17% by December 2011 or under the maximum<br />

limit of the provisions of <strong>Bank</strong> <strong>Indonesia</strong>, which was 5%. The<br />

commercial banking NPL rate in 2011 was better than the NPL<br />

by December 2010, which amounted to 2.67%. Furthermore,<br />

the Loan to Deposit Ratio (LDR) of commercial banks also<br />

increased to 78.8% in 2011 from 75.2% in 2010.<br />

Of the growth of Third Party Funds (TPFs) and lending, the<br />

national banking industry has also increased in 2011. TPFs<br />

continued to be accelerated in line with the loan growth. By<br />

the end of 2011, TPFs grew 19.1% (YoY) to IDR2.785 tn. This<br />

figure was higher than the growth at the end of 2010, which<br />

amounted to 18.5% (YoY) and it was also the highest growth<br />

rate in the banking history of <strong>Indonesia</strong>. Meanwhile, loan to<br />

finance economic activity continued to increase, as reflected<br />

in the loan growth reaching 24.6% (YoY) by December 2011 or<br />

at IDR2,200 tn. The investment loan came with the highest<br />

growth, by 33.2% (YoY), followed by growth in consumer loan<br />

by 24.2% (YoY) and working capital loans by 21.4% (YoY).<br />

<strong>Bank</strong>ing development was also evident from the improvement<br />

in the ratio of national bank loans to GDP reaching 29.7% in<br />

2011 from the previous 27.5% in 2010. This increasing ratio<br />

indicates that the intermediary function is getting better. By<br />

region, commercial bank also shows better performance in all<br />

areas, which are divided into regions of Sumatra, Java,<br />

Kalimantan, Sulawesi, Bali-Nusa Tenggara, and Maluku-Papua.<br />

© Office of Chief Economist Page 24 of 68<br />

Page 24 of 68<br />

© Office of Chief Economist

Development of the<br />

banking industry is<br />

highly affected by the<br />

economic development<br />

of a region<br />

12%<br />

The Role of Regions in <strong>Indonesia</strong>’s <strong>Bank</strong>ing Development<br />

The development of <strong>Indonesia</strong>’s banking industry<br />

performance mostly is still concentrated in Java and Sumatra.<br />

This corresponds to the economic activities and structures<br />

that are also centralized in the areas of Java and Sumatra.<br />

Both regions dominate the contribution of Gross Domestic<br />

Product (GDP) in 2011 nationwide, respectively for 57.7%, and<br />

23.5%.<br />

In this regard, the Ministry of Industry notes the spread of the<br />

concentration of industrial centers in <strong>Indonesia</strong> by 75% is in<br />

the areas of Java. Distribution of industries outside of Java was<br />

far below the percentage of Java, such as Sumatra by 18.37%,<br />

Kalimantan by 3.41%, Sulawesi by 2.16%, Bali-Nusa Tenggara<br />

by 0.79% and Maluku-Papua by 0.3%. Thus, the government<br />

needs to accelerate industrial development outside of Java in<br />

order to develop the industry in regions.<br />

When compared to 2007, the concentration of industry in<br />

<strong>Indonesia</strong> has not much changed. With the economic and<br />

industrial structures, banks are expected to take a role in<br />

advancing areas outside of Java and Sumatra. One way is to<br />

have an entrepreneurship program in regions to drive the<br />

local economy. In 2010, entrepreneurs in <strong>Indonesia</strong> amounted<br />

to 440,000 or 0.18% of the total population. Meanwhile,<br />

developed countries like the U.S. reached 11.5% and<br />

Singapore 7.2%. The government states that <strong>Indonesia</strong> ideally<br />

requires 2% entrepreneurs of the total population.<br />

TPFs Loan<br />

5% 3% 2% 2%<br />

76%<br />

Jawa Sumatera Kalimantan<br />

Sulawesi Bali NT Maluku Papua<br />

© Office of Chief Economist Page 25 of 68<br />

© Office of Chief Economist Page 25 of 68<br />

13%<br />

4% 4% 2%<br />

1%<br />

76%<br />

Jawa Sumatera Kalimantan<br />

Sulawesi Bali NT Maluku Papua<br />

Figure 16. Composition of the <strong>Bank</strong>ing Role by Region, 2011. The role of banks in the areas of Java is<br />

still dominating the banking industry in <strong>Indonesia</strong>. Collection of TPFs and lending amount more than<br />

70% are still done in Java. (Source: <strong>Bank</strong> <strong>Indonesia</strong>)

The high performance<br />

of commercial banks<br />

can also be seen from<br />

the high ratio of loan<br />

to GRDP<br />

© Office of Chief Economist Page 26 of 68<br />

Page 26 of 68<br />

Loan Ratio of Commercial <strong>Bank</strong>s to GRDP<br />

Performance of commercial banks in each province can also<br />

be seen from the ratio of loan to the economy or loan to Gross<br />

Regional Domestic Product (GRDP). The greater ratio the<br />

higher the commercial bank’s role of intermediation to the<br />

economy of the province. This is also related to the economic<br />

development in the province.<br />

In 2010, Jakarta has succeeded to have the highest ratio of<br />

lending to GDP compared to other provinces. This ratio also<br />

indicates that the role of commercial banks in Jakarta is still<br />

dominating in the economic development in <strong>Indonesia</strong>.<br />

Commercial banking in this provinces is able to achieve the<br />

ratio of loan to GRDP by 100.2%. Meanwhile, some general<br />

banking in <strong>Indonesia</strong> had a low ratio of loan to GDRP.<br />

However, it is estimated that Jakarta’s lending is not only from<br />

the province but also from other provinces such as the<br />

distribution in West Java because it is recorded to have a low<br />

ratio while it is the basis of several major industries in<br />

<strong>Indonesia</strong>.<br />

10 Provinces with the Highest and Lowest of Loan to GRDP Ratio, 2010<br />

The Highest Loan to GDRP The Lowest Loan to GDRP<br />

No. Province<br />

Ratio of<br />

Loan/GRDP<br />

(%) No. Province<br />

Ratio of<br />

Loan/GRDP<br />

(%)<br />

1. DKI Jakarta 100.2 1. West Nusa Tenggara 19.3<br />

2. Gorontalo 75.7 2. West Java 18.1<br />

3. Maluku 49.3 3. Lampung 17.7<br />

4. North Maluku 41.6 4. Bangka Belitung 14.5<br />

5. Riau Islands 38.5 5. West Papua 13.5<br />

6. Bali 36.5 6. East Kalimantan 10.1<br />

7. North Sulawesi 35.4 7. Papua 9.4<br />

8. South Sulawesi 35.4 8. South Sumatera 9.2<br />

9. West Sulawesi 33.1 9. Riau 8.6<br />

10. Bengkulu 31.9 10. Southeast Sulawesi 6.5<br />

Figure 17. Loan to GRDP Ratio, 2010. The role of commercial banks in Jakarta areas is still<br />

dominating the economic development in <strong>Indonesia</strong>. Commercial banking in this provinces is able to<br />

achieve the ratio of loan to GRDP by 100.2%. Meanwhile, Commercial <strong>Bank</strong>ing in Southeast Sulawesi<br />

recorded the lowest ratio at 6.5% level. (Source: <strong>Bank</strong> <strong>Indonesia</strong>, Central Bureau of Statistics)<br />

© Office of Chief Economist

Jakarta has become a<br />

province that is able to<br />

collect the largest TPFs<br />

with a share of 51% of<br />

total national TPFs<br />

1,417<br />

DKI Jakarta<br />

41%<br />

Gorontalo<br />

Factsheet of Commercial <strong>Bank</strong>ing by Region in <strong>Indonesia</strong><br />

Commercial <strong>Bank</strong>s TPFs<br />

In 2011, Jakarta has become a province that is able to collect<br />

the largest TPFs with a share of 51% of total national TPFs.<br />

East Java becomes the province with the second largest TPFs<br />

collection with a share of 9% of total national TPFs. In terms of<br />

TPFs, North Sumatera is able to increase the collection of TPFs<br />

from the top five ranking in 2005 to the top four ranking in<br />

2011 by shifting the position of Central Java.<br />

10 Provinces with the Highest TPF Distribution in <strong>Indonesia</strong>, 2011<br />

(IDR tn)<br />

251 219<br />

Jawa Timur<br />

Malut<br />

Jawa Barat<br />

Kalteng<br />

127 125<br />

Sumatera<br />

Utara<br />

Kaltim<br />

Jawa<br />

Tengah<br />

Bengkulu<br />

70 67 51 46 46<br />

© Office of Chief Economist Page 27 of 68<br />

© Office of Chief Economist Page 27 of 68<br />

Banten<br />

Kalsel<br />

Kalimantan<br />

Timur<br />

NTB<br />

Kepulauan<br />

Riau<br />

Kepri<br />

Sulawesi<br />

Selatan<br />

10 Provinces with the Highest TPF Growth in <strong>Indonesia</strong>, 2011<br />

(%)<br />

37%<br />

34% 34%<br />

32% 31%<br />

28%<br />

26%<br />

25% 24%<br />

Figure 18. Share and Growth of TPFs in <strong>Indonesia</strong>, 2011. The largest TPFs are in Jakarta, reaching<br />

IDR1,147 tn. North Sumatra managed to increase the collection of TPFs from the fifth rank in 2005 to<br />

the fourth rank in 2011. Meanwhile, there are six provinces that are able to grow the TPFs more than<br />

30% in 2011. (Source: <strong>Bank</strong> <strong>Indonesia</strong>)<br />

NTT<br />

Bali<br />

Banten<br />

National<br />

19.1%

A province that has the<br />

highest loan growth in<br />

2011 is North Maluku,<br />

which reached 35%<br />

(YoY).<br />

© Office of Chief Economist Page 28 of 68<br />

Page 28 of 68<br />

1,080<br />

DKI<br />

Jakarta<br />

Commercial <strong>Bank</strong>s Lending<br />

The highest lending in <strong>Indonesia</strong> is also in Jakarta of IDR1,080<br />

tn, followed by East Java of IDR190 tn. Both provinces have a<br />

share of 57.7% of total loans in <strong>Indonesia</strong> in 2011. In terms of<br />

loan, South Sumatra could shift the Riau lending rank from the<br />

top seven ranking in 2005 to the top six ranking in 2011.<br />

Meanwhile, the Riau lending rank fell from the sixth position<br />

in 2005 to the ninth position in 2011. In the meantime, a<br />

province that has the highest loan growth in 2011 is North<br />

Maluku, which reached 35% (YoY).<br />

35% 34% 34%<br />

Malut<br />

190 173<br />

Jatim<br />

10 Provinces with the Highest Lending in <strong>Indonesia</strong>, 2011<br />

(IDR tn)<br />

Gorontalo<br />

Jabar<br />

Babel<br />

121 106<br />

Jateng<br />

31% 30% 30% 29% 29% 29% 29%<br />

Papua<br />

Sumut<br />

Kalteng<br />

53 52 42 36 35<br />

10 Provinces with the Highest Loan Growth in <strong>Indonesia</strong>, 2011<br />

(%)<br />

Sumsel<br />

Jambi<br />

Banten<br />

NTT<br />

Kaltim<br />

Kaltim<br />

Riau<br />

Bengkulu<br />

Kepri<br />

Papua<br />

Barat<br />

National<br />

24.6%<br />

Figure 19. Share and Growth of Lending in <strong>Indonesia</strong>, 2011. The highest lending is also in Jakarta,<br />

reaching IDR 1,080 tn. South Sumatera managed to increase the loan Rank from the seventh position<br />

in 2005 to the sixth position in 2011. Meanwhile, there are six provinces that are able to have loan<br />

growth of more than 30% in 2011. (Source: <strong>Bank</strong> <strong>Indonesia</strong>)<br />

© Office of Chief Economist

In 2011, the highest<br />

loan based on the use<br />

in <strong>Indonesia</strong> is used for<br />

working capital loans<br />

which reaching 48.6%<br />

of total lending<br />

disbursed by<br />

commercial banks<br />

Commercial <strong>Bank</strong>s Lending Based on Type of Use<br />

In 2011, the highest loan based on the use in <strong>Indonesia</strong> is used<br />

for working capital loans which reaching 48.6% of total lending<br />

disbursed by commercial banks. If seen by the largest<br />

percentage in the lending, working capital loans in Java get the<br />

highest share, reaching 55.5%. Meanwhile, investment and<br />

consumption loans gained the highest share compared to<br />

other regions, respectively in Kalimantan (22.9%) and Maluku-<br />

Papua (53.1%).<br />

The development of lending based on the type of use in<br />

<strong>Indonesia</strong> experienced the share transfer. In 2011, the share<br />

of working capital lending of 48.6% decreased in share<br />

compared to 2007, reaching more than 50% or 53% of total<br />

loans provided. The share of consumer loans in 2011 also<br />

declined from 30.3% in 2007 to 28.4% in 2011. Meanwhile, the<br />

share of investment loans increased from 18.5% in 2007 to<br />

21.1% in 2011.<br />

When viewed from the loan growth by the type of use per<br />

region in <strong>Indonesia</strong>, in 2011 investment loans had the highest<br />

growth in Maluku-Papua, amounting to 63.1% (YoY). Working<br />

capital loans and consumer loans in the regions also<br />

experienced the highest growth, reaching 23.5% (YoY) and<br />

28.1% (YoY), respectively.<br />