Customs Information Paper (10) 37 (PDF 20K) - HM Revenue ...

Customs Information Paper (10) 37 (PDF 20K) - HM Revenue ...

Customs Information Paper (10) 37 (PDF 20K) - HM Revenue ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Centralisation of International Trade<br />

Authorising and Supervising Offices<br />

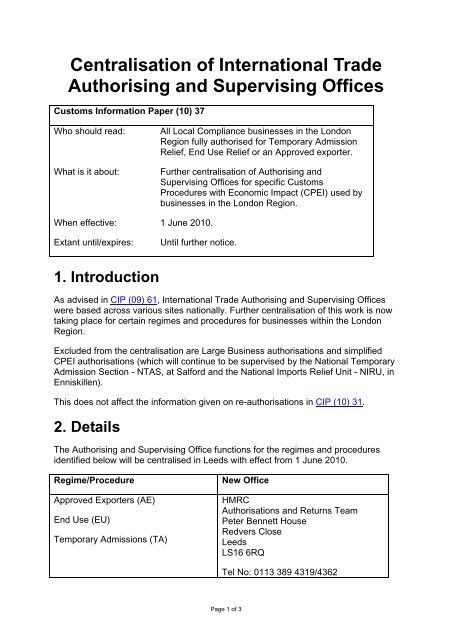

<strong>Customs</strong> <strong>Information</strong> <strong>Paper</strong> (<strong>10</strong>) <strong>37</strong><br />

Who should read: All Local Compliance businesses in the London<br />

Region fully authorised for Temporary Admission<br />

Relief, End Use Relief or an Approved exporter.<br />

What is it about: Further centralisation of Authorising and<br />

Supervising Offices for specific <strong>Customs</strong><br />

Procedures with Economic Impact (CPEI) used by<br />

businesses in the London Region.<br />

When effective: 1 June 20<strong>10</strong>.<br />

Extant until/expires: Until further notice.<br />

1. Introduction<br />

As advised in CIP (09) 61, International Trade Authorising and Supervising Offices<br />

were based across various sites nationally. Further centralisation of this work is now<br />

taking place for certain regimes and procedures for businesses within the London<br />

Region.<br />

Excluded from the centralisation are Large Business authorisations and simplified<br />

CPEI authorisations (which will continue to be supervised by the National Temporary<br />

Admission Section - NTAS, at Salford and the National Imports Relief Unit - NIRU, in<br />

Enniskillen).<br />

This does not affect the information given on re-authorisations in CIP (<strong>10</strong>) 31.<br />

2. Details<br />

The Authorising and Supervising Office functions for the regimes and procedures<br />

identified below will be centralised in Leeds with effect from 1 June 20<strong>10</strong>.<br />

Regime/Procedure New Office<br />

Approved Exporters (AE)<br />

End Use (EU)<br />

Temporary Admissions (TA)<br />

<strong>HM</strong>RC<br />

Authorisations and Returns Team<br />

Peter Bennett House<br />

Redvers Close<br />

Leeds<br />

LS16 6RQ<br />

Tel No: 0113 389 4319/4362<br />

Page 1 of 3

Fax No: 0113 389 4490<br />

The post codes affected for the above regimes/procedures are:<br />

BR1 – BR7 CR0 – CR5 CR7 – CR9 DA5 – DA8<br />

DA14 – DA18 E1 – E18 EC1 – EC4 EN1 – EN5<br />

HA0 – HA9 IG1 – IG6 IG8 and IG11 KT1 – KT6<br />

KT9 N1 – N22 NW1 – NW11 RM1 – RM3<br />

RM5 – RM7 RM9 – RM14 SE1 – SE8 SE<strong>10</strong> – SE28<br />

SM1 – SM6 SW1 – SW20 TW1 – TW14 UB1 – UB11<br />

W1 – W14 WC1 – WC2<br />

3. Regimes/Procedures to remain in London<br />

Businesses in the London Region located in the postcodes above, and involved in<br />

the regimes and procedures in the following list, should continue, until further notice,<br />

to send enquiries to the address below.<br />

Regime Office<br />

<strong>Customs</strong> Warehousing<br />

<strong>Customs</strong> Freight Simplified Procedures<br />

(CFSP)<br />

The Supervision Office<br />

<strong>HM</strong> <strong>Revenue</strong> & <strong>Customs</strong><br />

CITEX, 5 th Floor Dorset House<br />

Stamford Street<br />

London<br />

SE1 9PY<br />

Tel : 020 8929 6815/6574/6547<br />

Please note - All businesses who complete C&E 1179 (Claims for<br />

repayment/remission of import duty, CAP charges, VAT and Excise duty) and C 285<br />

(Application for repayment and remission) which are covered by the regimes<br />

remaining in London should continue to send them to the London office address<br />

(above).<br />

4. General enquiries<br />

General advice on any of the regimes or procedures mentioned in this paper and/or<br />

assistance required regarding the completion of forms, etc. should be directed to the<br />

Helpline on 0845 0<strong>10</strong> 9000.<br />

Issued on the 25 May 20<strong>10</strong> by the JCCC Secretary <strong>HM</strong>RC, Excise, <strong>Customs</strong> Stamps<br />

& Money Directorate.<br />

Page 2 of 3

For comprehensive guidance on international trade regulation, as well as advice on<br />

market information and business growth visit the Business Link website<br />

Page 3 of 3