english - About Heraeus

english - About Heraeus

english - About Heraeus

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Outlook: Stable<br />

The stable outlook reflects Standard & Poor's Ratings Services' belief that Germany-based precious metals and<br />

technology group <strong>Heraeus</strong> Holding GmbH will preserve its intermediate financial profile, despite the weak<br />

economic environment. We believe the company will be able to balance investments, dividends, and acquisitions<br />

in line with its financial profile. At the current rating level, we see headroom to accommodate small to midsize<br />

acquisitions, assuming no significant deterioration of industry conditions in <strong>Heraeus</strong>' end markets. We believe that<br />

<strong>Heraeus</strong> will be able to maintain credit metrics in line with our benchmarks for the current ratings, including funds<br />

from operations (FFO) to adjusted debt of about 35% and debt to EBITDA of about 2.5x.<br />

Downside scenario<br />

Ratings downside could result should <strong>Heraeus</strong>' debt to EBITDA rise above 2.5x on a protracted basis. Downside<br />

risks would likely be driven by a significant cyclical downturn in the industry, coupled with excessive debt levels<br />

from a substantial increase in investments or acquisition activities, or deteriorating liquidity.<br />

Upside scenario<br />

Ratings upside could arise if we were to see sustainable strong credit metrics, including FFO to debt of 45%-50%<br />

and debt to EBITDA of less than 1.5x.<br />

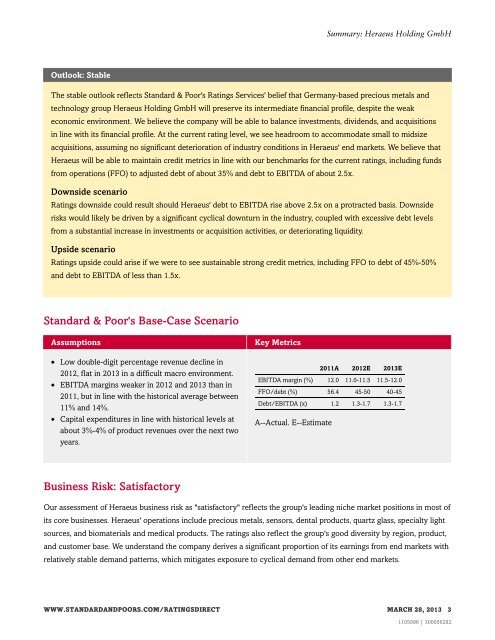

Standard & Poor's Base-Case Scenario<br />

Assumptions Key Metrics<br />

• Low double-digit percentage revenue decline in<br />

2012, flat in 2013 in a difficult macro environment.<br />

• EBITDA margins weaker in 2012 and 2013 than in<br />

2011, but in line with the historical average between<br />

11% and 14%.<br />

• Capital expenditures in line with historical levels at<br />

about 3%-4% of product revenues over the next two<br />

years.<br />

Business Risk: Satisfactory<br />

2011A 2012E 2013E<br />

EBITDA margin (%) 12.0 11.0-11.5 11.5-12.0<br />

FFO/debt (%) 56.4 45-50 40-45<br />

Debt/EBITDA (x) 1.2 1.3-1.7 1.3-1.7<br />

A--Actual. E--Estimate<br />

Summary: <strong>Heraeus</strong> Holding GmbH<br />

Our assessment of <strong>Heraeus</strong> business risk as "satisfactory" reflects the group's leading niche market positions in most of<br />

its core businesses. <strong>Heraeus</strong>' operations include precious metals, sensors, dental products, quartz glass, specialty light<br />

sources, and biomaterials and medical products. The ratings also reflect the group's good diversity by region, product,<br />

and customer base. We understand the company derives a significant proportion of its earnings from end markets with<br />

relatively stable demand patterns, which mitigates exposure to cyclical demand from other end markets.<br />

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MARCH 28, 2013 3<br />

1105096 | 300056282