fkUl NEW YORK

fkUl NEW YORK

fkUl NEW YORK

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

REPORT THIRD LIBERTY LOAN COMMITTEE OF BUFFALO<br />

House the promised subscriptions, but the Treasurer's department prepared and published<br />

in the newspapers each day a list of names of subscribers of $500 or more whose subscriptions<br />

had cleared through the banks with the amount of such subscription. This publicity<br />

had the double purpose of recognizing the liberal subscriber and encouraging the too conservative<br />

subscriber to increase into his proper class. The Treasurer and his assistant<br />

accounted for and banked the campaign funds, purchased supplies and equipment, issued<br />

all checks, hired the clerical help and posted the necessary ledger and journal entries for a<br />

complete record of the campaign funds and expenses. Their purchase records are particularly<br />

valuable for the preparation of a table of unit prices and quantities for reference in the<br />

ordering of supplies for the next campaign.<br />

THE RESULT<br />

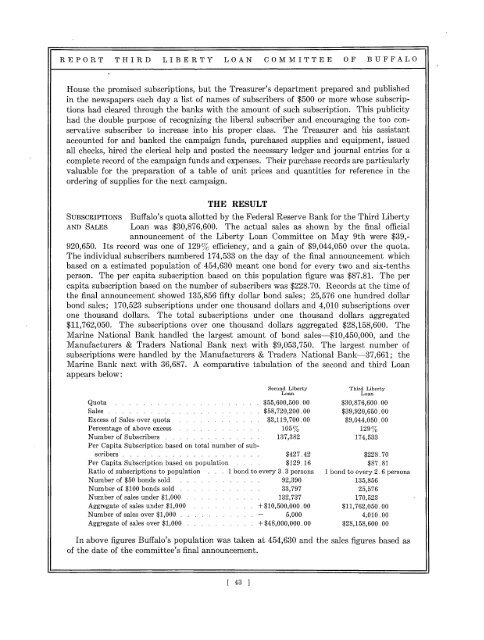

SUBSCRIPTIONS Buffalo's quota allotted by the Federal Reserve Bank for the Third Liberty<br />

AND SALES Loan was $30,876,600. The actual sales as shown by the final official<br />

announcement of the Liberty Loan Committee on May 9th were $39,-<br />

920,650. Its record was one of 129% efficiency, and a gain of $9,044,050 over the quota.<br />

The individual subscribers numbered 174,533 on the day of the final announcement which<br />

based on a estimated population of 454,630 meant one bond for every two and six-tenths<br />

person. The per capita subscription based on this population figure was $87.81. The per<br />

capita subscription based on the number of subscribers was $228.70. Records at the time of<br />

the final announcement showed 135,856 fifty dollar bond sales; 25,576 one hundred dollar<br />

bond sales; 170,523 subscriptions under one thousand dollars and 4,010 subscriptions over<br />

one thousand dollars. The total subscriptions under one thousand dollars aggregated<br />

$11,762,050. The subscriptions over one thousand dollars aggregated $28,158,600. The<br />

Marine National Bank handled the largest amount of bond sales—$10,450,000, and the<br />

Manufacturers & Traders National Bank next with $9,053,750. The largest number of<br />

subscriptions were handled by the Manufacturers & Traders National Bank—37,661; the<br />

Marine Bank next with 36,687. A comparative tabulation of the second and third Loan<br />

appears below:<br />

Second Liberty Third Liberty<br />

Loan Loan<br />

Quota $55,600,500.00 $30,876,600.00<br />

Sales $58,720,200.00 $39,920,650.00<br />

Excess of Sales over quota $3,119,700.00 $9,044,050.00<br />

Percentage of above excess 105% 129%<br />

Number of Subscribers 137,382 174,533<br />

Per Capita Subscription based on total number of subscribers<br />

$427.42 $228.70<br />

Per Capita Subscription based on population . . . . $129.16 $87.81<br />

Ratio of subscriptions to population ... 1 bond to every 3.3 persons 1 bond to every 2.6 persons<br />

Number of $50 bonds sold 92,390 135,856<br />

Number of $100 bonds sold 33,797 25,576<br />

Number of sales under $1,000 132,737 170,523<br />

Aggregate of sales under $1,000 +$10,500,000.00 $11,762,050.00<br />

Number of sales over $1,000 - 5,000 4,010.00<br />

Aggregate of sales over $1,000 +$48,000,000.00 $28,158,600.00<br />

In above figures Buffalo's population was taken at 454,630 and the sales figures based as<br />

of the date of the committee's final announcement.<br />

[ 43 ]