As Credit Crisis Spiraled, Alarm Led to Action - Morningbull

As Credit Crisis Spiraled, Alarm Led to Action - Morningbull

As Credit Crisis Spiraled, Alarm Led to Action - Morningbull

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

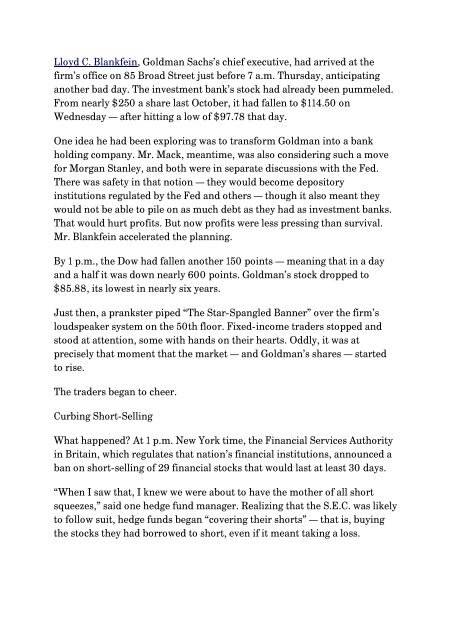

Lloyd C. Blankfein, Goldman Sachs’s chief executive, had arrived at the<br />

firm’s office on 85 Broad Street just before 7 a.m. Thursday, anticipating<br />

another bad day. The investment bank’s s<strong>to</strong>ck had already been pummeled.<br />

From nearly $250 a share last Oc<strong>to</strong>ber, it had fallen <strong>to</strong> $114.50 on<br />

Wednesday — after hitting a low of $97.78 that day.<br />

One idea he had been exploring was <strong>to</strong> transform Goldman in<strong>to</strong> a bank<br />

holding company. Mr. Mack, meantime, was also considering such a move<br />

for Morgan Stanley, and both were in separate discussions with the Fed.<br />

There was safety in that notion — they would become deposi<strong>to</strong>ry<br />

institutions regulated by the Fed and others — though it also meant they<br />

would not be able <strong>to</strong> pile on as much debt as they had as investment banks.<br />

That would hurt profits. But now profits were less pressing than survival.<br />

Mr. Blankfein accelerated the planning.<br />

By 1 p.m., the Dow had fallen another 150 points — meaning that in a day<br />

and a half it was down nearly 600 points. Goldman’s s<strong>to</strong>ck dropped <strong>to</strong><br />

$85.88, its lowest in nearly six years.<br />

Just then, a prankster piped “The Star-Spangled Banner” over the firm’s<br />

loudspeaker system on the 50th floor. Fixed-income traders s<strong>to</strong>pped and<br />

s<strong>to</strong>od at attention, some with hands on their hearts. Oddly, it was at<br />

precisely that moment that the market — and Goldman’s shares — started<br />

<strong>to</strong> rise.<br />

The traders began <strong>to</strong> cheer.<br />

Curbing Short-Selling<br />

What happened? At 1 p.m. New York time, the Financial Services Authority<br />

in Britain, which regulates that nation’s financial institutions, announced a<br />

ban on short-selling of 29 financial s<strong>to</strong>cks that would last at least 30 days.<br />

“When I saw that, I knew we were about <strong>to</strong> have the mother of all short<br />

squeezes,” said one hedge fund manager. Realizing that the S.E.C. was likely<br />

<strong>to</strong> follow suit, hedge funds began “covering their shorts” — that is, buying<br />

the s<strong>to</strong>cks they had borrowed <strong>to</strong> short, even if it meant taking a loss.