PCE Deflator, (Personal Consumption Expenditure ... - Morningbull

PCE Deflator, (Personal Consumption Expenditure ... - Morningbull

PCE Deflator, (Personal Consumption Expenditure ... - Morningbull

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

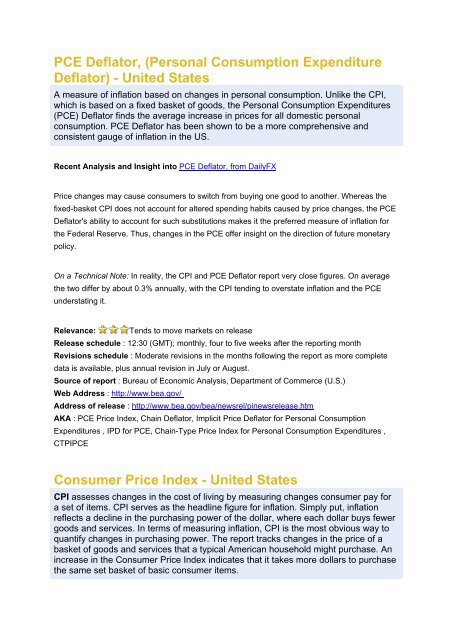

<strong>PCE</strong> <strong>Deflator</strong>, (<strong>Personal</strong> <strong>Consumption</strong> <strong>Expenditure</strong><br />

<strong>Deflator</strong>) - United States<br />

A measure of inflation based on changes in personal consumption. Unlike the CPI,<br />

which is based on a fixed basket of goods, the <strong>Personal</strong> <strong>Consumption</strong> <strong>Expenditure</strong>s<br />

(<strong>PCE</strong>) <strong>Deflator</strong> finds the average increase in prices for all domestic personal<br />

consumption. <strong>PCE</strong> <strong>Deflator</strong> has been shown to be a more comprehensive and<br />

consistent gauge of inflation in the US.<br />

Recent Analysis and Insight into <strong>PCE</strong> <strong>Deflator</strong>, from DailyFX<br />

Price changes may cause consumers to switch from buying one good to another. Whereas the<br />

fixed-basket CPI does not account for altered spending habits caused by price changes, the <strong>PCE</strong><br />

<strong>Deflator</strong>'s ability to account for such substitutions makes it the preferred measure of inflation for<br />

the Federal Reserve. Thus, changes in the <strong>PCE</strong> offer insight on the direction of future monetary<br />

policy.<br />

On a Technical Note: In reality, the CPI and <strong>PCE</strong> <strong>Deflator</strong> report very close figures. On average<br />

the two differ by about 0.3% annually, with the CPI tending to overstate inflation and the <strong>PCE</strong><br />

understating it.<br />

Relevance: Tends to move markets on release<br />

Release schedule : 12:30 (GMT); monthly, four to five weeks after the reporting month<br />

Revisions schedule : Moderate revisions in the months following the report as more complete<br />

data is available, plus annual revision in July or August.<br />

Source of report : Bureau of Economic Analysis, Department of Commerce (U.S.)<br />

Web Address : http://www.bea.gov/<br />

Address of release : http://www.bea.gov/bea/newsrel/pinewsrelease.htm<br />

AKA : <strong>PCE</strong> Price Index, Chain <strong>Deflator</strong>, Implicit Price <strong>Deflator</strong> for <strong>Personal</strong> <strong>Consumption</strong><br />

<strong>Expenditure</strong>s , IPD for <strong>PCE</strong>, Chain-Type Price Index for <strong>Personal</strong> <strong>Consumption</strong> <strong>Expenditure</strong>s ,<br />

CTPI<strong>PCE</strong><br />

Consumer Price Index - United States<br />

CPI assesses changes in the cost of living by measuring changes consumer pay for<br />

a set of items. CPI serves as the headline figure for inflation. Simply put, inflation<br />

reflects a decline in the purchasing power of the dollar, where each dollar buys fewer<br />

goods and services. In terms of measuring inflation, CPI is the most obvious way to<br />

quantify changes in purchasing power. The report tracks changes in the price of a<br />

basket of goods and services that a typical American household might purchase. An<br />

increase in the Consumer Price Index indicates that it takes more dollars to purchase<br />

the same set basket of basic consumer items.

Inflation is generally bad news for the economy, causing instability, uncertainty and hardship. To<br />

address inflation, the Fed may raise interest rates. However, the Fed relies on the <strong>PCE</strong> <strong>Deflator</strong><br />

as its primary gauge of inflation because the CPI does not account for the ability of consumer to<br />

substitute out of CPI's set. Price changes tend to cause consumers to switch from buying one<br />

good to a less expensive-other, a tendency that the fixed-basket CPI figure does not yet account<br />

for. Given that the <strong>PCE</strong> <strong>Deflator</strong> is a more comprehensive calculation, based on changes in<br />

consumption; it is the figure the Fed prefers.<br />

The figure is released monthly, as either a month over month annualized percentage change, or<br />

percentage change for the full year. The figure is seasonally adjusted to account seasonal<br />

consumption patterns.<br />

On A Technical Note: The CPI includes over 200 categories of goods and services included,<br />

divided into 8 main groups, each with a different weight: Housing, Transportation, Food, Medical<br />

Care, Education and Communication, Recreation, Apparel, and Other Goods and Services.<br />

CPI Excluding Food and Energy - United States<br />

The CPI is also reported excluding food and energy; two of its most volatile components. These<br />

components are particularly sensitive to temporary economic factors like oil prices, natural<br />

disasters and seasonal affects. Consequently, CPI excluding Food and Energy provides a more<br />

stable figure, but at the cost of overlooking two significant sectors in the economy (together food<br />

and energy comprise nearly a quarter of the goods included in the CPI).<br />

The figure is the monthly percent change in the index.<br />

Relevance: Tends to move markets on release<br />

Release schedule : 8:30 AM (EST); monthly<br />

Revisions schedule : Annual revisions made in February<br />

Source of report : Bureau of Labor Statistics, Department of Labor (U.S.)<br />

Web Address : http://www.bls.gov<br />

Address of release : http://www.bls.gov/cpi/<br />

Producer Price Index (PPI) - United States<br />

Measures changes in the selling prices producers charge for goods and services, and well as<br />

tracks how prices feed through the production process. Because producers tend to pass on<br />

higher costs to consumers as higher retail prices, the PPI is valuable as an early indicator of

inflation. Simply put, inflation reflects a decline in the purchasing power of the Dollar, where each<br />

dollar buys fewer goods and services. The report also gives insight into how higher prices from<br />

raw materials flow toward the final product.<br />

A rise in PPI signals an increase in inflationary pressures. Given the economic instability<br />

associated with rising price levels, the Fed often will raise interest rates to check inflation. A low<br />

or falling PPI is indicative of declining prices, and may suggest an economic slowdown.<br />

The headline figure is expressed in percentage change of producer price.<br />

Notes: The PPI records prices at various stages of production: raw goods, intermediate goods<br />

and finished goods. Though intermediate and crude goods price do provide insight for future<br />

inflationary pressure, it is the price of finished goods that generates most interest for market<br />

participants. The finished goods data is able to gauge price pressure before the goods reach the<br />

retail market.<br />

Core PPI, Excluding Food and Energy<br />

The PPI is also reported without the volatile food and energy components. In addition to being<br />

seasonally volatile, the two comprise a significant portion of US goods. As a result, any sudden<br />

disruption in oil or food supplies will significantly distort the Producer Price Index inflation<br />

assessment. By excluding such entities, Core PPI is able to provide a truer, more consistent<br />

picture of US inflation trends.<br />

Relevance: Moderate market impact<br />

Release schedule : 12:30 (GMT); monthly, 2 weeks after the reporting month<br />

Revision schedule: one monthly revision after four months, annual revisions every February<br />

Source of report : Bureau of Labor statistics, Department of Labor<br />

Web Address : www.bls.gov<br />

Address of release : http://www.bls.gov/ppi/<br />

Employment - (Non Farm Payrolls and<br />

Unemployment Rate) United States<br />

One of the most widely anticipated reports on the US economic calendar, the<br />

Employment Situation is a timely report that gives a picture of job creation, loss,<br />

wages and working hours in the United States. Data in the report relies on the<br />

Household Survey and the Establishment (or Payroll) Survey. While the Household<br />

Survey is based on the interviews to US households, the Establishment Survey

queries business establishments, making it the preferred source of data. The<br />

Employment Situation's has many significant figures such as: Change in Non Farm<br />

Payrolls, Unemployment, Manufacturing Payrolls, and Average Hourly Earnings.<br />

The headline figures for this report are reported monthly, as the total number of new jobs in<br />

thousands (say, 120K new jobs), and the unemployment rate.<br />

Change in Non-farm Payrolls<br />

Monthly change in employment excluding the farming sector. Non-farm payrolls is the most<br />

closely watched indicator in the Employment Situation, considered the most comprehensive<br />

measure of job creation in the US. Such a distinction makes the NFP figure highly significant,<br />

given the importance of labor to the US economy. Specifically, political pressures come into play,<br />

as the Fed is responsible for keeping employment in a healthy range and utilizes interest rate<br />

changes to do so. A surge in new Non-farm Payrolls suggests rising employment and potential<br />

inflation pressures, which the Fed often counters with rate increases. On the other hand, a<br />

consistent decline in Non-farm Employment suggests a slowing economy, which makes a decline<br />

in rates more likely.<br />

Unemployment Rate<br />

The percentage of people registered as unemployed in the United States. The figure is calculated<br />

by dividing the number of unemployed individuals in the labor force by the total labor force.<br />

Where the headline figure Change in Non-Farm Payrolls generally moves the market upon<br />

release, the Unemployment Rate serves as the most popular snap-shot figure for current labor<br />

conditions in the US.<br />

The unemployment figure can give insight into the economy's production, consumption, earnings,<br />

and consumer sentiment. A lower unemployment rate equates to increased expenditure, as more<br />

people have jobs and wages to spend. Increased expenditure encourages economic growth,<br />

which can spark inflation pressures. Conversely, high levels of unemployment signal economic<br />

instability and weakened demand.<br />

Persons are considered unemployed if they are able and willing to work but without a job and<br />

have actively sought employment within the last four weeks. The labor force includes all<br />

employed and unemployed individuals 16 years and older.<br />

Manufacturing Payrolls

Measures job creation or loss in manufacturing sector. Manufacturing Payroll is reported as the<br />

net change in jobs from the previous month's figure. The figure is significant as an indicator of the<br />

health of the manufacturing sector. A high Manufacturing Payrolls number can signal increased<br />

demand for manufactured goods and a subsequent increase in production.<br />

Average Hourly Earnings<br />

An indicator of how the average level of pay is changing. The Average Hourly Earnings figure<br />

provides insight into future spending and inflation. A High Average Hourly Earnings bodes well for<br />

future consumption, as workers have more disposable income. High figures may indicate<br />

inflationary pressures due to employee's additional potential to spend. The figure is either<br />

measured in hourly or weekly averages or as a percent change from the previous month.<br />

Relevance: Tends to move markets on release<br />

Release schedule: 8:30 (EST); monthly, usually first Friday of every month<br />

Revisions schedule: previous two months, can be major, benchmark changes every 10 years<br />

Source of report: Bureau of Labor Statistics, Department of Labor (U.S.)<br />

Web Address: http://www.bea.gov/<br />

Address of release:http://www.bls.gov/news.release/empsit.toc.htm, View Release Schedule<br />

AKA: Change in Non farm payrolls, New Job Creation, Payroll Data, Employment Rate,<br />

Unemployment Rate<br />

<strong>Personal</strong> <strong>Consumption</strong> <strong>Expenditure</strong> (<strong>PCE</strong>) - United<br />

States<br />

Comprehensive measure of how much consumers spend each month, counting<br />

expenditures on durable goods, consumer products, and services. <strong>Personal</strong><br />

<strong>Consumption</strong> is a comprehensive measure of GDP; consequently the figure is<br />

watched as an indicator for economic trends. Spending also has direct affect on<br />

inflationary pressures.<br />

A healthy <strong>Personal</strong> Spending figure means that consumers are buying goods and services,<br />

fueling the economy and spurring output growth. The report is particularly valued for forecasting<br />

inflationary pressures. Taken in excess these high levels of consumption and production may<br />

lead to an overall increase in prices. Indeed, the Fed uses a measure of inflation derived from the<br />

<strong>PCE</strong> as their primary gauge of inflation.<br />

On the other hand, persistently low <strong>Personal</strong> Spending may result in decreasing levels of output<br />

and an economic downturn.

Because income is either spent or saved, <strong>Personal</strong> Spending (when reported as a percent of<br />

income rather than the headline percent change) has an inverse relationship to personal saving.<br />

Economists watch the growth of <strong>Personal</strong> Spending in relation to income and saving to determine<br />

if consumers are living beyond their means, which would influence levels of borrowing and future<br />

consumption.<br />

The <strong>PCE</strong> figure is released in headlines as a percent change from the previous month.<br />

Core <strong>Personal</strong> <strong>Consumption</strong> <strong>Expenditure</strong><br />

Volatile items like food and energy can fluctuate widely due to seasonal and non-systemic factors.<br />

In order to provide a less erratic picture of <strong>Personal</strong> <strong>Consumption</strong>, food and energy items are<br />

excluded in the <strong>PCE</strong> core report.<br />

The headline figure of <strong>PCE</strong> is expressed in percentage change in spending for the quarter.<br />

Note: The <strong>Personal</strong> <strong>Consumption</strong> <strong>Expenditure</strong> figure is reported with the <strong>Personal</strong> Income and<br />

Outlays figure.<br />

Relevance: Moderate market impact<br />

Release schedule : 12:30 (GMT); monthly, four to five weeks after the reporting month<br />

Revisions schedule : Moderate revisions in the months following the report as more complete<br />

data is available, plus annual revision in July or August.<br />

Source of report : Bureau of Economic Analysis, Department of Commerce (U.S.)<br />

Web Address : http://www.bea.gov/<br />

Address of release : http://www.bea.gov/bea/newsrel/pinewsrelease.htm<br />

AKA : <strong>PCE</strong>, <strong>Personal</strong> Spending, <strong>Personal</strong> <strong>Consumption</strong><br />

GDP Price Index - United States<br />

Measures changes in the prices of goods and services that are included in US GDP. The GDP<br />

Price Index is an indicator for inflation calculated by comparing the current GDP to GDP in the<br />

reference year. A high or rising GDP Price Index, like other indicators of inflation, puts pressure<br />

on the Federal Reserve to raise interest rates.<br />

The GDP price index differs from other more popular inflation measures like CPI, in that it<br />

includes all products accounted for by GDP and does not include the affects of changes in import<br />

prices. Furthermore, the report is only released quarterly and commands little market attention<br />

because of it lack of timeliness.

The headline figure is the annualized percentage change.<br />

Relevance: Rarely affects markets<br />

Release schedule : 8:30 AM (EST); Quarterly<br />

Revisions schedule : Moderate monthly revisions, plus more substantial annual revisions at the<br />

end of July<br />

Source of report : Bureau of Economic Analysis, Department of Commerce (U.S.)<br />

Web Address : http://www.bea.gov/<br />

Address of release : http://www.bea.gov/bea/dn/home/gdp.htm<br />

AKA : Gross Domestic Product Index<br />

<strong>Personal</strong> Income - United States<br />

Broad gauge of employee earnings in the US . <strong>Personal</strong> Income measures the pre-tax income<br />

households receive from employment, investments, and transfer payments. As wages and<br />

salaries make up the majority of <strong>Personal</strong> Income, the figure can provide insight on the US<br />

employment situation. However, because <strong>Personal</strong> Income is released after the headline<br />

employment figure and earnings figures, its impact on the market is muted. The figure is still<br />

useful in gauging the purchasing ability of consumers, though, as rising <strong>Personal</strong> Income allows<br />

for strong consumers spending. Such spending drives output growth and fuels the US economy.<br />

Relevance: Rarely affects markets<br />

Release schedule : 8:30 AM (EST); monthly,<br />

Revisions schedule : Moderate revisions in the months following the report as more complete<br />

data is available, plus annual revision in July or August.<br />

Source of report : Bureau of Economic Analysis, Department of Commerce (U.S.)<br />

Web Address : http://www.bea.gov/<br />

Address of release : http://www.bea.gov/bea/dn/home/personalincome.htm<br />

Import Price Index - United States<br />

Tracks changes in the prices paid for goods imported to the United States . The figure is<br />

significant in relation to the trade balance, the difference between the total value of exports and<br />

the total value of imports. A positive trade balance (surplus) acts as an appreciating weight on the<br />

dollar, reflecting demand for dollars in exchange for exports. Conversely, a negative value<br />

(deficit) puts downward pressure on the dollar's value. Given such impacts, traders assess<br />

changes in import prices to gain insight on the trade balance. The Import Price Index becomes

useful in determining whether a change in import volume has actually sprung from a higher<br />

foreign demand or from a real increase in prices for foreign goods.<br />

The US is a net importer nation, where imports a significant part of the nation's GDP. Accordingly,<br />

a major price swing in foreign goods can have significant impact on the US inflation.<br />

The headline figure is the percentage change in the index from either the previous month or for<br />

the year. Import Price Index Excluding Petroleum gives a better overall assessment to the import<br />

price change in the United States since petroleum price is highly volatile.<br />

Relevance: Rarely affects markets<br />

Release schedule : 8:30 AM (EST); monthly, released monthly around the middle of the month<br />

Revisions schedule : Monthly revision to the previous three months<br />

Source of report : Bureau of Economic Analysis, Department of Commerce (U.S.)<br />

Web Address : http://www.bls.gov<br />

Address of release : http://www.bls.gov/mxp/home.htm#publications<br />

AKA : Import/Export Price Index, Import Price Index Excluding Petroleum<br />

Export Price Index - United States<br />

Tracks price changes of U.S. export goods. The figure is used to determine whether a change in<br />

the headline Export figure is representative of an increase of goods sold to foreign nations or just<br />

an increase in the price of export goods. United States exports account for approximately a tenth<br />

of the nation's GDP. The headline figure is the percentage change in the index from either the<br />

previous month or year.<br />

Relevance: Rarely affects markets<br />

Release schedule : 8:30 AM (EST); monthly, released monthly around the middle of the month<br />

Revisions schedule : Monthly revision to the previous three months<br />

Source of report : Bureau of Economic Analysis, Department of Commerce (U.S.)<br />

Web Address : http://www.bls.gov<br />

Address of release : http://www.bls.gov/mxp/home.htm#publications<br />

AKA : Import/Export Price Index

Advance Retail Sales - United States<br />

Monthly measure of sales of goods to consumers at retail outlets. The figure is a significant<br />

market mover, valuable both for its timeliness and insight into consumer demand and consumer<br />

confidence. Consumer spending is vital to the US economy, accounting for more than two-thirds<br />

of all economic activity. Given that retail sales make up a hefty one third of such spending, the<br />

Advanced Retail Sales figure acts as a measure of consumer demand before GDP is released.<br />

The figure has its limits, though. For instance, the timely release of the report comes at the cost of<br />

volatility in the figures and significant monthly revisions. It is not unusual for the figure to come out<br />

positive one month, only to be subsequently revised as negative. Retail Sales can also be volatile<br />

due to seasonality. Additionally, the report has been criticized for excluding service sector sales<br />

and failing to adjust for inflation. Despite these drawbacks, the figure still moves the market on<br />

release, mainly because of the importance of consumer spending to the US economy.<br />

The Retail Sales figure is calculated as the total receipts of retail sales in nominal dollars based<br />

on a sample of stores throughout the month - returns, taxes and finance charges are excluded. It<br />

appears in the headlines as the annualize percentage change from the previous month.<br />

Advance Retail Sales Less Autos<br />

The Retail Sales figure is also reported excluding automobile sales. Given their high cost, auto<br />

sales contribute significantly to retails sales, comprising nearly a quarter of the figure. As a result,<br />

changes in automobile sales can produce high fluctuations in the retails sales report. Vehicle<br />

sales are prone to seasonal changes, thereby easily distorting retail sales trends. To provide a<br />

more accurate picture of retail sales the auto component is removed and followed more closely.<br />

Relevance: Tends to move markets on release<br />

Release schedule : 8:30 AM (EST); monthly, midmonth and approximately two weeks following<br />

the reporting month's end<br />

Revisions schedule : Significant month to month revisions to adjust for data that was<br />

unavailable at the time of the original release. No adjustments are made for inflation.<br />

Source of report : Census Bureau, Department of Commerce<br />

Web Address : http://www.census.gov/<br />

Address of release : http://www.census.gov/svsd/www/advtable.html<br />

AKA : Monthly Advanced Retail Trade Survey, MARTS, Retail Sales Less Autos

FOMC Rate Decision - United States<br />

The announcement of whether the Federal Reserve has increased, decreased or<br />

maintained the key interest rate. The FOMC meets eight times per year to decide on<br />

monetary policy. After each meeting policy decisions are announced. The main task<br />

of the FOMC is to set the monetary stance by fixing the overnight borrowing rate,<br />

which essentially sets short-term lending rates in the US. Through this mechanism,<br />

the FOMC attempts to affect price levels in order to keep inflation within the target<br />

range while maintaining stable economic growth and employment.<br />

The Federal Reserve's Cash Rate Target decision significantly influences financial markets.<br />

Changes in rates affect interest rates for consumer loans, mortgages, bonds, and the exchange<br />

rate of the U.S. Dollar. Increases in rates or even expectations of increases tend to cause the<br />

Dollar to appreciate, while rate decreases cause the currency to depreciate. Unlike most central<br />

banks, the Federal Reserve does not announce an official target inflation rate, arguing<br />

independence and flexibility is necessary to implement monetary policy effectively.<br />

The Federal Reserve issues a statement with every rate announcement. Because the decision<br />

itself is usually highly anticipated, the wording of the FOMC statement is usually as important if<br />

not more important than the actual interest rate move made by the central bank. The FOMC<br />

statement contains the Fed's collective outlook on the economy as well as hints about future<br />

monetary policy while the change to interest rates is nothing more than a number. The statement<br />

provides clues on plans for the future. When it comes to interest rates, the future direction of rates<br />

is usually far more important than its current rate<br />

Ramifications for the U.S. Dollar<br />

Interest rate hike : The US dollar generally rallies on the back of an interest rate hike because<br />

the hike increases the yield offered by US assets. This attracts foreign investment into the US<br />

which tends to be positive for the dollar. The strength of the reaction will depend on how much<br />

the market has already priced in the decision as well as the whether the FOMC statement hints at<br />

more rate hikes to come.<br />

Interest rate cut : An interest rate cut tends to be perceived as bearish for the US dollar because<br />

the cut reduces the yield offered by US assets. The perception is that the economy has<br />

weakened enough that the Federal Reserve is forced to either reduce monetary tightening or<br />

increase the stimulus in the market to reignite growth. The strength of the reaction will depend on<br />

how much the market has already priced in the decision as well as the whether the FOMC<br />

statement hints that more rate cuts are to come.

Rates Left Unchanged : The reaction of the US dollar will depend upon whether the Fed is<br />

pausing after a prolonged tightening or easing cycle or has been pausing for some time. If it<br />

comes after a tightening cycle, it would be perceived as dollar bearish. If it is after an easing cycle,<br />

it would be perceived as dollar bullish. If they have been pausing for months already, the reaction<br />

would probably be more neutral.<br />

Relevance: Tends to move markets on release<br />

Release schedule : 2pm (EST); 8 times a year<br />

Source of report : Board of Governors of the Federal Reserve System<br />

Web Address : http://federalreserve.gov/<br />

Address of release : http://federalreserve.gov/fomc/fundsrate.htm<br />

Minutes of FOMC Meeting - United States<br />

The Federal Open Market Committee (FOMC) began publishing the minutes for its monetary<br />

policy meetings in 2005. The detailed minutes from these meetings give some of the best insight<br />

into the monetary policy decision making process and what the FED thinks about economic<br />

developments inside and outside of the US .<br />

Markets tend to focus most of their attention on the key points discussed during the meeting that<br />

suggest future interest rate changes. For example if the minutes state that high energy costs and<br />

a rapidly expanding housing market are fueling inflation, then markets participants will tend to<br />

monitor these key sectors closely in order to gauge the likelihood of a rate increases in the future.<br />

Because minutes come out three weeks after the FOMC meets, markets will discount some<br />

information in the report. Market participants tend to read into the overall mood the Federal<br />

Reserve gives during the meeting. If the FOMC is cautious about the inflationary outlook for the<br />

economy (characterized as "Hawkish"), then the market has a higher likelihood of future rate<br />

increases. If the Bank is optimistic ("Dovish") it suggests to markets that inflation is in check and<br />

that future rate increases are less likely.<br />

Relevance: Tends to move markets on release<br />

Release Schedule : Three weeks after the date of the policy decision<br />

Source of Report : Board of Governors of the Federal Reserve<br />

Web Address : http://federalreserve.gov/<br />

Address of Release : http://federalreserve.gov/fomc/

Fed Governor Speaks - United States<br />

The seven members of the Board of Governors have voting power in all three monetary tools of<br />

the Federal Reserve- open market operations, the discount rate, and reserve requirements. This<br />

makes the Board of Governors one of the most influential entities in governing U.S. monetary<br />

policy. Their speeches are important opportunities for markets to better understand Fed goals for<br />

the US economy and monetary policy, as well as understand the stance Governors take on<br />

significant economic issues. If the overall sentiment of the Governors is different from<br />

expectations, markets tend to move immediately in response to potential changes in future<br />

policies.<br />

Relevance: Tends to move markets on release<br />

Release schedule : No set schedule<br />

Source of report : Board of Governors of the Federal Reserve System<br />

Web Address : http://federalreserve.gov/<br />

Address of release : http://federalreserve.gov/newsevents.htm<br />

Fed President Speaks - United States<br />

There are 12 Federal Reserve Presidents, each from a different district of the country. All<br />

Reserve Bank Presidents attend the meetings of the Federal Open Market Committee (FOMC),<br />

but only five are allowed to vote on monetary policy. Although markets pay attention to all<br />

Presidents for their assessment of overall economic health, particular interest is focused on the<br />

comments of the voting members. As one of the most influential monetary policy tool, open<br />

market purchases can affect the money supply and move short-term interest rates. Speeches<br />

made by voting members are opportunities for markets to better understand the FOMC and its<br />

monetary policy goals, but even non-voting members may give insight into the direction of<br />

monetary policy in their statements. If a speech suggest sentiment in the FOMC is different from<br />

expectations, markets tend to move immediately.<br />

Markets focus heavily on the language used in speeches. If the President is cautious about the<br />

inflationary outlook for the economy ("Hawkish"), then the market sees a higher likelihood of<br />

future rate increases. Optimism in the President's outlook ("Dovish") would suggest to markets<br />

that inflation is in check and that future rate increases are less likely, with the possibility of<br />

declines in rates.

On a Technical Note: The Federal Open Market Committee (FOMC) consists of twelve members-<br />

-the seven members of the Board of Governors of the Federal Reserve System; the president of<br />

the Federal Reserve Bank of New York; and four of the remaining eleven Reserve Bank<br />

presidents, who serve one-year terms on a rotating basis.<br />

Relevance: Tends to move markets on release<br />

Release schedule : Not set schedule<br />

Source of report : Board of Governors of the Federal Reserve System<br />

Web Address : http://federalreserve.gov/<br />

Address of release : http://federalreserve.gov/newsevents.htm<br />

Employment - (Non Farm Payrolls and<br />

Unemployment Rate) United States<br />

One of the most widely anticipated reports on the US economic calendar, the<br />

Employment Situation is a timely report that gives a picture of job creation, loss,<br />

wages and working hours in the United States. Data in the report relies on the<br />

Household Survey and the Establishment (or Payroll) Survey. While the Household<br />

Survey is based on the interviews to US households, the Establishment Survey<br />

queries business establishments, making it the preferred source of data. The<br />

Employment Situation's has many significant figures such as: Change in Non Farm<br />

Payrolls, Unemployment, Manufacturing Payrolls, and Average Hourly Earnings.<br />

The headline figures for this report are reported monthly, as the total number of new jobs in<br />

thousands (say, 120K new jobs), and the unemployment rate.<br />

Change in Non-farm Payrolls<br />

Monthly change in employment excluding the farming sector. Non-farm payrolls is the most<br />

closely watched indicator in the Employment Situation, considered the most comprehensive<br />

measure of job creation in the US. Such a distinction makes the NFP figure highly significant,<br />

given the importance of labor to the US economy. Specifically, political pressures come into play,<br />

as the Fed is responsible for keeping employment in a healthy range and utilizes interest rate<br />

changes to do so. A surge in new Non-farm Payrolls suggests rising employment and potential<br />

inflation pressures, which the Fed often counters with rate increases. On the other hand, a<br />

consistent decline in Non-farm Employment suggests a slowing economy, which makes a decline<br />

in rates more likely.

Unemployment Rate<br />

The percentage of people registered as unemployed in the United States. The figure is calculated<br />

by dividing the number of unemployed individuals in the labor force by the total labor force.<br />

Where the headline figure Change in Non-Farm Payrolls generally moves the market upon<br />

release, the Unemployment Rate serves as the most popular snap-shot figure for current labor<br />

conditions in the US.<br />

The unemployment figure can give insight into the economy's production, consumption, earnings,<br />

and consumer sentiment. A lower unemployment rate equates to increased expenditure, as more<br />

people have jobs and wages to spend. Increased expenditure encourages economic growth,<br />

which can spark inflation pressures. Conversely, high levels of unemployment signal economic<br />

instability and weakened demand.<br />

Persons are considered unemployed if they are able and willing to work but without a job and<br />

have actively sought employment within the last four weeks. The labor force includes all<br />

employed and unemployed individuals 16 years and older.<br />

Manufacturing Payrolls<br />

Measures job creation or loss in manufacturing sector. Manufacturing Payroll is reported as the<br />

net change in jobs from the previous month's figure. The figure is significant as an indicator of the<br />

health of the manufacturing sector. A high Manufacturing Payrolls number can signal increased<br />

demand for manufactured goods and a subsequent increase in production.<br />

Average Hourly Earnings<br />

An indicator of how the average level of pay is changing. The Average Hourly Earnings figure<br />

provides insight into future spending and inflation. A High Average Hourly Earnings bodes well for<br />

future consumption, as workers have more disposable income. High figures may indicate<br />

inflationary pressures due to employee's additional potential to spend. The figure is either<br />

measured in hourly or weekly averages or as a percent change from the previous month.<br />

Relevance: Tends to move markets on release<br />

Release schedule: 8:30 (EST); monthly, usually first Friday of every month<br />

Revisions schedule: previous two months, can be major, benchmark changes every 10 years<br />

Source of report: Bureau of Labor Statistics, Department of Labor (U.S.)<br />

Web Address: http://www.bea.gov/<br />

Address of release:http://www.bls.gov/news.release/empsit.toc.htm, View Release Schedule

AKA: Change in Non farm payrolls, New Job Creation, Payroll Data, Employment Rate,<br />

Unemployment Rate<br />

Unemployment Rate - United States<br />

The US Unemployment Rate reflects the percentage of people considered<br />

unemployed in the United States. Unemployment is the single most popularly used<br />

figure to give a snapshot of US labor market conditions. Because the Federal<br />

Reserve is under strict pressure to keep unemployment under control, high<br />

unemployment puts downward pressure on interest rates, as the Fed will look to<br />

bolster the economy to remedy the employment situation.<br />

More generally, unemployment is indicative of the economy's production, private consumption,<br />

workers' earnings, and consumer sentiment. A lower unemployment rate translates into more<br />

employed individuals with paychecks, which leads to higher consumer spending, economic<br />

growth and potential inflationary pressures. Conversely, high levels of unemployment are<br />

connected with lower incomes, lower spending, and economic stagnation.<br />

Note: The figure is calculated by dividing the number of unemployed individuals in the labor force<br />

by the total labor force. Technically, Unemployment Rate = (# Unemployed Persons in Labor<br />

Force) / (Total # Persons in Labor Force). Persons are considered unemployed if they are able<br />

and willing to work but without a job and have actively sought employment within the last 4 weeks.<br />

The labor force includes all employed and unemployed individuals 16 years and older. Thus<br />

Unemployment could technical alter based on changes in the number of people in the people in<br />

the workforce, or changes in the number of people looking for employment.<br />

Relevance: Moderate market impact<br />

Release schedule : 8:30 (EST); monthly, usually first Friday of every month,<br />

Revisions schedule : previous two months, can be major, benchmark changes every 10 years<br />

Source of report: Bureau of Labor Statistics, Department of Labor (U.S.)<br />

Web Address : http://www.bls.gov/home.htm<br />

Address of release : http://www.bls.gov/news.release/empsit.toc.htm

Building Permits - United States<br />

The number of new building projects authorized for construction. Because receiving a Building<br />

Permit is the first step in the construction process, the figure is used as the earliest indicator for<br />

developments in the housing market. Additionally, because of the high outlays needed for<br />

construction projects an increase in Building Permits implies an increase in investment and<br />

corporate optimism. Finally, the figure gives insight into consumer activity, since new home<br />

purchases are associated with an increase in sales of "big ticket" durable goods. Given such<br />

connections to consumer and corporate sentiment, real estate generally leads economic<br />

developments - thriving at the start of a boom and waning at the onset of recession .<br />

Considering the above, one would expect the Building Permits figure to significantly move<br />

markets. After all, Building Permits is a part of the Conference Board's Leading Indicators index<br />

used to forecast US growth. However, the timeliness of the figure comes at a cost. The report is<br />

far removed from end market impacts, making it a less market-moving figure.<br />

The report headline number is expressed in total volume of permits issued and percentage<br />

change from<br />

Relevance: Rarely affects markets<br />

Release schedule : 8:30 AM (EST); monthly, two or three weeks after the reporting month<br />

Source of report : U.S. Census Bureau<br />

Web Address : www.census.gov<br />

Address of release : www.census.gov/const/www/newresconstindex.html<br />

Construction Spending - United States<br />

Construction spending gauges the level of construction activity in the United States . The<br />

Construction Spending report looks at both residential and non-residential construction. The<br />

construction industry makes a significant contribution to the United States GDP in the form of<br />

investment expenditure as well as stimulus of industries related to building. Furthermore, since<br />

builders are unlikely to pour money into construction projects unless they feel the economy favors<br />

their investment, changes in business sentiment like this are usually quickly seen in construction<br />

figures. However, the report has little significance for market participants because of its untimely<br />

release. By the time the report is announced other reports, such building permits and building<br />

starts have already provided similar information.<br />

The report headline is the percentage change from the previous month.

Technical notes: The construction industry is a major force to the United States economy, even<br />

without including non-construction businesses that are tied to building, such as finance, the<br />

furnishing industry, appliance industry and other manufacturing. Private Construction activity can<br />

be an effective indicator of business confidence.<br />

Relevance: Rarely affects markets<br />

Release schedule : 10:00 AM (EST); monthly, five weeks after the reported month<br />

Revision schedule: previous two months with new release, can be major<br />

Source of report : U.S. Census Bureau<br />

Web Address : http://www.census.gov<br />

Address of release : http://www.census.gov/const/www/c30index.html<br />

Housing Starts - United States<br />

Gauges the change in the number of new houses built in the United States. Housing<br />

Starts are one of the earliest indicators of the housing market, only trailing Building<br />

Permits in timeliness.<br />

Because high outlays are needed to start construction projects, an increase in Housing Starts<br />

implies an increase in investment and business optimism. Finally, the Housing Starts figure gives<br />

insight into consumer activity, since new home purchases typically require a large investment for<br />

consumers. Given such connections to consumer and corporate sentiment, real estate generally<br />

leads economic developments. A sharp drop in new home construction is a warning signal of<br />

economic slowdown. Conversely, a rebound in the Housing Starts paves the way for economic<br />

recovery.<br />

Housing Starts data is differentiated by building types (single family houses, 2 to 4 residence<br />

units and 5 or more residence units). The single family housing starts is a more reliable economic<br />

indicator than multi family housing starts, as single family house building is driven by demand and<br />

consumer confidence, whereas multi family house building is more often motivated by speculative<br />

real estate investors. The report headline is expressed in volume of houses built. The figures are<br />

in the thousands of units.<br />

Relevance: Tends to move markets on release<br />

Release schedule : 8:30 AM (EST); monthly, two or three weeks after the reporting month<br />

Source of report : U.S. Census Bureau<br />

Web Address : www.census.gov<br />

Address of release : www.census.gov/const/www/newresconstindex.html

MBA Mortgage Applications - United States<br />

Gauges demand for mortgage application in the US . Tracking new home mortgages and<br />

refinances, MBA Mortgage Applications Survey serves at a current indicator for the US housing<br />

market. Growth in mortgages suggests a healthy housing market. Due to the multiplier effect<br />

housing has on the rest of the economy, rising activity suggests increased household income and<br />

economic expansion. The headline figure is the weekly percentage change in the MBA Mortgage<br />

Applications figure.<br />

Among the various indices measured in the survey, the purchase index and refinancing index<br />

most accurately reflect where the housing market is headed. The purchasing index measures the<br />

change in existing home sales in all mortgage applications, while the refinance index measures<br />

the mortgage refinancing activity in all mortgage applications.<br />

Note: Due to volatility in the sector, markets also focus on the four week moving averages.<br />

Relevance: Rarely affects markets<br />

Release schedule : 7:00 AM (EST); weekly, every Wednesday with previous week report<br />

Revisions schedule : At this point we are unclear<br />

Source of report : Mortgage Bankers Association<br />

Web Address : http://www.mortgagebankers.org<br />

Address of release : http://www.mortgagebankers.org/NewsandMedia/PressCenter<br />

AKA : Mortgage Applications Survey<br />

Pending Home Sales - United States<br />

Tracks residential housing contract activity of existing single-family homes. The Pending Home<br />

Sales report is an advanced read on trends in the US housing market. Housing is typically<br />

correlated to the overall state of the economy; particularly indicative of economic turning points. A<br />

sharp drop in housing demand typically acts as a warning signal of economic slowdown as<br />

buyers are reluctant to purchase houses when interest rates are high, disposable income is low,

or consumer confidence is low. Conversely, a rebound in the housing market is often a leading<br />

indicator of an economic recovery.<br />

The report headline is expressed in percentage change in pending home sales from previous<br />

month.<br />

Relevance: Rarely affects markets<br />

Release schedule : 10:00 AM (EST); monthly, 4 weeks after reporting month<br />

Source of report : National Association of Realtors<br />

Web Address : http://www.realtor.org|<br />

Address of release : http://www.realtor.org/Research.nsf/Pages/PHSdata<br />

New Home Sales - United States<br />

Records sales of newly constructed residences in the United States . The figure is a timely gauge<br />

of housing market conditions counting home sales when initial housing contracts are signed.<br />

Because New Home Sales usually trigger a sequence of consumption, they have significant<br />

market impact upon release. In addition to the high expenditure of the new home, buyers are<br />

likely to spend more money on furnishing customizing and financing their home. Consequently, g<br />

rowth in the housing market spurs more consumption, generating demand for goods, services<br />

and the employees who provide them.<br />

Generally the housing market is tracked by a number of reports that mark different stages of the<br />

construction and home sale process. The first stage is Building Permits, which precede Housing<br />

Starts, which lead to Construction Spending, MBA Mortgage Applications and, finally, New Home<br />

Sales and Existing Home Sales. As the headline housing figure, New Home Sales are believed to<br />

control for some of the volatility of other data. For instance, Building Permits and Housing Starts<br />

are considered more indicative of business confidence and production rather than consumer<br />

spending. And while Existing Home Sales figures are more indicative of consumer expenditures,<br />

they are lagging indicators with less predictive value. New Home Sales numbers are considered<br />

confirmatory of housing trends and still predictive of consumer spending.<br />

New Home Sales is also a good indicator of economic turning points due to its sensitivity to<br />

consumer income. Buying a house is always a major expenditure, typically only undertaken when<br />

consumers have sufficient savings or are optimistic about future earnings. Historically, when<br />

economic conditions slow, New Home Sales are one of the first indicators to reflect the change.

By the same token, New Home Sales undergo substantial growth when the economy has<br />

emerged from recession and wages have begun to pick up.<br />

The report headline is the total amount of properties sold.<br />

Relevance: Tends to move markets on release<br />

Release schedule : 10:00 (EST); monthly, four weeks after the reporting month<br />

Revisions schedule : frequent revisions cover the preceding three months<br />

Source of report : U.S. Census Bureau<br />

Web Address : http://www.census.gov<br />

Address of release : http://www.census.gov/const/www/newressalesindex.html<br />

Existing Home Sales - United States<br />

Records sales of previously owned homes in the United States . This report provides a fairly<br />

accurate assessment of housing market conditions, and because of the sensitivity of the housing<br />

market to business cycle twists, it can be an important indicator of overall conditions at times<br />

when housing is particularly important to the economy.<br />

While used home sales are not counted in GDP, they do affect the United States economy.<br />

Sellers of used homes often use capital gains from property sales on consumption that stimulate<br />

the economy. Higher levels of consumer spending may also increase inflationary pressures, even<br />

as they help grow the economy.<br />

The existing home sales report is not as timely as other housing indicators like New Home Sales<br />

or Building Permits. By the time the Existing Home Sales are recorded, market conditions may<br />

have changed.<br />

The headline is the total value of properties sold.<br />

Relevance: Rarely affects markets<br />

Release schedule : 10:00 AM (EST); monthly, mid-month and covers the same month<br />

Source of report : National Association of Realtors<br />

Web Address : http://www.realtor.org<br />

Address of release : http://www.realtor.org/Research.nsf/Pages/EHSdata

NAHB Housing Market Index - United States<br />

A timely gauge of home sales and expectations for future home building. Based on a small<br />

sample of homebuilders, the Housing Market Index is a timely indicator of future US home sales.<br />

However, as the index is not as comprehensive as formal housing reports like new home sales or<br />

MBA mortgage applications, the index acts more like a supplemental indicator for predicting<br />

housing trends.<br />

As such, the NAHB Housing Market Index is still able to provide general insight to where the<br />

housing market is heading. Given that new home sales reflect 'big ticket' items that require<br />

construction and investment, the housing market is often viewed as an indicator of the direction of<br />

the economy as a whole. Growth in the housing market will spur subsequent spending,<br />

generating demand for goods and services and the employees who provide them.<br />

The report headline is expressed in percentage change from the previous month.<br />

As a Technical Aside: The NAHB Housing Market Index divides the Single-Family Sales data into<br />

three categories: Present, Next 6 Months and Prospective Buyers Traffic.<br />

Relevance: Rarely affects markets<br />

Release schedule : 1:00 PM (EST); monthly, mid-month and covers the same month<br />

Source of report : National Association of home Builders<br />

Web Address : www.nahb.org<br />

Address of release : http://www.nahb.org/ (type "HMI" in search box)