ANIMA PRIMA FUNDS PLC FIRST ADDENDUM TO ... - ANIMA Sgr

ANIMA PRIMA FUNDS PLC FIRST ADDENDUM TO ... - ANIMA Sgr

ANIMA PRIMA FUNDS PLC FIRST ADDENDUM TO ... - ANIMA Sgr

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

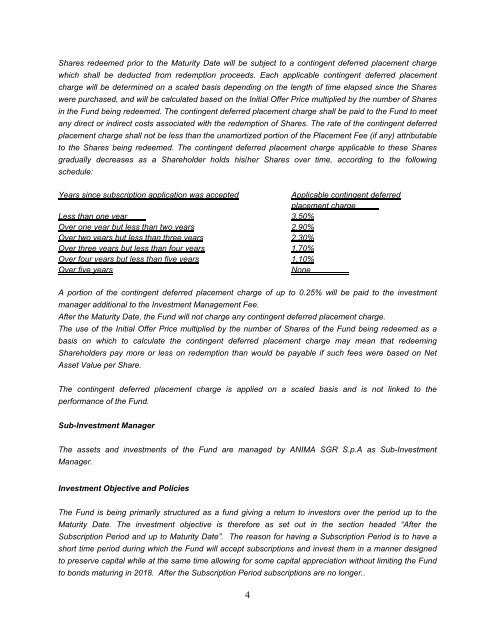

Shares redeemed prior to the Maturity Date will be subject to a contingent deferred placement charge<br />

which shall be deducted from redemption proceeds. Each applicable contingent deferred placement<br />

charge will be determined on a scaled basis depending on the length of time elapsed since the Shares<br />

were purchased, and will be calculated based on the Initial Offer Price multiplied by the number of Shares<br />

in the Fund being redeemed. The contingent deferred placement charge shall be paid to the Fund to meet<br />

any direct or indirect costs associated with the redemption of Shares. The rate of the contingent deferred<br />

placement charge shall not be less than the unamortized portion of the Placement Fee (if any) attributable<br />

to the Shares being redeemed. The contingent deferred placement charge applicable to these Shares<br />

gradually decreases as a Shareholder holds his/her Shares over time, according to the following<br />

schedule:<br />

Years since subscription application was accepted Applicable contingent deferred<br />

placement charge<br />

Less than one year 3.50%<br />

Over one year but less than two years 2.90%<br />

Over two years but less than three years 2.30%<br />

Over three years but less than four years<br />

1.70%<br />

Over four years but less than five years<br />

1.10%<br />

Over five years None<br />

A portion of the contingent deferred placement charge of up to 0.25% will be paid to the investment<br />

manager additional to the Investment Management Fee.<br />

After the Maturity Date, the Fund will not charge any contingent deferred placement charge.<br />

The use of the Initial Offer Price multiplied by the number of Shares of the Fund being redeemed as a<br />

basis on which to calculate the contingent deferred placement charge may mean that redeeming<br />

Shareholders pay more or less on redemption than would be payable if such fees were based on Net<br />

Asset Value per Share.<br />

The contingent deferred placement charge is applied on a scaled basis and is not linked to the<br />

performance of the Fund.<br />

Sub-Investment Manager<br />

The assets and investments of the Fund are managed by <strong>ANIMA</strong> SGR S.p.A as Sub-Investment<br />

Manager.<br />

Investment Objective and Policies<br />

The Fund is being primarily structured as a fund giving a return to investors over the period up to the<br />

Maturity Date. The investment objective is therefore as set out in the section headed “After the<br />

Subscription Period and up to Maturity Date”. The reason for having a Subscription Period is to have a<br />

short time period during which the Fund will accept subscriptions and invest them in a manner designed<br />

to preserve capital while at the same time allowing for some capital appreciation without limiting the Fund<br />

to bonds maturing in 2018. After the Subscription Period subscriptions are no longer..<br />

4