hawaii small business regulatory review board - Legislative ...

hawaii small business regulatory review board - Legislative ...

hawaii small business regulatory review board - Legislative ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

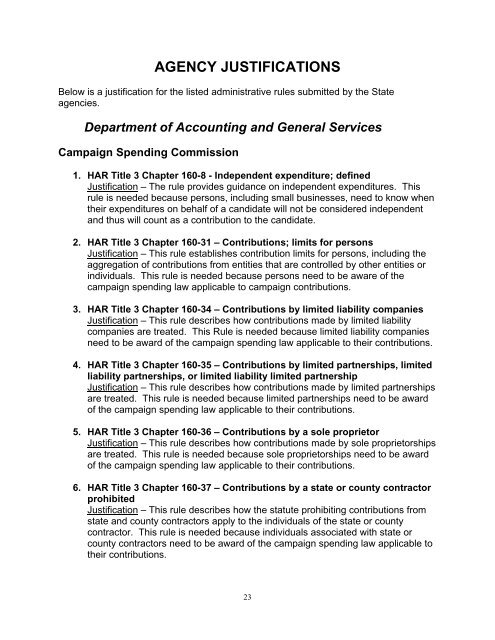

AGENCY JUSTIFICATIONS<br />

Below is a justification for the listed administrative rules submitted by the State<br />

agencies.<br />

Department of Accounting and General Services<br />

Campaign Spending Commission<br />

1. HAR Title 3 Chapter 160-8 - Independent expenditure; defined<br />

Justification – The rule provides guidance on independent expenditures. This<br />

rule is needed because persons, including <strong>small</strong> <strong>business</strong>es, need to know when<br />

their expenditures on behalf of a candidate will not be considered independent<br />

and thus will count as a contribution to the candidate.<br />

2. HAR Title 3 Chapter 160-31 – Contributions; limits for persons<br />

Justification – This rule establishes contribution limits for persons, including the<br />

aggregation of contributions from entities that are controlled by other entities or<br />

individuals. This rule is needed because persons need to be aware of the<br />

campaign spending law applicable to campaign contributions.<br />

3. HAR Title 3 Chapter 160-34 – Contributions by limited liability companies<br />

Justification – This rule describes how contributions made by limited liability<br />

companies are treated. This Rule is needed because limited liability companies<br />

need to be award of the campaign spending law applicable to their contributions.<br />

4. HAR Title 3 Chapter 160-35 – Contributions by limited partnerships, limited<br />

liability partnerships, or limited liability limited partnership<br />

Justification – This rule describes how contributions made by limited partnerships<br />

are treated. This rule is needed because limited partnerships need to be award<br />

of the campaign spending law applicable to their contributions.<br />

5. HAR Title 3 Chapter 160-36 – Contributions by a sole proprietor<br />

Justification – This rule describes how contributions made by sole proprietorships<br />

are treated. This rule is needed because sole proprietorships need to be award<br />

of the campaign spending law applicable to their contributions.<br />

6. HAR Title 3 Chapter 160-37 – Contributions by a state or county contractor<br />

prohibited<br />

Justification – This rule describes how the statute prohibiting contributions from<br />

state and county contractors apply to the individuals of the state or county<br />

contractor. This rule is needed because individuals associated with state or<br />

county contractors need to be award of the campaign spending law applicable to<br />

their contributions.<br />

23