The Impact of Innovative Activity in Economic Performance: An ...

The Impact of Innovative Activity in Economic Performance: An ...

The Impact of Innovative Activity in Economic Performance: An ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

International Conference on Applied <strong>Economic</strong>s – ICOAE 2008 599<br />

4.3. <strong>The</strong> Econometric Model<br />

Through the logistic regression analysis, we tried to explore the relationship between firm’s performance (<strong>in</strong>crease <strong>in</strong> the rate <strong>of</strong> sales and<br />

the employment) and the explanatory variables (size, <strong>in</strong>novation, ownership and <strong>in</strong>vestment). Both factors seem so far to be strongly<br />

correlated (positively) with the existed R&D process, as the pre-mentioned results underl<strong>in</strong>ed.<br />

As we can see to the follow<strong>in</strong>g tables, the predictability <strong>of</strong> the model seem to quite good, which validates our analysis, the results <strong>of</strong><br />

which are apposed to table 3.<br />

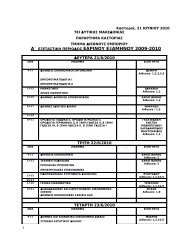

Tables 4-6: Result <strong>of</strong> the regression (sales)<br />

Model Summary<br />

-2 Log Cox & Snell Nagelkerke<br />

Step likelihood R Square R Square<br />

1 50,747 a a Estimation term<strong>in</strong>ated at iteration number 7 because<br />

parameter estimates changed by less than ,001.<br />

,317 ,424<br />

Observed<br />

Classification Table(a)<br />

Predicted<br />

DS96_05 Percentage Correct<br />

,00 1,00<br />

Step 1 DS96_05 ,00 24 4 85,7<br />

1,00 10 13 56,5<br />

a <strong>The</strong> cut value is ,500<br />

Overall Percentage 72,5<br />

Variables <strong>in</strong> the Equation<br />

B S.E. Wald Df Sig. Exp(B)<br />

Step 1(a) DF96_05 ,003 ,002 3,507 1 ,061 1,003<br />

Ownership 1,348 1,024 1,734 1 ,188 3,851<br />

Size -,197 ,357 ,305 1 ,581 ,821<br />

Innovation 2,975 1,274 5,454 1 ,020 19,586<br />

Constant -6,781 2,672 6,442 1 ,011 ,001<br />

a Variable(s) entered on step 1: DF96_05, Ownership, Size, Innovation<br />

As it is clear, <strong>in</strong>novation is the most important factor <strong>in</strong> the <strong>in</strong>terpretation <strong>of</strong> sales’ growth (<strong>in</strong> a 5% ratio), with <strong>in</strong>vestment <strong>in</strong> fixed assets<br />

to follow (sig. <strong>in</strong> a 10% ratio). As for the rema<strong>in</strong>der two variables Size and Ownership Status, they proved to be not significant <strong>in</strong> the<br />

<strong>in</strong>terpretation <strong>of</strong> the dependent variable. Logistic regression <strong>of</strong>fers us also the opportunity to calculate the exact impact <strong>of</strong> each explanatory<br />

variable to the dependent one, exam<strong>in</strong><strong>in</strong>g the odds ratio (Exp(B)), which represents the ratio-change <strong>in</strong> the odds <strong>of</strong> the event (<strong>of</strong> <strong>in</strong>terest) for<br />

an one-unit change <strong>in</strong> the predictor. It is the exponentiation <strong>of</strong> B coefficients, and is apposed to the last column <strong>of</strong> table 6. It is clear from the<br />

results, that the impact <strong>of</strong> the development <strong>of</strong> <strong>in</strong>novative activity <strong>in</strong> turnover’s growth, is almost twenty times the impact <strong>of</strong> the <strong>in</strong>crease <strong>in</strong><br />

fixed assets’ <strong>in</strong>vestment, mean<strong>in</strong>g that firm that present such activities, is 20 times more possible to present higher than sector’s average, rate<br />

<strong>of</strong> sales’ growth.<br />

Similar are the results concern<strong>in</strong>g employment as the dependent variable as apposed below, with <strong>in</strong>novation to be very important <strong>in</strong> the<br />

generation <strong>of</strong> employment (and as a result to firm’s growth), along with size. <strong>The</strong> latter, although seem to be logical as larger firms need more<br />

personnel, however, is <strong>in</strong>dicative <strong>of</strong> the m<strong>in</strong>or role <strong>of</strong> Greek pharmaceutical SMEs <strong>in</strong> the <strong>in</strong>crease <strong>in</strong> employment <strong>in</strong> the sector.<br />

Tables 7-9: Results <strong>of</strong> the regression (employment)<br />

Model Summary<br />

-2 Log Cox & Snell Nagelkerke<br />

Step likelihood R Square R Square<br />

1 56,624 a a Estimation term<strong>in</strong>ated at iteration number 5 because<br />

parameter estimates changed by less than ,001.<br />

,235 ,319