Salary Sacrifice for Work-Related Training - University of Ulster

Salary Sacrifice for Work-Related Training - University of Ulster

Salary Sacrifice for Work-Related Training - University of Ulster

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Salary</strong> <strong>Sacrifice</strong> <strong>for</strong> <strong>Work</strong>-<strong>Related</strong> <strong>Training</strong><br />

All staff should be aware that there is a specific tax exemption <strong>for</strong> work-related training. This exemption<br />

makes the provision <strong>of</strong> work-related training suitable <strong>for</strong> a salary sacrifice scheme/arrangement. The<br />

exemption also applies to NlCs.<br />

What is work-related training?<br />

The term "work-related training" means a training course or other activity designed to impart, instil, improve<br />

or rein<strong>for</strong>ce any knowledge, skills or personal qualities that are likely to prove useful to the employee when<br />

per<strong>for</strong>ming the duties <strong>of</strong> the employment, or will qualify or better qualify the employee to per<strong>for</strong>m those<br />

duties.<br />

Scope <strong>of</strong> the exemption<br />

Where training is provided <strong>for</strong> an employee, any benefit incidental to such training, or the payment or<br />

reimbursement <strong>of</strong>:-<br />

the cost <strong>of</strong> such training or benefit,<br />

costs that are incidental to the employee undertaking the training, and in line with normal<br />

<strong>University</strong> expenses guidelines<br />

expenses incurred in connection with an examination or other assessment <strong>of</strong> what the<br />

employee has gained from the training, and<br />

the cost <strong>of</strong> obtaining any qualification, registration or "award" to which the employee is<br />

entitled as a result <strong>of</strong> such training, examination or assessment.<br />

How do you apply?<br />

If you feel that you have paid <strong>for</strong> a course that falls within the work related training category, please<br />

submit the following to your line manager <strong>for</strong> approval:-<br />

1. Completed work related training claim pro-<strong>for</strong>ma (See <strong>Work</strong> <strong>Related</strong> <strong>Training</strong> Pro-<strong>for</strong>ma)<br />

2. Documentation outlining details <strong>of</strong> training provider, training & content<br />

3. Evidence <strong>of</strong> personal payment <strong>for</strong> work related training e.g. receipt as pro<strong>of</strong> <strong>of</strong> payment<br />

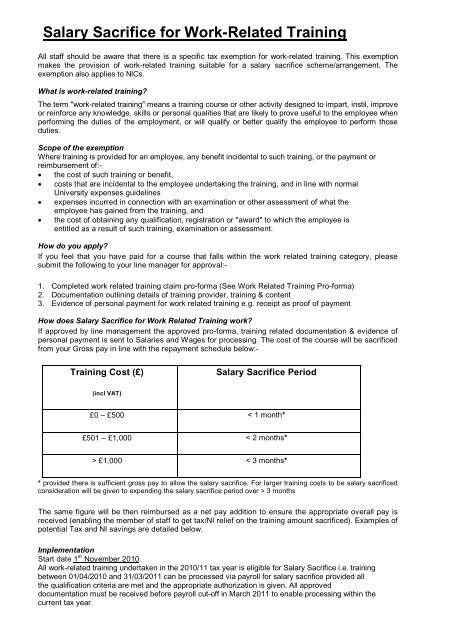

How does <strong>Salary</strong> <strong>Sacrifice</strong> <strong>for</strong> <strong>Work</strong> <strong>Related</strong> <strong>Training</strong> work?<br />

If approved by line management the approved pro-<strong>for</strong>ma, training related documentation & evidence <strong>of</strong><br />

personal payment is sent to Salaries and Wages <strong>for</strong> processing. The cost <strong>of</strong> the course will be sacrificed<br />

from your Gross pay in line with the repayment schedule below:-<br />

<strong>Training</strong> Cost (£)<br />

(incl VAT)<br />

<strong>Salary</strong> <strong>Sacrifice</strong> Period<br />

£0 – £500 < 1 month*<br />

£501 – £1,000 < 2 months*<br />

> £1,000 < 3 months*<br />

* provided there is sufficient gross pay to allow the salary sacrifice. For larger training costs to be salary sacrificed<br />

consideration will be given to expending the salary sacrifice period over > 3 months<br />

The same figure will be then reimbursed as a net pay addition to ensure the appropriate overall pay is<br />

received (enabling the member <strong>of</strong> staff to get tax/NI relief on the training amount sacrificed). Examples <strong>of</strong><br />

potential Tax and NI savings are detailed below.<br />

Implementation<br />

Start date 1 st November 2010.<br />

All work-related training undertaken in the 2010/11 tax year is eligible <strong>for</strong> <strong>Salary</strong> <strong>Sacrifice</strong> i.e. training<br />

between 01/04/2010 and 31/03/2011 can be processed via payroll <strong>for</strong> salary sacrifice provided all<br />

the qualification criteria are met and the appropriate authorization is given. All approved<br />

documentation must be received be<strong>for</strong>e payroll cut-<strong>of</strong>f in March 2011 to enable processing within the<br />

current tax year.

Deduction over 1 month<br />

WORK RELATED TRAINING SAVINGS<br />

EMPLOYEE FINANCIALS Basic Taxpayer<br />

Higher taxpayer<br />

20% tax and 9.4% NI 40% tax and 1% NI<br />

Cost <strong>of</strong> training incl. VAT 495.00 495.00<br />

Duration <strong>of</strong> deductions 1 month 1 month<br />

Monthly deduction 495.00 495.00<br />

Less tax saving -99.00 -198.00<br />

Less NI saving -46.53 -4.95<br />

Total cost after tax & NI<br />

savings<br />

349.47 292.05<br />

Deduction over 2 months<br />

EMPLOYEE FINANCIALS Basic Taxpayer<br />

20% tax and 9.4% NI 40% tax and 1% NI<br />

Cost <strong>of</strong> training incl. VAT 995.00 995.00<br />

Duration <strong>of</strong> deductions 2 months 2 months<br />

Monthly deduction 497.50 497.50<br />

Less tax saving -99.50 -199.00<br />

Less NI saving -46.77 -4.98<br />

Monthly net reduction 351.23 293.52<br />

Total cost after tax & NI<br />

savings<br />

702.46 587.04<br />

Deduction over 3 months<br />

EMPLOYEE FINANCIALS Basic Taxpayer<br />

Higher taxpayer<br />

Higher taxpayer<br />

20% tax and 9.4% NI 40% tax and 1% NI<br />

Cost <strong>of</strong> training incl. VAT 1495.00 1495.00<br />

Duration <strong>of</strong> deductions 3 months 3 months<br />

Monthly deduction 498.33 498.33<br />

Less tax saving -99.67 -199.33<br />

Less NI saving -46.84 -4.98<br />

Monthly net reduction 351.82 294.02<br />

Total cost after tax & NI<br />

savings<br />

1055.46 882.06