Ponzi scheme - Morningbull

Ponzi scheme - Morningbull

Ponzi scheme - Morningbull

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Ponzi</strong> <strong>scheme</strong><br />

From Wikipedia, the free encyclopedia<br />

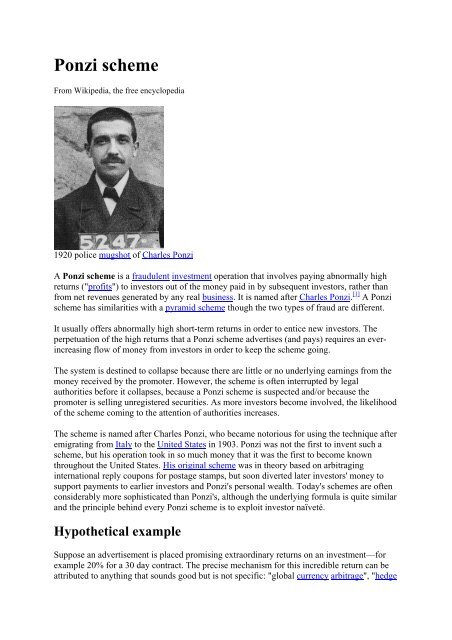

1920 police mugshot of Charles <strong>Ponzi</strong><br />

A <strong>Ponzi</strong> <strong>scheme</strong> is a fraudulent investment operation that involves paying abnormally high<br />

returns ("profits") to investors out of the money paid in by subsequent investors, rather than<br />

from net revenues generated by any real business. It is named after Charles <strong>Ponzi</strong>. [1] A <strong>Ponzi</strong><br />

<strong>scheme</strong> has similarities with a pyramid <strong>scheme</strong> though the two types of fraud are different.<br />

It usually offers abnormally high short-term returns in order to entice new investors. The<br />

perpetuation of the high returns that a <strong>Ponzi</strong> <strong>scheme</strong> advertises (and pays) requires an everincreasing<br />

flow of money from investors in order to keep the <strong>scheme</strong> going.<br />

The system is destined to collapse because there are little or no underlying earnings from the<br />

money received by the promoter. However, the <strong>scheme</strong> is often interrupted by legal<br />

authorities before it collapses, because a <strong>Ponzi</strong> <strong>scheme</strong> is suspected and/or because the<br />

promoter is selling unregistered securities. As more investors become involved, the likelihood<br />

of the <strong>scheme</strong> coming to the attention of authorities increases.<br />

The <strong>scheme</strong> is named after Charles <strong>Ponzi</strong>, who became notorious for using the technique after<br />

emigrating from Italy to the United States in 1903. <strong>Ponzi</strong> was not the first to invent such a<br />

<strong>scheme</strong>, but his operation took in so much money that it was the first to become known<br />

throughout the United States. His original <strong>scheme</strong> was in theory based on arbitraging<br />

international reply coupons for postage stamps, but soon diverted later investors' money to<br />

support payments to earlier investors and <strong>Ponzi</strong>'s personal wealth. Today's <strong>scheme</strong>s are often<br />

considerably more sophisticated than <strong>Ponzi</strong>'s, although the underlying formula is quite similar<br />

and the principle behind every <strong>Ponzi</strong> <strong>scheme</strong> is to exploit investor naïveté.<br />

Hypothetical example<br />

Suppose an advertisement is placed promising extraordinary returns on an investment—for<br />

example 20% for a 30 day contract. The precise mechanism for this incredible return can be<br />

attributed to anything that sounds good but is not specific: "global currency arbitrage", "hedge

futures trading", "high-yield investment programs", "offshore investment", or something<br />

similar.<br />

With no proven track record for the investors, only a few investors are tempted, usually for<br />

smaller sums. Sure enough, 30 days later the investor receives the original capital plus the<br />

20% return. At this point, the investor will have more incentive to put in additional money<br />

and, as word begins to spread, other investors grab the "opportunity" to participate. More and<br />

more people invest, and see their investments return the promised large returns.<br />

The reality of the <strong>scheme</strong> is that the "return" to the initial investors is being paid out of the<br />

new, incoming investment money, not out of profits. No "global currency arbitrage", "hedge<br />

futures trading" or "high yield investment program" is actually taking place. Instead, when<br />

investor D puts in money, that money becomes available to pay out "profits" to investors A, B,<br />

and C. When investors X, Y, and Z put in money, that money is available to pay "profits" to<br />

investors A through W.<br />

One reason that the <strong>scheme</strong> initially works so well is that early investors—those who actually<br />

got paid the large returns—quite commonly reinvest their money in the <strong>scheme</strong> (it does, after<br />

all, pay out much better than any alternative investment). Thus those running the <strong>scheme</strong> do<br />

not actually have to pay out very much (net)—they simply have to send statements to<br />

investors that show how much the investors have earned by keeping the money in what looks<br />

like a great place to get a high return. They also try to minimize withdrawals by offering new<br />

plans to investors, often where money is frozen for a longer period of time, for example 50%<br />

return per month for one year. They then get new cash flows as investors are told they could<br />

not transfer money from the first plan to the second.<br />

The catch is that at some point one of three things will happen:<br />

1. the promoters will vanish, taking all the investment money (less payouts) with them;<br />

2. the <strong>scheme</strong> will collapse under its own weight, as investment slows and the promoters<br />

start having problems paying out the promised returns. When the promoters start<br />

having problems, the word spreads and more people start asking for their money,<br />

similar to a bank run);<br />

3. the <strong>scheme</strong> is exposed, because when legal authorities begin examining accounting<br />

records of the so-called enterprise they find that many of the "assets" that should exist<br />

do not.<br />

What is and is not a <strong>Ponzi</strong> <strong>scheme</strong><br />

• A pyramid <strong>scheme</strong> is a form of fraud similar in some ways to a <strong>Ponzi</strong> <strong>scheme</strong>, relying<br />

as it does on a disbelief in financial reality, including the hope of an extremely high<br />

rate of return. However, several characteristics distinguish pyramid <strong>scheme</strong>s from<br />

<strong>Ponzi</strong> <strong>scheme</strong>s:<br />

o In a <strong>Ponzi</strong> <strong>scheme</strong>, the <strong>scheme</strong>r acts as a “hub” for the victims, interacting with<br />

all of them directly. In a pyramid <strong>scheme</strong>, those who recruit additional<br />

participants benefit directly (in fact, failure to recruit typically means no<br />

investment return).<br />

o A <strong>Ponzi</strong> <strong>scheme</strong> claims to rely on some esoteric investment approach, insider<br />

connections, etc., and often attracts well-to-do investors; pyramid <strong>scheme</strong>s

explicitly claim that new money will be the source of payout for the initial<br />

investments.<br />

o A pyramid <strong>scheme</strong> is bound to collapse a lot faster, due to the necessity of<br />

exponential increases in participants to sustain it. By contrast, <strong>Ponzi</strong> <strong>scheme</strong>s<br />

can survive simply by persuading most existing participants to "reinvest" their<br />

money, with a relatively small number of new participants.<br />

• A bubble. A bubble relies on suspension of disbelief and an expectation of large<br />

profits, but it is not the same as a <strong>Ponzi</strong> <strong>scheme</strong>. A bubble involves ever-rising (and<br />

unsustainable) prices in an open market (be that shares of a stock, housing prices, the<br />

price of tulip bulbs, or anything else). As long as buyers are willing to pay everincreasing<br />

prices, sellers can get out with a profit. And there doesn't need to be a<br />

<strong>scheme</strong>r behind a bubble. (In fact, a bubble can arise without any fraud at all - for<br />

example, housing prices in a local market that rise sharply but eventually drop sharply<br />

because of overbuilding.) Bubbles are often said to be based on "greater fool" theory.<br />

Although, according to the Austrian Business Cycle Theory, bubbles are caused by<br />

expanding the money supply beyond what genuine capital investment supports, and in<br />

this case would qualify as a <strong>Ponzi</strong> <strong>scheme</strong>, with expanded credit taking the place of an<br />

expanded pool of investors.<br />

• Robbing Peter to pay Paul. When debts are due and the money to pay them is lacking,<br />

whether because of bad luck or deliberate theft, debtors often make their payments by<br />

borrowing or stealing from other monies they have. It does not follow that this is a<br />

<strong>Ponzi</strong> <strong>scheme</strong>, because from the basic facts set out there is no indication that the<br />

lenders were promised unrealistically high rates of return via claims of unusual<br />

financial investments. Nor (from these basic facts) is there any indication that the<br />

borrower (banker) is progressively increasing the amount of borrowing ("investing")<br />

to cover payments to initial investors (as, again, <strong>Ponzi</strong> was not the first to do).<br />

• A pension fund can share some of the characteristics of a <strong>Ponzi</strong> <strong>scheme</strong> in that, except<br />

during the final period of the fund's life-span, the outgoing cash used in any month to<br />

pay pensions is usually taken from the incoming contributions of the active members<br />

of the pension <strong>scheme</strong>. In a year of poor equity returns such as 2008, a pension fund<br />

can often perform worse for its members than a <strong>Ponzi</strong> <strong>scheme</strong>.<br />

Notable <strong>Ponzi</strong> <strong>scheme</strong>s<br />

The eponymous <strong>scheme</strong> was orchestrated by Charles <strong>Ponzi</strong>, who went from anonymity to<br />

being a well-known Boston millionaire in six months using such a <strong>scheme</strong> in 1920. Profits<br />

were supposed to come from exchanging international postal reply coupons. He promised<br />

50% interest (return) on investments in 45 days or “double your money” in 90 days. About<br />

40,000 people invested about $15 million all together; in the end, only a third of that money<br />

was returned to them.<br />

Extremely high-volume <strong>scheme</strong>s<br />

Many <strong>Ponzi</strong> <strong>scheme</strong>s in unregulated markets have bankrupted hundreds or thousands of<br />

people when they finally run dry.<br />

19th century

1980s<br />

1990s<br />

• Before <strong>Ponzi</strong>, in 1899 William "520 Percent" Miller opened for business as the<br />

"Franklin Syndicate" in Brooklyn, New York. Miller promised 10% a week interest<br />

and exploited some of the main themes of <strong>Ponzi</strong> <strong>scheme</strong>s such as customers<br />

reinvesting the interest they made. He defrauded buyers out of $1 million and was<br />

sentenced to jail for 10 years. After he was pardoned, he opened a grocery store on<br />

Long Island. During the <strong>Ponzi</strong> investigation, Miller was interviewed by the Boston<br />

Post to compare his <strong>scheme</strong> to <strong>Ponzi</strong>'s — the interviewer found them remarkably<br />

similar, but <strong>Ponzi</strong>'s became more famous for taking in seven times as much money. [2]<br />

• Between 1970 and 1984 in Portugal, a woman known as Dona Branca maintained a<br />

<strong>scheme</strong> that paid 10% monthly interest. In 1988 she was sentenced to 10 years in<br />

prison. She always claimed that she was only trying to help the poor, but in her trial it<br />

was proven that she had received the equivalent of 85 million euros. [3][4]<br />

• In January 1984 Adriaan Nieuwoudt started a <strong>scheme</strong> with an apparent product in<br />

South Africa. Subscribers to the <strong>scheme</strong> were sent an "activator", that was used to<br />

grow "cultures" in milk, which was then sent back to the Kubus Kwekery for about<br />

30% return on the money paid for the "activator". The Cape Supreme Court held that<br />

the kubus <strong>scheme</strong> was an illegal lottery. [5]<br />

• Sixteen hundred investors in Diamond Mortgage Company and A.J. Obie, two firms<br />

with the same managers, lost approximately $50 million in what the Michigan Court<br />

of Appeals described as "the largest reported '<strong>Ponzi</strong>' <strong>scheme</strong> in the history of the<br />

state." It led to the passage in 1987 of the MBLSA (Mortgage Brokers, Lenders, and<br />

Servicers Act)." [6][7]<br />

• In the 1980s in San Diego, California, J. David & Company, an alleged currency and<br />

commodity trading and investing operation named after its founder, J. David<br />

Dominelli, a withdrawn and shy (and thus, presumably, "genius") currency and<br />

commodity trader, was revealed to be a <strong>Ponzi</strong> <strong>scheme</strong> which took in $200 million and<br />

returned $120 million to investors, leaving a net loss of $80 million. The <strong>scheme</strong><br />

touched all levels of upper class business and professional life in San Diego and<br />

environs, and involved the Mayor of Del Mar, California, a cozy upscale beach town<br />

just north of La Jolla, who was J. David's assistant and live-in companion, and others,<br />

including the prominent New York law firm Rogers & Wells (now Clifford Chance),<br />

which had advised J. David (through a rogue partner) and others. [8][9][10][11][12] When<br />

the fall came, J. David briefly escaped to Montserrat in the Caribbean, but was<br />

returned ultimately to plead guilty to federal charges and receive 20 years' federal<br />

imprisonment. [13]<br />

• In Romania, between 1991 and 1994, the Caritas <strong>scheme</strong> run by the "Caritas"<br />

company of Cluj-Napoca, owned by Ioan Stoica promised eight times the money<br />

invested in six months. It attracted 400,000 depositors from all over the country who<br />

invested 1,257 billion lei (about a billion USD) before it finally went bankrupt on 14<br />

August 1994, having a debt of 450 million USD. The owner, Ioan Stoica was<br />

sentenced in 1995 by the Cluj Court to a total of seven years in prison for fraud, but he<br />

appealed and it was reduced to two years; then he went on to the Supreme Court of<br />

Justice and the sentence was finally reduced to one year and a half.

• MMM was a Russian company that existed in the 1990s. It involved at least two<br />

million people and collected as much as $1.5 billion before its collapse. Its founder<br />

was sentenced to 4.5 years in prison in 2003.<br />

• In late 1994, the European Kings Club collapsed, with ensuing losses of about $1.1<br />

billion. This scam was led by Damara Bertges and Hans Günther Spachtholz. In the<br />

Swiss cantons Uri and Glarus, it was estimated that about one adult in ten invested<br />

into the EKC. The scam involved buying "letters" valued at 1,400 Swiss francs that<br />

entitled buyers to receive 12 monthly payments of 200 Swiss francs. The organisation<br />

was based in Gelnhausen, Germany. [14]<br />

• In May 1995, Pennsylvania's attorney general moved to freeze the assets of the<br />

Foundation for New Era Philanthropy and its chairman, John G. Bennett, Jr. The<br />

organization had raised over $500 million from 1,100 donors. Participants, including<br />

the Red Cross, had believed they were participating in a matching-gifts program<br />

through New Era but, in fact, it was really a <strong>Ponzi</strong> <strong>scheme</strong>. Losses amounted to $135<br />

million.<br />

• In early 1996, the SEC filed a civil action against Bennett Funding Group, its chief<br />

financial officer, Patrick R. Bennett, and other companies Bennett controlled, in<br />

connection with a massive <strong>Ponzi</strong> <strong>scheme</strong>. The companies fraudulently raised hundreds<br />

of millions of dollars, purportedly to purchase assignments of equipment leases and<br />

promissory notes. [15]<br />

• From 1993 until 1997 a church named Greater Ministries International in Tampa,<br />

Florida, headed by Gerald Payne bilked over 18,000 people out of 500 million<br />

dollars. [16] Payne and other church elders promised the church members double their<br />

money back, citing Biblical scripture. However, nearly all the money was lost and<br />

hidden away. Church leaders received prison sentences ranging from 13 to 27 years.<br />

• In the mid-1990s, Albania was transitioning into a liberalized market economy after<br />

years under a State-controlled economy reinforced by the cult of personality involving<br />

longtime Communist leader Enver Hoxha; the rudimentary financial system became<br />

dominated by pyramid <strong>scheme</strong>s, and government officials tacitly endorsed a series of<br />

pyramid investment funds. Many Albanians, approximately two-thirds of the<br />

population, invested in them. By 1997 the inevitable end came: Albanians, who had<br />

lost $1.2 billion, took their protest to the streets where uncontainable rioting and<br />

attacks on government infrastructure led to the toppling of the government and the<br />

temporary existence of a stateless society. Although technically a <strong>Ponzi</strong> Scheme, the<br />

Albanian scams were commonly referred to as Pyramid Schemes both popularly and<br />

by the IMF. [17]<br />

21st century<br />

• In 2000, a <strong>Ponzi</strong> <strong>scheme</strong> perpetrated by Scientology minister Reed Slatkin came<br />

unraveled when the U.S. Securities and Exchange Commission regulators became<br />

aware that Slatkin was not a licensed investment adviser. Slatkin had raised some<br />

$600 million from over 500 wealthy investors, mostly Hollywood celebrities. [citation<br />

needed]<br />

• In December 2005, in Los Angeles, California, Larry Toshio Osaki, who ran a <strong>Ponzi</strong><br />

<strong>scheme</strong> (of large purportion) and continued to offer bogus investments in accounts<br />

receivable "factoring" after being ordered to cease and desist by a Federal judge, was<br />

sentenced to 20 years in federal prison. In addition to the prison term, Judge Stephen<br />

V. Wilson ordered Osaki to pay more than $145 million in restitution to victims.

• The Brothers was a large investment operation, eventually exposed as a <strong>Ponzi</strong> <strong>scheme</strong>,<br />

in Costa Rica from the late 1980s until 2002. The fund was operated by brothers Luis<br />

Enrique and Osvaldo Villalobos. Investigators determined that the scam took in at<br />

least $400 million. Most of the clientele were American and Canadian retirees but<br />

some Costa Ricans also invested the minimum $10,000. About 6,300 individuals<br />

ultimately were involved. Interest rates were 3% per month, usually paid in cash, or<br />

2.8% compounded. The ability to pay such high interest was attributed to Luis Enrique<br />

Villalobos’ existing agricultural aviation business, investment in unspecified European<br />

high yield funds, and loans to Coca Cola, among others. Osvaldo Villalobos’ role was<br />

primarily to move money around a large number of shell companies and then pay<br />

investors. In May 2007 Osvaldo Villalobos was sentenced to 18 years in prison for<br />

fraud and illegal banking. Luis Enrique Villalobos remains a fugitive. [18]<br />

• In May 2006, James Paul Lewis, Jr. was sentenced to 30 years in federal prison for<br />

running a $311 million <strong>Ponzi</strong> <strong>scheme</strong> over a 20-year time period. He operated under<br />

the name Financial Advisory Consultants from Lake Forest, California<br />

[citation needed]<br />

• In October 2006 in Malaysia, two prominent members of society and several others<br />

were held for running an alleged scam, known as SwissCash or Swiss Mutual Fund<br />

(1948). SwissCash offered returns of up to 300% within a 15-month investment period.<br />

Currently, this HYIP investment is offered to citizens of Malaysia, Singapore, and<br />

Indonesia. It claimed investors’ funds were channeled to business activities ranging<br />

from oil exploration to shipping and agriculture in the Caribbean. The company claims<br />

to be operating out of New York and incorporated in the Commonwealth of<br />

Dominica. [19][20][21]<br />

• On Friday 13 April 2007 a person named Sibt-e-Hassan Shah, aka "Double Shah," was<br />

arrested by government officials in Wazirabad, a small town of Pakistan. [22] Sibt-e-<br />

Hassan claimed to double investors' money within 30 days in the beginning of his<br />

<strong>scheme</strong>, later extended to 90 days. He is suspected to have gathered very large<br />

investments (approx US$ 1 Billion) in a very short time period.<br />

• On June 27, 2007 former boy band mogul and notorious con artist Lou Pearlman was<br />

indicted by a grand jury on several counts of fraud which is turning out to be one of<br />

the largest and longest running United States <strong>Ponzi</strong> <strong>scheme</strong>s ever. [citation needed] His<br />

<strong>scheme</strong> lasted for over 20 years. The final total damage may rest somewhere near<br />

$500 million dollars. [23] Pearlman's scam involved bilking investors out of their<br />

savings with a fraudulent savings and loans program claiming it to be FDIC insured<br />

though it was not. On March 4, 2008, Pearlman agreed to plead guilty to charges of<br />

conspiracy, money laundering, and making false statements during a bankruptcy<br />

proceeding, and to testify for the prosecution of several accomplices, according to law<br />

enforcement officials. On May 21, 2008, Pearlman was sentenced to 300 months in<br />

jail with the stipulation that he could cut one month off his sentence for every $1<br />

million dollars he paid his investors back.<br />

• On August 17, 2007, the Philippine National Bureau of Investigation filed syndicated<br />

estafa cases against 27 officers and investors of FrancSwiss Investment, a "<strong>Ponzi</strong>"<br />

pyramiding scam on the Internet. Charged were Michael Mansfield, chief financial<br />

officer; Kurt Sandelman, risk management team leader; Rupert Benedict Da Vinco,<br />

investment team leader; Julia Rodriguez, international banking team leader; Hector<br />

Willem Sidberg, marketing and international affairs; and Fernando Munoz, customer<br />

service leader; Roger Smith, the British chief operation officer of FS Investment in the<br />

Asia-Pacific region; Bensy Fong, the Singaporean system operation officer; Raymond<br />

Chua, Singaporean marketing officer; a certain Michelle and Mike, Filipino secretaries<br />

and collectors of money from investors; 16 investors, including arrested suspect

Eleazard Castillo, 26, a native of Cabuyao, Ilocos Sur, allegedly one of the financial<br />

advisers of FrancSwiss Investment. 41 investors claimed they lost a total of $75,000 to<br />

the investment <strong>scheme</strong>. FrancSwiss deceived investors in the Philippines of 1 billion<br />

($50 million). [24]<br />

• In Slovakia, the so called non-banking institutions collected appx. 25 bil. SKK ($1<br />

billion) from 300-350 thousand people. There were around 30 of these companies,<br />

such as BMG Invest and Horizont Slovakia, Drukos, AGW, 1. dôchodková,<br />

Sporoinvest and SaS. Mr. Fruni, the owner and director of both BMG and Horizont<br />

will sit 11,5 years in prison, according to the Court's judgement from April 2008.<br />

• In the third and the biggest Philippines <strong>Ponzi</strong> scam (involving $150 million and $250<br />

million), criminal charges, based on suit filed by 21,000 complainants were filed on<br />

June, 2008, with the Department of Justice, against against Performance Investments<br />

Products Corp (PIPC) officers and incorporators for violation of the Securities<br />

Regulation Code (SRC), versus: Singaporean national Michael H.K. Liew, PIPC<br />

president; Cristina Gonzalez-Tuason, general manager, and other officers and agents -<br />

Ma. Cristina Bautista-Jurado, Barbara Garcia, Anthony Kierulf, Eugene Go, Michael<br />

Melchor Nubla, Ma. Pamela Morris, Luis Aragon, Renato Sarmiento Jr., Victor Jose<br />

Vergel de Dios, Nicoline Amoranto Mendoza, Jose Tengco III, Oudine Santos and<br />

Herley Jesuitas. [25]<br />

• Minnesota, USA - allegedly orchestrated by Minneapolis, Minnesota celebrity<br />

businessman Tom Petters. On December 1, 2008 Tom Petters was charged by the<br />

Federal government as the mastermind behind a $3.5 billion <strong>Ponzi</strong> <strong>scheme</strong> that bilked<br />

investors over a 13-year period. Tom Petters lived an extravagant lifestyle supported<br />

by his <strong>Ponzi</strong> <strong>scheme</strong>. Petters faces 20 counts of wire and mail fraud, conspiracy and<br />

money laundering for the alleged investment <strong>scheme</strong> that ran from 1995 through<br />

September of 2008. He is expected to plead not-guilty, but his co-conspirators in the<br />

<strong>Ponzi</strong> <strong>scheme</strong>, Deanna Coleman, Robert White, Michael Catain and Larry Reynolds,<br />

have all pled guilty. The Petters <strong>Ponzi</strong> <strong>scheme</strong> came to an end when Petters's top coconspirator<br />

Deanna Coleman turned government informant and wore a wire. Petters<br />

and the others were planning to flee to countries without extradition agreements with<br />

the U.S. Deanna Coleman and Michael Catain had properties in Costa Rica. [26][27]<br />

• Jordan : Many traders were arrested on October / November 2008 for multi Millions<br />

<strong>Ponzi</strong> Scams.<br />

[citation needed]<br />

• November 2008: The Kyiv Post reported on November 26th 2008 that American<br />

citizen Robert Fletcher (Robert T. Fletcher III; aka "Rob") was arrested by the the<br />

SBU (Ukraine State Police) after being accused by Ukrainian investors of running a<br />

ponzi <strong>scheme</strong> and associated pyramid scam netting $20 Million USD (Kyiv Post also<br />

reports that some estimates are as high as $150M USD).<br />

• In December 2008, former chairman of the NASDAQ Stock Market, Bernard Madoff,<br />

was arrested and charged with a single count of securities fraud, but one which "may<br />

rank among the biggest frauds ever" totaling "$50 billion of fraudulent losses"<br />

becoming the biggest <strong>Ponzi</strong> scam in history. [28]<br />

Other notable <strong>scheme</strong>s<br />

Other notable (but involving smaller amounts of money) <strong>Ponzi</strong> <strong>scheme</strong>s include:<br />

• Sarah Howe, who in 1880 opened up a "Ladies Deposit" in Boston promising eight<br />

percent interest, although she had no method of making profits. This unique <strong>scheme</strong><br />

was billed as "for women only". Howe disappeared with the money from her scam. [2]

• The novel Chance by Joseph Conrad depicted a <strong>Ponzi</strong> <strong>scheme</strong> in 1914 before <strong>Ponzi</strong><br />

himself had hit the scene. Conrad's scammer "de Barral" offered ten percent interest<br />

on deposits in his operation "without system, plan, foresight, or judgement".<br />

• On March 22, 2000, four people were indicted in the Northern District of Ohio, on<br />

charges including conspiracy to commit and committing mail and wire fraud. A<br />

company with which the defendants were affiliated allegedly collected more than $26<br />

million from "investors" without selling any product or service, and paid older<br />

investors with the proceeds of the money collected from the newer investors. [29]<br />

• In late 2003, a <strong>scheme</strong> by Bill Hickman, Sr., and his son, Bill Jr., was shut down. He<br />

had been selling unregistered securities that promised yields of up to 20 percent; more<br />

than $8 million was defrauded from dozens of residents of Pottawatomie County,<br />

Oklahoma, along with investors from as far away as California. [30] Hickman was<br />

sentenced to 8 years in state prison.<br />

• In December 2004, Mark Drucker pleaded guilty to a <strong>Ponzi</strong> <strong>scheme</strong> in which he told<br />

investors that he would use their funds to buy and sell securities through a brokerage<br />

account. He claimed that he was making significant profits on his day trades and that<br />

he had opportunities to invest in select IPOs that were likely to turn a substantial profit<br />

in a short period of time. He promised guaranteed returns of up to fifty (50%) percent<br />

in 90 days or less. In less than two years of trading, Drucker actually lost more than<br />

$850,000 in day trading and had no special access to IPOs. He paid out more than $3.6<br />

million to investors while taking in $6.3 million. [31][32]<br />

• In June 2005, in Los Angeles, California, John C. Jeffers was sentenced to 168 months<br />

(14 years) in federal prison and ordered to pay $26 million in restitution to more than<br />

80 victims. Jeffers and his confederate John Minderhout ran what they said was a<br />

high-yield investment program they called the "Short Term Financing Transaction".<br />

The funds were collected from investors around the world from 1996 through 2000.<br />

Some investors were told that proceeds would be used to finance humanitarian<br />

projects around the globe, such as low-cost housing for the poor in developing nations.<br />

Jeffers sent letters to some victims that falsely claimed the program had been licensed<br />

by the Federal Reserve and the program had a relationship with the International<br />

Monetary Fund and the United States Treasury. Jeffers and Minderhout promised<br />

investors profits of up to 4,000 percent. Most of the money collected in the <strong>scheme</strong><br />

went to Jeffers to pay commissions to salespeople, to make payments to investors to<br />

keep the <strong>scheme</strong> going, and to pay his own personal expenses. [33]<br />

• In February 2006, Edmundo Rubi pleaded guilty to bilking hundreds of middle and<br />

low-income investors out of more than $24 million between 1999 and 2001, when he<br />

fled the U.S. after becoming aware that he was under suspicion. The investors in the<br />

<strong>scheme</strong>, called “Knight Express”, were told that their funds would be used to purchase<br />

and resell Federal Reserve notes, and were promised a six percent monthly return.<br />

Most of those bilked were part of the Filipino community in San Diego. [34]<br />

• In April 2006, Hank Hankley and Snyder Nguyen fled from China after the bilkery of<br />

more than $3 million from investors in the Shanghai Stock Exchange. They remain at<br />

large. Hu Jintao and in conjunction with the Falun Gong movement have issued a<br />

$500 thousand reward for their capture.

• On May 10, 2006, Spanish police arrested nine people associated with Forum<br />

Filatelico and Afinsa Bienes Tangibles in an apparent <strong>Ponzi</strong> <strong>scheme</strong> that affected<br />

250,000 investors from 1998 to 2001. Investors were promised huge returns from<br />

investments in a stamp fund. [35]<br />

• 12DailyPro was a version of what is commonly known as a "paid autosurf" program<br />

where "investors" deposited money and received an extremely high profit (44%)<br />

within a short period (12 days). Charis Johnson created what authorities considered<br />

one of the largest modern-day versions of the <strong>Ponzi</strong> <strong>scheme</strong>. She accumulated a total<br />

of over US$1.9 million from the program. More than 300,000 people joined over the<br />

course of eight months, spending over $500 million. [36] When a federal investigation<br />

of 12DailyPro took place, its main payment processor, Stormpay, froze all funds<br />

related to it. Stormpay has since refused to return any of these funds. On February 24,<br />

2006, the United States Securities and Exchange Commission (SEC) ordered<br />

12DailyPro and its parent company to cease and desist all operations. On February 28,<br />

a Los Angeles judge ordered all company assets and records to be turned over to an<br />

appointed receiver for investigation. Charis F. Johnson now faces criminal and civil<br />

suits from both local and federal agencies.<br />

• On August 31, 2007, the Securities and Exchange Commission ("SEC") filed an<br />

emergency action against James Blackman Roberts ("Roberts"), FOMAC International,<br />

Inc. ("FOMAC"), and Consultores Las Tres Americas S.A. ("Consultores LTA") to<br />

halt an ongoing <strong>Ponzi</strong> <strong>scheme</strong> and freeze assets for the benefit of defrauded investors.<br />

The complaint filed by the SEC alleges that, since 2002, the defendants have raised at<br />

least $50 million in principal from approximately 450 investors located primarily in<br />

the U.S. and Costa Rica. The complaint further alleges that as early as 2005, the<br />

defendants experienced significant losses while trading investor funds in the Forex<br />

markets, misappropriated at least $3 million, and then used new investor money to pay<br />

returns and principal to existing investors. As a result, the complaint alleges, the<br />

defendants misrepresented to investors that these <strong>Ponzi</strong> payments were actually<br />

returns from their Forex trading. [37] It should be noted that the above-mentioned<br />

allegations have yet to be proved before a Court of law, and that the US and Costa<br />

Rican law considers any person innocent until proven guilty.<br />

• On September 20, 2007, a complaint was filed in Federal District Court in Manhattan,<br />

accusing political fund-raiser Norman Hsu of operating a <strong>Ponzi</strong> <strong>scheme</strong>. Hsu attracted<br />

investments by claiming to be running a legitimate business involving the importation<br />

of clothes from China, and is reported to have cheated investors out of at least $60<br />

million. [38]<br />

• In May 2007, the Florida Office of Financial Regulation and the Florida Department<br />

of Law Enforcement announced they were investigating local Bradenton investment<br />

broker Michael O. Traynor, 56, and his son, Matthew O. Traynor, 28, on complaints<br />

from at least a dozen residents in Sarasota and Manatee counties alleging that the<br />

Traynors defrauded clients out of approximately $8 million in investor funds. On<br />

November 16, 2007, Michael Traynor, who had found many of his clients though his<br />

church social circles, was arrested on a first degree felony grand theft charge that he<br />

had stolen $6.5 million from his investors. It is believed Traynor stole funds from at<br />

least 34 clients in Sarasota, Manatee and Hillsborough counties between 2001 and<br />

February 2007. At least ten investors filed complaints with state regulators, and many

had unfruitful meetings with Traynor to have money returned, including those who<br />

met him through Bradenton Christian Reformed Church and Bradenton Christian<br />

School. Representatives of the Florida Department of Law Enforcement called<br />

Traynor's scam a "classic <strong>Ponzi</strong>-<strong>scheme</strong>". Traynor had sold investments in Manatee<br />

County for InterSecurities Inc., also known as ISI, since 1997, and was the company's<br />

Bradenton branch manager before he was fired in February 2007.<br />

• Michael Eugene Kelly (born October 6, 1949) is the owner of Yucatan Resorts, Resort<br />

Holdings International, Puerto Cancun and Avanti Motor Corporation. He is accused<br />

by the FBI and the United States Attorney's Office of operating a $428 million <strong>Ponzi</strong><br />

<strong>scheme</strong> that defrauded over a thousand elderly and senior citizens of their retirement<br />

money. Kelly was arrested in his hospital room at the Mayo Clinic on December 22,<br />

2006 just before he was about to be discharged and return to one of his homes in<br />

Cancún, Mexico. In pretrial services, Kelly claimed that he makes $55,000 a year and<br />

only has $48,000 in assets. In spite of his claim of meager earnings, Kelly offered a<br />

private jet, four yachts and race track as collateral at his detention hearing. He was<br />

denied bail and is currently in the Metropolitan Correctional Center, Chicago waiting<br />

for arraignment. Since his arrest, Kelly has attempted to avoid indictment by arranging<br />

a plea agreement that includes paying restitution to the victims.<br />

• In 2008, many <strong>Ponzi</strong> <strong>scheme</strong>s are flourishing in Colombia [39] . Those <strong>scheme</strong>s for<br />

which complaints are filed are the only ones that the Colombian police have been able<br />

to stop and have their organizers detained. Curiously, an organizer of one of these<br />

<strong>scheme</strong>s was in fact a policeman. There are many <strong>Ponzi</strong> <strong>scheme</strong>s going on right now,<br />

and even though they are quite popular and, as of February 2008, at least one of the<br />

organizers publicly admitted operating what can be defined as a <strong>Ponzi</strong> <strong>scheme</strong>,<br />

authorities haven't been able to act legally against the people behind organizations<br />

such as People Winner, DRFE (Dinero Rápido, Fácil y Efectivo - Quick, Easy and<br />

Effective Money) and DMG which have strong support from individuals who have<br />

already got their profits. The most prominent of these organizations is DMG, which<br />

has a strong support from their investors, since it hasn't faced any complaint from their<br />

customers in three years. However, since DMG's mechanisms are obscure and haven't<br />

been revealed by its founder, David Murcia Guzmán; and rumours and accusations<br />

linking DMG with Chupeta, a well-known drug lord, Colombian government closed<br />

DMG on November 17th [40] . Throughout this exchange of accusations, Murcia<br />

Guzmán has accused Grupo Aval and its owner, Luis Carlos Sarmiento, of making<br />

fake pyramids like DRFE and pushing Colombian government and media to<br />

criminalize DMG [41] . Murcia Guzmán is now detained [42] .<br />

• Matteo Quintavalle is - according to the source quoted in the following footnote - an<br />

Italian scammer, who cheated investors with more than US$10 million by promising<br />

very high yield in Costa Rican real estates and hotels. After being involved in a serie<br />

of frauds in Italy, Mr. Quintavalle grabbed money in San Francisco,California and<br />

went to Costa Rica and bought hotels, resorts and even soccer players ' contracts and<br />

gave false contracts to the original investors let they think they were owning those<br />

properties in Costa Rica. Mr. Quintavalle is currently under arrest awaiting trial.[33<br />

• Currently (May 2008) the Finnish National Bureau of Investigation is investigating a<br />

long running <strong>scheme</strong> where possibly over 10,000 people could have lost up to €100<br />

million investing in WinCapita's WinClub "investment club", supposedly a currency

trading <strong>scheme</strong>. Investigators now say they have found no evidence that WinCapita<br />

ever engaged in any legitimate currency trading at all. [43]<br />

• On May 7, 2008, The U.S. SEC filed suit against The Little Shell<br />

Goldquestinternational (site currently down due to court order) as an alleged <strong>Ponzi</strong><br />

<strong>scheme</strong> [44] . The company claimed an 87.5% YoY return on an investment by trading<br />

on the Foreign Exchange. According to SEC filing, as much as 80% of an investors'<br />

investment would be paid out as commissions. On May 20, 2008, U.S. District Judge<br />

Lloyd George authorized the use of necessary force to help a receiver obtain property<br />

and records of GoldQuest [45] . Cook receiver services was appointed by the court in<br />

order to<br />

take such action that is necessary and appropriate to preserve and take control of and to<br />

prevent the dissipation, concealment, or disposition of any assets of, or managed by, Gold<br />

Quest and its affiliates. [46]<br />

.<br />

• On May 27, 2008, the Philippine National Bureau of Investigation (NBI) filed a case<br />

of syndicated estafa based on complaint of Korina Sanchez and 15 other investors,<br />

against the officials of Power Generation Trading Corporation regarding a<br />

multimillion-peso investment scam by using the “<strong>Ponzi</strong>” <strong>scheme</strong>. Those indicted were:<br />

Chief executive officer Rudy Enrique Olalia, treasurer Lourdes Olalia, corporate<br />

secretary Marie Frances Yuvienco and 21 others, including Bernie De Venecia. [47][48]<br />

• In September 2008 a one-time English teacher called Sakvithi Ranasinghe vanished<br />

with around $9 million in depositors' money in Sri Lanka.<br />

See also<br />

• Stock Market<br />

• Finance<br />

• Multi-level marketing<br />

• Holiday Magic<br />

• High-yield investment program<br />

• Investment<br />

• Bucket shop<br />

• List of finance topics<br />

• Pyramid <strong>scheme</strong><br />

• Lottery<br />

• Get-rich-quick <strong>scheme</strong>s<br />

• Matrix <strong>scheme</strong><br />

• Reed Slatkin<br />

• Double Shah<br />

• Federal Reserve<br />

References<br />

1. ^ "<strong>Ponzi</strong> Schemes" , which also describes the original <strong>Ponzi</strong> <strong>scheme</strong> in detail)

2. ^ a b Zuckoff, Mitchell. <strong>Ponzi</strong>'s Scheme: The True Story of a Financial Legend.<br />

Random House: New York, 2005. (ISBN 1-4000-6039-7)<br />

3. ^ Visão, Apanhados pelos selos, 18 May 2006.<br />

4. ^ CanalSurWeb, Banqueros del pueblo, 12 May 2006<br />

5. ^ Legal City, Scams and other money-making <strong>scheme</strong>s.<br />

6. ^ "People v. Greenberg,"176 Mich App 296, 299; 439 NW2nd 336(1989) cited in U.S.<br />

Supreme Court, 05-1342, Watters vs Wachovia Bank, page 6. At [1] American Bar<br />

Association site ABAnet.com, Retrieved August 29, 2007<br />

7. ^ [2] Keyfetz, Lisa, "The home ownership and equity protection act of 1994:<br />

extending liability for predatory subprime loans to secondary mortgage market<br />

participants." Loyola Consumer Law Review, Vol 18:2, pages 165-166. Retrieved<br />

August 29, 2007<br />

8. ^ "Rogers & Wells Settles Suit", New York Times (1986-03-31).<br />

9. ^ "J. David Case: Damages Set", New York Times (1987-08-28).<br />

10. ^ http://www.sandiegohistory.org/journal/86fall/dominelli.htm<br />

11. ^ Rancho Santa Fe, California<br />

12. ^ Lindsey, Robert (1985-08-21). "Retrial of San Diego Mayor is Opened", New York<br />

Times.<br />

13. ^ "20-Year Term For Dominelli", New York Times (1985-06-25).<br />

14. ^ http://www.graumarktinfo.de/gm/grauestars/starradar/walhalla/:Damara-Bertges-<br />

European-Kings-Club-Chefin:Die-K%F6nigin-und-ihr-Gefolge/493274.html<br />

15. ^ http://www.sec.gov/divisions/enforce/claims/bennett.htm<br />

16. ^ "Extremism in America: Greater Ministries International", Anti-Defamation League.<br />

Retrieved on 18 July 2007.<br />

17. ^ Christopher Jarvis, The Rise and Fall of Albania's Pyramid Schemes, Finance &<br />

Development: A Quarterly Magazine of the IMF, March 2000.<br />

18. ^ http://www.amcostarica.com/051707.htm<br />

19. ^ The Star, Malaysia, 4 October 2006.<br />

20. ^ Today, Singapore, 24 January 2007.<br />

21. ^ Bank Negara, Malaysia, Malaysia, 5 September 2006.<br />

22. ^ Ali, Hasan (April 14, 2007). "Pir Double Shah arrested". Daily Times.<br />

23. ^ Orlando Sentinel February 6, 2007 Pearlman, companies face $317 million in<br />

claims<br />

24. ^ Inquirer.net, Charges filed against 27 in alleged pyramiding scam<br />

25. ^ newsinfo.inquirer.net, $250-M ESTAFA, DOJ acts to speed up cases in PIPC scam<br />

26. ^ Star Tribune<br />

27. ^ Tom Petters Indictment - PDF<br />

28. ^ Bernard Madoff arrested over alleged '$50 billion fraud'<br />

29. ^ http://www.internetfraud.usdoj.gov/<br />

30. ^ http://www.ethicscheck.com/consumers/scamreport/rpt_04_11_23.htm<br />

31. ^ http://www.usdoj.gov/usao/gan/press/12-01-04.html<br />

32. ^ http://www.sec.gov/litigation/admin/34-49824.htm<br />

33. ^ http://www.usdoj.gov/usao/cac/pr2005/087.html<br />

34. ^ "Man Pleads Guilty to Federal Charges after Swindling more than $24 Million from<br />

Local Victims" November 16, 2005 U.S. Immigration and Customs Enforcement.<br />

Retrieved December 23, 2007<br />

35. ^ http://news.bbc.co.uk/2/hi/business/4757741.stm<br />

36. ^ http://www.tlennonfor12dailypro.com/media/12DP_FirstInterimReport.pdf<br />

37. ^ http://www.sec.gov/litigation/litreleases/2007/lr20264.htm<br />

38. ^ http://www.nytimes.com/2007/09/20/us/politics/20cnd-hsu.html

39. ^ La estafa <strong>Ponzi</strong> azota a Colombia, DMG también colapsará at YouTube<br />

40. ^ Gobierno intervino a DMG El Espectador, November 17, 2008<br />

41. ^ David Murcia Guzmán vs. Terrorismo Financiero at YouTube<br />

42. ^ [3] El Tiempo, November 20, 2008<br />

43. ^ WinCapita not engaged in currency trading (Finnish) YLE News, May 8, 2008<br />

44. ^ Gold-Quest International, et al.: Lit. Rel. No. 20557 / May 7, 2008<br />

45. ^ ReviewJournal.com - Business - Judge OKs using force to seize Gold-Quest records<br />

46. ^ Cook Receivership Services Inc. - Gold Quest International Receivership<br />

47. ^ Inquirer.net, 24 charged in multimillion-peso investment scam<br />

48. ^ GMA NEWS.TV, Colleagues deny human rights lawyer’s involvement in <strong>Ponzi</strong><br />

scam